Cooperative Bankshares, Inc. (NASDAQ: COOP) (the "Company")

reported net income for the twelve months ended December 31, 2005,

of $5.50 million or $1.26 per diluted share, a 17.5% increase in

net income compared to last year. Net income for the twelve months

ended December 31, 2004 was $4.68 million or $1.07 per diluted

share. Net income for the quarter ended December 31, 2005, was

$1.46 million or $0.33 per diluted share, an increase of $104,000

or 7.7% over the same quarter last year. Net income for the quarter

ended December 31, 2004 was $1.35 million or $0.31 per diluted

share. The increase in net income for both the December 2005

quarter and 2005 was mainly due to a rise in net interest income

caused primarily by an increase in loans. Loans increased 41.9%

from December 31, 2004 to December 31, 2005. The majority of the

loan growth occurred in construction and land development loans

which grew $65.0 million (101.7%), commercial real estate loans

which grew $40.1 million (36.9%) and one-to-four family residential

loans which grew $68.9 million (30.3%) during this period. Loan

growth is primarily attributable to continued strength in the

economy of the markets in which the Company conducts its business

and a continued emphasis on increased loan production. Per share

data for 2004 has been adjusted to reflect the 3-for-2 stock split

in the form of a 50% stock dividend. The shares were issued

February 24, 2005. The increase in net income for both the December

2005 quarter and the year 2005 included a $428,000 gain realized on

the sale of an unoccupied former branch office. Net income for the

quarter and the year ended December 31, 2005 also reflected

additional provisions for loan losses charged to operations of

$710,000 and $1.52 million respectively, as compared to the

provisions for loan losses for the same periods last year. The

increase in the provision for loan losses was caused by the overall

increase in the loan portfolio, hurricane related collateral

impairment and the Company's increased emphasis on commercial

loans. Net income for the quarter and the year ended December 2005

was also reduced by $285,000 and $597,000 respectively due to an

increase in the provision for income taxes. As previously reported,

the provision for income taxes was increased as a result of an

announcement by the state taxing authority with respect to its

proposed treatment regarding certain dividends received from

entities such as the real estate investment trust controlled by the

Company. While the Company is currently undergoing a state tax

audit, it believes that, as of December 31, 2005, it has accrued

for the possible effect of the State's announced tax position other

than interest that may accrue after December 31, 2005. Total assets

increased 35.7%, primarily as a result of continued loan growth,

since December 31, 2004 and at December 31, 2005 were $746.3

million; stockholders' equity was $51.1 million and represented

6.85% of assets. Cooperative Bankshares, Inc. is the parent company

of Cooperative Bank. Chartered in 1898, Cooperative Bank provides a

full range of financial services through 21 offices in Eastern

North Carolina. The Bank's subsidiary, Lumina Mortgage, Inc., is a

mortgage banking firm, originating and selling residential mortgage

loans through three offices in North Carolina, and offices in North

Myrtle Beach, South Carolina, and Virginia Beach, Virginia.

