UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For the month of November 2024

Commission File Number: 000-30666

NETEASE, INC.

NetEase Building, No. 599 Wangshang Road

Binjiang District, Hangzhou, 310052

People’s Republic of China

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form

20-F x Form 40-F ¨

Exhibit

Exhibit 99.1 - NetEase Reports Third Quarter 2024 Unaudited Financial Results

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

NETEASE, INC. |

| |

|

| |

By: |

/s/ William Lei Ding |

| |

Name: |

William Lei Ding |

| |

Title: |

Chief Executive Officer |

Date: November 14, 2024

Exhibit 99.1

Contact for Media and Investors:

Email:

ir@service.netease.com

Tel:

(+86) 571-8985-3378

NetEase

Announces Third Quarter 2024 Unaudited Financial Results

Hangzhou,

China, November 14, 2024 - NetEase, Inc. (NASDAQ: NTES and HKEX: 9999, “NetEase” or the “Company”),

a leading internet and game services provider, today announced its unaudited financial results for the third quarter ended September 30,

2024.

Third

Quarter 2024 Financial Highlights

| · | Net revenues were RMB26.2 billion (US$3.7 billion), a decrease of 3.9% compared with the same quarter

of 2023. |

| · | Games and related value-added services net revenues were RMB20.9 billion (US$3.0 billion), a decrease

of 4.2% compared with the same quarter of 2023. |

| · | Youdao net revenues were RMB1.6 billion (US$224.1 million), an increase of 2.2% compared with the same

quarter of 2023. |

| · | NetEase Cloud Music net revenues were RMB2.0 billion (US$284.9 million), an increase of 1.3% compared

with the same quarter of 2023. |

| · | Innovative businesses and others net revenues were RMB1.8 billion (US$252.8 million), a decrease of 10.3%

compared with the same quarter of 2023. |

| · | Gross profit was RMB16.5 billion (US$2.3 billion), a decrease of 2.9% compared with the same quarter of

2023. |

| · | Total operating expenses were RMB9.3 billion (US$1.3 billion), a decrease of 0.8% compared with the same

quarter of 2023. |

| · | Net income attributable to the Company’s shareholders was RMB6.5 billion (US$931.7 million). Non-GAAP

net income attributable to the Company’s shareholders was RMB7.5 billion (US$1.1 billion).[1] |

| · | Basic net income per share was US$0.29 (US$1.46 per ADS). Non-GAAP basic net income per share was US$0.33

(US$1.67 per ADS).[1] |

Third

Quarter 2024 and Recent Operational Highlights

| · | Launched popular new titles and expanded established games in new regions, strengthening NetEase’s

competitive edge across more markets in diversified genres. |

| · | Naraka: Bladepoint mobile game gained significant popularity since its launch in July, reaching

No. 4 on the iOS grossing chart with its September seasonal update, effectively catering to growing player demand for action-based

PvP games. |

| · | Racing Master topped the App Store and Google Play free-to-play charts in Japan following its launch

in August. |

| · | World of Warcraft and Hearthstone’s return to China reignited historic level of player

community enthusiasm. Following their relaunch, World of Warcraft saw a 50% increase in daily active players as compared to levels

before the shutdown, while Hearthstone achieved over 150% growth. |

| · | Generated continued popularity of hit games Identity V and Naraka: Bladepoint, showcasing

NetEase’s long-term operation capabilities for online games. |

| · | Strengthened diversified portfolio, announcing more exciting titles in the making, including Destiny:

Rising and MARVEL Mystic Mayhem, and new games, such as Marvel Rivals and Where Winds Meet, set for launch in

December. |

| · | Youdao significantly improved its profitability in the third quarter, achieving its first-ever third-quarter

operating profit and a record-high quarterly operating profit, compared with a loss in the same period last year. |

| · | NetEase Cloud Music continued to drive quality development across its music-centric ecosystem, further

expanding its subscriber base and sustaining healthy revenue growth momentum in its online music services. |

[1]

As used in this announcement, non-GAAP net income attributable to the Company’s shareholders and non-GAAP basic and

diluted net income per share and per ADS are defined to exclude share-based compensation expenses. See the unaudited reconciliation of

GAAP and non-GAAP results at the end of this announcement.

“To further diversify our game portfolio

across genres and expand globally, we launched a variety of new games to captivate players worldwide and achieved breakthrough milestones,”

said Mr. William Ding, Chief Executive Officer and Director of NetEase. “Throughout our development journey over the past two

decades, players have remained at the core of our creations and operations, ensuring the long-lasting popularity of our games. As we expand,

we will continue to prioritize player demand and propel innovation, bringing more exciting NetEase gaming experiences to players domestically

and around the world.

“NetEase Cloud Music and Youdao are both

positioned for steady growth alongside our games. Across the NetEase family, we focus on creating unique, engaging and impactful experiences

for our community that fuel our ongoing success,” Mr. Ding concluded.

Third

Quarter 2024 Financial Results

Net

Revenues

Net

revenues for the third quarter of 2024 were RMB26.2 billion (US$3.7 billion), compared with RMB25.5 billion and RMB27.3 billion for the

preceding quarter and the same quarter of 2023, respectively.

Net

revenues from games and related value-added services were RMB20.9 billion (US$3.0 billion) for the third quarter of 2024, compared

with RMB20.1 billion and RMB21.8 billion for the preceding quarter and the same quarter of 2023, respectively. Net revenues from the operation

of online games accounted for approximately 96.8% of the segment’s net revenues for the third quarter of 2024, compared with 96.1%

and 93.7% for the preceding quarter and the same quarter of 2023, respectively. Net revenues from mobile games accounted for approximately

70.8% of net revenues from the operation of online games for the third quarter of 2024, compared with 76.4% and 77.6% for the preceding

quarter and the same quarter of 2023, respectively.

Net

revenues from Youdao were RMB1.6 billion (US$224.1 million) for the third quarter of 2024, compared with RMB1.3 billion and RMB1.5

billion for the preceding quarter and the same quarter of 2023, respectively.

Net

revenues from NetEase Cloud Music were RMB2.0 billion (US$284.9 million) for the third quarter of 2024, compared with RMB2.0 billion

each for the preceding quarter and the same quarter of 2023.

Net

revenues from innovative businesses and others were RMB1.8 billion (US$252.8 million) for the third quarter of 2024, compared with

RMB2.1 billion and RMB2.0 billion for the preceding quarter and the same quarter of 2023, respectively.

