The Trade Desk, Inc. (NASDAQ: TTD), a provider of a global

technology platform for buyers of advertising, today announced

financial results for its second quarter ended June 30, 2022.

“We delivered outstanding performance in the second quarter,

growing 35% versus a year ago, significantly outpacing worldwide

programmatic advertising growth. More of the world’s leading brands

are signing major new or expanded long-term agreements with The

Trade Desk, which speaks to the innovation and value that our

platform provides compared to the limitations of walled gardens,”

said Jeff Green, Co-Founder and CEO of The Trade Desk. “This trend

also gives us confidence that we will continue to gain market share

in any market environment. At the same time, we continue to invest

to drive future growth in key areas such as identity, Connected TV,

retail media and supply chain optimization. In each of these areas,

we signed major new partnerships with some of the world’s leading

publishers, broadcasters, retailers and technology partners in the

second quarter.”

Second Quarter 2022 Financial

Highlights:

The following table summarizes our consolidated financial

results for the three and six months ended June 30, 2022 and 2021

($ in millions, except per share amounts):

Three Months Ended

June 30,

Six Months Ended

June 30,

2022

2021

2022

2021

GAAP Results

Revenue

$

377

$

280

$

692

$

500

Increase in revenue year over year

35

%

101

%

39

%

67

%

Net income (loss)

$

(19

)

$

48

$

(34

)

$

70

GAAP diluted earnings (loss) per share

$

(0.04

)

$

0.10

$

(0.07

)

$

0.14

Non-GAAP Results

Adjusted EBITDA

$

139

$

118

$

260

$

188

Adjusted EBITDA margin

37

%

42

%

38

%

38

%

Non-GAAP net income

$

99

$

88

$

203

$

158

Non-GAAP diluted earnings per share

$

0.20

$

0.18

$

0.41

$

0.32

Second Quarter and Recent Business

Highlights:

- Strong Customer Retention: Customer retention remained

over 95% during the second quarter, as it has for the past eight

consecutive years.

- Continued Collaboration and Support for Unified ID 2.0:

The Trade Desk is building support for Unified ID 2.0 (UID2), an

industry-wide approach to identity that preserves the value of

relevant advertising, while putting user control and privacy at the

forefront. UID2 is an upgrade and alternative to third-party

cookies. Recent partnerships and pledges of integration and support

include:

- Integration with Disney to power interoperability between

Disney’s industry-leading Audience Graph and the open-source

addressability framework of UID2. Equips advertisers with the

ability to leverage UID2 when making programmatic buys on Disney

properties, including ESPN, ABC, Hulu, FX, and National

Geographic.

- Amazon Web Services (AWS) announced it will support UID2 on its

platform. The move will provide AWS customers with a turnkey

identity solution bolstering the scalability and accessibility of

UID2.

- Integration with Vox Media (owner of SB Nation, Curbed, Eater,

Polygon, New York Magazine, Thrillist and The Verge) and its

first-party data solution as they debut their supply-side platform,

Concert SSP.

- Expanded Partnerships:

- In June, The Trade Desk announced a partnership with Albertsons

Media Collective, the retail media arm for Albertsons Companies, to

bring verified-buyer audience and measurement solutions to The

Trade Desk platform, helping advertisers understand the connection

between ad campaigns and customer sales.

- Industry Recognition:

- 2022 Customers’ Choice for Ad Tech on Gartner® Peer

Insights™

- 2022 BIG Innovation Award for Technology Product (Solimar)

- 2022 Top Women in Media & Ad Tech

- Adweek Readers’ Choice: Best of Tech awards for both Demand

Side Platform and Innovator of the Year categories.

- Best Overall Ad Tech Solution in the Martech Breakthrough

Awards

- Best Overall Technology for Programmatic Trading in the Drum

Digital Advertising Awards US

Financial Guidance:

Third Quarter 2022 outlook summary:

- Revenue at least $385 million

- Adjusted EBITDA of approximately $140 million

We have not provided an outlook for GAAP Net Income or

reconciliation of Adjusted EBITDA guidance to Net Income, the

closest corresponding U.S. GAAP measure, because Net Income outlook

is not available without unreasonable efforts on a forward-looking

basis due to the variability and complexity with respect to the

charges excluded from these non-GAAP measures; in particular, the

measures and effects of our stock-based compensation expense that

are directly impacted by unpredictable fluctuations in our share

price. We expect the variability of the above charges could have a

significant and potentially unpredictable impact on our future U.S.

GAAP financial results.

