00014686662/32024Q3FALSE111111111P3Y00014686662023-02-042023-11-030001468666us-gaap:CommonClassAMember2023-12-05xbrli:shares0001468666us-gaap:CommonClassBMember2023-12-0500014686662023-11-03iso4217:USD00014686662023-02-03iso4217:USDxbrli:shares0001468666us-gaap:CommonClassAMember2023-02-030001468666us-gaap:CommonClassAMember2023-11-030001468666us-gaap:CommonClassBMember2023-02-030001468666us-gaap:CommonClassBMember2023-11-030001468666us-gaap:LicenseAndServiceMember2023-08-052023-11-030001468666us-gaap:LicenseAndServiceMember2022-07-302022-10-280001468666us-gaap:LicenseAndServiceMember2023-02-042023-11-030001468666us-gaap:LicenseAndServiceMember2022-01-292022-10-280001468666scwx:ProfessionalServicesMember2023-08-052023-11-030001468666scwx:ProfessionalServicesMember2022-07-302022-10-280001468666scwx:ProfessionalServicesMember2023-02-042023-11-030001468666scwx:ProfessionalServicesMember2022-01-292022-10-2800014686662023-08-052023-11-0300014686662022-07-302022-10-2800014686662022-01-292022-10-2800014686662022-01-2800014686662022-10-280001468666us-gaap:CommonClassAMemberus-gaap:CommonStockMember2023-08-040001468666us-gaap:CommonClassBMemberus-gaap:CommonStockMember2023-08-040001468666us-gaap:AdditionalPaidInCapitalMember2023-08-040001468666us-gaap:RetainedEarningsMember2023-08-040001468666us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-08-040001468666us-gaap:TreasuryStockCommonMember2023-08-0400014686662023-08-040001468666us-gaap:RetainedEarningsMember2023-08-052023-11-030001468666us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-08-052023-11-030001468666us-gaap:CommonClassAMemberus-gaap:CommonStockMember2023-08-052023-11-030001468666us-gaap:AdditionalPaidInCapitalMember2023-08-052023-11-030001468666us-gaap:CommonClassAMemberus-gaap:CommonStockMember2023-11-030001468666us-gaap:CommonClassBMemberus-gaap:CommonStockMember2023-11-030001468666us-gaap:AdditionalPaidInCapitalMember2023-11-030001468666us-gaap:RetainedEarningsMember2023-11-030001468666us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-11-030001468666us-gaap:TreasuryStockCommonMember2023-11-030001468666us-gaap:CommonClassAMemberus-gaap:CommonStockMember2023-02-030001468666us-gaap:CommonClassBMemberus-gaap:CommonStockMember2023-02-030001468666us-gaap:AdditionalPaidInCapitalMember2023-02-030001468666us-gaap:RetainedEarningsMember2023-02-030001468666us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-02-030001468666us-gaap:TreasuryStockCommonMember2023-02-030001468666us-gaap:RetainedEarningsMember2023-02-042023-11-030001468666us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-02-042023-11-030001468666us-gaap:CommonClassAMemberus-gaap:CommonStockMember2023-02-042023-11-030001468666us-gaap:AdditionalPaidInCapitalMember2023-02-042023-11-030001468666us-gaap:CommonClassAMemberus-gaap:CommonStockMember2022-07-290001468666us-gaap:CommonClassBMemberus-gaap:CommonStockMember2022-07-290001468666us-gaap:AdditionalPaidInCapitalMember2022-07-290001468666us-gaap:RetainedEarningsMember2022-07-290001468666us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-07-290001468666us-gaap:TreasuryStockCommonMember2022-07-2900014686662022-07-290001468666us-gaap:RetainedEarningsMember2022-07-302022-10-280001468666us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-07-302022-10-280001468666us-gaap:CommonClassAMemberus-gaap:CommonStockMember2022-07-302022-10-280001468666us-gaap:AdditionalPaidInCapitalMember2022-07-302022-10-280001468666us-gaap:CommonClassAMemberus-gaap:CommonStockMember2022-10-280001468666us-gaap:CommonClassBMemberus-gaap:CommonStockMember2022-10-280001468666us-gaap:AdditionalPaidInCapitalMember2022-10-280001468666us-gaap:RetainedEarningsMember2022-10-280001468666us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-10-280001468666us-gaap:TreasuryStockCommonMember2022-10-280001468666us-gaap:CommonClassAMemberus-gaap:CommonStockMember2022-01-280001468666us-gaap:CommonClassBMemberus-gaap:CommonStockMember2022-01-280001468666us-gaap:AdditionalPaidInCapitalMember2022-01-280001468666us-gaap:RetainedEarningsMember2022-01-280001468666us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-280001468666us-gaap:TreasuryStockCommonMember2022-01-280001468666us-gaap:RetainedEarningsMember2022-01-292022-10-280001468666us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-292022-10-280001468666us-gaap:CommonClassAMemberus-gaap:CommonStockMember2022-01-292022-10-280001468666us-gaap:AdditionalPaidInCapitalMember2022-01-292022-10-280001468666us-gaap:IPOMemberscwx:DenaliMember2023-02-042023-11-03xbrli:pure0001468666us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2023-11-030001468666scwx:SubscriptionBasedTaegisSoftwareAsAServiceMember2023-08-052023-11-030001468666scwx:SubscriptionBasedTaegisSoftwareAsAServiceMember2022-07-302022-10-280001468666scwx:SubscriptionBasedTaegisSoftwareAsAServiceMember2023-02-042023-11-030001468666scwx:SubscriptionBasedTaegisSoftwareAsAServiceMember2022-01-292022-10-280001468666scwx:SubscriptionBasedSecurityServicesMember2023-08-052023-11-030001468666scwx:SubscriptionBasedSecurityServicesMember2022-07-302022-10-280001468666scwx:SubscriptionBasedSecurityServicesMember2023-02-042023-11-030001468666scwx:SubscriptionBasedSecurityServicesMember2022-01-292022-10-280001468666scwx:SubscriptionBasedSolutionsMember2023-11-042023-11-0300014686662023-11-04scwx:ProfessionalServicesMember2023-11-03scwx:performanceObligationElement0001468666scwx:ActivePerformanceObligationMember2023-11-030001468666scwx:ActivePerformanceObligationMember2023-11-042023-11-0300014686662024-11-03scwx:ActivePerformanceObligationMember2023-11-030001468666scwx:ActivePerformanceObligationMember2025-11-022023-11-030001468666scwx:ActivePerformanceObligationMember2026-11-012023-11-030001468666scwx:BacklogPerformanceObligationMember2023-11-030001468666scwx:BacklogPerformanceObligationMember2023-11-042023-11-0300014686662024-11-03scwx:BacklogPerformanceObligationMember2023-11-030001468666scwx:BacklogPerformanceObligationMember2025-11-022023-11-0300014686662026-11-01scwx:BacklogPerformanceObligationMember2023-11-0300014686662023-11-042023-11-0300014686662024-11-032023-11-0300014686662025-11-022023-11-0300014686662026-11-012023-11-030001468666scwx:DeferredCommissionsMember2023-02-030001468666scwx:DeferredCommissionsMember2023-02-042023-11-030001468666scwx:DeferredCommissionsMember2023-11-030001468666scwx:DeferredFulfillmentCostsMember2023-02-030001468666scwx:DeferredFulfillmentCostsMember2023-02-042023-11-030001468666scwx:DeferredFulfillmentCostsMember2023-11-030001468666scwx:DeferredCommissionsMember2022-01-280001468666scwx:DeferredCommissionsMember2022-01-292022-10-280001468666scwx:DeferredCommissionsMember2022-10-280001468666scwx:DeferredFulfillmentCostsMember2022-01-280001468666scwx:DeferredFulfillmentCostsMember2022-01-292022-10-280001468666scwx:DeferredFulfillmentCostsMember2022-10-28scwx:reportingUnit0001468666us-gaap:CustomerRelationshipsMember2023-11-030001468666us-gaap:CustomerRelationshipsMember2023-02-030001468666scwx:AcquiredTechnologyMember2023-11-030001468666scwx:AcquiredTechnologyMember2023-02-030001468666scwx:DevelopedTechnologyMember2023-11-030001468666scwx:DevelopedTechnologyMember2023-02-030001468666us-gaap:TradeNamesMember2023-11-030001468666us-gaap:TradeNamesMember2023-02-030001468666us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2023-02-042023-11-030001468666us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2023-02-042023-11-030001468666us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2023-02-030001468666us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2022-10-280001468666srt:MinimumMember2023-02-042023-11-030001468666srt:MaximumMember2023-02-042023-11-030001468666us-gaap:StateAndLocalJurisdictionMember2023-11-030001468666srt:MinimumMember2023-11-030001468666srt:MaximumMember2023-11-0300014686662023-05-062023-08-040001468666us-gaap:RestrictedStockUnitsRSUMemberscwx:A2016LongTermIncentivePlanMember2023-08-052023-11-030001468666us-gaap:RestrictedStockUnitsRSUMemberscwx:A2016LongTermIncentivePlanMember2023-02-042023-11-030001468666us-gaap:RestrictedStockUnitsRSUMemberscwx:A2016LongTermIncentivePlanMember2022-07-302022-10-280001468666us-gaap:RestrictedStockUnitsRSUMemberscwx:A2016LongTermIncentivePlanMember2022-01-292022-10-280001468666us-gaap:RestrictedStockUnitsRSUMember2023-02-042023-11-030001468666scwx:RestrictedStockAndRestrictedStockUnitsMemberscwx:A2016LongTermIncentivePlanMember2023-02-042023-11-030001468666us-gaap:RestrictedStockUnitsRSUMemberscwx:A2016LongTermIncentivePlanMember2023-05-062023-08-040001468666us-gaap:CommonClassAMemberscwx:A2016LongTermIncentivePlanMember2023-08-052023-11-030001468666scwx:IncentiveCashAwardsMember2023-08-052023-11-030001468666scwx:IncentiveCashAwardsMember2023-02-042023-11-030001468666scwx:IncentiveCashAwardsMember2022-01-292022-10-280001468666scwx:IncentiveCashAwardsMember2022-07-302022-10-280001468666srt:ProFormaMember2023-02-042023-11-030001468666us-gaap:PrincipalOwnerMemberus-gaap:OtherNoncurrentAssetsMemberscwx:NetOperatingLossReceivableMemberscwx:DellInc.Member2023-11-030001468666us-gaap:PrincipalOwnerMemberus-gaap:OtherNoncurrentAssetsMemberscwx:NetOperatingLossReceivableMemberscwx:DellInc.Member2023-02-030001468666us-gaap:PrincipalOwnerMemberscwx:DellInc.Member2023-08-052023-11-030001468666us-gaap:PrincipalOwnerMemberscwx:DellInc.Member2023-02-042023-11-030001468666us-gaap:PrincipalOwnerMemberscwx:DellInc.Member2022-07-302022-10-280001468666us-gaap:PrincipalOwnerMemberscwx:DellInc.Member2022-01-292022-10-280001468666scwx:DellAndEMCMemberus-gaap:PrincipalOwnerMember2023-08-052023-11-030001468666scwx:DellAndEMCMemberus-gaap:PrincipalOwnerMember2023-02-042023-11-030001468666scwx:DellAndEMCMemberus-gaap:PrincipalOwnerMember2022-07-302022-10-280001468666scwx:DellAndEMCMemberus-gaap:PrincipalOwnerMember2022-01-292022-10-280001468666scwx:EMCandVMwareMemberus-gaap:SubsidiaryOfCommonParentMember2023-08-052023-11-030001468666scwx:EMCandVMwareMemberus-gaap:SubsidiaryOfCommonParentMember2023-02-042023-11-030001468666scwx:EMCandVMwareMemberus-gaap:SubsidiaryOfCommonParentMember2022-07-302022-10-280001468666scwx:EMCandVMwareMemberus-gaap:SubsidiaryOfCommonParentMember2022-01-292022-10-280001468666scwx:VMwareMemberus-gaap:SubsidiaryOfCommonParentMember2023-08-052023-11-030001468666scwx:VMwareMemberus-gaap:SubsidiaryOfCommonParentMember2023-02-042023-11-030001468666scwx:VMwareMemberus-gaap:SubsidiaryOfCommonParentMember2022-07-302022-10-280001468666scwx:VMwareMemberus-gaap:SubsidiaryOfCommonParentMember2022-01-292022-10-280001468666scwx:CarbonBlackInc.Memberus-gaap:SubsidiaryOfCommonParentMemberscwx:SolutionsPurchasesMember2023-08-052023-11-030001468666scwx:CarbonBlackInc.Memberus-gaap:SubsidiaryOfCommonParentMemberscwx:SolutionsPurchasesMember2023-02-042023-11-030001468666scwx:CarbonBlackInc.Memberus-gaap:SubsidiaryOfCommonParentMemberscwx:SolutionsPurchasesMember2022-07-302022-10-280001468666scwx:CarbonBlackInc.Memberus-gaap:SubsidiaryOfCommonParentMemberscwx:SolutionsPurchasesMember2022-01-292022-10-280001468666srt:ChiefExecutiveOfficerMemberscwx:DellInc.Member2023-08-052023-11-030001468666srt:ChiefExecutiveOfficerMemberscwx:DellInc.Member2023-02-042023-11-030001468666srt:ChiefExecutiveOfficerMemberscwx:DellInc.Member2022-07-302022-10-280001468666srt:ChiefExecutiveOfficerMemberscwx:DellInc.Member2022-01-292022-10-280001468666us-gaap:PrincipalOwnerMemberscwx:ContractsNotYetTransferredMemberscwx:DellInc.Member2023-08-052023-11-030001468666us-gaap:PrincipalOwnerMemberscwx:ContractsNotYetTransferredMemberscwx:DellInc.Member2023-02-042023-11-030001468666us-gaap:PrincipalOwnerMemberscwx:ContractsNotYetTransferredMemberscwx:DellInc.Member2022-07-302022-10-280001468666us-gaap:PrincipalOwnerMemberscwx:ContractsNotYetTransferredMemberscwx:DellInc.Member2022-01-292022-10-280001468666us-gaap:PrincipalOwnerMemberscwx:ContractsNotYetTransferredMemberscwx:DellInc.Member2023-11-030001468666us-gaap:PrincipalOwnerMemberscwx:SolutionsPurchasesMemberscwx:DellInc.Member2023-08-052023-11-030001468666us-gaap:PrincipalOwnerMemberscwx:SolutionsPurchasesMemberscwx:DellInc.Member2023-02-042023-11-030001468666us-gaap:PrincipalOwnerMemberscwx:SolutionsPurchasesMemberscwx:DellInc.Member2022-07-302022-10-280001468666us-gaap:PrincipalOwnerMemberscwx:SolutionsPurchasesMemberscwx:DellInc.Member2022-01-292022-10-280001468666scwx:RelatedPartyPayableMemberus-gaap:RelatedPartyMember2023-11-030001468666scwx:RelatedPartyPayableMemberus-gaap:RelatedPartyMember2023-02-030001468666us-gaap:PrincipalOwnerMemberscwx:DellInc.Member2023-11-030001468666us-gaap:PrincipalOwnerMemberscwx:DellInc.Member2023-02-030001468666us-gaap:PrincipalOwnerMemberscwx:NetOperatingLossReceivableMemberscwx:DellInc.Member2023-11-030001468666us-gaap:PrincipalOwnerMemberscwx:NetOperatingLossReceivableMemberscwx:DellInc.Member2023-02-030001468666us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel1Member2023-11-030001468666us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel1Member2023-02-0300014686662022-01-292023-02-030001468666scwx:WorkforceSegmentMember2022-01-280001468666scwx:RealEstateRelatedSegmentMember2022-01-280001468666us-gaap:AllOtherSegmentsMember2022-01-280001468666scwx:WorkforceSegmentMember2022-01-292023-02-030001468666scwx:RealEstateRelatedSegmentMember2022-01-292023-02-030001468666us-gaap:AllOtherSegmentsMember2022-01-292023-02-030001468666scwx:WorkforceSegmentMember2023-02-030001468666scwx:RealEstateRelatedSegmentMember2023-02-030001468666us-gaap:AllOtherSegmentsMember2023-02-030001468666scwx:WorkforceSegmentMember2023-02-042023-11-030001468666scwx:RealEstateRelatedSegmentMember2023-02-042023-11-030001468666us-gaap:AllOtherSegmentsMember2023-02-042023-11-030001468666scwx:WorkforceSegmentMember2023-11-030001468666scwx:RealEstateRelatedSegmentMember2023-11-030001468666us-gaap:AllOtherSegmentsMember2023-11-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| | | | | | | | | | | |

