Southern Missouri Bancorp, Inc. (“Company”) (NASDAQ: SMBC), the

parent corporation of Southern Bank (“Bank”), today announced

preliminary net income available to common stockholders for the

fourth quarter of fiscal 2019 of $7.6 million, an increase of $1.9

million, or 34.1%, as compared to the same period of the prior

fiscal year. The increase was attributable to increased net

interest income and noninterest income, combined with a reduction

in provision for loan losses, and partially offset by increases in

noninterest expense and provision for income taxes. Preliminary net

income available to common stockholders was $.81 per fully diluted

common share for the fourth quarter of fiscal 2019, an increase of

$.18 as compared to the $.63 per fully diluted common share

reported for the same period of the prior fiscal year. For fiscal

year 2019, preliminary net income available to common stockholders

was $28.9 million, an increase of $8.0 million, or 38.1%, as

compared to the prior fiscal year. Per fully diluted common share,

preliminary net income available to common stockholders was $3.14

for fiscal 2019, an increase of $.75 as compared to the $2.39 per

fully diluted common share reported for fiscal 2018.

Highlights for the fourth quarter of fiscal

2019:

- Annualized return on average assets was 1.37%, while annualized

return on average common equity was 12.9%, as compared to 1.21% and

11.4%, respectively, in the same quarter a year ago, and 1.30% and

12.5%, respectively, in the third quarter of fiscal 2019, the

linked quarter.

- Earnings per common share (diluted) were $.81, up $.18, or

28.6%, as compared to the same quarter a year ago, and up $.05, or

6.6%, from the third quarter of fiscal 2019, the linked

quarter.

- Net loan growth for the fourth quarter of fiscal 2019 was $23.0

million. The Company’s loan growth typically improves in the June

quarter following a seasonally slow March quarter, but those

impacts in both directions were somewhat less pronounced this year.

Net loans are up $283.0 million, or 18.1%, for fiscal 2019, which

included $144.3 million in loans acquired in the Company’s November

2018 acquisition of Gideon Bancshares, the parent of First

Commercial Bank (the “Gideon Acquisition”).

- Deposit growth was $19.6 million for the fourth quarter, as the

Company continued to prioritize organic deposit growth. For fiscal

2019, deposits are up $313.8 million, or 19.9%, which includes

$170.7 million in deposit assumed in the Gideon Acquisition.

- Net interest margin for the fourth quarter of fiscal 2019 was

3.77%, up from the 3.72% reported for the year ago period, and up

from the 3.73% figure reported for the third quarter of fiscal

2019, the linked quarter. Discount accretion on acquired loan

portfolios was relatively unchanged in the current quarter as

compared the linked quarter, and increased as compared to year ago

period, as discussed in detail below.

- Noninterest income, excluding securities gains, was up 6.6% for

the fourth quarter of fiscal 2019, as compared to the year ago

period, and up 1.1% as compared to the third quarter of fiscal

2019, the linked quarter.

- Noninterest expense was up 13.3% for the fourth quarter of

fiscal 2019, compared to the year ago period, and down 3.1% from

the third quarter of fiscal 2019, the linked quarter. After

reporting acquisition-related costs in both the linked quarter and

the year ago period, there were no comparable charges in the

current period.

- Nonperforming assets were $24.8 million, or 1.12% of total

assets, at June 30, 2019, as compared to $13.1 million, or 0.69% of

total assets, at June 30, 2018. The increase was primarily

attributable to assets acquired in the Gideon Acquisition.

Dividend Declared:

The Board of Directors, on July 17, 2019, declared a quarterly

cash dividend on common stock of $0.15, payable August 30, 2019, to

stockholders of record at the close of business on August 15, 2019,

marking the 101st consecutive quarterly dividend since the

inception of the Company, and representing an increase of 15.4%

over the quarterly dividend paid previously. The Board of Directors

and management believe the payment of a quarterly cash dividend

enhances stockholder value and demonstrates our commitment to and

confidence in our future prospects.

Conference Call:

The Company will host a conference call to review the

information provided in this press release on Tuesday, July 23,

2019, at 3:30 p.m. central time. The call will be available live to

interested parties by calling 1-888-339-0709 in the United States

(Canada: 1-855-669-9657, international: 1-412-902-4189).

