Filed by Baytex Energy Corp.

(Commission

File No. 1-32754)

pursuant

to Rule 425 of the Securities Act of 1933

Subject Company: Ranger Oil Corporation

(Commission

File No. 1-13283)

|

|

| |

|

| |

Company Name: Baytex Energy Corp. (BTE) |

Explanatory Note: This filing amends the

Form 425 that was previously filed on March 10, 2023 by inserting the legend listed below under the heading “IMPORTANT

INFORMATION FOR SHAREHOLDERS.”

Event: 51st Annual Scotia Howard Weil Energy

Conference

Date: March 7, 2023

Jason Bouvier, Analyst, Scotia Capital

Good afternoon, everyone. We’ll get started

with the next fireside chat of the day. Next up, we have Baytex Energy. On behalf of the company, we have Eric Greager, company CEO,

so welcome.

Eric T. Greager, President and Chief Executive

Officer

Thank you.

Jason Bouvier, Analyst, Scotia Capital

And obviously M&A is topical. You guys recently

announced a big acquisition in the Eagle Ford, so hoping you would start us off with the key strategic rationale for that deal.

Eric T. Greager, President and Chief Executive

Officer

Sure. Sure. Thank you. So Baytex has a large

asset in the Eagle Ford. It’s a non-opposition operated by Marathon, represents a third of our production half of our free cash

flow. And on that basis, we look at our WCSB be in our Eagle Ford non-opposition and asked ourselves the question, how do we create opportunities

out of this Eagle Ford non-opposition?

I think the first thing that comes to mind for

anybody who’s been in the oil and gas business is we need to build an operating capability. So you look at kind of two signs of

any deal. One, what’s it worth if you sell it? And two, if that price is not accretive to your current multiple then can you buy

at a price that’s also a discount to your current multiple and create value that way?

So we did both of those. We obviously check the

market now. Our current non-opposition Southwest of the Karnes Trough is absolutely fabulous unconventional reservoir, as good as it

gets in North America. I think everyone knows that. Marathon is a very, very good operator. So there’s nothing about that partnership

that we don’t like, what -- we wanted to do is create an operating capability proximal so that we could start unlocking value through

swaps and trades, and kind of bring some of that value forward.

|

|

| |

|

| |

Company Name: Baytex Energy Corp. (BTE) |

And buyers don’t control when deals come

to market. And so I was pretty new in the seat, but having a long history in oil and gas and a lot of history in Eagle Ford and all over

South of the border in the United States saw this as an opportunity. So our rationale was one, create an operating capability, do so

at a discount to our current multiple thus providing accretion to the standalone Baytex business.

And we managed to get all of that done. We made

this acquisition of Ranger at 2.8 times EBITDA, the time we were trading in the mid-3s, generating accretion from revenue per share all

the way through our return of capital per share of double digits. And so that was really good and then in the meantime, creating a significant

operating capability in the Eagle Ford that will help us unlock some value as well.

Jason Bouvier, Analyst, Scotia Capital

Good. Well, you’ve had a little time now

to talk to investors about the deal. Can you talk about what the feedback has been? And then if you have received like kind of pushback

on the deal, what your thoughts are and the issues they bring up?

Eric T. Greager, President and Chief Executive

Officer

Yeah. I think one of the things that that we’ve

heard is, the deal basically doubles the size of the company. Not in acres or in production necessarily, but darn near in production,

but certainly in operating cash flow and free cash flow. And that’s I think just the scale of a single transaction of that scale

tends to get people’s attention, right?

So you’re doubling the size of your business

in one transaction. That tends to get people’s attention. I think it also folks needed to understand the rationale around building

an operating capability and what it does for the business in general. So we talked a little bit about accretion already, whether we’re

talking about operating cash flow per share through free cash flow per share, through the return of capital framework, which we are able

to both accelerate and also boost on a per share basis.

So really -- it really demonstrates confidence

in the deal. And we stood up or intend to stand up a base -- a fixed base dividend upon closing. So higher return of capital on a per

share basis, including a more durable return of capital, including that fixed base dividend. If there was any pushback, it was one on

the size and scale.

|

|

| |

|

| |

Company Name: Baytex Energy Corp. (BTE) |

Jason Bouvier, Analyst, Scotia Capital

Yeah.

Eric T. Greager, President and Chief Executive

Officer

There was a little bit of pushback around Greager,

this is me and third person, you’ve been in the seat for five months now. That’s pretty fast.