| (Mark One) | | |

| ☑ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended November 3, 2023

| | | | | | | | | | | |

| or |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to |

Commission File Number: 001-37748

SecureWorks Corp.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Delaware | | | | | | 27-0463349 | |

| (State or other jurisdiction of incorporation or organization) | | | | | | (I.R.S. Employer Identification No.) | |

| One Concourse Parkway NE | | | | | |

| Suite 500 | | | | | |

| Atlanta, | Georgia | | | | | | 30328 | |

| (Address of principal executive offices) | | | | (Zip Code) | |

(Registrant’s telephone number, including area code): (404) 327-6339

Not Applicable

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A Common Stock, | SCWX | The Nasdaq Stock Market LLC |

| par value $0.01 per share | (Nasdaq Global Select Market) |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large accelerated filer | ☐ | | Accelerated filer | ☑ |

| Non-accelerated filer | ☐ | | Smaller reporting company | ☐ |

| | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

As of December 5, 2023, there were 86,329,480 shares of the registrant's common stock outstanding, consisting of 16,329,480 outstanding shares of Class A common stock and 70,000,000 outstanding shares of Class B common stock.

| | | | | | | | | | | | | | |

| TABLE OF CONTENTS |

| | | | |

| ITEM | | | | PAGE |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

Except where the content otherwise requires or where otherwise indicated, all references in this report to "Secureworks," "we," "us," "our" and "our Company" to refer to SecureWorks Corp. and our subsidiaries on a consolidated basis.

