false000172820500017282052024-02-222024-02-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________

FORM 8-K

___________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): February 22, 2024

___________________________________

Piedmont Lithium Inc.

(Exact name of registrant as specified in its charter)

___________________________________

| | | | | | | | |

Delaware | 001-38427 | 36-4996461 |

(State or other jurisdiction of incorporation or organization) | (Commission File Number) | (I.R.S. Employer Identification Number) |

42 E Catawba Street Belmont, North Carolina 28012 |

(Address of principal executive offices and zip code) |

(704) 641-8000 |

(Registrant's telephone number, including area code) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | |

Securities registered pursuant to Section 12(b) of the Act: |

Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common stock $0.0001 par value per share | PLL | Nasdaq |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 12b-2 of the Exchange Act.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 2.02 - Results of Operations and Financial Condition

On February 22, 2024, Piedmont Lithium Inc. issued a press release announcing its financial results for the quarter ended December 31, 2023. A copy of the press release is attached as Exhibit 99.1 to this current report on Form 8-K and is incorporated by reference herein.

The information in this current report on Form 8-K and the exhibits attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing.

Item 9.01 - Financial Statements and Exhibits

(d): Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

| 99.2 | | |

104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized on this 22nd day of February, 2024.

| | | | | |

Piedmont Lithium Inc. (Registrant) |

| |

By: | /s/ Michael White |

Name: | Michael White |

Title: | Executive Vice President and Chief Financial Officer |

PRESS RELEASE | February 22, 2024 | NASDAQ: PLL

PIEDMONT LITHIUM REPORTS Q4 & FULL YEAR 2023 RESULTS

NAL Operations Ramping, Growth Projects Progressing, and Balance Sheet Reinforced

•$39.8 million full year revenue on sales of 43.2 thousand dry metric tons (dmt) of spodumene concentrate

•$5.7 million full year gross profit, reflecting settlement accruals in Q4’23

•Ramp up continues at NAL with further improvements in production and costs expected in 2024

•2024 shipments expected to shift toward multi-year customer contracts; de-emphasizing volatile spot sales

•Permitting and regulatory approvals advancing in Ghana and North Carolina

•$71.7 million in cash and cash equivalents at December 31, 2023

•Net proceeds of approximately $49.1 million from sales of Sayona Mining and Atlantic Lithium shares in Q1’24

Belmont, North Carolina, February 22, 2024 – Piedmont Lithium Inc. (“Piedmont” or the “Company”) (Nasdaq:PLL; ASX:PLL), a leading global supplier of lithium resources critical to the U.S. electric vehicle supply chain, today announced fourth quarter and full year financial results for 2023.

“2023 was a pivotal year for Piedmont as our Quebec joint-venture, North American Lithium (“NAL”), successfully commenced operations last March, leading to the first revenue in Q3 via shipments made under our NAL offtake agreement. As the largest lithium operation in North America, NAL has been successfully ramping up production over the past 10 months, with production hitting record levels in December. We are completing a few remaining capital projects in the first half of 2024 that we expect will result in further improvements in production and operating costs as NAL looks to achieve full run-rate production levels later this year.

“We are pleased with the production ramp-up and prospects for long-term operations at NAL; however, our 2023 financial results were adversely impacted by the sharp downturn in lithium prices that occurred during the year and into 2024. We plan to shift our offtake volumes towards our multi-year customer contracts and reduce shipment volumes under spot sales agreements. We expect this strategy to result in less volatility and higher average realized prices.

“While NAL is a current focus given its status as a producing asset, we believe Piedmont is well-positioned for the long-term with growth opportunities across our project portfolio. In Ghana, we are encouraged by the support of the Ghanaian government evidenced by the sovereign wealth fund’s investment into the Ewoyaa Lithium Project (“Ewoyaa”) announced last year. Ewoyaa continues to advance through the permitting and approvals processes, and the project is poised to be a near-term spodumene producer with exceptional logistics and relatively modest capital and operating costs.

“We continue to make advances towards our mining permit in North Carolina for our Carolina Lithium Project, with the most recent set of questions from the state indicating that the review process for this important milestone could be approaching its conclusion. Our Carolina and Tennessee projects are strategically located in the growing Battery Belt and critical to the goal of achieving some level of lithium self-sufficiency in America. These projects will be advanced on timelines that take into account lithium market conditions, strategic partnering efforts, and government debt financing opportunities.

“Lithium has been a cyclical business for the past decade with trough markets in pricing generally followed by new record highs. As we navigate the current market, which seems to be in the throes of ‘peak pessimism,’ we’re bolstering our balance sheet by monetizing non-core assets, deferring capital spending, and employing cost savings plans designed to reduce our corporate overhead. Our goal is to protect shareholder value in this downturn, while remaining strategically positioned for the lithium market recovery that we believe is a matter of time.”