Participants should ask to be joined into the Southern Missouri

Bancorp (SMBC) call. Telephone playback will be available beginning

one hour following the conclusion of the call through August 5,

2019. The playback may be accessed by dialing 1-877-344-7529

(Canada: 1-855-669-9658, international: 1-412-317-0088), and using

the conference passcode 10133821.

Balance Sheet Summary:

The Company experienced balance sheet growth in fiscal 2019,

with total assets of $2.2 billion at June 30, 2019, reflecting an

increase of $328.3 million, or 17.4%, as compared to June 30, 2018.

Asset growth was comprised mainly of increases in loans,

available-for-sale (“AFS”) securities, cash equivalents and time

deposits, and premises and equipment, and was attributable in large

part to the Gideon Acquisition.

AFS securities were $165.5 million at June 30, 2019, an increase

of $19.2 million, or 13.1%, as compared to June 30, 2018. AFS

securities are lower than the balances reported at December 31,

2018, the first quarter end following the Gideon Acquisition, as

the Company sold some securities acquired, primarily utilizing

proceeds to reduce Federal Home Loan Bank (“FHLB”) borrowings. Cash

equivalents and time deposits were a combined $36.4 million, an

increase of $8.1 million, or 28.6%, as compared to June 30,

2018.

Loans, net of the allowance for loan losses, were $1.8 billion

at June 30, 2019, an increase of $283.0 million, or 18.1%, as

compared to June 30, 2018. The increase was attributable in large

part to the Gideon Acquisition, which included loans recorded at a

fair value of $144.3 million at the acquisition date. Inclusive of

the Gideon Acquisition, the portfolio primarily saw growth in loans

secured by commercial real estate, commercial loans, and

residential real estate loans. Commercial real estate loans

increased due mostly to growth in loans secured by nonresidential

properties, accompanied by smaller increases in loans secured by

agricultural real estate and unimproved land. The increase in

commercial loan balances was attributable primarily to growth in

commercial & industrial loan balances, accompanied by smaller

increases in agricultural operating and equipment loans. Growth in

residential real estate loans was attributable primarily to loans

secured by multifamily real estate, accompanied by a smaller

increase in loans secured by one- to four-family real estate. Loans

anticipated to fund in the next 90 days stood at $83.3 million at

June 30, 2019, as compared to $80.8 million at June 30, 2018, and

$77.7 million at March 31, 2019.

Nonperforming loans were $21.0 million, or 1.13% of gross loans,

at June 30, 2019, as compared to $22.7 million, or 1.23% of gross

loans at March 31, 2019, and $9.2 million, or 0.58% of gross loans,

at June 30, 2018. Nonperforming assets were $24.8 million, or 1.12%

of total assets, at June 30, 2019, as compared to $13.1 million, or

0.69% of total assets, at June 30, 2018. The increase in

nonperforming loans was attributed primarily to the Gideon

Acquisition, which included nonperforming loans of $12.9 million as

of the acquisition date. The increase in nonperforming loans was

also the principal reason for the increase in nonperforming assets.

Our allowance for loan losses at June 30, 2019, totaled $19.9

million, representing 1.07% of gross loans and 94.7% of

nonperforming loans, as compared to $18.2 million, or 1.15% of

gross loans and 198.6% of nonperforming loans, at June 30, 2018.

For all impaired loans, the Company has measured impairment under

ASC 310-10-35. Management believes the allowance for loan losses at

June 30, 2019, is adequate, based on that measurement.

Total liabilities were $2.0 billion at June 30, 2019, an

increase of $290.6 million, or 17.2%, as compared to June 30,

2018.

Deposits were $1.9 billion at June 30, 2019, an increase of

$313.8 million, or 19.9%, as compared to June 30, 2018. The

increase was attributable in large part to the Gideon Acquisition,

which included deposits assumed at a fair value of $170.7 million.

Inclusive of the Gideon Acquisition, deposit balances saw growth

primarily in certificates of deposit, money market deposit

accounts, and interest-bearing transaction accounts. Since June 30,

2018, the Company’s public unit deposits increased by $19.2

million, primarily reflecting approximately $18.6 million in public

unit deposits assumed in the Gideon Acquisition, and totaled $266.8

million at June 30, 2019. Also since June 30, 2018, brokered

certificates of deposit increased by $31.3 million, to total $44.9

million at June 30, 2019, while brokered nonmaturity deposits

increased by $8.3 million, to total $8.3 million at June 30, 2019.

