false

0001624326

0001624326

2024-08-13

2024-08-13

0001624326

PAVM:CommonStockParValue0.001PerShareMember

2024-08-13

2024-08-13

0001624326

PAVM:SeriesZWarrantsToPurchaseCommonStockMember

2024-08-13

2024-08-13

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): August 13, 2024

| PAVMED

INC. |

| (Exact

Name of Registrant as Specified in Charter) |

| Delaware |

|

001-37685 |

|

47-1214177 |

(State

or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

| 360

Madison Avenue, 25th Floor, New York, New York |

|

10017 |

| (Address

of Principal Executive Offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (917) 813-1828

| N/A |

| (Former

Name or Former Address, if Changed Since Last Report) |

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425). |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12). |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)). |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)). |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, Par Value $0.001 Per Share |

|

PAVM |

|

The

Nasdaq Stock Market LLC |

| Series

Z Warrants to Purchase Common Stock |

|

PAVMZ |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

2.02. Results of Operations and Financial Condition.

On

August 13, 2024, PAVmed Inc. (the “Company”) issued a press release announcing financial results for its fiscal

quarter ended June 30, 2024 and providing a business update. A copy of the press release is attached to this report as Exhibit 99.1 and

is incorporated herein by reference.

Item

7.01. Regulation FD Disclosure.

The

disclosure set forth under Item 2.02 is incorporated herein by reference.

The

information furnished under Items 2.02 and 7.01, including the exhibit related thereto, shall not be deemed “filed” for purposes

of Section 18 of the Securities Exchange Act of 1934, nor shall it be deemed incorporated by reference in any disclosure document of

the Company, except as shall be expressly set forth by specific reference in such document.

Item

9.01. Financial Statements and Exhibits.

(d)

Exhibits:

| Exhibit

No. |

|

Description |

| 99.1 |

|

Press release. |

| 104 |

|

Cover

Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| Dated:

August 13, 2024 |

PAVMED

INC. |

| |

|

| |

By:

|

/s/

Dennis McGrath |

| |

|

Dennis

McGrath |

| |

|

President

and Chief Financial Officer |

Exhibit

99.1

PAVmed

Provides Business Update and Second Quarter 2024 Financial Results

Lucid

reports record quarterly EsoGuard® test volume and held productive meeting with CMS Medicare Administrative Contractor

(MAC) Palmetto GBA’s MolDX Program

Veris

Health actively pursuing financing following launch of pilot program with The Ohio State’s James Cancer Hospital

Conference

call and webcast to be held today, August 13th at 8:30 AM EDT

NEW

YORK, August 13, 2024 - PAVmed Inc. (NASDAQ: PAVM, PAVMZ) (“PAVmed” or the “Company”), a diversified

commercial-stage medical technology company, operating in the medical device, diagnostics, and digital health sectors, today provided

a business update for the Company and its subsidiaries, Lucid Diagnostics Inc. (NASDAQ: LUCD) (“Lucid”) and Veris Health

Inc. (“Veris”), and presented financial results for the Company for the three months ended June 30, 2024.

Conference

Call and Webcast

The

webcast will take place on Tuesday, August 13, 2024, at 8:30 AM and is accessible in the investor relations section of the Company’s

website at pavmed.com. Alternatively, to access the conference call by telephone, U.S.-based callers should dial 1-800-836-8184

and international listeners should dial 1-646-357-8785. All listeners should provide the operator with the conference call name “PAVmed

Business Update” to join.

Following

the conclusion of the conference call, a replay will be available for 30 days on the investor relations section of the Company’s

website at pavmed.com.

Business

Update Highlights

“Our

strategy for PAVmed remains to strengthen its finances and long-term stability by seeking to have each of its subsidiaries become independently

financeable and well-positioned to leverage PAVmed’s shared infrastructure,” said Lishan Aklog, M.D., PAVmed’s

Chairman and Chief Executive Officer. “Lucid remains PAVmed’s strongest asset and it has been able to independently finance

its operations and continue to make solid progress over multiple fronts towards fulfilling its large commercial potential. PAVmed’s

two other subsidiaries, Veris Health and the PMX incubator are also advancing consistent with this strategy, with Veris and PMX asset

PortIO actively pursuing independent financing.