Use of Non-GAAP Financial

Information

Included within this press release are the non-GAAP financial

measures of Adjusted EBITDA, Non-GAAP Net Income and Non-GAAP

Diluted EPS that supplement the Consolidated Statements of

Operations of The Trade Desk, Inc. (the Company) prepared under

generally accepted accounting principles (GAAP). Adjusted EBITDA is

earnings before interest expense (income), net; provision for

(benefit from) income taxes; depreciation and amortization; and

stock-based compensation. Non-GAAP Net Income excludes charges and

the related income tax effects for stock-based compensation. Tax

rates on the tax-deductible portions of the stock-based

compensation expense approximating 25% to 30% have been used in the

computation of non-GAAP Net Income and non-GAAP Diluted EPS.

Reconciliations of GAAP to non-GAAP amounts for the periods

presented herein are provided in schedules accompanying this

release and should be considered together with the Consolidated

Statements of Operations. These non-GAAP measures are not meant as

a substitute for GAAP, but are included solely for informational

and comparative purposes. The Company's management believes that

this information can assist investors in evaluating the Company's

operational trends, financial performance, and cash generating

capacity. Management believes these non-GAAP measures allow

investors to evaluate the Company’s financial performance using

some of the same measures as management. However, the non-GAAP

financial measures should not be regarded as a replacement for or

superior to corresponding, similarly captioned, GAAP measures and

may be different from non-GAAP financial measures used by other

companies.

Second Quarter 2022 Financial Results

Webcast and Conference Call Details

- When: August 9, 2022 at 2:00 P.M. Pacific Time (5:00

P.M. Eastern Time).

- Webcast: A live webcast of the call can be accessed from

the Investor Relations section of The Trade Desk’s website at

http://investors.thetradedesk.com/. Following the call, a replay

will be available on the company’s website.

- Dial-in: To access the call via telephone in North

America, please dial 877-545-0320. For callers outside the United

States, please dial 1-973-528-0002. Participants should reference

the conference call ID code “432394” after dialing in.

- Audio replay: An audio replay of the call will be

available beginning about two hours after the call. To listen to

the replay in the United States, please dial 877-481-4010 (replay

code: 46182). Outside the United States, please dial 1-919-882-2331

(replay code: 46182). The audio replay will be available via

telephone until August 16, 2022.

The Trade Desk, Inc. uses its Investor Relations website

(http://investors.thetradedesk.com/investor-overview), its Twitter

feed (@TheTradeDesk), LinkedIn page

(https://www.linkedin.com/company/the-trade-desk/), and Facebook

page (https://www.facebook.com/TheTradeDesk/), and Jeff Green’s

Twitter feed (@jefftgreen) and LinkedIn profile

(https://www.linkedin.com/in/jefftgreen/) as a means of disclosing

information about the company and for complying with its disclosure

obligations under Regulation FD. The information that is posted

through these channels may be deemed material. Accordingly,

investors should monitor these channels in addition to The Trade

Desk’s press releases, SEC filings, public conference calls and

webcasts.

About The Trade Desk

The Trade Desk™ is a technology company that empowers buyers of

advertising. Through its self-service, cloud-based platform, ad

buyers can create, manage, and optimize digital advertising

campaigns across ad formats and devices. Integrations with major

data, inventory, and publisher partners ensure maximum reach and

decisioning capabilities, and enterprise APIs enable custom

development on top of the platform. Headquartered in Ventura, CA,

The Trade Desk has offices across North America, Europe, and Asia

Pacific. To learn more, visit thetradedesk.com or follow us on

Facebook, Twitter, LinkedIn and YouTube.

Forward-Looking Statements

This document contains “forward-looking statements” within the

meaning of the Private Securities Litigation Reform Act of 1995.

These statements relate to expectations concerning matters that (a)

are not historical facts, (b) predict or forecast future events or

results, or (c) embody assumptions that may prove to have been

inaccurate, including statements relating to the industry and

market trends, and the Company’s financial targets, such as revenue

and Adjusted EBITDA. When words such as “believe,” “expect,”

“anticipate,” “will,” “outlook” or similar expressions are used,

the Company is making forward-looking statements. Although the

Company believes that the expectations reflected in such

forward-looking statements are reasonable, it cannot give readers

any assurance that such expectations will prove correct. These

forward-looking statements involve risks, uncertainties and

assumptions, including those related to the Company’s relatively

limited operating history, which makes it difficult to evaluate the

Company’s business and prospects, the market for programmatic

advertising developing slower or differently than the Company’s

expectations, the demands and expectations of clients and the

ability to attract and retain clients. The actual results may

differ materially from those anticipated in the forward-looking

statements as a result of numerous factors, many of which are

beyond the control of the Company. These are disclosed in the

Company’s reports filed from time to time with the Securities and

Exchange Commission, including its most recent Form 10-K and any

subsequent filings on Forms 10-Q or 8-K, available at www.sec.gov.