No brokered funding was assumed in the Gideon Acquisition. The

Company utilized brokered funding during the fiscal year in order

to provide funding for loan growth, reduce overnight borrowings,

and to maintain pricing discipline for retail deposits. Our

discussion of brokered deposits excludes those deposits originated

through reciprocal arrangements, as our reciprocal deposits are

primarily originated by our public unit depositors and utilized as

an alternative to pledging securities against those deposits.

Recently updated regulatory guidance, adopted following the May

2018 enactment of the Economic Growth, Regulatory Relief, and

Consumer Protection Act (Senate Bill 2155), has generally exempted

deposits originated through such reciprocal arrangements from

classification as brokered deposits for regulatory purposes,

subject to some limitations. The average loan-to-deposit ratio for

the third quarter of fiscal 2019 was 97.6%, as compared to 98.5%

for the same period of the prior fiscal year.

FHLB advances were $44.9 million at June 30, 2019, a decrease of

$31.7 million, or 41.4%, as compared to June 30, 2018, with the

decrease attributable primarily to the Company’s use of brokered

funding and sales of AFS securities (primarily those acquired in

the Gideon Acquisition), as discussed above. The Company held no

overnight advances at June 30, 2019, declining from a balance of

$66.6 million at June 30, 2018, while term advances increased to

$44.9 million at June 30, 2019, from $10.1 million a year earlier,

partially as a result of term advances assumed in the Gideon

Acquisition.

The Company’s stockholders’ equity was $238.4 million at June

30, 2019, an increase of $37.7 million, or 18.8%, as compared to

June 30, 2018. The increase was attributable to retained earnings,

equity issued in the Gideon Acquisition, and a decrease in

accumulated other comprehensive loss, which was due to a decrease

in market interest rates, partially offset by modest repurchase

activity in the fourth fiscal quarter, which totaled 35,351 shares

acquired at an average price of $31.58 per share.

Quarterly Income Statement Summary:

The Company’s net interest income for the three-month period

ended June 30, 2019, was $19.0 million, an increase of $3.1

million, or 19.4%, as compared to the same period of the prior

fiscal year. The increase was attributable primarily to a 17.7%

increase in the average balance of interest-earning assets,

combined with an increase in net interest margin to 3.77% in the

current three-month period, from 3.72% in the three-month period a

year ago.

Loan discount accretion and deposit premium amortization related

to the Company’s August 2014 acquisition of Peoples Bank of the

Ozarks (Peoples), the June 2017 acquisition of Capaha Bank

(Capaha), the February 2018 acquisition of Southern Missouri Bank

of Marshfield (SMB-Marshfield), and the Gideon Acquisition resulted

in an additional $615,000 in net interest income for the

three-month period ended June 30, 2019, as compared to $358,000 in

net interest income for the same period a year ago. Discount

accretion from the Gideon Acquisition had no comparable item in the

same period a year ago. Combined, these components of net interest

income contributed 12 basis points to net interest margin in the

three-month period ended June 30, 2019, as compared to a

contribution of eight basis points for the same period of the prior

fiscal year. For the linked quarter, ended March 31, 2019, when net

interest margin was 3.73%, comparable discount accretion

contributed 13 basis points to the net interest margin. Over the

longer term, the Company expects this component of net interest

income to decline, although to the extent that we have periodic

resolutions of specific credit impaired loans, this may create

volatility in this component of net interest income.

The provision for loan losses for the three-month period ended

June 30, 2019, was $546,000, as compared to $987,000 in the same

period of the prior fiscal year. Decreased provisioning was

attributed primarily to continued low levels of net charge offs,

comparatively slower loan growth in the current period, and a

stable outlook regarding the credit quality of the Company’s legacy

loan portfolio. As a percentage of average loans outstanding, the

provision for loan losses in the current three-month period

represented a charge of 0.12% (annualized), while the Company

recorded net charge offs during the period of 0.02% (annualized).

During the same period of the prior fiscal year, the provision for

loan losses as a percentage of average loans outstanding

represented a charge of 0.26% (annualized), while the Company

recorded net charge offs of 0.01% (annualized).

The Company’s noninterest income, for the three-month period

ended June 30, 2019, was $3.7 million, an increase of $187,000, or

5.3%, as compared to the same period of the prior fiscal year.

Results for the prior year period included gains on the sale of AFS

securities of $43,000, with no comparable gains in the current

period. Increases in deposit account service charges, bank card

interchange income, and gains realized on sales of residential

loans originated for sale into the secondary market were partially

offset by decreases in mortgage servicing income, as a result of a

charge to reduce the carrying value of mortgage servicing rights,

as lower market interest rates increased prepayment

projections.

