0001601830FALSE00016018302024-09-032024-09-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 3, 2024

RECURSION PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

Delaware | | 001-40323 | | 46-4099738 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

41 S Rio Grande Street

Salt Lake City, UT 84101

(Address of principal executive offices) (Zip code)

(385) 269 - 0203

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☒ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading symbol(s) | Name of each exchange on which registered |

| Class A Common Stock, par value $0.00001 per share | RXRX | Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01. Regulation FD Disclosure.

On September 3, 2024, Recursion Pharmaceuticals, Inc. (“Recursion” or the “Company”) released an updated investor presentation. The investor presentation will be used from time to time in meetings with investors. A copy of the presentation is attached hereto as Exhibit 99.1.

The information furnished in this Item 7.01 (including Exhibit 99.1), shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 8.01. Other Events.

SYCAMORE Trial Top-Line Results

On September 3, 2024, the Company issued a press release announcing top-line results of its SYCAMORE trial, a 12-month Phase 2 randomized double-blind, placebo-controlled, safety, tolerability and exploratory efficacy study for REC-994 in symptomatic cerebral cavernous malformation patients. A copy of the press release is attached hereto as Exhibit 99.2 and incorporated by reference herein.

Certain Financial Information Relating to the Proposed Transaction with Exscientia

As previously disclosed in the Current Report on Form 8-K filed on August 8, 2024 (the “Original Form 8-K”), the Company, entered into a transaction agreement dated August 8, 2024 (the “Transaction Agreement”) with Exscientia plc (“Exscientia”). The Transaction Agreement provides that, subject to the terms and conditions set forth therein, including the requisite approval of each of the Company’s stockholders and Exscientia’s shareholders, the Company will acquire the entire issued and to be issued share capital of Exscientia pursuant to a scheme of arrangement under Part 26 of the United Kingdom Companies Act 2006 (the “Scheme of Arrangement” and such transaction, the “Transaction”).

In connection with the Transaction Agreement, the proposed Transaction, and the related transactions described in this Current Report on Form 8-K and the Original Form 8-K, which description is hereby incorporated by reference herein, the Company is providing the following information:

The Company is filing the following financial information related to Exscientia and the proposed Transaction:

•The audited consolidated statement of financial position of Exscientia as of and for the years ended December 31, 2023, and December 31, 2022, and the related consolidated statement of loss and other comprehensive (loss)/income, of changes in equity and of cash flows for each of the three years in the period ended December 31, 2023 are attached as Exhibit 99.3 hereto and incorporated by reference herein.

•The unaudited condensed consolidated financial statements of Exscientia as of June 30, 2024, and June 30, 2023, and for the three and six months ended June 30, 2024, and June 30, 2023, and the notes related thereto are attached as Exhibit 99.4 hereto and incorporated by reference herein.

•The unaudited pro forma condensed combined balance sheet of Recursion as of June 30, 2024, which combines the unaudited condensed consolidated balance sheets of Recursion and Exscientia as of June 30, 2024 and gives effect to the proposed Transaction as if it occurred on June 30, 2024, and the unaudited pro forma condensed combined statements of operation of Recursion and Exscientia for the year ended December 31, 2023, and the six months ended June 30, 2024, which combines the historical results of

Recursion and Exscientia for the year ended December 31, 2023 and the six months ended June 30, 2024 and gives effect to the proposed Transaction as if it occurred on January 1, 2023, and the notes related thereto are filed as Exhibit 99.5 hereto and incorporated by reference herein.

The consent of PricewaterhouseCoopers LLP, Exscientia’s independent registered public accounting firm, is attached as Exhibit 23.1 hereto.

Risk Factors Relating to the Transaction

Completion of the Transaction is subject to certain conditions, some of which are outside of the parties’ control, and if these conditions are not satisfied or waived, the Transaction will not be completed.

The obligation of Recursion and Exscientia to complete the Transaction is subject to customary conditions under the Transaction Agreement, including (i) required approvals from Recursion stockholders and Exscientia shareholders, (ii) clearance under the Hart-Scott Rodino Antitrust Improvements Act of 1976, as amended, and the rules and regulations thereunder (the “HSR Act”) and certain other merger control and investment laws and regulations of non-U.S. jurisdictions, (iii) the sanction of the Scheme of Arrangement by the High Court of Justice of England and Wales (the “Court”), (iv) the absence of any law or order that enjoins, prevents, prohibits, or makes illegal the consummation of the Transaction; and (v) the Recursion Shares issuable in the Transaction having been approved for listing on Nasdaq.

The requirement to satisfy the applicable conditions could delay completion of the Transaction for a significant period of time or prevent the Transaction from occurring at all. There can be no assurance that the conditions to the closing of the Transaction will be satisfied or, where applicable, waived or that the Transaction will be completed. Any delay in completing the Transaction could cause Recursion not to realize some or all of the benefits that the parties expect Recursion to achieve if the Transaction is successfully completed within the expected timeframe.

Further, as a condition to approving the Transaction, governmental authorities may impose conditions, terms, obligations or restrictions on the conduct of the parties’ business after the completion of the Transaction. If the parties were to become subject to any conditions, terms, obligations or restrictions, it is possible that such conditions, terms, obligations or restrictions will delay completion of the Transaction or otherwise adversely affect the parties’ business, financial condition, or operations. Furthermore, governmental authorities may require that the parties divest assets or businesses as a condition to the closing of the Transaction. If the parties are required to divest assets or businesses, there can be no assurance that Recursion or Exscientia will be able to negotiate such divestitures expeditiously or on favorable terms or that the governmental authorities will approve the terms of such divestitures.

In addition, if the Effective Time shall not have occurred by August 8, 2025, either Recursion or Exscientia may choose not to proceed with the Transaction and terminate the Transaction Agreement. Recursion and Exscientia may also terminate the Transaction Agreement under certain other circumstances.

Some of the conditions to the Transaction and termination rights may be waived by Recursion or Exscientia without resoliciting Recursion stockholder or Exscientia shareholder approval.

Certain conditions to completing the Transaction and termination rights set forth in the Transaction Agreement may be waived, in whole or in part, by Recursion or Exscientia. If any conditions or termination rights are waived after the approval of Recursion stockholders or of Exscientia shareholders has been obtained, Recursion and Exscientia will evaluate whether amendment of a future joint proxy statement and resolicitation of proxies would be warranted. Subject to applicable law, if Recursion and Exscientia determine that resolicitation of Exscientia shareholders or Recursion stockholders is not warranted, the parties will have the discretion to complete the Transaction without seeking such additional Recursion stockholder approval or Exscientia shareholder approval, as applicable.

Failure to complete the Transaction could negatively impact the Recursion stock price or Exscientia ADS price and the future business and financial results of Recursion and Exscientia, respectively.

