As

filed with the Securities and Exchange Commission on February 5, 2024

Registration

No. 333-______________

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

S- 8

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

SURGEPAYS,

INC.

(Exact

name of registrant as specified in charter)

| Nevada |

|

98-0550352 |

(State

or Other Jurisdiction of

Incorporation

or Organization) |

|

(IRS

Employer

Identification

No.) |

| |

|

|

3124

Brother Blvd, Suite 410

Bartlett,

TN |

|

38133 |

| (Address

of Principal Executive Offices) |

|

(Zip

Code) |

| 2022

Omnibus Securities and Incentive Plan |

| (Full

Title of the Plan) |

Kevin

Brian Cox, Chief Executive Officer

Anthony

Evers, Chief Financial Office

SurgePays,

Inc.

3124

Brother Blvd, Suite 410

Bartlett,

TN 38133

(Name

and Address of Agent For Service)

(901)-302-9587

Telephone

Number, Including Area Code of Agent For Service.

Copy

to:

Barry

I. Grossman, Esq.

Sarah

Williams, Esq.

Ellenoff

Grossman & Schole LLP

1345

Avenue of the Americas, 11th Floor

New

York, New York 10105

Telephone:

(212) 370-1300

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large

accelerated filer |

☐ |

|

Accelerated

filer |

☐ |

| Non-accelerated

filer |

☒ |

|

Smaller

reporting company |

☒ |

| |

|

Emerging

growth company |

☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

Explanatory

Note

This

Registration Statement is being filed by the Registrant relating to 4,928,320 shares of our common stock which may be offered and sold

pursuant to our 2022 Omnibus Securities and Incentive Plan and the provisions included therein.

This

Registration Statement includes, pursuant to General Instruction E to Form S-8 and Rule 429 of the Securities Act, a re-offer prospectus

in Part I (the “Reoffer Prospectus”). The Reoffer Prospectus may be utilized for reofferings and resales by certain executive

officers and directors listed in the Reoffer Prospectus who may be deemed “affiliates” of the Company on a continuous or

a delayed basis in the future of up to 4,928,320 shares of Common Stock. These shares constitute “control securities” or

“restricted securities” which have been issued prior to or issuable after the filing of this Registration Statement. The

Reoffer Prospectus does not contain all of the information included in the Registration Statement, certain items of which are contained

in schedules and exhibits to the Registration Statement, as permitted by the rules and regulations of the SEC. Statements contained in

this Reoffer Prospectus as to the contents of any agreement, instrument or other document referred to are not necessarily complete. With

respect to each such agreement, instrument or other document filed as an exhibit to the Registration Statement, we refer you to the exhibit

for a more complete description of the matter involved, and each such statement shall be deemed qualified in its entirety by this reference.

PART

I

INFORMATION

REQUIRED IN THE SECTION 10(a) PROSPECTUS

SurgePays,

Inc., a Nevada corporation (the “Company”, “us”, “our” or “we”), has prepared this Registration

Statement on Form S-8 (the “Registration Statement”) in accordance with the requirements of Form S-8 under the Securities

Act of 1933, as amended (the “Securities Act”), to register 4,928,320 shares of our common stock, par value $0.001 per share

(the “Common Stock”), which may be offered and sold pursuant to the 2022 Omnibus Securities and Incentive Plan (the “2022

Plan”) and the provisions included therein, and to file a prospectus, prepared in accordance with the requirements of Part I of

Form S-3 and, pursuant to General Instruction C of Form S-8, to be used for reoffers and resales of Common Stock acquired by persons

to be named therein upon the exercise of options and restricted share awards granted under the 2022 Plan.

Pursuant

to the Note to Part I on Form S-8, the documents containing the information specified in Part I of this Registration Statement will be

sent or given to plan participants specified by Rule 428(b)(1) of the Securities Act. Such documents are not required to be filed, and

are not filed, with the United States Securities and Exchange Commission either as part of this Registration Statement or as prospectuses

or prospectus supplements pursuant to Rule 424 of the Securities Act. These documents and the documents incorporated by reference in

this Registration Statement pursuant to Item 3 of Part II of this Form S-8, taken together, constitute a prospectus that meets the requirements

of Section 10(a) of the Securities Act.

REOFFER

PROSPECTUS

SurgePays,

Inc.

Up

to 4,928,320 shares of Common Stock under the 2022 Omnibus Securities and Incentive Plan

This

prospectus relates to the resale of up to 4,928,320 shares (the “Shares”) of common stock, par value $0.001 per share (the

“Common Stock”), of SurgePays, Inc., a Nevada corporation (the “Company”, “us”, “our”

or “we”), which may be offered and sold from time to time by certain stockholders of the Company (the “Selling Stockholders”)

who have acquired or will acquire such Shares in connection with the exercise of stock options granted, and with stock or other awards

made, and with the purchase of stock under, the Company’s 2022 Omnibus Securities and Incentive Plan (the “2022 Plan). The

2022 Plan is intended to provide incentives which will attract, retain, and motivate highly competent persons such as officers, employees,

directors, and consultants to our Company by providing them opportunities to acquire shares of our Common Stock. Additionally, the 2022

Plan is intended to assist in further aligning the interests of our officers, employees, directors and consultants to those of the Company’s

other stockholders.

The

persons who are issued such Shares may include our directors, officers, employees and consultants, certain of whom may be considered

our “affiliates”. Such persons may, but are not required to, sell the Shares they acquire pursuant to this prospectus. If

any additional awards are issued to or shares are purchased by affiliates under the 2022 Plan we will file with the Securities and Exchange

Commission (the “Commission”) an update to this prospectus naming such person as a selling shareholder and indicating the

number of shares such person is offering pursuant to the prospectus. See “Selling Stockholders” on page 12 of this prospectus.

Our Common Stock and warrants are listed on The NASDAQ Capital Market under the symbols “SURG” and “SURGW”. On

February 1, 2024, the closing price of the Common Stock on The NASDAQ Capital Market was $7.34 per share.

We

will not receive any of the proceeds from sales of the Shares by any of the Selling Stockholders. The Shares may be offered from time

to time by any or all of the Selling Stockholders through ordinary brokerage transactions, in negotiated transactions or in other transactions,

at such prices as such Selling Stockholder may determine, which may relate to market prices prevailing at the time of sale or be a negotiated

price. See “Plan of Distribution.” Sales may be made through brokers or to dealers, who are expected to receive customary

commissions or discounts. We are paying all expenses of registration incurred in connection with this offering but the Selling Stockholders

will pay all brokerage commissions and other selling expenses.

The

Selling Stockholders and participating brokers and dealers may be deemed to be “underwriters” within the meaning of the Securities

Act, in which event any profit on the sale of shares of those Selling Stockholders and any commissions or discounts received by those

brokers or dealers may be deemed to be underwriting compensation under the Securities Act.

SEE

“RISK FACTORS” BEGINNING ON PAGE 12 OF THIS PROSPECTUS FOR A DISCUSSION OF CERTAIN RISKS AND OTHER FACTORS THAT YOU SHOULD

CONSIDER BEFORE PURCHASING OUR COMMON STOCK.