Gross Profit

Gross

profit for the third quarter of 2024 was RMB16.5 billion (US$2.3 billion), compared with RMB16.0 billion and RMB17.0 billion for

the preceding quarter and the same quarter of 2023, respectively.

The quarter-over-quarter increase in games and related value-added services’

gross profit was primarily due to higher net revenues from PC games. The year-over-year decrease was primarily due to decreased net revenues

from mobile games.

The

quarter-over-quarter increase in Youdao’s gross profit was primarily due to higher net revenues from sales of smart devices

and learning services. The year-over-year decrease was primarily due to decreased net revenues from its learning services.

The

year-over-year increase in NetEase Cloud Music’s gross profit was primarily due to increased net revenues from sales of membership

subscriptions and continued improvement in cost control measures.

The

quarter-over-quarter decrease in innovative businesses and others’ gross profit was primarily due to decreased e-commerce

gross profit from Yanxuan. The year-over-year increase was primarily due to increased gross profit from several businesses included within

the segment.

Gross Profit Margin

Gross

profit margin for games and related value-added services for the third quarter of 2024 was 68.8%, compared with 70.0% and 69.0%

for the preceding quarter and the same quarter of 2023, respectively. The quarter-over-quarter and year-over-year decreases were mainly

attributable to changes in product mix.

Gross

profit margin for Youdao for the third quarter of 2024 was 50.2%, compared with 48.2% and 55.9% for the preceding quarter and the

same quarter of 2023, respectively. The quarter-over-quarter and year-over-year fluctuations were mainly due to the factors enumerated

above.

Gross

profit margin for NetEase Cloud Music for the third quarter of 2024 was 32.8%, compared with 32.1% and 27.2% for the preceding

quarter and the same quarter of 2023, respectively. The quarter-over-quarter and year-over-year increases were mainly due to increased

net revenues from sales of membership subscriptions and continued improvement in cost control measures.

Gross

profit margin for innovative businesses and others for the third quarter of 2024 was 37.8%, compared with 34.0% and 27.3% for the

preceding quarter and the same quarter of 2023, respectively. The quarter-over-quarter and year-over-year increases were mainly due to

increased gross profit margins from several businesses included within the segment.

Operating Expenses

Total

operating expenses for the third quarter of 2024 were RMB9.3 billion (US$1.3 billion), compared with RMB9.0 billion and RMB9.4

billion for the preceding quarter and the same quarter of 2023, respectively. The quarter-over-quarter increase was mainly due to increased

marketing expenditures related to games and related value-added services.

Other Income/(Expenses)

Other

income/(expenses) consisted of investment income, interest income, exchange (losses)/gains and others. The quarter-over-quarter

and year-over-year decreases were mainly due to higher net exchange losses in the third quarter of 2024.

Income Tax

The

Company recorded a net income tax charge of RMB1.3 billion (US$183.8 million) for the third quarter of 2024, compared with RMB1.3

billion each for the preceding quarter and the same quarter of 2023. The effective tax rate for the third quarter of 2024 was 16.1%, compared

with 16.0% and 14.2% for the preceding quarter and the same quarter of 2023, respectively. The effective tax rate represents certain estimates

by the Company as to the tax obligations and benefits applicable to it in each quarter.

Net Income and Non-GAAP Net Income

Net income attributable to the Company’s

shareholders totaled RMB6.5 billion (US$931.7 million) for the third quarter of 2024, compared with RMB6.8 billion and RMB7.8 billion

for the preceding quarter and the same quarter of 2023, respectively.

NetEase reported basic net income of US$0.29 per

share (US$1.46 per ADS) for the third quarter of 2024, compared with US$0.30 per share (US$1.50 per ADS) and US$0.35 per share (US$1.74

per ADS) for the preceding quarter and the same quarter of 2023, respectively.

Non-GAAP

net income attributable to the Company’s shareholders totaled RMB7.5 billion (US$1.1 billion) for the third quarter of 2024, compared

with RMB7.8 billion and RMB8.6 billion for the preceding quarter and the same quarter of 2023, respectively.

NetEase reported non-GAAP basic net income of

US$0.33 per share (US$1.67 per ADS) for the third quarter of 2024, compared with US$0.35 per share (US$1.73 per ADS) and US$0.38 per share

(US$1.92 per ADS) for the preceding quarter and the same quarter of 2023, respectively.

Other Financial Information

As

of September 30, 2024, the Company’s net cash (total cash and cash equivalents, current and non-current time deposits

and restricted cash, as well as short-term investments balance, minus short-term and long-term loans) totaled RMB120.0 billion (US$17.1

billion), compared with RMB110.9 billion as of December 31, 2023. Net cash provided by operating activities was RMB10.6 billion (US$1.5

billion) for the third quarter of 2024, compared with RMB6.5 billion and RMB9.8 billion for the preceding quarter and the same quarter

of 2023, respectively.

Quarterly

Dividend

The

board of directors approved a dividend of US$0.0870 per share (US$0.4350 per ADS) for the third quarter of 2024 to holders of ordinary

shares and holders of ADSs as of the close of business on November 29, 2024, Beijing/Hong Kong Time and New York Time, respectively,

payable in U.S. dollars. For holders of ordinary shares, in order to qualify for the dividend, all valid documents for the transfer of

shares accompanied by the relevant share certificates must be lodged for registration with the Company’s Hong Kong branch share

registrar, Computershare Hong Kong Investor Services Limited, at Shops 1712-1716, 17th Floor, Hopewell Centre, 183 Queen’s

Road East, Wanchai, Hong Kong no later than 4:30 p.m. on November 29, 2024 (Beijing/ Hong Kong Time). The payment date is expected

to be December 10, 2024 for holders of ordinary shares and on or around December 13, 2024 for holders of ADSs.

NetEase

paid a dividend of US$0.0870 per share (US$0.4350 per ADS) for the second quarter of 2024 in September 2024.

Under the Company’s current dividend policy,

the determination to make dividend distributions and the amount of such distribution in any particular quarter will be made at the discretion

of its board of directors and will be based upon the Company’s operations and earnings, cash flow, financial condition and other

relevant factors.

Share Repurchase Program

On

November 17, 2022, the Company announced that its board of directors had approved a share repurchase program of up to US$5.0

billion of the Company’s ADSs and ordinary shares in open market transactions. This share repurchase program commenced on January 10,

2023 and will be in effect for a period not to exceed 36 months from such date. As of September 30, 2024, approximately 18.2 million

ADSs had been repurchased under this program for a total cost of US$1.6 billion.

The extent to which NetEase repurchases its ADSs

and its ordinary shares depends upon a variety of factors, including market conditions. These programs may be suspended or discontinued

at any time.

