Plug Highlights Year of Strategic Growth and Advancements in Accelerating the Green Hydrogen Economy

March 01 2024 - 7:00AM

Today, Plug Power Inc. (NASDAQ: PLUG), a global leader in

comprehensive hydrogen solutions for the green hydrogen economy

announced its financial results and operational milestones for the

quarter and fiscal year ended December 31, 2023. With a steadfast

commitment to advancing the green hydrogen economy, the Company has

achieved significant progress in revenue growth, operational

efficiency, and strategic investments aimed at promoting global

sustainability and energy independence.

Commercial and Operational

Highlights

- Operational

Milestones:The successful commissioning and operational

status of the Georgia hydrogen plant, which currently operates the

largest PEM electrolyzer system in the United States, and the

deployment of our first large-scale megawatt (MW) level stationary

product represent significant strides in enhancing our hydrogen

production capabilities and expanding our energy solution

portfolio.

- New Business in 2023:In the applications

business, Plug expanded the material handling installed base on

existing key customers such as Walmart, Home Depot, and Amazon.

Plug also installed a 1 MW electrolyzer system at an Amazon

fulfillment center, enabling on-site green hydrogen generation for

use in material handling equipment.The introduction of a new

platform for mid-market material handling sites with 100 or fewer

forklifts, enabled the addition of Tyson and Sam’s Club as new

pedestal customers to Plug’s portfolio. Plug also added STEF as its

first European pedestal customer, providing its complete green

hydrogen ecosystem across two distribution centers in France and

Spain.Additionally, Plug launched its new high-power stationary

fuel cell system for electric vehicle fleet charging by

commissioning a 1MW system for last mile vehicle charging with one

of Plug’s largest customers and securing a deal for the same

product line to provide Energy Vault with an 8 MW hydrogen fuel

cell stationary power system for a back-up power hybrid micro-grid

in the event there is a Public Safety Power Shutoff in Calistoga,

CA.In the Energy Solutions business, Plug closed a 100MW

electrolyzer project for GALP and nearly 1GW in Basic Engineering

Design Package (BEDP) for various projects during 2023 and closed

additional large scale BEDP during 2024.The Company launched

multiple new products in the energy business including hydrogen

storage tanks and a first-of-its-kind mobile liquid hydrogen

refueler that is being delivered to customers.

Financial Highlights

- Financial Stability and

Growth: Plug has resolved the going concern issue as

previously disclosed in the Form 10-Q for the quarter ended

September 30, 2023, and has concluded that there is no longer

substantial doubt of the Company’s ability to continue as a going

concern, demonstrating the Company's financial foundation and

commitment to sustainable operations and growth. The Company has

determined it has sufficient cash on hand coupled with available

liquidity to fund its ongoing operations for the foreseeable

future.

- Record Revenue

Achievement: The Company achieved revenue of $891 million

for the year ended December 31, 2023, which is a record and

reflects a 27% growth over the prior year. This revenue growth

stems from the successful execution of our business strategies in

the renewable energy market and our ongoing dedication to

innovation and market expansion.

- Earnings Per Share (EPS)

Performance: The fiscal year concluded with an EPS loss of

$2.30, as compared to a loss of $1.25 in the previous year. The

incremental loss for 2023 was largely driven by increased

investments in growth and expansion and the varied non-cash charges

recorded in the fourth quarter as discussed below.

- Enhanced Focus on Cash

Management: Acknowledging the challenges encountered in

cash management during 2023, Plug has embraced an increased

emphasis on strengthening the Company’s cash management strategy in

2024. This initiative is aimed at optimizing financial operations

and ensuring the Company’s agility in capitalizing on market

opportunities in the near and mid-term.

-

Impairment and Other Provisions: As a result of

the evolving market dynamics, the Company wrote down certain assets

which resulted in non-cash charges recorded in Q4 2023 of ~$325

million. Further details regarding these charges are provided in

our Annual Report on Form 10-K for the year ended December 31,

2023.

Strategic Achievements and CEO's

Vision

- Andy

Marsh, CEO of Plug, shared: "This fiscal year has marked a

pivotal period in our journey towards growth and sustainability

within the hydrogen economy. Recognizing the past challenges with

cash management, we are dedicated in 2024 to bolstering our

financial profile. Our commitment to driving forward the hydrogen

economy remains unwavering. With leveraging existing investments

and a prudent approach to cash management, we are well-positioned

for sustainable growth and continued innovation in renewable

energy."

Conference Call

Plug Power has scheduled a conference call

today, March 1, at 8:30 am ET to review the Company’s results for

the fourth quarter of 2023. Interested parties are invited to

listen to the conference call by calling 877-407-9221 / +1

201-689-8597.