Neither

the Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is

truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this prospectus is February 5, 2024.

TABLE

OF CONTENTS

You

should rely only on the information contained in or incorporated by reference into this prospectus or any prospectus supplement. We have

not authorized any person to give any information or to make any representations other than those contained or incorporated by reference

in this prospectus, and, if given or made, you must not rely upon such information or representations as having been authorized. This

prospectus does not constitute an offer to sell or the solicitation of an offer to buy any securities other than our shares of common

stock described in this prospectus or an offer to sell or the solicitation to buy such securities in any circumstances in which such

offer or solicitation is unlawful. You should not assume that the information we have included in this prospectus is accurate as of any

date other than the date of this prospectus or that any information we have incorporated by reference is accurate as of any date other

than the date of the document incorporated by reference regardless of the time of delivery of this prospectus or of any securities registered

hereunder.

WHERE

YOU CAN FIND MORE INFORMATION

The

Company is subject to the information requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

and, in accordance therewith, files reports, proxy statements and other information with the Commission. We are required to file electronic

versions of those materials with the Commission through the Commission’s EDGAR system. The Commission maintains an Internet site

at http://www.sec.gov, which contains reports, proxy and information statements and other information regarding registrants that file

electronically with the Commission. You can read and copy the reports, proxy statements and other information filed by the Company with

the Commission at such Internet site.

This

prospectus constitutes part of a Registration Statement on Form S-8 filed on the date hereof (herein, together with all amendments and

exhibits, referred to as the “Registration Statement”) by the Company with the Commission under the Securities Act. This

prospectus does not contain all of the information set forth in the Registration Statement, certain parts of which we have omitted, in

accordance with the rules and regulations of the Commission. You should refer to the full Registration Statement for further information

with respect to the Company and our Common Stock.

Statements

contained herein concerning the provisions of any contract, agreement or other document are not necessarily complete, and in each instance

reference is made to the copy of such contract, agreement or other document filed as an exhibit to the Registration Statement or otherwise

filed with the Commission. Each such statement is qualified in its entirety by such reference. Copies of the Registration Statement together

with exhibits may be inspected at the offices of the Commission as indicated above without charge and copies thereof may be obtained

therefrom upon payment of a prescribed fee.

No

person is authorized to give any information or to make any representations, other than those contained in this prospectus, in connection

with the offering described herein, and, if given or made, such information or representations must not be relied upon as having been

authorized by the Company or any Selling Stockholder. This prospectus does not constitute an offer to sell, or a solicitation of an offer

to buy, nor shall there be any sale of these securities by any person in any jurisdiction in which it is unlawful for such person to

make such offer, solicitation or sale. Neither the delivery of this prospectus nor any sale made hereunder shall under any circumstances

create an implication that the information contained herein is correct as of any time subsequent to the date hereto.

INCORPORATION

OF CERTAIN DOCUMENTS BY REFERENCE

We

are “incorporating by reference” in this prospectus certain documents we file with the Commission, which means that we can

disclose important information to you by referring you to those documents. The information in the documents incorporated by reference

is considered to be part of this prospectus. Statements contained in documents that we file with the Commission and that are incorporated

by reference in this prospectus will automatically update and supersede information contained in this prospectus, including information

in previously filed documents or reports that have been incorporated by reference in this prospectus, to the extent the new information

differs from or is inconsistent with the old information. We have filed or may file the following documents with the Commission and they

are incorporated herein by reference as of their respective dates of filing.

| (i) |

our

Annual Report on Form 10-K for the fiscal year ended December 31, 2022, filed with the SEC on March 30, 2023; |

| |

|

| (ii) |

our

Definitive Proxy Statements on Schedule 14A filed on January 19, 2023; |

| |

|

| (iii) |

the

description of our common stock, par value $0.001 per share (the “Common Stock”) and warrants with an exercise price of $4.73

(the “Tradeable Warrants”) contained in our Registration Statement on Form 8-A, filed with the SEC on November 1, 2021, as

updated by “Description of the Registrant’s Securities Registered Pursuant to Section 12 of the Securities Exchange Act of

1934” filed as Exhibit 4.4 to our Annual Report on Form 10-K for the fiscal year ended December 31, 2021, and any amendment or

report filed for the purpose of updating such description; |

| |

|

| (iv) |

our

Quarterly Reports on Form 10-Q for the period ended March 31, 2023, filed with the SEC on May 11, 2023, for the period ended June 30,

2023, filed with the SEC on August 10, 2023, and for the period ended September 30, 2023, filed with the SEC on November 14, 2023; and |

| |

|

| (iv) |

Our

Current Reports on Form 8-K filed with the SEC on January 11, 2023, March 2, 2023, March 13, 2023, July 13, 2023, October 4, 2023, October

18, 2023, January 3, 2024, January 12, 2024 and January 22, 2024. |

All

documents that we filed with the Commission pursuant to Sections 13(a), 13(c), 14, and 15(d) of the Exchange Act subsequent to the date

of this prospectus that indicates that all securities offered under this prospectus have been sold, or that deregisters all securities

then remaining unsold, will be deemed to be incorporated in this prospectus by reference and to be a part hereof from the date of filing

of such documents.

Any

statement contained in a document incorporated or deemed to be incorporated by reference in this prospectus shall be deemed modified,

superseded or replaced for purposes of this prospectus to the extent that a statement contained in this prospectus, or in any subsequently

filed document that also is deemed to be incorporated by reference in this prospectus, modifies, supersedes or replaces such statement.

Any statement so modified, superseded or replaced shall not be deemed, except as so modified, superseded or replaced, to constitute a

part of this prospectus. None of the information that we disclose under Items 2.02 or 7.01 of any Current Report on Form 8-K or any corresponding

information, either furnished under Item 9.01 or included as an exhibit therein, that we may from time to time furnish to the Commission

will be incorporated by reference into, or otherwise included in, this prospectus, except as otherwise expressly set forth in the relevant

document. Subject to the foregoing, all information appearing in this prospectus is qualified in its entirety by the information appearing

in the documents incorporated by reference.

You

may request a free copy of any of the documents incorporated by reference in this prospectus (other than exhibits, unless they are specifically

incorporated by reference in the documents) by writing or telephoning us at the following address: 3124 Brother Blvd, Suite 410, Bartlett,

TN 38133 (Telephone: 901-302-9587).

NOTE

ON FORWARD LOOKING STATEMENTS

This

prospectus and the documents incorporated by reference herein may contain forward looking statements that involve risks and uncertainties.

All statements other than statements of historical fact contained in this prospectus and the documents incorporated by reference herein,

including statements regarding future events, our future financial performance, business strategy, and plans and objectives of management

for future operations, are forward-looking statements. We have attempted to identify forward-looking statements by terminology including

“anticipates,” “believes,” “can,” “continue,” “could,” “estimates,”

“expects,” “intends,” “may,” “plans,” “potential,” “predicts,”

“should,” or “will” or the negative of these terms or other comparable terminology. Although we do not make forward

looking statements unless we believe we have a reasonable basis for doing so, we cannot guarantee their accuracy. These statements are

only predictions and involve known and unknown risks, uncertainties and other factors, including the risks outlined under “Risk

Factors” or elsewhere in this prospectus and the documents incorporated by reference herein, which may cause our or our industry’s

actual results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. Moreover, we

operate in a highly regulated, very competitive, and rapidly changing environment. New risks emerge from time to time and it is not possible

for us to predict all risk factors, nor can we address the impact of all factors on our business or the extent to which any factor, or

combination of factors, may cause our actual results to differ materially from those contained in any forward-looking statements.