Jason Bouvier, Analyst, Scotia Capital

Yeah.

Eric T. Greager, President and Chief Executive

Officer

And the answer to that, essentially the context

around that is, yeah, it’s pretty fast, but the team had a model built already because our team in Calgary had been looking at

Ranger as a solution to the operating capability for quite a long time. I had as well as a longtime operator in Texas. So when I joined

Baytex in November, it was really just the fusion of those two views, if you like, or models.

And then obviously buyers don’t control

when deals come to market. We were invited to the data room and we’re able to make progress on fusing our models together, informing

those with kind of the private data in the data room and really bringing those to crystallize. And then I think thirdly one of the things

that made Ranger such an interesting acquisition for us is the fact that they were trading at kind of 2.5 times EBITDA, which is pretty

significant discount to our own market multiple. And that’s what drives the accretion to our business.

And so we were able to capture them at a discount

primarily because they’ve got a 54% private equity holder. And that holder in a small cap public space with a pure play generally

means they’re going to be traded at a bit of a discount. And so we were able to capitalize on that and then build the structure

of the deal around the 54% owner delivering both the Board and the shareholders. So deal certainty becomes an important element of the

business as well.

Jason Bouvier, Analyst, Scotia Capital

Yeah. When you look at the potential synergies

between the assets you bought versus the non-op, is there still a material amount of land swaps to do there or had the previous management

team done a lot of that over the last couple of years?

|

|

| |

|

| |

Company Name: Baytex Energy Corp. (BTE) |

Eric T. Greager, President and Chief Executive

Officer

Yeah. So the previous management team has a really

good relationship with Marathon.

Jason Bouvier, Analyst, Scotia Capital

Yeah.

Eric T. Greager, President and Chief Executive

Officer

Marathon has spurious collection of acreage assets

that extend, as does EOG, that extend up into the Ranger lands. And so the team has been building relationships, swapping and trading

on a value basis. But we think now because we’ve got this significant working interest in the Four AMI’s that are operated

by Marathon, so that’s notionally a 25% working interest in 80,000 gross acres.

Jason Bouvier, Analyst, Scotia Capital

Yeah.

Eric T. Greager, President and Chief Executive

Officer

And then of course, we have now the Eagle Ford

position -- Eagle Ford and Austin Chalk position that is operated by Ranger. We now have more tools in our toolbox, essentially to unlock

value.

Jason Bouvier, Analyst, Scotia Capital

Yeah.

Eric T. Greager, President and Chief Executive

Officer

Having an operating capability also creates the

opportunity that should Marathon for whatever reason, need to reallocate their capital, that on behalf of the partnership, we can step

up and propose activity and even operate should that be useful for the partnership.

Jason Bouvier, Analyst, Scotia Capital

Makes sense. And just to give the audience a

sense of milestones, what’s needed to kind of close on the deal and what’s the timing of those events?

|

|

| |

|

| |

Company Name: Baytex Energy Corp. (BTE) |

Eric T. Greager, President and Chief Executive

Officer

Yeah. So we announced on Tuesday morning -- last

Tuesday morning a week ago, we have filed our Hart-Scott-Rodino filing that’s the competitive process or the anti-competitive process

in the United States that has to be cleared. I’ve done a lot of deals in the U.S. and I’ve never tripped up on HSR, so I

anticipate we’ll clear that says -- yeah, says the guy who knocks on wood.

And that’s a 30-day clearance window. Then

we’ll have the merger proxy filing on both sides with the SEC and the regular -- so regulatory filings on both sides, again, a

30-day review period. I’ve had deals clear within 30 days. I’ve had them extend after Comment Letters. But we can also file

the merger proxy filing statements in conjunction with that clearance period. And then any letters we get, we simply amend the filing

because it’s an online filing.

Jason Bouvier, Analyst, Scotia Capital

Yeah.

Eric T. Greager, President and Chief Executive

Officer

So some of these paths can run, they don’t

all have to run kind of in series. Some can run in parallel. And then of course, we’ve got shareholder votes on both sides. As

I mentioned earlier, Juniper Capital can deliver, we’ve got both boards unanimous approval, they can deliver their shareholders

and we’ll have a shareholder vote on our side, which I’m confident in.