**

The United States dollar (US$) amounts disclosed in this announcement are presented solely for the convenience of the reader. The percentages

stated are calculated based on RMB.

Conference Call

NetEase’s

management team will host a teleconference call with a simultaneous webcast at 7:00 a.m. New York Time on Thursday, November 14,

2024 (Beijing/Hong Kong Time: 8:00 p.m., Thursday, November 14, 2024). NetEase’s management will be on the call to discuss

the quarterly results and answer questions.

Interested

parties may participate in the conference call by dialing 1-914-202-3258 and providing conference ID: 10042941, 15 minutes prior

to the initiation of the call. A replay of the call will be available by dialing 1-855-883-1031 and entering PIN: 10042941. The replay

will be available through November 21, 2024.

This

call will be webcast live and the replay will be available for 12 months. Both will be available on NetEase’s Investor Relations

website at http://ir.netease.com/.

About NetEase, Inc.

NetEase, Inc.

(NASDAQ: NTES and HKEX: 9999, “NetEase”) is a leading internet and game services provider centered around premium content.

With extensive offerings across its expanding gaming ecosystem, the Company develops and operates some of the most popular and longest

running mobile and PC games available in China and globally.

Powered by one of the largest in-house game R&D

teams focused on mobile, PC and console, NetEase creates superior gaming experiences, inspires players, and passionately delivers value

for its thriving community worldwide. By infusing play with culture, and education with technology, NetEase transforms gaming into a meaningful

vehicle to build a more entertaining and enlightened world.

Beyond

games, NetEase service offerings include its majority-controlled subsidiaries Youdao (NYSE: DAO), an intelligent learning company

with industry-leading technology, and NetEase Cloud Music (HKEX: 9899), a well-known online music platform featuring a vibrant

content community, as well as Yanxuan, NetEase’s private label consumer lifestyle brand.

For

more information, please visit: http://ir.netease.com/.

Forward Looking Statements

This

announcement contains statements of a forward-looking nature. These statements are made under the “safe harbor” provisions

of the U.S. Private Securities Litigation Reform Act of 1995. You can identify these forward-looking statements by terminology such as

“will,” “expects,” “anticipates,” “future,” “intends,” “plans,”

“believes,” “estimates” and similar expressions. In addition, statements that are not historical facts, including

statements about NetEase’s strategies and business plans, its expectations regarding the growth of its business and its revenue

and the quotations from management in this announcement are or contain forward-looking statements. NetEase may also make forward-looking

statements in its periodic reports to the U.S. Securities and Exchange Commission (the “SEC”), in announcements made on the

website of The Stock Exchange of Hong Kong Limited (the “Hong Kong Stock Exchange”), in press releases and other written materials

and in oral statements made by its officers, directors or employees to third parties. The accuracy of these statements may be impacted

by a number of business risks and uncertainties that could cause actual results to differ materially from those projected or anticipated,

including risks related to: the risk that the online games market will not continue to grow or that NetEase will not be able to maintain

its position in that market in China or globally; risks associated with NetEase’s business and operating strategies and its ability

to implement such strategies; NetEase’s ability to develop and manage its operations and business; competition for, among other

things, capital, technology and skilled personnel; potential changes in government regulation that could adversely affect the industry

and geographical markets in which NetEase operates; the risk that NetEase may not be able to continuously develop new and creative online

services or that NetEase will not be able to set, or follow in a timely manner, trends in the market; risks related to economic

uncertainty and capital market disruption; risks related to the expansion of NetEase’s businesses and operations internationally;

risks associated with cybersecurity threats or incidents; and the risk that fluctuations in the value of the Renminbi with respect to

other currencies could adversely affect NetEase’s business and financial results. Further information regarding these and other

risks is included in NetEase’s filings with the SEC and announcements on the website of the Hong Kong Stock Exchange. NetEase does

not undertake any obligation to update this forward-looking information, except as required under applicable law.

Non-GAAP Financial Measures

NetEase considers and uses non-GAAP financial

measures, such as non-GAAP net income attributable to the Company’s shareholders and non-GAAP basic and diluted net income per ADS

and per share, as supplemental metrics in reviewing and assessing its operating performance and formulating its business plan. The presentation

of non-GAAP financial measures is not intended to be considered in isolation or as a substitute for the financial information prepared

and presented in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”).

NetEase defines non-GAAP net income attributable

to the Company’s shareholders as net income attributable to the Company’s shareholders excluding share-based compensation

expenses. Non-GAAP net income attributable to the Company’s shareholders enables NetEase’s management to assess its operating

results without considering the impact of share-based compensation expenses. NetEase believes that this non-GAAP financial measure provide

useful information to investors in understanding and evaluating the Company’s current operating performance and prospects in the

same manner as management does, if they so choose. NetEase also believes that the use of this non-GAAP financial measure facilitates investors’

assessment of its operating performance.

Non-GAAP financial measures are not defined under

U.S. GAAP and are not presented in accordance with U.S. GAAP. Non-GAAP financial measures have limitations as analytical tools. One of

the key limitations of using non-GAAP net income attributable to the Company’s shareholders is that it does not reflect all items

of expense/ income that affect our operations. Share-based compensation expenses have been and may continue to be incurred in NetEase’s

business and are not reflected in the presentation of non-GAAP net income attributable to the Company’s shareholders. In addition,

the non-GAAP financial measures NetEase uses may differ from the non-GAAP measures used by other companies, including peer companies,

and therefore their comparability may be limited.

NetEase compensates for these limitations by reconciling

non-GAAP net income attributable to the Company’s shareholders to the nearest U.S. GAAP performance measure, all of which should

be considered when evaluating the Company’s performance. See the unaudited reconciliation of GAAP and non-GAAP results at the end

of this announcement. NetEase encourages you to review its financial information in its entirety and not rely on a single financial measure.

NETEASE,INC.