If the Transaction is not completed for any reason, including as a result of a failure to obtain required approvals from Recursion stockholders and Exscientia shareholders, the ongoing businesses of Recursion and Exscientia may be adversely affected and, without realizing any of the benefits of having completed the Transaction, Recursion and Exscientia would be subject to a number of risks, including the following:

•Recursion may be required, under certain circumstances, to pay Exscientia a termination fee of approximately $58.77 million or reimburse Exscientia for certain fees and expenses;

•Exscientia may be required, under certain circumstances, to pay Recursion a termination fee of approximately $6.88 million;

•Recursion and Exscientia are subject to certain restrictions on the conduct of their businesses and capital raising activities prior to completing the Transaction, which may adversely affect their respective abilities to execute certain of their respective business strategies going forward if the Transaction is not completed;

•Recursion and Exscientia have incurred and will continue to incur significant costs and fees associated with the proposed Transaction, such as legal, accounting, financial advisor and printing fees, regardless of whether the Transaction is completed;

•Recursion and Exscientia may experience negative reactions from the financial markets, including negative impacts on their stock price and Exscientia ADS price, respectively;

•Recursion and Exscientia may experience negative reactions from their business partners, regulators and employees; and

•matters relating to the Transaction (including integration planning) will require substantial commitments of time and resources by Recursion’s and Exscientia’s management, which would otherwise have been devoted to day-to-day operations and other opportunities that may have been beneficial to Recursion and Exscientia as independent companies.

In addition, Recursion and Exscientia could be subject to litigation related to the Transaction that may prevent the Transaction from being completed in the time frame expected or at all. Litigation related to the Transaction may also result from failure to complete the Transaction or related to any enforcement proceeding commenced against Recursion or Exscientia to perform its obligations under the Transaction Agreement. If such Transaction litigation occurs it may result in significant costs of defense, indemnification and liability. If the Transaction is not completed, the related litigation risks may materialize and may adversely affect Recursion’s or Exscientia’s respective businesses, financial conditions, financial results and stock price or Exscientia’s ADS price, respectively.

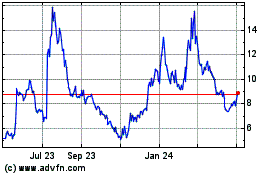

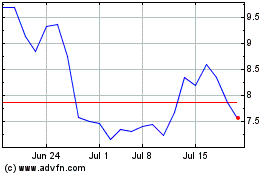

The number of Recursion Class A Common Stock that Exscientia shareholders will receive pursuant to the Transaction (the “Recursion Shares”) is based on a fixed exchange ratio that will not be adjusted to reflect changes in the market value of Recursion Shares or Exscientia ordinary shares (“Exscientia Shares”) or Exscientia ADSs or the number of Recursion Shares or Exscientia Shares or Exscientia ADSs outstanding prior to the completion of the Transaction. Further, when Recursion stockholders and Exscientia shareholders vote on the issuance of Recursion Shares, Scheme of Arrangement, and other related matters, as applicable, they will not know the exact market value of the Recursion Shares, or the aggregate number of Recursion Shares, that will be issued in connection with the Transaction.

Upon completion of the Transaction, Exscientia shareholders will be entitled to receive 0.7729 Recursion Shares for each Exscientia Share and Exscientia ADS (the “Exchange Ratio”) that such Exscientia shareholders own. The market value of the Recursion Shares that Exscientia shareholders will be entitled to receive when the Transaction and Scheme of Arrangement are completed could vary significantly due to a change in the market value of Recursion Shares from the date the Transaction Agreement was entered into, the date of a future special meeting of Recursion stockholders to approve the proposals relevant to the transaction (the “Recursion Special Meeting”) or the meetings of Exscientia shareholders to approve proposals relevant to the transaction (the “Exscientia Shareholder Meetings”). Because the Exchange Ratio will not be adjusted to reflect any changes in the market value of Recursion Shares or Exscientia ADSs, such market price fluctuations may affect the relative value that Exscientia shareholders and Exscientia ADS holders will receive. Changes in market value may result from a variety of factors, including

changes in the business, operations or prospects of Recursion or Exscientia, market assessments of the likelihood that the Transaction will be completed, market assessments of the value of Recursion, the timing of the Transaction, regulatory considerations, governmental actions, general market and economic conditions, legal proceedings and other factors, each of which may be beyond the control of Recursion or Exscientia. Prior to making any investment decision, stockholders and shareholders are urged to obtain updated market quotations for Recursion Shares and Exscientia ADSs.

It is anticipated that, based on the number of Exscientia Shares and Recursion Shares outstanding as of August 7, 2024, calculated on a fully diluted basis, immediately following completion of the Transaction, pre-Transaction Recursion stockholders will own approximately 74% of Recursion on a fully diluted basis and former Exscientia shareholders will own approximately 26% of Recursion on a fully diluted basis. The Exchange Ratio will not be adjusted based on the number of Recursion Shares or Exscientia Shares or Exscientia ADSs outstanding prior to the completion of the Transaction. As a result, the exact aggregate equity stakes that pre-Transaction Recursion stockholders and former Exscientia shareholders will hold in Recursion immediately following the completion of the Transaction will depend on the number of Recursion Shares and Exscientia Shares issued and outstanding immediately prior to the Effective Time. The number of Recursion Shares or Exscientia Shares or Exscientia ADSs outstanding may change based on issuances of Recursion Shares or Exscientia Shares in connection with capital raising activities, strategic transactions or grants of equity awards by either Recursion or Exscientia, subject to the terms and conditions of the Transaction Agreement.

The issuance of Recursion Shares in the Transaction, and the trading of Recursion Shares after completion of the Transaction may cause the market price of Recursion Shares to fall.

The issuance of Recursion Shares in connection with the Transaction could have the effect of decreasing the market price for Recursion Shares, including as a result of market assessments of the business, operations or prospects of Recursion, Exscientia and the combined company, as well as benefits anticipated to be derived from the Transaction. In addition, following completion of the Transaction, Recursion Shares are expected to be publicly traded on Nasdaq, enabling former Exscientia shareholders and Exscientia ADS holders to sell the Recursion Shares that they receive in the Transaction. Such sales of Recursion Shares may take place promptly following the Transaction and could have the effect of decreasing the market price for Recursion Shares, including below the market price of the Recursion Shares or Exscientia Shares or Exscientia ADSs owned by such Recursion stockholders or Exscientia shareholders or ADS holders, respectively, prior to completion of the Transaction.

The Transaction may be completed even though a material adverse effect subsequent to the announcement of the Transaction, such as industry-wide changes or other events, may occur.

In general, either Recursion or Exscientia may, on the terms and conditions set forth in the Transaction Agreement, refuse to complete the Transaction if there is a material adverse effect affecting the other party. However, some types of changes do not permit either Recursion or Exscientia to refuse to complete the Transaction, even if such changes would have a material adverse effect on either of the parties. For example, any changes in conditions generally affecting the industry in which Exscientia or its subsidiaries operate, or any change in regulatory, legislative or political conditions or conditions in securities, credit, financial, debt or other capital markets, in each case in the United States or any foreign country, except to the extent affecting Exscientia or Recursion in a disproportionate manner relative to other businesses operating in the industries in which they operate, or changes in the market value of Recursion Shares, Exscientia Shares, or Exscientia ADSs, would not give the other party the right to refuse to complete the Transaction. If adverse changes occur that affect either party, but the parties are still required to complete the Transaction, the share price of Recursion Shares and the business and financial results of Recursion may suffer.

The Transaction Agreement contains provisions that restrict Recursion’s and Exscientia’s ability to pursue alternatives to the Transaction and, in specified circumstances, would require Recursion or Exscientia to pay the other party a termination fee.

