PacBio (NASDAQ: PACB) today announced financial results for the

quarter and fiscal year ended December 31, 2024.

Fourth quarter results

- Revenue of $39.2 million, a 33%

decrease compared with $58.4 million in the prior-year period.

- Instrument revenue of $15.3 million

compared with $35.1 million in the prior-year period. Instrument

revenue in the fourth quarter of 2024 included 23 Revio® sequencing

systems and 7 Vega™ sequencing systems.

- Consumables revenue of $18.8 million

compared with $18.9 million in the prior-year period.

- Service and other revenue of $5.1

million compared with $4.4 million in the prior-year period.

Gross margin, operating expenses, net income (loss), and net

income (loss) per share are reported on a GAAP and non-GAAP basis.

The non-GAAP measures are described below and reconciled to the

corresponding GAAP measures at the end of this release.

GAAP gross margin of 26% in the fourth quarter of 2024 compared

to 16% for the fourth quarter of 2023. Non-GAAP gross margin of 31%

in the fourth quarter of 2024 compared to 19% in the fourth quarter

of 2023.

GAAP operating expenses totaled $161.9 million for the fourth

quarter of 2024, compared to $97.1 million for the fourth quarter

of 2023. Non-GAAP operating expenses totaled $68.6 million for the

fourth quarter of 2024, compared to $88.4 million for the fourth

quarter of 2023. GAAP and non-GAAP operating expenses for the

fourth quarter of 2024 and the fourth quarter of 2023 included

non-cash share-based compensation of $14.8 million and $15.4

million, respectively.

Operating expenses, net income, and basic net income per share

for the quarter ended December 31, 2024 include the impact of

estimated preliminary non-cash impairment charges of approximately

$90.1 million related to goodwill and in-process research and

development. The impairments were driven by macroeconomic headwinds

and a revised outlook on future cash flows, among other factors.

These preliminary estimates are subject to finalization as the

Company completes its interim assessment and year-end financial

reporting procedures. The final impairment charges reported in the

Annual Report on Form 10-K may differ materially from these

estimates.

GAAP net income for the fourth quarter of 2024 was $3.6 million,

compared to a GAAP net loss of $82.0 million for the fourth quarter

of 2023. GAAP basic net income per share for the fourth quarter of

2024 was $0.01 compared to GAAP basic net loss per share of $0.31

for the fourth quarter of 2023. GAAP net income and GAAP basic net

income per share for the quarter ended December 31, 2024 include a

$154.4 million gain on debt restructuring in relation to our note

exchange that closed on November 21, 2024. Non-GAAP net loss was

$55.3 million for the fourth quarter of 2024, compared to $72.5

million for the fourth quarter of 2023. Non-GAAP basic net loss per

share for the fourth quarter of 2024 was $0.20 compared to $0.27

for the fourth quarter of 2023.

Cash, cash equivalents, and investments, excluding restricted

cash, at December 31, 2024, totaled $389.9 million, compared

to $631.4 million at December 31, 2023.

Highlights since PacBio's last earnings

release

- Accelerated Launch of

Vega: Commenced shipments of Vega, our benchtop sequencing

platform, ahead of schedule—expanding access to HiFi long-read

sequencing for a broader range of customers.

- Clinical Collaboration with

Berry Genomics:

Delivered the first Vega systems as part of an early access

agreement, supporting targeted assay development for prenatal

health, carrier screening, and newborn screening programs in China

and other markets. Additionally, Berry plans to obtain NMPA

approval for its thalassemia carrier screening assay on existing

PacBio technology.

- Breakthrough in Cost and

Efficiency with SPRQ Chemistry: Commenced shipment of SPRQ

chemistry, enabling sub-$500 HiFi long-read human genome sequencing

while reducing DNA input requirements by 75%, driving increased

sample throughput and helped drive Revio instrument placements at

new customers in the fourth quarter.

- Strengthened Financial

Position: Executed the convertible note exchange, reducing

the outstanding principal balance of the convertible notes by $259

million by replacing $459 million in 1.5% convertible notes due

2028 with $200 million in new 1.5% convertible notes due August

2029, 20.5 million shares of common stock and $50 million in

cash.

- Scientific Leadership in

Genetic Disease Research:

- Radboud University Medical Center

Study: Used Revio to identify 93% of pathogenic variants in samples

that had been difficult to detect and required multiple testing

modalities.

- University of Washington & UDN

Research: Demonstrated PacBio’s ability to simultaneously analyze

the genome, methylome, epigenome, and transcriptome, providing

novel insights into a rare and complex Mendelian condition.