Noninterest expense for the three-month period ended June 30,

2019, was $12.8 million, an increase of $1.5 million, or 13.3%, as

compared to the same period of the prior fiscal year. The increase

was attributable primarily to increases in compensation and

benefits, occupancy expenses, bank card network expense, and

deposit insurance premiums. Noninterest expense items were

generally increased as a result of additional staff, facilities,

and transactions following the Gideon Acquisition. After recording

$149,000 in charges related to merger and acquisition activity in

the same quarter a year ago, there were no comparable expenses in

the current period. The Company realized a reduced off-balance

sheet credit exposure, resulting in a recovery of $46,000 in the

current period, as compared to a $162,000 recovery in the year ago

period. The efficiency ratio for the three-month period ended June

30, 2019, was 56.2%, as compared to 58.1% in the same period of the

prior fiscal year.

The income tax provision for the three-month period ended June

30, 2019, was $1.9 million, an increase of $294,000, or 18.9%, as

compared to the same period of the prior fiscal year, attributable

primarily to higher pre-tax income, partially offset by a decrease

in the effective tax rate, to 19.7%, as compared to 21.7% in the

year-ago period. The lower effective tax rate was attributed to the

December 2017 enactment of a reduction in the federal corporate

income tax rate, the benefits of which were not fully realized by

the Company until the tax and fiscal year beginning July 1, 2018,

at which point the annual effective tax rate to which the Company

was administratively subject declined from 28.1% to 21.0%.

Forward-Looking Information:

Except for the historical information contained herein, the

matters discussed in this press release may be deemed to be

forward-looking statements that are subject to known and unknown

risks, uncertainties, and other factors that could cause the actual

results to differ materially from the forward-looking statements,

including: expected cost savings, synergies and other benefits from

our merger and acquisition activities might not be realized to the

extent anticipated, within the anticipated time frames, or at all,

and costs or difficulties relating to integration matters,

including but not limited to customer and employee retention, might

be greater than expected; the strength of the United States economy

in general and the strength of the local economies in which we

conduct operations; fluctuations in interest rates and in real

estate values; monetary and fiscal policies of the FRB and the U.S.

Government and other governmental initiatives affecting the

financial services industry; the risks of lending and investing

activities, including changes in the level and direction of loan

delinquencies and write-offs and changes in estimates of the

adequacy of the allowance for loan losses; our ability to access

cost-effective funding; the timely development of and acceptance of

our new products and services and the perceived overall value of

these products and services by users, including the features,

pricing and quality compared to competitors' products and services;

fluctuations in real estate values and both residential and

commercial real estate markets, as well as agricultural business

conditions; demand for loans and deposits; legislative or

regulatory changes that adversely affect our business; changes in

accounting principles, policies, or guidelines; results of

regulatory examinations, including the possibility that a regulator

may, among other things, require an increase in our reserve for

loan losses or write-down of assets; the impact of technological

changes; and our success at managing the risks involved in the

foregoing. Any forward-looking statements are based upon

management’s beliefs and assumptions at the time they are made. We

undertake no obligation to publicly update or revise any

forward-looking statements or to update the reasons why actual

results could differ from those contained in such statements,

whether as a result of new information, future events or otherwise.

In light of these risks, uncertainties and assumptions, the

forward-looking statements discussed might not occur, and you

should not put undue reliance on any forward-looking

statements.

|

Southern Missouri Bancorp, Inc. |

|

UNAUDITED CONDENSED CONSOLIDATED FINANCIAL

INFORMATION |

| |

|

|

|

|

|

|

|

|

|

|

|

| Summary Balance Sheet

Data as of: |

|

June 30, |

|

Mar. 31, |

|

Dec. 31, |

|

Sep. 30, |

|

June 30, |

|

| (dollars in thousands,

except per share data) |

|

|

2019 |

|

|

|

2019 |

|

|

|

2018 |

|

|

|

2018 |

|

|

|

2018 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Cash equivalents and time