Under the Transaction Agreement, each of Recursion and Exscientia is restricted, subject to certain exceptions, from soliciting, initiating, knowingly facilitating, assisting or encouraging, discussing or negotiating, or furnishing non-public information with regard to, any inquiry, proposal or offer for an acquisition proposal from any third person or entity. If any party receives an acquisition proposal and such party’s board of directors determines (after

consultation with such party’s financial advisors and outside legal counsel) that such proposal constitutes a superior proposal for Recursion or Exscientia, as the case may be, and the Recursion Board or the Exscientia Board, respectively, makes a change in recommendation in response to such proposal to the stockholders or shareholders of such company, Recursion, on the one hand, or Exscientia, on the other hand, would be entitled, upon complying with certain requirements, to terminate the Transaction Agreement, subject to the terms of the Transaction Agreement. Under such circumstances, Recursion may be required to pay Exscientia a termination fee of approximately $58.77 million or Exscientia may be required to pay Recursion a termination fee of approximately $6.88 million. These provisions could discourage a third party that may have an interest in acquiring all or a significant part of either company from considering or proposing such an acquisition, even if such third party was prepared to enter into a transaction that would be more favorable to one of the companies and its respective stockholders or shareholders than the Transaction.

Until the completion of the Transaction or the termination of the Transaction Agreement pursuant to its terms, Recursion and Exscientia are each prohibited from entering into certain transactions and taking certain actions that might otherwise be beneficial to Recursion and its stockholders and/or Exscientia and its shareholders, respectively.

From and after the date of the Transaction Agreement and prior to the completion of the Transaction or the termination of the Transaction Agreement pursuant to its terms, the Transaction Agreement restricts Recursion and Exscientia from taking specified actions without the consent of the other party and requires that their respective businesses be conducted in the ordinary course. These restrictions may prevent Recursion or Exscientia, as applicable, from taking actions during the pendency of the Transaction that would have been beneficial, including capital raising activities. Adverse effects arising from these restrictions during the pendency of the Transaction could be exacerbated by any delays in the completion of the Transaction or termination of the Transaction Agreement.

Recursion and Exscientia will incur significant transaction and related costs in connection with the Transaction.

Recursion and Exscientia have incurred and expect to incur a number of non-recurring direct and indirect costs associated with the Transaction. These costs and expenses include fees paid to financial, legal and accounting advisors, severance and other potential employment-related costs, including payments that may be made to certain Recursion and Exscientia employees, filing fees, printing expenses and other related charges. Some of these costs are payable by Recursion and Exscientia regardless of whether the Transaction is completed. There are also processes, policies, procedures, operations, technologies and systems that must be integrated in connection with the Transaction and the integration of the two companies’ businesses. While both Recursion and Exscientia have assumed that a certain level of expenses would be incurred in connection with the Transaction and the other transactions contemplated by the Transaction Agreement and continue to assess the magnitude of these costs, there are many factors beyond their control that could affect the total amount or the timing of the integration and implementation expenses.

There may also be additional unanticipated significant costs in connection with the Transaction that Recursion and Exscientia may not recoup, including as a result of litigation related to the Transaction. These costs and expenses could reduce the realization of efficiencies and strategic benefits Recursion and Exscientia expect Recursion to achieve from the Transaction. Although Recursion and Exscientia expect that these benefits will offset the transaction expenses and implementation costs over time, this net benefit may not be achieved in the near term or at all.

In connection with the Transaction, Recursion and Exscientia may be required to take write-downs or write-offs, restructuring and impairment or other charges that could negatively affect the business, assets, liabilities, prospects, outlook, financial condition and results of operations of Recursion or Exscientia.

Although Recursion and Exscientia have conducted due diligence in connection with the Transaction and related transactions, they cannot assure you that this diligence revealed all material issues that may be present, that it would be possible to uncover all material issues through a customary amount of due diligence or that factors outside of Recursion’s and Exscientia’s control will not later arise. Even if Recursion’s and Exscientia’s due diligence successfully identifies certain risks, unexpected risks may arise and previously known risks may materialize in a manner not consistent with Recursion’s and Exscientia’s preliminary risk analysis. Further, as a result of the Transaction, purchase accounting and the proposed operation of Recursion going forward, Recursion and Exscientia

may be required to take write-offs or write-downs, restructuring and impairment or other charges. As a result, Recursion and Exscientia may be forced to write-down or write-off assets, restructure its operations or incur impairment or other charges that could negatively affect the business, assets, liabilities, prospects, outlook, financial condition and results of operations of Recursion and/or Exscientia.

After the Transaction, Recursion stockholders and Exscientia shareholders will have a reduced ownership and voting interest in Recursion than they currently have in Recursion and Exscientia respectively, and will exercise less influence over Recursion’s management.

It is anticipated that, based on the number of Exscientia Shares and Recursion Shares outstanding as of August 7, 2024, calculated on a fully diluted basis, immediately following completion of the Transaction, pre-Transaction Recursion stockholders will own approximately 74% of Recursion on a fully diluted basis and former Exscientia shareholders will own approximately 26% of Recursion on a fully diluted basis. The Exchange Ratio will not be adjusted based on the number of Recursion Shares or Exscientia Shares or Exscientia ADSs outstanding prior to the completion of the Transaction. Consequently, Recursion stockholders will have a reduced ownership of Recursion than they currently have of Recursion and will exercise less influence over the management and policies of Recursion than they currently have over the management and policies of Recursion. Former Exscientia shareholders will have a reduced ownership of Recursion than they currently have of Exscientia and will exercise less influence over the management and policies of Recursion than they currently have over the management and policies of Exscientia.

Recursion and Exscientia may have difficulty attracting, motivating and retaining executives and other key employees due to uncertainty associated with the Transaction.

Recursion’s success after completion of the Transaction will depend in part upon the ability of Recursion to retain key employees of Exscientia and Recursion. Competition for qualified personnel can be intense. Current and prospective employees of Exscientia or Recursion may experience uncertainty about the effect of the Transaction, which may impair Exscientia’s and Recursion’s ability to attract, retain and motivate key management, technical and other personnel prior to and following the Transaction. Employee retention may be particularly challenging during the pendency of the Transaction, as employees of Exscientia and Recursion may experience uncertainty about their future roles with Recursion.

In addition, pursuant to change in control and/or severance provisions in Exscientia’s severance schemes and employment agreements, certain key employees of Exscientia are entitled to receive severance payments upon certain qualifying terminations of their employment. Certain key Exscientia employees potentially could terminate their employment following specified circumstances set forth in the applicable severance scheme or employment agreement, including certain changes in such key employees’ title, status, authority, duties, responsibilities or compensation, and be entitled to receive severance. Such circumstances could occur in connection with the Transaction as a result of changes in roles and responsibilities.

While Recursion and Exscientia may employ the use of certain retention programs, there can be no guarantee that they will prove to be successful. If key employees of Recursion or Exscientia depart, the integration of the companies may be more difficult and Recursion’s business following the Transaction may be harmed. Furthermore, Recursion may be required to incur significant costs in identifying, hiring, training and retaining replacements for departing employees and may lose significant expertise and talent relating to the businesses of Exscientia, which may adversely affect Recursion’s ability to realize the anticipated benefits of the Transaction. In addition, there could be disruptions to or distractions for the workforce and management associated with activities of labor groups or integrating employees into Recursion. Accordingly, no assurance can be given that Recursion will be able to attract or retain key employees of Recursion or Exscientia to the same extent that those companies have been able to attract or retain their own employees in the past.

