1540 Broadway24th FloorNew YorkNYFALSE000149097800014909782023-11-012023-11-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

________________________________________

FORM 8-K

________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 1, 2023

________________________________________

Schrodinger, Inc.

(Exact name of Registrant as Specified in Its Charter)

________________________________________

| | | | | | | | |

| Delaware | 001-39206 | 95-4284541 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| (Commission File Number) |

| | |

1540 Broadway, 24th Floor New York, NY | | 10036 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (212) 295-5800

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading

Symbol(s) | | Name of each exchange on which registered |

| Common stock, par value $0.01 per share | | SDGR | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02 Results of Operations and Financial Condition.

On November 1, 2023, Schrödinger, Inc. (the “Company”) issued a press release announcing its financial results for the third quarter ended September 30, 2023. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information in this Form 8-K, including Exhibit 99.1 attached hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing made by the Company under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filings, unless expressly incorporated by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d)Exhibits:

| | | | | | | | |

Exhibit Number | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | |

| Schrödinger, Inc. |

| | |

Date: November 1, 2023 | By: | /s/ Geoffrey Porges |

| | Geoffrey Porges, MBBS |

| | Executive Vice President and Chief Financial Officer |

Exhibit 99.1

Schrödinger Reports Third Quarter 2023 Financial Results

Delivers Third Quarter Total Revenue of $42.6 Million; Maintains Full-Year 2023 Revenue Guidance

Continued Progress for SGR-1505, Healthy Volunteer Data Expected in Fourth Quarter of 2023

Phase 1 Study Initiated for SGR-2921; Discloses PRMT5-MTA Discovery Program

BMS Returns Two Programs From Collaboration

New York, November 1, 2023 – Schrödinger, Inc. (Nasdaq: SDGR), whose physics-based computational platform is transforming the way therapeutics and materials are discovered, today announced financial results for the quarter ended on September 30, 2023.

“Schrodinger had an excellent third quarter marked by strong revenue growth and significant pipeline progress. More of our software customers are increasing the scale of their use of our technology, and we remain very confident about the outlook for the full year,” said Ramy Farid, Ph.D., chief executive officer of Schrödinger. “We initiated our Phase 1 clinical study of SGR-2921 and our Phase 1 study of SGR-1505 in healthy volunteers is nearing completion. We look forward to sharing more details about our proprietary programs later this year.”

Today, Schrodinger announced that the rights to two related oncology discovery programs would revert to the company, after Bristol Myers Squibb elected not to proceed with further development of these programs for strategic reasons.

Third Quarter 2023 GAAP Financial Results

•Total revenue for the third quarter was $42.6 million compared to $37.0 million in the third quarter of 2022.

•Software revenue for the third quarter was $28.9 million compared to $24.7 million in the third quarter of 2022.

•Drug discovery revenue was $13.7 million for the third quarter compared to $12.3 million in the third quarter of 2022.

•Software gross margin was 76% for the third quarter compared to 72% in the third quarter of 2022.

•Operating expenses were $79.8 million for the third quarter compared to $63.4 million for the third quarter of 2022.

•Other expense for the third quarter was $8.7 million compared to other income of $6.5 million in the third quarter of 2022, driven by changes in the fair value of equity investments and interest income.

•Net loss for the third quarter was $62.0 million, compared to $39.9 million in the third quarter of 2022.

•At September 30, 2023, Schrödinger had cash, cash equivalents, restricted cash and marketable securities of approximately $503 million, compared to approximately $456 million at December 31, 2022.

| | | | | | | | | | | | | | | | | |

| Three Months Ended |

| September 30, |

| 2023 | | 2022 | | % Change |

| (in millions) | | |

| Total revenue | $ | 42.6 | | | $ | 37.0 | | | 15.1% |

| Software revenue | 28.9 | | | 24.7 | | | 17.0% |

| Drug discovery revenue | 13.7 | | | 12.3 | | | 11.4% |

| Software gross margin | 76 | % | | 72 | % | | |

| Operating expenses | $ | 79.8 | | | $ | 63.4 | | | 25.9% |

| Other (expense) income | $ | (8.7) | | | $ | 6.5 | | | N/M |

| Net loss | $ | (62.0) | | | $ | (39.9) | | | N/M |

For the three and nine months ended September 30, 2023, Schrödinger reported net losses of $62.0 million and net income of $71.4 million, respectively, compared to net losses of $39.9 million and $122 million for the three and nine months ended September 30, 2022, respectively.

