UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 1)*

Rumble Inc.

(Name of Issuer)

Class A Common

Stock, par value $0.0001 per share

(Title of Class of Securities)

78137L105

(CUSIP Number)

Christopher Pavlovski

c/o Rumble Inc.

444 Gulf of Mexico Dr.

Longboat Key, FL 34228

Telephone Number: (941) 210-0196

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

With copies to:

Russell L. Leaf

Sean M. Ewen

Willkie Farr & Gallagher LLP

787 Seventh Avenue

New York, NY 10019-6099

(212) 728-8000

September

5, 2023

(Date of Event which Requires Filing of this Statement)

If the filing person has previously filed

a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because

of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ☐

| * | The remainder of this cover page shall be filled out for

a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment

containing information which would alter disclosures provided in a prior cover page. |

The information required on the remainder

of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”)

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see

the Notes).

| 1. |

Names of Reporting Persons

Christopher Pavlovski |

| 2. |

Check the Appropriate Box if a Member of a Group (See Instructions) |

| |

(a) ☐ |

| |

(b) ☐ |

| 3. |

SEC Use Only

|

| 4. |

Source of Funds (See Instructions)

OO |

| 5. |

Check if Disclosure of Legal Proceedings Is Required Pursuant to

Items 2(d) or 2(e)

☐ |

| 6. |

Citizenship or Place of Organization

Canada |

Number

of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

7. |

Sole

Voting Power

140,182,173(1) |

| 8. |

Shared

Voting Power

0 |

| 9. |

Sole Dispositive

Power

140,182,173(1) |

| 10. |

Shared

Dispositive Power

0 |

| 11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

140,182,173(1) |

| 12. |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions)

☐ |

| 13. |

Percent of Class Represented by Amount in Row (11)

44.6% (2) |

| 14. |

Type

of Reporting Person (See Instructions)

IN |

| (1) |

Includes (i) 104,682,403 shares of Class A Common Stock (as defined below) of the Issuer (as defined below) issuable upon the exchange of exchangeable shares in 1000045728 Ontario Inc., a corporation formed under the laws of the Province of Ontario, Canada, and an indirect, wholly owned subsidiary of the Issuer (“ExchangeCo”, and such shares, the “ExchangeCo Shares”), of which 34,858,165 ExchangeCo Shares have been placed in escrow pursuant to the terms of the Business Combination Agreement, dated December 1, 2021 (the “Business Combination Agreement”), by and between CF Acquisition Corp. VI (n/k/a Rumble Inc.) (“CF VI”) and Rumble Inc. (n/k/a Rumble Canada Inc.) (“Rumble Canada”), and are subject to vesting conditions and forfeiture pursuant to the terms of the Business Combination Agreement; (ii) 34,399,769 shares of Class A Common Stock issuable upon the exercise of options, of which 11,335,655 shares of Class A Common Stock issuable upon the exercise of such options are subject to vesting conditions and forfeiture pursuant to the terms of the Business Combination Agreement; and (iii) a grant to the Reporting Person of restricted stock units (RSUs) covering 1,100,000 shares of Class A Common Stock pursuant to the 2022 Rumble Inc. Stock Incentive Plan, which RSUs, subject to the Reporting Person’s continuous employment through the applicable vesting dates, will vest in one-third installments on each of September 16, 2023, September 16, 2024 and September 16, 2025. Excludes (i) 104,682,403 shares of Class C Common Stock, par value $0.0001 per share, of the Issuer (the “Class C Common Stock”), which are issued in “tandem” with each ExchangeCo Share, with each such share of Class C Common Stock intended to give the holder thereof the same voting rights as one share of Class A Common Stock, but are otherwise non-economic and (ii) 105,782,403 shares of Class D Common Stock, par value $0.0001 per share, of the Issuer (the “Class D Common Stock”), with each share carrying 11.2663 votes per share, which together with any shares of Class A Common Stock and Class C Common Stock held by the Reporting Person as of the consummation of the transactions contemplated by the Business Combination Agreement, give the Reporting Person approximately 85% of the voting power of the Issuer on a fully-diluted basis. |

| |

|

| (2) |

Percentage based on 280,141,358 shares of Class A Common Stock issued and outstanding (inclusive of all shares of Class A Common Stock issuable upon exchange of the ExchangeCo Shares and which also includes shares of Class A Common Stock and ExchangeCo Shares placed in escrow pursuant to the terms of the Business Combination Agreement) as of August 10, 2023, as reported in the Issuer’s Quarterly Report on Form 10-Q filed on August 14, 2023. For purposes of the foregoing calculation, the issued and outstanding Class A Common Stock also includes 1,100,000 shares of Class A Common Stock issuable upon vesting of the RSUs granted to the Reporting Person as described in note 1 above. |