Recursion’s and Exscientia’s business relationships may be subject to disruption due to uncertainty associated with the Transaction.

Companies with which Recursion or Exscientia do business may experience uncertainty associated with the Transaction, including with respect to current or future business or strategic relationships with Recursion or Exscientia. Recursion’s and Exscientia’s business and strategic relationships may be subject to disruption as partners

and others may attempt to negotiate changes in existing business relationships or consider entering into business relationships with parties other than Recursion or Exscientia. These disruptions could have an adverse effect on the businesses, financial condition, results of operations or prospects of Recursion, including an adverse effect on Recursion’s ability to realize the anticipated benefits of the Transaction. The risk and adverse effect of such disruptions could be exacerbated by a delay in completion of the Transaction.

The respective opinions of Recursion’s and Exscientia’s financial advisors will not reflect changes in circumstances between the signing of the Transaction Agreement and the completion of the Transaction.

The Recursion board of directors (the “Recursion Board”) and the Exscientia board of directors (the “Exscientia Board”) received opinions from their respective financial advisors in connection with their determinations to approve the Transaction Agreement, the Transaction and all other transactions contemplated by the Transaction Agreement. However, Recursion and Exscientia do not expect to receive updated opinions from their respective financial advisors prior to completion of the Transaction, and thus, the opinions do not speak as of the time of the Recursion Special Meeting, the Exscientia Shareholder Meetings, or completion of the Transaction or as of any date other than the date of such opinions. Changes in the operations and prospects of Recursion or Exscientia, general market and economic conditions and other factors that may be beyond the control of Recursion or Exscientia and on which the financial advisors’ opinions were based may significantly affect the relative value of Recursion and Exscientia and the prices of Recursion Shares, Exscientia’s Shares, or Exscientia’s ADSs by the time the Transaction is completed.

Exscientia’s executive officers and directors have interests in the Transaction that may be different from the interests of Exscientia shareholders generally.

When considering the recommendation of the Exscientia Board that Exscientia shareholders approve the Scheme of Arrangement, Exscientia shareholders should be aware that directors and executive officers of Exscientia have certain interests in the Transaction that may be different from or in addition to the interests of Exscientia shareholders generally. These interests include, but are not limited to, the treatment of Exscientia equity compensation awards in the Scheme of Arrangement. The Exscientia Board was aware of these interests and considered them, among other things, in evaluating and negotiating the Transaction Agreement and the Transaction and in recommending that the Exscientia shareholders approve the Scheme of Arrangement. Additional information regarding such interests will be included in the joint proxy statement to be filed by Recursion and Exscientia with the SEC relating to the Transaction.

Completion of the Transaction may trigger change-in-control or other provisions in certain agreements that Recursion or Exscientia is party to.

The completion of the Transaction may trigger change-in-control or other provisions in certain agreements that Recursion or Exscientia is party to. If Recursion or Exscientia, as applicable, is unable to negotiate waivers of those provisions, the respective counterparties may exercise their rights and remedies under the applicable agreements, including in some instances potentially terminating the agreements or seeking damages or other remedies. Even if Recursion or Exscientia, as applicable, is able to negotiate waivers, the respective counterparties may require a fee for such waivers or seek to renegotiate the agreements on terms less favorable to the combined business.

Risks Relating to Recursion Following Completion of the Transaction

In addition to the risks described below, you should carefully consider the risks discussed under “—Risks Relating to Exscientia’s Business,” and the risk contained in Recursion’s most recent Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q, as these risks will be applicable to the business of Recursion following the completion of the Transaction.

The failure to integrate successfully the businesses of Recursion and Exscientia in the expected timeframe would adversely affect Recursion’s future business and financial performance following the Transaction.

The combination of two independent companies is a complex, costly and time-consuming process. As a result, the combined company will be required to devote significant management attention and resources to integrate the business practices and operations of Exscientia and Recursion. The integration process may disrupt the business of

either or both of the companies and, if implemented ineffectively, could preclude realization of the full benefits expected by Exscientia and Recursion from the Transaction. The failure of Recursion to meet the challenges involved in successfully integrating the operations of Exscientia and Recursion or otherwise to realize the anticipated benefits of the Transaction could cause an interruption of the activities of Recursion and could seriously harm its results of operations. In addition, the overall integration of the two companies may result in material unanticipated problems, expenses, liabilities, competitive responses, loss of customer relationships and diversion of management’s attention, and may cause Recursion’s stock price to decline. The difficulties of combining the operations of Recursion and Exscientia include, among others:

•managing a significantly larger company;

•coordinating geographically separate organizations, including extensive operations outside of the U.S.;

•the potential diversion of management’s focus and resources from other strategic opportunities and from operational matters;

•performance shortfalls at one or both of the companies as a result of the diversion of management’s attention caused by completing the Transaction and integrating the companies’ operations;

•aligning and executing the strategy of Recursion following the Transaction;

•retaining existing business relationships and executing new strategic or commercial relationships;

•maintaining employee morale and retaining key management and other employees;

•the disruption of, or the loss of momentum in, each company’s ongoing business or inconsistencies in standards, controls, systems, procedures and policies;

•integrating two unique business cultures, which may prove to be incompatible;

•the possibility of faulty assumptions underlying expectations regarding the integration process;

•consolidating corporate and administrative infrastructures and eliminating duplicative operations;

•integrating IT, communications and other systems;

•changes in applicable laws and regulations;

•managing tax costs or inefficiencies associated with integrating the operations of Recursion and Exscientia;

•unforeseen expenses or delays associated with the Transaction; and

•taking actions that may be required in connection with obtaining regulatory approvals.

Many of these factors will be outside of Recursion’s control and any one of them could result in increased costs, decreased revenues and diversion of management’s time and energy, which could materially impact the combined company’s business, financial condition and results of operations. In addition, even if the operations of Recursion and Exscientia are integrated successfully, Recursion may not realize the full benefits of the Transaction, including the cost savings or other benefits and synergies that Recursion and Exscientia expect. These benefits may not be achieved within the anticipated timeframe, or at all. As a result, Recursion and Exscientia cannot assure their respective stockholders, shareholders and ADS holders that the combination of Recursion and Exscientia will result in the realization of the full benefits anticipated from the Transaction.

The anticipated benefits of the Transaction may vary from expectations.

Recursion may fail to realize the anticipated cost savings or other benefits expected from the Transaction, which could adversely affect its business, financial condition and operating results. The success of the Transaction will depend, in significant part, on Recursion’s ability to successfully integrate the businesses of Recursion and Exscientia and realize the anticipated strategic benefits and synergies from the Transaction. Recursion and Exscientia believe that the combination of the two businesses will complement each party’s strategy by providing a

balanced and diversified product portfolio, operational efficiencies, supply chain optimization, complementary geographic footprints, product development synergies and capital raising opportunities. However, achieving these goals requires, among other things, realization of the targeted cost synergies expected from the Transaction. The anticipated benefits of the Transaction and actual operating, technological, strategic and revenue opportunities may not be realized fully or at all, or may take longer to realize than expected. If Recursion is not able to achieve these objectives and realize the anticipated benefits and synergies expected from the Transaction within the anticipated timeframe or at all, Recursion’s business, financial condition and operating results may be adversely affected.