For the three and nine months ended September 30, 2023, Schrödinger reported non-GAAP net losses of $50.4 million and $134.8 million, respectively, compared to non-GAAP net losses of $44.9 million and $117.0 million for the three and nine months ended September 30, 2022, respectively. See “Non-GAAP Information” below and the table at the end of this press release for a reconciliation of non-GAAP net income (loss) to GAAP net income (loss).

2023 Financial Outlook

•Schrödinger today updated its financial guidance for 2023. The company’s financial expectations for the fiscal year ending December 31, 2023 are as follows:

•Software revenue growth is expected to be in the range of 15 percent to 18 percent.

•Drug discovery revenue is expected to range from $50 million to $70 million.

•Software gross margin is expected to be similar to software gross margin for the full year 2022.

•Operating expense growth in 2023 is expected to be significantly lower than operating expense growth in 2022.

•Cash used for operating activities is now expected to be higher in 2023 than 2022, based on the mix of revenue, the timing and size of milestones and expectations for new business development activity this year.

Recent Company Highlights

Wholly-Owned Pipeline

•Schrödinger continues to advance SGR-1505, its investigational MALT1 inhibitor. The Phase 1 dose-escalation study in healthy volunteers is nearing completion, and the company expects to report data from the study in the fourth quarter of 2023. Enrollment in the Phase 1 dose-escalation study in relapsed or refractory B-cell malignancy patients is ongoing in the U.S. and EU. The U.S. Food and Drug Administration recently granted Orphan Drug Designation to SGR-1505 for potential treatment in mantle cell lymphoma.

•Today Schrödinger announced the initiation of the Phase 1 clinical study of SGR-2921, an investigational CDC7 inhibitor, in patients with acute myeloid leukemia or myelodysplastic syndrome. The study is designed to evaluate the safety, pharmacokinetics, pharmacodynamics, and determine the recommended dose. SGR-2921 has exhibited anti-tumor activity as a monotherapy and in combination with standard of care agents in multiple preclinical tumor models.

•Schrödinger continues to advance SGR-3515, an inhibitor of Wee1 and Myt1. Concurrent loss of function of Wee1 and Myt1 confers selective vulnerability in cancer cells, a mechanism referred to as synthetic lethality. IND-enabling activities are ongoing to support an IND submission for SGR-3515 in the first half of 2024.

•Today Schrödinger announced that one of its previously undisclosed discovery programs is PRMT5-MTA (protein arginine methyltransferase 5/methylthioadenosine). PRMT5 has been shown to be a synthetic lethal target for MTAP-deleted cancers with potential roles in the treatment of both hematologic and solid tumors. The company expects to provide more details about its PRMT5-MTA program and other early-stage programs at its Pipeline Day on December 14, 2023.

Schrödinger Collaborators

•In October, Schrödinger collaborator Morphic Holdings presented additional Phase 2a data from the EMERALD-1 trial of MORF-057, an oral ɑ4ꞵ7 inhibitor in development for ulcerative colitis and Crohn’s disease at United European Gastroenterology (UEG) week.

•In September, Structure Therapeutics presented positive results from the Phase Ib multiple ascending dose study of GSBR-1290, an oral GLP-1R, in healthy overweight or obese individuals.

•In September, Schrödinger and the Bill & Melinda Gates Foundation renewed their agreement to invest in the discovery and development of novel non-hormonal contraceptive agents for global health.

Platform

•During the third quarter, Schrödinger and Gates Ventures LLC extended their agreement to develop and apply simulation methods to improve battery performance for a second three-year period. The new research agreement includes total consideration of $6M and runs through August 2026.

•Schrödinger announced quarterly software release 2023-3, which incorporated a number of important updates, including a major enhancement to the company’s Induced Fit Docking (IFD) technology for optimization of certain key ADMET properties, the first full release of technology that can be used to optimize antibody affinity as a function of pH, and technology to more accurately predict small molecule pKa values, a key intrinsic molecular property.

•In August, Schrödinger scientists published the results of a novel automated workflow, FEP Protocol Builder (FEP-PB), which uses active-learning to automate development of accurate FEP+ protocols, increasing the number of targets amenable to the technology.

Third Quarter 2023 Webcast and Conference Call Information

Schrödinger will host a conference call to discuss its third quarter 2023 financial results on Wednesday, November 1, 2023, at 4:30 p.m. ET. The live webcast can be accessed under “News & Events” in the investors section of Schrödinger’s website, https://ir.schrodinger.com/news-and-events/event-calendar. The archived webcast will be available on Schrödinger’s website for approximately 90 days following the event.

