Synlogic, Inc. (Nasdaq: SYBX), a clinical-stage biotechnology

company advancing novel, oral, non-systemically absorbed

biotherapeutics to transform the care of serious diseases, today

reported financial results for the second quarter ended June 30,

2023, and provided an update on its pipeline programs.

“With our pivotal Phase 3 study, Synpheny-3, now underway, we

are focused on trial execution and ensuring access, inclusion and

an optimal experience for the patients who participate in this

landmark study of a potential breakthrough in the management of

PKU,” said Aoife Brennan, M.B. Ch.B., Synlogic President and

Chief Executive Officer. “We were also pleased to share important

regulatory milestones for the product candidate this quarter,

including receipt of the FDA’s Fast Track designation, reenforcing

the great medical need for this investigational medicine, and the

World Health Organization (WHO)’s approval of the international

non-proprietary name (INN) for SYNB1934: labafenogene

marselecobac.”

Second Quarter 2023 and Recent Business

Highlights

- Announced initiation of Synpheny-3,

the global, pivotal Phase 3 study of efficacy and safety of

labafenogene marselecobac (previously known as SYNB1934), as a

treatment for patients with PKU (n=150)

- Received Fast Track designation from

the U.S. Food and Drug Administration (FDA) for

labafenogene marselecobac as a potential treatment for PKU

- WHO acceptance of the international

non-proprietary name (INN) of labafenogene marselecobac for the

drug candidate previously known as SYNB1934

- Presented data

from multiple programs at 2023 Synthetic Biology: Engineering,

Evolution & Design (SEED) conference

Second Quarter 2023 Financial Results and Financial

Outlook

As of June 30, 2023, Synlogic had cash and cash equivalents of

$46.3 million.

Revenue for the three months ended June 30, 2023 was $35

thousand compared to $152 thousand for the corresponding period in

2022. Revenue in both periods was primarily associated with the

ongoing research collaboration with Roche for the discovery of a

novel Synthetic Biotic for the treatment of inflammatory bowel

disease.

For the three months ended June 30, 2023, Synlogic reported a

consolidated net loss of $15.0 million, or $0.21 per share,

compared to a consolidated net loss of $15.8 million, or $0.22 per

share, for the corresponding period in 2022.

Research and development expenses were $11.8 million for the

three months ended June 30, 2023, compared to $12.1 million for the

corresponding period in 2022.

General and administrative expenses were $3.9 million for the

three months ended June 30, 2023, compared to $4.1 million for the

corresponding period in 2022.

Based upon its current operating plan and balance sheet as of

June 30, 2023, Synlogic expects to have sufficient cash to be able

to fund operations further into the second half of 2024.

Investor Conference Participation

Synlogic leadership will participate in The H.C. Wainwright

Global Investment Conference, being held September 11-13, 2023

in-person in New York City. Participation will include both

investor meetings and a company presentation. A live webcast of the

presentation, if available, will be accessible under the “Event

Calendar” in the Investors & Media section of the Synlogic

website. An archived version will be available afterwards at the

same location.

About Synlogic

Synlogic is a clinical-stage biotechnology company advancing

novel, oral, non-systemically absorbed biotherapeutics to transform

the care of serious diseases in need of new treatment options. The

Company’s late-stage pipeline is focused on rare metabolic

diseases, led by labafenogene marselecobac (previously known as

SYNB1934), currently being studied as a potential treatment for

phenylketonuria (PKU) in Synpheny-3, a global, pivotal Phase 3

study. Additional product candidates address diseases including

homocystinuria (HCU), enteric hyperoxaluria, gout and cystinuria.

This pipeline is fueled by the Synthetic Biotic platform, which

applies precision genetic engineering to well-characterized

probiotics. This enables Synlogic to create GI-restricted, oral

medicines designed to consume or modify disease-specific

metabolites – an approach well suited for PKU and HCU, both inborn

errors of metabolism, as well as other disorders in which the

disease–specific metabolites transit through the GI tract,

providing validated targets for these Synthetic Biotics. Research

activities include a partnership with Roche focused on inflammatory

bowel disease (IBD), and a collaboration with Ginkgo Bioworks in

synthetic biology, which has contributed to two pipeline programs

to date. For more information, please visit www.synlogictx.com or

follow us on Twitter, LinkedIn, Facebook or Instagram.

Forward Looking

Statements

This press release contains "forward-looking statements" that

involve substantial risks and uncertainties for purposes of the

safe harbor provided by the Private Securities Litigation Reform

Act of 1995. All statements, other than statements of historical

facts, included in this press release regarding strategy, future

operations, clinical development plans, future financial position,

future revenue, projected expenses, prospects, plans and objectives

of management are forward-looking statements. In addition, when or

if used in this press release, the words "may," "could," "should,"

"anticipate," "believe," "look forward, " "estimate," "expect,"

“focused on,” "intend," "on track, " "plan," "predict" and similar

expressions and their variants, as they relate to Synlogic,

may identify forward-looking statements. Examples of

forward-looking statements, include, but are not limited to,

statements regarding the potential of Synlogic's approach

to Synthetic Biotics to develop therapeutics to address a wide

range of diseases including: inborn errors of metabolism and

inflammatory and immune disorders; our expectations about

sufficiency of our existing cash balance; the future clinical

development of Synthetic Biotics; the

approach Synlogic is taking to discover and develop novel

therapeutics using synthetic biology; and the expected timing

of Synlogic's clinical trials of labafenogene

marselecobac (previously known as SYNB1934), SYNB1353, SYNB8802 and

SYNB2081 and availability of clinical trial data. Actual results

could differ materially from those contained in any forward-looking

statements as a result of various factors, including: the

uncertainties inherent in the clinical and preclinical development

process; the ability of Synlogic to protect its

intellectual property rights; and legislative, regulatory,

political and economic developments, as well as those risks

identified under the heading "Risk Factors"

in Synlogic's filings with the U.S. Securities and

Exchange Commission. The forward-looking statements contained in

this press release reflect Synlogic's current views with

respect to future events. Synlogic anticipates that

subsequent events and developments will cause its views to change.

