false000175028400017502842024-08-062024-08-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): August 06, 2024 |

Olema Pharmaceuticals, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-39712 |

30-0409740 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

780 Brannan Street |

|

San Francisco, California |

|

94103 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 415 651-3316 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, par value $0.0001 per share |

|

OLMA |

|

The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On August 6, 2024, Olema Pharmaceuticals, Inc. (the “Company”) reported its financial results for the quarter ended June 30, 2024. A copy of the press release is furnished pursuant to Item 2.02 as Exhibit 99.1 hereto and is incorporated herein by reference.

The information in Item 2.02, including the press release attached as Exhibit 99.1 hereto, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section 11 and 12(a)(2) of the Securities Act of 1933, as amended, nor shall it be incorporated by reference into any filing with the U.S. Securities and Exchange Commission made by the Company, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

OLEMA PHARMACEUTICALS, INC. |

|

|

|

|

Date: |

August 6, 2024 |

By: |

/s/ Shane Kovacs |

|

|

|

Shane Kovacs

Chief Operating and Financial Officer |

Olema Oncology Reports Second Quarter 2024 Financial Results and Provides Corporate Update

•Presented promising interim clinical results from the ongoing study of palazestrant in combination with ribociclib at the 2024 ESMO Breast Cancer Congress. Updated results expected to be presented at a future medical meeting

•Successfully completed Investigational New Drug (IND)-enabling studies for OP-3136, Olema’s novel KAT6 inhibitor, with IND application expected to be filed with FDA in late 2024. Additional pre-clinical data for OP-3136 to be presented in the fourth quarter

•Cash, cash equivalents and marketable securities of $239.1 million as of June 30, 2024

SAN FRANCISCO, August 6, 2024 – Olema Pharmaceuticals, Inc. (“Olema”, “Olema Oncology”, Nasdaq: OLMA), a clinical-stage biopharmaceutical company focused on the discovery, development and commercialization of targeted therapies for women’s cancers, today reported financial results for the second quarter ended June 30, 2024, and provided a corporate update.

“The clinical data we presented at the ESMO Breast Cancer Annual Congress in May demonstrated that the palazestrant-ribociclib combination was well tolerated with no new safety signals or enhancement of toxicity. The preliminary efficacy data is highly encouraging and we look forward to updating with more mature efficacy,” said Sean P. Bohen, M.D., Ph.D., President and Chief Executive Officer of Olema Oncology. “The OPERA-01 Phase 3 clinical trial for palazestrant as a monotherapy in second/third-line metastatic breast cancer is ongoing, and later this year we are looking forward to presenting new data on our KAT6 inhibitor, OP-3136, and filing an Investigational New Drug (IND) application with the FDA.”

Second Quarter 2024 Highlights

•Presented interim Phase 1b/2 clinical results of palazestrant (OP-1250) in combination with ribociclib at the ESMO Breast Cancer Annual Congress 2024 in Berlin, Germany. Results showed palazestrant in combination with ribociclib was well tolerated with no new safety signals or enhancement of toxicity and no meaningful impact on drug exposure of either therapy. In addition, a preliminary clinical benefit rate (CBR) of 85% was observed across 13 CBR-eligible patients.

•Presented trial-in-progress poster on OPERA-01, a pivotal Phase 3 monotherapy clinical trial in the second- and third-line setting of ER+/HER2- advanced or metastatic breast cancer, at the 2024 ASCO Annual Meeting in Chicago, IL.

•Successfully completed IND-enabling studies for OP-3136 in support of a potential IND filing in late 2024

Upcoming Milestones

•Initiate Phase 1b/2 clinical study of palazestrant in combination with mTOR inhibitor, everolimus, in the third quarter of 2024.

•Present pre-clinical data supporting the Investigational New Drug (IND) application for OP-3136, an orally-bioavailable KAT6 inhibitor, anticipated in the fourth quarter of 2024.

•File an Investigational New Drug (IND) application with the U.S. Food and Drug Administration (FDA) for OP-3136 in late 2024 and advance clinical development.

