Current Report Filing (8-k)

January 13 2022 - 7:36AM

Edgar (US Regulatory)

0001314196

false

0001314196

2022-01-11

2022-01-11

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or Section 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

January 11, 2022

THE OLB GROUP, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

000-52994

|

|

13-4188568

|

(State or other jurisdiction of

incorporation or organization)

|

|

(Commission File Number)

|

|

(I.R.S. Employer

Identification

Number)

|

|

200

Park Avenue, Suite

1700, New

York, NY

|

|

10166

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including

area code: (212) 278-0900

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation to the registrant under any of the following provisions:

|

|

☐

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Securities registered pursuant to Section 12(b)

of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, $0.0001 par value

|

|

OLB

|

|

Nasdaq Capital Market

|

Item 5.02. Departure of Directors or Certain Officers; Election

of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On January 11, 2022, the Board of Directors (the “Board”)

and Compensation Committee of the Board of The OLB Group, Inc. (the “Company” or “OLB”) approved an employment

agreement with Mr. Ronny Yakov (the “Yakov Agreement”) and an employment agreement with Mr. Patrick Smith (the “Smith

Agreement”). The Yakov Agreement maintains Mr. Yakov’s role as the Company’s Chief Executive Officer through December

31, 2027 and extended for one-year terms thereafter. The Smith Agreement maintains Mr. Smith’s role as the Company’s Vice

President, Finance unless terminated or upon his resignation.

The Yakov Agreement increases Mr. Yakov’s base

salary to $750,000.00 and he will continue to be eligible for insurance coverages and benefits available to the Company’s employees

pursuant to the terms of such plans. Mr. Yakov will also receive a $490,000 bonus for acquisitions closed by the Company in 2020 and 2021

and he will be eligible to receive an acquisition bonus equal tot two percent (2%) of the gross purchase price paid in connection with

a future acquisition. Mr. Yakov shall be eligible to receive an annual bonus of Three Hundred Thousand Dollars ($300,000) based on performance

criteria established by the Board. In addition, on an annual basis, Mr. Yakov shall receive options to purchase up to 200,000 shares of

common stock of the Company at an exercise price of $0.001 per share.

The Yakov Agreement also states that, if Mr. Yakov’s

employment is terminated without cause or he voluntarily terminates his employment for good reason, he will continue to receive his base

salary for the remainder of the term along with all earned bonuses. In the event the termination is in connection with Mr. Yakov’s

death, disability or bankruptcy of the Company, he will receive the pro rata amount of his base salary through the termination date and

all bonuses earned through the termination date.

The Smith Agreement increases Mr. Yakov’s base

salary to $350,000.00 and he will continue to be eligible for insurance coverages and benefits available to the Company’s employees

pursuant to the terms of such plans. Mr. Smith shall be eligible to receive an annual bonus of One Hundred Fifty Thousand Dollars ($150,000)

based on performance criteria established by the Committee. In addition, Mr. Smith shall receive options (the “Options”) to

purchase up to 275,000 shares of common stock of the Company at an exercise price of $0.001 per share. The Options vest equally over five

years at the rate of one-fifth (1/5th) beginning on the anniversary of the Effective Date of the Agreement.

The Smith Agreement also states that, if Mr. Smith’s

employment is terminated without cause or he voluntarily terminates his employment for good reason, he will continue to receive his base

salary for the remainder of the term along with all earned bonuses. In the event the termination is in connection with Mr. Smith’s

death, disability or bankruptcy of the Company, he will receive the pro rata amount of his base salary through the termination date and

all bonuses earned through the termination date.

The foregoing description of the Yakov Agreement and

Smith Agreement is not intended to be complete and is qualified in its entirety by reference to the Employment Agreement with Mr. Yakov

and Employment Agreement with Mr. Smith attached to this Current Report as Exhibit 10.1 and 10.2 and incorporated by reference into this

Item 5.02.

There is no arrangement or understanding between Mr.

Yakov and any other person pursuant to which he was selected as Chief Executive Officer. In addition, there are no familial relationships

between Mr. Yakov and any director or executive officer of the Company, and Mr. Yakov has no direct or indirect material interest in any

transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K.

There is no arrangement or understanding between Mr.

Smith and any other person pursuant to which he was selected as Vice President, Finance. In addition, there are no familial relationships

between Mr. Smith and any director or executive officer of the Company, and Mr. Smith has no direct or indirect material interest in any

transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K.

Item

9.01 Financial Statements and Exhibits

(d) Exhibits

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

Dated: January 12, 2022

|

|

THE OLB GROUP

|

|

|

|

|

|

By:

|

/s/ Ronny Yakov

|

|

|

Name:

Title:

|

Ronny Yakov

Chief Executive Officer

|

2

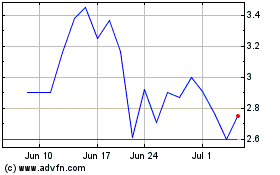

OLB (NASDAQ:OLB)

Historical Stock Chart

From Oct 2024 to Nov 2024

OLB (NASDAQ:OLB)

Historical Stock Chart

From Nov 2023 to Nov 2024