deposits |

|

$ |

36,369 |

|

|

$ |

32,353 |

|

|

$ |

40,095 |

|

|

$ |

24,086 |

|

|

$ |

28,279 |

|

|

| Available for sale

securities |

|

|

165,535 |

|

|

|

161,510 |

|

|

|

197,872 |

|

|

|

144,625 |

|

|

|

146,325 |

|

|

| FHLB/FRB membership stock |

|

|

9,583 |

|

|

|

9,216 |

|

|

|

12,905 |

|

|

|

11,007 |

|

|

|

9,227 |

|

|

| Loans receivable, gross |

|

|

1,866,308 |

|

|

|

1,842,883 |

|

|

|

1,820,500 |

|

|

|

1,642,946 |

|

|

|

1,581,594 |

|

|

| Allowance for loan

losses |

|

|

19,903 |

|

|

|

19,434 |

|

|

|

19,023 |

|

|

|

18,790 |

|

|

|

18,214 |

|

|

| Loans receivable, net |

|

|

1,846,405 |

|

|

|

1,823,449 |

|

|

|

1,801,477 |

|

|

|

1,624,156 |

|

|

|

1,563,380 |

|

|

| Bank-owned life insurance |

|

|

38,337 |

|

|

|

38,086 |

|

|

|

37,845 |

|

|

|

37,794 |

|

|

|

37,547 |

|

|

| Intangible assets |

|

|

23,328 |

|

|

|

23,991 |

|

|

|

24,429 |

|

|

|

19,634 |

|

|

|

19,996 |

|

|

| Premises and equipment |

|

|

62,727 |

|

|

|

62,508 |

|

|

|

62,253 |

|

|

|

54,669 |

|

|

|

54,832 |

|

|

| Other assets |

|

|

32,118 |

|

|

|

25,334 |

|

|

|

29,403 |

|

|

|

27,657 |

|

|

|

26,529 |

|

|

| Total assets |

|

$ |

2,214,402 |

|

|

$ |

2,176,447 |

|

|

$ |

2,206,279 |

|

|

$ |

1,943,628 |

|

|

$ |

1,886,115 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Interest-bearing deposits |

|

$ |

1,674,806 |

|

|

$ |

1,649,830 |

|

|

$ |

1,556,051 |

|

|

$ |

1,392,006 |

|

|

$ |

1,376,385 |

|

|

| Noninterest-bearing

deposits |

|

|

218,889 |

|

|

|

224,284 |

|

|

|

239,955 |

|

|

|

199,120 |

|

|

|

203,517 |

|

|

| Securities sold under

agreements to repurchase |

|

|

4,376 |

|

|

|

4,703 |

|

|

|

4,425 |

|

|

|

3,631 |

|

|

|

3,267 |

|

|

| FHLB advances |

|

|

44,908 |

|

|

|

38,388 |

|

|

|

155,765 |

|

|

|

118,307 |

|

|

|

76,652 |

|

|

| Note payable |

|

|

3,000 |

|

|

|

3,000 |

|

|

|

3,000 |

|

|

|

3,000 |

|

|

|

3,000 |

|

|

| Other liabilities |

|

|

14,988 |

|

|

|

9,845 |

|

|

|

8,060 |

|

|

|

6,533 |

|

|

|

7,655 |

|

|

| Subordinated debt |

|

|

15,043 |

|

|

|

15,018 |

|

|

|

14,994 |

|

|

|

14,969 |

|

|

|

14,945 |

|

|

| Total liabilities |

|

|

1,976,010 |

|

|

|

1,945,068 |

|

|

|

1,982,250 |

|

|

|

1,737,566 |

|

|

|

1,685,421 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Common stockholders'

equity |

|

|

238,392 |

|

|

|

231,379 |

|

|

|

224,029 |

|

|

|

206,062 |

|

|

|

200,694 |

|

|

| Total stockholders'

equity |

|

|

238,392 |

|

|

|

231,379 |

|

|

|

224,029 |

|

|

|

206,062 |

|

|

|

200,694 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Total liabilities and

stockholders' equity |

|

$ |

2,214,402 |

|

|

$ |

2,176,447 |

|

|

$ |

2,206,279 |

|

|

$ |

1,943,628 |

|

|

$ |

1,886,115 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Equity to assets ratio |

|

|

10.77 |

% |

|

|

10.63 |

% |

|

|

10.15 |

% |

|

|

10.60 |

% |

|

|

10.64 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Common shares outstanding |