Schrödinger Pipeline Day Webcast Information

Schrödinger will host its Pipeline Day in New York City on Thursday, December 14, 2023, beginning at 10:00 a.m. ET. Pipeline Day will be a hybrid event, with limited in-person attendance available to members of the investment community, and a simultaneous webcast will be available for individual investors and other interested parties who wish to join virtually. The live presentation can be accessed in the “Investors” section of Schrödinger’s website and will be archived for approximately 90 days. To participate in the live webcast, please register for the event here. It is recommended that participants register at least 15 minutes in advance of the event.

Non-GAAP Information

Included in this press release is certain financial information that has not been prepared in accordance with generally accepted accounting principles in the United States (GAAP). The company presents non-GAAP net income (loss) and non-GAAP net income (loss) per share, which exclude gains and losses on equity investments, changes in fair value, and income tax benefits and expenses. Adjusting net income to exclude the impact of these items results in a financial presentation for the company without the impact of our equity investments and tax benefits and expenses. Management believes non-GAAP net income (loss) and non-GAAP net income (loss) per share are useful measures for investors, taken in conjunction with the company’s GAAP financial statements because they provide greater period-over-period comparability with respect to the company’s operating performance, by excluding non-cash mark-to-market and other valuation adjustments for the company’s equity investments, non-recurring cash distributions from the company’s equity investments and the tax impact of these distributions that are not reflective of the ongoing operating performance of the business. However, the non-GAAP measures should be considered only in addition to, not as a substitute for or as superior to, net income (loss) and net income (loss) per share or other financial measures prepared in accordance with GAAP.

Other companies in Schrödinger’s industry may calculate non-GAAP net income (loss) and non-GAAP net income (loss) per share, differently than we do, limiting their usefulness as comparative measures. For a reconciliation of non-GAAP net income (loss) and non-GAAP net income (loss) per share to GAAP net income (loss) and GAAP net income (loss) per share, respectively, please refer to the tables at the end of this press release.

About Schrödinger

Schrödinger is transforming the way therapeutics and materials are discovered. Schrödinger has pioneered a physics-based computational platform that enables discovery of high-quality, novel molecules for drug development and materials applications more rapidly and at lower cost compared to traditional methods. The software platform is licensed by biopharmaceutical and industrial companies, academic institutions, and government laboratories around the world. Schrödinger’s multidisciplinary drug discovery team also leverages the software platform to advance a portfolio of collaborative and proprietary programs to address unmet medical needs.

Founded in 1990, Schrödinger has approximately 800 employees and is engaged with customers and collaborators in more than 70 countries. To learn more, visit www.schrodinger.com, follow us on LinkedIn and Instagram, or visit our blog, Extrapolations.com.

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements within the meaning of The Private Securities Litigation Reform Act of 1995 including, but not limited to those statements regarding Schrödinger’s expectations about the speed and capacity of its computational platform, its financial outlook for the fiscal year ending December 31, 2023, its plans to continue to invest in research and its strategic plans to accelerate the growth of its software licensing business and advance its collaborative and proprietary drug discovery programs, the long-term potential of its business, its ability to improve and advance the science underlying its platform, the initiation, timing, progress, and results of its proprietary drug discovery programs and product candidates and the drug discovery programs and product candidates of its collaborators, the clinical potential and favorable properties of its CDC7, MALT1, and Wee1/Myt1 inhibitors, including SGR-1505, SGR-2921, and SGR-3515, the clinical potential and favorable properties of its collaborators’ product candidates, as well as expectations related to the use of its cash, cash equivalents and marketable securities. Statements including words such as “aim,” “anticipate,” “believe,” “contemplate,” “continue,” “could,” “estimate,” “expect,” “goal,” “intend,” “may,” “might,” “plan,” “potential,” “predict,” “project,” “should,” “target,” “will,” “would” and statements in the future tense are forward-looking statements. These forward-looking statements reflect Schrödinger’s current views about its plans, intentions, expectations, strategies and prospects, which are based on the information currently available to the company and on assumptions the company has made. Actual results may differ materially from those described in these forward-looking statements and are subject to a variety of assumptions, uncertainties, risks and important factors that are beyond Schrödinger’s control, including the demand for its software platform, its ability to further develop its computational platform, its reliance upon third-party providers of cloud-based infrastructure to host its software solutions, factors adversely affecting the life sciences industry, fluctuations in the value of the U.S. dollar and foreign currencies, its reliance upon its third-party drug discovery collaborators, the uncertainties inherent in drug development and commercialization, such as the conduct of research activities and the timing of and its ability to initiate and complete preclinical studies and clinical trials, whether results from preclinical studies will be predictive of the results of later preclinical studies and clinical trials, uncertainties associated with the regulatory review of IND submissions, clinical trials and applications for marketing approvals, and the ability to retain and hire key personnel on its business and other risks detailed under the caption “Risk Factors” and elsewhere in the company’s Securities and Exchange Commission filings and reports, including its Quarterly Report on Form 10-Q for the fiscal quarter ended September 30, 2023, filed with the Securities and Exchange Commission on November 1, 2023, as well as future filings and reports by the company. Any forward-looking statements contained in this press release speak only as of the date hereof. Except as required by law, Schrödinger undertakes no duty or obligation to update any forward-looking statements contained in this press release as a result of new information, future events, changes in expectations or otherwise.