The future results of Recursion will suffer if Recursion does not effectively manage its expanded operations following the Transaction.

Following the Transaction, the size of the business of Recursion will increase significantly beyond the current size of either Recursion’s or Exscientia’s business. Recursion’s future results depends, in part, upon its ability to manage this expanded business, which will pose substantial challenges for management, including challenges related to the management and monitoring of new operations and associated increased costs and complexity. There can be no assurance that Recursion will be successful or that it will realize the expected operating efficiencies, cost savings, revenue enhancements and other benefits currently anticipated from the Transaction.

Business issues currently faced by Recursion or Exscientia may be imputed to the operations of the other.

To the extent either Recursion or Exscientia currently has, or is perceived by business partners to have, operational challenges, such as performance, management or workforce issues, those challenges may raise concerns by existing business partners of the other company following the Transaction, which may limit or impede Recursion’s future ability to obtain additional business from those business partners.

The market price of Recursion Shares may be volatile.

The market price of Recursion Shares may be volatile. Broad general economic, political, market and industry factors may adversely affect the market price of Recursion Shares, regardless of Recursion’s actual operating performance and the success of the integration of Recursion and Exscientia. Factors that could cause fluctuations in the price of Recursion Shares include:

•actual or anticipated variations in operational and financial results, including the results of clinical trials with respect to Recursion’s and Exscientia’s drug product candidates;

•changes in price targets or financial projections by Recursion, if any, or by any securities analysts that may cover Recursion Shares;

•conditions or trends in the industry, including regulatory changes or changes in the securities marketplace;

•announcements by Recursion or its competitors of strategic or commercial partnerships or other transactions;

•announcements of investigations or regulatory scrutiny of Recursion’s operations or lawsuits filed against it;

•additions or departures of key personnel; and

•issuances or sales of Recursion Shares, including sales of shares by Recursion’s directors and officers or its key investors.

Future sales of Recursion Shares by Recursion or its stockholders in the public market, or the perception that such sales may occur, could reduce the price of Recursion Shares, and any additional capital raised by Recursion through the sale of equity or convertible securities may dilute ownership in Recursion.

The sale of Recursion Shares in the public market, or the perception that such sales could occur, could harm the prevailing market price of Recursion Shares. These sales, or the possibility that these sales may occur, also might make it more difficult for Recursion to sell equity securities in the future at a time and at a price that Recursion deems appropriate.

It is anticipated that, based on the number of Exscientia Shares and Recursion Class A Common Stock and Recursion Class B Common Stock outstanding as of August 7, 2024, calculated on a fully diluted basis, immediately following completion of the Transaction, pre-Transaction Recursion stockholders will own approximately 74% of Recursion on a fully diluted basis and former Exscientia shareholders will own approximately 26% of Recursion on a fully diluted basis.

All Recursion Shares that will be issued in connection with the Transaction are expected to be freely tradable without restriction or further registration under the Securities Act, except for any Recursion Shares held by Recursion’s affiliates, as that term is defined under Rule 144 of the Securities Act (“Rule 144”), including certain of Recursion’s directors, executive officers and other affiliates, which shares may be sold in the public market only if they are registered under the Securities Act or are sold pursuant to an exemption from registration such as Rule 144.

In addition, Recursion intends to file a registration statement with the SEC on Form S-8 providing for the registration of Recursion Shares issued or reserved for issuance under Exscientia’s equity incentive plans, as proposed to be amended and assumed by Recursion. Subject to the satisfaction of vesting conditions, shares registered under the registration statement on Form S-8 may be made available for resale immediately in the public market without restriction.

In the future, Recursion may also issue its securities in connection with capital raising activities, strategic transactions or grants of equity awards, or otherwise. Recursion cannot predict the size of future issuances of Recursion Shares or securities convertible into Recursion Shares or the effect, if any, that future issuances and sales of Recursion Shares will have on the market price of Recursion Shares. Sales of substantial amounts of Recursion Shares (including shares issued in connection with an acquisition), or the perception that such sales could occur, may adversely affect prevailing market prices of Recursion Shares.

Recursion’s ability to utilize its U.S. net operating loss carryforwards may be limited.

Recursion and its affiliates have substantial net operating loss (“NOL”) carryforwards and other tax attributes. To the extent that Recursion continues to generate taxable losses as expected, unused losses will carry forward to offset future taxable income, if any, until such unused losses expire, except the federal NOLs generated during and after fiscal year 2018 are carried forward indefinitely. Under Section 382 of the United States Internal Revenue Code of 1986, as amended (the “Code”), if a corporation undergoes an “ownership change,” its ability to use pre-change NOL carryforwards and certain other pre-change tax attributes (such as research tax credits) to offset its post-change income could be subject to an annual limitation. An “ownership change” is generally defined as a greater than 50% change by value in the ownership of the corporation’s equity by one or more 5% shareholders over a three-year period. Such annual limitation could result in the expiration of a portion of Recursion’s NOL carryforwards before full utilization thereof. Recursion may have experienced ownership changes within the meaning of Section 382 in the past, and Recursion may experience some ownership changes in the future as a result of subsequent shifts in stock ownership, including as a result of the Transaction, follow-on offerings or subsequent shifts in Recursion’s stock ownership (some of which are outside Recursion’s control). In addition, Exscientia is expected to undergo an ownership change in connection with this Transaction. As a result, if Recursion attains profitability, Recursion may be unable to use all or a material portion of its NOL carryforwards and other tax attributes for federal and state tax purposes, which could result in increased tax liability and adversely affect its future cash flows.

Recursion’s actual financial position and results of operations may differ materially from the unaudited pro forma financial information included in this Current Report on Form 8-K.

While the unaudited pro forma financial information contained in this Current Report on Form 8-K represents the best estimates of Recursion’s and Recursion’s management, it is presented for illustrative purposes only and may not be an accurate indication of Recursion’s financial position or results of operations if the Transaction were completed on the dates indicated. The unaudited pro forma financial information has been derived from the audited and unaudited historical financial statements of Recursion and Exscientia and certain adjustments and assumptions have been made. The unaudited pro forma financial information does not include any fair value adjustments associated with the assets and liabilities of Exscientia with the exception of the fair value of intangible assets, as Recursion’s and Exscientia’s management have preliminarily concluded that these historical carrying values approximate their fair values as of June 30, 2024. The process for estimating the fair value of acquired assets requires the use of judgment in determining the appropriate assumptions and estimates. These estimates may be revised as additional

information becomes available and as additional analyses are performed. Differences between preliminary estimates in the unaudited pro forma financial information and the final acquisition accounting will occur and could have a material impact on the unaudited pro forma financial information and Recursion’s financial position and future results of operations.

In addition, the assumptions used in preparing the unaudited pro forma financial information may not prove to be accurate, and other factors may affect Recursion’s financial condition or results of operations following the closing of the Transaction. Any potential decline in Recursion’s financial condition or results of operations may cause significant fluctuations in the price of Recursion Shares.

Recursion will be exposed to greater foreign currency exchange risk.