|

|

9,289,308 |

|

|

|

9,324,659 |

|

|

|

9,313,109 |

|

|

|

8,995,884 |

|

|

|

8,996,584 |

|

|

| Less: Restricted common

shares not vested |

|

|

28,250 |

|

|

|

28,250 |

|

|

|

23,050 |

|

|

|

27,200 |

|

|

|

28,700 |

|

|

| Common shares for book value

determination |

|

|

9,261,058 |

|

|

|

9,296,409 |

|

|

|

9,290,059 |

|

|

|

8,968,684 |

|

|

|

8,967,884 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Book value per common

share |

|

$ |

25.74 |

|

|

$ |

24.89 |

|

|

$ |

24.11 |

|

|

$ |

22.98 |

|

|

$ |

22.38 |

|

|

| Closing market price |

|

|

34.83 |

|

|

|

30.80 |

|

|

|

33.90 |

|

|

|

37.27 |

|

|

|

39.02 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Nonperforming asset

data as of: |

|

June 30, |

|

Mar. 31, |

|

Dec. 31, |

|

Sep. 30, |

|

June 30, |

|

| (dollars in

thousands) |

|

|

2019 |

|

|

|

2019 |

|

|

|

2018 |

|

|

|

2018 |

|

|

|

2018 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Nonaccrual loans |

|

$ |

21,013 |

|

|

$ |

22,690 |

|

|

$ |

20,453 |

|

|

$ |

7,557 |

|

|

$ |

9,172 |

|

|

| Accruing loans 90 days or more

past due |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

| Total nonperforming

loans |

|

|

21,013 |

|

|

|

22,690 |

|

|

|

20,453 |

|

|

|

7,557 |

|

|

|

9,172 |

|

|

| Other real estate owned

(OREO) |

|

|

3,723 |

|

|

|

3,617 |

|

|

|

3,894 |

|

|

|

4,926 |

|

|

|

3,874 |

|

|

| Personal property

repossessed |

|

|

29 |

|

|

|

2 |

|

|

|

54 |

|

|

|

51 |

|

|

|

50 |

|

|

| Total nonperforming

assets |

|

$ |

24,765 |

|

|

$ |

26,309 |

|

|

$ |

24,401 |

|

|

$ |

12,534 |

|

|

$ |

13,096 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Total nonperforming assets to

total assets |

|

|

1.12 |

% |

|

|

1.21 |

% |

|

|

1.11 |

% |

|

|

0.64 |

% |

|

|

0.69 |

% |

|

| Total nonperforming loans to

gross loans |

|

|

1.13 |

% |

|

|

1.23 |

% |

|

|

1.12 |

% |

|

|

0.46 |

% |

|

|

0.58 |

% |

|

| Allowance for loan losses to

nonperforming loans |

|

|

94.72 |

% |

|

|

85.65 |

% |

|

|

93.01 |

% |

|

|

248.64 |

% |

|

|

198.58 |

% |

|

| Allowance for loan losses to

gross loans |

|

|

1.07 |

% |

|

|

1.05 |

% |

|

|

1.04 |

% |

|

|

1.14 |

% |

|

|

1.15 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Performing troubled debt

restructurings (1) |

|

$ |

13,289 |

|

|

$ |

17,577 |

|

|

$ |

13,148 |

|

|

$ |

11,168 |

|

|

$ |

11,685 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| (1)

Nonperforming troubled debt restructurings are included with

nonaccrual loans or accruing loans 90 days or more past due. |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the three-month period ended |

|

| Quarterly Average

Balance Sheet Data: |

|

June 30, |

|

Mar. 31, |

|

Dec. 31, |

|

Sep. 30, |

|

June 30, |

|

| (dollars in

thousands) |

|

|

2019 |

|

|

|

2019 |

|

|

|

2018 |

|

|

|

2018 |

|

|

|

2018 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Interest-bearing cash

equivalents |

|

$ |

6,079 |

|

|

$ |

3,544 |

|

|

$ |

4,020 |

|

|

$ |

3,196 |

|

|

$ |

4,316 |

|

|

| Available for sale securities

and membership stock |

|

|

174,063 |

|

|

|

183,717 |

|

|

|

199,885 |

|

|

|

161,552 |

|

|

|

158,765 |

|

|

| Loans receivable, gross |

|

|

1,833,344 |

|

|

|

1,803,070 |

|

|

|

1,744,153 |

|

|

|

1,585,741 |

|

|

|

1,547,635 |

|

|

| Total interest-earning

assets |

|

|

2,013,486 |

|

|

|

1,990,331 |

|

|

|

1,948,058 |

|

|

|

1,750,489 |

|

|

|

1,710,716 |

|

|

| Other assets |

|

|

185,403 |

|

|

|

189,503 |

|

|

|

164,815 |

|

|

|

150,038 |

|

|

|

152,200 |

|

|

| Total assets |

|

$ |

2,198,889 |

|

|

$ |

2,179,834 |

|

|

$ |

2,112,873 |

|

|

$ |

1,900,527 |

|

|

$ |

1,862,916 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Interest-bearing deposits |