Keith Phillips, Piedmont Lithium President and Chief Executive Officer

Fourth Quarter and Full Year 2023 Financial Highlights

All references to dry metric tons (“dmt”) in this release relate to spodumene concentrate.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Units | | 2023 | | Q4’23 | | Q3’23 |

| Sales | | | | | | | | | | |

| Concentrate shipped | dmt thousands | | 43.2 | | | | 14.2 | | | | 29.0 | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Revenue | $ millions | | 39.8 | | | | (7.3) | | | | 47.1 | | |

| Realized price (~5.5% Li2O)(1) | $/dmt | | 920 | | | (513) | | | | 1,624 | |

| Realized cost of sales(2) | $/dmt | | 789 | | | | 756 | | | | 805 | | |

| | | | | | | | | | | |

| Profitability | | | | | | | | | | |

| Gross profit | $ millions | | 5.7 | | | | (18.1) | | | | 23.8 | | |

| Gross profit margin | % | | 14.3 | | | | NM | | | 50.4 | | |

| Net income (loss)(3) | $ millions | | (21.8) | | | | (25.4) | | | | 22.9 | | |

| Adjusted net income (loss)(4) | $ millions | | (31.3) | | | | (23.7) | | | | 16.9 | | |

| Adjusted diluted EPS(4) | $ | | (1.64) | | | | (1.23) | | | | 0.88 | | |

| Adjusted EBITDA(4) | $ millions | | (35.1) | | | | (24.4) | | | | 16.2 | | |

| Adjusted EBITDA margin(4) | % | | (88.1) | | | | NM | | | 34.3 | | |

| | | | | | | | | | | |

| Cash | | | | | | | | | | |

| Cash and cash equivalents(5) | $ millions | | 71.7 | | | | 71.7 | | | | 94.5 | | |

___________________________________________________________

(1) Realized price is the average estimated price, net of certain distribution and other fees, for ~5.5% Li2O grade, which includes referenced pricing data up to December 31, 2023 and is subject to final adjustment. The final adjusted price may be higher or lower than the estimated average realized price based on future price movements.

(2) Realized cost of sales is the average cost of sales including Piedmont’s offtake pricing agreement with Sayona Quebec for the purchase of spodumene concentrate at a market price subject to a floor of $500 per metric ton and a ceiling of $900 per metric ton, adjustments for product grade, freight, and insurance.

(3) Net income (loss) includes gain (loss) on dilution from equity method investments, which is reported on a one-quarter lag, of $8.0 million, $1.8 million and $17.0 million, for the three months ended September 30, 2023, three months ended December 31, 2023, and twelve months ended December 31, 2023, respectively.

(4) See end of this release for reconciliation of non-GAAP measures.

(5) Cash and cash equivalents are reported as of the end of the period.

NM - Not meaningful

Fourth Quarter and Recent Business Highlights

Piedmont Lithium

•Purchased 14.2 thousand dmt (~5.7%% Li2O) from NAL in Q4’23 and shipped to customers.

•A shipment totaling 13.1 thousand dmt was delayed from Q4’23 to mid-January 2024 due to inclement weather and port congestion.

•$29.2 million accrued at December 31, 2023 for settlements in 2024 associated with spot shipments in 2023, negatively impacting Q4’23 revenue and gross profit.

•We had $71.7 million in cash and cash equivalents at December 31, 2023. In Q1’24, we sold our holdings in Sayona Mining and a portion of our holdings in Atlantic Lithium for approximately $49.1 million. The sale of these shares had no impact on our joint ventures or offtake positions with either Sayona Quebec or Atlantic Lithium.

•In February 2024, we initiated a cost-savings plan to reduce operating expenses by $10 million annually and defer capital spending in 2024. As part of our plan, we reduced our workforce by 27%, mainly within our corporate office staff. We will record approximately $1 million in severance and related costs in the first quarter of 2024, and expect to recognize the majority of our cost savings in 2024.

•In Q1’24, the U.S. District Court for the Eastern District of New York granted Piedmont’s motion to dismiss a securities class action lawsuit, originally filed in July 2021, against Piedmont and two of its executives.

North American Lithium (Quebec, Canada)

•In Q4’23, NAL produced 34.2 thousand dmt and shipped 23.9 thousand dmt, of which 14.2 thousand dmt were sold to Piedmont.

•In October 2023, Sayona Mining provided a forecast for the one-year period July 1, 2023 through June 30, 2024 projecting production of 140,000 to 160,000 dmt and shipments of 160,000 to 180,000 dmt.

•In November 2023, Sayona released initial drill results from the 2023 drill campaign at NAL, identifying multiple thick, high-grade, spodumene-bearing pegmatites. Additional assays and drill results are pending, and Sayona Quebec expects to publish a mineral resource update in 2024, which may upgrade the classification of current mineral resources and offer the possibility to convert mineral resources to additional mineral reserves.

•In December 2023, operations at NAL achieved records in concentrate production (13.9 thousand dmt), mill availability (80%), and global lithium recovery (66%).

•In Q4’23, NAL substantially progressed ongoing capital improvement projects, including a capacity increase for its tailings storage facility and a new crushed-ore dome. In particular, the crushed ore dome will enable the operations at NAL to achieve better mechanical availability and process stability. Both production and cash operating costs at NAL are expected to improve upon completion of these projects in mid-2024.

•Concentrate produced and shipped by NAL and concentrate shipped by Piedmont:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Share | | Units | | FY23 | | Q4’23 | | Q3’23 |

| North American Lithium | | | | | | | | | |

| Concentrate produced | 100%(1) | | dmt thousands | | 98.8 | | 34.2 | | 31.5 |

| Concentrate shipped | 100%(2) | | dmt thousands | | 72.1 | | 23.9 | | 48.2 |

| | | | | | | | | | |

| Piedmont Lithium | | | | | | | | | |

| Concentrate shipped | 100% | | dmt thousands | | 43.2 | | 14.2 | | 29.0 |

___________________________________________________________

(1) Concentrate produced represents 100% of NAL’s production.

(2) Concentrate shipped represents 100% of NAL’s shipments, inclusive of shipments to Piedmont totaling 29.0 thousand dmt and 14.2 thousand dmt in Q3’23 and Q4’23, respectively.

