Shoe Carnival Beats on Both Lines - Analyst Blog

November 21 2012 - 4:00AM

Zacks

Shoe Carnival Inc.

(SCVL) recently posted third quarter 2012 earnings of 60 cents per

share, up 15.4% year over year. Earnings per share were also ahead

of the Zacks Consensus Estimate of 58 cents.

Net sales grew 13.4% year over year

to $244.4 million during the quarter, aided by comparable store

sales (comps) growth of 6.2%. The increase in traffic (up

low-single digit) and transaction (up mid-single digit) resulted in

the strong comps growth. Net sales beat the Zacks Consensus

Estimate of $242.0 million.

During the quarter, gross margin

increased 110 basis points (bps) to 31.3%. Higher merchandise

margin as well as a fall in buying, distribution and occupancy

costs led to the hike in gross margin. Selling, general and

administrative (SG&A) expenses, as a percentage of sales,

increased 50 bps year over year to 22.9%. Increased number of

stores operated as well as higher incentive compensation led to

higher SG&A expenses.

Financial

Position

At the end of the quarter, the

company had cash and cash equivalents of $67.1 million and

shareholders’ equity of $312.6 million.

Outlook

For fourth quarter 2012, the

company anticipates revenue growth between $215.0—$220.0 million

and earnings per share in the range of 19–23 cents. Comparable

store sales are expected to increase in the range of 2.0–4.0%.

For fiscal 2012, Shoe Carnival

expects net sales in the range of $864—$869 million. Comparable

store sales are expected to increase in the range of 4.8–5.3%.

Earnings per diluted share are expected in the range of $1.47 to

$1.51.

For fiscal 2012, Shoe Carnival

remains on track to open approximately 31 new stores and close 7.

Among the scheduled openings, the company has already opened 13

stores in the first quarter, 11 in the second and 6 in the third

quarter. As a result, the fourth quarter will now witness only one

opening.

Year to date, the company closed 3

stores in the first quarter and 2 stores in the second quarter. The

third quarter did not witness any unit shutdown but the company

intends to close the remaining two in the final quarter. Shoe

Carnival plans to finish the year with 352 stores. Management also

plans to open as many as 30–35 new stores in 2013.

Our Take

Shoe Carnival, a leading retailer

of value-priced footwear and accessories, posted

better-than-expected performance in the reported quarter.

Furthermore, the company has outperformed the Zacks Consensus

Estimates in the trailing four quarters with an average surprise of

12.72%.

Solid sales momentum combined with

margins improvement reflect its strong performance. The company’s

e-commerce drive and new loyalty programs are also contributing

considerably. Management also remains optimistic about the

company’s expansion plan, which will likely broaden its market

reach.

Shoe Carnival currently carries a

Zacks #1 Rank, which translates into a short-term Strong Buy

rating. We are maintaining our long-term Outperform recommendation

on the stock. One of its close peers, Cache Inc.

(CACH) recently reported loss of 39 cents per share beating the

Zacks consensus estimate of 40 cents of loss. Its net sales

declined 5.9% to $45.8 million.

CACHE INC (CACH): Free Stock Analysis Report

SHOE CARNIVAL (SCVL): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

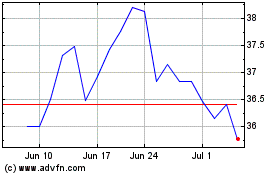

Shoe Carnival (NASDAQ:SCVL)

Historical Stock Chart

From Sep 2024 to Oct 2024

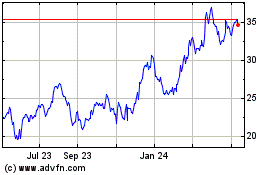

Shoe Carnival (NASDAQ:SCVL)

Historical Stock Chart

From Oct 2023 to Oct 2024