Jason Bouvier, Analyst, Scotia Capital

Good. And then when you look at the other side

of the equation, now you got another avenue to allocate capital two. Does it -- when you look at the portfolio now, is there something

that you want to shed to lighten up or streamline the company? Are you pretty happy with where the portfolio sits now?

Eric T. Greager, President and Chief Executive

Officer

Well, I’m really happy with where

the portfolio sits, but I do think anytime you introduce something this big into a portfolio that you’re always going to change

the competition within the portfolio for capital.

Jason Bouvier, Analyst, Scotia Capital

Yeah.

|

|

| |

|

| |

Company Name: Baytex Energy Corp. (BTE) |

Eric T. Greager, President and Chief Executive

Officer

And I think as we -- so the team’s already

working on this, but as we review the way various parts of the assets, not just the assets in whole, right, Duvernay, Viking, Lloyd,

Clearwater, and Eagle Ford, but the sub portions of those assets as well. So as you tear off Tier 1, Tier 2, Tier 3, within those assets, I’m

sure there are going to be parts that don’t compete well and are more valuable in someone else’s hands.

Jason Bouvier, Analyst, Scotia Capital

Yeah.

Eric T. Greager, President and Chief Executive

Officer

That is to say they -- funding of those assets

in our portfolio might be years out.

Jason Bouvier, Analyst, Scotia Capital

Yeah.

Eric T. Greager, President and Chief Executive

Officer

And we could probably pull value forward for

Baytex shareholders by disclosing it otherwise the besting of those.

Jason Bouvier, Analyst, Scotia Capital

Makes sense. Makes sense. Just want to hit on

capital that it sounds like pro forma the deal, capital budget run about $1.2 billion a year that order of magnitude 155,000, 160,000

boes a day targeting 3% to 4% growth. When you think about that, that formula, that $1.2 billion, how much of that is necessary to just

keep production flat and how much is growth capital?

Eric T. Greager, President and Chief Executive

Officer

Yeah. So it’s a little over CAD1.2 billion.

And that’s an important distinction because when I say it’s a little -- it’s right at a $100 million growth capital.

Jason Bouvier, Analyst, Scotia Capital

Yeah.

|

|

| |

|

| |

Company Name: Baytex Energy Corp. (BTE) |

Eric T. Greager, President and Chief Executive

Officer

Sustaining capital is a little over CAD1.1 billion,

so that 3% to 4% takes $100 million.

Jason Bouvier, Analyst, Scotia Capital

Got it. Got it. And then is there any scenario

like whether it’s seeing societal pressures or government or whatnot that would cause you to get more growth orientated allocate

more capital to growth? Or do you feel pretty comfortable with the run rate that we just outlined?

Eric T. Greager, President and Chief Executive

Officer

We really like the 3% to 4%. It’s predicated

essentially on level loading our assets, creating the maximum degree of operational efficiency within the assets drilling, completions,

having a working doc inventory, but not building a significant amount of docs.

Jason Bouvier, Analyst, Scotia Capital

Yeah.

Eric T. Greager, President and Chief Executive

Officer

And it’s about kind of proper allocation

of resources across all the assets. I think like any E&P, we’re going to be looking for the signal from our shareholders.

Jason Bouvier, Analyst, Scotia Capital

Yeah.

Eric T. Greager, President and Chief Executive

Officer

And I think the tail will be either a market

multiple or free cash flow yield.

Jason Bouvier, Analyst, Scotia Capital

Yeah.

Eric T. Greager, President and Chief Executive

Officer

If it suggests that that our shareholders are

asking or compelling us to grow faster, increase our reinvestment rate. We’re certainly going to be willing to do so. But I think

until we see that, whether that’s an expansion of the market multiple or lower free cash flow yield.

|

|

| |

|

| |

Company Name: Baytex Energy Corp. (BTE) |

Jason Bouvier, Analyst, Scotia Capital

Yeah.

Eric T. Greager, President and Chief Executive

Officer

That’ll suggest that we hold the line on

this. And 3% to 4% is very convenient because it allows for basically the quarters that are challenging in Canada, like Q2 due to breakup.

Jason Bouvier, Analyst, Scotia Capital

Yeah.

Eric T. Greager, President and Chief Executive

Officer

Or Q3 due to hurricanes in the Gulf Coast, allows

you to hold those quarters flat without kind of declining, if you target kind of 3% to 4% overall annualized growth.

Jason Bouvier, Analyst, Scotia Capital

Great.

Eric T. Greager, President and Chief Executive

Officer

Yeah.

