Plug Receives $1.66 Billion Conditional Commitment Loan Guarantee From Department of Energy for Green Hydrogen Development Pipeline

May 14 2024 - 8:00AM

Plug Power Inc. (NASDAQ: PLUG), a global leader in comprehensive

hydrogen solutions for the green hydrogen economy, received a

conditional commitment for an up to $1.66 billion loan guarantee

from the Department of Energy’s (“DOE”) Loan Programs Office

(“LPO”) to finance the development, construction, and ownership of

up to six green hydrogen production facilities.

The production facilities, which will be

selected for financing in accordance with procedures to be set

forth in definitive documentation with DOE, will be built across

the nation and supply major companies, including Plug’s existing

customers, with low-carbon, made-in-America green hydrogen. The

hydrogen generated will be used in applications in the material

handling, transportation, and industrial sectors.

“Green hydrogen is an essential driver of

industrial decarbonization in the United States,” said Plug Power

CEO Andy Marsh. “Earlier this year, Plug successfully demonstrated

our innovation and technical ability by launching the first

commercial-scale green hydrogen plant in the country in Woodbine,

Georgia. This loan guarantee will help us build on that success

with additional green hydrogen plants.”

Marsh added, “We appreciate the partnership with

the DOE Loan Programs Office and are pleased to have worked through

an intensive due diligence process. The loan guarantee will prove

instrumental to grow and scale not only Plug’s green hydrogen plant

network, but the clean hydrogen industry in the United States.”

Plug, the leading commercial-scale manufacturer

of electrolyzers, currently operates the largest proton exchange

membrane (PEM) electrolyzer system in the United States at its

Woodbine, Ga., hydrogen plant. Plug’s current green hydrogen

generation network now has a liquid hydrogen production capacity of

approximately 25 tons per day.

Plug’s green hydrogen production plants utilize

the company’s own electrolyzer stacks manufactured at its

state-of-the-art gigafactory in Rochester, NY, and Plug’s

liquefaction and hydrogen storage systems engineered at its

facility in Houston.

DOE’s support for Plug’s green hydrogen projects

represents a major milestone in the U.S.’s commitment to advance

the development of large-scale hydrogen production, processing,

delivery, and storage. It also underscores the application of green

hydrogen to help meet decarbonization goals across multiple sectors

of the economy.

While this conditional commitment represents a

significant milestone and demonstrates the DOE’s intent to finance

the project, certain technical, legal, environmental and financial

conditions, including negotiation of definitive financing

documents, must be satisfied before funding of the loan

guarantee.

LPO works in support of President Biden’s

ambitions to drive growth in US manufacturing and innovation,

create jobs, and build a clean energy economy that will address

climate change and make communities more resilient.

Plug’s projects under the loan will adhere to

the Biden Administration’s Justice 40 Initiative. This process

includes gathering input from local labor, workforce, and economic

development organizations in addition to first responder and

non-profit organizations. The plants are expected to create

good-paying jobs accessible to a diverse talent supply and help

develop workforce skills needed to drive the transition to a clean

energy economy.

LPO’s Title 17 Clean Energy Financing Program,

which supports innovative energy and supply chain projects and

projects that reinvest in existing energy infrastructure, will

provide the financing to Plug.

About PlugPlug is building an

end-to-end green hydrogen ecosystem, from production, storage, and

delivery to energy generation, to help its customers meet their

business goals and decarbonize the economy. In creating the first

commercially viable market for hydrogen fuel cell technology, the

company has deployed more than 69,000 fuel cell systems and over

250 fueling stations, more than anyone else in the world, and is

the largest buyer of liquid hydrogen.

With plans to operate a green hydrogen highway

across North America and Europe, Plug built a state-of-the-art

Gigafactory to produce electrolyzers and fuel cells and is

developing multiple green hydrogen production plants targeting

commercial operation by year-end 2028. Plug delivers its green

hydrogen solutions directly to its customers and through joint

venture partners into multiple environments, including material

handling, e-mobility, power generation, and industrial

applications.

For more information, visit

www.plugpower.com.

Plug Power Safe Harbor

Statement This communication contains “forward-looking

statements” within the meaning of the Private Securities Litigation

Reform Act of 1995 that involve significant risks and uncertainties

about Plug Power Inc. (“Plug”), including but not limited to

statements about: Plug’s expectations regarding the loan guarantee

that it expects to receive from the Department of Energy, including

the timing, size and intended use of such loan guarantee; Plug’s

expectation that such loan guarantee will bolster the buildout of

its green hydrogen plant network in the United States and drive

rapid advancement of the hydrogen economy; Plug’s expectations

regarding which production facilities will be selected for

financing, including with respect to locations and intended use of

hydrogen generated from such facilities; whether and when the loan

guarantee will be funded, including whether and when certain

conditions such as negotiation of definitive financing documents

will be satisfied; and Plug’s expectations that its projects under

the loan will adhere to the Biden Administration’s Justice 40

Initiative and create good-paying jobs accessible to a diverse

talent supply and help develop workforce skills needed to drive the

transition to a clean energy economy. Such statements are subject

to risks and uncertainties that could cause actual performance or

results to differ materially from those expressed in these

statements. For a further description of the risks and

uncertainties that could cause actual results to differ from those

expressed in these forward-looking statements, as well as risks

relating to the business of Plug in general, see Plug’s public

filings with the Securities and Exchange Commission (the “SEC”),

including the “Risk Factors” section of Plug’s Annual Report on

Form 10-K for the year ended December 31, 2023, Plug’s Quarterly

Report on Form 10-Q for the quarter ended March 31, 2024 and any

subsequent filings with the SEC. Readers are cautioned not to place

undue reliance on these forward-looking statements. The

forward-looking statements are made as of the date hereof, and Plug

undertakes no obligation to update such statements as a result of

new information.

Plug Media ContactFatimah Nouilati

AllisonPlugPR@allisonworldwide.com

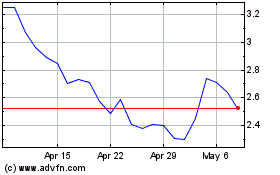

Plug Power (NASDAQ:PLUG)

Historical Stock Chart

From Oct 2024 to Nov 2024

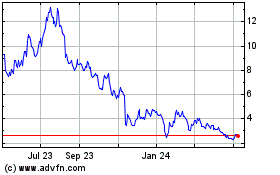

Plug Power (NASDAQ:PLUG)

Historical Stock Chart

From Nov 2023 to Nov 2024