Upon completion of the Transaction, Recursion expects that a greater portion of its business will take place in international markets. Recursion will conduct its business and prepare its consolidated financial statements in its functional currency, while the financial statements of each of its subsidiaries will be prepared in the functional currency of that entity and the business of that entity will be conducted in the functional currency of that entity. Accordingly, fluctuations in the exchange rate of the functional currencies of Recursion’s foreign currency entities against the functional currency of Recursion will impact its results of operations and financial condition. Accordingly, it is expected that Recursion’s revenues and earnings will be exposed to the risks that may arise from fluctuations in foreign currency exchange rates, which could have a material adverse effect on Recursion’s business, results of operations or financial condition.

Risks Relating to Exscientia’s Business

Risks Related to Exscientia’s Financial Position

Exscientia has a history of significant operating losses, and Exscientia expects to incur losses over the next several years.

Exscientia has a history of significant operating losses. Exscientia’s net losses before taxation were £162.1 million for the year ended December 31, 2023. As of December 31, 2023, Exscientia had accumulated total losses of £349.5 million since inception. Exscientia is still in the early stages of development of its own drug discovery programmes. Exscientia has no drug products licensed for commercial sale and has not generated any revenue from its own drug product sales to date. Exscientia expects to continue to incur significant expenses and operating losses over the next several years. Exscientia's operating expenses and net losses may fluctuate significantly from quarter-to-quarter and year-to-year. Exscientia anticipates that its expenses will increase substantially as it:

•continues to invest in and develop its computational platform and software solutions;

•continues its research and development efforts for its internal and joint arrangement drug discovery programmes;

•conducts preclinical studies, submit investigational new drug applications, or INDs, and comparable foreign applications, and conduct clinical trials for any of its current or future drug candidates;

•seeks marketing approvals for any drug candidates that successfully complete clinical trials;

•establishes a sales, marketing and distribution infrastructure and scale-up manufacturing capabilities, whether alone or with third parties, to commercialise any drug candidates for which it may obtain regulatory approval, if any;

•maintains, expands, enforces, defends and protects its intellectual property;

•hires additional software engineers, programmers, sales and marketing and other personnel to support the development of its software solutions;

•hires additional clinical, quality control and other scientific personnel;

•experiences any delays or encounter any issues with any of the above, including but not limited to failed studies, complex results, safety issues or other regulatory challenges;

•acquires and integrates new technologies, businesses or other assets; and

•adds operational, financial and management information systems and personnel to support its operations as a public company.

Exscientia’s operating history may make it difficult for you to evaluate the success of its business to date and to assess its future viability.

Exscientia commenced operations in July 2012, and its operations to date have been limited to organizing and staffing its company, business planning, raising capital, conducting discovery and research activities, developing its drug discovery platform, filing patent applications, identifying potential drug candidates, undertaking research activities and identifying and entering into collaborations that would allow it to further develop viable drug candidates. Exscientia has not yet demonstrated its ability to successfully complete any clinical trials, obtain marketing approvals, manufacture a commercial-scale product or arrange for a third party to do so on its behalf, or conduct sales, marketing and distribution activities necessary for successful product commercialisation. Consequently, any predictions you make about Exscientia’s future success or viability may not be as accurate as they could be if Exscientia had a longer operating history.

In addition, as an early-stage company, Exscientia may encounter unforeseen expenses, difficulties, complications, delays and other known and unknown factors. Exscientia will need to transition at some point from a company with a research and development focus to a company capable of supporting commercial activities. Exscientia may not be successful in such a transition.

If Exscientia and its present and future collaborators are unable to successfully develop and commercialise drug products, revenues may be insufficient for Exscientia to achieve or maintain profitability.

Exscientia has never generated revenue from drug product sales and its most advanced drug candidate is in a Phase 1/2 clinical trial. Exscientia currently generates revenue primarily from upfront and milestone payments under its agreements with its collaborators. To achieve and maintain profitability, Exscientia must succeed in developing, and eventually commercialising, a drug product or drug products that generate significant revenue. As such, Exscientia will be dependent on the ability of its platform to identify promising molecules for preclinical and clinical development. Achieving success in drug development will require Exscientia and its collaborators to be effective in a range of challenging activities, including completing preclinical testing and clinical trials of drug candidates, obtaining regulatory approval for these drug candidates and manufacturing, marketing and selling any products for which Exscientia or its collaborators may obtain regulatory approval. All Exscientia’s wholly owned drug candidates and those that it has developed with its collaborators are in the preliminary stages of most of these activities. Exscientia and its collaborators may never succeed in these activities and, even if Exscientia or its collaborators do, Exscientia may never generate revenues that are significant enough to achieve profitability. Because of the intense competition that Exscientia’s technology platform faces in the market and the numerous risks and uncertainties associated with biopharmaceutical product development, Exscientia is unable to accurately predict when, or if, it will be able to achieve or sustain profitability.

Even if Exscientia achieves profitability, it may not be able to sustain or increase profitability. Exscientia's failure to become and remain profitable would depress the value of Exscientia and could impair its ability to raise capital, expand its business, maintain its research and development efforts, increase sales of its software, develop a pipeline of drug candidates, enter into collaborations or even continue its operations. A decline in the value of Exscientia could also cause you to lose all or part of your investment.

Exscientia’s interim and annual results may fluctuate significantly, which could adversely impact the value of its ADSs.

Exscientia's results of operations, including its revenues, gross profit, profitability and cash flows, have historically varied from period-to-period, and Exscientia expects that they will continue to do so. As a result, period-to-period comparisons of Exscientia's operating results may not be meaningful, and Exscientia’s interim and annual results should not be relied upon as an indication of future performance. Exscientia's interim and annual financial results may fluctuate as a result of a variety of factors, many of which are outside of its control. Factors that may cause fluctuations in Exscientia’s interim and annual financial results include, without limitation, those listed elsewhere in this “Risk Factors” section and those listed below:

•the amount and timing of operating expenses related to the maintenance and expansion of Exscientia’s business, operations and infrastructure;

•the success of its drug discovery collaborators in developing and commercialising drug products for which Exscientia is entitled to receive upfront payments, milestone or royalty payments and the timing of receipt of such payments, if any;

•Exscientia's ability to enter into new collaboration agreements;

•Exscientia’s ability to collect receivables from its collaborators;

•unforeseen business disruptions that increase Exscientia's costs or expenses;

•the timing and success of the introduction of new software solutions by Exscientia or its competitors or any other change in the competitive dynamics of its industry, including consolidation among competitors, customers or strategic collaborators;

•changes in the fair value of or receipt of distributions or proceeds on account of the equity interests Exscientia holds in its drug discovery collaborators;

•future accounting pronouncements or changes in Exscientia’s accounting policies;

•general economic, industry and market conditions, including within the life sciences industry; and

•the timing and amount of expenses related to Exscientia’s drug discovery programmes, the development or acquisition of technologies or businesses and potential future charges for impairment of goodwill from acquired companies.

Exscientia may need additional funding in the future which may not be available on terms acceptable to it, or at all. If Exscientia is unable to raise additional capital or to generate cash flows necessary to maintain or expand its operations, Exscientia may not be able to compete successfully, which would harm its business, operations, financial condition and prospects.

