Form 8-K - Current report

March 11 2024 - 4:19PM

Edgar (US Regulatory)

false

0001686850

0001686850

2024-03-05

2024-03-05

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d)

of

the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): March 5, 2024

Motus

GI Holdings, Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-38389 |

|

81-4042793 |

(State

or Other Jurisdiction

of

Incorporation) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification

No.) |

1301

East Broward Boulevard, 3rd

Floor

Ft.

Lauderdale, FL

(Address

of principal executive offices, including zip code)

(954)

541-8000

(Registrant’s

telephone number, including area code)

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 § CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 § CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR § 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR § 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of Each Class: |

|

Trading

Symbol |

|

Name

of Each Exchange on which Registered |

| Common

Stock, par value $0.0001 per share |

|

MOTS |

|

The

Nasdaq Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §

230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR § 240.12b-2).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of

Certain Officers.

Amendment

to the Employment Agreement

On

March 5, 2024, the board of directors (“the Board”) of Motus GI Holdings, Inc. (the “Company”) approved an amendment

(the “Amendment”) to the employment agreement, dated April 1, 2018, with Ravit Ram, the Company’s Chief Financial Officer

(the “Employment Agreement”), to provide that if Ms. Ram is terminated by the Company for Good Reason (as defined in the

Amendment), then Ms. Ram will be entitled to a special adjustment payment, in a gross amount equal to nine (9) months’ salary,

including social benefits. If Ms. Ram accepts and commences any alternate employment during the nine (9) month period, she shall be entitled

to a reduced adjustment payment equal to nine (9) months’ salary minus her new position’s salary and social benefits for

the remaining period.

All

other material terms of the Employment Agreement remained the same.

The

foregoing description of the Amendment does not purport to be compete and is qualified entirely by reference to the text of the Amendment,

a form of which is filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Director

Compensation & Employee Bonuses

On

March 10, 2024, the Board acted to defer the cash compensation earned during the year ended December 31, 2023 (none of which has been

paid to date) and to be earned during the year ending December 31, 2024 by the non-employee members of the Board, such compensation to

be paid upon achievement of a strategic transaction, the criteria of which to be determined by the Board (a “Strategic Transaction”),

and cancelled if not achieved during the year ending 2024. In addition, the Board reserved a total of $900,000 for potential cash bonus

payments to the Company’s employees, contingent upon the achievement of a Strategic Transaction during the year ending December

31, 2024.

Item

9.01. Financial Statements and Exhibits.

(d)

Exhibits.

Signature

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

MOTUS

GI HOLDINGS, INC. |

| |

|

|

| Dated:

March 11, 2024 |

By: |

/s/

Mark Pomeranz |

| |

|

Mark

Pomeranz |

| |

|

Chief

Executive Officer |

Exhibit

10.1

AMENDMENT

TO THE EMPLOYMENT AGREEMENT

According

to Section 3 of the Notice to an Employee and Job Applicant (Employment Conditions and

Screening and Hiring Procedures) Law, 5762-2002

THIS

AMENDMENT (“Amendment”) to the Employment Agreement is made as of March __, 2024 (and shall be in effect as of

____, 2024) (“Effective Date”), by and between Motus G.I. Medical Technologies Ltd., a private company

incorporated under the laws of the state of Israel. Registration No. 514188135 (“Company”), and Ms. Ravit

Ram, holder of Israeli ID No. , residing at

(“Executive” and together with the Company,

“Parties”).

| WHEREAS,

|

the

Executive has been employed by the Company since April 1, 2018 according to certain employment agreement signed on April 1, 2018

(“Employment Agreement”); and |

| |

|

| WHEREAS,

|

the

Parties wish to amend certain terms of the Employment Agreement on the terms and conditions as fully set forth herein; |

NOW,

THEREFORE, it is hereby agreed as follows:

| 1.1. | As

of the Effective Date, and under the circumstance of employment termination by the Company

or termination of employment by the Executive for Good Reason (as such term specified below),

the Executive shall be entitled to a special adjustment payment, beyond the letter of the

law, in a gross amount equal to 9 monthly salaries, including social benefits (“Adjustment

Payment”). During the period of the Adjustment Payment, the Executive shall not

be required to attend to work, or perform her position duties. |

| 1.2. | In

this Section, “Good Reason” shall mean any of the following actions taken

without the Executive’s consent: (i) any reduction in the employment terms taken as

a whole and measured by the aggregate cost of the employment with the Executive (ii) a diminution

by the Company of the Executive’s position, authority or duties, except any change

in title alone; (iii) any material breach by the Company of any of its obligations under

the Employment Agreement; or (iv) any resignation that, pursuant to applicable law is deemed

to be a dismissal by the Company, provided, however, that the Executive shall provide the

Company with 30 days prior written notice of the occurrence of any of the events listed in

sub-clauses (i) through (iii), and the Company shall have 30 days from the date of receipt

of such notice to cure such breach (“Cure Period”) and that in each case

the Executive has voluntarily terminated her employment with the Company no later than 30

days after the lapse of such Cure Period. |

| 1.3. | For

the avoidance of doubt, under circumstance of termination for Cause (as such terms is defined

in the Employment Agreement), the Executive shall not be entitled to the Adjustment Payment,

or any part of it. |

| 1.4. | If

the Executive accepts and commences any alternate employment during the Adjustment Payment

period (“New Position”), she shall be entitled to a reduced adjustment

payment equal to the Adjustment Payment minus the Executive’s New Position’s

salary and social benefits (“Reduced Adjustment Payment”) for the remaining

period. Should the Company decide to cease the employer-employee relationship during the

Reduces Adjustment Payment, it shall redeem the Reduced Adjustment Payment and pay it as

a lump - sum payment. |

| 2.1. | The

Executive shall bear full responsibility for all taxed, levies and other payment obligations

relating to the Adjustment Payment, or Reduced Adjustment payment. The Company shall be entitled

to withhold from payments any and all amounts as may be required from time to time under

the applicable law. |

| 2.2. | Except

as specifically amended herein, all other terms and conditions of the Employment Agreement

remain in full force and effect. |

| 2.3. | Any

capitalized term used but not defined herein shall have the meanings ascribed to it in the

Employment Agreement. |

| 2.4. | This

Amendment shall be deemed for all intents and purposes as an integral part of the Employment

Agreement. |

| 2.5. | Nothing

in this section or in any other part of this Amendment shall be considered as an undertaking

of the Company to employ the Executive for any fixed period. |

IN

WITNESS WHEREOF, the Company has caused this Amendment to be executed by its duly authorized officer, and the Employee has executed

this Amendment as of the day and year set forth below.

| Motus G.I. Medical Technologies Ltd. |

Employee: |

Ravit

Ram |

| |

|

|

| By:

|

[____________] |

Signature:

|

[____________] |

| Title:

|

[____________]

|

|

|

| Signature:

|

[____________] |

|

|

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

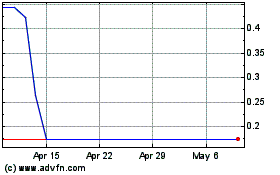

Motus GI (NASDAQ:MOTS)

Historical Stock Chart

From Jan 2025 to Feb 2025

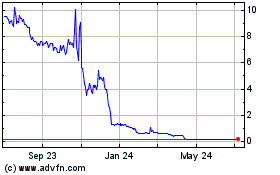

Motus GI (NASDAQ:MOTS)

Historical Stock Chart

From Feb 2024 to Feb 2025