Jason Bouvier, Analyst, Scotia Capital

Just want to shift a bit to net debt. Can you

walk the audience through kind of what the target is, how you come up with that target, and then the timeline for hitting it?

Eric T. Greager, President and Chief Executive

Officer

Yeah. So our goal is $1.5 billion. I wouldn’t

call it a goal necessarily, but the next milestone we’ve committed to stepping up for free cash flow allocation to 50% upon closing.

That 50% is biased significantly toward share repurchases. So the way to think about this is that $80 WTI is a benchmark.

The combined business will print about $1.2 billion

of free cash flow in a four-quarter period starting let’s say mid-year this year when we close to mid-year 2024. So that CAD1.2

billion will be -- half of it will be committed to debt pay down CAD600 million, the other CAD600 million will be committed to return

of capital to shareholders. CAD520 million of the CAD600 million will go to share repurchases, CAD80 million goes to the dividend. That’s

pretty modest, but it gives us the opportunity to grow that dividend over time as market conditions dictate.

|

|

| |

|

| |

Company Name: Baytex Energy Corp. (BTE) |

So that again, $80 WTI is a benchmark, CAD600

million a year going to debt pay down. By the time we get to CAD1.5 billion in total debt, CAD1.5 billion, then we’ll step up our

return of capital framework for 75% and that 75% will then be allocated between share repurchases and a dividend.

And we intend to keep growing the dividend, perhaps

not every quarter, but systematically over time. As we mop up excess shares, you’re going to get kind of rising tide on both fronts.

Jason Bouvier, Analyst, Scotia Capital

Yeah. And when you guys are comparing now what

to do with free cash flow, and you obviously got M&A, growth capital, share buybacks, debt repayment. How does the share buyback

equation fit in there? Do you guys have your own views of intrinsic value or how do you think about that relative to the other uses?

Eric T. Greager, President and Chief Executive

Officer

Yeah. I mean, we definitely run our NAV models

pretty much constantly. So we have a view on our own intrinsic value. I think share repurchase plans are best when they run through the

cycle almost continuously. Because it’s the bottom half of the cycle where you get equity at a deeper discount and where you can

really make the gains and mopping up a lot of shares at a discount. I think a dividend is really important because if you’re buying

back only through the top half of the cycle, which we’re all living today, you want to have some defense for – in the event

that you do mop up enough excess shares to get your market price up toward your intrinsic value, you want to be able to shift immediately

over to your dividend.

And I think that’s really important to

have both sides of that. But I think it’s really important to run a share repurchase plan pretty much constantly through the entire

cycle. Because again, you can’t be as effective on a cost averaging basis if you only run it through the contact cycle.

Jason Bouvier, Analyst, Scotia Capital

Yeah. Yeah. Fair.

Eric T. Greager, President and Chief Executive

Officer

I would say, just to expand that conversation

a little bit more, in terms of – kind of pure corporate finance, I think of the marginal operating cash flow dollar this way,

you really have three uses. You have pay down of debt, which has about an 8% return. You have repurchase of your shares, which today

has a 15% to 20% return, let’s call it based on a free cash flow yield. And then you have investing in your business. And we run

about a 50% to 55% reinvestment rate. Right now, our average IRR is 75%.

|

|

| |

|

| |

Company Name: Baytex Energy Corp. (BTE) |

So you’re comparing dollars that are generated

by the business at the operating cash flow level 8% versus, let’s say, freeze in that 16%, which is a two times bang for the buck

versus 75%, which is I think four times if – maybe more than four times. So for me, this is a conversation we need to continue

to have with our shareholder community. Because a lot of people are still suffering from PTSD from a decade in the rear view mirror,

where E&P companies were always promising returns three to five years out, but never quite getting there. It was always beyond the

grasp of the shareholders. And then there’s the fourth dimension, which I wouldn’t call a use of free cash flow or operating

cash flow, but more use of kind of corporate weighted average cost of capital and that is corporate M&A.

And if you think about just our example most

recently here with the Ranger acquisition, we funded that, let’s call it, notionally 50% out of debt and 50% out of equity. And

so let’s just per round numbers call that a 12% or 13% weighted average cost of capital 50-50 debt and equity. We bought 12 to

15 years of 75% returns for 12% or 13%. To me, that’s a pretty compelling use of company resources. That might not be perfect corporate

math, but it’s a reasonable way to think about, because you’re not actually using free cash flow for M&A, you’re

actually using the entire kind of corporate currency, right, because you’re offering equity in my business and exchange for equity

in your business.