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands)

| | |

December 31, | | |

September 30, | | |

September 30, | |

| | |

2023 | | |

2024 | | |

2024 | |

| | |

RMB | | |

RMB | | |

USD (Note 1) | |

| Assets | |

| | | |

| | | |

| | |

| Current assets: | |

| | | |

| | | |

| | |

| Cash and cash equivalents | |

| 21,428,902 | | |

| 20,184,013 | | |

| 2,876,199 | |

| Time deposits | |

| 100,856,034 | | |

| 91,195,431 | | |

| 12,995,245 | |

| Restricted cash | |

| 2,777,206 | | |

| 2,994,096 | | |

| 426,655 | |

| Accounts receivable, net | |

| 6,422,417 | | |

| 6,173,077 | | |

| 879,656 | |

| Inventories | |

| 695,374 | | |

| 613,685 | | |

| 87,449 | |

| Prepayments and other current assets, net | |

| 6,076,595 | | |

| 6,811,171 | | |

| 970,584 | |

| Short-term investments | |

| 4,436,057 | | |

| 12,607,188 | | |

| 1,796,510 | |

| Total current assets | |

| 142,692,585 | | |

| 140,578,661 | | |

| 20,032,298 | |

| | |

| | | |

| | | |

| | |

| Non-current assets: | |

| | | |

| | | |

| | |

| Property, equipment and software, net | |

| 8,075,044 | | |

| 8,200,464 | | |

| 1,168,557 | |

| Land use rights, net | |

| 4,075,143 | | |

| 4,204,865 | | |

| 599,188 | |

| Deferred tax assets | |

| 1,560,088 | | |

| 1,173,270 | | |

| 167,190 | |

| Time deposits | |

| 1,050,000 | | |

| 4,025,000 | | |

| 573,558 | |

| Restricted cash | |

| 550 | | |

| 5,277 | | |

| 752 | |

| Other long-term assets | |

| 28,471,568 | | |

| 26,708,737 | | |

| 3,805,965 | |

| Total non-current assets | |

| 43,232,393 | | |

| 44,317,613 | | |

| 6,315,210 | |

| Total assets | |

| 185,924,978 | | |

| 184,896,274 | | |

| 26,347,508 | |

| | |

| | | |

| | | |

| | |

| Liabilities, Redeemable Noncontrolling Interests and Shareholders’ Equity | |

| | | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | | |

| | |

| Accounts payable | |

| 881,016 | | |

| 755,372 | | |

| 107,640 | |

| Salary and welfare payables | |

| 4,857,206 | | |

| 2,941,618 | | |

| 419,177 | |

| Taxes payable | |

| 2,571,534 | | |

| 2,606,842 | | |

| 371,472 | |

| Short-term loans | |

| 19,240,163 | | |

| 10,594,342 | | |

| 1,509,682 | |

| Contract liabilities | |

| 13,362,166 | | |

| 15,543,023 | | |

| 2,214,863 | |

| Accrued liabilities and other payables | |

| 12,930,399 | | |

| 13,270,811 | | |

| 1,891,075 | |

| Total current liabilities | |

| 53,842,484 | | |

| 45,712,008 | | |

| 6,513,909 | |

| | |

| | | |

| | | |

| | |

| Non-current liabilities: | |

| | | |

| | | |

| | |

| Deferred tax liabilities | |

| 2,299,303 | | |

| 1,828,869 | | |

| 260,612 | |

| Long-term loans | |

| 427,997 | | |

| 427,997 | | |

| 60,989 | |

| Other long-term liabilities | |

| 1,271,113 | | |

| 1,199,075 | | |

| 170,867 | |

| Total non-current liabilities | |

| 3,998,413 | | |

| 3,455,941 | | |

| 492,468 | |

| Total liabilities | |

| 57,840,897 | | |

| 49,167,949 | | |

| 7,006,377 | |

| | |

| | | |

| | | |

| | |

| Redeemable noncontrolling interests | |

| 115,759 | | |

| 122,494 | | |

| 17,455 | |

| | |

| | | |

| | | |

| | |

| NetEase,Inc.’s shareholders’ equity | |

| 124,285,776 | | |

| 132,150,155 | | |

| 18,831,246 | |

| Noncontrolling interests | |

| 3,682,546 | | |

| 3,455,676 | | |

| 492,430 | |

| Total equity | |

| 127,968,322 | | |

| 135,605,831 | | |

| 19,323,676 | |

| | |

| | | |

| | | |

| | |

| Total liabilities, redeemable noncontrolling interests and shareholders’ equity | |

| 185,924,978 | | |

| 184,896,274 | | |

| 26,347,508 | |

The accompanying notes are an integral part of this announcement.

NETEASE, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(in

thousands, except per share data or per ADS data)

| | |

Three

Months Ended | | |

Nine

Months Ended | |

| | |

September 30, | | |

June 30, | | |

September 30, | | |

September 30, | | |

September 30, | | |

September 30, | | |

September 30, | |

| | |

2023 | | |

2024 | | |

2024 | | |

2024 | | |

2023 | | |

2024 | | |

2024 | |

| | |

RMB | | |

RMB | | |

RMB | | |

USD (Note 1) | | |

RMB | | |

RMB | | |

USD (Note 1) | |

| Net revenues | |

| 27,270,406 | | |

| 25,485,805 | | |

| 26,209,879 | | |

| 3,734,878 | | |

| 76,327,994 | | |

| 78,547,425 | | |

| 11,192,919 | |

| Cost of revenues | |

| (10,304,106 | ) | |

| (9,443,587 | ) | |

| (9,733,274 | ) | |

| (1,386,980 | ) | |

| (30,089,735 | ) | |

| (29,012,682 | ) | |

| (4,134,274 | ) |

| Gross

profit | |

| 16,966,300 | | |

| 16,042,218 | | |

| 16,476,605 | | |

| 2,347,898 | | |

| 46,238,259 | | |

| 49,534,743 | | |

| 7,058,645 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Selling and marketing expenses | |

| (3,567,153 | ) | |

| (3,501,737 | ) | |

| (3,805,071 | ) | |

| (542,218 | ) | |

| (9,743,904 | ) | |

| (11,329,012 | ) | |

| (1,614,371 | ) |

| General and administrative expenses | |

| (1,494,186 | ) | |

| (1,091,441 | ) | |

| (1,100,328 | ) | |

| (156,795 | ) | |

| (3,648,011 | ) | |

| (3,388,244 | ) | |

| (482,821 | ) |

| Research

and development expenses | |

| (4,347,052 | ) | |

| (4,455,717 | ) | |

| (4,424,469 | ) | |

| (630,482 | ) | |

| (12,005,691 | ) | |

| (13,054,944 | ) | |

| (1,860,315 | ) |

| Total operating

expenses | |

| (9,408,391 | ) | |

| (9,048,895 | ) | |

| (9,329,868 | ) | |

| (1,329,495 | ) | |

| (25,397,606 | ) | |

| (27,772,200 | ) | |

| (3,957,507 | ) |

| Operating

profit | |

| 7,557,909 | | |

| 6,993,323 | | |

| 7,146,737 | | |

| 1,018,403 | | |

| 20,840,653 | | |

| 21,762,543 | | |

| 3,101,138 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Other income/(expenses): | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Investment income, net | |

