Southern Missouri Bancorp, Inc. (NASDAQ: SMBC, "Southern

Missouri"), the parent corporation of Southern Bank, and Fortune

Financial Corporation ("Fortune"), the parent company of

FortuneBank, today announced the signing of a definitive merger

agreement whereby Southern Missouri will acquire Fortune in a stock

and cash transaction.

Fortune operates two branches in Jefferson and St. Louis

Counties, Missouri, both located within the St. Louis, Missouri,

MSA. At June 30, 2021, Fortune’s consolidated assets were $253.7

million, including loans, net, of $209.3 million, while deposits

totaled $214.5 million.

Southern Missouri reported total assets at June 30, 2021, of

approximately $2.7 billion, including loans, net, of $2.2 billion,

and total deposits of $2.3 billion. On a pro forma basis, following

the acquisition, the combined company's total assets will

approximate $3.0 billion, with total loans, net, of $2.4 billion,

and total deposits of $2.5 billion. The combined company will

operate 51 locations in Missouri, Arkansas, and Illinois.

Under the terms of the merger agreement, unanimously approved by

the boards of both entities, Fortune shareholders are projected to

receive either a fixed exchange ratio of 0.2853 shares of Southern

Missouri common stock or a cash payment of $12.55 for each Fortune

share, at the election of the shareholders, subject to adjustment

based on Fortune’s capital and the total outstanding shares of

Fortune at closing. Based on Southern Missouri’s $43.99 average

closing price over the 20-day trading period ended September 24,

2021, the transaction’s indicated value is approximately $29.9

million, with merger consideration comprised of stock and cash at a

60:40 ratio. As part of the merger, Southern Missouri will also

assume approximately $7.5 million in subordinated debt.

"Southern Missouri is pleased to announce this merger with

Fortune and an important step in our long-term growth," stated Greg

Steffens, President and CEO of Southern Missouri. "Fortune has

developed a number of business lines that complement our

organization well, and provides a point of entry to a large and

growing banking market where we believe our community banking model

will perform well. Fortune customers will benefit from the scale

and technology we will help their banking officers bring to their

relationships. We have been very impressed with the talented

personnel who will be joining our team through this partnership and

look forward to building on the success Fortune has achieved."

Daniel Jones, Founder, Chairman & CEO of Fortune, is

expected to join the boards of directors of Southern Missouri and

Southern Bank. “It is with a feeling of overwhelming gratitude to

our amazing customer base and wonderful staff that I announce we

have decided to partner with Southern Bank to continue the

FortuneBank legacy,” Mr. Jones noted. “From the inception of

Fortune, it has been my desire and that of Chris Ford, as the

founding family members, to offer the highest level of customer

service from a true community bank platform. Many things have

changed over the sixteen years since we chartered the bank, but our

desire to operate with the highest level of integrity within our

amazing community never wavered. Chris and I will remain with the

combined organization, ensuring the same founding principles carry

on well after the merger. We are confident that Southern brings the

same spirit of excellent, community bank-focused customer service,

and these services will be provided by the same FortuneBank team

members. The merger will add enhancements in technology and scale

such that we are able to do more for our community and loyal

customers. We are blessed and have been given much for which to be

thankful. I am most certainly thankful for these past sixteen years

and look forward to many ahead with Southern Bank as our

partner!”

“We are convinced this merger is an important and logical

strategic step in Southern Missouri’s growth," added Steffens.

“Entering the St. Louis MSA will help us achieve our long-term

growth goals, which we know are necessary for our organization to

remain competitive and continue to invest in the technological

advances required in our industry. Moreover, we believe this growth

can be achieved along with strong core profitability as we combine

our institutions and capitalize on the core competencies of

each.”

The deal value equates to 155% of Fortune’s capital at

announcement, represents a 5.8% premium to core deposits, and is a

multiple of 6.4 times Fortune’s projected forward earnings

including fully phased-in cost savings, which are estimated at 30%.

Excluding certain one-time merger charges, including Southern

Missouri’s additional provision for credit losses as required under

ASU 2016-13 (“CECL”), the transaction is anticipated to be

accretive to earnings per share by approximately 8.8% in our fiscal

year ended June 30, 2022, and by 9.1% in our fiscal year ended June

30, 2023. Tangible book value per common share is expected to be

diluted by approximately 3.8% at closing, with a projected earnback

period of approximately 11 quarters, based on the crossover

method.

Southern Missouri and Fortune anticipate completion of the

transaction late in the first calendar quarter of 2022, subject to

satisfaction of customary closing conditions, including regulatory

and shareholder approvals.

Piper Sandler & Co. acted as financial advisor and Armstrong

Teasdale LLP served as legal advisor to Fortune, while Silver,

Freedman, Taff & Tiernan LLP served as legal advisor to

Southern Missouri.