- Leadership

Appointments:

- Appointed David Ruggiero as Head of Global Sales and Service,

bringing deep experience in sales leadership across technology and

life sciences, including Zoom Video Communications, Microsoft

Corporation, and Thermo Fisher Scientific.

- Added Chris Smith, Chief Executive

Officer of NeoGenomics, Inc., to the Board of Directors, leveraging

his expertise in genomics, diagnostics, and corporate strategy to

support PacBio’s growth initiatives.

"2024 was a challenging yet transformative year for PacBio,

marked by the successful launch of new products, disciplined cost

management, and strategic progress in our clinical strategy.

Despite macroeconomic pressures, we have continued to innovate and

expand accessibility to HiFi sequencing,” said Christian Henry,

President and CEO of PacBio. "Looking ahead to 2025, while the

macro environment remains uncertain, I believe PacBio can return to

growth and expand market share as the Vega benchtop platform and

SPRQ chemistry enable more researchers, clinical labs, and smaller

institutions to harness the power of HiFi sequencing."

Quarterly Conference Call Information

Management will host a quarterly conference call to discuss its

fourth quarter ended December 31, 2024 results today at 4:30

p.m. Eastern Time. Investors may listen to the call by dialing

1-888-349-0136 if outside the U.S., by dialing 1-412-317-0459,

requesting to join the “PacBio Q4 Earnings Call". The call will be

webcast live and available for replay at PacBio's website at

https://investor.pacificbiosciences.com.

About PacBio

PacBio (NASDAQ: PACB) is a premier life science technology

company that designs, develops, and manufactures advanced

sequencing solutions to help scientists and clinical researchers

resolve genetically complex problems. Our products and technologies

stem from two highly differentiated core technologies focused on

accuracy, quality and completeness which include our HiFi long-read

sequencing and our SBB® short-read sequencing technologies. Our

products address solutions across a broad set of research

applications including human germline sequencing, plant and animal

sciences, infectious disease and microbiology, oncology, and other

emerging applications. For more information, please visit

www.pacb.com and follow @PacBio.

PacBio products are provided for Research Use Only. Not for use

in diagnostic procedures.

Statement regarding use of non‐GAAP financial

measures

PacBio reports non‐GAAP results for basic net income and loss

per share, net income, net loss, gross margins, gross profit and

operating expenses in addition to, and not as a substitute for, or

because it believes that such information is superior to, financial

measures calculated in accordance with GAAP. PacBio believes that

non-GAAP financial information, when taken collectively, may be

helpful to investors because it provides consistency and

comparability with past financial performance. However, non-GAAP

financial information is presented for supplemental informational

purposes only, has limitations as an analytical tool and should not

be considered in isolation or as a substitute for financial

information presented in accordance with GAAP. In addition, other

companies may calculate similarly titled non-GAAP measures

differently or may use other measures to evaluate their

performance, all of which could reduce the usefulness of PacBio’s

non-GAAP financial measures as tools for comparison.

PacBio's financial measures under GAAP include substantial

charges that are listed in the itemized reconciliations between

GAAP and non‐GAAP financial measures included in this press

release, such as impairment charges, merger-related expenses,

changes in fair value of contingent consideration, loss on

extinguishment of debt, gain on debt restructuring, amortization of

acquired intangible assets, income tax benefits, restructuring

costs and other adjustments and rounding differences. The

amortization of acquired intangible assets excluded from GAAP

financial measures relates to acquired intangible assets. The

amortization related to these intangible assets will occur in

future periods until they are fully amortized. Management has

excluded the effects of these items in non‐GAAP measures to assist

investors in analyzing and assessing past and future operating

performance. In addition, management uses non-GAAP measures to

compare PacBio’s performance relative to forecasts and strategic

plans and to benchmark its performance externally against

competitors.

PacBio encourages investors to carefully consider its results

under GAAP, as well as its supplemental non‐GAAP information and

the reconciliation between these presentations, to more fully

understand its business. A reconciliation of PacBio’s non-GAAP

financial measures to their most directly comparable financial

measure stated in accordance with GAAP has been provided in the

financial statement tables included in this press release.

Statement regarding preliminary financial

results

This press release contains preliminary financial results which

are unaudited and based on current expectations and may be adjusted

as a result of, among other things, completion of annual audit

procedures.