Item

1. Security and Issuer

This Amendment No. 1 to Schedule 13D (this “Amendment

No. 1”) is filed in relation to the shares of the Class A Common Stock, par value $0.0001 per share (the “Class A Common Stock”),

of Rumble Inc., a Delaware corporation (the “Issuer”) and amends the Schedule 13D filed by the Reporting Person on September

26, 2022 (the “Original 13D” and, together with this Amendment No. 1, the “Schedule 13D”). The principal executive

offices of the Issuer are located at 444 Gulf of Mexico Drive, Longboat Key, Florida 34228. Capitalized terms used and not defined in

this Amendment No. 1 have the meanings set forth in the Schedule 13D.

Item 2.

Identity and Background

| (a) | This Schedule 13D is being filed by Christopher Pavlovski

(the “Reporting Person”). |

| (b) | The principal business address of the Reporting Person is

c/o Rumble Inc., 444 Gulf of Mexico Drive, Longboat Key, Florida 34228. |

| (c) | The Reporting Person’s principal occupation or employment is Chief

Executive Officer of the Issuer. The name, principal business and address of the corporation or other organization in which such employment

is conducted is Rumble Canada Inc., an indirect, wholly owned subsidiary of the Issuer, 218 Adelaide Street West, Suite 400, Toronto,

Ontario, M5H 1W7, Canada. |

| (d) | During the last five years, the Reporting Person has not

been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors). |

| (e) | During the last five years, the Reporting Person was not

a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of such proceeding was or

is subject to a judgment, decree, or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal

or state securities laws, or finding any violation with respect to such laws. |

| (f) | The Reporting Person is a citizen of Canada. |

Item 4. Purpose of the Transaction

Item 4 of the Original Schedule 13D is hereby

amended and supplemented to include the following:

On September 5, 2023, the Issuer issued a press

release stating that the Reporting Person plans to continue standing firmly behind the Issuer and its mission and will therefore not sell

any of his Issuer shares when the Lock-Up Agreement expires on September 16, 2023. A copy of the press release is attached hereto as Exhibit

99.1 and incorporated herein by reference.

Item 5. Interest in Securities

of the Issuer

| (a) | The Reporting Person beneficially owns 140,182,173 shares

of Class A Common Stock (as determined and described in note 1 above), which represent 44.6% of the outstanding shares of Class A Common

Stock of the Issuer (as determined and described in note 2 above). |

| (b) | The Reporting Person has sole power to vote and sole power

to dispose of 140,182,173 shares of Class A Common Stock (which assumes 1,100,000 RSUs granted to the Reporting Person as described in

note 1 above have vested). |

| (c) | No transactions in the Issuer’s capital stock were

effected during the past 60 days by the Reporting Person except as set forth in Item 3 above and Item 6 below. |

Item 7. Material to be Filed as Exhibits

Signature

After reasonable

inquiry and to the best of my knowledge and belief, the undersigned certifies that the information set forth in this statement is true,

complete and correct.

Dated: September 6, 2023 |

/s/ Michael Ellis, as attorney-in-fact |

|

Christopher Pavlovski |

- 6 -

Exhibit 99.1

Chris

Pavlovski, Rumble’s Founder, CEO and Largest Shareholder, Comments on Upcoming Lock-Up Expiration

LONGBOAT

KEY, Fla., Sept. 05, 2023 (GLOBE NEWSWIRE) -- Rumble Inc. (Nasdaq: RUM), the popular video-sharing platform, today announced that the

company’s Founder and CEO Chris Pavlovski plans to continue standing firmly behind the company and its mission and will therefore

not sell any of his Rumble shares when the lock-up agreements that were part of the company’s business combination with CF Acquisition

Corp. VI expire on September 16, 2023.

“When

the lock-up is lifted, it will become evident who truly stands for free speech and who has other motivations. I, for one, remain deeply

and passionately committed to our mission to protect a free and open internet,” commented Mr. Pavlovski. “I did

not take Rumble public just to sell my shares as soon as I can, and therefore have no plans to sell.”

As

presented in Rumble’s proxy statement related to its most recent annual shareholder meeting, as of April 21, 2023, Mr. Pavlovski

was the beneficial owner of 140,182,173 shares of Rumble’s Class A Common Stock, all of which are subject to lock-up or vesting

requirements, representing 44.6% beneficial ownership of Class A Common Stock.

About

Rumble

Rumble

is a high-growth neutral video platform that is creating the rails and independent infrastructure designed to be immune to cancel culture.

Rumble’s mission is to restore the Internet to its roots by making it free and open once again. For more information, visit corp.rumble.com.