Part I. Financial Information

Item 1. Financial Statements

SECUREWORKS CORP.

CONDENSED CONSOLIDATED STATEMENTS OF FINANCIAL POSITION (Unaudited)

(in thousands, except for per share data)

| | | | | | | | | | | |

| | November 3,

2023 | | February 3,

2023 |

| | | |

| ASSETS |

| Current assets: | | | |

| Cash and cash equivalents | $ | 58,105 | | | $ | 143,517 | |

Accounts receivable, net of allowances of $2,017 and $2,402, respectively | 55,914 | | | 72,627 | |

| Inventories, net | 759 | | | 620 | |

| Other current assets | 12,865 | | | 17,526 | |

| Total current assets | 127,643 | | | 234,290 | |

| Property and equipment, net | 2,626 | | | 4,632 | |

| Operating lease right-of-use assets, net | 5,262 | | | 9,256 | |

| Goodwill | 425,241 | | | 425,519 | |

| Intangible assets, net | 86,942 | | | 106,208 | |

| Other non-current assets | 72,236 | | | 60,965 | |

| Total assets | $ | 719,950 | | | $ | 840,870 | |

|

| LIABILITIES AND STOCKHOLDERS' EQUITY |

| Current liabilities: | | | |

| Accounts payable | $ | 11,675 | | | $ | 18,847 | |

| Accrued and other current liabilities | 60,890 | | | 81,566 | |

| Short-term deferred revenue | 126,198 | | | 145,170 | |

| | | |

| Total current liabilities | 198,763 | | | 245,583 | |

| Long-term deferred revenue | 6,988 | | | 11,162 | |

| Operating lease liabilities, non-current | 8,800 | | | 12,141 | |

| Other non-current liabilities | 7,662 | | | 14,023 | |

| Total liabilities | 222,213 | | | 282,909 | |

Commitments and contingencies (Note 6) | | | |

| Stockholders' equity: | | | |

Preferred stock - $0.01 par value: 200,000 shares authorized; — shares issued | — | | | — | |

Common stock - Class A of $0.01 par value: 2,500,000 shares authorized; 16,329 and 14,749 shares issued and outstanding, at November 3, 2023 and February 3, 2023, respectively. | 163 | | | 147 | |

Common stock - Class B of $0.01 par value: 500,000 shares authorized; 70,000 shares issued and outstanding | 700 | | | 700 | |

| Additional paid in capital | 986,257 | | | 967,367 | |

| Accumulated deficit | (461,871) | | | (384,121) | |

| Accumulated other comprehensive loss | (7,616) | | | (6,237) | |

Treasury stock, at cost - 1,257 shares | (19,896) | | | (19,896) | |

| Total stockholders' equity | 497,737 | | | 557,961 | |

| Total liabilities and stockholders' equity | $ | 719,950 | | | $ | 840,870 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

SECUREWORKS CORP.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited)

(in thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| | November 3,

2023 | | October 28,

2022 | | November 3,

2023 | | October 28,

2022 |

| | | | | | | |

| Net revenue: | | | | | | | |

| Subscription | $ | 75,212 | | | $ | 87,191 | | | $ | 229,296 | | | $ | 271,926 | |

| Professional services | 14,152 | | | 23,751 | | | 47,429 | | | 76,213 | |

| Total net revenue | 89,364 | | | 110,942 | | | 276,725 | | | 348,139 | |

| Cost of revenue: | | | | | | | |

| Subscription | 25,986 | | | 32,136 | | | 87,089 | | | 99,022 | |

| Professional services | 8,629 | | | 13,444 | | | 30,369 | | | 45,572 | |

| Total cost of revenue | 34,615 | | | 45,580 | | | 117,458 | | | 144,594 | |

| Gross profit | 54,749 | | | 65,362 | | | 159,267 | | | 203,545 | |

| Operating expenses: | | | | | | | |

| Research and development | 26,358 | | | 35,263 | | | 85,766 | | | 102,232 | |

| Sales and marketing | 27,079 | | | 41,380 | | | 92,842 | | | 121,565 | |

| General and administrative | 20,565 | | | 24,725 | | | 63,194 | | | 74,359 | |

| Reorganization and other related charges | — | | | — | | | 14,232 | | | — | |

| Total operating expenses | 74,002 | | | 101,368 | | | 256,034 | | | 298,156 | |

| Operating loss | (19,253) | | | (36,006) | | | (96,767) | | | (94,611) | |

| Interest and other (expense) income, net | 684 | | | (661) | | | (1,698) | | | (1,227) | |

| Loss before income taxes | (18,569) | | | (36,667) | | | (98,465) | | | (95,838) | |

| Income tax benefit | (4,148) | | | (8,521) | | | (20,715) | | | (21,375) | |

| Net loss | $ | (14,421) | | | $ | (28,146) | | | $ | (77,750) | | | $ | (74,463) | |

| | | | | | | |

| Loss per common share (basic and diluted) | $ | (0.17) | | | $ | (0.33) | | | $ | (0.90) | | | $ | (0.88) | |

| Weighted-average common shares outstanding (basic and diluted) | 86,278 | | | 84,584 | | | 85,943 | | | 84,277 | |

| | | | | | | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

SECUREWORKS CORP.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS (Unaudited)

(in thousands)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| November 3,

2023 | | October 28,

2022 | | November 3,

2023 | | October 28,

2022 |

| Net loss | $ | (14,421) | | | $ | (28,146) | | | $ | (77,750) | | | $ | (74,463) | |

| Foreign currency translation adjustments, net of tax | (2,038) | | | (2,717) | | | (1,379) | | | (6,715) | |

| Comprehensive loss | $ | (16,459) | | | $ | (30,863) | | | $ | (79,129) | | | $ | (81,178) | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

SECUREWORKS CORP.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited)

(in thousands)

| | | | | | | | | | | | |

| Nine Months Ended | |

| | November 3,

2023 | | October 28,

2022 | |

| Cash flows from operating activities: | | | | |

| Net loss | $ | (77,750) | | | $ | (74,463) | | |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | | |

| Depreciation and amortization | 26,028 | | | 27,728 | | |

| Amortization of right of use asset | 1,686 | | | 2,853 | | |

| Reorganization and other related charges | 3,272 | | | — | | |

| Amortization of costs capitalized to obtain revenue contracts | 12,964 | | | 13,319 | | |

| Amortization of costs capitalized to fulfill revenue contracts | 2,562 | | | 3,635 | | |

| | | | |

| Stock-based compensation expense | 24,852 | | | 27,504 | | |

| Effects of exchange rate changes on monetary assets and liabilities denominated in foreign currencies | 1,575 | | | 1,386 | | |

| Income tax benefit | (20,715) | | | (21,375) | | |

| | | | |

| Provision for credit losses | 232 | | | (552) | | |

| Changes in assets and liabilities: | | | | |

| Accounts receivable | 15,951 | | | 21,584 | | |

| Net transactions with Dell | 2,028 | | | (3,741) | | |

| Inventories | (139) | | | (178) | | |

| Other assets | (1,237) | | | (9,709) | | |

| Accounts payable | (7,462) | | | 4,550 | | |

| Deferred revenue | (24,011) | | | (33,171) | | |

| Operating leases, net | (4,031) | | | (4,086) | | |

| Accrued and other liabilities | (30,299) | | | (23,462) | | |

| Net cash used in operating activities | (74,494) | | | (68,178) | | |

| Cash flows from investing activities: | | | | |

| Capital expenditures | (865) | | | (1,609) | | |

| Software development costs | (4,106) | | | (3,352) | | |

| | | | |

| Net cash used in investing activities | (4,971) | | | (4,961) | | |

| Cash flows from financing activities: | | | | |

| | | | |

| Taxes paid on vested restricted shares | (5,947) | | | (8,484) | | |

| | | | |

| | | | |

| | | | |

| Net cash used in financing activities | (5,947) | | | (8,484) | | |

| Net decrease in cash and cash equivalents | (85,412) | | | (81,623) | | |

| Cash and cash equivalents at beginning of the period | 143,517 | | | 220,655 | | |

| Cash and cash equivalents at end of the period | $ | 58,105 | | | $ | 139,032 | | |

| | | | |

| | | | |

| | | | |

| | | | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

SECUREWORKS CORP.