Forward-Looking Statements

This press release contains “forward-looking statements” within

the meaning of Section 21E of the Securities Exchange Act of 1934,

as amended, and the U.S. Private Securities Litigation Reform Act

of 1995. All statements other than statements of historical fact

are forward-looking statements, including statements relating to

the availability, uses, accuracy, coverage, advantages, quality or

performance of, or benefits or expected benefits of using, PacBio

products or technologies; expectations with respect to

commercialization, development and shipment of PacBio products;

PacBio’s financial guidance and expectations for future periods;

the amounts of the preliminary estimated non-cash impairment

charges; and developments affecting our industry and the markets in

which we compete, including the impact of new products and

technologies. Reported results and orders for any instrument system

should not be considered an indication of future performance. You

should not place undue reliance on forward-looking statements

because they are subject to assumptions, risks, and uncertainties

and could cause actual outcomes and results to differ materially

from currently anticipated results, including, challenges inherent

in developing, manufacturing, launching, marketing and selling new

products, and achieving anticipated new sales; potential

cancellation of existing instrument orders; assumptions, risks and

uncertainties related to the ability to attract new customers and

retain and grow sales from existing customers; risks related to

PacBio's ability to successfully execute and realize the benefits

of acquisitions; the impact of U.S. export restrictions on the

shipment of PacBio products to certain countries; rapidly changing

technologies and extensive competition in genomic sequencing;

unanticipated increases in costs or expenses; interruptions or

delays in the supply of components or materials for, or

manufacturing of, PacBio products and products under development;

potential product performance and quality issues and potential

delays in development timelines; the possible loss of key

employees, customers, or suppliers; customers and prospective

customers curtailing or suspending activities using PacBio's

products; third-party claims alleging infringement of patents and

proprietary rights or seeking to invalidate PacBio's patents or

proprietary rights; risks associated with international operations;

other risks associated with general macroeconomic conditions and

geopolitical instability; additional sustained declines in PacBio’s

stock price and further changes in the timing of expected future

cash flows; and adjustments arising in connection with the

preparation and audit of PacBio’s financial statements as of and

for the year ended December 31, 2024 resulting in changes to the

amounts of the preliminary estimated non-cash impairment charges

and other preliminary financial results presented in this press

release. Additional factors that could materially affect actual

results can be found in PacBio's most recent filings with the

Securities and Exchange Commission, including PacBio's most recent

reports on Forms 8-K, 10-K, and 10-Q, and include those listed

under the caption “Risk Factors.” These forward-looking statements

are based on current expectations and speak only as of the date

hereof; except as required by law, PacBio disclaims any obligation

to revise or update these forward-looking statements to reflect

events or circumstances in the future, even if new information

becomes available.

The unaudited condensed consolidated financial statements that

follow should be read in conjunction with the notes set forth in

PacBio's Annual Report on Form 10-K when filed with the Securities

and Exchange Commission.

Contacts

Investors:

Todd Friedmanir@pacb.com

Media:pr@pacb.com

|

Pacific Biosciences of California,

Inc.Unaudited Condensed Consolidated Statements of

Operations |

|

|

|

|

|

Three Months Ended |

| (in thousands, except per

share amounts) |

December 31, 2024 |

|

September 30, 2024 |

|

December 31, 2023 |

| Revenue: |

|

|

|

|

|

|

Product revenue |

$ |

34,098 |

|

|

$ |

35,296 |

|

|

$ |

54,001 |

|

|

Service and other revenue |

|

5,126 |

|

|

|

4,671 |

|

|

|

4,356 |

|

|

Total revenue |

|

39,224 |

|

|

|

39,967 |

|

|

|

58,357 |

|

| Cost of Revenue: |

|

|

|

|

|

|

Cost of product revenue (1) |

|

23,476 |

|

|

|

23,278 |

|

|

|

40,421 |

|

|

Cost of service and other revenue |

|

3,469 |

|

|

|

3,484 |

|

|

|

3,496 |

|

|

Amortization of acquired intangible assets |

|

2,221 |

|

|

|

3,201 |

|

|

|

1,433 |

|

|

Loss on purchase commitment |

|

— |

|

|

|

— |

|

|

|

3,436 |

|

|

Total cost of revenue |

|

29,166 |

|

|

|

29,963 |

|

|

|

48,786 |

|

|

Gross profit |

|

10,058 |

|

|

|

10,004 |

|

|

|

9,571 |

|

| Operating Expense: |

|

|

|

|

|

|

Research and development |

|

27,466 |

|

|

|

25,516 |

|

|

|

44,544 |

|

|

Sales, general and administrative (2) |

|

41,641 |

|

|

|

43,746 |

|

|

|

45,996 |

|

|

Impairment charges (3) |

|

90,100 |

|

|

|

— |

|

|

|

— |

|

|

Merger-related expenses (4) |

|

— |

|

|

|

— |

|

|

|

63 |

|

|

Change in fair value of contingent consideration (5) |

|

(1,950 |

) |

|

|

1,170 |

|

|

|

1,100 |

|

|

Amortization of acquired intangible assets |

|

4,629 |

|

|

|

3,649 |

|

|

|

5,416 |

|

|

Total operating expense |

|

161,886 |

|

|

|

74,081 |

|

|

|

97,119 |

|

| Operating loss |

|

(151,828 |

) |

|

|

(64,077 |

) |

|

|

(87,548 |

) |

|

Gain on debt restructuring (6) |

|

154,407 |

|

|

|

— |

|

|

|

— |

|

|

Interest expense |

|

(2,757 |

) |

|

|

(3,538 |

) |

|

|

(3,571 |

) |

|

Other income, net |

|

4,065 |

|

|

|

6,890 |

|

|

|

8,383 |

|

| Income (loss) before income

taxes |

|

3,887 |

|

|

|

(60,725 |

) |

|

|

(82,736 |

) |

| Income tax provision (benefit)