| 556,603 | | |

| 103,674 | | |

| 578,398 | | |

| 82,421 | | |

| 1,315,662 | | |

| 861,363 | | |

| 122,743 | |

| Interest income, net | |

| 1,147,227 | | |

| 1,186,219 | | |

| 1,282,766 | | |

| 182,793 | | |

| 2,858,835 | | |

| 3,746,582 | | |

| 533,884 | |

| Exchange (losses)/gains, net | |

| (400,483 | ) | |

| (239,375 | ) | |

| (1,055,518 | ) | |

| (150,410 | ) | |

| 677,905 | | |

| (1,279,882 | ) | |

| (182,382 | ) |

| Other, net | |

| 240,024 | | |

| 85,694 | | |

| 43,600 | | |

| 6,213 | | |

| 618,883 | | |

| 323,182 | | |

| 46,053 | |

| Income before tax | |

| 9,101,280 | | |

| 8,129,535 | | |

| 7,995,983 | | |

| 1,139,420 | | |

| 26,311,938 | | |

| 25,413,788 | | |

| 3,621,436 | |

| Income tax | |

| (1,290,398 | ) | |

| (1,300,939 | ) | |

| (1,289,545 | ) | |

| (183,759 | ) | |

| (3,631,047 | ) | |

| (4,076,394 | ) | |

| (580,881 | ) |

| Net income | |

| 7,810,882 | | |

| 6,828,596 | | |

| 6,706,438 | | |

| 955,661 | | |

| 22,680,891 | | |

| 21,337,394 | | |

| 3,040,555 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Accretion of redeemable noncontrolling interests | |

| (895 | ) | |

| (960 | ) | |

| (962 | ) | |

| (137 | ) | |

| (2,623 | ) | |

| (2,880 | ) | |

| (410 | ) |

| Net loss/(income) attributable to noncontrolling interests and redeemable noncontrolling interests | |

| 26,901 | | |

| (68,887 | ) | |

| (167,041 | ) | |

| (23,803 | ) | |

| 156,021 | | |

| (403,384 | ) | |

| (57,482 | ) |

| Net income attributable to the Company’s shareholders | |

| 7,836,888 | | |

| 6,758,749 | | |

| 6,538,435 | | |

| 931,721 | | |

| 22,834,289 | | |

| 20,931,130 | | |

| 2,982,663 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net income per share * | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 2.44 | | |

| 2.10 | | |

| 2.04 | | |

| 0.29 | | |

| 7.10 | | |

| 6.52 | | |

| 0.93 | |

| Diluted | |

| 2.41 | | |

| 2.08 | | |

| 2.03 | | |

| 0.29 | | |

| 7.02 | | |

| 6.46 | | |

| 0.92 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net income per ADS * | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 12.19 | | |

| 10.50 | | |

| 10.22 | | |

| 1.46 | | |

| 35.48 | | |

| 32.61 | | |

| 4.65 | |

| Diluted | |

| 12.06 | | |

| 10.42 | | |

| 10.14 | | |

| 1.44 | | |

| 35.11 | | |

| 32.30 | | |

| 4.60 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Weighted average number of

ordinary shares used in calculating net income per share * | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 3,213,834 | | |

| 3,217,699 | | |

| 3,198,646 | | |

| 3,198,646 | | |

| 3,217,873 | | |

| 3,209,298 | | |

| 3,209,298 | |

| Diluted | |

| 3,249,649 | | |

| 3,243,056 | | |

| 3,224,110 | | |

| 3,224,110 | | |

| 3,251,666 | | |

| 3,238,834 | | |

| 3,238,834 | |

* Each

ADS represents five ordinary shares.

The accompanying notes are an integral part of this announcement.

NETEASE, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

| | |

Three

Months Ended | | |

Nine

Months Ended | |

| | |

September 30, | | |

June 30, | | |

September 30, | | |

September 30, | | |

September 30, | | |

September 30, | | |

September 30, | |

| | |

2023 | | |

2024 | | |

2024 | | |

2024 | | |

2023 | | |

2024 | | |

2024 | |

| | |

RMB | | |

RMB | | |

RMB | | |

USD (Note 1) | | |

RMB | | |

RMB | | |

USD (Note 1) | |

| Cash flows from operating

activities: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net income | |

| 7,810,882 | | |

| 6,828,596 | | |

| 6,706,438 | | |

| 955,661 | | |

| 22,680,891 | | |

| 21,337,394 | | |

| 3,040,555 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Depreciation and amortization | |

| 651,856 | | |

| 631,957 | | |

| 520,567 | | |

| 74,180 | | |

| 2,395,488 | | |

| 1,720,447 | | |

| 245,162 | |

| Fair value changes of equity security, other investments and financial instruments | |

| (382,132 | ) | |

| (7,887 | ) | |

| (824,608 | ) | |

| (117,506 | ) | |

| (686,887 | ) | |

| (1,200,753 | ) | |

| (171,106 | ) |

| Impairment losses on investments | |

| 280,641 | | |

| 210,741 | | |

| 529,668 | | |

| 75,477 | | |

| 328,511 | | |

| 868,826 | | |

| 123,807 | |

| Fair value changes of short-term investments | |

| (72,875 | ) | |

| (128,295 | ) | |

| (100,071 | ) | |

| (14,260 | ) | |

| (307,675 | ) | |

| (289,176 | ) | |

| (41,207 | ) |

| Share-based compensation cost | |

| 819,548 | | |

| 1,079,056 | | |

| 978,139 | | |

| 139,384 | | |

| 2,429,823 | | |

| 2,951,495 | | |

| 420,584 | |

| Allowance for expected credit losses | |

| 22,386 | | |

| 9,281 | | |

| 36,022 | | |

| 5,133 | | |

| 51,646 | | |

| 56,903 | | |

| 8,109 | |

| Losses/(gains) on disposal of property, equipment and software | |

| 2,649 | | |

| (326 | ) | |

| (2,920 | ) | |

| (416 | ) | |

| 2,291 | | |

| (1,114 | ) | |

| (159 | ) |

| Unrealized exchange losses/(gains) | |

| 362,213 | | |

| (209,311 | ) | |

| 1,050,644 | | |

| 149,715 | | |

| (718,121 | ) | |

| 823,824 | | |

| 117,394 | |

| Gains on disposal of long-term investments, business and subsidiaries | |

| (3,197 | ) | |

| (141,114 | ) | |

| (118,046 | ) | |

| (16,821 | ) | |

| (25,347 | ) | |

| (272,647 | ) | |

| (38,852 | ) |

| Deferred income taxes | |

| (305,703 | ) | |

| (1,280,076 | ) | |

| 711,639 | | |

| 101,408 | | |

| (62,417 | ) | |

| (83,383 | ) | |

| (11,882 | ) |

| Share of results on equity method investees | |

| (160,042 | ) | |

| 39,200 | | |

| (28,466 | ) | |

| (4,057 | ) | |

| (385,142 | ) | |

| 175,005 | | |

| 24,938 | |

| Changes in operating assets and liabilities: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Accounts receivable | |

