Solidifi Releases Results from its 2022 Consumer Mortgage Experience Survey and the New Solidifi 2022 Future Plans of Homeowners Survey

October 25 2022 - 2:52PM

Business Wire

Customer Experience is Critical to Winning

Future Business in Today’s Mortgage Market

The fourth annual national survey(1) commissioned by Solidifi

U.S. Inc. (“Solidifi”) reaffirmed that the customer experience and

in-person interactions will drive future business for the mortgage

industry. However, rising interest rates and concerns of home

affordability have given borrowers pause for concern on their

future plans as the mortgage industry continues to slow.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20221025006016/en/

Borrowers open up about the mortgage

experience in the Solidifi 2022 Consumer Mortgage Experience

Survey. (Graphic: Business Wire)

“The customer experience is critical to winning future business,

and the mortgage process can be a gateway for lenders to build

customer loyalty,” said Solidifi President Loren Cooke. “In fact,

96% of very satisfied borrowers were very likely to use their

lender again, and 72% were likely to recommend their lender. In the

current market, good experiences and relationships were four times

more likely than interest rates to drive repeat business with a

lender. The results showcased that good relationships and

experiences build not only trust but also loyalty towards lenders –

equating to future business.”

The new Solidifi 2022 Future Plans of Homeowners Survey(2)

revealed that the majority of homeowners intend to purchase,

refinance, or take out a home equity line of credit (“HELOC”) in

the next three to five years. And more than half of all survey

respondents want to invest in their future by buying an investment

property or vacation home. But there are headwinds to their plans

as interest rates are at or near the ceiling for most consumers in

America. “Our survey showed that the current rate environment has

put pressure on homeowners’ impending plans. However, the survey

revealed that life events like caring for an aging relative,

education expenses and getting married will continue to drive

mortgage decisions,” added Cooke.

Home improvements are also driving borrowing decisions. Nearly

half of homeowners would refinance to pay for home improvements,

and a resounding 75% of those surveyed cited home improvements as

the #1 reason for getting a home equity loan or line of credit. The

survey revealed that homeowners are most likely to borrow for major

investments that add significant value to their home: 81% want to

renovate a kitchen or bathroom, 38% want to add living space or a

home office, and 21% want a pool.

The Solidifi 2022 Consumer Mortgage Experience Survey polled

over 1,000 residential borrowers 18 years of age or older in the

United States who have refinanced or purchased a home within the

last two years to assess two of the most critical touchpoints in

the mortgage transaction: the appraisal and closing experiences.

The survey took a comprehensive look at the borrower’s experience

from what drives their decision-making to how their satisfaction

results in future business. The results reaffirmed findings of the

past three years and uncovered interesting synergies across all

transaction types on how our industry can better serve consumers

and win business in the future.

“This year’s survey results reaffirmed that borrowers continue

to value in-person interactions for both appraisals and closings.

People have a better experience when they interact with the

appraiser and closing agent. While digital is increasingly becoming

part of the closing experience, the process itself is becoming more

– not less – personal,” said Cooke.

Borrowers continue to want in-person closings for better

communication and increased trust. In fact, 81% said that

face-to-face is the ideal way to close with 60% preferring a paper

process, 15% preferring in-person with fully electronic documents

(“in-person electronic notary” or “IPEN”), and 25% preferring an

in-person hybrid process of both paper and electronic documents.

The results continued to reveal that most borrowers use and prefer

digital tools prior to closing for the review of documents, with

Millennials preferring an in-person digitally enabled closing. In

line with past results, face-to-face interactions were also

preferred for home equity loan and HELOC closings. While most

borrowers closed their purchase transactions in the title agent’s

office, 71% indicated they preferred a mobile notary for their

refinance transaction, and more than half for purchase

transactions.

“Consumers want more closing options and flexibility, and as an

industry we still have work to do to educate consumers on the

options available to them,” said Cooke. “But regardless of how the

closing is conducted, the experience has to be flawless.”

“Our survey confirmed that good communication and trusted agents

are the key to a great closing experience,” concluded Cooke.

“Borrowers rely on trusted partners to guide them through the

transaction process – that’s why we continue to focus on creating

an extraordinary experience through our network of trusted

appraisers and notaries who meet and exceed consumer expectations,

every time. In fact, 95% of those who used Solidifi were satisfied

with the appraisal process, and those who closed with Solidifi were

unanimously satisfied with the closing process.”

To download the full survey results, visit:

go.solidifi.com/2022mortgageexperiencesurvey.

[1] In the Solidifi 2022 Consumer Mortgage Experience Survey,

Market Street Research surveyed more than 1,000 residential

borrowers 18 years of age or older in the United States who

refinanced or purchased a home within the last two years. Panelists

included an equal mix of those who purchased a home or refinanced a

mortgage in the last year and a mix of those who closed between one

or two years ago.

[2] In the Solidifi 2022 Future Plans of Homeowners Survey,

Market Street Research surveyed more than 500 residential borrowers

18 years of age or older in the United States who closed on a new

mortgage, refinanced an existing property, borrowed against their

home via a home equity loan or HELOC with a representative mix of

those who closed within the past year, between one or two years ago

and those having closed more than two years ago.

Both surveys were fielded using Snap Surveys, and the panels

were sourced from Dynata. Fielding was executed in July 2022.

About Solidifi Solidifi is a leading network management services

provider for the residential lending industry. Our platform

combines proprietary technology and network management capabilities

with tens of thousands of independent qualified field professionals

to create an efficient marketplace for the provision of mortgage

lending services. We are a leading independent provider of

residential real estate appraisals and title services. Our clients

include top 100 mortgage lenders in the U.S. Solidifi is a

wholly-owned subsidiary of Real Matters Inc. (TSX: REAL). Visit

www.solidifi.com for more information and stay connected with our

latest news on LinkedIn.

Solidifi and the Solidifi logo are trademarks of Real Matters

Inc. and/or its subsidiaries. All other trademarks are the property

of their respective owners.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221025006016/en/

Jennie Craig Vice President, Marketing jlcraig@solidifi.com

832.236.3392

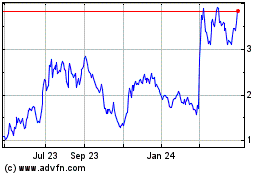

RealReal (NASDAQ:REAL)

Historical Stock Chart

From Jul 2024 to Jul 2024

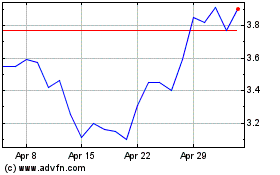

RealReal (NASDAQ:REAL)

Historical Stock Chart

From Jul 2023 to Jul 2024