(7) |

|

316 |

|

|

|

— |

|

|

|

(718 |

) |

| Net income (loss) |

|

3,571 |

|

|

|

(60,725 |

) |

|

|

(82,018 |

) |

| |

|

|

|

|

|

|

Net income (loss) per share: |

|

|

|

|

|

|

Basic |

$ |

0.01 |

|

|

$ |

(0.22 |

) |

|

$ |

(0.31 |

) |

|

Diluted |

$ |

(0.49 |

) |

|

$ |

(0.22 |

) |

|

$ |

(0.31 |

) |

| |

|

|

|

|

|

| Weighted average shares

outstanding used in calculating net income (loss) per share |

|

|

|

|

|

|

Basic |

|

282,999 |

|

|

|

272,915 |

|

|

|

267,121 |

|

|

Diluted |

|

306,892 |

|

|

|

272,915 |

|

|

|

267,121 |

|

|

(1) |

Balance for the three months ended September 30, 2024 includes

restructuring costs. Refer to the Reconciliation of Non-GAAP

Financial Measures table below for additional information on such

costs and related amounts. |

| (2) |

Balances for the three months

ended December 31, 2024 and September 30, 2024 include

restructuring costs. Refer to the Reconciliation of Non-GAAP

Financial Measures table below for additional information on such

costs and related amounts. |

| (3) |

Preliminary estimated goodwill

and in-process research and development impairment charges during

the three months ended December 31, 2024 driven primarily by

macroeconomic factors which have impacted our cash flow

projections, among other factors. |

| (4) |

Merger-related expenses for the

three months ended December 31, 2023 consisted of transaction costs

arising from the acquisition of Apton. |

| (5) |

Change in fair value of

contingent consideration during the three months ended

December 31, 2024, September 30, 2024, and December 31,

2023 was due to fair value adjustments of milestone payments

payable upon the achievement of the respective milestone

event. |

| (6) |

Gain on debt restructuring during

the three months ended December 31, 2024, represents the gain

resulting from the November 2024 convertible notes exchange

transaction. |

| (7) |

Deferred income tax benefits

during the three months ended December 31, 2023 are related to

the release of the valuation allowance for deferred tax assets due

to the recognition of deferred tax liabilities in connection with

the Apton acquisition. |

| |

|

|

Pacific Biosciences of California,

Inc.Unaudited Condensed Consolidated Statements of

Operations |

| |

|

|

|

|

|

Three Months Ended December 31, |

|

Twelve Months Ended December 31, |

|

(in thousands, except per share amounts) |

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Revenue: |

|

|

|

|

|

|

|

|

Product revenue |

$ |

34,098 |

|

|

$ |

54,001 |

|

|

$ |

136,149 |

|

|

$ |

183,872 |

|

|

Service and other revenue |

|

5,126 |

|

|

|

4,356 |

|

|

|

17,865 |

|

|

|

16,649 |

|

|

Total revenue |

|

39,224 |

|

|

|

58,357 |

|

|

|

154,014 |

|

|

|

200,521 |

|

| Cost of Revenue: |

|

|

|

|

|

|

|

|

Cost of product revenue(1) |

|

23,476 |

|

|

|

40,421 |

|

|

|

92,284 |

|

|

|

127,568 |

|

|

Cost of service and other revenue(1) |

|

3,469 |

|

|

|

3,496 |

|

|

|

14,057 |

|

|

|

14,754 |

|

|

Amortization of acquired intangible assets |

|

2,221 |

|

|

|

1,433 |

|

|

|

9,393 |

|

|

|

1,983 |

|

|

Loss on purchase commitment |

|

— |

|

|

|

3,436 |

|

|

|

998 |

|

|

|

3,436 |

|

|

Total cost of revenue |

|

29,166 |

|

|

|

48,786 |

|

|

|

116,732 |

|

|

|

147,741 |

|

|

Gross profit |

|

10,058 |

|

|

|

9,571 |

|

|

|

37,282 |

|

|

|

52,780 |

|

| Operating Expense: |

|

|

|

|

|

|

|

|

Research and development(1) |

|

27,466 |

|

|

|

44,544 |

|

|

|

134,922 |

|

|

|

187,170 |

|

|

Sales, general and administrative(2) |

|

41,641 |

|

|

|

45,996 |

|

|

|

175,017 |

|

|

|

169,818 |

|

|

Impairment charges(3) |

|

90,100 |

|

|

|

— |

|

|

|

183,300 |

|

|

|

— |

|

|

Merger-related expenses(4) |

|

— |

|

|

|

63 |

|

|

|

— |

|

|

|

9,042 |

|

|

Change in fair value of contingent consideration(5) |

|

(1,950 |

) |

|

|

1,100 |

|

|

|

(850 |

) |

|

|

15,060 |

|

|

Amortization of acquired intangible assets |

|

4,629 |

|

|

|

5,416 |

|

|

|

18,006 |

|

|

|

6,157 |

|

|

Total operating expense |

|

161,886 |

|

|

|

97,119 |

|

|

|

510,395 |

|

|

|

387,247 |

|

| Operating loss |

|

(151,828 |

) |

|

|

(87,548 |

) |

|

|

(473,113 |

) |

|

|

(334,467 |

) |

|

Loss on extinguishment of debt(6) |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(2,033 |

