Mr. Cooper Group Inc. Announces Pricing of Offering of $750 Million of Senior Notes

July 29 2024 - 4:30PM

Business Wire

Mr. Cooper Group Inc. (NASDAQ: COOP) (“Mr. Cooper”) announced

the pricing of an offering by Nationstar Mortgage Holdings Inc., a

direct wholly-owned subsidiary of Mr. Cooper (“Nationstar”), of

$750,000,000 6.500% Senior Notes due 2029 (the “Notes”). The Notes

will bear interest at 6.500% per annum and will mature on August 1,

2029. Interest on the Notes will be payable semi-annually on

February 1 and August 1 of each year, beginning on February 1,

2025.

The offering is expected to close on or around August 1, 2024,

subject to customary closing conditions. It is expected that the

net proceeds of the offering will be used to repay a portion of the

amounts outstanding under Mr. Cooper’s MSR facilities.

The Notes will be guaranteed on a joint and several basis by Mr.

Cooper and wholly-owned domestic subsidiaries of Nationstar (other

than certain excluded subsidiaries).

The offering of the Notes was made in reliance upon an exemption

from the registration requirements of the Securities Act of 1933,

as amended (the “Securities Act”), in the United States only to

investors who are “qualified institutional buyers,” as that term is

defined in Rule 144A under the Securities Act, or outside the

United States pursuant to Regulation S under the Securities Act.

The Notes have not been registered under the Securities Act or the

securities laws of any other jurisdiction and may not be offered or

sold in the United States without registration or an applicable

exemption from registration requirements.

This press release does not constitute an offer to sell or the

solicitation of an offer to buy, nor shall there be any sale of any

of the Notes in any jurisdiction in which such an offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such

jurisdiction.

Forward-Looking Statements

This press release may include information that could constitute

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. Any such forward-looking

statements may involve risk and uncertainties that could cause

actual results to differ materially from any future results

encompassed within the forward-looking statements. Factors that

could cause or contribute to such differences include those matters

disclosed in Mr. Cooper’s Securities and Exchange Commission

filings. Past results of Mr. Cooper are not necessarily indicative

of future results. Mr. Cooper does not undertake any obligation to

update any forward-looking statement.

About Mr. Cooper Group

Mr. Cooper Group Inc. (NASDAQ: COOP) provides customer-centric

servicing, origination and transaction-based services related

principally to single-family residences throughout the United

States with operations under its primary brands: Mr. Cooper® and

Xome®. Mr. Cooper is the largest home loan servicer in the country

focused on delivering a variety of servicing and lending products,

services and technologies.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240729441839/en/

Investor Contact: Kenneth Posner, SVP Strategic Planning and

Investor Relations (469) 426-3633 Shareholders@mrcooper.com

Media Contact: Christen Reyenga, VP Corporate Communications

MediaRelations@mrcooper.com

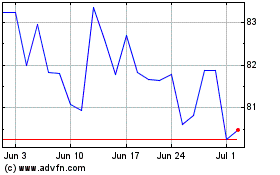

Mr Cooper (NASDAQ:COOP)

Historical Stock Chart

From Feb 2025 to Mar 2025

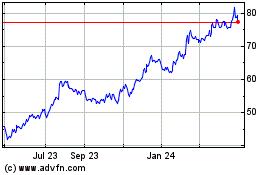

Mr Cooper (NASDAQ:COOP)

Historical Stock Chart

From Mar 2024 to Mar 2025