We

have based these forward-looking statements largely on our current expectations and projections about future events and financial trends

that we believe may affect our financial condition, results of operations, business strategy, short term and long term business operations,

and financial needs. These forward-looking statements are subject to certain risks and uncertainties that could cause our actual results

to differ materially from those reflected in the forward looking statements. Factors that could cause or contribute to such differences

include, but are not limited to, those discussed in this prospectus, and in particular, the risks discussed below and under the heading

“Risk Factors” and those discussed in other documents we file with the Commission. The following discussion should be read

in conjunction with the consolidated financial statements for the fiscal years ended December 31, 2022 and 2021 and notes incorporated

by reference herein. We undertake no obligation to revise or publicly release the results of any revision to these forward-looking statements,

except as required by law. In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed

in this prospectus may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking

statement.

You

should not place undue reliance on any forward-looking statement, each of which applies only as of the date of this prospectus. Except

as required by law, we undertake no obligation to update or revise publicly any of the forward-looking statements after the date of this

prospectus to conform our statements to actual results or changed expectations.

Any

forward-looking statement you read in this prospectus or any document incorporated by reference reflects our current views with respect

to future events and is subject to these and other risks, uncertainties and assumptions relating to our operations, operating results,

growth strategy and liquidity. You should not place undue reliance on these forward-looking statements because such statements speak

only as to the date when made. We assume no obligation to publicly update or revise these forward-looking statements for any reason,

or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new

information becomes available in the future, except as otherwise required by applicable law. You are advised, however, to consult any

further disclosures we make on related subjects in our reports on Forms 10-Q, 8-K and 10-K filed with the Commission. You should understand

that it is not possible to predict or identify all risk factors. Consequently, you should not consider any such list to be a complete

set of all potential risks or uncertainties.

THE

COMPANY

Overview

Business

Overview

SurgePays,

Inc., incorporated in Nevada on August 18, 2006, is a technology and telecom company focused on the underbanked and underserved communities.

SurgePhone and Torch Wireless provide subsidized mobile broadband to over 250,000 low-income subscribers nationwide. SurgePays fintech

platform empowers clerks at thousands of convenience stores to provide a suite of prepaid wireless and financial products to underbanked

customers.

About

SurgePays, Inc.

SurgePays,

Inc. is a financial technology and telecom company focused on providing these essential services to the underbanked community. The Company’s

wireless subsidiaries provide mobile broadband, voice and SMS text messaging to both subsidized and direct retail prepaid customers.

The Company’s blockchain fintech platform utilizes a suite of financial and prepaid products to convert corner stores into tech-hubs

for underbanked neighborhoods.

SurgePhone

Wireless and Torch Wireless

SurgePhone

and Torch, wholly owned subsidiaries of SurgePays, are mobile virtual network operators (MVNO) licensed by the Federal Communications

Commission (the “FCC”) to provide subsidized access to quality internet through mobile broadband services to consumers qualifying

under the federal guidelines of the Affordable Connectivity Program (the “ACP”). The ACP (the successor program, as of March

1, 2022 to the Emergency Broadband Benefit program) provides SurgePhone and Torch up to a $100 reimbursement for the cost of each tablet

device distributed and a $30 per customer, per month subsidy for mobile broadband (internet connectivity) services. SurgePhone and Torch

combined are licensed to offer subsidized mobile broadband to all fifty states.

SurgePays

Fintech (ECS Business)

We

refer to the collective operations of ECS Prepaid, LLC, a Missouri limited liability company, Electronic Check Services, Inc., a Missouri

corporation, and Central States Legal Services, Inc., a Missouri corporation, as “Surge Fintech.” This was previously referred

to as the “ECS Business.”

Surge

Fintech has been a financial technology tech and wireless top-up platform for over 15 years. Through a series of transactions between

October 2019 and January 2020, we acquired the ECS Business primarily for the favorable ACH banking relationship and a fintech transactions

platform processing over 20,000 transactions a day at approximately 8,000 independently owned convenience stores. The platform serves

as the proven backbone for wireless top-up transactions and wireless product aggregation for the SurgePays nationwide network.

Surge

Blockchain

Surge

Blockchain Software is a back-office marketplace (accessed through the SurgePays fintech portal for convenience stores) offering wholesale

consumable goods direct to convenience stores who are transacting on the SurgePays Fintech platform. The wholesale e-commerce platform

is easily accessed through the secure app interface – similar to a website. We believe what makes this sales platform unique is

that it also offers the merchant the ability to order wholesale consumable goods at a significant discount from traditional distributors

with one touch ease. We are able to sell products at a significant discount by using on demand Direct Store Delivery (DSD). Our platform

is connected directly to manufactures, who ship products direct to the store while cutting out the middleman. The goal of the SurgePays

Portal is to leverage the competitive advantage and efficiencies of e-commerce to provide as many commonly sold consumable products as

possible to convenience stores, corner markets, bodegas, and supermarkets while increasing profit margins for these stores.

LogicsIQ,

Inc.

LogicsIQ,

Inc. is a lead generation and case management solutions company primarily serving law firms in the mass tort industry. LogicsIQ’s

CRM “Intake Logics” facilitates the entire life cycle of converting a lead into a signed retainer client integrated into

the law firms case management software. Our proven strategy of delivering cost-effective retained cases to our attorney and law firm

clients means those clients are better able to manage their media and advertising budgets and reach targeted audiences more quickly and

effectively when utilizing our proprietary data driven analytics dashboards. Our ability to deliver transparent results through our integrated

Business Intelligence (B.I.) dashboards has bolstered our reputation as an industry leader in the mass tort client acquisition field.

ShockWave

CRM™

SurgePays

acquired the Software as a Service (SaaS) Customer Relationship Management (CRM) and Billing System software platform “MVNO Cloud

Services” on June 7, 2022. S Payment for the software consisted of $300,000 in cash, of which $100,000 was paid in June 2022, and

the remaining $200,000 in July 2022. Additionally, the Company issued 85,000 shares of Common Stock having a fair value of $411,400 ($4.84/share),

based upon the quoted closing trading price. SurgePays has rebranded the software as ShockWave CRM.

ShockWave

is an end-to-end cloud-based SaaS offering an Omnichannel CRM, billing system and carrier integrations specific to the telecommunication

and broadband industry. Some of these services include sales agent management, device and SIM inventory management, order processing

and provisioning, retail Point of Service (POS) activations and payments, customer service management, retention tools, billing, and

payments.

Centercom

Since

2019, we have owned a 40% equity interest in Centercom Global, S.A. de C.V. (“Centercom”). Centercom is a bilingual operations

center providing the Company with sales support, customer service, IT infrastructure design, graphic media, database programming, software

development, revenue assurance, lead generation, and other various operational back-office services. Centercom is based in El Salvador.