However, while Synlogic may elect to update these

forward-looking statements in the

future, Synlogic specifically disclaims any obligation to

do so. These forward-looking statements should not be relied upon

as representing Synlogic's view as of any date subsequent

to the date hereof.

| |

| Synlogic,

Inc. |

| Condensed

Consolidated Statements of Operations |

| (unaudited) |

|

|

|

|

|

|

|

|

|

|

(in thousands, except share and per share data) |

Three Months Ended June 30 |

|

Six Months Ended June 30 |

| |

2023 |

|

2022 |

|

2023 |

|

2022 |

| |

|

|

|

|

|

|

|

|

Revenue |

$ |

35 |

|

|

$ |

152 |

|

|

$ |

209 |

|

|

$ |

396 |

|

| |

|

|

|

|

|

|

|

|

Operating expenses |

|

|

|

|

|

|

|

|

Research and development |

|

11,765 |

|

|

|

12,057 |

|

|

|

24,215 |

|

|

|

23,795 |

|

|

General and administrative |

|

3,924 |

|

|

|

4,112 |

|

|

|

7,891 |

|

|

|

8,383 |

|

|

Total operating expenses |

|

15,689 |

|

|

|

16,169 |

|

|

|

32,106 |

|

|

|

32,178 |

|

|

Loss from operations |

|

(15,654 |

) |

|

|

(16,017 |

) |

|

|

(31,897 |

) |

|

|

(31,782 |

) |

|

Other income, net |

|

615 |

|

|

|

175 |

|

|

|

1,236 |

|

|

|

243 |

|

|

Loss before income taxes |

|

(15,039 |

) |

|

|

(15,842 |

) |

|

|

(30,661 |

) |

|

|

(31,539 |

) |

|

Income tax expense |

|

(9 |

) |

|

|

- |

|

|

|

(9 |

) |

|

|

- |

|

|

Net loss |

$ |

(15,048 |

) |

|

$ |

(15,842 |

) |

|

$ |

(30,670 |

) |

|

$ |

(31,539 |

) |

| |

|

|

|

|

|

|

|

|

Net loss per share - basic and diluted |

$ |

(0.21 |

) |

|

$ |

(0.22 |

) |

|

$ |

(0.44 |

) |

|

$ |

(0.44 |

) |

|

Weighted-average common shares used in computing net loss per share

- basic and diluted |

|

70,219,442 |

|

|

|

72,106,224 |

|

|

|

69,651,392 |

|

|

|

72,038,460 |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

| Synlogic,

Inc. |

| Condensed

Consolidated Balance Sheets |

| (unaudited) |

|

(in thousands, except share data) |

|

|

|

|

|

June 30, 2023 |

|

December 31, 2022 |

|

Assets |

|

|

|

|

Cash, cash equivalents & marketable securities |

$ |

46,261 |

|

|

$ |

77,629 |

|

|

Property and equipment, net |

|

6,398 |

|

|

|

7,323 |

|

|

Other assets |

|

26,625 |

|

|

|

25,913 |

|

|

Total assets |

$ |

79,284 |

|

|

$ |

110,865 |

|

|

|

|

|

|

|

Liabilities and stockholders' equity |

|

|

|

|

Current liabilities |

$ |

9,632 |

|

|

$ |

12,122 |

|

|

Long-term liabilities |

|

14,878 |

|

|

|

16,133 |

|

|

Total liabilities |

|

24,510 |

|

|

|

28,255 |

|

|

Total stockholders' equity |

|

54,774 |

|

|

|

82,610 |

|

|

|

|

|

|

|

Total liabilities and stockholders' equity |

$ |

79,284 |

|

|

$ |

110,865 |

|

|

|

|

|

|

|

Common stock and common stock equivalents |

|

|

|

|

Common stock |

|

68,613,862 |

|

|

|

66,736,251 |

|

|

Common stock warrants (pre-funded) |

|

2,548,117 |

|

|

|

2,548,117 |

|

| Total common stock |

|

71,161,979 |

|

|

|

69,284,368 |

|

|

|

|

|

|

|

|

|

|

Media Contact: media@synlogictx.com

Investor Relations: investor@synlogictx.com

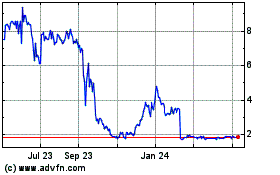

Synlogic (NASDAQ:SYBX)

Historical Stock Chart

From Oct 2024 to Nov 2024

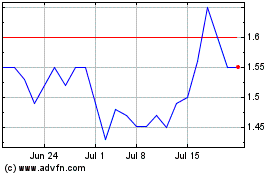

Synlogic (NASDAQ:SYBX)

Historical Stock Chart

From Nov 2023 to Nov 2024