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY (Unaudited)

(in thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended November 3, 2023 | | Common Stock - Class A | | Common Stock - Class B | | | | | | | | | | | |

| | | Outstanding Shares | | Amount | | Outstanding Shares | | Amount | | Additional Paid in Capital | | Accumulated Deficit | | Accumulated Other Comprehensive (Loss) Income | | Treasury

Stock | | Total Stockholders' Equity | |

| Balances, August 4, 2023 | | 16,235 | | | $ | 162 | | | 70,000 | | | $ | 700 | | | $ | 976,532 | | | $ | (447,450) | | | $ | (5,578) | | | $ | (19,896) | | | $ | 504,470 | | |

| Net loss | | — | | | — | | | — | | | — | | | — | | | (14,421) | | | — | | | — | | | (14,421) | | |

| Other comprehensive loss | | — | | | — | | | — | | | — | | | — | | | — | | | (2,038) | | | — | | | (2,038) | | |

| Vesting of restricted stock units | | 142 | | | 1 | | | — | | | — | | | (1) | | | — | | | — | | | — | | | — | | |

| | | | | | | | | | | | | | | | | | | |

| Common stock withheld as payment for withholding taxes upon the vesting of restricted shares | | (48) | | | — | | | — | | | — | | | (236) | | | — | | | — | | | — | | | (236) | | |

| Stock-based compensation | | — | | | — | | | — | | | — | | | 9,962 | | | — | | | — | | | — | | | 9,962 | | |

| | | | | | | | | | | | | | | | | | | |

| Balances, November 3, 2023 | | 16,329 | | | $ | 163 | | | 70,000 | | | $ | 700 | | | $ | 986,257 | | | $ | (461,871) | | | $ | (7,616) | | | $ | (19,896) | | | $ | 497,737 | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended November 3, 2023 | | Common Stock - Class A | | Common Stock - Class B | | | | | | | | | | | |

| | | Outstanding Shares | | Amount | | Outstanding Shares | | Amount | | Additional Paid in Capital | | Accumulated Deficit | | Accumulated Other Comprehensive (Loss) Income | | Treasury

Stock | | Total Stockholders' Equity | |

| Balances, February 3, 2023 | | 14,749 | | | $ | 147 | | | 70,000 | | | $ | 700 | | | $ | 967,367 | | | $ | (384,121) | | | $ | (6,237) | | | $ | (19,896) | | | $ | 557,961 | | |

| Net loss | | — | | | — | | | — | | | — | | | — | | | (77,750) | | | — | | | — | | | (77,750) | | |

| Other comprehensive loss | | — | | | — | | | — | | | — | | | — | | | — | | | (1,379) | | | — | | | (1,379) | | |

| Vesting of restricted stock units | | 2,355 | | | 24 | | | — | | | — | | | (24) | | | — | | | — | | | — | | | — | | |

| | | | | | | | | | | | | | | | | | | |

| Common stock withheld as payment for withholding taxes upon the vesting of restricted shares | | (775) | | | (8) | | | — | | | — | | | (5,938) | | | — | | | — | | | — | | | (5,947) | | |

| Stock-based compensation | | — | | | — | | | — | | | — | | | 24,852 | | | — | | | — | | | — | | | 24,852 | | |

| | | | | | | | | | | | | | | | | | | |

| Balances, November 3, 2023 | | 16,329 | | | $ | 163 | | | 70,000 | | | $ | 700 | | | $ | 986,257 | | | $ | (461,871) | | | $ | (7,616) | | | $ | (19,896) | | | $ | 497,737 | | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

SECUREWORKS CORP.

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY (Unaudited)

(in thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended October 28, 2022 | | Common Stock - Class A | | Common Stock - Class B | | | | | | | | | | | |

| | | Outstanding Shares | | Amount | | Outstanding Shares | | Amount | | Additional Paid in Capital | | Accumulated Deficit | | Accumulated Other Comprehensive (Loss) Income | | Treasury

Stock | | Total Stockholders' Equity | |

| Balances, July 29, 2022 | | 14,970 | | | $ | 150 | | | 70,000 | | | $ | 700 | | | $ | 949,248 | | | $ | (315,939) | | | $ | (6,670) | | | $ | (19,896) | | | $ | 607,593 | | |

| Net loss | | — | | | — | | | — | | | — | | | — | | | (28,146) | | | — | | | — | | | (28,146) | | |

| Other comprehensive loss | | — | | | — | | | — | | | — | | | — | | | — | | | (2,717) | | | — | | | (2,717) | | |

| Vesting of restricted stock units | | 168 | | | 2 | | | — | | | — | | | (2) | | | — | | | — | | | — | | | — | | |

| | | | | | | | | | | | | | | | | | | |

| Grant and forfeitures of restricted stock awards | | (423) | | | (4) | | | — | | | — | | | 4 | | | — | | | — | | | — | | | — | | |

| Common stock withheld as payment for withholding taxes upon the vesting of restricted shares | | (65) | | | (1) | | | — | | | — | | | (396) | | | — | | | — | | | — | | | (397) | | |

| Stock-based compensation | | — | | | — | | | — | | | — | | | 9,566 | | | — | | | — | | | — | | | 9,566 | | |

| | | | | | | | | | | | | | | | | | | |

| Balances, October 28, 2022 | | 14,650 | | | $ | 147 | | | 70,000 | | | $ | 700 | | | $ | 958,420 | | | $ | (344,085) | | | $ | (9,387) | | | $ | (19,896) | | | $ | 585,899 | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended October 28, 2022 | | Common Stock - Class A | | Common Stock - Class B | | | | | | | | | | | |

| | | Outstanding Shares | | Amount | | Outstanding Shares | | Amount | | Additional Paid in Capital | | Accumulated Deficit | | Accumulated Other Comprehensive (Loss) Income | | Treasury

Stock | | Total Stockholders' Equity | |

| Balances, January 28, 2022 | | 14,282 | | | $ | 143 | | | 70,000 | | | $ | 700 | | | $ | 939,404 | | | $ | (269,622) | | | $ | (2,672) | | | $ | (19,896) | | | $ | 648,057 | | |

| Net loss | | — | | | — | | | — | | | — | | | — | | | (74,463) | | | — | | | — | | | (74,463) | | |

| Other comprehensive loss | | — | | | — | | | — | | | — | | | — | | | — | | | (6,715) | | | — | | | (6,715) | | |

| Vesting of restricted stock units | | 1,549 | | | 15 | | | — | | | — | | | (15) | | | — | | | — | | | — | | | — | | |

| | | | | | | | | | | | | | | | | | | |

| Grant and forfeitures of restricted stock awards | | (423) | | | (4) | | | — | | | — | | | 4 | | | — | | | — | | | — | | | — | | |

| Common stock withheld as payment for withholding taxes upon the vesting of restricted shares | | (758) | | | (7) | | | — | | | — | | | (8,477) | | | — | | | — | | | — | | | (8,484) | | |

| Stock-based compensation | | — | | | — | | | — | | | — | | | 27,504 | | | — | | | — | | | — | | | 27,504 | | |

| | | | | | | | | | | | | | | | | | | |

| Balances, October 28, 2022 | | 14,650 | | | $ | 147 | | | 70,000 | | | $ | 700 | | | $ | 958,420 | | | $ | (344,085) | | | $ | (9,387) | | | $ | (19,896) | | | $ | 585,899 | | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

SECUREWORKS CORP.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

NOTE 1 — DESCRIPTION OF THE BUSINESS AND BASIS OF PRESENTATION

Description of the Business

SecureWorks Corp. is a leading global cybersecurity provider of technology-driven solutions singularly focused on protecting the Company’s customers. Except where the context otherwise requires or where otherwise indicated, all references in this report to “Secureworks,” “we,” “us,” “our” and “Company” refer to SecureWorks Corp. and our subsidiaries on a consolidated basis. References to “Dell” refer to Dell Inc. and its subsidiaries on a consolidated basis.

The Company has one primary business activity, which is to provide customers with technology-driven cybersecurity solutions. The Company’s chief operating decision-maker, who is the Chief Executive Officer, makes operating decisions, assesses performance and allocates resources on a consolidated basis. There are no segment managers who are held accountable for operations and operating results below the consolidated unit level. Accordingly, Secureworks operates its business as a single reportable segment.