Competition

There

are many competitors in the prepaid wireless and mobile broadband industry. We feel what makes SurgePhone different is we are a grassroots

company with our products placed in convenience stores where the underbanked shop. We can offer prepaid wireless and financial services,

through these stores, at a lower price to customers since we own the transaction software processing the activations and top-ups.

Many

of our current and potential competitors are well established and have longer operating histories, significantly greater financial and

operational resources, and name recognition than we have. Most traditional convenience store distributors are companies that have been

in business for over 50 years and utilize the historical “manufacturing plant to truck to warehouse to truck to store” logistics

model. However, we believe that with our diverse product line, better efficiencies resulting in lower wholesale cost of goods sold, we

have the ability to obtain a large market share and continue to generate sales growth and compete in the industry. We believe, in some

cases, we will be able to partner with our competition through integration and compensate them for helping us grow due to the uniqueness

of the suite of products we offer and the additional revenue stores can unlock. The principal competitive factors in all our product

markets are technical features, quality, availability, price, customer support, and distribution coverage. The relative importance of

each of these factors varies depending on the region. We believe using our direct store distribution model nationwide will open significant

opportunities for growth.

The

markets in which we operate can be generally categorized as highly competitive. In order to maximize our competitive advantages, we continue

to expand our product portfolio to capitalize on market trends, changes in technology and new product releases. Based on available data

for our served markets, we estimate that our market share of the convenience store sales business at this time is less than 1%. A substantial

acquisition would be necessary to meaningfully and rapidly change our market share percentage.

Distributors

generally do not have a broad set of product and service offerings or capabilities, and no single distributor currently provides all

the top selling consumables while offering products and services to enhance the lifestyle of the underbanked such as prepaid wireless,

gift cards, bill payment and reloadable debit cards. We believe this creates a significant opportunity for a dynamic paradigm shift to

a nationwide wholesale e-commerce platform.

Corporate

Information

We

were previously known as North American Energy Resources, Inc. and KSIX Media Holdings, Inc. Prior to April 27, 2015, we operated solely

as an independent oil and natural gas company engaged in the acquisition, exploration and development of oil and natural gas properties

and the production of oil and natural gas through its wholly owned subsidiary, NAER. On April 27, 2015, NAER entered into a Share Exchange

Agreement with KSIX Media whereby KSIX Media became a wholly-owned subsidiary of NAER and which resulted in the shareholders of KSIX

Media owning approximately 90% of the voting stock of the surviving entity. While we continued the oil and gas operations of NAER following

this transaction, on August 4, 2015, we changed its name to KSIX Media Holdings, Inc. On December 21, 2017, we changed its name to Surge

Holdings, Inc. to better reflect the diversity of its business operations. We changed its name to SurgePays, Inc. on October 29, 2020.

Historically,

we operated through these direct and indirect subsidiaries: (i) KSIX Media, Inc., incorporated in Nevada on November 5, 2014; (ii) KSIX,

LLC, a Nevada limited liability company that was formed on September 14, 2011; (iii) Surge Blockchain, LLC, formerly Blvd. Media Group,

LLC, a Nevada limited liability company that was formed on January 29, 2009; (iv) DigitizeIQ, LLC an Illinois limited liability company

that was formed on July 23, 2014; (v) Surge Cryptocurrency Mining, Inc., formerly North American Exploration, Inc., a Nevada corporation

that was incorporated on August 18, 2006 (this has been a dormant entity that does not own any assets since January 1, 2019); (vi) LogicsIQ,

Inc., a Nevada corporation that was formed on October 2, 2018; (vii) True Wireless, Inc., an Oklahoma corporation (formerly True Wireless,

LLC); (viii) Surge Payments, LLC, a Nevada limited liability company; (ix) Surgephone Wireless, LLC, a Nevada limited liability company;

and (x) SurgePays Fintech, Inc., a Nevada limited liability company. On January 22, 2021, the issued and outstanding equity securities

of DigitizeIQ, LLC and KSIX, LLC were transferred to LogicsIQ and became wholly-owned subsidiaries of LogicsIQ.

On

May 7, 2021, the Company disposed of its subsidiary True Wireless, Inc., however we retained $1,097,659 in liabilities which consisted

of $1,077,659 in accounts payable and accrued expenses as well as $20,000 in related party loans. The balance at December 31, 2022 was

$668,649. In connection with the sale, the Company received an unsecured note receivable for $176,851, bearing interest at 0.6%, with

a default interest rate of 10%. Starting in June 2023, the Company was scheduled to receive what will ultimately be 25 payments of principal

and accrued interest of $7,461 per month. However, as of August 30, 2023, the Company has not received any payments.

On

January 30, 2020, the Company acquired ECS Prepaid, LLC, a Missouri limited liability company, Electronic Check Services, Inc., a Missouri

corporation, and Central States Legal Services, Inc., a Missouri corporation.

On

January 1, 2022, the Company acquired 100% of Torch Wireless, LLC resulting in Torch becoming a wholly-owned subsidiary, in a transaction

accounted for as a business combination. The Company paid $800,000 and agreed to pay the Sellers monthly residual payments for customers

enrolled by the Company through December 31, 2022 of either $2 or $3 per customer. This amount totaled $1,679,723.

Our

executive offices are located at 3124 Brother Blvd, Suite 410, Bartlett, TN 38133, and our telephone number is (800) 760-9689. Our website

is www.surgepays.com. Our website and the information contained in, or accessible through, our website will not be deemed to be incorporated

by reference into this prospectus and does not constitute part of this prospectus.

Employees

As

of January 29, 2024, our human capital resources consist of twenty (20) employees and approximately eight (8) independent contractors.

Historically all salaries have been consolidated under SurgePays while contractor expenses are paid by the appropriate subsidiary. Since

January 1, 2021, all salaries are allocated to the appropriate subsidiary.

We

believe that our future success will depend in part on our continued ability to attract, hire and retain qualified personnel. Our human

capital resources objectives include, as applicable, identifying, recruiting, retaining, incentivizing and integrating our existing and

new employees, advisors and consultants. The principal purposes of our equity and cash incentive plans are to attract, retain and reward

personnel through the granting of stock-based and cash-based compensation awards, in order to increase stockholder value and the success

of our company by motivating such individuals to perform to the best of their abilities and achieve our objectives.

Other

We

were incorporated in Nevada on August 18, 2006. Our principal executive offices are located at 3124 Brother Blvd, Suite 410, Bartlett,

TN, 38133; our telephone number is (901)-302-9587 and our Internet website address is https://ir.surgepays.com/. We make available free

of charge on or through our Internet website our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form

8-K, proxy statements on Schedule 14A, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange

Act as soon as reasonably practicable after we electronically file such materials with, or furnish them to, the Securities and Exchange

Commission (the “SEC”). Alternatively, you may also access our reports at the SEC’s website at www.sec.gov.