Statements in this news release that are not historical facts are

forward-looking statements as defined in the Private Securities

Litigation Reform Act of 1995. Such forward-looking statements,

which contain the words "expects", "intends" and words of similar

import, are subject to numerous risks and uncertainties disclosed

from time to time in documents the company files with the

Securities and Exchange Commission, which could cause actual

results to differ materially from the results currently

anticipated. Undue reliance should not be placed on such

forward-looking statements. SEC Form 8-K has been filed containing

additional financial information. -0- *T COOPERATIVE BANKSHARES,

INC. 201 MARKET ST. WILMINGTON, NC 28401 UNAUDITED SELECTED

FINANCIAL DATA NASDAQ SYMBOL: COOP

----------------------------------------------------------------------

BALANCES AS OF: 12/31/05 09/30/05 06/30/05

----------------------------------------------------------------------

ASSETS $746,266,040 $715,581,019 $667,080,438 STOCKHOLDERS' EQUITY

51,095,958 49,929,424 48,965,978 DEPOSITS 564,989,604 542,009,276

512,096,853 BOOK VALUE (4,305,316 SHARES as of 12/31/05) 11.87

11.60 11.39 NON-PERFORMING ASSETS: ACCRUING LOANS 90 DAYS PAST DUE

8,707 315,865 566,318 NON-ACCRUAL LOANS 23,111 3,060 2,900

FORECLOSED REO 26,291 26,291 16,003

--------------------------------------- TOTAL NON-PERFORMING ASSETS

$ 58,109 $ 345,216 $ 585,221

=======================================

----------------------------------------------------------------------

----------------------------------------------------------------------

BALANCES AS OF: 03/31/05 12/31/04

--------------------------------------- ------------ ------------

ASSETS $596,336,244 $550,107,444 STOCKHOLDERS' EQUITY 47,479,803

46,909,701 DEPOSITS 441,985,339 414,757,904 BOOK VALUE (4,305,316

SHARES as of 12/31/05) 11.06 10.93 NON-PERFORMING ASSETS: ACCRUING

LOANS 90 DAYS PAST DUE 321,203 111,792 NON-ACCRUAL LOANS 2,581

95,209 FORECLOSED REO 16,003 - ------------ ------------ TOTAL

NON-PERFORMING ASSETS $ 339,787 $ 207,001 ============ ============

----------------------------------------------------------------------

FOR THE QUARTER ENDED: 12/31/05 09/30/05 06/30/05

------------------------------------- ---------- ----------

---------- NET INTEREST MARGIN 3.69% 3.69% 3.69% (net interest

income / average interest- earning assets) EARNING ASSETS /

LIABILITIES 111.5% 111.8% 111.7% STOCKHOLDERS' EQUITY/ASSETS 6.85%

6.98% 7.34%

----------------------------------------------------------------------

NET INCOME $1,457,118 $1,505,870 $1,390,913 ========== ==========

========== NET INCOME PER DILUTED SHARE $ 0.33 $ 0.34 $ 0.32

========== ========== ========== DILUTED WEIGHTED AVERAGE NUMBER OF

SHARES 4,386,369 4,379,214 4,373,929 ========== ==========

========== ALLOWANCE FOR LOAN LOSSES PROVISION $ 935,000 $ 575,000

$ 650,000 CHARGE OFFS 18,723 18,327 22,029 RECOVERIES 2,856 95

1,544 ---------- ---------- ---------- BALANCE $6,763,238

$5,844,105 $5,287,337 ========== ========== ========== FOR THE

QUARTER ENDED: 03/31/05 12/31/04

------------------------------------------------ ----------

---------- NET INTEREST MARGIN 3.76% 3.76% (net interest income /

average interest- earning assets) EARNING ASSETS / LIABILITIES

112.2% 112.0% STOCKHOLDERS' EQUITY/ASSETS 7.96% 8.53%

----------------------------------------------------------------------

NET INCOME $1,147,636 $1,352,693 ========== ========== NET INCOME

PER DILUTED SHARE $ 0.26 $ 0.31 ========== ========== DILUTED

WEIGHTED AVERAGE NUMBER OF SHARES 4,372,202 4,369,425 ==========

========== ALLOWANCE FOR LOAN LOSSES PROVISION $ 325,000 $ 225,000

CHARGE OFFS 25,032 27,843 RECOVERIES 4,627 103 ----------

---------- BALANCE $4,657,822 $4,353,227 ========== ==========

Note: 2004 per share information is computed based on the weighted

average number of dilutive shares outstanding, after giving the

retroactive effect for the 3-for-2 stock split in the form of a 50%

stock dividend declared on January 19, 2005 and paid on February

24, 2005. *T

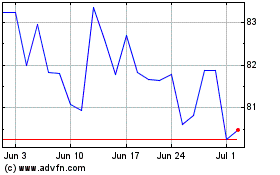

Mr Cooper (NASDAQ:COOP)

Historical Stock Chart

From Jun 2024 to Jul 2024

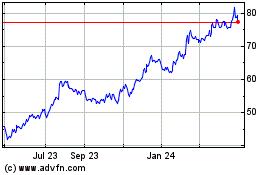

Mr Cooper (NASDAQ:COOP)

Historical Stock Chart

From Jul 2023 to Jul 2024