The webcast can be accessed at:

https://event.webcasts.com/starthere.jsp?ei=1655050&tp_key=5d9634a1a2

A playback of the call will be available online

for a period following the event.

About Plug

Plug is building an end-to-end green hydrogen

ecosystem, from production, storage, and delivery to energy

generation, to help its customers meet their business goals and

decarbonize the economy. In creating the first commercially viable

market for hydrogen fuel cell technology, the Company has deployed

more than 69,000 fuel cell systems and over 250 fueling stations,

more than anyone else in the world, and is the largest buyer of

liquid hydrogen.

With plans to operate a green hydrogen highway

across North America and Europe, Plug built a state-of-the-art

Gigafactory to produce electrolyzers and fuel cells and is

developing multiple green hydrogen production plants targeting

commercial operation by year-end 2028. Plug delivers its green

hydrogen solutions directly to its customers and through joint

venture partners into multiple environments, including material

handling, e-mobility, power generation, and industrial

applications.

For more information, visit www.plugpower.com.

Cautionary Note on Forward-Looking

Statements

This communication contains “forward-looking

statements” within the meaning of the Private Securities Litigation

Reform Act of 1995 that involve significant risks and uncertainties

about Plug Power Inc. (“Plug”), including but not limited to

statements about Plug’s cash management strategic initiative and

the anticipated benefits from the implementation of such

initiative; Plug’s ability to deliver on its business and strategic

objectives; Plug’s expectations regarding its financial profile and

market outlook, including its ability to capitalize on market

opportunities; Plug’s expectation that existing investments and

prudent cash management will position it for sustainable growth and

continued innovation in renewable energy; Plug’s expectations

regarding its projects and products, including its Georgia hydrogen

plant, material handling products, stationary products,

electrolyzer projects and new products in its energy business, and

Plug’s plans regarding its production plants and the timing of the

development and commercial operation of such plants.

You are cautioned that such statements should

not be read as a guarantee of future performance or results as such

statements are subject to risks and uncertainties. Actual

performance or results may differ materially from those expressed

in these statements as a result of various factors, including, but

not limited to, the following: the risk that we may continue to

incur losses and might never achieve or maintain profitability; the

risk that we may not be able to raise additional capital to fund

our operations and such capital may not be available to us on

favorable terms or at all; the risk that we may not be able to

expand our business or manage our future growth effectively; the

risk that we may not be able to remediate the material weaknesses

identified in internal control over financial reporting as of

December 31, 2023, or otherwise maintain an effective system of

internal control over financial reporting; the risk that global

economic uncertainty, including inflationary pressures, fluctuating

interest rates, currency fluctuations, and supply chain

disruptions, may adversely affect our operating results; the risk

that we may not be able to obtain from our hydrogen suppliers a

sufficient supply of hydrogen at competitive prices or the risk

that we may not be able to produce hydrogen internally at

competitive prices; the risk that delays in or not completing our

product and project development goals may adversely affect our

revenue and profitability; the risk that our estimated future

revenue may not be indicative of actual future revenue or

profitability; the risk of elimination, reduction of, or changes in

qualifying criteria for government subsidies and economic

incentives for alternative energy products, including the Inflation

Reduction Act; and the risk that we may not be able to manufacture

and market products on a profitable and large-scale commercial

basis. For a further description of the risks and uncertainties

that could cause actual results to differ from those expressed in

these forward-looking statements, as well as risks relating to the

business of Plug in general, see Plug’s public filings with the

Securities and Exchange Commission, including the “Risk Factors”

section of Plug’s Annual Report on Form 10-K for the year ended

December 31, 2023 as well as any subsequent filings. Readers are

cautioned not to place undue reliance on these forward-looking

statements. The forward-looking statements are made as of the date

hereof and are based on current expectations, estimates, forecasts

and projections as well as the beliefs and assumptions of

management. We disclaim any obligation to update forward-looking

statements except as may be required by law.

MEDIA CONTACT

Kristin Monroe

Allison+Partners

plugPR@allisonworldwide.com

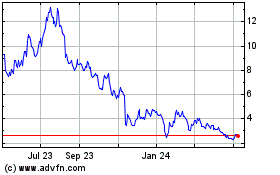

Plug Power (NASDAQ:PLUG)

Historical Stock Chart

From Jan 2025 to Feb 2025

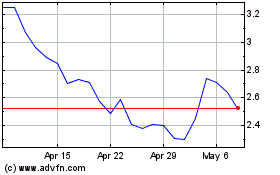

Plug Power (NASDAQ:PLUG)

Historical Stock Chart

From Feb 2024 to Feb 2025