Highlights

from the second quarter and recent weeks:

| ● | Lucid

reported that 2Q24 EsoGuard® Esophageal DNA Test revenue was $1.0

million, which was flat compared to 1Q24 and represents a 514 percent increase from 2Q23. |

| ● | Lucid’s

CLIA-certified clinical laboratory performed 3,147 commercial EsoGuard tests in 2Q24, which

represents a single-quarter record and 31 percent increase sequentially from 1Q24

and a 44 percent annual increase from 2Q23. |

| ● | Released

positive data from both the ENVET-BE clinical utility study and ESOGUARD BE-1 clinical

validation study |

| ● | Held

productive meeting with CMS Medicare Administrative Contractor (MAC) Palmetto GBA’s

Molecular Diagnostics Program (MolDX) focused on EsoGuard’s clinical data. |

| ● | Lucid

held first major #CheckYourFoodTube Precancer Testing Event with upfront contracted payment. |

| ● | Veris

launched pilot program with The Ohio State’s James Cancer Hospital and enrolled

first patients onto the Veris Cancer Care Platform. |

| ● | Veris

actively pursuing financing to relaunch the development of its implantable monitor. |

| ● | PMX

incubator making meaningful advancements in its efforts to raise capital for PortIO Corp. |

Financial

Results:

| ● | For

the three months ended June 30, 2024, EsoGuard related revenues were $1.0 million. Operating

expenses were approximately $14.6 million, which includes stock-based compensation expenses

of $1.9 million. GAAP net loss attributable to common stockholders was approximately $10.9

million, or $(1.19) per common share. |

| ● | As

shown below and for the purpose of illustrating the effect of stock-based compensation and

other non-cash income and expenses on the Company’s financial results, the Company’s

non-GAAP adjusted loss was approximately $7.7 million or $(0.84) per common share. |

| ● | PAVmed

had cash and cash equivalents of $25.5 million as of June 30, 2024, compared to $19.6 million

as of December 31, 2023. |

| ● | The

unaudited financial results for the three months ended June 30, 2024 were filed with the

SEC on Form 10-Q on August 12, 2024, and are available at www.pavmed.com or www.sec.gov. |

PAVmed

Non-GAAP Measures

| ● | To

supplement our financial results presented in accordance with U.S. generally accepted accounting

principles (GAAP), management provides certain non-GAAP financial measures of the Company’s

financial results. These non-GAAP financial measures include net loss before interest, taxes,

depreciation, and amortization (EBITDA) and non-GAAP adjusted loss, which further adjusts

EBITDA for stock-based compensation expense, loss on the issuance or modification of convertible

securities, the periodic change in fair value of convertible securities, and loss on debt

extinguishment. The foregoing non-GAAP financial measures of EBITDA and non-GAAP adjusted

loss are not recognized terms under U.S. GAAP. |

| ● | Non-GAAP

financial measures are presented with the intent of providing greater transparency to the

information used by us in our financial performance analysis and operational decision-making.

We believe these non-GAAP financial measures provide meaningful information to assist investors,

shareholders, and other readers of our financial statements in making comparisons to our

historical financial results and analyzing the underlying performance of our results of operations.

These non-GAAP financial measures are not intended to be, and should not be, a substitute

for, considered superior to, considered separately from, or as an alternative to, the most

directly comparable GAAP financial measures. |

| ● | Non-GAAP

financial measures are provided to enhance readers’ overall understanding of our current

financial results and to provide further information for comparative purposes. Management

believes the non-GAAP financial measures provide useful information to management and investors

by isolating certain expenses, gains, and losses that may not be indicative of our core operating

results and business outlook. Specifically, the non-GAAP financial measures include non-GAAP

adjusted loss, and its presentation is intended to help the reader understand the effect

of the loss on the issuance or modification of convertible securities, the periodic change

in fair value of convertible securities, the loss on debt extinguishment and the corresponding

accounting for non-cash charges on financial performance. In addition, management believes

