Current Report Filing (8-k)

April 11 2022 - 1:50PM

Edgar (US Regulatory)

0001210618

false

0001210618

2022-04-08

2022-04-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

United States

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

April

8, 2022

Date of Report (Date of earliest event reported)

SPI Energy

Co., Ltd.

(Exact Name of Registrant as Specified in its Charter)

| Cayman Islands |

|

001-37678 |

|

20-4956638 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

|

4677 Old Ironsides Drive, Suite 190

Santa Clara, CA |

|

95054 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (408) 919-8000

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

☐ |

Written communications pursuant to Rule 425 under the Securities Act |

| |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act |

| |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act |

| |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Ordinary Share |

|

SPI |

|

The NASDAQ Global Select Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities

Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 1.01. |

Entry into a Material Definitive Agreement. |

On April 8, 2022, SPI Energy Co., Ltd. (the “Company”)

entered into a Securities Purchase Agreement (the “Agreement”) pursuant to which the Company issued an unsecured convertible

promissory note with a one-year maturity (“Note”) to an institutional accredited investor Streeterville Capital, LLC (“Investor”).

The Note has the original principal amount of $2,110,000 and Investor gave consideration of $2,000,000, reflecting original issue discount

of $100,000 and Investor’s legal fee of $10,000.

Interest accrues on the outstanding balance of

the Note at 10% per annum. Upon the occurrence of an Event of Default (as defined in the Note), interest accrues at the lesser of 15%

per annum or the maximum rate permitted by applicable law. Certain Major Defaults (as defined in the Note) will result in an additional

15% of the aggregate principal amount of the Note outstanding at such time being added to the total outstanding amount of such note.

Pursuant to the terms of the Agreement and the

Note, the Company must obtain Investor’s consent for certain fundamental transactions such as consolidation, merger, disposition

of substantial assets, change of control, reorganization or recapitalization. Any occurrence of a fundamental transaction without Investor’s

prior written consent will be deemed an Event of Default.

Investor may redeem all or any part of the outstanding

balance of the Note, subject to maximum monthly redemption amount of $350,000, at any time after six months from the Note issue date,

in cash or converting into the Company’s ordinary shares at a conversion price of $20.00 per share, subject to certain adjustments

and ownership limitations specified in the Note. The number of ordinary shares that may be issued upon conversion of the Note shall not

exceed the requirement of Nasdaq Listing Rule 5635(d). The Note provides for liquidated damages upon failure to comply with any of the

terms or provisions of the Note. The Company may prepay the outstanding balance of the Note in cash equal to 115% multiplied by the portion

of the outstanding balance the Company elects to prepay.

The Company relied on the exemption from registration

afforded by Section 4(a)(2) of the Securities Act of 1933 in connection with the issuance and sale of the Note and underlying ordinary

shares.

The foregoing description is qualified in its

entirety by reference to the full text of the Note and the Agreement, a copy of each of which is filed as Exhibit 4.1 and Exhibit 10.1

hereto, and each of which is incorporated herein by reference.

| Item 2.03. |

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant. |

The information in Item 1.01 is incorporated herein

by reference.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

SPI ENERGY CO., LTD. |

|

| |

|

|

|

| April 11, 2022 |

By: |

/s/ Xiaofeng Peng |

|

| |

|

Xiaofeng Peng |

|

| |

|

Chief Executive Officer |

|

| |

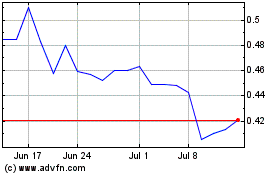

SPI Energy (NASDAQ:SPI)

Historical Stock Chart

From Nov 2024 to Dec 2024

SPI Energy (NASDAQ:SPI)

Historical Stock Chart

From Dec 2023 to Dec 2024