Note: The table above reports quarterly and year-to-date information in accordance with Piedmont’s fiscal year reporting, which is on a calendar-year basis. Concentrate produced and concentrate shipped (above) are reported in the periods in which activities actually occurred. For financial statement purposes, Piedmont reports income (loss) from its 25% ownership in Sayona Quebec, which includes NAL, on a one-quarter lag.

Ewoyaa Project (Ghana)

•In Q4’23, Ghana’s Ministry of Lands and Natural Resources granted a mining lease for the Ewoyaa project. The lease remains subject to ratification by the Ghanaian Parliament. The mining lease includes a 13% free-carried interest in Ewoyaa for the Government of Ghana and a 10% royalty.

•In January 2024, the Minerals Income Investment Fund, Ghana’s sovereign wealth fund, commenced its funding of Atlantic Lithium with a $5 million subscription of Atlantic Lithium’s common stock.

•In February 2024, Patrick Brindle, Piedmont’s Executive Vice President and Chief Operating Officer, stepped down as a member of Atlantic Lithium’s board of directors due to our reduction in ownership of Atlantic Lithium.

Carolina Lithium (North Carolina)

•Piedmont continues to advance the state mining permit process. In January 2024, Piedmont submitted a response to additional information request (“ADI”) #3 to North Carolina’s Department of Environmental Quality Division of Energy, Minerals, and Land Resources (“DEMLR”). Subsequently, DEMLR provided an ADI #4, which consisted of two further questions. We note that the questions posed by DEMLR are straightforward in nature and the number of questions in ADI #4 is substantially reduced from prior information requests. We are encouraged by this most recent round of questions and look forward to concluding the state mine permitting process in due course.

•Piedmont continues to engage with community stakeholders, including the Gaston County Board of Commissioners, in advance of anticipated rezoning efforts.

Tennessee Lithium (Tennessee)

•In Q4’23, Piedmont purchased a tailings storage facility adjacent to the Tennessee Lithium plant site for the placement of inert tailings to be produced as part of the alkaline pressure leach process.

•Also in Q4’23, Piedmont negotiated a purchase agreement to acquire a large industrial complex in close proximity to the Tennessee Lithium plant site.

•In 2024, Piedmont will continue to assess funding strategies for Tennessee Lithium, which has already received the final material permits required to proceed with construction of the 30,000 metric ton per year lithium hydroxide conversion facility.

Exploration and Development

•In October 2023, we paid $1.5 million for a 19.9% equity interest in Vinland Lithium, a Canadian-based entity jointly owned with Sokoman Minerals and Benton Resources. Vinland Lithium owns the Killick Lithium Project, a large exploration property prospective for lithium located in southern Newfoundland, Canada.

•We have entered into an earn-in agreement with Vinland Lithium to acquire up to a 62.5% equity interest in Killick Lithium through staged-investments. As part of our investment, we entered into a marketing agreement with Killick Lithium for 100% marketing rights and right of first refusal to purchase 100% of all lithium products produced by Killick Lithium on a life-of-mine basis at competitive commercial rates.

2024 Outlook

| | | | | | | | | | | | |

| | | | 2024 |

| | | | |

| | | | |

| Capital expenditures | | | | $10 million — $14 million |

Investments in and advances to affiliates | | | | $32 million — $38 million |

The majority of forecasted capital expenditures relate to Carolina Lithium and Tennessee Lithium. Investments in and advances to affiliates reflect cash contributions to Sayona Quebec and advances to Atlantic Lithium for the Ewoyaa project. Our outlook for forecasted capital expenditures and investments in and advances to affiliates is subject to market conditions.

Piedmont expects funding for Ewoyaa to be minimal in 2024 and is evaluating a range of options that would be non-dilutive to Piedmont Lithium shareholders to fund its share of project capital. We expect a final investment decision for Ewoyaa to be made by 2025.

Under our offtake agreement with Sayona Quebec, Piedmont has the right to purchase the greater of 50% of production or 113,000 dmt/year, in addition to the 13.1 thousand dmt shipment that sailed in mid-January. However, actual purchases in 2024 may differ from the allotment based on how deliveries under contract are scheduled. As we begin deliveries under our customer contracts, we expect to provide more stable price realizations and reduce our reliance on unpredictable spot market sales.

Safety and Sustainability

Piedmont continues to build safety as a foundational pillar of its business and to further development of policies and procedures to enhance the Company’s safety and environmental management systems. Engagement in identifying hazards also improved with increased reporting that enabled proactive strategies for addressing unsafe conditions.

Additionally, Piedmont performed a materiality assessment in Q4’23 with key shareholders to identify, categorize, and prioritize material environmental, social, and governance matters. The Company expects to use the results of the assessment to further develop and guide the organization’s sustainability strategy as we advance toward operations at Carolina Lithium and Tennessee Lithium.

Conference Call Information

| | | | | | | | |

| Date: | | Thursday, February 22, 2024 |

| Time: | | 4:30 pm Eastern Standard Time |

| Dial-in (Toll Free): | | 1 (800) 715-9871 |

| Dial-in (Toll): | | 1 (646) 307-1963 |

| Conference ID: | | 6860456 |

| Participant URL: | | https://events.q4inc.com/attendee/957370119 |

Piedmont’s earnings presentation and supporting material are available at:

https://piedmontlithium.com/investors-overview/.