Contacts:

Matthew Luchini (Investors)

Schrödinger, Inc.

matthew.luchini@schrodinger.com

917-719-0636

Allie Nicodemo (Media)

Schrödinger, Inc.

allie.nicodemo@schrodinger.com

617-356-2325

Condensed Consolidated Statements of Operations (Unaudited)

(in thousands, except for share and per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Revenues: | | | | | | | |

| Software products and services | $ | 28,904 | | | $ | 24,667 | | | $ | 90,469 | | | $ | 87,759 | |

| Drug discovery | 13,665 | | | 12,313 | | | 52,071 | | | 36,353 | |

| Total revenues | 42,569 | | | 36,980 | | | 142,540 | | | 124,112 | |

| Cost of revenues: | | | | | | | |

| Software products and services | 7,034 | | | 6,866 | | | 20,844 | | | 21,478 | |

| Drug discovery | 11,896 | | | 12,913 | | | 38,554 | | | 40,316 | |

| Total cost of revenues | 18,930 | | | 19,779 | | | 59,398 | | | 61,794 | |

| Gross profit | 23,639 | | | 17,201 | | | 83,142 | | | 62,318 | |

| Operating expenses: | | | | | | | |

| Research and development | 46,833 | | | 32,885 | | | 130,279 | | | 91,830 | |

| Sales and marketing | 9,109 | | | 7,161 | | | 27,276 | | | 21,260 | |

| General and administrative | 23,890 | | | 23,318 | | | 73,414 | | | 67,507 | |

| Total operating expenses | 79,832 | | | 63,364 | | | 230,969 | | | 180,597 | |

| Loss from operations | (56,193) | | | (46,163) | | | (147,827) | | | (118,279) | |

| Other (expense) income | | | | | | | |

| (Loss) gain on equity investments | — | | | (3) | | | 147,322 | | | 11,825 | |

| Change in fair value | (14,522) | | | 5,273 | | | 61,869 | | | (16,591) | |

| Other income | 5,804 | | | 1,234 | | | 13,067 | | | 1,265 | |

| Total other (expense) income | (8,718) | | | 6,504 | | | 222,258 | | | (3,501) | |

| (Loss) income before income taxes | (64,911) | | | (39,659) | | | 74,431 | | | (121,780) | |

| Income tax (benefit) expense | (2,887) | | | 194 | | | 3,041 | | | 199 | |

| Net (loss) income | $ | (62,024) | | | $ | (39,853) | | | $ | 71,390 | | | $ | (121,979) | |

| | | | | | | |

| | | | | | | |

| Net (loss) income per share of common and limited common stockholders, basic: | $ | (0.86) | | | $ | (0.56) | | | $ | 1.00 | | | $ | (1.71) | |

| Weighted average shares used to compute net (loss) income per share of common and limited common stockholders, basic: | 71,924,451 | | 71,207,992 | | 71,679,765 | | 71,140,682 |

| Net (loss) income per share of common and limited common stockholders, diluted: | $ | (0.86) | | | $ | (0.56) | | | $ | 0.95 | | | $ | (1.71) | |

| Weighted average shares used to compute net (loss) income per share of common and limited common stockholders, diluted: | 71,924,451 | | 71,207,992 | | 74,966,791 | | 71,140,682 |

Condensed Consolidated Balance Sheets (Unaudited)