) |

|

Gain on debt restructuring(7) |

|

154,407 |

|

|

|

— |

|

|

|

154,407 |

|

|

|

— |

|

|

Interest expense |

|

(2,757 |

) |

|

|

(3,571 |

) |

|

|

(13,412 |

) |

|

|

(14,343 |

) |

|

Other income, net |

|

4,065 |

|

|

|

8,383 |

|

|

|

23,783 |

|

|

|

32,684 |

|

| Income (loss) before income

taxes |

|

3,887 |

|

|

|

(82,736 |

) |

|

|

(308,335 |

) |

|

|

(318,159 |

) |

| Income tax provision

(benefit)(8) |

|

316 |

|

|

|

(718 |

) |

|

|

316 |

|

|

|

(11,424 |

) |

| Net income (loss) |

|

3,571 |

|

|

|

(82,018 |

) |

|

|

(308,651 |

) |

|

|

(306,735 |

) |

| |

|

|

|

|

|

|

|

|

Net income (loss) per share: |

|

|

|

|

|

|

|

|

Basic |

$ |

0.01 |

|

|

$ |

(0.31 |

) |

|

$ |

(1.12 |

) |

|

$ |

(1.21 |

) |

|

Diluted |

$ |

(0.49 |

) |

|

$ |

(0.31 |

) |

|

$ |

(1.58 |

) |

|

$ |

(1.21 |

) |

| |

|

|

|

|

|

|

|

| Weighted average shares

outstanding used in calculating net income (loss) per share |

|

|

|

|

|

|

|

|

Basic |

|

282,999 |

|

|

|

267,121 |

|

|

|

274,488 |

|

|

|

253,629 |

|

|

Diluted |

|

306,892 |

|

|

|

267,121 |

|

|

|

288,366 |

|

|

|

253,629 |

|

|

(1) |

Balance for the twelve months ended December 31, 2024 includes

restructuring costs. Refer to the Reconciliation of Non-GAAP

Financial Measures table below for additional information on such

costs and related amounts. |

| (2) |

Balances for the three and twelve

months ended December 31, 2024 include restructuring costs. Refer

to the Reconciliation of Non-GAAP Financial Measures table below

for additional information on such costs and related amounts. |

| (3) |

Preliminary estimated goodwill

and in-process research and development impairment charges during

the three and twelve months ended December 31, 2024 of $90.1

million was driven primarily by macroeconomic factors which have

impacted our cash flow projections, among other factors. Goodwill

impairment of $93.2 million included in the twelve months ended

December 31, 2024 was related to a sustained decrease in the

Company's share price, among other factors. |

| (4) |

Merger-related expenses for the

three months ended December 31, 2023 consisted of transaction costs

arising from the acquisition of Apton. Merger-related expenses for

the twelve months ended December 31, 2023 consisted of $4.9 million

of transaction costs arising from the acquisition of Apton, $2.8

million of compensation expense resulting from the liquidity event

bonus plan in connection with the Apton merger, and $1.3 million of

compensation expense resulting from the acceleration of certain

equity awards in connection with the Apton merger. |

| (5) |

Change in fair value of

contingent consideration during the three and twelve months ended

December 31, 2024 and December 31, 2023 was due to fair

value adjustments of milestone payments payable upon the

achievement of the respective milestone event. |

| (6) |

Loss on extinguishment of debt

during the twelve months ended December 31, 2023 is related to the

exchange of a portion of PacBio's 1.50% Convertible Senior Notes

due 2028 for PacBio's 1.375% Convertible Senior Notes due

2030. |

| (7) |

Gain on debt restructuring during

the three and twelve months ended December 31, 2024,

represents the gain resulting from the November 2024 convertible

notes exchange transaction. |

| (8) |

Deferred income tax benefits

during the three and twelve months ended December 31, 2023 are

related to the release of the valuation allowance for deferred tax

assets due to the recognition of deferred tax liabilities in

connection with the Apton acquisition. |

| |

|

|

Pacific Biosciences of California,

Inc.Unaudited Condensed Consolidated Balance

Sheets |

| |

|

|

|

|

|

(in thousands) |

|

December 31,2024 |

|

December 31,2023 |

|

Assets |

|

|

|

|

|

Cash and investments |

|

$ |

389,931 |

|

$ |

631,416 |

|

Accounts receivable, net |

|

|

27,524 |

|

|

36,615 |

|

Inventory, net |

|

|

58,755 |

|

|

56,676 |

|

Prepaid and other current assets |

|

|

18,781 |

|

|

17,040 |

|

Property and equipment, net |

|

|

30,505 |

|

|

36,432 |

|

Operating lease right-of-use assets, net |

|

|

16,091 |

|

|