On April 27, 2016, the Company completed its initial public offering, or IPO. Upon the closing of the IPO, Dell Technologies Inc., or Dell Technologies, owned, indirectly through Dell and its subsidiaries, all shares of the Company’s outstanding Class B common stock, which as of November 3, 2023, represented approximately 81.1% of the Company's total outstanding shares of common stock and approximately 97.7% of the combined voting power of both classes of the Company's outstanding common stock.

Basis of Presentation and Consolidation

The Company’s condensed consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America, or GAAP. The preparation of financial statements in accordance with GAAP requires management to make assumptions and estimations that affect the amounts reported in the Company’s financial statements and notes. The inputs into certain of the Company’s assumptions and estimations considered the economic implications of the Ukraine/Russia conflict and inflation concerns on the Company’s critical and significant accounting estimates. The condensed consolidated financial statements include assets, liabilities, revenue and expenses of all majority-owned subsidiaries. Intercompany transactions and balances are eliminated in consolidation.

For the periods presented, Dell has provided various corporate services to the Company in the ordinary course of business, including finance, tax, human resources, legal, insurance, IT, procurement and facilities-related services. The cost of these services is charged in accordance with a shared services agreement that went into effect on August 1, 2015. For more information regarding related party transactions, see “Note 10—Related Party Transactions.”

During the periods presented in the financial statements, Secureworks did not file separate federal tax returns, as the Company is generally included in the tax grouping of other Dell entities within the respective entity’s tax jurisdiction. The income tax benefit has been calculated using the separate return method, modified to apply the benefits-for-loss approach. Under this approach, net operating losses or other tax attributes are characterized as realized or as realizable by Secureworks when those attributes are utilized or expected to be utilized by other members of the Dell consolidated group. See “Note 9—Income and Other Taxes” for more information.

Fiscal Year

The Company’s fiscal year is the 52- or 53-week period ending on the Friday closest to January 31. The Company refers to the fiscal year ending February 2, 2024 and the fiscal year ended February 3, 2023 as fiscal 2024 and fiscal 2023, respectively. Fiscal 2024 consists of 52 weeks and fiscal 2023 consisted of 53 weeks. In fiscal 2024, each quarter has 13 weeks. In fiscal 2023, each quarter consisted of 13 weeks except for the fourth quarter, which consisted of 14 weeks. Unless otherwise indicated, all changes identified for the current-period results represent comparisons to results for the prior corresponding fiscal periods.

SECUREWORKS CORP.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reporting periods. Estimates are revised as additional information becomes available. In the Condensed Consolidated Statements of Operations, estimates are used when accounting for revenue arrangements, determining the cost of revenue, allocating cost, estimating the impact of contingencies, and evaluating long-lived asset impairment. In the Condensed Consolidated Statements of Financial Position, estimates are used in determining the valuation and recoverability of assets, such as accounts receivables, inventories, fixed assets, capitalized software, goodwill and other identifiable intangible assets. Estimates are also used in determining the reported amounts of liabilities, such as taxes payable and the impact of contingencies. All estimates also impact the Condensed Consolidated Statements of Operations. Actual results could differ from these estimates due to risks and uncertainties, including uncertainty in the current economic environment due to the Ukraine/Russia conflict and impacts of inflation. The Company considered the potential impact of the current economic and geopolitical uncertainty on its estimates and assumptions and determined there was not a material impact to the Company’s condensed consolidated financial statements as of and for the three and nine months ended November 3, 2023. As the current economic environment continues to develop, many of the Company’s estimates could require increased judgment and be subject to a higher degree of variability and volatility. As a result, the Company’s estimates may change materially in future periods.

Liquidity

In recent periods, the Company has incurred losses from operations and operating cash outflows and, as of the Balance Sheet date, the Company has reported a deficit in working capital.

During the second quarter of fiscal 2024, the Company completed reorganization actions which are expected to result in significant cost savings as the Company completes a transition to higher value, higher margin Taegis solutions. These efforts are expected to optimize the organizational structure and increase scalability to better position the Company for continued growth with improving operating margins over time. In the event that the Company’s financial results are below our expectations as a result of these or other factors, the Company may need to take additional actions to preserve existing cash reserves.

As of November 3, 2023, the Company held $58.1 million of cash and cash equivalents. There were no amounts drawn on the $50 million Revolving Credit Facility with Dell as of November 3, 2023. We believe that our cash and cash equivalents and access to the Revolving Credit Facility will provide us with sufficient liquidity to meet our material cash requirements, including to fund our business and meet our obligations for at least 12 months from the filing date of this report.

Recently Adopted Accounting Pronouncements

None.

Summary of Significant Accounting Policies

There have been no significant changes to the Company’s significant accounting policies as of and for the three and nine months ended November 3, 2023, as compared to the significant accounting policies described in the Company’s Annual Report on Form 10-K for the fiscal year ended February 3, 2023.

SECUREWORKS CORP.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

NOTE 2 — LOSS PER SHARE

Loss per share is calculated by dividing net loss for the periods presented by the respective weighted-average number of common shares outstanding, and excludes any dilutive effects of share-based awards that may be anti-dilutive. Diluted net loss per common share is computed by giving effect to all potentially dilutive common shares, including common stock issuable upon the exercise of stock options and restricted stock units. The Company applies the two-class method to calculate earnings per share. Because the Class A common stock and the Class B common stock share the same rights in dividends and earnings, earnings per share (basic and diluted) are the same for both classes of common stock. Since losses were incurred in all periods presented, all potential common shares were determined to be anti-dilutive.

The following table sets forth the computation of loss per common share (in thousands, except per share amounts):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| November 3,

2023 | | October 28,

2022 | | November 3,

2023 | | October 28,

2022 |

| Numerator: | | | | | | | |

| Net loss | $ | (14,421) | | | $ | (28,146) | | | $ | (77,750) | | | $ | (74,463) | |

| Denominator: | | | | | | | |

| Weighted-average number of shares outstanding: | | | | | | | |

| Basic and Diluted | 86,278 | | | 84,584 | | | 85,943 | | | 84,277 | |

| | | | | | | |

| Loss per common share: | | | | | | | |

| Basic and Diluted | $ | (0.17) | | | $ | (0.33) | | | $ | (0.90) | | | $ | (0.88) | |

| | | | | | | |

| Weighted-average anti-dilutive share-based awards | 8,845 | | | 6,099 | | | 7,693 | | | 6,020 | |

SECUREWORKS CORP.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

NOTE 3 — CONTRACT BALANCES AND CONTRACT COSTS

The Company derives revenue primarily from subscriptions and professional services. Subscription revenue is derived from (i) Taegis software-as-a-service, or SaaS, security platform and supplemental Managed Detection and Response, or MDR, services, and (ii) Managed Security Services. Taegis’ core offerings are the security platform, Taegis Extended Detection and Response, or XDR, and the MDR service, ManagedXDR. Managed Security Services are subscription-based arrangements that typically include a suite of security services utilizing the legacy platform. Professional services typically include incident response, adversarial testing services and other security consulting arrangements.

The following table presents revenue by service type (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| | November 3,

2023 | | October 28,

2022 | | November 3,

2023 | | October 28,

2022 |

| Net revenue: | | | | | | | | |

| Taegis Subscription Solutions | | $ | 67,346 | | | $ | 47,888 | | | $ | 196,368 | | | $ | 127,913 | |

| Managed Security Services | | 7,866 | | | 39,303 | | | 32,928 | | | 144,013 | |

| Total Subscription revenue | | $ | 75,212 | | | $ | 87,191 | | | $ | 229,296 | | | $ | 271,926 | |

| Professional Services | | 14,152 | | | 23,751 | | | 47,429 | | | 76,213 | |

| Total net revenue | | $ | 89,364 | | | $ | 110,942 | | | $ | 276,725 | | | $ | 348,139 | |

Promises to provide the Company’s subscription-based SaaS solutions are accounted for as separate performance obligations and managed security services are accounted for as a single performance obligation. Our subscription-based solutions have an average contract term of approximately two years as of November 3, 2023. Performance obligations related to the Company’s professional services contracts are separate obligations associated with each service. Although the Company has multi-year customer relationships for various professional service solutions, the arrangement is typically structured as a separate performance obligation over the contract period and recognized over a duration of less than one year.

The deferred revenue balance does not represent the total contract value of annual or multi-year, non-cancelable subscription agreements. The Company invoices its customers based on a variety of billing schedules. During the nine months ended November 3, 2023, on average, approximately 65% of the Company’s recurring revenue was billed annually in advance and approximately 35% was billed on either a monthly or quarterly basis in advance. In addition, many of the Company’s professional services engagements are billed in advance of service commencement. The deferred revenue balance is influenced by several factors, including seasonality, the compounding effects of renewals, billing frequency and invoice timing.

