Form SC TO-I/A - Tender offer statement by Issuer: [Amend]

May 16 2024 - 4:38PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549 |

| |

Amendment No. 1

to

SCHEDULE

TO |

Tender

Offer Statement under Section 14(d)(1) or 13(e)(1)

of the Securities Exchange

Act of 1934

|

MONSTER

BEVERAGE CORPORATIOn

(Name of Subject

Company (Issuer) and Filing Person (Offeror))

Common Stock, $0.005

par value

(Title of Class of Securities)

61174X109

(CUSIP Number of Class of Securities)

Paul J. Dechary,

Executive Vice President & General Counsel

Monster Beverage Corporation

1 Monster Way

Corona, California 92879

(951) 739-6200

(Name, address and telephone number of person authorized to

receive notices and communications on behalf of filing person)

Copy to:

|

Andrew M. Levine

Rory T. Hood

Jones Day

250 Vesey Street

New York, New York 10281

(212) 326-3939

Roxane F. Reardon

Marisa D. Stavenas

Simpson Thacher &

Bartlett LLP

425 Lexington Avenue

New York, NY 10017

(212) 455-2000 |

| ¨ | Check

the box if filing relates solely to preliminary communications made before the commencement

of a tender offer.

Check the appropriate boxes below to designate any transactions to which the statement relates: |

| ¨ | third-party tender offer

subject to Rule 14d-1. |

| x | issuer

tender offer subject to Rule 13e-4. |

| ¨ | going-private

transaction subject to Rule 13e-3. |

| ¨ | amendment

to Schedule 13D under Rule 13d-2. |

Check the following box if

the filing is a final amendment reporting the results of the tender offer: ¨

If applicable, check the appropriate box(es) below to designate

the appropriate rule provision(s) relied upon:

| ¨ | Rule 13e-4(i) (Cross-Border

Issuer Tender Offer) |

| ¨ | Rule 14d-1(d) (Cross-Border

Third Party Tender Offer) |

This Amendment No. 1 (this “Amendment”)

amends and supplements the Tender Offer Statement on Schedule TO originally filed with the Securities and Exchange Commission by Monster

Beverage Corporation (the “Company,” “Monster,” “our,” or “us”) on May 8, 2024 (together with any subsequent amendments and supplements thereto, the

“Schedule TO”) relating to the offer by Monster to purchase for cash shares of its common stock, $0.005 par value per share,

for an aggregate purchase price of up to $3.0 billion, at a purchase price of not less than $53.00 nor greater than $60.00 per share,

without interest and subject to any applicable withholding taxes. Monster’s offer was made upon the terms and subject to the conditions

set forth in the Offer to Purchase, dated May 8, 2024, a copy of which was filed as Exhibit (a)(1)(A) to the Schedule

TO (as it may be amended or supplemented from time to time, the “Offer to Purchase”), and in the related Letter of Transmittal,

a copy of which was filed as Exhibit (a)(1)(B) to the Schedule TO (as it may be amended or supplemented from time to time,

the “Letter of Transmittal”), which together constitute the tender offer (the “Offer”).

The purpose of this Amendment is to amend and

supplement the Schedule TO and the Offer to Purchase. Only those items amended are reported in this Amendment. Except as specifically

provided herein, the information contained in this Schedule TO, the Offer to Purchase and the Letter of Transmittal remains unchanged.

This Amendment should be read with the Schedule TO, the Offer to Purchase and the Letter of Transmittal.

Items 1 through 9 and Item 11.

The disclosure in the Offer to Purchase and Items

1 through 9 and Item 11 of the Schedule TO, to the extent such items incorporate by reference the information contained in the Offer

to Purchase, is hereby amended and supplemented as follows:

Summary Term Sheet; How will Monster pay for

the shares?

Page 2 of the Offer to Purchase is hereby

amended and supplemented by adding a second paragraph under “How will Monster pay for the shares?” as follows:

There are no specific alternative financing arrangements

or alternative financing plans in connection with the Offer in the event the Credit Agreement described herein is not entered into and

at least $1.0 billion is not funded under the Term Loan and the RCF.

Summary Term Sheet; What are the conditions

to the Offer

Page 5 of the Offer to Purchase is hereby

amended and supplemented by replacing the fifth bullet with the following:

“no change, condition, event or development

occurs relating to (1) general political, market, economic, financial or industry conditions in the United States or (2) our

business, management, financial position, results of operations, assets, liabilities, or prospects, which in our reasonable judgment

is materially adverse to us;”

Section 7. Conditions of the Offer.

Page 34 of the Offer to Purchase is hereby

amended and supplemented by replacing the first bullet with the following:

“any change, condition, event or development

occurs relating to (1) general political, market, economic, financial or industry conditions in the United States or (2) our

business, management, financial position, results of operations, assets, liabilities, or prospects, which in our reasonable judgment

is materially adverse to us; or”

Section 9. Source and Amount of Funds.

Page 35 of the Offer to Purchase is hereby

amended and supplemented by adding, after the second paragraph in Section 9 on page 35, a third paragraph, as follows:

There are no specific alternative financing arrangements

or alternative financing plans in connection with the Offer in the event the Credit Agreement described herein is not entered into and

at least $1.0 billion is not funded under the Term Loan and the RCF. The Offer is, however, subject to the satisfaction or waiver of

the Financing Condition, as well as a number of other terms and conditions.

Section 10. Certain Information Concerning

the Company; Financial Information.