RISK

FACTORS

Investing

in our securities involves a high degree of risk. Before deciding whether to invest in our securities, you should carefully consider

the risk factors we describe in any prospectus supplement and in any related free writing prospectus for a specific offering of securities,

as well as those incorporated by reference into this prospectus and any prospectus supplement. You should also carefully consider other

information contained and incorporated by reference in this prospectus and any applicable prospectus supplement, including our financial

statements and the related notes thereto incorporated by reference in this prospectus. The risks and uncertainties described in the applicable

prospectus supplement and our other filings with the SEC incorporated by reference herein are not the only ones we face. Additional risks

and uncertainties not presently known to us or that we currently consider immaterial may also adversely affect us. If any of the described

risks occur, our business, financial condition or results of operations could be materially harmed. In such case, the value of our securities

could decline and you may lose all or part of your investment.

SELLING

STOCKHOLDERS

The

following table sets forth (a) the name and position or positions with the Company of each Selling Stockholder; (b) the aggregate of

(i) the number of shares of Common Stock held by each Selling Stockholder as of the date of this prospectus and (ii) the number of shares

issuable upon exercise of options granted to each Selling Stockholder under the 2022 Plan that are being registered pursuant to this

Registration Statement for resale by each Selling Stockholder as of the date of this prospectus; (c) the number of shares of Common Stock

that each Selling Stockholder may offer for sale from time to time pursuant to this prospectus, whether or not such Selling Stockholder

has a present intention to do so; and (d) the number of shares of Common Stock to be owned by each Selling Stockholder following the

sale of all shares that may be so offered pursuant to this prospectus, assuming no other change in ownership of Common Stock by such

Selling Stockholder after the date of this prospectus. Unless otherwise indicated, beneficial ownership is direct and the person indicated

has sole voting and investment power.

Inclusion

of an individual’s name in the table below does not constitute an admission that such individual is an “affiliate”

of the Company.

| Selling Stockholder | |

Principal Position with the Company (1) | |

Shares Owned Prior to

Resale (2) | | |

Number of Shares Offered for Resale | | |

Shares Beneficially Owned After Resale (5) | |

| | |

| |

Number | | |

Percent | | |

| | |

Number | | |

Percent | |

| Keving Brian Cox (3) | |

Chief Executive Officer and Chairman of the Board | |

| 7,953,760 | | |

| 32.2 | % | |

| 2,500,000 | | |

| 5,453,760 | | |

| 28.0 | % |

| Anthony Evers (4) | |

Chief Financial Officer | |

| 624,275 | | |

| * | % | |

| 600,000 | | |

| 24,275 | | |

| * | % |

| David N. Keys (5) | |

Director | |

| 49,404 | | |

| * | % | |

| 32,000 | | |

| 17,404 | | |

| * | % |

| Laurie Weisberg | |

Director | |

| 24,000 | | |

| * | % | |

| 24,000 | | |

| - | | |

| * | % |

| Richard Schurfeld (6) | |

Director | |

| 66,201 | | |

| * | % | |

| 24,000 | | |

| 42,201 | | |

| * | % |

| David May (7) | |

Director | |

| 197,694 | | |

| 1.1 | % | |

| 15,000 | | |

| 182,694 | | |

| 1.1 | % |

*

Less than 1%.

| (1) |

All

positions described are with the Company, unless otherwise indicated. |

| |

|

| (2) |

The

number of shares owned prior to resale by each Selling Stockholder includes (i) shares of Common Stock and (ii) restricted stock

agreements granted to such Selling Stockholders under the 2022 Plan, including restricted stock agreements that have not vested as

of the date of this prospectus, that are being registered pursuant to this prospectus for resale. Some of these shares may have been

sold prior to the date of this prospectus. |

| |

|

| (3) |

Includes

(i) 4,569,384 shares owned by BLC Family Investments, (ii) 561,758 shares owned by SMDMM, LLC, a Tennessee liability company, (iii)

270,745 shares owned by BC Family Holdings (Mr. Cox is a beneficial owner of all three entities), (iii) 51,873 shares of Common Stock

that Mr. Cox owns directly in a brokerage account and (iv) 2,500,000 restricted stock agreements granted to Mr. Cox pursuant to his

employment agreement, entered into with the Company on December 27, 2023, which remain subject to vesting milestones outlined in

such employment agreement. |

| |

|

| (4) |

Includes

600,000 restricted stock agreements granted to Mr. Evers pursuant to his employment agreement, entered into with the Company on November

11, 2023, which remain subject to vesting milestones outlined in such employment agreement |

| |

|

| (5) |

Includes

(i) 1,666 shares held in an IRA owned by Mr. Keys’ wife, however, Mr. Keys shares investing and dipositive power over these

holdings, (ii) 5,378 shares in total held by two different IRAs owned by Mr. Keys and (iii) 10,000 shares are held by PCC Holdings

LLC. Mr. Keys shares investing and dispositive power over these holdings. |

| |

|

| (6) |

Includes

(i) 30,200 shares owned directly by Mr. Schurfeld; (ii) 957 shares held in Mr. Schurfeld’s IRA; (iii) 11,044 shares held in

Mr. Schurfeld’s 401(K). |

| |

|

| (7) |

Includes

41,750 shares held by XIV, LLC. Mr. May has investing and dispositive power of the shares held by XIV, LLC. |

| |

|

| (8) |

Percentage

is computed with reference to 16,962,478 shares of our Common Stock outstanding as of January 29, 2024 and assumes for each Selling

Stockholder the sale of all shares offered by that particular Selling Stockholder under this prospectus. |

The

Company may supplement this prospectus from time to time as required by the rules of the Commission to include certain information concerning

the security ownership of the Selling Stockholders or any new Selling Stockholders, the number of securities offered for resale and the

position, office or other material relationship which a Selling Stockholder has had within the past three years with the Company or any

of its predecessors or affiliates.

USE

OF PROCEEDS

We

will not receive any proceeds from the resale of our Common Stock by the Selling Stockholders pursuant to this prospectus. However, we

will receive the exercise price of any Common Stock issued to the Selling Stockholders upon cash exercise by them of their options. We

would expect to use these proceeds, if any, for general working capital purposes. We have agreed to pay the expenses of registration

of these shares.

PLAN

OF DISTRIBUTION

In

this section of the prospectus, the term “Selling Stockholder” means and includes:

| ● |

the

persons identified in the table above as the Selling Stockholders; |

| |

|

| ● |

those

persons whose identities are not known as of the date hereof but may in the future be eligible to receive options under the 2022

Plan; and |

| |

|

| ● |

any

of the donees, pledgees, distributees, transferees or other successors in interest of those persons referenced above who may: (a)

receive any of the shares of our common stock offered hereby after the date of this prospectus and (b) offer or sell those shares

hereunder. |

The

shares of our Common Stock offered by this prospectus may be sold from time to time directly by the Selling Stockholders. Alternatively,

the Selling Stockholders may from time to time offer such shares through underwriters, brokers, dealers, agents or other intermediaries.