|

$ |

1,652,831 |

|

|

$ |

1,621,580 |

|

|

$ |

1,493,333 |

|

|

$ |

1,363,570 |

|

|

$ |

1,375,333 |

|

|

| Securities sold under

agreements to repurchase |

|

|

4,463 |

|

|

|

4,267 |

|

|

|

3,573 |

|

|

|

3,649 |

|

|

|

3,802 |

|

|

| FHLB advances |

|

|

51,304 |

|

|

|

67,091 |

|

|

|

146,010 |

|

|

|

105,081 |

|

|

|

60,246 |

|

|

| Note payable |

|

|

3,000 |

|

|

|

3,000 |

|

|

|

3,957 |

|

|

|

3,000 |

|

|

|

3,000 |

|

|

| Subordinated debt |

|

|

15,031 |

|

|

|

15,006 |

|

|

|

14,982 |

|

|

|

14,957 |

|

|

|

14,933 |

|

|

| Total interest-bearing

liabilities |

|

|

1,726,629 |

|

|

|

1,710,944 |

|

|

|

1,661,855 |

|

|

|

1,490,257 |

|

|

|

1,457,314 |

|

|

| Noninterest-bearing

deposits |

|

|

224,932 |

|

|

|

233,296 |

|

|

|

226,559 |

|

|

|

198,140 |

|

|

|

196,476 |

|

|

| Other noninterest-bearing

liabilities |

|

|

12,548 |

|

|

|

7,994 |

|

|

|

9,816 |

|

|

|

8,696 |

|

|

|

10,711 |

|

|

| Total liabilities |

|

|

1,964,109 |

|

|

|

1,952,234 |

|

|

|

1,898,230 |

|

|

|

1,697,093 |

|

|

|

1,664,501 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Common stockholders'

equity |

|

|

234,780 |

|

|

|

227,600 |

|

|

|

214,643 |

|

|

|

203,434 |

|

|

|

198,415 |

|

|

| Total stockholders'

equity |

|

|

234,780 |

|

|

|

227,600 |

|

|

|

214,643 |

|

|

|

203,434 |

|

|

|

198,415 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Total liabilities and

stockholders' equity |

|

$ |

2,198,889 |

|

|

$ |

2,179,834 |

|

|

$ |

2,112,873 |

|

|

$ |

1,900,527 |

|

|

$ |

1,862,916 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the three-month period ended |