(in thousands, except for share and per share amounts)

| | | | | | | | | | | |

| Assets | September 30, 2023 | | December 31, 2022 |

| Current assets: | | | |

| Cash and cash equivalents | $ | 249,378 | | | $ | 90,474 | |

| Restricted cash | 6,230 | | | 5,243 | |

| Marketable securities | 246,905 | | | 360,613 | |

Accounts receivable, net of allowance for doubtful accounts of $150 and $125 | 19,884 | | | 55,953 | |

Unbilled and other receivables, net for allowance for unbilled receivables of $100 and $100 | 12,253 | | | 13,137 | |

| Prepaid expenses | 13,111 | | | 8,569 | |

| Total current assets | 547,761 | | | 533,989 | |

| Property and equipment, net | 22,498 | | | 14,244 | |

| Equity investments | 91,863 | | | 25,683 | |

| Goodwill | 4,791 | | | 4,791 | |

| Intangible assets, net | — | | | 587 | |

| Right of use assets - operating leases | 119,822 | | | 105,982 | |

| Other assets | 7,413 | | | 3,311 | |

| Total assets | $ | 794,148 | | | $ | 688,587 | |

| Liabilities and Stockholders' Equity: | | | |

| Current liabilities: | | | |

| Accounts payable | 10,318 | | | $ | 9,470 | |

| Income taxes payable | 1,084 | | | 355 | |

| Accrued payroll, taxes, and benefits | 25,508 | | | 24,882 | |

| Deferred revenue | 43,313 | | | 57,931 | |

| Lease liabilities - operating leases | 16,279 | | | 11,006 | |

| Other accrued liabilities | 8,536 | | | 5,166 | |

| Total current liabilities | 105,038 | | | 108,810 | |

| Deferred revenue, long-term | 12,102 | | | 25,598 | |

| Lease liabilities - operating leases, long-term | 112,720 | | | 105,485 | |

| Other liabilities, long-term | 707 | | | 800 | |

| Total liabilities | 230,567 | | | 240,693 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Stockholders' equity: | | | |

Preferred stock, $0.01 par value. Authorized 10,000,000 shares; zero shares issued and outstanding at September 30, 2023 and December 31, 2022, respectively | — | | | — | |

Common stock, $0.01 par value. Authorized 500,000,000 shares; 62,823,295 and 62,163,739 shares issued and outstanding at September 30, 2023 and December 31, 2022 , respectively | 628 | | | 622 | |

Limited common stock, $0.01 par value. Authorized 100,000,000 shares; 9,164,193 shares issued and outstanding at September 30, 2023 and December 31, 2022, respectively | 92 | | | 92 | |

| Additional paid-in capital | 871,100 | | | 828,700 | |

| Accumulated deficit | (307,748) | | | (379,138) | |

| Accumulated other comprehensive loss | (491) | | | (2,382) | |

| | | |

| | | |

| Total stockholders' equity | 563,581 | | | 447,894 | |

| Total liabilities and stockholders' equity | $ | 794,148 | | | $ | 688,587 | |

Condensed Consolidated Statements of Cash Flows (Unaudited)

(in thousands)

| | | | | | | | | | | | | |

| Nine Months Ended September 30, | | |

| 2023 | | 2022 | | |

| Cash flows from operating activities: | | | | | |

| Net income (loss) | $ | 71,390 | | | $ | (121,979) | | | |

| Adjustments to reconcile net income (loss) to net cash used in operating activities: | | | | | |

| Gain on equity investments | (147,322) | | | (11,825) | | | |

| | | | | |

| Fair value adjustments | (61,869) | | | 16,591 | | | |

| Depreciation and amortization | 4,198 | | | 3,202 | | | |

| Stock-based compensation | 35,307 | | | 29,425 | | | |

| | | | | |

| Noncash investment (accretion) amortization | (4,962) | | | 2,102 | | | |

| Loss on disposal of property and equipment | 140 | | | 14 | | | |

| | | | | |

| | | | | |

| Decrease (increase) in assets, net of acquisition: | | | | | |

| Accounts receivable, net | 36,069 | | | 8,673 | | | |

| Unbilled and other receivables | 884 | | | (3,272) | | | |

| Reduction in the carrying amount of right of use assets - operating leases | 5,722 | | | 4,812 | | | |