The Selling Stockholders as of the date of this prospectus have advised us that there were no underwriting or distribution arrangements

entered into with respect to the Common Stock offered hereby. The distribution of the Common Stock by the Selling Stockholders may be

effected: in one or more transactions that may take place on The NASDAQ Capital Market (including one or more block transaction) through

customary brokerage channels, either through brokers acting as agents for the Selling Stockholders, or through market makers, dealers

or underwriters acting as principals who may resell these shares on The NASDAQ Capital Market; in privately-negotiated sales; by a combination

of such methods; or by other means. These transactions may be effected at market prices prevailing at the time of sale, at prices related

to such prevailing market prices or at other negotiated prices. Usual and customary or specifically negotiated brokerage fees or commissions

may be paid by the Selling Stockholders in connection with sales of our Common Stock.

The

Selling Stockholders may enter into hedging transactions with broker-dealers in connection with distributions of the shares or otherwise.

In such transactions, broker-dealers may engage in short sales of the shares of our Common Stock in the course of hedging the positions

they assume with the Selling Stockholders. The Selling Stockholders also may sell shares short and redeliver the shares to close out

such short positions. The Selling Stockholders may enter into option or other transactions with broker-dealers which require the delivery

to the broker-dealer of shares of our Common Stock. The broker-dealer may then resell or otherwise transfer such shares of Common Stock

pursuant to this prospectus.

The

Selling Stockholders also may lend or pledge shares of our Common Stock to a broker-dealer. The broker-dealer may sell the shares of

Common Stock so lent, or upon a default the broker-dealer may sell the pledged shares of Common Stock pursuant to this prospectus. Any

securities covered by this prospectus which qualify for sale pursuant to Rule 144 may be sold under Rule 144 rather than pursuant to

this prospectus.

The

Selling Stockholders have advised us that they have not entered into any agreements, understandings or arrangements with any underwriters

or broker-dealers regarding the sale of their securities. There is no underwriter or coordinating broker acting in connection with the

proposed sale of shares of Common Stock the Selling Stockholders.

Although

the shares of Common Stock covered by this prospectus are not currently being underwritten, the Selling Stockholders or their underwriters,

brokers, dealers or other agents or other intermediaries, if any, that may participate with the selling security holders in any offering

or distribution of Common Stock may be deemed “underwriters” within the meaning of the Securities Act and any profits realized

or commissions received by them may be deemed underwriting compensation thereunder.

Under

applicable rules and regulations under the Exchange Act, any person engaged in a distribution of shares of the Common Stock offered hereby

may not simultaneously engage in market making activities with respect to the Common Stock for a period of up to five days preceding

such distribution. The Selling Stockholders will be subject to the applicable provisions of the Exchange Act and the rules and regulations

promulgated thereunder, including without limitation Regulation M, which provisions may limit the timing of purchases and sales by the

Selling Stockholders.

In

order to comply with certain state securities or blue sky laws and regulations, if applicable, the Common Stock offered hereby will be

sold in such jurisdictions only through registered or licensed brokers or dealers. In certain states, the Common Stock may not be sold

unless they are registered or qualified for sale in such state, or unless an exemption from registration or qualification is available

and is obtained.

We

will bear all costs, expenses and fees in connection with the registration of the Common Stock offered hereby. However, the Selling Stockholders

will bear any brokerage or underwriting commissions and similar selling expenses, if any, attributable to the sale of the shares of Common

Stock offered pursuant to this prospectus. We have agreed to indemnify the Selling Stockholders against certain liabilities, including

liabilities under the Securities Act, or to contribute to payments to which any of those security holders may be required to make in

respect thereof.

There

can be no assurance that the Selling Stockholders will sell any or all of the securities offered by them hereby.

LEGAL

MATTERS

The

validity of the securities being offered herein has been passed upon for us by Ellenoff Grossman & Schole LLP, New York, New York.

EXPERTS

The

consolidated financial statements of SurgePays, Inc. and subsidiaries as of December 31, 2022 and 2021, and for each of the years in

the two-year period ended December 31, 2022, have been included in the registration statement in reliance upon the report of Rodefer

Moss & Co, PLLC, independent registered public accounting firm, and upon the authority of said firm as experts in accounting and

auditing.

DISCLOSURE

OF COMMISSION POSITION ON

INDEMNIFICATION

FOR SECURITIES LAWS VIOLATIONS

Our

directors and officers are indemnified as provided by the Nevada Revised Statutes and our Bylaws. These provisions provide that we shall

indemnify a director or former director against all expenses incurred by him by reason of him acting in that position. The directors

may also cause us to indemnify an officer, employee or agent in the same fashion.

Insofar

as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons

of Registrant pursuant to the foregoing provisions, or otherwise, we have been advised that, in the opinion of the Securities and Exchange

Commission, such indemnification is against public policy as expressed in the Securities Act of 1933 and is, therefore, unenforceable.

You

should rely only on the information contained in this document. We have not authorized anyone to provide you with information that is

different. This document may only be used where it is legal to sell these securities. The information in this document may only be accurate

on the date of this document.

Additional

risks and uncertainties not presently known or that are currently deemed immaterial may also impair our business operations. The risks

and uncertainties described in this document and other risks and uncertainties which we may face in the future will have a greater impact

on those who purchase our common stock. These purchasers will purchase our common stock at the market price or at a privately negotiated

price and will run the risk of losing their entire investment.

SurgePays,

INC.

Up

to 4,928,320 Shares of

Common

Stock

PROSPECTUS

February

5, 2024

PART

II

INFORMATION

NOT REQUIRED IN PROSPECTUS

Item

3. Incorporation of Documents by Reference

We

are “incorporating by reference” in this prospectus certain documents we file with the Commission, which means that we can

disclose important information to you by referring you to those documents. The information in the documents incorporated by reference

is considered to be part of this prospectus. Statements contained in documents that we file with the Commission and that are incorporated

by reference in this prospectus will automatically update and supersede information contained in this prospectus, including information

in previously filed documents or reports that have been incorporated by reference in this prospectus, to the extent the new information

differs from or is inconsistent with the old information. We have filed or may file the following documents with the Commission and they

are incorporated herein by reference as of their respective dates of filing.

| (i) |

our

Annual Report on Form 10-K for the fiscal year ended December 31, 2022, filed with the SEC on March 30, 2023; |

| |

|

| (ii) |

our

Definitive Proxy Statements on Schedule 14A filed on January 19, 2023; and Q-3 |

| |

|

| (iii) |

the

description of our common stock, par value $0.001 per share (the “Common Stock”) and warrants with an exercise price of $4.73

(the “Tradeable Warrants”) contained in our Registration Statement on Form 8-A, filed with the SEC on November 1, 2021, as

updated by “Description of the Registrant’s Securities Registered Pursuant to Section 12 of the Securities Exchange Act of

1934” filed as Exhibit 4.4 to our Annual Report on Form 10-K for the fiscal year ended December 31, 2021, and any amendment or

report filed for the purpose of updating such description; |

| |

|

| (iv) |

our

Quarterly Reports on Form 10-Q for the period ended March 31, 2023, filed with the SEC on May 11, 2023, for the period ended June 30, 2023, filed with the SEC on August 10, 2023 and for the period ended September 30, 2023, filed with the SEC on November 14, 2023; and |

| |

|

| (iv) |

Our

Current Reports on Form 8-K filed with the SEC on January 11, 2023, March 2, 2023, March 13, 2023, July 13, 2023, October 4, 2023,

October 18, 2023, January 3, 2024, January 12, 2024 and January 22, 2024. |

All

documents that we filed with the Commission pursuant to Sections 13(a), 13(c), 14, and 15(d) of the Exchange Act subsequent to the date

of this prospectus that indicates that all securities offered under this prospectus have been sold, or that deregisters all securities

then remaining unsold, will be deemed to be incorporated in this prospectus by reference and to be a part hereof from the date of filing

of such documents.