And I’ll take on your debt for a pro forma

ownership in your business via your debt. So it’s a real – if you like, it’s a real fusion of the two businesses, a

real integration of it – of the two businesses. So I think operating cash flow in the three prior uses, debt, equity, reinvestment,

and then I think of mergers at the corporate level more in terms of this fusion using your weighted average cost of capital, but creating

this opportunity for 75% returns over time, given the new business’s ability to generate cash flow.

Jason Bouvier, Analyst, Scotia Capital

Yeah. That’s a nice segue into my next

question just on returns, like, the Clearwater’s obviously been a pretty nice area for you guys, but you’re also in other

heavy oil plays, biking yet your Eagle Ford non-op, now op. When you think about the rates of returns of those various plays, how do

they stack up on a risk adjusted basis to you?

|

|

| |

|

| |

Company Name: Baytex Energy Corp. (BTE) |

Eric T. Greager, President and Chief Executive

Officer

Yeah. So in my mind’s eye, and there’s

a slide in our deck if you want to go out on the website, I think it’s Slide 11 and we ran it at $75 TI on one side and $55

TI on the other. And on the left, this is a skyline plot. So on the Y axis, it’s relative IRR on the X axis, it’s all of

our reserves, all of our 2P reserves. And that skyline has our Clearwater at Peavine on the left absolutely spectacular. $75, it’s

like 300% rate of return. So it sets the Y axis, it’s off the chart. The next large group of resources is – has a little

bit of Lloydminster heavy in there, but it’s mostly our Karnes Trough. So this is the Marathon operated Karnes Trough acreage.

Again, from an unconventional perspective, it’s the best unconventional resource in North America.

And Marathon’s a great operator. So we’re

extremely pleased about it. Just one block to the right of that is kind of the top 40% of our Ranger, Eagle Ford. If you think of the

Karnes Trough as Tier 1 Eagle Ford, ours is probably Tier 2 plus. So I’d consider slightly lower and we’re being fairly transparent

about that and our skyline plot. It lines up below the Clearwater and below our Karnes Trough, but running pretty close to our Karnes

Trough.

And then you see Duvernay and Viking and then

another block maybe the next 30% or 40% of the Eagle Ford inventory coming in right around the Duvernay. And then you see kind of the

rest of the inventory tail off to the right. What’s interesting is when the price goes down and you move to the right, the $55

TI skyline all of the Eagle Ford assets – they compress together and they move to the left.

And this is one of the things that we think is

particularly interesting about this acquisition and merger is it creates a defense against low prices. So what we have is the opportunity

now with break with assets with $40, $41 breakevens down in the Eagle Ford, we can invest capital there when price drops deep into the

40s and still print free cash flow. And this creates a real opportunity for us. But if prices don’t go to that level, then these

assets continue to print a great deal of free cash flow, but we also have the torque that the heavy oil provides. And so we’ve

got torque to the upside, we’ve got defense to the downside. We also have a diversified exposure to this – so these correlated

risks in North America that keep popping up all over the place.

I think California, Colorado, New Mexico, parts

of Canada, now we have diversified exposure to regulatory environments, Alberta, Saskatchewan, Texas. And we have diversified products.

So we’ve got heavy oil with access both west via TMX, but also south via the mainline. And we’ve got Edmonton par, Viking

that runs absolutely fantastic operating net back right there, light suite Canadian, and then we’ve got MEH pricing along the Gulf

Coast, which is TI plus a couple of months, really premium realized pricing. And we’ve got ship channel gas if that’s ever

worked anything.

Jason Bouvier, Analyst, Scotia Capital

Good. Well, I want you to frame for the

audience where the Clearwater’s at kind of where it’s current production level is, how you see that asset being managed over

the next few years where it’ll kind of peak at.

|

|

| |

|

| |

Company Name: Baytex Energy Corp. (BTE) |

Eric T. Greager, President and Chief Executive

Officer

Yeah. I want to be really clear, like the Clearwater

at Peavine is absolutely spectacular. It is – if as a child you knelt down to the angels of oil and gas and said, show me a play

that I can drill a well for CAD1.7 million, CAD1.8 million under CAD2 million, that will flow 1,000 barrels a day without casing, without

production casing, without cement, without stimulation. Just drill 15,000 meters of open hole in the rock, pull out, install production

equipment and go home. That’s the Clearwater at Peavine. It’s unbelievable.