| Prepaid expenses and other assets | (13,048) | | | (6,837) | | | |

| Increase (decrease) in liabilities, net of acquisition: | | | | | |

| Accounts payable | 742 | | | 1,959 | | | |

| Income taxes payable | 729 | | | 638 | | | |

| Accrued payroll, taxes, and benefits | 626 | | | 499 | | | |

| Deferred revenue | (28,114) | | | (19,535) | | | |

| Lease liabilities - operating leases | (2,577) | | | 920 | | | |

| Other accrued liabilities | 2,607 | | | (128) | | | |

| Net cash used in operating activities | (99,478) | | | (94,741) | | | |

| Cash flows from investing activities: | | | | | |

| Purchases of property and equipment | (10,924) | | | (6,668) | | | |

| Purchases of equity investments | (4,125) | | | (600) | | | |

| Distribution from equity investment | 147,136 | | | 11,825 | | | |

| | | | | |

| Acquisition, net of acquired cash | — | | | (6,427) | | | |

| Purchases of marketable securities | (224,513) | | | (203,375) | | | |

| Proceeds from maturity of marketable securities | 345,074 | | | 283,711 | | | |

| Net cash provided by investing activities | 252,648 | | | 78,466 | | | |

| Cash flows from financing activities: | | | | | |

| Issuances of common stock upon stock option exercises | 7,099 | | | 1,628 | | | |

| Principal payments on finance leases | (5) | | | — | | | |

| | | | | |

| | | | | |

| Payment of offering costs | (373) | | | — | | | |

| Net cash provided by financing activities | 6,721 | | | 1,628 | | | |

| Net increase (decrease) in cash and cash equivalents and restricted cash | 159,891 | | | (14,647) | | | |

| Cash and cash equivalents and restricted cash, beginning of period | 95,717 | | | 123,267 | | | |

| Cash and cash equivalents and restricted cash, end of period | $ | 255,608 | | | $ | 108,620 | | | |

| | | | | |

| Supplemental disclosure of cash flow and noncash information | | | | | |

| Cash paid for income taxes | $ | 2,194 | | | $ | 462 | | | |

| Supplemental disclosure of non-cash investing and financing activities | | | | | |

| | | | | |

| Purchases of property and equipment in accounts payable | 274 | | | 198 | | | |

| Purchases of property and equipment in accrued liabilities | 685 | | | 109 | | | |

| Acquisition of right of use assets - operating leases, contingency resolution | 514 | | | 1,513 | | | |

| Acquisition of right of use assets - operating leases in exchange for lease liabilities - operating leases | 15,085 | | | 14,767 | | | |

| Acquisition of right of use assets in exchange for lease liabilities - finance leases | 279 | | | — | | | |

Reconciliation of GAAP to Non-GAAP Financial Measures (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 30, | | September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| (in thousands, except per share data) |

| Net (loss) income (GAAP) | $ | (62,024) | | | $ | (39,853) | | | $ | 71,390 | | | $ | (121,979) | |

| Income tax (benefit) expense | (2,887) | | | 194 | | | 3,041 | | | 199 | |

| Loss (gain) on equity investments | — | | | 3 | | | (147,322) | | | (11,825) | |

| Change in fair value | 14,522 | | | (5,273) | | | (61,869) | | | 16,591 | |

| Non-GAAP net loss | $ | (50,389) | | | $ | (44,929) | | | $ | (134,760) | | | $ | (117,014) | |

Non-GAAP net loss per share of common and

limited common stockholders, basic and

diluted | $ | (0.70) | | | $ | (0.63) | | | $ | (1.88) | | | $ | (1.64) | |

Weighted average shares used to compute net loss per

share of common and limited

common stockholders, basic and diluted | 71,924,451 | | | 71,207,992 | | | 71,679,765 | | | 71,140,682 | |

| | | | | | | |

Cover

|

Nov. 01, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Nov. 01, 2023

|

| Entity Registrant Name |

Schrodinger, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-39206

|

| Entity Tax Identification Number |

95-4284541

|

| Entity Address, Address Line One |

1540 Broadway

|

| Entity Address, Address Line Two |

24th Floor

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10036

|

| City Area Code |

212

|

| Local Phone Number |

295-5800

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, par value $0.01 per share

|

| Trading Symbol |

SDGR

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001490978

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

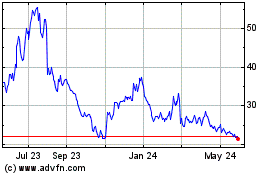

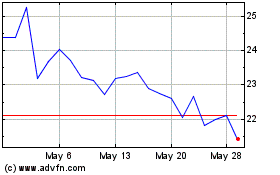

Schrodinger (NASDAQ:SDGR)

Historical Stock Chart

From Oct 2024 to Nov 2024

Schrodinger (NASDAQ:SDGR)

Historical Stock Chart

From Nov 2023 to Nov 2024