Form SC TO-I/A - Tender offer statement by Issuer: [Amend]

June 06 2024 - 7:40AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549 |

| |

Amendment No. 3 to

SCHEDULE

TO |

Tender

Offer Statement under Section 14(d)(1) or 13(e)(1)

of the Securities Exchange

Act of 1934

|

MONSTER

BEVERAGE CORPORATIOn

(Name of Subject Company (Issuer) and Filing

Person (Offeror))

Common Stock, $0.005 par value

(Title of Class of Securities)

61174X109

(CUSIP Number of Class of Securities)

Paul J. Dechary, Executive Vice President &

General Counsel

Monster Beverage Corporation

1 Monster Way

Corona, California 92879

(951) 739-6200

(Name, address and telephone number of person authorized to

receive notices and communications on behalf of filing person)

Copy to:

|

Andrew M. Levine

Rory T. Hood

Jones Day

250 Vesey Street

New York, New York 10281

(212) 326-3939

Roxane F. Reardon

Marisa D. Stavenas

Simpson Thacher & Bartlett LLP

425 Lexington Avenue

New York, NY 10017

(212) 455-2000 |

| ¨ | Check the box if

filing relates solely to preliminary communications made before the commencement of a tender

offer.

Check the appropriate boxes below to designate any transactions to which the statement relates: |

| ¨ | third-party

tender offer subject to Rule 14d-1. |

| x | issuer tender offer subject to Rule 13e-4. |

| ¨ | going-private

transaction subject to Rule 13e-3. |

| ¨ | amendment

to Schedule 13D under Rule 13d-2. |

Check

the following box if the filing is a final amendment reporting the results of the tender offer: ¨

If applicable, check the appropriate box(es) below to designate

the appropriate rule provision(s) relied upon:

| ¨ | Rule 13e-4(i) (Cross-Border

Issuer Tender Offer) |

| ¨ | Rule 14d-1(d) (Cross-Border

Third Party Tender Offer) |

This Amendment No. 3 (this “Amendment”)

amends and supplements the Tender Offer Statement on Schedule TO originally filed with the Securities and Exchange Commission by Monster

Beverage Corporation (the “Company,” “Monster,” “we,” “our,” or “us”) on

May 8, 2024, as amended and supplemented on May 16, 2024 and May 29, 2024 (as amended and supplemented, the “Schedule

TO”) relating to the offer by Monster to purchase for cash shares of its common stock, $0.005 par value per share, for an aggregate

purchase price of up to $3.0 billion, at a purchase price of not less than $53.00 nor greater than $60.00 per share, without interest

and subject to any applicable withholding taxes. Monster’s offer was made upon the terms and subject to the conditions set forth

in the Offer to Purchase, dated May 8, 2024, a copy of which was filed as Exhibit (a)(1)(A) to the Schedule TO (as amended

and supplemented, the “Offer to Purchase”), and in the related Letter of Transmittal, a copy of which was filed as Exhibit (a)(1)(B) to

the Schedule TO (the “Letter of Transmittal”), which together constitute the tender offer (the “Offer”).

The purpose of this Amendment is to amend and

supplement the Schedule TO. Only those items amended are reported in this Amendment. Except as specifically provided herein, the information

contained in this Schedule TO, the Offer to Purchase and the Letter of Transmittal remains unchanged. This Amendment should be read with

the Schedule TO, the Offer to Purchase and the Letter of Transmittal.

| Item 11. | Additional Information. |

Item 11 of the Schedule TO is hereby amended and

supplemented by adding the following:

On June 6, 2024, Monster issued a press release

announcing the preliminary results of the Offer, which expired at 11:59 p.m., New York City time, on June 5, 2024. A copy of the

press release is filed as Exhibit (a)(5)(E) hereto and is incorporated by reference herein.

Item 12 of the Schedule TO is hereby amended and

supplemented by adding the following exhibits:

(a)(5)(E) Press release issued by Monster Beverage Corporation on June 6, 2024.