Any

statement contained in a document incorporated or deemed to be incorporated by reference in this prospectus shall be deemed modified,

superseded or replaced for purposes of this prospectus to the extent that a statement contained in this prospectus, or in any subsequently

filed document that also is deemed to be incorporated by reference in this prospectus, modifies, supersedes or replaces such statement.

Any statement so modified, superseded or replaced shall not be deemed, except as so modified, superseded or replaced, to constitute a

part of this prospectus. None of the information that we disclose under Items 2.02 or 7.01 of any Current Report on Form 8-K or any corresponding

information, either furnished under Item 9.01 or included as an exhibit therein, that we may from time to time furnish to the Commission

will be incorporated by reference into, or otherwise included in, this prospectus, except as otherwise expressly set forth in the relevant

document. Subject to the foregoing, all information appearing in this prospectus is qualified in its entirety by the information appearing

in the documents incorporated by reference.

You

may request a free copy of any of the documents incorporated by reference in this prospectus (other than exhibits, unless they are specifically

incorporated by reference in the documents) by writing or telephoning us at the following address: 3124 Brother Blvd, Suite 410, Bartlett,

TN 38133 (Telephone: 901-302-9587).

Item

4. Description of Securities

Not

applicable.

Item

5. Interests of Named Experts and Counsel

Not

applicable.

Item

6. Indemnification of Officers and Directors

Our

directors and officers are indemnified as provided by the Nevada Revised Statutes and our Bylaws. These provisions provide that we shall

indemnify a director or former director against all expenses incurred by him by reason of him acting in that position. The directors

may also cause us to indemnify an officer, employee or agent in the same fashion.

Insofar

as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons

of Registrant pursuant to the foregoing provisions, or otherwise, we have been advised that, in the opinion of the Securities and Exchange

Commission, such indemnification is against public policy as expressed in the Securities Act of 1933 and is, therefore, unenforceable.

Item

7. Exemption from Registration Claimed

Not

applicable.

Item

8. Exhibits

The

following exhibits are filed with this Registration Statement.

Item

9. Undertakings.

(a)

The undersigned registrant hereby undertakes:

(1)

To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement

(i)

To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or

any material change to such information in the registration statement.

(2)

That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed

to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall

be deemed to be the initial bona fide offering thereof.

(3)

To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the

termination of the offering.

(4)

That prior to any public reoffering of the securities registered hereunder through use of a prospectus which is a part of this registration

statement, by any person or party who is deemed to be an underwriter within the meaning of Rule 145(c), such reoffering prospectus will

contain the information called for by the applicable registration form with respect to reofferings by persons who may be deemed underwriters,

in addition to the information called for by the other items of the applicable form.

(5)

That every prospectus (i) that is filed pursuant to paragraph (4) immediately preceding, or (ii) that purports to meet the requirements

of Section 10(a)(3) of the Securities Act of 1933 and is used in connection with an offering of securities subject to Rule 415, will

be filed as a part of an amendment to the registration statement and will not be used until such amendment is effective, and that, for

purposes of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new

registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to

be the initial bona fide offering thereof.

(6)

That, for purposes of determining any liability under the Securities Act of 1933, each filing of the registrant’s annual report

pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit

plan’s annual report pursuant to Section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the

registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering

of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(7)

To respond to requests for information that is incorporated by reference into the joint proxy statement/prospectus pursuant to Item 4,

10(b), 11 or 13 of this form, within one business day of receipt of such request, and to send the incorporated documents by first class

mail or other equally prompt means. This includes information contained in documents filed subsequent to the effective date of the registration

statement through the date of responding to the request.

(8)

To supply by means of a post-effective amendment all information concerning a transaction, and the company being acquired involved therein,

that was not the subject of and included in the registration statement when it became effective.

(b)

Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling

persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of

the Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore,

unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses

incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding)

is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will,

unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction

the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the

final adjudication of such issue.

(c)

The undersigned registrant hereby undertakes that, for purposes of determining any liability under the Securities Act of 1933, each filing

of the registrant’s annual report pursuant to section 13(a) or section 15(d) of the Securities Exchange Act of 1934 (and, where

applicable, each filing of an employee benefit plan’s annual report pursuant to section 15(d) of the Securities Exchange Act of

1934) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to

the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering

thereof.

SIGNATURES

Pursuant

to the requirements of the Securities Act of 1933, as amended, the registrant certifies that it has reasonable grounds to believe that

it meets all of the requirements for filing on Form S-8 and has duly caused this registration statement to be signed on its behalf by

the undersigned, thereunto duly authorized, on February 5, 2024.

| SURGEPAYS,

INC. |

|

| |

|

|

| By: |

/s/

Kevin Brian Cox |

|

| |

Kevin

Brian Cox |

|

| |

Chairman

and Chief Executive Officer |

|

POWER

OF ATTORNEY

KNOW

ALL MEN BY THESE PRESENTS, that each person whose signature appears below constitutes and appoints Dr. Amit Kumar his true and lawful

attorney-in-fact, with full power of substitution and resubstitution for him and in his name, place and stead, in any and all capacities

to sign any and all amendments including post-effective amendments to this registration statement, and to file the same, with all exhibits

thereto, and other documents in connection therewith, with the Commission, hereby ratifying and confirming all that said attorney-in-fact

or his substitute, each acting alone, may lawfully do or cause to be done by virtue thereof.

Pursuant

to the requirements of the Securities Act of 1933, as amended, this Registration Statement has been signed by the following persons in

the capacities and on the dates indicated.

| By: |

/s/

Kevin Brian Cox |

February

5, 2024 |

| |

Kevin

Brian Cox |

|

| |

Chief

Executive Officer and Chairman of the Board |

|

| |

(Principal

Executive Officer) |

|

| |

|

|

| By: |

/s/

Anthony Evers |

February

5, 2024 |

| |

Anthony

Evers |

|

| |

Chief

Financial Officer |

|

| |

(Principal

Financial and Accounting Officer) |

|

| |

|

|

| By: |

/s/

David May |

February

5, 2024 |

| |

David

May |

|

| |

Director |

|

| |

|

|

| By: |

/s/

David N. Keys |

February

5, 2024 |

| |

David

N. Keys |

|

| |

Director |

|

| |

|

|

| By: |

/s/

Laurie Weisberg |

February

5, 2024 |

| |

Laurie

Weisberg |

|

| |

Director |

|

| |

|

|

| By: |

/s/

Richard Schurfeld |

February

5, 2024 |

| |

Richard

Schurfeld |

|

| |

Director |

|

Exhibit

4.1

Exhibit

5.1

|

1345 AVENUE OF THE AMERICAS, 11th FLOOR

NEW

YORK, NEW YORK 10017

TELEPHONE: (212) 370-1300

FACSIMILE: (212) 370-7889

www.egsllp.com |

February

5, 2024

SurgePays,

Inc.