Exscientia expects to devote substantial financial resources to its ongoing and planned activities, including the development of its current and future drug discovery programmes and continued investment in its technology platform. Exscientia expects its expenses to increase substantially in connection with these activities, particularly as Exscientia advances its internal drug discovery programmes, initiate and complete preclinical and investigational new drug enabling studies, and invest in the further development of its platform.

Exscientia and its current drug discovery collaborators, from whom it is entitled to receive milestone payments upon achievement of various development, regulatory and commercial milestones as well as royalties on commercial sales, if any, under the collaboration agreements that it has entered into with them, face numerous risks in the development of drugs, including conducting preclinical and clinical tests, obtaining regulatory approval and achieving product sales. In addition, the amounts Exscientia is entitled to receive upon the achievement of such milestones tend to be smaller for near-term development milestones and increase if and as a collaborative drug candidate advances through development to commercialisation and will vary depending on regulatory approval and the level of commercial success achieved, if any. Accordingly, Exscientia may need to obtain substantial additional capital to fund its continuing operations.

As of December 31, 2023, Exscientia had cash, cash equivalents and short term bank deposits of £363.0 million. Exscientia believes that its existing cash, cash equivalents and short term bank deposits will be sufficient to fund its operations and capital expenditure requirements for at least the next twelve months. However, Exscientia has based this estimate on assumptions that may prove to be wrong, and Exscientia's operating plans may change as a result of many factors currently unknown to it. As a result, Exscientia could deplete its capital resources sooner than it currently expects. Exscientia's future capital requirements will depend on many factors, including:

•the scope, timing, progress and extent of spending to support research and development efforts of its drug candidates, including preclinical studies and clinical trials;

•the costs, timing and outcome of regulatory review of its drug candidates;

•the development requirements of other drug candidates that Exscientia may pursue;

•the costs of acquiring, licensing or investing in drug discovery technologies;

•the timing and receipt of payments from its collaborations;

•its ability to establish additional discovery collaborations on favourable terms, if at all;

•the timing and receipt of any distributions or proceeds it may receive from its equity stakes in companies;

•the costs of preparing, filing and prosecuting patent applications, obtaining, maintaining, enforcing and protecting its intellectual property rights and defending intellectual-property-related claims;

•the costs of expanding its operations, including its sales and marketing efforts to drive market recognition of its platform and address competitive developments;

•the costs of future commercialisation activities, including product sales, marketing, manufacturing and distribution, for any drug candidate for which it receives marketing approval;

•the impacts of the global geopolitical tension, supply chain disruptions, worsening macroeconomic conditions, including rising interest rates and inflation; and

•the costs of operating as a public company.

In the event that Exscientia requires additional financing, it may not be able to raise such financing on terms acceptable to it or at all. In addition, Exscientia may seek additional capital due to favourable market conditions or strategic considerations, even if it believes it has sufficient funds for its current or future operating plans. If Exscientia is unable to raise additional capital on terms acceptable to it or at all or generate cash flows necessary to maintain or expand its operations and invest in its computational platform, Exscientia may not be able to compete successfully, which would harm its business, financial condition, results of operations and prospects.

Unfavourable global economic and geopolitical conditions could adversely affect Exscientia’s business, financial condition or results of operations.

Exscientia's financial condition or results of operations could be adversely affected by general conditions in the global economy and in the global financial markets or by geopolitical events such as the war in Ukraine war or the conflict between Hamas and Israel. For example, inflation rates, particularly in the United States and the U.K., increased in 2023 to levels not seen in decades. Increased inflation, even if rates are decreasing, may result in increased operating costs (including labour costs) and may affect Exscientia's operating budgets. A weak or declining economy could strain Exscientia’s suppliers, possibly resulting in supply disruption, or cause delays in payments for its services by third-party payors or its collaborators. While the long-term economic impact of either the war in Ukraine or the conflict between Hamas and Israel is difficult to assess or predict, each of these events has caused significant disruptions to the global financial markets. In addition, Exscientia’s potential collaborators’ businesses and cash flows have recently been and may continue to be negatively impacted by the global economic developments and geopolitical uncertainty which has led and may continue to lead to a decreased willingness to enter into new research and development partnerships and collaborations across the life sciences industry. If the disruptions and slowdown deepen or persist, Exscientia may not be able to enter into new collaboration agreements

or to raise any additional financing on terms acceptable it or at all. Any of the foregoing could harm Exscientia’s business and it cannot anticipate all of the ways in which the current economic climate and financial market conditions could adversely impact its business.

Risks Related to the Discovery and Development of Exscientia’s Drug Candidates

Exscientia is substantially dependent on its technology platform to identify promising molecules to accelerate drug discovery and development. Exscientia’s platform technology may fail to discover and design molecules with therapeutic potential or may not result in the discovery and development of commercially viable products for it or its collaborators.

Exscientia uses its technology platform to conduct AI-enabled laboratory experimentation and its technology platform underpins all its efforts. As a result, the quality and sophistication of Exscientia's platform and technology is critical to its ability to conduct its research discovery activities, to design and deliver promising molecule candidates and to accelerate and lower the cost of drug discovery as compared to traditional methods for its partnerships. Exscientia originated the first three AI-designed precision drugs to enter human clinical trials. Because AI-designed drug candidates are novel, there is greater uncertainty about Exscientia's ability to develop, advance and commercialise drug candidates using its AI-design process.

While the results of certain of Exscientia's internal drug discovery programmes and drug discovery collaborations suggest that its platform is capable of accelerating drug discovery and identifying high-quality drug candidates, these results do not assure future success for its drug discovery collaborators or for Exscientia with its internal drug discovery programmes. Even if Exscientia or its drug discovery collaborators are able to develop drug candidates that demonstrate potential in preclinical studies, Exscientia or its collaborators may not succeed in demonstrating safety and efficacy of these drug candidates in human clinical trials. Moreover, preclinical and clinical data are susceptible to error and inaccurate or varying interpretations and analyses, and many companies that believed their drug candidates performed satisfactorily in preclinical studies and clinical trials have nonetheless failed to obtain marketing approval of their drug candidates.

All of Exscientia’s drug candidates are in early-stage clinical development or in preclinical development. If Exscientia is unable to advance its drug candidates through clinical development, to obtain regulatory approval and ultimately to commercialise its drug candidates, or if it experiences significant delays in doing so, Exscientia’s business will be materially harmed.

Four drug candidates that Exscientia has developed are currently in clinical trials: The Phase 1/2 clinical trial of GTAEXS617, Exscientia's jointly owned candidate with GT Apeiron ("GTA"), commenced in July 2023. BMY-licensed EXS4318 and an additional two compounds that Exscientia developed for one of its collaborators for which Exscientia has no economic interest are all currently in clinical trials. Thus far, no approved therapeutics have been developed using AI. There is no assurance that any current or future clinical trials of Exscientia's drug candidates will be successful or will generate positive clinical data, and Exscientia may not receive marketing approval from the U.S. Food and Drug Administration, or FDA, or other regulatory authorities for any of its drug candidates. Exscientia has never submitted an IND to the FDA. Exscientia's other drug candidates are in preclinical development. There can be no assurance that the FDA will permit the INDs for any of Exscientia's drug candidates to go into effect in a timely manner or at all.