32,593 |

|

Restricted cash |

|

|

2,222 |

|

|

2,722 |

|

Intangible assets, net (1) |

|

|

394,572 |

|

|

456,984 |

|

Goodwill (2) |

|

|

313,961 |

|

|

462,261 |

|

Other long-term assets |

|

|

9,305 |

|

|

13,274 |

|

Total Assets |

|

$ |

1,261,647 |

|

$ |

1,746,013 |

| |

|

|

|

|

|

Liabilities and Stockholders' Equity |

|

|

|

|

|

Accounts payable |

|

$ |

16,590 |

|

$ |

15,062 |

|

Accrued expenses |

|

|

22,595 |

|

|

45,708 |

|

Deferred revenue |

|

|

19,764 |

|

|

21,872 |

|

Operating lease liabilities |

|

|

24,940 |

|

|

41,197 |

|

Contingent consideration liability |

|

|

18,700 |

|

|

19,550 |

|

Convertible senior notes, net |

|

|

647,494 |

|

|

892,243 |

|

Other liabilities |

|

|

3,770 |

|

|

9,077 |

|

Stockholders' equity |

|

|

507,794 |

|

|

701,304 |

|

Total Liabilities and Stockholders' Equity |

|

$ |

1,261,647 |

|

$ |

1,746,013 |

|

(1) |

Balance as of December 31, 2024 reflects preliminary estimated

in-process research and development impairment charge of $35.0

million These preliminary estimates are subject to finalization as

the Company completes its interim assessment and year-end financial

reporting procedures. The final Intangible assets, net, balance

reported in the Annual Report on Form 10-K may differ materially

from these estimates. |

| (2) |

Balance as of December 31,

2024 reflects preliminary estimated goodwill impairment charge of

$55.1 million These preliminary estimates are subject to

finalization as the Company completes its interim assessment and

year-end financial reporting procedures. The final Goodwill balance

reported in the Annual Report on Form 10-K may differ materially

from these estimates. |

| |

|

|

Pacific Biosciences of California,

Inc.Reconciliation of Non-GAAP Financial

Measures |

| |

|

|

|

|

|

|

|

Three Months Ended |

|

Twelve Months Ended |

| (in thousands, except per

share amounts) |

|

December 31,2024 |

|

September 30,2024 |

|

December 31,2023 |

|

December 31,2024 |

|

December 31,2023 |

|

GAAP net income (loss) |

|

$ |

3,571 |

|

|

$ |

(60,725 |

) |

|

$ |

(82,018 |

) |

|

$ |

(308,651 |

) |

|

$ |

(306,735 |

) |

|

Impairment charges (1) |

|

|

90,100 |

|

|

|

— |

|

|

|

— |

|

|

|

183,300 |

|

|

|

— |

|

|

Merger-related expenses (2) |

|

|

— |

|

|

|

— |

|

|

|

63 |

|

|

|

— |

|

|

|

9,042 |

|

|

Change in fair value of contingent consideration (3) |

|

|

(1,950 |

) |

|

|

1,170 |

|

|

|

1,100 |

|

|

|

(850 |

) |

|

|

15,060 |

|

|

Loss on extinguishment of debt (4) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

2,033 |

|

|

Gain on debt restructuring (5) |

|

|

(154,407 |

) |

|

|

— |

|

|

|

— |

|

|

|

(154,407 |

) |

|

|

— |

|

|

Amortization of acquired intangible assets |

|

|

6,850 |

|

|

|

6,850 |

|

|

|

6,849 |

|

|

|

27,399 |

|

|

|

8,244 |

|

|

Income tax benefit (6) |

|

|

— |

|

|

|

— |

|

|

|

(718 |

) |

|

|

— |

|

|

|

(11,424 |

) |

|

Restructuring (7) |

|

|

493 |

|

|

|

6,701 |

|

|

|

2,224 |

|

|

|

25,222 |

|

|

|

2,224 |

|

| Non-GAAP net loss |

|

$ |

(55,343 |

) |

|

$ |

(46,004 |

) |

|

$ |

(72,500 |

) |

|

$ |

(227,987 |

) |

|

$ |

(281,556 |

) |

| |

|

|

|

|

|

|

|

|

|

|

| GAAP basic net income (loss)

per share |

|

$ |

0.01 |

|

|

$ |

(0.22 |

) |

|

$ |

(0.31 |

) |

|

$ |

(1.12 |

) |

|

$ |

(1.21 |

) |

|

Impairment charges (1) |

|

|

0.32 |

|

|

|

— |

|

|

|

— |

|

|

|

0.67 |

|

|

|

— |

|

|

Merger-related expenses (2) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

0.04 |

|

|

Change in fair value of contingent consideration (3) |

|

|

(0.01 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

0.06 |

|

|

Loss on extinguishment of debt (4) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

0.01 |

|

|

Gain on debt restructuring (5) |

|

|

(0.55 |

) |

|

|

— |

|

|

|

— |

|

|

|

(0.56 |

) |

|

|

— |

|

|

Amortization of acquired intangible assets |

|

|

0.02 |

|

|

|

0.03 |

|

|

|

0.03 |

|

|

|

0.10 |

|

|

|

0.03 |

|

|

Income tax benefit (6) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(0.05 |