SIGNATURE

After due inquiry and to the best of my knowledge

and belief, I certify that the information set forth in this statement is true, complete and correct.

| |

MONSTER BEVERAGE CORPORATION |

| |

|

|

|

| |

By: |

/s/ Thomas J. Kelly |

| |

|

Name: |

Thomas J. Kelly |

| |

|

Title: |

Chief Financial Officer |

Date: June 6, 2024

INDEX

TO EXHIBITS

Exhibit

Number |

Description |

| (a)(1)(A) |

Offer to Purchase, dated May 8, 2024.* |

| (a)(1)(B) |

Letter of Transmittal.* |

| (a)(1)(C) |

Notice of Guaranteed Delivery.* |

| (a)(1)(D) |

Letter to Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees.* |

| (a)(1)(E) |

Letter to Clients for use by Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees.* |

| (a)(1)(F) |

Summary Advertisement.* |

| (a)(5)(A) |

Press release issued by Monster Beverage Corporation on May 2, 2024 (incorporated by reference to Exhibit 99.1 to our Form 8-K dated May 2, 2024).* |

| (a)(5)(B) |

Transcript of applicable portions of our First Quarter 2024 Earnings Call, dated May 2, 2024 (incorporated by reference to Exhibit 99.1 to our Schedule TO-C dated May 2, 2024).* |

| (a)(5)(C) |

Press release issued by Monster Beverage Corporation on May 8, 2024.* |

| (a)(5)(D) |

Press release issued by Monster Beverage Corporation on May 29, 2024.* |

| (a)(5)(E) |

Press release issued by Monster Beverage Corporation on June 6, 2024. |

| (b) |

Credit Agreement dated as of May 22, 2024 among Monster Beverage Corporation, Monster Energy Company, Monster Energy US LLC, JPMorgan Chase Bank, N.A., as administrative agent and the lenders party thereto (incorporated by reference from Exhibit 10.1 to our Form 8-K dated May 23, 2024).* |

| (d)(1) |

Transaction Agreement, dated as of August 14, 2014, by and among Monster Beverage Corporation, New Laser Corporation, New Laser Merger Corp, The Coca-Cola Company and European Refreshments (incorporated by reference from Exhibit 2.1 to our Form 8-K dated August 18, 2014).* |

| (d)(2) |

Amendment to Transaction Agreement, dated as of March 16, 2018, by and among Monster Beverage Corporation, New Laser Corporation, New Laser Merger Corp., The Coca-Cola Company and European Refreshments (incorporated by reference to Exhibit 2.1 to our Form 8-K dated March 20, 2018).* |

| (d)(3) |

Asset Transfer Agreement, dated as of August 14, 2014, by and among Monster Beverage Corporation, New Laser Corporation and The Coca-Cola Company Refreshments (incorporated by reference from Exhibit 2.2 to our Form 8-K dated August 18, 2014).* |

| (d)(4) |

Form of Indemnification Agreement (to be provided by Monster Beverage Corporation to its directors and officers) (incorporated by reference to Exhibit 10.1 to our Form 8-K dated June 11, 2019).* |

| (d)(5) |

Form of Restricted Stock Unit Agreement pursuant to the Monster Beverage Corporation 2017 Compensation Plan for Non-Employee Directors (incorporated by reference to Exhibit 10.4 to our Form 10-K dated March 1, 2021).* |

Exhibit

Number |

Description |

| (d)(6) |

Form of Restricted Stock Agreement (incorporated by reference to Exhibit 10.1 to our Form 10-Q dated August 9, 2011).* |

| (d)(7) |

Monster Beverage Corporation 2011 Omnibus Incentive Plan (incorporated by reference to Exhibit 10.1 to our Form 8-K dated May 24, 2011).* |

| (d)(8) |

Employment Agreement between Monster Beverage Corporation and Rodney C. Sacks (incorporated by reference to Exhibit 10.1 to our Form 8-K dated March 19, 2014).* |

| (d)(9) |

Employment Agreement between Monster Beverage Corporation and Hilton H. Schlosberg (incorporated by reference to Exhibit 10.2 to our Form 8-K dated March 19, 2014).* |

| (d)(10) |

Form of Stock Option Agreement for grants under the Monster Beverage Corporation 2011 Omnibus Incentive Plan (incorporated by reference to Exhibit 10.10 to our Form 10-K dated March 1, 2018).* |

| (d)(11) |

Form of Stock Option Agreement of Co-Chief Executive Officers for grants under the Monster Beverage Corporation 2011 Omnibus Incentive Plan (incorporated by reference to Exhibit 10.11 to our Form 10-K dated March 1, 2018).* |