non-GAAP financial measures enhance the comparability of results against prior periods. |

| ● | A

reconciliation to the most directly comparable GAAP measure of all non-GAAP financial measures

included in this press release for the three and six months ended June 30, 2024 and 2023

are as follows: |

Condensed Consolidated Statement of Operations (Unaudited)

| | |

For the three months ended

June 30, | | |

For the six months ended

June 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| (in thousands except per-share amounts) | |

| | | |

| | | |

| | | |

| | |

| Revenue | |

$ | 979 | | |

$ | 166 | | |

$ | 1,989 | | |

$ | 612 | |

| Operating expenses | |

| 14,663 | | |

| 16,650 | | |

| 29,711 | | |

| 37,496 | |

| Other (Income) Expense | |

| 1,230 | | |

| 1,408 | | |

| 5,704 | | |

| 3,222 | |

| Net Loss | |

| 14,914 | | |

| 17,892 | | |

| 33,426 | | |

| 40,106 | |

| Net income (loss) per common share, basic and diluted | |

$ | (1.19 | ) | |

$ | (2.10 | ) | |

$ | (3.78 | ) | |

$ | (4.86 | ) |

| Net loss attributable to common stockholders | |

| (10,908 | ) | |

| (14,612 | ) | |

| (33,696 | ) | |

| (32,617 | ) |

| Preferred Stock dividends and deemed dividends | |

| 81 | | |

| 75 | | |

| 7,657 | | |

| 149 | |

| Net income (loss) as reported | |

| (10,827 | ) | |

| (14,537 | ) | |

| (26,039 | ) | |

| (32,468 | ) |

| Adjustments: | |

| | | |

| | | |

| | | |

| | |

| Depreciation and amortization expense1 | |

| 305 | | |

| 747 | | |

| 891 | | |

| 1,474 | |

| Interest expense, net2 | |

| (99 | ) | |

| 65 | | |

| (156 | ) | |

| 128 | |

| NCI ownership share of Interest and Depreciation adjustments | |

| (40 | ) | |

| (225 | ) | |

| (180 | ) | |

| (403 | ) |

| EBITDA | |

| (10,661 | ) | |

| (13,950 | ) | |

| (25,484 | ) | |

| (31,269 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other non-cash or financing related expenses: | |

| | | |

| | | |

| | | |

| | |

| Stock-based compensation expense3 | |

| 1,904 | | |

| 2,507 | | |

| 3,786 | | |

| 6,926 | |

| ResearchDx acquisition/settlement paid in stock1 | |

| — | | |

| — | | |

| — | | |

| 713 | |

| Operating expenses issued in stock1 | |

| 140 | | |

| 625 | | |

| 163 | | |

| 625 | |

| Change in FV convertible debt2 | |

| 566 | | |

| 340 | | |

| 2,728 | | |

| 1,380 | |

| Offering costs convertible debt2 | |

| — | | |

| — | | |

| — | | |

| 1,186 | |

| Loss on debt extinguishment2 | |

| 763 | | |

| 743 | | |

| 1,132 | | |

| 1,268 | |

| Debt modification expense | |

| — | | |

| — | | |

| 2,000 | | |

| — | |

| Other non-cash charges | |

| — | | |

| — | | |

| — | | |

| — | |

| NCI ownership share of non-GAAP adjustments | |

| (363 | ) | |

| (450 | ) | |

| (602 | ) | |

| (2,192 | ) |

| Non-GAAP adjusted (loss) | |

$ | (7,651 | ) | |

$ | (10,185 | ) | |

$ | (16,277 | ) | |

$ | (21,363 | ) |

| Basic and Diluted shares outstanding | |

| 9,153 | | |

| 6,957 | | |

| 8,924 | | |

| 6,716 | |

| Non-GAAP adjusted (loss) income per share | |

$ | (0.84 | ) | |

$ | (1.46 | ) | |

$ | (1.82 | ) | |

$ | (3.18 | ) |

1

Included in general and administrative expenses in the financial statements.

2

Included in other income and expenses.

