Northern Trust Releases Third Business Owner Benchmark

December 09 2024 - 9:00AM

Business Wire

2025 promises to be a consequential year for

business owners who face decisions about growth, family and

legacy

Business owners are forging ahead with big plans in 2025,

according to The Northern Trust Institute’s third Business Owner

Benchmark. The report, based on a survey of Northern Trust’s

business owner clients, reveals that despite mixed feelings about

the economy, many respondents are poised to undertake large scale

changes within their business next year.

According to Eric Czepyha, Northern Trust’s Director of Business

Services, the economy, market conditions and industry trends will

always be important factors, but based on years of working with

thousands of business owners, the future of these businesses is

often largely determined by family dynamics and the overlapping

roles of owners, their families and management.

“With this survey, we delve into the ambitions of startup

founders to multigenerational family business owners amid a rapidly

shifting landscape,” Czepyha said. “We discovered that many

respondents are thinking big – for instance, evaluating new areas

to grow their business or considering ways to monetize their

business, all the while attempting to navigate how to best prepare

their children for the wealth they will eventually inherit.”

Cautious about the state of the economy

The survey was conducted in third quarter of 2024 when the

Federal Reserve initiated its rate cutting cycle and expectations

increased for a “soft landing.” Yet only 8% of respondents said

they are optimistic about next year’s economic outlook. The leading

cause of respondents’ malaise was the current political environment

(54%), followed by potential changes to tax policy (42%) and the

impact of ongoing global conflicts (34%).

Committed to undertaking major changes

While it remains to be seen whether the new administration will

help assuage these concerns, business owners will be proactive next

year, depending on where they are in their lives. Respondents

younger than 65 exhibited a growth mindset with plans to expand

into a new line of business (30%) or acquire a new business (28%)

next year. On the other hand, respondents older than 65 were more

interested in selling all or part of their business (33%).

Cultivating the next generation

Although business owners are committed to instilling the next

generation with values such as integrity and gratitude, 64% of

respondents lack confidence in their children’s ability to manage

the wealth and businesses they will one day inherit. Further, 25%

of respondents have either not thought about the greater purpose

(or “why”) behind their wealth or have thought about it but have

yet to share this purpose with their children.

Considering alternative ownership structures

Business owners are often driven to succeed for reasons well

beyond making money, including keeping their business in the family

or eventually transferring ownership to their employees. For 43% of

respondents, it is also important for their business to still exist

100 years from now. However, 64% of respondents are not familiar

with the emerging trend of transferring ownership of your business

to a perpetual purpose trust, which can be a powerful strategy for

preserving the legacy of a business over the long-term.

About the Business Owner Benchmark

An online survey was fielded in September 2024 and responses

were received from 123 business owners with a median age of 67. The

respondents represent small, midsize and large companies from all

industries. The resulting report provides a window into their

diverse perspectives around how they deploy their wealth and what

drives them as they prepare for the future.

Download the full report for additional insights and advice.

Northern Trust Wealth Management offers holistic wealth

management services for affluent individuals and families, family

offices, foundations and endowments, and privately held businesses.

It is recognized for its innovative technology, service excellence

and depth of expertise, with over $440 billion in assets under

management as of September 30, 2024. The Northern Trust Company is

an Equal Housing Lender. Member FDIC.

About Northern Trust Northern Trust Corporation (Nasdaq:

NTRS) is a leading provider of wealth management, asset servicing,

asset management and banking to corporations, institutions,

affluent families and individuals. Founded in Chicago in 1889,

Northern Trust has a global presence with offices in 24 U.S. states

and Washington, D.C., and across 22 locations in Canada, Europe,

the Middle East and the Asia-Pacific region. As of September 30,

2024, Northern Trust had assets under custody/administration of

US$17.4 trillion, and assets under management of US$1.6 trillion.

For more than 135 years, Northern Trust has earned distinction as

an industry leader for exceptional service, financial expertise,

integrity and innovation. Visit us on northerntrust.com. Follow us

on Instagram @northerntrustcompany or Northern Trust on

LinkedIn.

Northern Trust Corporation, Head Office: 50 South La Salle

Street, Chicago, Illinois 60603 U.S.A., incorporated with limited

liability in the U.S. Global legal and regulatory information can

be found at https://www.northerntrust.com/terms-and-conditions.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241209027674/en/

Media Contact: Landis Cullen 312-444-3188

landis.cullen@ntrs.com

http://www.northerntrust.com

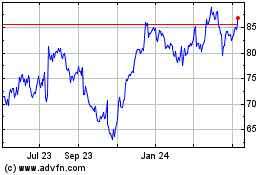

Northern (NASDAQ:NTRS)

Historical Stock Chart

From Dec 2024 to Jan 2025

Northern (NASDAQ:NTRS)

Historical Stock Chart

From Jan 2024 to Jan 2025