| (d)(12) |

Form of 2020 Annual Incentive Award Agreement for grants under the Monster Beverage Corporation 2011 Omnibus Incentive Plan (incorporated by reference to Exhibit 10.1 to our Form 10-Q dated May 11, 2020).* |

| (d)(13) |

Form of Performance Share Unit Award Agreement for grants under the Monster Beverage Corporation 2011 Omnibus Incentive Plan (incorporated by reference to Exhibit 10.2 to our Form 10-Q dated May 11, 2020).* |

| (d)(14) |

Form of Restricted Stock Unit Agreement for grants under the Monster Beverage Corporation 2011 Omnibus Incentive Plan (incorporated by reference to Exhibit 10.13 to our Form 10-K dated March 1, 2021).* |

| (d)(15) |

Form of Restricted Stock Unit Agreement of Co-Chief Executive Officers for grants under the Monster Beverage Corporation 2011 Omnibus Incentive Plan (incorporated by reference to Exhibit 10.14 to our Form 10-K dated March 1, 2021).* |

| (d)(16) |

Monster Beverage Corporation 2020 Omnibus Incentive Plan (incorporated by reference to Appendix A to our Definitive Proxy Statement on Schedule 14A, filed April 21, 2020).* |

| (d)(17) |

Monster Beverage Corporation 2017 Compensation Plan for Non-Employee Directors as Amended and Restated on February 23, 2022 (incorporated by reference to Exhibit 10.1 to our Form 10-Q dated May 6, 2022).* |

| (d)(18) |

Monster Beverage Corporation Deferred Compensation Plan for Non-Employee Directors (incorporated by reference to Exhibit 4.2 to our Form S-8 dated June 21, 2017).* |

| (d)(19) |

Amended and Restated Monster Beverage Corporation Deferred Compensation Plan (incorporated by reference to Exhibit 10.14 to our Form 10-K dated March 1, 2018).* |

| (d)(20) |

Form of Stock Option Award Agreement for grants under the Monster Beverage Corporation 2020 Omnibus Incentive Plan (incorporated by reference to Exhibit 10.1 to our Form 10-Q dated May 7, 2021).* |

* Previously filed.

Exhibit (a)(5)(E)

Monster Beverage

Corporation announces preliminary

results of tender

offer

CORONA, Calif., June 6, 2024 (GLOBE NEWSWIRE) -- Monster Beverage Corporation

(“Monster”) (NASDAQ: MNST) announced today the preliminary results of its modified “Dutch auction” tender offer,

which expired at 11:59 p.m., New York City time, on June 5, 2024.

Based on the preliminary count by Equiniti Trust Company, LLC, the

depositary for the tender offer, a total of approximately 77,418,093 shares of Monster’s common stock were validly tendered and

not validly withdrawn at a purchase price of $53.00 per share or as purchase price tenders. Additionally, approximately 41,603,083 shares

were tendered through notice of guaranteed delivery at such purchase price or as purchase price tenders. Rodney Sacks and Hilton Schlosberg,

who are Monster’s co-CEOs and members of the Board of Directors of Monster, have tendered 608,114 and 350,000 shares, respectively,

that they beneficially own. In addition, Sterling Trustees LLC, which controls certain trusts and entities for the benefit of certain

family members of Messrs. Sacks and Schlosberg, has tendered 8,450,000 shares on behalf of such trusts and entities.

In accordance with the terms and conditions of the tender offer and

based on the preliminary count by the depositary, Monster expects to accept for payment an aggregate of 56,603,773 shares of its common

stock at a purchase price of $53.00 per share, for an aggregate cost of approximately $3.0 billion, excluding fees and expenses relating

to the tender offer. Monster expects to accept the shares on a pro rata basis, except for tenders of “odd lots,” which will

be accepted in full, and conditional tenders that will automatically be regarded as withdrawn because the condition of the tender has

not been met. Monster has been informed by the depositary that the preliminary proration factor for the tender offer is approximately

47.56%. The shares expected to be accepted for payment represent approximately 5.4% of the shares that were outstanding as of April 22,

2024.