3

Stock-based compensation (“SBC”) expense included in operating expenses is detailed as follows in the table below by

category within operating expenses for the non-GAAP Net operating expenses:

Reconciliation of GAAP Operating Expenses to Non-GAAP Net Operating Expenses

| (in thousands except per-share amounts) | |

For the three months ended

June 30, | | |

For the six months ended

June 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

| | |

| | |

| | |

| |

| Cost of revenue | |

$ | 1,666 | | |

$ | 1,685 | | |

$ | 3,411 | | |

$ | 3,030 | |

| Stock-based compensation expense3 | |

| (44 | ) | |

| (31 | ) | |

| (80 | ) | |

| (54 | ) |

| Net cost of revenue | |

| 1,622 | | |

| 1,654 | | |

| 3,331 | | |

| 2,976 | |

| | |

| | | |

| | | |

| | | |

| | |

| Amortization of acquired intangible assets | |

| 105 | | |

| 505 | | |

| 477 | | |

| 1,010 | |

| | |

| | | |

| | | |

| | | |

| | |

| Sales and marketing | |

| 4,242 | | |

| 4,339 | | |

| 8,552 | | |

| 8,877 | |

| Stock-based compensation expense3 | |

| (387 | ) | |

| (455 | ) | |

| (790 | ) | |

| (899 | ) |

| Net sales and marketing | |

| 3,855 | | |

| 3,884 | | |

| 7,762 | | |

| 7,978 | |

| | |

| | | |

| | | |

| | | |

| | |

| General and administrative | |

| 7,009 | | |

| 6,652 | | |

| 13,688 | | |

| 17,060 | |

| Depreciation expense | |

| (200 | ) | |

| (242 | ) | |

| (414 | ) | |

| (464 | ) |

| ResearchDx acquisition/settlement paid in stock | |

| — | | |

| — | | |

| — | | |

| (713 | ) |

| Operating expenses issued in stock | |

| (140 | ) | |

| (625 | ) | |

| (163 | ) | |

| (625 | ) |

| Stock-based compensation expense3 | |

| (1,214 | ) | |

| (1,674 | ) | |

| (2,292 | ) | |

| (5,262 | ) |

| Net general and administrative | |

| 5,455 | | |

| 4,111 | | |

| 10,819 | | |

| 9,996 | |

| | |

| | | |

| | | |

| | | |

| | |

| Research and development | |

| 1,641 | | |

| 3,469 | | |

| 3,583 | | |

| 7,519 | |

| Stock-based compensation expense3 | |

| (259 | ) | |

| (347 | ) | |

| (624 | ) | |

| (711 | ) |

| Net research and development | |

| 1,382 | | |

| 3,122 | | |

| 2,959 | | |

| 6,808 | |

| | |

| | | |

| | | |

| | | |

| | |

| Total operating expenses | |

| 14,663 | | |

| 16,650 | | |

| 29,711 | | |

| 37,496 | |

| Depreciation and amortization expense | |

| (305 | ) | |

| (747 | ) | |

| (891 | ) | |

| (1,474 | ) |

| ResearchDx acquisition/settlement paid in stock | |

| — | | |

| — | | |

| — | | |

| (713 | ) |

| Operating expenses issued in stock | |

| (140 | ) | |

| (625 | ) | |

| (163 | ) | |

| (625 | ) |

| Stock-based compensation expense3 | |

| (1,904 | ) | |

| (2,507 | ) | |

| (3,786 | ) | |

| (6,926 | ) |

| Net operating expenses | |

$ | 12,314 | | |

$ | 12,771 | | |

$ | 24,871 | | |

$ | 27,758 | |

About

PAVmed and its Subsidiaries

PAVmed

Inc. is a diversified commercial-stage medical technology company operating in the medical device, diagnostics, and digital health sectors.

Its subsidiary, Lucid Diagnostics Inc. (NASDAQ: LUCD), is a commercial-stage cancer prevention medical diagnostics company that markets

the EsoGuard® Esophageal DNA Test and EsoCheck® Esophageal Cell Collection Device—the first and only

commercial tools for widespread early detection of esophageal precancer to mitigate the risks of esophageal cancer deaths. Its other

subsidiary, Veris Health Inc., is a digital health company focused on enhanced personalized cancer care through remote patient monitoring

using implantable biologic sensors with wireless communication along with a custom suite of connected external devices. Veris is concurrently

developing an implantable physiological monitor, designed to be implanted alongside a chemotherapy port, which will interface with the

Veris Cancer Care Platform.