Forward-Looking Information:

Except for the historical information contained herein, the

matters discussed in this press release may be deemed to be

forward-looking statements that are subject to known and unknown

risks, uncertainties, and other factors that could cause the actual

results to differ materially from the forward-looking statements,

including: the requisite regulatory and shareholder approvals for

this acquisition might not be obtained, or other conditions to

completion of the transaction might not be satisfied or waived;

expected cost savings, synergies and other benefits from Southern

Missouri's merger and acquisition activities, including this

acquisition and Southern Missouri's other acquisitions, might not

be realized within the anticipated time frames or at all, and costs

or difficulties relating to integration matters, including but not

limited to customer and employee retention, might be greater than

expected; potential adverse impacts to economic conditions in the

Company’s local market areas, other markets where the Company has

lending relationships, or other aspects of the Company’s business

operations or financial markets, generally, resulting from the

ongoing COVID-19 pandemic and any governmental or societal

responses thereto; the strength of the United States economy in

general and the strength of the local economies in which we conduct

operations; fluctuations in interest rates and in real estate

values; monetary and fiscal policies of the Board of Governors of

the Federal Reserve System (the “Federal Reserve Board”) and the

U.S. Government and other governmental initiatives affecting the

financial services industry; the risks of lending and investing

activities, including changes in the level and direction of loan

delinquencies and write-offs and changes in estimates of the

adequacy of the allowance for loan losses; our ability to access

cost-effective funding; the timely development of and acceptance of

our new products and services and the perceived overall value of

these products and services by users, including the features,

pricing and quality compared to competitors’ products and services;

fluctuations in real estate values and both residential and

commercial real estate markets, as well as agricultural business

conditions; demand for loans and deposits in our market area;

legislative or regulatory changes that adversely affect our

business; changes in accounting principles, policies, or

guidelines; results of examinations of us by our regulators,

including the possibility that our regulators may, among other

things, require us to increase our reserve for loan losses or to

write-down assets; the impact of technological changes; and our

success at managing the risks involved in the foregoing.

Any forward-looking statements are based upon management's

beliefs and assumptions at the time they are made. We undertake no

obligation to publicly update or revise any forward-looking

statements or to update the reasons why actual results could differ

from those contained in such statements, whether as a result of new

information, future events or otherwise. In light of these risks,

uncertainties and assumptions, the forward-looking statements

discussed might not occur, and you should not put undue reliance on

any forward-looking statements.

No Offer or Solicitation:

This press release is being provided for informational purposes

only and does not constitute (i) an offer to purchase, nor a

solicitation of an offer to sell, subscribe for or buy any

securities, (ii) an offer to exchange any securities or (iii) the

solicitation of any vote for approval of any transaction. There

shall not be any offer, solicitation, sale or exchange of any

securities in any state or other jurisdiction in which such offer,

solicitation, sale, or exchange is not permitted.

Additional Information:

Southern Missouri Bancorp, Inc. will file a registration

statement on Form S-4 with the SEC in connection with the proposed

transaction. The registration statement will include a proxy

statement of Fortune that also constitutes a prospectus of Southern

Missouri, which will be sent to the shareholders of Fortune.

Fortune shareholders are advised to read the proxy

statement/prospectus when it becomes available because it will

contain important information about Southern Missouri, Fortune, and

the proposed transaction. When filed, this document and other

documents relating to the merger filed by Southern Missouri can be

obtained free of charge from the SEC's website at www.sec.gov.

These documents also can be obtained free of charge by accessing

Southern Missouri's website at www.bankwithsouthern.com under the

tab "Investor Relations" and then under "SEC Filings."

Alternatively, these documents, when available, can be obtained

free of charge from Southern Missouri upon written request to

Southern Missouri Bancorp, Inc., Attn: Investor Relations, 2991 Oak

Grove Road, Poplar Bluff, Missouri, 63901, or by calling (573)

778-1800, or from Fortune upon written request to Fortune Financial

Corporation., Attn: Investor Relations, 3494 Jeffco Boulevard,

Arnold, Missouri, 63010.

Participants in this Transaction:

Southern Missouri, Fortune, and certain of their respective

directors and executive officers may be deemed to be participants

in the solicitation of proxies from Fortune’s shareholders in

connection with the proposed transaction. Information about the

directors and executive officers of Southern Missouri may be found

in the definitive proxy statement of Southern Missouri relating to

its 2021 Annual Meeting of Shareholders filed with the SEC by

Southern Missouri on September 20, 2021. This definitive proxy

statement can be obtained free of charge from the sources indicated

above. Information about the directors and executive officers of

Fortune will be included in the proxy statement/prospectus when

filed with the SEC. Additional information regarding the interests

of these participants will also be included in the proxy

statement/prospectus regarding the proposed transaction when it

becomes available.

Matt Funke, CFO

573-778-1800

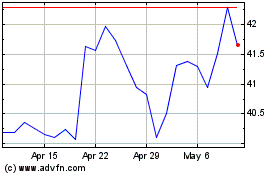

Southern Missouri Bancorp (NASDAQ:SMBC)

Historical Stock Chart

From Oct 2024 to Nov 2024

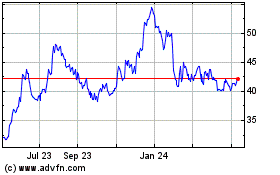

Southern Missouri Bancorp (NASDAQ:SMBC)

Historical Stock Chart

From Nov 2023 to Nov 2024