•Present updated Phase 2 clinical study results for palazestrant in combination with CDK4/6 inhibitor, ribociclib, anticipated at a future medical meeting.

Second Quarter 2024 Financial Results

Cash, cash equivalents and marketable securities as of June 30, 2024, were $239.1 million.

Net loss for the quarter ended June 30, 2024, was $30.4 million, as compared to $20.1 million for the quarter ended June 30, 2023. The increase in net loss for the second quarter was primarily related to increased spending on clinical development and research activities as a result of late-stage clinical trials for palazestrant and the advancement of our KAT6 inhibitor program, as well as general and administrative activities. The increase was partially offset by higher interest income earned from marketable securities.

GAAP research and development (R&D) expenses were $29.1 million for the quarter ended June 30, 2024, as compared to $18.0 million for the quarter ended June 30, 2023. The increase in R&D expenses was primarily related to increased spending on clinical development activities as we continue to advance palazestrant into late-stage clinical trials, research-related activities associated with the advancement of our KAT6 inhibitor program, and personnel related costs, including non-cash stock-based compensation expense of $1.3 million.

Non-GAAP R&D expenses were $24.9 million for the quarter ended June 30, 2024, which excluded $4.2 million non-cash stock-based compensation expense. Non-GAAP R&D expenses were $15.0 million for the quarter ended June 30, 2023, excluding $3.0 million non-cash stock-based compensation expense. A reconciliation of GAAP to non-GAAP financial measures used in this press release can be found at the end of this press release.

GAAP G&A expenses were $4.4 million for the quarter ended June 30, 2024, as compared to $3.6 million for the quarter ended June 30, 2023. The increase in G&A expenses was primarily due to increased spending on corporate-related costs, and an increase in non-cash stock-based compensation expense of $0.3 million.

Non-GAAP G&A expenses were $2.9 million for the quarter ended June 30, 2024, excluding $1.5 million non-cash stock-based compensation expense. Non-GAAP G&A expenses were $2.4 million for the quarter ended June 30, 2023, excluding $1.2 million non-cash stock-based compensation expense. A reconciliation of GAAP to non-GAAP financial measures used in this press release can be found at the end of this press release.

About Palazestrant (OP-1250)

Palazestrant (OP-1250) is a novel, orally-available small molecule with dual activity as both a complete estrogen receptor (ER) antagonist (CERAN) and selective ER degrader (SERD). It is currently being investigated in patients with recurrent, locally advanced or metastatic

ER-positive (ER+), human epidermal growth factor receptor 2-negative (HER2-) breast cancer. In clinical studies, palazestrant completely blocks ER-driven transcriptional activity in both wild-type and mutant forms of metastatic ER+ breast cancer and has demonstrated anti-tumor efficacy along with attractive pharmacokinetics and exposure, favorable tolerability, CNS penetration, and combinability with CDK4/6 inhibitors. Palazestrant has been granted U.S. Food and Drug Administration (FDA) Fast Track designation for the treatment of ER+/HER2- metastatic breast cancer that has progressed following one or more lines of endocrine therapy with at least one line given in combination with a CDK4/6 inhibitor. It is being evaluated both as a single agent in an ongoing Phase 3 clinical trial, OPERA-01, and in Phase 1/2 combination studies with CDK4/6 inhibitors (palbociclib and ribociclib), a PI3Ka inhibitor (alpelisib), and an mTOR inhibitor (everolimus). For more information on OPERA-01, please visit www.opera01study.com.

About Olema Oncology

Olema Oncology is a clinical-stage biopharmaceutical company committed to transforming the standard of care and improving outcomes for women living with cancer. Olema is advancing a pipeline of novel therapies by leveraging our deep understanding of endocrine-driven cancers, nuclear receptors, and mechanisms of acquired resistance. In addition to our lead product candidate, palazestrant (OP-1250), a proprietary, orally-available complete estrogen receptor (ER) antagonist (CERAN) and a selective ER degrader (SERD), Olema is developing a potent KAT6 inhibitor (OP-3136). Olema is headquartered in San Francisco and has operations in Cambridge, Massachusetts. For more information, please visit us at www.olema.com.