The number of shares expected to be purchased in the tender offer and

proration factor are preliminary and subject to change. The preliminary information contained in this press release is subject to confirmation

by the depositary and is based on the assumption that all shares tendered through notice of guaranteed delivery will be delivered within

the one business day settlement period. The final number of shares to be purchased in the tender offer will be announced following the

expiration of the guaranteed delivery period and the completion by the depositary of the confirmation process. Payment for the shares

accepted for purchase pursuant to the tender offer, and the return of all other shares tendered and not purchased, will occur promptly

thereafter. Payment for shares will be made in cash, without interest.

Monster may purchase additional shares in the future in the open market

subject to market conditions, or in private transactions, exchange offers, tender offers or otherwise. Under applicable securities laws,

however, Monster may not repurchase any shares until June 21, 2024. Whether Monster makes additional repurchases in the future will depend

on many factors, including the market price of the shares, the results of the tender offer, Monster’s business and financial condition

and general economic and market conditions.

Evercore Group L.L.C. and J.P. Morgan Securities LLC are acting as

dealer managers for the tender offer. D.F. King & Co., Inc. is serving as the information agent, and Equiniti Trust Company, LLC is

acting as the depositary. Questions regarding the tender offer may be directed to Evercore Group L.L.C. at (888) 474-0200 or J.P. Morgan

Securities LLC at (877) 371-5947.

Monster Beverage Corporation

Based in Corona, California, Monster Beverage Corporation

is a holding company and conducts no operating business except through its consolidated subsidiaries. Monster’s subsidiaries develop

and market energy drinks, including Monster Energy® drinks, Monster Energy Ultra® energy drinks, Juice Monster® Energy +

Juice energy drinks, Java Monster® non-carbonated coffee + energy drinks, Rehab® Monster® non-carbonated energy drinks, Monster

Energy® Nitro energy drinks, Reign® Total Body Fuel high performance energy drinks, Reign Inferno® thermogenic fuel high

performance energy drinks, Reign Storm® total wellness energy drinks, NOS® energy drinks, Full Throttle® energy drinks, Bang

Energy® drinks, BPM® energy drinks, BU® energy drinks, Burn® energy drinks, Gladiator® energy drinks, Live+®

energy drinks, Mother® energy drinks, Nalu® energy drinks, Play® and Power Play® (stylized) energy drinks, Relentless®

energy drinks, Samurai® energy drinks, Ultra Energy® drinks, Predator® energy drinks and Fury® energy drinks. Monster’s

subsidiaries also develop and market still and sparkling waters under the Monster Tour Water® brand name. Monster’s subsidiaries

also develop and market craft beers, hard seltzers and flavored malt beverages under a number of brands, including Jai Alai® IPA,

Dale’s Pale Ale®, Dallas Blonde®, Wild Basin® hard seltzers, The Beast Unleashed® and Nasty Beast™ Hard Tea.

For more information visit www.monsterbevcorp.com.

Caution Concerning Forward-Looking Statements

Certain statements made in this announcement may

constitute “forward-looking statements.” Monster cautions that these statements are based on management’s current knowledge

and expectations and are subject to certain risks and uncertainties, many of which are outside of the control of Monster, that could cause

actual results and events to differ materially from the statements made herein. For a more detailed discussion of the risks that could

affect Monster’s operating results, see Monster’s reports filed with the Securities and Exchange Commission, including Monster’s

annual report on Form 10-K for the year ended December 31, 2023 and subsequently filed reports. Monster’s actual results could differ

materially from those contained in the forward-looking statements, including with respect to the tender offer.

CONTACTS:

Rodney C. Sacks

Chairman and Co-Chief Executive Officer

(951) 739-6200

Hilton H. Schlosberg

Vice Chairman and Co-Chief Executive Officer

(951) 739-6200

Roger S. Pondel / Judy Lin

PondelWilkinson Inc.

(310) 279-5980

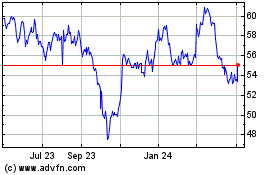

Monster Beverage (NASDAQ:MNST)

Historical Stock Chart

From Dec 2024 to Jan 2025

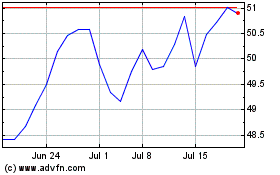

Monster Beverage (NASDAQ:MNST)

Historical Stock Chart

From Jan 2024 to Jan 2025