|

| Quarterly Summary

Income Statement Data: |

|

June 30, |

|

Mar. 31, |

|

Dec. 31, |

|

Sep. 30, |

|

June 30, |

|

| (dollars in thousands,

except per share data) |

|

|

2019 |

|

|

|

2019 |

|

|

|

2018 |

|

|

|

2018 |

|

|

|

2018 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Interest income: |

|

|

|

|

|

|

|

|

|

|

|

| Cash equivalents |

|

$ |

38 |

|

|

$ |

28 |

|

|

$ |

35 |

|

|

$ |

25 |

|

|

$ |

26 |

|

|

| Available for sale

securities and membership stock |

|

|

1,220 |

|

|

|

1,320 |

|

|

|

1,387 |

|

|

|

1,101 |

|

|

|

1,028 |

|

|

| Loans receivable |

|

|

24,789 |

|

|

|

23,838 |

|

|

|

22,785 |

|

|

|

20,916 |

|

|

|

19,093 |

|

|

| Total interest

income |

|

|

26,047 |

|

|

|

25,186 |

|

|

|

24,207 |

|

|

|

22,042 |

|

|

|

20,147 |

|

|

| Interest expense: |

|

|

|

|

|

|

|

|

|

|

|

| Deposits |

|

|

6,422 |

|

|

|

5,851 |

|

|

|

4,925 |

|

|

|

4,009 |

|

|

|

3,656 |

|

|

| Securities sold under

agreements to repurchase |

|

|

10 |

|

|

|

10 |

|

|

|

8 |

|

|

|

8 |

|

|

|

8 |

|

|

| FHLB advances |

|

|

352 |

|

|

|

495 |

|

|

|

932 |

|

|

|

599 |

|

|

|

332 |

|

|

| Note payable |

|

|

38 |

|

|

|

37 |

|

|

|

48 |

|

|

|

35 |

|

|

|

33 |

|

|

| Subordinated debt |

|

|

232 |

|

|

|

239 |

|

|

|

226 |

|

|

|

224 |

|

|

|

215 |

|

|

| Total interest

expense |

|

|

7,054 |

|

|

|

6,632 |

|

|

|

6,139 |

|

|

|

4,875 |

|

|

|

4,244 |

|

|

| Net interest income |

|

|

18,993 |

|

|

|

18,554 |

|

|

|

18,068 |

|

|

|

17,167 |

|

|

|

15,903 |

|

|

| Provision for loan losses |

|

|

546 |

|

|

|

491 |

|

|

|

314 |

|

|

|

682 |

|

|

|

987 |

|

|

| Securities gains |

|

|

- |

|

|

|

244 |

|

|

|

- |

|

|

|

- |

|

|

|

43 |

|

|

| Other noninterest income |

|

|

3,741 |

|

|

|

3,702 |

|

|

|

4,054 |

|

|

|

3,430 |

|

|

|

3,511 |

|

|

| Noninterest expense |

|

|

12,778 |

|

|

|

13,190 |

|

|

|

12,552 |

|

|

|

11,449 |

|

|

|

11,275 |

|

|

| Income taxes |

|

|

1,853 |

|

|

|

1,725 |

|

|

|

1,802 |

|

|

|

1,666 |

|

|

|

1,559 |

|

|

| Net income available to

common stockholders |

|

$ |

7,557 |

|

|

$ |

7,094 |

|

|

$ |

7,454 |

|

|

$ |

6,800 |

|

|

$ |

5,636 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Basic earnings per common

share |

|

$ |

0.81 |

|

|

$ |

0.76 |

|

|

$ |

0.82 |

|

|

$ |

0.76 |

|

|

$ |

0.63 |

|

|

| Diluted earnings per common

share |

|

|

0.81 |

|

|

|

0.76 |

|

|

|

0.81 |

|

|

|

0.76 |

|

|

|

0.63 |

|

|

| Dividends per common

share |

|

|

0.13 |

|

|

|

0.13 |

|

|

|

0.13 |

|

|

|

0.13 |

|

|

|

0.11 |

|

|

| Average common shares

outstanding: |

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

9,316,000 |

|

|

|

9,323,000 |

|

|

|

9,137,000 |

|

|

|

8,996,000 |

|

|

|

8,995,000 |

|

|

| Diluted |

|

|

9,328,000 |

|

|

|

9,331,000 |

|

|

|

9,149,000 |

|

|

|

9,006,000 |

|

|

|

9,006,000 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Return on average assets |

|

|

1.37 |

% |

|

|

1.30 |

% |

|

|

1.41 |

% |

|

|

1.43 |

% |

|

|

1.21 |

% |

|

| Return on average common

stockholders' equity |

|

|

12.9 |

% |

|

|

12.5 |

% |

|

|

13.9 |

% |

|

|

13.4 |

% |

|

|

11.4 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Net interest margin |

|

|

3.77 |

% |

|

|

3.73 |

% |

|

|

3.71 |

% |

|

|

3.92 |

% |

|

|

3.72 |

% |

|

| Net interest spread |

|

|

3.54 |

% |

|

|

3.51 |

% |

|

|

3.49 |

% |

|

|

3.73 |

% |

|

|

3.55 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Efficiency ratio |

|

|

56.2 |

% |

|

|

59.3 |

% |

|

|

56.7 |

% |

|

|

55.6 |

% |

|

|

58.1 |

% |

|

Matt Funke

573-778-1800

Southern Missouri Bancorp (NASDAQ:SMBC)

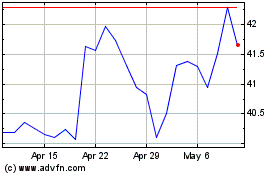

Historical Stock Chart

From Jun 2024 to Jul 2024

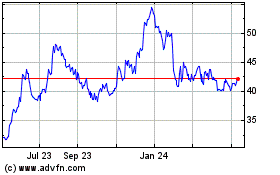

Southern Missouri Bancorp (NASDAQ:SMBC)

Historical Stock Chart

From Jul 2023 to Jul 2024