Biopharmaceutical development is a long, expensive and uncertain process, and delay or failure can occur at any stage of any of Exscientia’s clinical trials. Failure to obtain regulatory approval for Exscientia’s drug candidates will prevent it from commercialising and marketing its drug candidates. Successful development of Exscientia’s drug candidates will depend on many factors, including:

•completing preclinical studies;

•submission of INDs and comparable foreign applications for and receipt of allowance to proceed with Exscientia’s planned clinical trials or other future clinical trials;

•initiating, enrolling and completing clinical trials;

•obtaining positive results from Exscientia's preclinical studies and clinical trials that demonstrate safety and efficacy for its drug candidates;

•receiving approvals for commercialisation of Exscientia's drug candidates from applicable regulatory authorities;

•establishing sales, marketing and distribution capabilities and successfully launching commercial sales of Exscientia’s products, if and when approved, whether alone or in collaboration with others;

•making arrangements with third-party manufacturers for, or establishing, clinical and commercial manufacturing capabilities;

•manufacturing Exscientia’s drug candidates at an acceptable cost;

•acceptance of Exscientia’s products, if and when approved, by patients, the medical community and third-party payors; and

•maintaining and growing an organisation of scientists, medical professionals and businesspeople who can develop and commercialise Exscientia’s products and technology.

Many of these factors are beyond Exscientia’s control, including the time needed to adequately complete clinical testing and the regulatory submission process. It is possible that none of Exscientia’s drug candidates will ever obtain regulatory approval, even if it expends substantial time and resources seeking such approval. If Exscientia does not achieve one or more of the above-listed requirements in a timely manner or at all, or if any other factor impacts the successful development of biopharmaceutical products, Exscientia could experience significant delays or an inability to successfully develop its drug candidates, which would materially harm its business, financial condition, results of operations and prospects.

Clinical development involves a lengthy and expensive process with uncertain outcomes. If Exscientia’s preclinical studies and clinical trials are not sufficient to support regulatory approval of any of its drug candidates, Exscientia may incur additional costs or experience delays in completing, or ultimately be unable to complete, the development of such drug candidate.

All of Exscientia’s drug candidates are in preclinical development or early-stage clinical trials and their risk of failure is high. Clinical testing is expensive, is difficult to design and implement, can take many years to complete and has an uncertain outcome. Exscientia cannot guarantee that any of its clinical trials will be conducted as planned or completed on schedule, or at all. A failure of one or more clinical trials can occur at any stage of testing, which may result from a multitude of factors, including, but not limited to, flaws in trial design, dose selection issues, participant enrolment criteria and failure to demonstrate favourable safety or efficacy traits.

Before Exscientia can commence clinical trials for a drug candidate, it must complete extensive preclinical testing and studies that support its planned INDs and other regulatory filings in the United States and abroad. Exscientia cannot be certain of the timely completion or outcome of its preclinical testing and studies and cannot predict if regulatory authorities will accept Exscientia’s proposed clinical programmes or if the outcome of its preclinical testing and studies will ultimately support the further development of any drug candidates. As a result, Exscientia cannot be sure that it will be able to submit INDs or corresponding regulatory filings for its preclinical programmes on the timelines it expects, if at all, and Exscientia cannot be sure that submission of INDs or non-U.S. regulatory filings will result in regulatory authorities allowing clinical trials to begin.

The time required to obtain approval from the FDA, the European Commission, or other non-U.S. regulatory authorities is unpredictable but typically takes many years following the commencement of clinical trials and depends upon numerous factors, including the substantial discretion of regulatory authorities. Before obtaining marketing approval from regulatory authorities for the sale of any drug candidate, Exscientia must complete preclinical development and then conduct extensive clinical trials to demonstrate the safety and efficacy of such drug candidate in humans. Clinical trials may fail to demonstrate that Exscientia’s drug candidates are safe and effective for indicated uses. Even if the clinical trials are successful, changes in marketing approval policies during the development period, changes in or the enactment or promulgation of additional statutes, regulations or guidance

or changes in regulatory review for each submitted product application may cause delays in the approval or rejection of an application.

Furthermore, drug candidates are subject to continued preclinical safety studies, which may be conducted concurrently with Exscientia’s clinical testing. The outcomes of these safety studies may delay the launch of or enrolment in future clinical trials and could impact Exscientia’s ability to continue to conduct its clinical trials.

Other events that may prevent successful or timely completion of clinical development include:

•inability to generate sufficient preclinical, toxicology or other in vivo or in vitro data to support the initiation of clinical trials;

•delays in reaching a consensus with regulatory authorities on trial design;

•delays in reaching agreement on acceptable terms with prospective contract research organisations, or CROs and clinical trial sites;

•delays in opening clinical trial sites or obtaining required institutional review board, or IRB, or institutional biosafety committee, or IBC, approval, or a positive opinion from an ethics committee, or that of the equivalent review groups for sites outside the United States, at each clinical trial site;

•imposition of a clinical hold by regulatory authorities, including as a result of a serious adverse event or after an inspection of Exscientia’s clinical trial operations or trial sites;

•failure by us, any CROs Exscientia engages or any other third parties to adhere to clinical trial requirements;

•failure to perform in accordance with Good Clinical Practices, or GCPs;

•failure by investigators and clinical sites to adhere to protocols leading to variable results;

•failure of Exscientia’s delivery approach in humans;

•delays in the testing, validation, manufacturing and delivery of Exscientia’s drug candidates to the clinical sites, including delays by third parties with whom Exscientia has contracted to perform certain of those functions;

•failure of Exscientia’s third-party contractors to comply with regulatory requirements or to meet their contractual obligations to it in a timely manner, or at all;

•inability to enrol participants or delays in having enrolled participants complete their participation in a trial or return for post-administration follow-up;

•clinical trial sites or participants dropping out of a trial;

•selection of clinical endpoints that require prolonged periods of clinical observation or analysis of the resulting data;

•clinical trials of Exscientia’s drug candidates may produce negative or inconclusive results, and Exscientia may decide, or regulators may require it, to conduct additional clinical trials or abandon development programmes;

•occurrence of serious adverse events associated with the drug candidate or administration of the drug candidate that are viewed to outweigh its potential benefits;

•occurrence of serious adverse events or other unexpected events in trials of the same class of agents conducted by other sponsors;

•changes in regulatory requirements and guidance that require amending or submitting new clinical trial protocols;

•changes in the legal or regulatory regimes domestically or internationally related to patient rights and privacy; or

•lack of adequate funding to continue a given clinical trial.

Any inability to successfully complete preclinical studies and clinical trials could result in additional costs to Exscientia or impair its ability to generate revenues from product sales, regulatory and commercialisation milestones and royalties. In addition, if Exscientia makes manufacturing or formulation changes to its drug candidates, Exscientia may need to conduct additional preclinical studies or clinical trials to bridge its modified drug candidates to earlier versions. Clinical trial delays also could shorten any periods during which Exscientia may have the exclusive right to commercialise its drug candidates or allow its competitors to bring products to market before Exscientia does, which could impair its ability to successfully commercialise its drug candidates and may harm its business, financial condition, results of operations and prospects.

Exscientia’s research activities and clinical trials may fail to demonstrate adequately the safety and efficacy of GTAEXS617 or any other drug candidate, which would prevent or delay development, regulatory approval and commercialisation.