Changes to the Company’s deferred revenue during the nine months ended November 3, 2023 and October 28, 2022 are as follows (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | As of February 3, 2023 | | Upfront payments received and billings during the nine months ended November 3, 2023 | | Revenue recognized during the nine months ended November 3, 2023 | | As of November 3, 2023 |

| Deferred revenue | | $ | 156,332 | | | $ | 150,135 | | | $ | (173,281) | | | $ | 133,186 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | As of January 28, 2022 | | Upfront payments received and billings during the nine months ended October 28, 2022 | | Revenue recognized during the nine months ended October 28, 2022 | | As of October 28, 2022 |

| Deferred revenue | | $ | 176,068 | | | $ | 175,301 | | | $ | (206,853) | | | $ | 144,516 | |

SECUREWORKS CORP.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

Remaining Performance Obligation

The remaining performance obligation represents the transaction price allocated to contracted revenue that has not yet been recognized, which includes deferred revenue and non-cancellable contracts that are expected to be invoiced and recognized as revenue in future periods. The remaining performance obligation consists of two elements: (i) the value of remaining services to be provided through the contract term for customers whose services have been activated, or active; and (ii) the value of subscription-based solutions contracted with customers that have not yet been installed, or backlog. Backlog is not recorded in revenue, deferred revenue or elsewhere in the consolidated financial statements until the Company establishes a contractual right to invoice, at which point backlog is recorded as revenue or deferred revenue, as appropriate. The Company applies the practical expedient in Accounting Standards Codification paragraph 606-10-50-14(a) and does not disclose information about remaining performance obligations that are part of a contract that has an original expected duration of one year or less.

The Company expects that the amount of backlog relative to the total value of its contracts will change from year to year due to several factors, including the amount invoiced at the beginning of the contract term, the timing and duration of the Company’s customer agreements, varying invoicing cycles of agreements and changes in customer financial circumstances. Accordingly, fluctuations in backlog are not always a reliable indicator of future revenues.

As of November 3, 2023, the Company expects to recognize remaining performance obligations as follows (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Total | | Expected to be recognized in the next 12 months | | Expected to be recognized in 12-24 months | | Expected to be recognized in 24-36 months | | Expected to be recognized thereafter |

| Performance obligation - active | | $ | 210,557 | | | $ | 129,595 | | | $ | 66,976 | | | $ | 13,837 | | | $ | 149 | |

| Performance obligation - backlog | | 2,901 | | | 1,003 | | | 1,002 | | | 896 | | | — | |

| Total | | $ | 213,458 | | | $ | 130,598 | | | $ | 67,978 | | | $ | 14,733 | | | $ | 149 | |

Deferred Commissions and Fulfillment Costs

The Company capitalizes a significant portion of its commission expense and related fringe benefits earned by its sales personnel. Additionally, the Company capitalizes certain costs to install and activate hardware and software used in its managed security services, primarily related to a portion of the compensation for the personnel who perform the installation activities. These deferred costs are amortized on a systematic basis that is consistent with the transfer to the customer of the goods or services to which the assets relate.

Changes in the balance of total deferred commission and total deferred fulfillment costs during the nine months ended November 3, 2023 and October 28, 2022 are as follows (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | As of February 3, 2023 | | Amount capitalized | | Amount recognized | | As of November 3, 2023 |

| Deferred commissions | | $ | 49,565 | | | $ | 6,155 | | | $ | (12,964) | | | $ | 42,756 | |

| Deferred fulfillment costs | | 3,232 | | | — | | | (2,562) | | | 670 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | As of January 28, 2022 | | Amount capitalized | | Amount recognized | | As of October 28, 2022 |

| Deferred commissions | | $ | 53,978 | | | $ | 8,319 | | | $ | (13,319) | | | $ | 48,978 | |

| Deferred fulfillment costs | | 7,597 | | | 241 | | | (3,635) | | | 4,203 | |

During the fourth quarter of fiscal 2022, Secureworks announced the end-of-sale for a number of managed security service offerings effective the first day of fiscal 2023. Accordingly, the Company no longer has new deferred fulfillment costs that meet the criteria for capitalization in accordance with ASC 340. The Company evaluated these deferred costs as part of a broader asset group for impairment and potential changes to their estimated lives. The Company did not record any impairment losses on the deferred commissions or deferred fulfillment costs and did not identify any material changes to the expense recognition pattern during the nine months ended November 3, 2023 or October 28, 2022.

SECUREWORKS CORP.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

NOTE 4 — GOODWILL AND INTANGIBLE ASSETS

Goodwill relates to the acquisition of Dell by Dell Technologies and represents the excess of the purchase price attributable to Secureworks over the fair value of the assets acquired and liabilities assumed, as well as subsequent business combinations completed by the Company. Goodwill decreased $0.3 million due to foreign currency translation for the nine months ended November 3, 2023, compared to February 3, 2023. Goodwill totaled $425.2 million and $425.5 million as of November 3, 2023 and February 3, 2023, respectively.

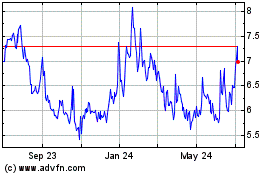

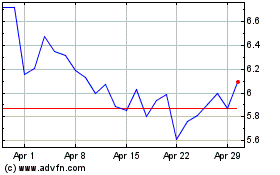

Goodwill and indefinite-lived intangible assets are tested for impairment on an annual basis during the third fiscal quarter of each fiscal year, or earlier if an indicator of impairment occurs. The Company completed the most recent annual impairment test in the third quarter of fiscal 2024 by performing a "Step 0" qualitative assessment of goodwill at the reporting unit level, as well as the Company's indefinite-lived trade name asset at the individual asset level. The Company has one reporting unit. The qualitative assessment includes the Company's consideration of the relevant events and circumstances that would affect the Company's single reporting unit, including macroeconomic, industry and market conditions, the Company's overall financial performance including changes to its cost structure during calendar 2023 and trends in the market price of the Company's Class A common stock. After assessing the totality of these events and circumstances, the Company determined it was not more-likely-than not that the fair value of the reporting unit and indefinite-lived intangible asset is less than their respective carrying values. No triggering events have transpired since the performance of the qualitative assessment that would indicate a potential impairment occurred during the period through November 3, 2023.

The Company did not recognize any impairment charges on goodwill or trade name asset during the period through November 3, 2023.

Intangible Assets

The Company’s intangible assets as of November 3, 2023 and February 3, 2023 were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | November 3, 2023 | | February 3, 2023 |

| | | Gross | | Accumulated

Amortization | | Net | | Gross | | Accumulated

Amortization | | Net |

| | | | | | | | | | | | |

| | | (in thousands) |

| Customer relationships | | $ | 189,518 | | | $ | (144,101) | | | $ | 45,417 | | | $ | 189,518 | | | $ | (133,530) | | | $ | 55,988 | |

| Acquired Technology | | 141,784 | | | (138,783) | | | 3,001 | | | 141,784 | | | (128,612) | | | 13,172 | |

| Developed Technology | | 15,933 | | | (7,527) | | | 8,406 | | | 11,827 | | | (4,897) | | | 6,930 | |

| Finite-lived intangible assets | | 347,235 | | | (290,411) | | | 56,824 | | | 343,129 | | | (267,039) | | | 76,090 | |

| Trade name | | 30,118 | | | — | | | 30,118 | | | 30,118 | | | — | | | 30,118 | |

| Total intangible assets | | $ | 377,353 | | | $ | (290,411) | | | $ | 86,942 | | | $ | 373,247 | | | $ | (267,039) | | | $ | 106,208 | |

Amortization expense related to finite-lived intangible assets was approximately $7.3 million and $23.4 million for the three and nine months ended November 3, 2023, respectively, and $7.9 million and $23.3 million for the three and nine months ended October 28, 2022, respectively. Amortization expense is included within cost of revenue and general and administrative expense in the Condensed Consolidated Statements of Operations. There were no impairment charges related to intangible assets during the three and nine months ended November 3, 2023 or October 28, 2022.

SECUREWORKS CORP.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

NOTE 5 — DEBT

Revolving Credit Facility

SecureWorks, Inc., a wholly-owned subsidiary of SecureWorks Corp., is a party to a revolving credit agreement with a wholly-owned subsidiary of Dell under which the Company obtained a $50 million senior, unsecured revolving credit facility. Effective September 6, 2023, the Company executed an amendment to the revolving credit agreement that was effectuated on March 23, 2023. This amended agreement: (1) increased the maximum principal amount of borrowings outstanding under the revolving credit facility to $50 million, (2) removed the one-time increase of up to an additional $30 million in borrowings upon mutual agreement by lender and borrower, (3) extended the commitment and required repayment date under the revolving credit agreement to March 23, 2026, and (4) modified the rate at which interest accrues on funds drawn against the revolving credit agreement to SOFR plus 2.00%.