About Piedmont

Piedmont Lithium Inc. (Nasdaq: PLL; ASX: PLL) is developing a world-class, multi-asset, integrated lithium business focused on enabling the transition to a net zero world and the creation of a clean energy economy in North America. Our goal is to become one of the largest lithium hydroxide producers in North America by processing lithium (spodumene) concentrate produced from assets where we hold an economic interest. Our projects include our Carolina Lithium and Tennessee Lithium projects in the United States and partnerships in Quebec with Sayona Mining (ASX: SYA) and in Ghana with Atlantic Lithium (AIM: ALL; ASX: A11). These geographically diversified operations will enable us to play a pivotal role in supporting America’s move toward energy independence and the electrification of transportation and energy storage.

| | | | | |

| For further information, contact: |

| |

| Erin Sanders | |

| SVP, Corporate Communications & | |

| Investor Relations | |

| T: +1 704 575 2549 | |

E: esanders@piedmontlithium.com | |

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of or as described in securities legislation in the United States and Australia, including statements regarding exploration, development, construction and production activities of Sayona Mining, Atlantic Lithium, and Piedmont; current plans for Piedmont’s mineral and chemical processing projects; Piedmont’s potential acquisition of an ownership interest in Ewoyaa; and strategy. Such forward-looking statements involve substantial and known and unknown risks, uncertainties, and other risk factors, many of which are beyond our control, and which may cause actual timing of events, results, performance or achievements and other factors to be materially different from the future timing of events, results, performance, or achievements expressed or implied by the forward-looking statements. Such risk factors include, among others: (i) that Piedmont, Sayona Mining, or Atlantic Lithium may be unable to commercially extract mineral deposits, (ii) that Piedmont’s, Sayona Mining’s or Atlantic Lithium’s properties may not contain expected reserves, (iii) risks and hazards inherent in the mining business (including risks inherent in exploring, developing, constructing and operating mining projects, environmental hazards, industrial accidents, weather or geologically related conditions), (iv) uncertainty about Piedmont’s ability to obtain required capital to execute its business plan, (v) Piedmont’s ability to hire and retain required personnel, (vi) changes in the market prices of lithium and lithium products, (vii) changes in technology or the development of substitute products, (viii) the uncertainties inherent in exploratory, developmental and production activities, including risks relating to permitting, zoning and regulatory delays related to our projects as well as the projects of our partners in Quebec and Ghana, (ix) uncertainties inherent in the estimation of lithium resources, (x) risks related to competition, (xi) risks related to the information, data and projections related to Sayona Mining or Atlantic Lithium, (xii) occurrences and outcomes of claims, litigation and regulatory actions, investigations and proceedings, (xiii) risks regarding our ability to achieve profitability, enter into and deliver product under supply agreements on favorable terms, our ability to obtain sufficient financing to develop and construct our projects, our ability to comply with governmental regulations and our ability to obtain necessary permits, and (xiv) other uncertainties and risk factors set out in filings made from time to time with the U.S. Securities and Exchange Commission (“SEC”) and the Australian Securities Exchange, including Piedmont’s most recent filings with the SEC. The forward-looking statements, projections and estimates are given only as of the date of this press release and actual events, results, performance and achievements could vary significantly from the forward-looking statements, projections and estimates presented in this press release. Readers are cautioned not to put undue reliance on forward-looking statements. Piedmont disclaims any intent or obligation to update publicly such forward-looking statements, projections, and estimates, whether as a result of new information, future events or otherwise. Additionally, Piedmont, except as required by applicable law, undertakes no obligation to comment on analyses, expectations or statements made by third parties in respect of Piedmont, its financial or operating results or its securities.

PIEDMONT LITHIUM INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

December 31, | | Years Ended

December 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Revenue | | $ | (7,310) | | | $ | — | | | $ | 39,817 | | | $ | — | |

| Costs of sales | | 10,775 | | | — | | | 34,138 | | | — | |

| Gross profit | | (18,085) | | | — | | | 5,679 | | | — | |

| | | | | | | | |

| Exploration costs | | 261 | | | 454 | | | 1,929 | | | 1,939 | |

| Selling, general and administrative expenses | | 11,526 | | | 9,250 | | | 43,319 | | | 29,449 | |

| Total operating expenses | | 11,787 | | | 9,704 | | | 45,248 | | | 31,388 | |

| Income (loss) from equity method investments | | 1,759 | | | (1,804) | | | 194 | | | (8,352) | |

| Loss from operations | | (28,113) | | | (11,508) | | | (39,375) | | | (39,740) | |

| | | | | | | | |

| Interest income | | 900 | | | 780 | | | 3,859 | | | 1,153 | |

| Interest expense | | (5) | | | (18) | | | (39) | | | (116) | |

| Loss from foreign currency exchange | | (3) | | | (28) | | | (91) | | | (88) | |

| Gain (loss) on dilution of equity method investments | | 1,767 | | | (412) | | | 16,975 | | | 28,955 | |

| Total other income | | 2,659 | | | 322 | | | 20,704 | | | 29,904 | |

| Loss before income taxes | | (25,454) | | | (11,186) | | | (18,671) | | | (9,836) | |

| Income tax expense (benefit) | | (64) | | | (282) | | | 3,106 | | | 3,139 | |

| Net loss | | $ | (25,390) | | | $ | (10,904) | | | $ | (21,777) | | | $ | (12,975) | |

| | | | | | | | |

| Basic and diluted: | | | | | | | | |

| Loss per share | | $ | (1.32) | | | $ | (0.61) | | | $ | (1.14) | | | $ | (0.74) | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Weighted-average shares outstanding | | 19,209 | | | 17,966 | | | 19,033 | | | 17,518 | |

| | | | | | | | |

PIEDMONT LITHIUM INC.