But it’s – we’ve got 80 net

acres in Peavine with another 45 or so net acres in the broader Peace River. We had a first mover advantage. We ring-fenced the best

of the acreage and it is spectacular, but it’s small and by small I mean it’ll run at 15,000 barrels a day for the next 10

years and print $1 billion of free cash flow.

So – and I mean free cash flow, because

we’ve already within the first – something like the first 10 months, we paid out all the acquisition capital plus the B&C

Capital up to that point. So now every well we drill, it’s essentially a half cycle and $1 billion of free cash flow over the next

decade. However, we also are very conscious of the fact that we operate this asset and the Métis settlement and it’s –

this is people’s homes, people’s lifestyles. If there’s one thing I learned in the DJ over many years also operating

on the Jicarilla Apache or the Navajo or the Northern Arapaho, it’s – you have to be very respectful of people’s homes

in people’s way of life.

And we’ll run it at 15,000 barrels a day,

and if we can find a way to accelerate it and do so without damaging our landowner relations, we’ll absolutely do that. But we’re

really trying to be just conscious of the fact that we don’t want to overrun our headlights. We want to be respectful of the Métis

and recognize that it’s not appropriate to mislead our shareholder audience and just be very transparent about this plateau, right.

So people don’t expect 20, 30, 50 mboe a day or 50,000 boe a day that we can’t deliver. We want to be really transparent.

|

|

| |

|

| |

Company Name: Baytex Energy Corp. (BTE) |

Jason Bouvier, Analyst, Scotia Capital

Yeah. That makes sense. I wanted to touch on

inflation a bit. Obviously, it’s a topic that that’s come up. Can you maybe walk the audience through what you saw last year,

what you expect to see this year, and if it’s hidden any particular areas, whether it’s geographic or easel or label or so

forth, but where you’re seeing…

Eric T. Greager, President and Chief Executive

Officer

Yeah. So given the fact that we’ve got

exposure from significant fracture stimulation plays in the Eagle Ford, and then we also of course have the Duvernay, which is intensely

fracture stimulated. We got the Viking, which is frac stem, but not quite as intense, doesn’t have the treating pressures, the

high spec rigs. And then of course we have our conventional. That gives us the opportunity to really kind of fine tune where we put the

capital depending on where the pressures are. Through 2022, we saw a lot of upward pressure on fracture stimulation horsepower. People,

15,000 treating iron high spec rigs required to drill those kind of deep high pressure, high temperature well. That has backed off a

lot in the lap just in the last couple of months. The Haynesville because of the retreat of natural gas prices, the Haynesville is now

releasing high spec rigs and high spec treating iron, and that’s helped turn some of the inflation around.

But if you look from the beginning of 2021 to

the end of 2022, we experienced about 25% inflation. Through 2023, we built another 5% in. And we actually think that’s pretty

conservative now, given how things are turning. If you look at rig – if you look at total rigs drilling right now in the U.S. it’s

actually rolled over. You look at a Baker Hughes rig count, it’s rolled over and has now slightly in decline with a little bit

of declining trajectory. I think that’s primarily related to Henry Hub.

Jason Bouvier, Analyst, Scotia Capital

You’re right. One last question on environmental,

if you just walk the audience through kind of what your targets are for emissions, whether it’s intensity or absolute maybe how

the recent acquisition kind of changed that profile.

|

|

| |

|

| |

Company Name: Baytex Energy Corp. (BTE) |

Eric T. Greager, President and Chief Executive

Officer

Yeah. So the company’s done a really great

job over the last, since 2018 baseline Baytex has year-over-year dropped very consistently. We use greenhouse gas intensity, so metric

tons of CO2 equivalent per boe consistently dropped year-over-year. And this year, we can – we dropped again 2022 below 2021, another

reduction. And it’s starting to get pretty challenging. You’re upgrading now instead of just going from say, venting to controlled

utility flares or flares to incinerators, you’re now upgrading all the instrument air, you’re upgrading to kind of high efficiency

combustors and that sort of thing. One of the things that the Ranger acquisition has allowed us to do is take advantage of the fact that

it has a much lower GHD intensity.