Amounts under the facility may be borrowed, repaid and reborrowed from time to time during the term of the facility. The proceeds from loans made under the facility may be used for general corporate purposes. The credit agreement contains customary representations, warranties, covenants and events of default. The unused portion of the facility is subject to a commitment fee of 0.35%, which is due upon expiration of the facility. There was no outstanding balance under the credit facility, and the Company was in compliance with all covenants as of November 3, 2023 or February 3, 2023. Additionally, there were no amounts borrowed under the credit facility during the three and nine months ended November 3, 2023.

The borrower will be required to repay, in full, all of the loans outstanding, including all accrued interest, and the facility will terminate upon a change of control of SecureWorks Corp. or following a transaction in which SecureWorks, Inc. ceases to be a direct or indirect wholly-owned subsidiary of SecureWorks Corp. The facility is not guaranteed by SecureWorks Corp. or its subsidiaries.

SECUREWORKS CORP.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

NOTE 6 — COMMITMENTS AND CONTINGENCIES

Legal Contingencies— From time to time, the Company is involved in claims and legal proceedings that arise in the ordinary course of business. The Company accrues a liability when it believes that it is both probable that a liability has been incurred and that it can reasonably estimate the amount of the loss. The Company reviews the status of such matters at least quarterly and adjusts its liabilities as necessary to reflect ongoing negotiations, settlements, rulings, advice of legal counsel and other relevant information. Whether the outcome of any claim, suit, assessment, investigation or legal proceeding, individually or collectively, could have a material adverse effect on the Company’s business, financial condition, results of operations or cash flows will depend on a number of factors, including the nature, timing and amount of any associated expenses, amounts paid in settlement, damages or other remedies or consequences. To the extent new information is obtained and the Company’s views on the probable outcomes of claims, suits, assessments, investigations or legal proceedings change, changes in accrued liabilities would be recorded in the period in which such a determination is made. As of November 3, 2023, the Company does not believe that there were any such matters that, individually or in the aggregate, would have a material adverse effect on its business, financial condition, results of operations or cash flows.

Customer-based Taxation Contingencies—Various government entities, or taxing authorities, require the Company to bill its customers for the taxes they owe based on the services they purchase from the Company. The application of the rules of each taxing authority concerning which services are subject to each tax and how those services should be taxed involves the application of judgment. Taxing authorities periodically perform audits to verify compliance and include all periods that remain open under applicable statutes, which generally range from three to four years. These audits could result in significant assessments of past taxes, fines and interest if the Company were found to be non-compliant. During the course of an audit, a taxing authority may question the Company’s application of its rules in a manner that, if the Company were not successful in substantiating its position, could result in a significant financial impact to the Company. In the course of preparing its financial statements and disclosures, the Company considers whether information exists that would warrant disclosure or an accrual with respect to such a contingency.

As of November 3, 2023, the Company is under audit with various state taxing authorities in which rulings related to the taxability of certain of its services are pending; the Company has recorded an estimated liability of $8.9 million related to such matters. The Company expects to continue to appeal certain of these rulings, but should the Company not prevail, it could be subject to obligations to pay additional taxes together with associated penalties and interest for the audited tax period, as well as additional taxes for periods subsequent to the tax audit period, including penalties and interest. While Dell does provide an indemnification for certain state tax issues for tax periods prior to August 1, 2015, such indemnification would not cover a material portion of the current estimated liability.

Indemnifications—In the ordinary course of business, the Company enters into contractual arrangements under which it agrees to indemnify its customers from certain losses incurred by the customer as to third-party claims relating to the services performed on behalf of the Company or for certain losses incurred by the customer as to third-party claims arising from certain events as defined within the particular contract. Such indemnification obligations may not be subject to maximum loss clauses. Historically, payments related to these indemnifications have been immaterial.

Concentrations—The Company sells solutions to customers of all sizes through a combination of partners and its sales organization. During the three and nine months ended November 3, 2023 and October 28, 2022, the Company had no customer that represented 10% or more of its net revenue.

SECUREWORKS CORP.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

NOTE 7 — LEASES

The Company’s leases primarily relate to office facilities that have remaining lease terms of 0.8 years to 3.2 years, inclusive of renewal or termination options that the Company is reasonably certain to exercise.

The components of lease expense were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| | November 3,

2023 | | October 28,

2022 | | November 3,

2023 | | October 28,

2022 |

| | (in thousands) |

| Operating lease cost | | $ | 1,079 | | | $ | 1,161 | | | $ | 3,243 | | | $ | 3,543 | |

| Variable lease costs | | 98 | | | 121 | | | 249 | | | 326 | |

| Short term lease costs | | — | | | 40 | | | — | | | 87 | |

| Total lease costs | | $ | 1,177 | | | $ | 1,322 | | | $ | 3,492 | | | $ | 3,956 | |

| Supplemental cash flow information: | | | | | | | | |

| Cash paid for amounts included in the measurement of operating lease liabilities | | $ | 1,352 | | | $ | 1,419 | | | $ | 4,013 | | | $ | 4,575 | |

Weighted-average information associated with the measurement of remaining operating lease obligations is as follows:

| | | | | | | | |

| | | November 3, 2023 |

| Weighted-average remaining lease term | | 3.0 years |

| Weighted-average discount rate | | 5.4 | % |

The following table summarizes the maturity of the Company’s operating lease liabilities as of November 3, 2023 (in thousands):

| | | | | | | | |

| Fiscal Years Ending | | November 3, 2023 |

| 2024 | | $ | 1,350 | |

| 2025 | | 5,095 | |

| 2026 | | 4,526 | |

| 2027 | | 4,088 | |

| 2028 | | — | |

| Thereafter | | — | |

| Total operating lease payments | | $ | 15,059 | |

| Less imputed interest | | 1,072 | |

| Total operating lease liabilities | | $ | 13,987 | |

During the second quarter of fiscal 2024, as part of its actions to rebalance investments cross-functionally in alignment with its current strategy and growth opportunities, the Company ceased use of certain corporate office space as a part of its real estate-related cost optimization actions. In consideration of updated facts and circumstances relating to the Company's right-of-use asset that was partially impaired in the fourth quarter of fiscal 2023, the Company reassessed the discounted cash flow methodology used to derive fair value of this asset group. The Company determined the asset values were not recoverable and recorded an impairment loss of $2.9 million to its operating lease right-of-use assets during the second quarter of fiscal 2024.

SECUREWORKS CORP.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

NOTE 8 — STOCK-BASED COMPENSATION AND OTHER LONG-TERM PERFORMANCE INCENTIVES

The SecureWorks Corp. 2016 Long-Term Incentive Plan, or the 2016 Plan, provides for the grant of options, stock appreciation rights, restricted stock, restricted stock units, whether time-based, performance-based or time- and performance-based, deferred stock units, unrestricted stock, dividend equivalent rights, other equity-based awards, and cash bonus awards. Awards may be granted under the 2016 Plan to individuals who are employees, officers, or non-employee directors of the Company or any of its affiliates, consultants and advisors who perform services for the Company or any of its affiliates, and any other individual whose participation in the 2016 Plan is determined to be in the best interests of the Company by the compensation committee of the board of directors.

Under the 2016 Plan, the Company granted 222,185 and 8,276,147 restricted stock units during the three and nine months ended November 3, 2023, respectively, and 200,736 and 4,183,636 restricted stock units during the three and nine months ended October 28, 2022, respectively. The majority of the restricted stock units granted during these periods vest over a three-year period. Approximately 17% of such awards granted during each of the nine months ended November 3, 2023 and October 28, 2022 are subject to performance conditions. The majority of the 7,142,257 restricted stock unit awards made during the three months ended May 5, 2023 were subject to stockholder approval of an amendment to the 2016 Plan to increase the number of shares of Class A common stock issuable under the plan by 7,500,000 shares at the Company’s 2023 annual meeting on June 27, 2023. Such stockholder approval was obtained at the annual meeting, and those awards were deemed granted and outstanding for accounting purposes as of the approval date.

The Company grants long-term cash awards to certain employees under the 2016 Plan. The Company granted zero and $0.1 million of cash awards during the three and nine months ended November 3, 2023, respectively, compared to $0.1 million cash awards granted during the three and nine months ended October 28, 2022. The Company recognized $0.4 million and $1.5 million of related compensation expense for the three and nine months ended November 3, 2023, respectively, and $1.0 million and $3.5 million of related compensation expense for the three and nine months ended October 28, 2022, respectively.