| (1,177,732 | ) | |

| 1,410,478 | | |

| 146,758 | | |

| 20,913 | | |

| (1,523,463 | ) | |

| 198,525 | | |

| 28,289 | |

| Inventories | |

| 84,970 | | |

| 29,552 | | |

| (39,285 | ) | |

| (5,598 | ) | |

| 271,710 | | |

| 81,645 | | |

| 11,634 | |

| Prepayments and other assets | |

| (573,631 | ) | |

| 530,856 | | |

| (1,234,390 | ) | |

| (175,899 | ) | |

| (455,037 | ) | |

| (377,394 | ) | |

| (53,778 | ) |

| Accounts payable | |

| 150,868 | | |

| (126,862 | ) | |

| 6,316 | | |

| 900 | | |

| (577,862 | ) | |

| (127,547 | ) | |

| (18,175 | ) |

| Salary and welfare payables | |

| (588,217 | ) | |

| 879,058 | | |

| (670,750 | ) | |

| (95,581 | ) | |

| (2,055,848 | ) | |

| (1,970,300 | ) | |

| (280,766 | ) |

| Taxes payable | |

| 515,087 | | |

| (1,462,700 | ) | |

| 224,015 | | |

| 31,922 | | |

| 255,911 | | |

| 33,137 | | |

| 4,722 | |

| Contract liabilities | |

| 1,560,628 | | |

| (1,270,324 | ) | |

| 1,928,060 | | |

| 274,746 | | |

| 2,009,423 | | |

| 2,231,822 | | |

| 318,032 | |

| Accrued liabilities and other payables | |

| 845,721 | | |

| (490,048 | ) | |

| 755,882 | | |

| 107,712 | | |

| (104,899 | ) | |

| 507,904 | | |

| 72,376 | |

| Net cash provided by operating activities | |

| 9,843,920 | | |

| 6,531,832 | | |

| 10,575,612 | | |

| 1,507,013 | | |

| 23,522,996 | | |

| 26,664,613 | | |

| 3,799,677 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Cash flows from investing

activities: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Purchase of property, equipment and software | |

| (643,144 | ) | |

| (168,880 | ) | |

| (379,520 | ) | |

| (54,081 | ) | |

| (1,816,627 | ) | |

| (963,418 | ) | |

| (137,286 | ) |

| Proceeds from sale of property, equipment and software | |

| 3,101 | | |

| 660 | | |

| 1,072 | | |

| 153 | | |

| 9,897 | | |

| 5,238 | | |

| 746 | |

| Purchase of intangible assets, content and licensed copyrights | |

| (742,523 | ) | |

| (399,533 | ) | |

| (222,247 | ) | |

| (31,670 | ) | |

| (1,852,526 | ) | |

| (810,601 | ) | |

| (115,510 | ) |

| Net changes of short-term investments with terms of three months or less | |

| (1,993,921 | ) | |

| (8,194,289 | ) | |

| 1,585,395 | | |

| 225,917 | | |

| (1,087,059 | ) | |

| (4,207,245 | ) | |

| (599,528 | ) |

| Purchase of short-term investments with terms over three months | |

| - | | |

| - | | |

| (3,675,000 | ) | |

| (523,683 | ) | |

| - | | |

| (3,675,000 | ) | |

| (523,683 | ) |

| Proceeds from maturities of short-term investments with terms over three months | |

| 376,950 | | |

| - | | |

| - | | |

| - | | |

| 481,219 | | |

| - | | |

| - | |

| Investment in long-term investments and acquisition of subsidiaries | |

| (417,448 | ) | |

| (193,450 | ) | |

| (226,086 | ) | |

| (32,217 | ) | |

| (1,916,724 | ) | |

| (901,340 | ) | |

| (128,440 | ) |

| Proceeds from disposal of long-term investments, businesses, subsidiaries and other financial instruments | |

| 20,898 | | |

| 840,649 | | |

| 1,541,338 | | |

| 219,639 | | |

| 78,709 | | |

| 2,467,443 | | |

| 351,608 | |

| Placement/rollover of matured time deposits | |

| (30,831,994 | ) | |

| (61,775,606 | ) | |

| (36,766,094 | ) | |

| (5,239,127 | ) | |

| (78,026,928 | ) | |

| (133,100,536 | ) | |

| (18,966,675 | ) |

| Proceeds from maturities of time deposits | |

| 33,893,436 | | |

| 55,211,839 | | |

| 37,546,192 | | |

| 5,350,289 | | |

| 78,144,576 | | |

| 138,806,413 | | |

| 19,779,756 | |

| Change in other long-term assets | |

| (181,263 | ) | |

| (172,543 | ) | |

| (125,911 | ) | |

| (17,942 | ) | |

| (333,293 | ) | |

| (333,079 | ) | |

| (47,463 | ) |

| Net cash used in investing activities | |

| (515,908 | ) | |

| (14,851,153 | ) | |

| (720,861 | ) | |

| (102,722 | ) | |

| (6,318,756 | ) | |

| (2,712,125 | ) | |

| (386,475 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Cash flows from financing

activities: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net changes from loans with terms of three months or less | |

| (7,501,788 | ) | |

| (2,085,053 | ) | |

| (4,778,301 | ) | |

| (680,902 | ) | |

| (19,834,683 | ) | |

| (7,263,080 | ) | |

| (1,034,981 | ) |

| Proceeds of loans with terms over three months | |

| 7,607,060 | | |

| 1,069,020 | | |

| 5,395,810 | | |

| 768,897 | | |

| 11,058,160 | | |

| 13,463,080 | | |

| 1,918,473 | |

| Payment of loans with terms over three months | |

| (4,250,550 | ) | |

| (10,681,827 | ) | |

| (3,100,520 | ) | |

| (441,821 | ) | |

| (7,524,472 | ) | |

| (14,739,347 | ) | |

| (2,100,340 | ) |

| Net amounts

received/(paid) related to capital contribution from or repurchase of noncontrolling interests shareholders | |