CONSOLIDATED BALANCE SHEETS

(In thousands, except per share amounts)

| | | | | | | | | | | |

| December 31,

2023 | | December 31,

2022 |

| Assets | | | |

| Cash and cash equivalents | $ | 71,730 | | | $ | 99,247 | |

| Accounts receivable | 595 | | | — | |

| Other current assets | 3,829 | | | 2,612 | |

| Total current assets | 76,154 | | | 101,859 | |

| Property, plant and mine development, net | 127,086 | | | 71,541 | |

| Other non-current assets | 30,353 | | | 18,873 | |

| Equity method investments | 147,662 | | | 95,648 | |

| Total assets | 381,255 | | | 287,921 | |

| | | |

| Liabilities and Stockholders’ Equity | | | |

| Accounts payable and accrued expenses | 11,754 | | | 12,862 | |

| Current portion of long-term debt | 149 | | | 425 | |

| Other current liabilities | 29,463 | | | 124 | |

| Total current liabilities | 41,366 | | | 13,411 | |

| Long-term debt, net of current portion | 14 | | | 163 | |

| Operating lease liabilities, net of current portion | 1,091 | | | 1,177 | |

Other non-current liabilities | 431 | | | — | |

| Deferred tax liabilities | 6,023 | | | 2,881 | |

| Total liabilities | 48,925 | | | 17,632 | |

| Commitments and contingencies (Note 15) | | | |

| Stockholders’ equity: | | | |

| Common stock; $0.0001 par value, 100,000 shares authorized; 19,272 and 18,073 shares issued and outstanding at December 31, 2023 and December 31, 2022, respectively | 2 | | | 2 | |

| Additional paid-in capital | 462,899 | | | 381,242 | |

| Accumulated deficit | (126,844) | | | (105,658) | |

| Accumulated other comprehensive loss | (3,727) | | | (5,297) | |

| Total stockholders’ equity | 332,330 | | | 270,289 | |

| Total liabilities and stockholders’ equity | $ | 381,255 | | | $ | 287,921 | |

PIEDMONT LITHIUM INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

| | | | | | | | | | | |

| Years Ended

December 31, |

| 2023 | | 2022 |

| Cash flows from operating activities: | | | |

| Net loss | $ | (21,777) | | | $ | (12,975) | |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | |

| Stock-based compensation expense | 9,516 | | | 3,490 | |

| Loss from equity method investments | (194) | | | 8,352 | |

| Gain on dilution of equity method investments | (16,975) | | | (28,955) | |

| Deferred taxes | 3,106 | | | 3,139 | |

| Depreciation and amortization | 272 | | | 74 | |

| Noncash lease expense | 245 | | | 106 | |

| Loss on sale of property, plant and mine development | — | | | 12 | |

| Unrealized loss on investment | — | | | 30 | |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable | (595) | | | — | |

| Other assets | (1,021) | | | (201) | |

| Operating lease liabilities | (220) | | | (97) | |

| Accounts payable | (1,281) | | | 1,413 | |

| Accrued expenses and other current liabilities | 30,494 | | | (837) | |

| Net cash provided by (used in) operating activities | 1,570 | | | (26,449) | |

| Cash flows from investing activities: | | | |

| | | |

| Capital expenditures | (56,723) | | | (25,732) | |

| Advances to affiliates | (9,361) | | | (13,006) | |

| Investments in equity method investments | (33,239) | | | (21,062) | |

| Net cash used in investing activities | (99,323) | | | (59,800) | |

| Cash flows from financing activities: | | | |

| Proceeds from issuances of common stock, net of issuance costs | 71,084 | | | 122,059 | |

| Proceeds from exercise of stock options | — | | | 279 | |

| Principal payments on long-term debt | (426) | | | (1,087) | |

| | | |

| Payments to tax authorities for employee stock-based compensation | (422) | | | — | |

| Net cash provided by financing activities | 70,236 | | | 121,251 | |

| Net (decrease) increase in cash | (27,517) | | | 35,002 | |

| Cash and cash equivalents at beginning of period | 99,247 | | | 64,245 | |

| | | |

| Cash and cash equivalents at end of period | $ | 71,730 | | | $ | 99,247 | |

Non-GAAP Financial Measures

The following information provides definitions and reconciliations of certain non-GAAP financial measures to the most directly comparable financial measures calculated and presented in accordance with GAAP. The non-GAAP financial measures presented do not have any standard meaning prescribed by GAAP and may differ from similarly-titled measures used by other companies. However, we present these measures in this press release because we believe these non-GAAP financial measures provide useful means of evaluating and understanding how our management evaluates our financial condition and results of operations.

The following are non-GAAP financial measures for Piedmont:

Adjusted net income (loss) is defined as net income (loss) plus or minus the gain or loss from gain on dilution of equity method investments, gain or loss from foreign currency exchange, and certain other adjustments we believe are not reflective of our ongoing operations and performance.

Adjusted diluted earnings per share (or adjusted diluted EPS) is defined as diluted EPS before gain on dilution of equity method investments, gain or loss from foreign currency exchange, and certain other costs we believe are not reflective of our ongoing operations and performance. Any references to adjusted EPS are to adjusted diluted EPS.

EBITDA is defined as net income before interest expenses, income tax expense, and depreciation.