For

more and for more information about PAVmed, please visit pavmed.com.

For

more information about Lucid Diagnostics, please visit luciddx.com.

For

more information about Veris Health, please visit verishealth.com.

Forward-Looking

Statements

This

press release includes forward-looking statements that involve risks and uncertainties. Forward-looking statements are any statements

that are not historical facts. Such forward-looking statements, which are based upon the current beliefs and expectations of PAVmed’s

and Lucid’s management, are subject to risks and uncertainties, which could cause actual results to differ from the forward-looking

statements. Risks and uncertainties that may cause such differences include, among other things, volatility in the price of PAVmed’s

and Lucid’s common stock; PAVmed’s Series Z warrants; general economic and market conditions; the uncertainties inherent

in research and development, including the cost and time required to advance PAVmed’s and Lucid’s products to regulatory

submission; whether regulatory authorities will be satisfied with the design of and results from PAVmed’s and Lucid’s clinical

and preclinical studies; whether and when PAVmed’s and Lucid’s products are cleared by regulatory authorities; market acceptance

of PAVmed’s and Lucid’s products once cleared and commercialized; PAVmed’s and Lucid’s ability to raise additional

funding as needed; and other competitive developments. In addition, new risks and uncertainties may arise from time to time and are difficult

to predict. For a further list and description of these and other important risks and uncertainties that may affect PAVmed’s and

Lucid’s future operations, see Part I, Item 1A, “Risk Factors,” in PAVmed’s and Lucid’s most recent Annual

Report on Form 10-K filed with the Securities and Exchange Commission, as the same may be updated in Part II, Item 1A, “Risk Factors”

in any Quarterly Report on Form 10-Q filed by PAVmed or Lucid after its most recent Annual Report. PAVmed and Lucid disclaim any intention

or obligation to publicly update or revise any forward-looking statement to reflect any change in its expectations or in events, conditions,

or circumstances on which those expectations may be based, or that may affect the likelihood that actual results will differ from those

contained in the forward-looking statements.

Investor

and Media Contact

Matt

Riley

PAVmed

and Lucid Diagnostics

610.348.8926

mjr@pavmed.com

v3.24.2.u1

Cover

|

Aug. 13, 2024 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 13, 2024

|

| Entity File Number |

001-37685

|

| Entity Registrant Name |

PAVMED

INC.

|

| Entity Central Index Key |

0001624326

|

| Entity Tax Identification Number |

47-1214177

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

360

Madison Avenue

|

| Entity Address, Address Line Two |

25th Floor

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10017

|

| City Area Code |

(917)

|

| Local Phone Number |

813-1828

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock, Par Value $0.001 Per Share |

|

| Title of 12(b) Security |

Common

Stock, Par Value $0.001 Per Share

|

| Trading Symbol |

PAVM

|

| Security Exchange Name |

NASDAQ

|

| Series Z Warrants to Purchase Common Stock |

|

| Title of 12(b) Security |

Series

Z Warrants to Purchase Common Stock

|

| Trading Symbol |

PAVMZ

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=PAVM_CommonStockParValue0.001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=PAVM_SeriesZWarrantsToPurchaseCommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

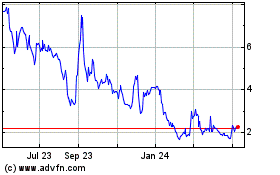

PAVmed (NASDAQ:PAVM)

Historical Stock Chart

From Oct 2024 to Nov 2024

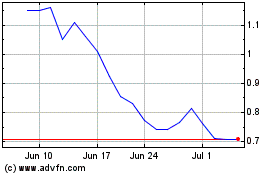

PAVmed (NASDAQ:PAVM)

Historical Stock Chart

From Nov 2023 to Nov 2024