| 11,573 | | |

| 50,572 | | |

| (8,394 | ) | |

| (1,196 | ) | |

| 58,150 | | |

| 84,392 | | |

| 12,026 | |

| Cash paid for repurchase of NetEase’s ADSs/purchase of subsidiaries’ ADSs and shares | |

| (296,495 | ) | |

| (2,007,030 | ) | |

| (3,994,212 | ) | |

| (569,171 | ) | |

| (4,608,462 | ) | |

| (7,235,022 | ) | |

| (1,030,982 | ) |

| Dividends paid to NetEase’s shareholders | |

| (2,423,355 | ) | |

| (2,264,799 | ) | |

| (1,972,928 | ) | |

| (281,140 | ) | |

| (5,755,011 | ) | |

| (9,182,743 | ) | |

| (1,308,530 | ) |

| Net cash used in financing activities | |

| (6,853,555 | ) | |

| (15,919,117 | ) | |

| (8,458,545 | ) | |

| (1,205,333 | ) | |

| (26,606,318 | ) | |

| (24,872,720 | ) | |

| (3,544,334 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Effect of exchange rate changes on cash, cash equivalents and restricted cash held in foreign currencies | |

| 4,197 | | |

| 8,234 | | |

| (68,136 | ) | |

| (9,710 | ) | |

| (28,181 | ) | |

| (103,040 | ) | |

| (14,683 | ) |

| Net increase/(decrease) in cash, cash equivalents and restricted cash | |

| 2,478,654 | | |

| (24,230,204 | ) | |

| 1,328,070 | | |

| 189,248 | | |

| (9,430,259 | ) | |

| (1,023,272 | ) | |

| (145,815 | ) |

| Cash, cash equivalents and restricted cash, at the beginning of the period | |

| 15,679,412 | | |

| 46,085,520 | | |

| 21,855,316 | | |

| 3,114,358 | | |

| 27,588,325 | | |

| 24,206,658 | | |

| 3,449,421 | |

| Cash,

cash equivalents and restricted cash, at end of the period | |

| 18,158,066 | | |

| 21,855,316 | | |

| 23,183,386 | | |

| 3,303,606 | | |

| 18,158,066 | | |

| 23,183,386 | | |

| 3,303,606 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Supplemental disclosures

of cash flow information: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Cash paid for income taxes, net | |

| 1,165,196 | | |

| 2,848,493 | | |

| 554,867 | | |

| 79,068 | | |

| 3,864,820 | | |

| 4,586,071 | | |

| 653,510 | |

| Cash paid for interest expenses | |

| 105,665 | | |

| 152,943 | | |

| 165,881 | | |

| 23,638 | | |

| 708,025 | | |

| 465,279 | | |

| 66,302 | |

The

accompanying notes are an integral part of this announcement.

NETEASE, INC.

UNAUDITED SEGMENT INFORMATION

(in thousands, except percentages)

| | |

Three

Months Ended | | |

Nine

Months Ended | |

| | |

September 30, | | |

June 30, | | |

September 30, | | |

September 30, | | |

September 30, | | |

September 30, | | |

September 30, | |

| | |

2023 | | |

2024 | | |

2024 | | |

2024 | | |

2023 | | |

2024 | | |

2024 | |

| | |

RMB | | |

RMB | | |

RMB | | |

USD (Note 1) | | |

RMB | | |

RMB | | |

USD (Note 1) | |

| Net revenues: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Games and related

value-added services | |

| 21,779,851 | | |

| 20,055,819 | | |

| 20,864,036 | | |

| 2,973,102 | | |

| 60,644,094 | | |

| 62,380,233 | | |

| 8,889,113 | |

| Youdao | |

| 1,538,783 | | |

| 1,321,721 | | |

| 1,572,541 | | |

| 224,085 | | |

| 3,908,687 | | |

| 4,286,121 | | |

| 610,767 | |

| NetEase Cloud Music | |

| 1,973,064 | | |

| 2,040,952 | | |

| 1,999,163 | | |

| 284,878 | | |

| 5,881,444 | | |

| 6,069,656 | | |

| 864,919 | |

| Innovative

businesses and others | |

| 1,978,708 | | |

| 2,067,313 | | |

| 1,774,139 | | |

| 252,813 | | |

| 5,893,769 | | |

| 5,811,415 | | |

| 828,120 | |

| Total net

revenues | |

| 27,270,406 | | |

| 25,485,805 | | |

| 26,209,879 | | |

| 3,734,878 | | |

| 76,327,994 | | |

| 78,547,425 | | |

| 11,192,919 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Cost of revenues: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Games and related value-added

services | |

| (6,749,507 | ) | |

| (6,008,604 | ) | |

| (6,503,146 | ) | |

| (926,691 | ) | |

| (19,555,391 | ) | |

| (19,067,061 | ) | |

| (2,717,034 | ) |

| Youdao | |

| (679,147 | ) | |

| (684,942 | ) | |

| (783,085 | ) | |

| (111,588 | ) | |

| (1,880,026 | ) | |

| (2,178,383 | ) | |

| (310,417 | ) |

| NetEase Cloud Music | |

| (1,436,552 | ) | |

| (1,385,756 | ) | |

| (1,343,921 | ) | |

| (191,507 | ) | |

| (4,379,785 | ) | |

| (3,988,683 | ) | |

| (568,383 | ) |

| Innovative

businesses and others | |

| (1,438,900 | ) | |

| (1,364,285 | ) | |

| (1,103,122 | ) | |

| (157,194 | ) | |

| (4,274,533 | ) | |

| (3,778,555 | ) | |

| (538,440 | ) |

| Total cost

of revenues | |

| (10,304,106 | ) | |

| (9,443,587 | ) | |

| (9,733,274 | ) | |

| (1,386,980 | ) | |

| (30,089,735 | ) | |

| (29,012,682 | ) | |

| (4,134,274 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Gross profit: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Games and related value-added

services | |

| 15,030,344 | | |

| 14,047,215 | | |

| 14,360,890 | | |

| 2,046,411 | | |

| 41,088,703 | | |

| 43,313,172 | | |

| 6,172,079 | |

| Youdao | |

| 859,636 | | |

| 636,779 | | |

| 789,456 | | |

| 112,497 | | |

| 2,028,661 | | |

| 2,107,738 | | |

| 300,350 | |

| NetEase Cloud Music | |

| 536,512 | | |

| 655,196 | | |

| 655,242 | | |

| 93,371 | | |

| 1,501,659 | | |

| 2,080,973 | | |

| 296,536 | |

| Innovative

businesses and others | |

| 539,808 | | |

| 703,028 | | |

| 671,017 | | |

| 95,619 | | |

| 1,619,236 | | |

| 2,032,860 | | |

| 289,680 | |

| Total gross

profit | |

| 16,966,300 | | |

| 16,042,218 | | |

| 16,476,605 | | |

| 2,347,898 | | |

| 46,238,259 | | |

| 49,534,743 | | |

| 7,058,645 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Gross profit margin: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Games and related value-added