3124

Brother Blvd, Suit 410

Bartlett,

TN 38133

| |

Re: |

Registration Statement on Form S-8 |

Gentlemen:

We

have acted as counsel to SurgePays, Inc., a Nevada corporation (the “Company”), in connection with the preparation

of the Company’s Registration Statement on Form S-8 (the “Registration Statement”) being filed with the Securities

and Exchange Commission under the Securities Act of 1933, as amended (the “Securities Act”). The Registration Statement

has been filed to register 4,928,320 shares (the “Plan Shares”) of Company common stock to be issued pursuant to the

Company’s 2022 Omnibus Securities and Incentive Plan (the “2022 Plan”).

In

arriving at the opinion expressed below, we have examined and relied on the following documents:

(1) the

Articles of Incorporation and Amended Bylaws of the Company, each as amended as of the date hereof;

(2) the

2022 Plan; and

(3) records

of meetings and consents of the Board of Directors of the Company provided to us by the Company.

In

addition, we have examined and relied on the originals or copies certified or otherwise identified to our satisfaction of all such corporate

records of the Company and such other instruments and other certificates of public officials, officers and representatives of the Company

and such other persons, and we have made such investigations of law, as we have deemed appropriate as a basis for the opinion expressed

below. In such examination, we have assumed, without independent verification, the genuineness of all signatures (whether original or

photostatic), the accuracy and completeness of each document submitted to us, the authenticity of all documents submitted to us as originals,

the conformity to original documents of all documents submitted to us as facsimile, electronic, certified, conformed or photostatic copies

thereof. We have further assumed the legal capacity of natural persons, that persons identified to us as officers of the Company are

actually serving in such capacity, that the representations of officers and employees of the Company are correct as to questions of fact

and that each party to the documents we have examined or relied on (other than the Company) has the power, corporate or other, to enter

into and perform all obligations thereunder and also have assumed the due authorization by all requisite action, corporate or other,

of the execution and delivery by such parties of such documents, and the validity and binding effect thereon on such parties. We have

also assumed that the Company will not in the future issue or otherwise make unavailable so many shares of its Common Stock that there

are insufficient authorized and unissued shares of Common Stock for issuance of the shares issuable upon exercise of the options being

registered in the Registration Statement. We have not independently verified any of these assumptions.

The

opinions expressed in this opinion letter are limited to the applicable statutory provisions of Chapter 78 of the Nevada Revised Statutes.

We are not opining on, and we assume no responsibility for, the applicability or effect on any of the matters covered herein of: (a)

any other laws; (b) the laws of any other jurisdiction; or (c) the laws of any county, municipality or other political subdivision or

local government agency or authority. The opinions set forth below are rendered as of the date of this opinion letter. We assume no obligation

to update or supplement such opinions to reflect any change of law or fact that may occur.

Based

upon and subject to the foregoing, it is our opinion that the Plan Shares have been duly authorized and, upon issuance and payment therefor

in accordance with the terms of the 2022 Plan, and the awards, agreements or certificates issued thereunder, will be validly issued,

fully paid and nonassessable.

We

hereby consent to the filing of this opinion as an exhibit to the Registration Statement. In giving such consent, we do not thereby admit

that we are experts with respect to any part of the Registration Statement within the meaning of the term “expert” as used

in Section 11 of the Securities Act or the rules and regulations promulgated thereunder by the Securities and Exchange Commission, nor

do we admit that we are within the category of persons whose consent is required under Section 7 of the Securities Act or the rules and

regulations of the Securities and Exchange Commission promulgated thereunder.

| |

Very truly yours, |

| |

|

| |

/s/ Ellenoff Grossman & Schole LLP |

Exhibit

23.1

Consent

of Independent Registered Public Accounting Firm

We

consent to the inclusion in this Registration Statement on Form S-8 of Surge Pays Inc. & Subsidiaries, (the “Company”)

of our report dated March 30, 2023, related to the financial statements of the Company as of and for the years ended December 31, 2022

and 2021.

/s/

Rodefer Moss & Co, PLLC

Johnson

City, Tennessee

February 5, 2024

Exhibit

107

Calculation

of Filing Fee Tables

Form

S-8

(Form

Type)

SurgePays,

Inc.

(Exact

Name of Registrant as Specified in its Charter)

Table

1: Newly Registered and Carry Forward Securities

| | |

Security Type | |

Security Class Title | |

Fee Calculation or Carry Forward Rule | |

Amount Registered | | |

Proposed Maximum Offering Price Per Share | | |

Maximum Aggregate Offering Price | | |

Fee Rate | | |

Amount of Registration Fee | |

| Newly Registered Securities |

| Fees to Be Paid | |

Equity | |

Common Stock, par value $0.001 per share | |

457(h) | |

| (1 | ) | |

| (2 | ) | |

$ | 33,832,916.80 | | |

| 0.0001476 | | |

$ | 4,993.74 | |

| | |

Fees previously Paid | |

| |

| |

| | | |

| | | |

| 0 | | |

| | | |

| 0 | |

| Carry Forward Securities | |

| | |

Carry Forward Securities | |

— | |

— | |

| — | | |

| — | | |

| | | |

| | | |

| | |

| | |

| |

Total Offering Amounts | | |

| 33,832,916.80 | | |

| | | |

$ | 4,993.74 | |

| | |

| |

Total Fees Previously Paid | | |

| | | |

| | | |

$ | 0 | |

| | |

| |

Total Fee Offsets | | |

| | | |

| | | |

$ | 0 | |

| | |

| |

Net Fees Due | | |

| | | |

| | | |

$ | 4,993.74 | |

| (1) |

Pursuant

to Rule 416(a) of the Securities Act of 1933, as amended (the “Securities Act”), this Registration Statement shall also

cover any additional shares of Common Stock attributable to these registered shares which become issuable under the SurgePays, Inc.

2022 Omnibus Securities and Incentive Plan (the “Plan”) by reason of any stock dividend, stock split, recapitalization

or other similar transaction effected without the Registrant’s receipt of consideration which results in an increase in the

number of the outstanding shares of the Registrant’s Common Stock. |

| |

|

| (2) |

Estimated

solely for purposes of calculating the registration fee pursuant to Rule 457(c) and Rule 457(h) under the Securities Act of 1933.

The above calculation is based on the average of the high and low prices reported on the NASDAQ on January 29, 2024. |

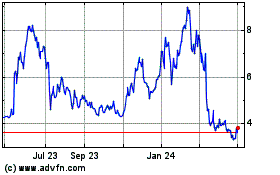

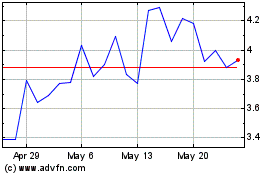

SurgePays (NASDAQ:SURG)

Historical Stock Chart

From Oct 2024 to Nov 2024

SurgePays (NASDAQ:SURG)

Historical Stock Chart

From Nov 2023 to Nov 2024