) |

|

Restructuring (7) |

|

|

— |

|

|

|

0.02 |

|

|

|

0.01 |

|

|

|

0.09 |

|

|

|

0.01 |

|

|

Other adjustments and rounding differences |

|

|

0.01 |

|

|

|

— |

|

|

|

— |

|

|

|

(0.01 |

) |

|

|

— |

|

| Non-GAAP basic net loss per

share |

|

$ |

(0.20 |

) |

|

$ |

(0.17 |

) |

|

$ |

(0.27 |

) |

|

$ |

(0.83 |

) |

|

$ |

(1.11 |

) |

| |

|

|

|

|

|

|

|

|

|

|

| GAAP gross profit |

|

$ |

10,058 |

|

|

$ |

10,004 |

|

|

$ |

9,571 |

|

|

$ |

37,282 |

|

|

$ |

52,780 |

|

|

Amortization of acquired intangible assets |

|

|

2,221 |

|

|

|

3,201 |

|

|

|

1,433 |

|

|

|

9,393 |

|

|

|

1,983 |

|

|

Restructuring (7) |

|

|

— |

|

|

|

(207 |

) |

|

|

112 |

|

|

|

4,443 |

|

|

|

112 |

|

| Non-GAAP gross profit |

|

$ |

12,279 |

|

|

$ |

12,998 |

|

|

$ |

11,116 |

|

|

$ |

51,118 |

|

|

$ |

54,875 |

|

| |

|

|

|

|

|

|

|

|

|

|

| GAAP gross profit % |

|

|

26 |

% |

|

|

25 |

% |

|

|

16 |

% |

|

|

24 |

% |

|

|

26 |

% |

| |

|

|

|

|

|

|

|

|

|

|

| Non-GAAP gross profit % |

|

|

31 |

% |

|

|

33 |

% |

|

|

19 |

% |

|

|

33 |

% |

|

|

27 |

% |

| |

|

|

|

|

|

|

|

|

|

|

| GAAP total operating

expense |

|

$ |

161,886 |

|

|

$ |

74,081 |

|

|

$ |

97,119 |

|

|

$ |

510,395 |

|

|

$ |

387,247 |

|

|

Impairment charges (1) |

|

|

(90,100 |

) |

|

|

— |

|

|

|

— |

|

|

|

(183,300 |

) |

|

|

— |

|

|

Merger-related expenses (2) |

|

|

— |

|

|

|

— |

|

|

|

(63 |

) |

|

|

— |

|

|

|

(9,042 |

) |

|

Change in fair value of contingent consideration (3) |

|

|

1,950 |

|

|

|

(1,170 |

) |

|

|

(1,100 |

) |

|

|

850 |

|

|

|

(15,060 |

) |

|

Amortization of acquired intangible assets |

|

|

(4,629 |

) |

|

|

(3,649 |

) |

|

|

(5,416 |

) |

|

|

(18,006 |

) |

|

|

(6,261 |

) |

|

Restructuring (7) |

|

|

(493 |

) |

|

|

(6,908 |

) |

|

|

(2,112 |

) |

|

|

(20,779 |

) |

|

|

(2,112 |

) |

| Non-GAAP total operating

expense |

|

$ |

68,614 |

|

|

$ |

62,354 |

|

|

$ |

88,428 |

|

|

$ |

289,160 |

|

|

$ |

354,772 |

|

|

(1) |

Preliminary estimated goodwill and in-process research and

development impairment charges during the three and twelve months

ended December 31, 2024 of $90.1 million was driven primarily

by macroeconomic factors which have impacted our cash flow

projections, among other factors. Goodwill impairment of $93.2

million included in the twelve months ended December 31, 2024

was related to a sustained decrease in the Company's share price,

among other factors. |

| (2) |

Merger-related expenses for the

three months ended December 31, 2023 consisted of transaction costs

arising from the acquisition of Apton. Merger-related expenses for

the twelve months ended December 31, 2023 consisted of $4.9 million

of transaction costs arising from the acquisition of Apton, $2.8

million of compensation expense resulting from the liquidity event

bonus plan in connection with the Apton merger, and $1.3 million of

compensation expense resulting from the acceleration of certain

equity awards in connection with the Apton merger. |

| (3) |

Change in fair value of

contingent consideration was due to fair value adjustments of

milestone payments payable upon the achievement of the respective

milestone event. |

| (4) |

Loss on extinguishment of debt is

related to the exchange of a portion of PacBio's 1.50% Convertible

Senior Notes due 2028 for PacBio's 1.375% Convertible Senior Notes

due 2030. |

| (5) |

Gain on debt restructuring during

the three and twelve months ended December 31, 2024,

represents the gain resulting from the November 2024 convertible

notes exchange transaction. |

| (6) |

Deferred income tax benefits

during the three and twelve months ended December 31, 2023 are

related to the release of the valuation allowance for deferred tax

assets due to the recognition of deferred tax liabilities in

connection with the Apton acquisition. |

| (7) |

Restructuring costs consist

primarily of employee separation costs, accelerated amortization

and depreciation for right-of-use assets, leasehold improvements,

and furniture and fixtures relating to the abandonment of the San

Diego office, including charges for excess inventory due to a

decrease in internal demand relating to the expense reduction

initiatives. |

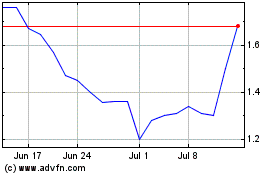

Pacific Biosciences of C... (NASDAQ:PACB)

Historical Stock Chart

From Jan 2025 to Feb 2025

Pacific Biosciences of C... (NASDAQ:PACB)

Historical Stock Chart

From Feb 2024 to Feb 2025