Adjusted EBITDA is defined as EBITDA plus or minus the gain or loss from gain on dilution of equity method investments, gain or loss from foreign currency exchange, and certain other adjustments we believe are not reflective of our ongoing operations and performance.

Adjusted EBITDA margin is adjusted EBITDA as a percentage of revenue.

Below are reconciliations of non-GAAP financial measures on a consolidated basis for adjusted net income (loss), adjusted diluted EPS, EBITDA, and adjusted EBITDA.

Adjusted Net Loss and Adjusted Diluted EPS

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Three Months Ended

December 31, 2023 | | Three Months Ended

December 31, 2022 |

| | | | | | | | | | | | | |

(in thousands, except per share amounts) | | | | | | | | | | | | Diluted EPS | | | | Diluted EPS |

| Net loss | | | | | | | | $ | (25,390) | | | | | $ | (1.32) | | | $ | (10,904) | | | $ | (0.61) | |

(Gain) loss on dilution of equity method investments(1) | | | | | | | | (1,767) | | | | | (0.09) | | | 412 | | | 0.02 | |

Impairment of equity method investment(2) | | | | | | | | 2,242 | | | | | 0.12 | | | — | | | — | |

Loss from foreign currency exchange(3) | | | | | | | | 3 | | | | | — | | | 28 | | | — | |

Other costs(4) | | | | | | | | 1,359 | | | | | 0.07 | | | 283 | | | 0.02 | |

Tax effect of adjustments(5) | | | | | | | | (109) | | | | | (0.01) | | | — | | | — | |

| Adjusted net loss | | | | | | | | $ | (23,662) | | | | | $ | (1.23) | | | $ | (10,181) | | | $ | (0.57) | |

| | | | | | | | | | | | | | | | |

______________________________________________________

(1) Gain on dilution of equity method investments in the three months ended December 31, 2023 represents a noncash gain recognized primarily due to Piedmont electing not to participate in Sayona Mining’s share issuances. These shares were issued at a greater value than the carrying value of our ownership interest and as a result our interest in Sayona Mining was diluted and reduced. Loss on dilution of equity method investments in the three months ended December 31, 2022 represents a noncash loss recognized due to Atlantic Lithium’s employee stock option exercises. These shares were issued at a lower value than the carrying value of our ownership interest and as a result our interest in Atlantic Lithium was diluted and reduced. These gains (losses) are reported on a one-quarter lag.

(2) Impairment of equity method investment represents the difference between the carrying value, which includes $46.3 million in accumulated gains on dilution, and fair value of Sayona Mining as of December 31, 2023.

(3) Loss from foreign currency exchange relates to currency fluctuations in our foreign bank accounts denominated in Canadian dollars and Australian dollars and marketable securities denominated in Australian dollars.

(4) Other costs include legal and transactional costs associated with the Department of Energy loan and grant initiatives and costs related to certain significant strategic transactions.

(5) No income tax impacts have been given to any items that were recorded in jurisdictions with full valuation allowances.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Year Ended

December 31, 2023 | | Year Ended

December 31, 2022 |

| | | | | | | | | | | | | |

(in thousands, except per share amounts) | | | | | | | | | | | | Diluted EPS | | | | Diluted EPS |

| Net loss | | | | | | | | $ | (21,777) | | | | | $ | (1.14) | | | $ | (12,975) | | | $ | (0.74) | |

Gain on dilution of equity method investments(1) | | | | | | | | (16,975) | | | | | (0.89) | | | (28,955) | | | (1.65) | |

Impairment of equity method investment(2) | | | | | | | | 2,242 | | | | | 0.12 | | | — | | | — | |

Loss from foreign currency exchange(3) | | | | | | | | 91 | | | | | — | | | 88 | | | 0.01 | |

Other costs(4) | | | | | | | | 1,800 | | | | | 0.09 | | | 824 | | | 0.05 | |

Tax effect of adjustments(5) | | | | | | | | 3,340 | | | | | 0.18 | | | 3,422 | | | 0.20 | |

| Adjusted net loss | | | | | | | | $ | (31,279) | | | | | $ | (1.64) | | | $ | (37,596) | | | $ | (2.15) | |

| | | | | | | | | | | | | | | | |

______________________________________________________

(1) Gain on dilution of equity method investments represents a noncash gain recognized due primarily to Piedmont electing not to participate in Sayona Mining’s share issuances and is reported on a one-quarter lag. These shares were issued at a greater value than the carrying value of our ownership interest and as a result our interest in Sayona Mining was diluted and reduced.

(2) Impairment of equity method investment represents the difference between the carrying value, which includes $46.3 million in accumulated gains on dilution, and fair value of Sayona Mining as of December 31, 2023.

(3) Loss from foreign currency exchange relates to currency fluctuations in our foreign bank accounts denominated in Canadian dollars and Australian dollars and marketable securities denominated in Australian dollars.

(4) Other costs include severance costs, legal and transactional costs associated with the Department of Energy loan and grant initiatives and costs related to certain significant strategic transactions.

(5) No income tax impacts have been given to any items that were recorded in jurisdictions with full valuation allowances.