Forward-Looking

Statements

Certain

statements in this press release and the associated conference call constitute “forward-looking statements” within the meaning

of the U.S. Private Securities Litigation Reform Act of 1995. Statements contained in this press release that are not historical facts

are forward-looking statements and include, for example, results of operations, financial condition and cash flows (including revenues,

operating expenses, and net income (loss)); our ability to meet working capital needs and cash requirements over the next 12 months;

statements by our CEO regarding his intentions with respect to his company shares; and our expectations regarding future results and

certain key performance indicators. Certain of these forward-looking statements can be identified by using words such as “anticipates,”

“believes,” “intends,” “estimates,” “targets,” “expects,” “endeavors,”

“forecasts,” “could,” “will,” “may,” “future,” “likely,” “on

track to deliver,” “accelerate,” “looks forward to,” “begins to focus on,” “plans,”

“projects,” “assumes,” “should” or other similar expressions. Such forward-looking statements involve

known and unknown risks and uncertainties, and our actual results could differ materially from future results expressed or implied in

these forward-looking statements. The forward-looking statements included in this release are based on our current beliefs and expectations

of our management as of the date of this release. These statements are not guarantees or indicative of future performance. Important

assumptions and other important factors that could cause actual results to differ materially from those forward- looking statements include,

but are not limited to, the possibility that we may be adversely impacted by economic, business, and/or competitive factors; our limited

operating history making it difficult to evaluate our business and prospects; our inability to effectively manage future growth and achieve

operational efficiencies; our recent and rapid growth not being indicative of future performance; our inability to grow or maintain our

active user base; our inability to achieve or maintain profitability; our failure to comply with applicable privacy laws; occurrence

of a cyber incident resulting in information theft, data corruption, operational disruption and/or financial loss; potential liability

for hosting a variety of tortious or unlawful materials uploaded by third parties; negative publicity for removing, or declining to remove,

certain content, regardless of whether such content violated any law; impediment of access to our content and services on the Internet;

significant market competition that we face; changes to our existing content and services resulting in failure to attract traffic and

advertisers or to generate revenue; our dependence on third party vendors; our inability to realize the expected benefits of financial

incentives that we offer to our content creators; potential diversion of management's attention and consumption of resources as a result

of acquisitions of other companies and success in integrating and otherwise achieving the benefits of recent and potential acquisitions;

failure to maintain adequate operational and financial resources or raise additional capital or generate sufficient cash flows; adverse

effect on our business by compliance obligations imposed by new privacy laws, laws regulating social media platforms and online speech

in the U.S. and Canada; regulations regarding paid endorsements by content creators; and those additional risks, uncertainties and factors

described in more detail under the caption “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31,

2022, Quarterly Report on Form 10-Q for the quarter ended June 30, 2023, and in our other filings with the Securities and Exchange Commission.

We do not intend, and, except as required by law, we undertake no obligation, to update any of our forward-looking statements after the

issuance of this release to reflect any future events or circumstances. Given these risks and uncertainties, readers are cautioned not

to place undue reliance on such forward-looking statements.

Rumble Social

Media

Investors

and others should note that we announce material financial and operational information to our investors using our investor relations

website (investors.rumble.com), press releases, SEC filings and public conference calls and webcasts. We also intend to use certain social

media accounts as a means of disclosing information about us and our services and for complying with our disclosure obligations under

Regulation FD: the @rumblevideo X (formerly Twitter) account (twitter.com/rumblevideo), the @rumble TRUTH Social account (truthsocial.com/@rumble),

the @chrispavlovski X (formerly Twitter) account (twitter.com/chrispavlovski), and the @chris TRUTH Social account (truthsocial.com/@chris),

which Chris Pavlovski, our Chairman and Chief Executive Officer, also uses as a means for personal communications and observations. The

information we post through these social media channels may be deemed material. Accordingly, investors should monitor these social media

channels in addition to following our press releases, SEC filings and public conference calls and webcasts. The social media channels

that we intend to use as a means of disclosing the information described above may be updated from time to time as listed on our investor

relations website.

For

investor inquiries, please contact:

Shannon

Devine

MZ Group, MZ North America

203-741-8811

investors@rumble.com

Source:

Rumble Inc.

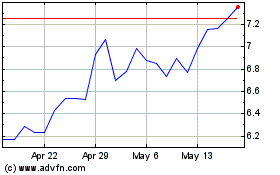

Rumble (NASDAQ:RUM)

Historical Stock Chart

From Jun 2024 to Jul 2024

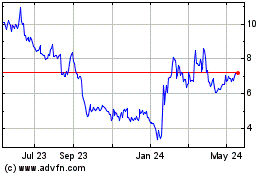

Rumble (NASDAQ:RUM)

Historical Stock Chart

From Jul 2023 to Jul 2024