Current Report Filing (8-k)

March 01 2022 - 5:45PM

Edgar (US Regulatory)

0000916907false00009169072022-02-252022-02-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) February 25, 2022

SOUTHERN MISSOURI BANCORP, INC.

(Exact name of registrant as specified in its charter)

| | | | |

Missouri | | 000-23406 | | 43-1665523 |

(State or other | | (Commission File No.) | | (IRS Employer |

jurisdiction of incorporation) | | | | Identification Number) |

| | |

2991 Oak Grove Road, Poplar Bluff, Missouri | | 63901 |

(Address of principal executive offices) | | (Zip Code) |

Registrant's telephone number, including area code: (573) 778-1800

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common Stock, par value $0.01 per share | SMBC | The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On February 25, 2022, effective upon completion of the merger of Fortune Financial Corporation (“Fortune”) with and into Southern Missouri Acquisition V Corp (“Merger Sub”), a wholly owned subsidiary of Southern Missouri Bancorp, Inc. (“Southern Missouri”), and the merger of FortuneBank, a subsidiary of Fortune, with and into Southern Bank, a wholly owned subsidiary of Southern Missouri, (collectively, the “Merger”), Daniel L.Jones, Chairman and Chief Executive Officer of Fortune and FortuneBank, became a director of Southern Missouri and Southern Bank. Mr. Jones’s term as a director of Southern Missouri will expire at the 2022 annual meeting of Southern Missouri shareholders. The Board committees to which Mr. Jones will be appointed have not yet been determined. The appointment of Mr. Jones as a director of Southern Missouri was contemplated by and made in accordance with the Agreement and Plan of Merger, dated as of September 28, 2021, by and among Southern Missouri, Merger Sub and Fortune.

As a director of Southern Missouri and Southern Bank, Mr. Jones is expected to be entitled to the same general compensation arrangement as is provided to the other non-employee directors of Southern Missouri and Southern Bank. A description of this arrangement is contained under the heading “Compensation of Directors” in the Company’s definitive proxy statement filed with the Securities and Exchange Commission on September 20, 2021 and is incorporated herein by reference.

Mr. Jones is an affiliate of two entities that each have a site lease with Fortune. These leases were assumed by Southern Missouri in the Merger. Lease payments paid by Fortune to these entities totaled $67,000 in calendar year 2021. In addition, Mr. Jones is an affiliate of an entity that has provided maintenance services for properties acquired by Southern Missouri in the Merger. Payments by Fortune to this entity totaled $61,000 in calendar year 2021. There are no other related party transactions of the kind described in Item 404(a) of Regulation S-K in which Mr. Jones was a participant or in which he has any direct or indirect material interest.

Item 8.01. Other Events

As a result of the Merger, each share of Fortune common stock held immediately prior to completion of the Merger is being exchanged for 0.3025 shares of Southern Missouri common stock or $13.31 in cash (as adjusted based on Fortune’s capital and total number of shares outstanding immediately prior to closing) at the election of the shareholder, subject to the proration and allocation procedures set forth in the Merger agreement. Southern Missouri paid approximately $31.7 million in Merger consideration, comprised of stock and cash at a 60:40 ratio.

A copy of the press release Southern Missouri issued announcing completion of the transaction is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits

(d)Exhibits

99.1Press Release dated February 25, 2022

| 104 | Cover Page Interactive Data File – the cover page XBRL tags are embedded within the Inline XBRL document |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | |

| | SOUTHERN MISSOURI BANCORP, INC. |

| | | |

Date: March 1, 2022 | | By: | /s/ Matthew T. Funke |

| | | Matthew T. Funke |

| | | Executive Vice President and Chief Financial Officer |

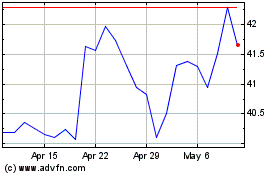

Southern Missouri Bancorp (NASDAQ:SMBC)

Historical Stock Chart

From Jun 2024 to Jul 2024

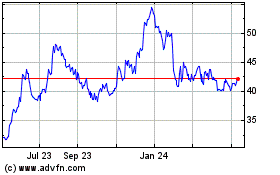

Southern Missouri Bancorp (NASDAQ:SMBC)

Historical Stock Chart

From Jul 2023 to Jul 2024