EBITDA, Adjusted EBITDA, and Adjusted EBITDA Margin

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Years Ended

December 31, |

| (in thousands) | 2023 | | 2022 | | 2023 | | 2022 |

| Net loss | $ | (25,390) | | | $ | (10,904) | | | $ | (21,777) | | | $ | (12,975) | |

| Interest income, net | (895) | | | (762) | | | (3,820) | | | (1,037) | |

| Income tax expense (benefit) | (64) | | | (282) | | | 3,106 | | | 3,139 | |

| Depreciation and amortization | 67 | | | 42 | | | 241 | | | 74 | |

| EBITDA | (26,282) | | | (11,906) | | | (22,250) | | | (10,799) | |

(Gain) loss on dilution of equity method investments(1) | (1,767) | | | 412 | | | (16,975) | | | (28,955) | |

Impairment of equity method investment(2) | 2,242 | | | — | | | 2,242 | | | — | |

Loss from foreign currency exchange(3) | 3 | | | 28 | | | 91 | | | 88 | |

Other Costs(4) | 1,359 | | | 283 | | | 1,800 | | | 824 | |

| Adjusted EBITDA | $ | (24,445) | | | $ | (11,183) | | | $ | (35,092) | | | $ | (38,842) | |

Adjusted EBITDA margin(5) | NM | | | | NM | | |

______________________________________________________

(1) Gain on dilution of equity method investments in the three months ended December 31, 2023 represents a noncash gain recognized primarily due to Piedmont electing not to participate in Sayona Mining’s share issuances. These shares were issued at a greater value than the carrying value of our ownership interest and as a result our interest in Sayona Mining was diluted and reduced. Loss on dilution of equity method investments in the three months ended December 31, 2022 represents a noncash loss recognized due to Atlantic Lithium’s employee stock option exercises. These shares were issued at a lower value than the carrying value of our ownership interest and as a result our interest in Atlantic Lithium was diluted and reduced. These gains (losses) are reported on a one-quarter lag.

(2) Impairment of equity method investment represents the difference between the carrying value, which includes $46.3 million in accumulated gains on dilution, and fair value of Sayona Mining as of December 31, 2023

(3) Loss from foreign currency exchange relates to currency fluctuations in our foreign bank accounts denominated in Canadian dollars and Australian dollars and marketable securities denominated in Australian dollars.

(4) Other costs include severance costs, legal and transactional costs associated with the Department of Energy loan and grant initiatives and costs related to certain significant strategic transactions.

(5) Adjusted EBITDA margin is defined as adjusted EBITDA divided by revenue.

NM - Not meaningful

:PLL ARBN 647 286 360 :PLL February 22, 2024 EARNINGS PRESENTATION FULL YEAR 2023 : PLL : PLL DISCLAIMERS Forward Looking Statements This presentation contains forward-looking statements within the meaning of or as described in securities legislation in the United States and Australia, including statements regarding exploration, development, construction and production activities of Sayona Mining, Atlantic Lithium and Piedmont Lithium; current plans for Piedmont’s mineral and chemical processing projects; Piedmont’s potential acquisition of an ownership interest in Ewoyaa; and strategy. Such forward-looking statements involve substantial and known and unknown risks, uncertainties and other risk factors, many of which are beyond our control, and which may cause actual timing of events, results, performance or achievements expressed or implied by the forward-looking statements. Such risk factors include, among others: (i) that Piedmont, Sayona Mining or Atlantic Lithium may be unable to commercially extract mineral deposits, (ii) that Piedmont’s, Sayona Mining’s or Atlantic Lithium’s properties may not contain expected reserves, (iii) risks and hazards inherent in the mining business (including risks inherent in exploring, developing, constructing and operating mining projects, environmental hazards, industrial accidents, weather or geologically related conditions), (iv) uncertainty about Piedmont’s ability to obtain required capital to execute its business plan, (v) Piedmont’s ability to hire and retain required personnel, (vi) changes in the market prices of lithium and lithium products, (vii) changes in technology or the development of substitute products, (viii) the uncertainties inherent in exploratory, developmental and production activities, including risks relating to permitting, zoning and regulatory delays related to Piedmont’s projects as well as the projects of our partners in Quebec and Ghana, (ix) uncertainties inherent in the estimation of lithium resources, (x) risks related to competition, (xi) risks related to the information, data and projections related to Sayona Mining or Atlantic Lithium, (xii) occurrences and outcomes of claims, litigation and regulatory actions, investigations and proceedings, (xiii) risks regarding our ability to achieve profitability, enter into and deliver product under supply agreements on favorable terms, our ability to obtain sufficient financing to develop and construct our projects, our ability to comply with governmental regulations and our ability to obtain necessary permits, and (xiv) other uncertainties and risk factors set out in filings made from time to time with the U.S. Securities and Exchange Commission (“SEC”) and the Australian Securities Exchange, including Piedmont’s most recent filings with the SEC. The forward-looking statements, projections and estimates are given only as of the date of this presentation and actual events, results, performance and achievements could vary significantly from the forward-looking statements, projections and estimates presented in this presentation. Readers are cautioned not to put undue reliance on forward-looking statements. Piedmont disclaims any intent or obligation to update publicly such forward-looking statements, projections and estimates, whether as a result of new information, future events or otherwise. Additionally, Piedmont, except as required by applicable law, undertakes no obligation to comment on analyses, expectations or statements made by third parties in respect of Piedmont, its financial or operating results or its securities.