So when you roll this together with our larger

kind of heavier oil to the north, it actually brings us down by another 16%. So among all the accretion that we experienced 24%, 25%

accretion on AFF per share basis, all the way through free cash flow and return of capital. One of the things that we haven’t made

as big a fuss about, but is in the deck and we’re very proud of is the reduction in greenhouse gas intensity. So it makes us on

the whole, a better and more responsible company. Now, we’ll continue to improve the Eagle Ford as well as the rest of our assets,

but that transaction alone makes us better.

Jason Bouvier, Analyst, Scotia Capital

Great. Well, that will wraps up our time for

those with more questions for Eric. Breakout rooms on Hong Kong B. So it’s just down and your first left and he can handle questions

there, but on behalf of Scotiabank. Thank you.

Eric T. Greager, President and Chief Executive

Officer

Jason, thank you.

Jason Bouvier, Analyst, Scotia Capital

Appreciate it.

IMPORTANT INFORMATION FOR SHAREHOLDERS

Important Information for Shareholders and Where to Find It

No Offer or Solicitation

This communication relates

to the proposed merger transactions of Baytex Energy Corp. (“Baytex”) with Ranger Oil Corporation (“Ranger”

and such transactions, collectively, the “Transaction”). This communications is not intended to and does not constitute

an offer to sell or the solicitation of an offer to subscribe for or buy any securities or a solicitation of any vote or approval with

respect to the Transaction or otherwise, nor shall there be any offer, solicitation or sale of securities in any jurisdiction in which

such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

No offer of securities in the United States shall be made except by means of a prospectus meeting the requirements of Section 10

of the Securities Act of 1933.

Important Additional Information and Where to Find It

In connection with the proposed

Transaction, Baytex intends to file with the U.S. Securities and Exchange Commission (the “SEC”) a registration statement

on Form F-4 (the “Registration Statement”) to register the Baytex securities to be issued in connection with

the proposed Transaction (including a prospectus therefor). Baytex and Ranger also plan to file other documents with the SEC regarding

the proposed Transaction. This communication is not a substitute for the Registration Statement or the prospectus or for any other document

that Baytex or Ranger may file with the SEC in connection with the Transaction. U.S. INVESTORS AND U.S. HOLDERS OF BAYTEX AND RANGER

SECURITIES ARE URGED TO READ THE REGISTRATION STATEMENT AND OTHER DOCUMENTS RELATING TO THE PROPOSED TRANSACTION (INCLUDING ALL AMENDMENTS

AND SUPPLEMENTS TO THOSE DOCUMENTS) THAT WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE

THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT BAYTEX, RANGER AND THE PROPOSED TRANSACTION. Shareholders will be able to obtain free copies

of the Registration Statement, prospectus and other documents containing important information about Baytex and Ranger once such documents

are filed with the SEC, through the website maintained by the SEC at http://www.sec.gov. Copies of such documents may also be

obtained from Baytex and Ranger without charge.

|

|

| |

|

| |

Company Name: Baytex Energy Corp. (BTE) |

Participants in the Solicitation

Baytex, Ranger and certain

of their respective directors, executive officers and other members of management and employees may be deemed to be participants in the

solicitation of proxies from the Baytex’s shareholders and the solicitation of proxies from Ranger’s shareholders, in each

case with respect to the Transaction. Information about Baytex’s directors and executive officers is available in the Annual Information

Form published February 23, 2023 and in the proxy statement/prospectus (when available). Information about the Ranger’s

directors and executive officers is available in its definitive proxy statement for its 2022 annual meeting filed with the SEC on April 1,

2022, and in the proxy statement/prospectus (when available). Other information regarding the participants in the solicitations and a

description of their direct and indirect interests, by security holdings or otherwise, will be contained in the Registration Statement,

the proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the Transaction when they become available.

Shareholders, potential investors and other readers should read the proxy statement/prospectus carefully when it becomes available before

making any voting or investment decisions.

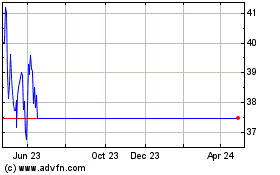

Ranger Oil (NASDAQ:ROCC)

Historical Stock Chart

From Jan 2025 to Feb 2025

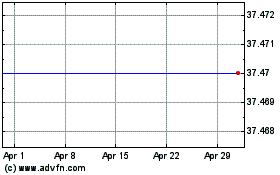

Ranger Oil (NASDAQ:ROCC)

Historical Stock Chart

From Feb 2024 to Feb 2025