SECUREWORKS CORP.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

NOTE 9 — INCOME AND OTHER TAXES

The Company’s loss before income taxes and income tax benefit (in thousands) and effective income tax rate for the three and nine months ended November 3, 2023 and October 28, 2022 was as follows (in thousands, except percentages):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| November 3,

2023 | | October 28,

2022 | | November 3,

2023 | | October 28,

2022 |

| | | | | | | |

| Loss before income taxes | $ | (18,569) | | | $ | (36,667) | | | $ | (98,465) | | | $ | (95,838) | |

| Income tax benefit | $ | (4,148) | | | $ | (8,521) | | | $ | (20,715) | | | $ | (21,375) | |

| Effective tax rate | 22.3 | % | | 23.2 | % | | 21.0 | % | | 22.3 | % |

During the periods presented in the accompanying Condensed Consolidated Statements of Financial Position, the Company did not file separate federal tax returns as the Company generally was included in the tax grouping of other Dell entities within the respective entity’s tax jurisdiction. The income tax benefit has been calculated using the separate return method, modified to apply the benefits-for-loss approach. Under the benefits-for-loss approach, net operating losses or other tax attributes are characterized as realized by the Company when those attributes are utilized by other members of the Dell consolidated group.

Effective for tax years beginning on or after January 1, 2022, the Tax Cuts and Jobs Act of 2017 eliminated the option to deduct research and development, or R&D, expenses in the year incurred and instead requires taxpayers to capitalize R&D expenses, including software development cost, and subsequently amortize such expenses over five years for R&D activities conducted in the United States and over fifteen years for R&D activities conducted outside of the United States.

The Company’s effective tax benefit rate was 22.3% and 21.0% for the three and nine months ended November 3, 2023, respectively, and 23.2% and 22.3% for the three and nine months ended October 28, 2022, respectively. The changes in the Company’s effective income tax rate between the periods was primarily attributable to the impact of certain discrete adjustments related to stock-based compensation expense of approximately $0.2 million and $1.8 million for the three and nine months ended November 3, 2023, respectively, and $0.1 million and $0.7 million for the three and nine months ended October 28, 2022, respectively. The changes related specifically to the impact of the vesting of certain equity awards for which the fair value on the vesting date was lower than the fair value for both the three and nine month periods ended November 3, 2023 and higher than the fair value for both the three and nine month periods ended October 28, 2022 in comparison to the fair value on the dates the equity awards were originally granted. The changes in fair value, which is measured by the price of the Class A common stock as reported on the Nasdaq Global Select Market, resulted in a lower actual tax deduction than the amounts deducted for financial reporting purposes for both the three and nine month periods ended November 3, 2023 and October 28, 2022.

As of each of November 3, 2023 and February 3, 2023, respectively, the Company had $5.8 million of deferred tax assets related to net operating loss carryforwards for state tax returns that are not included with those of other Dell entities. These net operating loss carryforwards began expiring in the fiscal year ended February 3, 2023. Due to the uncertainty surrounding the realization of these net operating loss carryforwards, the Company has provided valuation allowances for the full amount as of November 3, 2023 and February 3, 2023, respectively.

Because the Company is included in the tax filings of other Dell entities, management has determined that it will be able to realize its deferred tax assets. If Dell's ownership percentage were to fall below 80%, the Company would become ineligible for inclusion in the Dell Technologies consolidated tax group. The Company's ability to benefit from its losses and other tax attributes may be impaired resulting from the need to file its own Federal and State tax returns without the ability to offset its losses against the profits from the parent. The Company may be required to record a valuation allowance against its deferred tax assets that are currently recorded based on the tax sharing agreement with Dell. Currently, net deferred tax assets are approximately $21.3 million. If the Company’s tax provision had been prepared using the separate return method, the unaudited pro forma pre-tax loss, tax expense and net loss for the nine months ended November 3, 2023 would have been $(98.5) million, $1.2 million and $(99.7) million, respectively, as a result of the recognition of a valuation allowance that would have been recorded on a significant amount of deferred tax assets as well as certain attributes from the Tax Cuts and Jobs Act of 2017 that would be lost if not utilized by the Dell consolidated group.

Net deferred tax balances are included in other non-current assets and other non-current liabilities in the Condensed Consolidated Statements of Financial Position.

As of November 3, 2023 and February 3, 2023, the Company had a net operating loss receivable from Dell of $7.6 million and $3.5 million, respectively. The Company had $4.7 million and $4.5 million of unrecognized tax benefits as of November 3, 2023 and February 3, 2023, respectively.

SECUREWORKS CORP.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

NOTE 10 — RELATED PARTY TRANSACTIONS

Allocated Expenses

For the periods presented, Dell has provided various corporate services to Secureworks in the ordinary course of business. The costs of services provided to Secureworks by Dell are governed by a shared services agreement between Secureworks and Dell Inc. The total amounts of the charges under the shared services agreement with Dell were $0.7 million and $2.3 million for the three and nine months ended November 3, 2023, respectively, and $0.9 million and $2.8 million for the three and nine months ended October 28, 2022, respectively. Management believes that the basis on which the expenses have been allocated is a reasonable reflection of the utilization of services provided to or the benefit received by the Company during the periods presented.

Related Party Arrangements

For the periods presented, related party transactions and activities involving Dell Inc. and its wholly-owned subsidiaries were not always consummated on terms equivalent to those that would prevail in an arm’s-length transaction where conditions of competitive, free-market dealing may exist.

The Company purchases computer equipment for internal use from Dell Inc. and its subsidiaries that is capitalized within property and equipment in the Condensed Consolidated Statements of Financial Position. Purchases of computer equipment from Dell and EMC Corporation, or EMC, an indirect, wholly-owned subsidiary of Dell that provides enterprise software and storage, totaled $7 thousand and $0.4 million for the three and nine months ended November 3, 2023, respectively, and $0.2 million and $0.6 million for the three and nine months ended October 28, 2022, respectively.

EMC previously maintained a majority ownership interest in VMware, Inc., or VMware, a company that provides cloud and virtualization software and services. The Company’s purchases of annual maintenance services, software licenses and hardware systems for internal use from Dell, EMC and VMware totaled $23 thousand and $0.7 million for the three and nine months ended November 3, 2023, respectively and $0.5 million and $1.0 million for the three and nine months ended October 28, 2022, respectively. On November 1, 2021, Dell Technologies completed its spin-off of all shares of common stock of VMware that were beneficially owned by Dell Technologies and its subsidiaries, including EMC, to Dell Technologies’ stockholders. As a result of the spin-off transaction, the businesses of VMware were separated from the remaining businesses of Dell Technologies, although, as of November 3, 2023, Michael S. Dell, the Chairman, Chief Executive Officer and majority stockholder of Dell Technologies, continued to serve as Chairman of the Board of VMware.

The Company recognized revenue related to solutions provided to VMware that totaled $0.2 million and $0.4 million for the three and nine months ended November 3, 2023, respectively, and $0.1 million and $0.4 million for the three and nine months ended October 28, 2022, respectively. In October 2019, VMware acquired Carbon Black Inc., a security business with which the Company had an existing commercial relationship. Purchases by the Company of solutions from Carbon Black totaled $0.3 million and $1.9 million for the three and nine months ended November 3, 2023, respectively, and $0.8 million and $2.5 million for the three and nine months ended October 28, 2022, respectively.

The Company also recognized revenue related to solutions provided to significant beneficial owners of Secureworks common stock, which include Mr. Dell and affiliates of Mr. Dell. The revenues recognized by the Company from solutions provided to Mr. Dell, MSD Capital, L.P. (a firm founded for the purposes of managing investments of Mr. Dell and his family), DFI Resources LLC, an entity affiliated with Mr. Dell, and the Michael and Susan Dell Foundation totaled $34 thousand and $0.2 million for the three and nine months ended November 3, 2023, respectively, and $35 thousand and $0.2 million for the three and nine months ended October 28, 2022, respectively.

The Company provides solutions to certain customers whose contractual relationships have historically been with Dell rather than Secureworks, although the Company has the primary responsibility to provide the services. Effective August 1, 2015, in connection with the IPO, many of such customer contracts were transferred from Dell to the Company, forming a direct contractual relationship between the Company and the end customer. For customers whose contracts have not yet been transferred or whose contracts were subsequently originated through Dell under a reseller agreement, the Company recognized revenues of approximately $13.6 million and $42.9 million for the three and nine months ended November 3, 2023, respectively, and $14.0 million and $44.6 million for the three and nine months ended October 28, 2022, respectively. In addition, as of November 3, 2023, the Company had approximately $2.9 million of contingent obligations to Dell related to outstanding performance bonds for certain customer contracts which Dell issued on behalf of the Company. These contingent obligations are not recognized as liabilities on the Company’s financial statements.

As the Company’s customer and on behalf of certain of its own customers, Dell also purchases solutions from the Company. The Company recognized revenues from such purchases of approximately $0.2 million and $0.6 million for the three and nine months ended November 3, 2023, respectively, and $1.2 million and $4.0 million for the three and nine months ended October 28, 2022, respectively.