Readers are urged not to place undue reliance on these

forward-looking statements, which speak only as of the date of this

press release. The Company does not intend to update any

forward-looking statement contained in this press release to

reflect events or circumstances arising after the date hereof.

THE TRADE DESK, INC.

CONSOLIDATED STATEMENTS OF

OPERATIONS

(Amounts in thousands, except

per share amounts)

(Unaudited)

Three Months Ended

June 30,

Six Months Ended

June 30,

2022

2021

2022

2021

Revenue

$

376,962

$

279,967

$

692,285

$

499,778

Operating expenses (1):

Platform operations

67,490

50,809

131,380

101,309

Sales and marketing

89,420

61,755

160,108

117,519

Technology and development

83,483

53,536

155,482

107,454

General and administrative

134,826

51,919

260,625

103,764

Total operating expenses

375,219

218,019

707,595

430,046

Income (loss) from operations

1,743

61,948

(15,310

)

69,732

Total other expense (income), net

(339

)

398

(58

)

90

Income (loss) before income taxes

2,082

61,550

(15,252

)

69,642

Provision for (benefit from) income

taxes

21,155

13,853

18,419

(697

)

Net income (loss)

$

(19,073

)

$

47,697

$

(33,671

)

$

70,339

Earnings (loss) per share:

Basic

$

(0.04

)

$

0.10

$

(0.07

)

$

0.15

Diluted

$

(0.04

)

$

0.10

$

(0.07

)

$

0.14

Weighted-average shares outstanding:

Basic

486,310

475,512

485,256

474,172

Diluted

486,310

496,987

485,256

497,449

___________________________

(1) Includes stock-based compensation

expense as follows:

STOCK-BASED COMPENSATION

EXPENSE

(Amounts in thousands)

(Unaudited)

Three Months Ended

June 30,

Six Months Ended

June 30,

2022

2021

2022

2021

Platform operations

$

4,787

$

4,091

$

10,737

$

9,106

Sales and marketing

17,332

14,579

33,857

28,263

Technology and development

22,224

13,974

44,617

30,068

General and administrative (1)

80,870

12,553

160,897

30,114

Total

$

125,213

$

45,197

$

250,108

$

97,551

___________________________

(1) Includes stock-based compensation

expense related to a long-term CEO performance grant of $66 million

and $131 million for the three and six months ended June 30, 2022,

respectively.

THE TRADE DESK, INC.

CONSOLIDATED BALANCE

SHEETS

(Amounts in thousands)

(Unaudited)

As of June

30,

2022

As of

December 31,

2021

ASSETS

Current assets:

Cash and cash equivalents

$

932,683

$

754,154

Short-term investments, net

280,459

204,625

Accounts receivable, net

1,902,504

2,020,720

Prepaid expenses and other current

assets

80,531

112,150

Total current assets

3,196,177

3,091,649

Property and equipment, net

139,214

135,856

Operating lease assets

225,380

234,091

Deferred income taxes

66,689

68,244

Other assets, non-current

45,286

47,500

Total assets

$

3,672,746

$

3,577,340

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current liabilities:

Accounts payable

$

1,537,448

$

1,655,684

Accrued expenses and other current

liabilities

79,339

101,472

Operating lease liabilities

48,287

46,149

Total current liabilities

1,665,074

1,803,305

Operating lease liabilities,

non-current

219,341

238,449

Other liabilities, non-current

8,500

8,280

Total liabilities

1,892,915

2,050,034

Stockholders' equity:

Preferred stock

—

—

Common stock

—

—

Additional paid-in capital

1,201,373

915,177

Retained earnings

578,458

612,129

Total stockholders' equity

1,779,831

1,527,306

Total liabilities and stockholders'

equity

$

3,672,746

$

3,577,340

THE TRADE DESK, INC.