Non-GAAP Financial Information

The results presented in this press release include both GAAP information and non-GAAP information. As used in this release, non-GAAP R&D expense is defined by Olema as GAAP R&D expense excluding stock-based compensation expense, and non-GAAP G&A expense is defined by Olema as GAAP G&A expense excluding stock-based compensation expense. We use these non-GAAP financial measures to evaluate our ongoing operations and for internal planning and forecasting purposes. We believe that non-GAAP financial information, when taken collectively, may be helpful to investors because it provides consistency and comparability with past financial performance. However, non-GAAP financial information is presented for supplemental informational purposes only, has limitations as an analytical tool, and should not be considered in isolation or as a substitute for financial information presented in accordance with GAAP. Other companies, including companies in our industry, may calculate similarly titled non-GAAP measures differently or may use other measures to evaluate their performance, all of which could reduce the usefulness of our non-GAAP financial measures as tools for comparison. Investors are encouraged to review the related GAAP financial measures and the reconciliation of these non-GAAP financial measures to their most directly comparable GAAP financial measures and not rely on any single financial measure to evaluate our business.

Forward Looking Statements

Statements contained in this press release regarding matters that are not historical facts are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Words such as “anticipate,” “believe,” “could,” “expect,” “goal,” “may,” “potential,” “upcoming,” “will” and similar expressions (as well as other words or expressions referencing future events, conditions or circumstances) are intended to identify forward-looking statements. These statements include those related to the timelines for initiation and enrollment for potential clinical studies and for results of clinical trials of palazestrant (OP-1250) as a monotherapy and in combination trials, Olema’s financial condition and resources, results of operations, cash position, potential beneficial characteristics, including but not limited to safety, tolerability, activity, efficacy and therapeutic effects of palazestrant, the potential of palazestrant to advance the standard of care for women living with cancer, palazestrant’s combinability with other drugs, the initiation of a phase 1b/2 clinical study of palazestrant in combination with everolimus and timing thereof, and the sufficiency and timing of Olema’s preclinical program, including the potential beneficial characteristics of its KAT6 inhibitor compounds and the timing of a potential IND application and advancement into clinical development for OP-3136. Because such statements deal with future events and are based on Olema’s current expectations, they are subject to various risks and uncertainties, and actual results, performance or achievements of Olema could differ materially from those described in or implied by the statements in this press release. These forward-looking statements are subject to risks and uncertainties, including, without limitation, those discussed in the section titled “Risk Factors” in Olema’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2024, and future filings and reports that Olema makes from time to time with the U.S. Securities and Exchange Commission. Except as required by law, Olema assumes no obligation to update these forward-looking statements, including in the event that actual results differ materially from those anticipated in the forward-looking statements.

# # #

IR and Media Contact:

Geoffrey Mogilner, Investor Relations and Communications

ir@olema.com

v3.24.2.u1

Document And Entity Information

|

Aug. 06, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 06, 2024

|

| Entity Registrant Name |

Olema Pharmaceuticals, Inc.

|

| Entity Central Index Key |

0001750284

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

001-39712

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

30-0409740

|

| Entity Address, Address Line One |

780 Brannan Street

|

| Entity Address, City or Town |

San Francisco

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94103

|

| City Area Code |

415

|

| Local Phone Number |

651-3316

|

| Entity Information, Former Legal or Registered Name |

N/A

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

OLMA

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

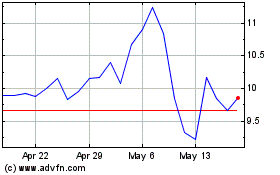

Olema Pharmaceuticals (NASDAQ:OLMA)

Historical Stock Chart

From Oct 2024 to Nov 2024

Olema Pharmaceuticals (NASDAQ:OLMA)

Historical Stock Chart

From Nov 2023 to Nov 2024