: PLL : PLL DISCLAIMERS Non-GAAP Measures Non-GAAP financial metrics such as “Adjusted Net Income,” “Adjusted Diluted Earnings Per Share,” “EBITDA,” “Adjusted EBITDA,” and “Adjusted EBITDA Margin” are used throughout the presentation to provide additional information on business performance. The non-GAAP financial measures presented do not have any standard meaning prescribed by GAAP and may differ from similarly-titles measures used by other companies. However, we present these measures in this press release because we believe these non-GAAP financial measures provide useful means of evaluating and understanding how our management evaluates our financial condition and results of operations. A reconciliation of Non-GAAP metrics to statutory financial metrics is provided in Non-GAAP Measures section. Throughout this presentation, amounts may not sum due to rounding. : PLL : PLL CORPORATE SNAPSHOT KEITH PHILLIPS MICHAEL WHITE PATRICK BRINDLE ▪ ▪ ▪ ▪ ▪ ▪ ▪ ▪ ▪

: PLL : PLL PIEDMONT DEVELOPMENT PIPELINE Aligning near-term upstream production with long-term value creation MICHAEL WHITE EXECUTIVE VICE PRESIDENT & CHIEF FINANCIAL OFFICER FINANCIALS

: PLL : PLL $39.8 $5.7 ($1.14)43.2 $71.7 ($1.64) FY2023 FINANCIAL HIGHLIGHTS $920 $789 : PLL : PLL 2023 REVENUE ▪ ▪ ▪ ▪ ▪ Q4’23 Revenue impacted by adjustment for provisional revenue recorded in Q3’23

: PLL : PLL PIEDMONT SHIPMENTS Timing of shipment price reporting ▪ ▪ ▪ ▪ ▪ ▪ ▪ : PLL : PLL SOURCES AND USES OF CASH

: PLL : PLL 2024 OUTLOOK : PLL : PLL SUPPLY AGREEMENTS ▪ ▪ ▪ ▪ ▪ ▪ ▪ ▪ ▪ ▪ Ramping deliveries under supply agreements in 2024; reduced volatility vs. spot shipments

OPERATIONS AND PROJECTS UPDATE PATRICK BRINDLE EXECUTIVE VICE PRESIDENT & CHIEF OPERATING OFFICER : PLL : PLL 2023 OPERATIONAL RESULTS SUMMARY

: PLL : PLL NORTH AMERICAN LITHIUM RESTART ▪ ▪ ▪ ▪ ▪ ▪ ▪ ▪ Ramp continues to progress; record recovery, utilization and production in December : PLL : PLL NAL - OPTIMIZATION EFFORTS ▪ ▪ ▪ ▪ ▪ ▪ ▪ ▪ ▪ ▪ Progressing final restart construction activities and implementing controls upgrades; reviewing cost structure

: PLL : PLL GHANA Advancing the Ewoyaa Project ▪ ▪ ▪ ▪ ▪ ▪ ▪ ▪ ▪ ▪ ▪ ▪ ▪ ▪ : PLL : PLL CAROLINA LITHIUM Planned fully-integrated 30,000 tpy LiOH operation 100% owned by Piedmont Lithium ▪ ▪ ▪ ▪ ▪

: PLL : PLL TENNESSEE LITHIUM 100% owned by Piedmont Lithium ▪ ▪ ▪ ▪ MARKETS AND FUNDING KEITH PHILLIPS PRESIDENT & CHIEF EXECUTIVE OFFICER

: PLL : PLL Prices have settled near current levels LITHIUM MARKETS : PLL : PLL MARKET OUTLOOK Demand growth remains strong; low prices increase risk to future supply

: PLL : PLL Futures market in contango; NAL offtake price ceiling drives attractive economics when prices rise LEVERAGED TO LITHIUM PRICES : PLL : PLL WHAT IS DRIVING GROWING DEMAND?

: PLL : PLL SUPPLY CHAIN DEVELOPMENTSUPPLY CHAIN DEVELOPMENT U.S. battery plants expected to require ~40x1 current U.S. lithium hydroxide capacity : PLL : PLL ▪ ▪ ▪ ▪ ▪ ▪ ▪ ▪ ▪ ▪ ▪ ▪ ▪ ▪ Prudent cash management during period of heightened price volatility COST SAVINGS ACTIONS

: PLL : PLL ▪ ▪ ▪ ▪ ▪ ▪ ▪ ▪ ▪ ▪ ▪ ▪ ▪ Evaluating project finance options with a view to minimizing dilution to Piedmont shareholders FUNDING OUR GROWTH : PLL : PLL Piedmont offers scale, diversification, downstream integration, and current production PEER BENCHMARKING

Q&A APPENDIX

: PLL : PLL Q1 2024 INVESTOR RELATIONS EVENTS NON-GAAP RECONCILIATIONS

: PLL : PLL DEFINITIONS OF NON-GAAP MEASURES NON-GAAP MEASURES DESCRIPTION : PLL : PLL ADJUSTED NET INCOME (LOSS) Net income (loss) attributable to Piedmont stockholders is reconciled to adjusted net income (loss)

: PLL : PLL ADJUSTED NET INCOME (LOSS) Net income (loss) attributable to Piedmont stockholders is reconciled to adjusted net income (loss) : PLL : PLL EBITDA AND ADJUSTED EBITDA Net income (loss) attributable to Piedmont stockholders is reconciled to EBITDA and adjusted EBITDA

: PLL : PLL PEER PROJECT NOTES :PLL ARBN 647 286 360 :PLL FULL YEAR 2023 EARNINGS PRESENTATION

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

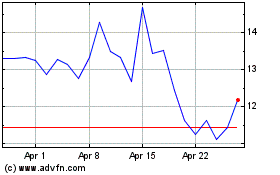

Piedmont Lithium (NASDAQ:PLL)

Historical Stock Chart

From Oct 2024 to Nov 2024

Piedmont Lithium (NASDAQ:PLL)

Historical Stock Chart

From Nov 2023 to Nov 2024