services | |

| 69.0 | % | |

| 70.0 | % | |

| 68.8 | % | |

| 68.8 | % | |

| 67.8 | % | |

| 69.4 | % | |

| 69.4 | % |

| Youdao | |

| 55.9 | % | |

| 48.2 | % | |

| 50.2 | % | |

| 50.2 | % | |

| 51.9 | % | |

| 49.2 | % | |

| 49.2 | % |

| NetEase Cloud Music | |

| 27.2 | % | |

| 32.1 | % | |

| 32.8 | % | |

| 32.8 | % | |

| 25.5 | % | |

| 34.3 | % | |

| 34.3 | % |

| Innovative businesses and others | |

| 27.3 | % | |

| 34.0 | % | |

| 37.8 | % | |

| 37.8 | % | |

| 27.5 | % | |

| 35.0 | % | |

| 35.0 | % |

The accompanying notes are an integral part of this announcement.

NETEASE, INC.

NOTES TO UNAUDITED FINANCIAL INFORMATION

Note 1: The conversion of Renminbi (RMB) into

United States dollars (USD) is based on the noon buying rate of USD1.00 = RMB7.0176 on the last trading day of September 2024 (September 30,

2024) as set forth in the H.10 statistical release of the U.S. Federal Reserve Board. No representation is made that the RMB amounts could

have been, or could be, converted into US$ at that rate on September 30, 2024, or at any other certain date.

Note 2: Share-based compensation cost reported

in the Company’s unaudited condensed consolidated statements of comprehensive income is set out as follows in RMB and USD (in thousands):

| | |

Three Months Ended | | |

Nine Months Ended | |

| | |

September 30, | | |

June 30, | | |

September 30, | | |

September 30, | | |

September 30, | | |

September 30, | | |

September 30, | |

| | |

2023 | | |

2024 | | |

2024 | | |

2024 | | |

2023 | | |

2024 | | |

2024 | |

| | |

RMB | | |

RMB | | |

RMB | | |

USD (Note 1) | | |

RMB | | |

RMB | | |

USD (Note 1) | |

| Share-based compensation cost included in: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Cost of revenues | |

| 210,533 | | |

| 319,949 | | |

| 306,283 | | |

| 43,645 | | |

| 607,048 | | |

| 881,167 | | |

| 125,565 | |

| Operating expenses | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Selling and marketing expenses | |

| 33,804 | | |

| 42,865 | | |

| 36,365 | | |

| 5,182 | | |

| 97,226 | | |

| 97,099 | | |

| 13,836 | |

| General and administrative expenses | |

| 280,581 | | |

| 286,350 | | |

| 247,440 | | |

| 35,260 | | |

| 856,188 | | |

| 823,426 | | |

| 117,337 | |

| Research and development expenses | |

| 294,630 | | |

| 429,892 | | |

| 388,051 | | |

| 55,297 | | |

| 869,361 | | |

| 1,149,803 | | |

| 163,846 | |

The accompanying notes are an integral part of this announcement.

Note 3: The financial information prepared and

presented in this announcement might be different from those published and to be published by NetEase’s listed subsidiary to meet

the disclosure requirements under different accounting standards requirements.

Note 4: The unaudited reconciliation of GAAP and

non-GAAP results is set out as follows in RMB and USD (in thousands, except per share data or per ADS data):

| | |

Three Months Ended | | |

Nine Months Ended | |

| | |

September 30, | | |

June 30, | | |

September 30, | | |

September 30, | | |

September 30, | | |

September 30, | | |

September 30, | |

| | |

2023 | | |

2024 | | |

2024 | | |

2024 | | |

2023 | | |

2024 | | |

2024 | |

| | |

RMB | | |

RMB | | |

RMB | | |

USD (Note 1) | | |

RMB | | |

RMB | | |

USD (Note 1) | |

| Net income attributable to the Company’s shareholders | |

| 7,836,888 | | |

| 6,758,749 | | |

| 6,538,435 | | |

| 931,721 | | |

| 22,834,289 | | |

| 20,931,130 | | |

| 2,982,663 | |

| Add: Share-based compensation | |

| 808,276 | | |

| 1,059,939 | | |

| 960,706 | | |

| 136,900 | | |

| 2,394,559 | | |

| 2,897,543 | | |

| 412,897 | |

| Non-GAAP net income attributable to the Company’s shareholders | |

| 8,645,164 | | |

| 7,818,688 | | |

| 7,499,141 | | |

| 1,068,621 | | |

| 25,228,848 | | |

| 23,828,673 | | |

| 3,395,560 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Non-GAAP net income per share * | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 2.69 | | |

| 2.43 | | |

| 2.34 | | |

| 0.33 | | |

| 7.84 | | |

| 7.42 | | |

| 1.06 | |

| Diluted | |

| 2.66 | | |

| 2.41 | | |

| 2.33 | | |

| 0.33 | | |

| 7.76 | | |

| 7.35 | | |

| 1.05 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Non-GAAP net income per ADS * | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 13.45 | | |

| 12.15 | | |

| 11.72 | | |

| 1.67 | | |

| 39.20 | | |

| 37.12 | | |

| 5.29 | |

| Diluted | |

| 13.30 | | |

| 12.05 | | |

| 11.63 | | |

| 1.66 | | |

| 38.79 | | |

| 36.77 | | |

| 5.24 | |

* Each ADS represents five ordinary

shares.

The accompanying notes are an integral part of this announcement.

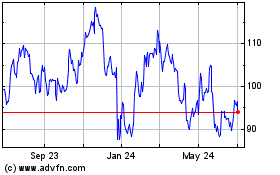

NetEase (NASDAQ:NTES)

Historical Stock Chart

From Jan 2025 to Feb 2025

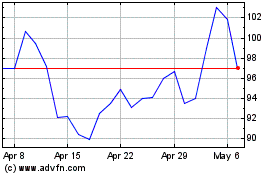

NetEase (NASDAQ:NTES)

Historical Stock Chart

From Feb 2024 to Feb 2025