CONSOLIDATED STATEMENTS OF

CASH FLOWS

(Amounts in thousands)

(Unaudited)

Six Months Ended June

30,

2022

2021

OPERATING ACTIVITIES:

Net income (loss)

$

(33,671

)

$

70,339

Adjustments to reconcile net income (loss)

to net cash provided by operating activities:

Depreciation and amortization

24,624

21,017

Stock-based compensation

250,108

97,551

Allowance for credit losses on accounts

receivable

2,078

239

Noncash lease expense

21,343

19,553

Deferred income taxes

1,555

5,044

Other

6,630

9,065

Changes in operating assets and

liabilities:

Accounts receivable

112,345

49,802

Prepaid expenses and other current and

non-current assets

29,018

(6,812

)

Accounts payable

(129,853

)

(133,510

)

Accrued expenses and other current and

non-current liabilities

(22,190

)

(22,852

)

Operating lease liabilities

(24,029

)

(23,995

)

Net cash provided by operating

activities

237,958

85,441

INVESTING ACTIVITIES:

Purchases of investments

(233,877

)

(164,031

)

Sales of investments

1,977

4,539

Maturities of investments

154,092

116,769

Purchases of property and equipment

(12,541

)

(18,499

)

Capitalized software development costs

(3,226

)

(2,675

)

Net cash used in investing activities

(93,575

)

(63,897

)

FINANCING ACTIVITIES:

Payment of debt financing costs

—

(1,852

)

Proceeds from exercise of stock

options

31,795

26,339

Proceeds from employee stock purchase

plan

25,547

22,758

Taxes paid related to net settlement of

restricted stock awards

(23,196

)

(29,235

)

Net cash provided by financing

activities

34,146

18,010

Increase in cash and cash equivalents

178,529

39,554

Cash and cash equivalents—Beginning of

period

754,154

437,353

Cash and cash equivalents—End of

period

$

932,683

$

476,907

Non-GAAP Financial Metrics

(Amounts in thousands, except per share

amounts)

The following tables show the Company’s

non-GAAP financial metrics reconciled to the comparable GAAP

financial metrics included in this release.

Three Months Ended

June 30,

Six Months Ended

June 30,

2022

2021

2022

2021

Net income (loss)

$

(19,073

)

$

47,697

$

(33,671

)

$

70,339

Add back:

Depreciation and amortization expense

12,274

11,006

24,624

21,017

Stock-based compensation expense

125,213

45,197

250,108

97,551

Interest expense (income), net

(656

)

194

420

239

Provision for (benefit from) income

taxes

21,155

13,853

18,419

(697

)

Adjusted EBITDA

$

138,913

$

117,947

$

259,900

$

188,449

Three Months Ended

June 30,

Six Months Ended

June 30,

2022

2021

2022

2021

GAAP net income (loss)

$

(19,073

)

$

47,697

$

(33,671

)

$

70,339

Add back (deduct):

Stock-based compensation expense

125,213

45,197

250,108

97,551

Adjustment for income taxes

(7,500

)

(4,682

)

(13,135

)

(9,689

)

Non-GAAP net income

$

98,640

$

88,212

$

203,302

$

158,201

GAAP diluted earnings (loss) per share

$

(0.04

)

$

0.10

$

(0.07

)

$

0.14

GAAP weighted-average shares

outstanding—diluted

486,310

496,987

485,256

497,449

Non-GAAP diluted earnings per share

$

0.20

$

0.18

$

0.41

$

0.32

Non-GAAP weighted-average shares used in

computing Non-GAAP earnings per share, diluted (1)

499,155

496,987

499,477

497,449

_________________________

(1) Includes an additional 12.8 million

and 14.2 million of dilutive securities for the three and six

months ended June 30, 2022, respectively, which are not included in

GAAP diluted weighted-average shares outstanding due to the

Company's net loss position for the three and six months ended June

30, 2022.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220809005736/en/

Investors Jake Graves Manager, Investor Relations The

Trade Desk ir@thetradedesk.com 312-620-0806

Media Melinda Zurich VP, Communications The Trade Desk

melinda.zurich@thetradedesk.com 201-320-9398

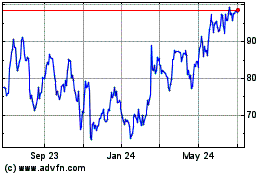

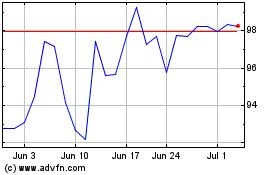

The Trade Desk (NASDAQ:TTD)

Historical Stock Chart

From Oct 2024 to Nov 2024

The Trade Desk (NASDAQ:TTD)

Historical Stock Chart

From Nov 2023 to Nov 2024