Page 37 of the Offer to Purchase is hereby

amended and supplemented to add, after the final paragraph in Section 10 on page 37, the following:

Financial

Information. This Offer to Purchase should be read in conjunction with the “Management’s Discussion and Analysis

of Financial Condition and Results of Operations” and the consolidated financial statements and financial statement schedule and

the notes thereto (beginning on page 45 and 77, respectively), included in our Annual Report on Form 10-K (File No. 001-18761) for the year ended December 31, 2023, filed with the SEC on February 29, 2024 (the “Annual Report”), and in our

Quarterly Report on Form 10-Q (File No. 001-18761) for the quarter ended March 31, 2024 (beginning on page 29 and 3, respectively), filed with the SEC on May 7, 2024 (the “Q1 10-Q”), which are incorporated herein by reference. Our

book value per share as of March 31, 2024 was $8.23, which is the date as of the most recent balance sheet incorporated herein by

reference.

Set forth below are summary consolidated balance

sheet data presented as of December 31, 2023 and 2022, and summary consolidated statement of income and comprehensive income data

for the years ended December 31, 2023 and 2022, which should be read in conjunction with the “Management’s Discussion

and Analysis of Financial Condition and Results of Operations” and the audited financial statements and financial statement schedule

and the notes thereto included in our Annual Report, and summary consolidated balance sheet data as of March 31, 2024, and summary

consolidated statement of income and comprehensive income data for the three months ended March 31, 2024 and 2023, which should

be read in conjunction with the “Management’s Discussion and Analysis of Financial Condition and Results of Operations”

and the unaudited financial statements and the notes thereto included in our Q1 10-Q, each of which is incorporated herein by reference

as set forth above.

| Consolidated statement of | |

Year Ended

December 31, | | |

Three Months

Ended

March 31, | |

| income and

comprehensive income data | |

2023 | | |

2022 | | |

2024 | | |

2023 | |

| Net Sales | |

$ | 7,140,027 | | |

$ | 6,311,050 | | |

$ | 1,899,098 | | |

$ | 1,698,930 | |

| Cost of Sales | |

| 3,345,821 | | |

| 3,136,483 | | |

| 871,969 | | |

| 801,081 | |

| Gross Profit | |

| 3,794,206 | | |

| 3,174,567 | | |

| 1,027,129 | | |

| 897,849 | |

| Operating Expenses | |

| 1,840,851 | | |

| 1,589,846 | | |

| 485,138 | | |

| 412,785 | |

| Operating Income | |

| 1,953,355 | | |

| 1,584,721 | | |

| 541,991 | | |

| 485,064 | |

| Operating

Income per common share1: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | 1.87 | | |

$ | 1.50 | | |

$ | 0.52 | | |

$ | 0.46 | |

| Diluted | |

$ | 1.85 | | |

$ | 1.49 | | |

$ | 0.52 | | |

$ | 0.46 | |

| Interest and other income (expense),

net | |

| 115,127 | | |

| (12,757 | ) | |

| 35,754 | | |

| 12,496 | |

| Income before provision for income taxes | |

| 2,068,482 | | |

| 1,571,964 | | |

| 577,745 | | |

| 497,560 | |

| Provision for income taxes | |

| 437,494 | | |

| 380,340 | | |

| 135,696 | | |

| 100,116 | |

| Net income | |

$ | 1,630,988 | | |

$ | 1,191,624 | | |

$ | 442,049 | | |

$ | 397,444 | |

| Net

income per common share1: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | 1.56 | | |

$ | 1.13 | | |

$ | 0.42 | | |

$ | 0.38 | |

| Diluted | |

$ | 1.54 | | |

$ | 1.12 | | |

$ | 0.42 | | |

$ | 0.38 | |

| Weighted

average number of shares of common stock and common stock equivalents1: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 1,044,887 | | |

| 1,053,558 | | |

| 1,041,081 | | |

| 1,044,909 | |

| Diluted | |

| 1,057,981 | | |

| 1,066,442 | | |

| 1,051,282 | | |

| 1,059,069 | |

| Net income, as reported | |

$ | 1,630,988 | | |

$ | 1,191,624 | | |

$ | 442,049 | | |

$ | 397,444 | |

| Other comprehensive income (loss) | |

| 33,736 | | |

| (89,908 | ) | |

| (32,603 | ) | |

| 11,162 | |

| Comprehensive income | |

$ | 1,664,724 | | |

$ | 1,101,716 | | |

$ | 409,446 | | |

$ | 408,606 | |

1

These figures have been adjusted retroactively to reflect the Stock Split. See Section 8.

| Consolidated balance sheet data | |

March 31,

2024 | | |

December 31,

2023 | | |

December 31,

2022 | |

| Total current assets | |

$ | 6,035,514 | | |

$ | 5,588,996 | | |

$ | 4,764,897 | |

| Total assets | |

$ | 10,098,066 | | |

$ | 9,686,522 | | |

$ | 8,293,105 | |

| Total current liabilities | |

$ | 1,228,828 | | |

$ | 1,161,689 | | |

$ | 1,001,978 | |

| Total liabilities | |

$ | 1,520,277 | | |

$ | 1,457,778 | | |

$ | 1,268,064 | |

| Total stockholders’ equity | |

$ | 8,577,789 | | |

$ | 8,228,744 | | |

$ | 7,025,041 | |

| Item 10. | Financial Information. |

Item 10(a) of the Schedule TO is hereby deleted

in its entirety and replaced with the following:

Incorporated

herein by reference is the Company’s financial statements that were included as Part II. Item 8 in its Annual Report on Form 10-K (File No. 001-18761) for the year ended December 31, 2023, filed with the SEC on February 29, 2024, and that were included

as Part I. Item 1 in its Quarterly Report on Form 10-Q (File No. 001-18761) for the quarter ended March 31, 2024, filed with the SEC on May 7, 2024. A summary of such financial statements is set forth in the Offer to Purchase under the heading

“Section 10 — Certain Information Concerning the Company; Financial Information.” The full text

of such financial statements and other financial information, as well as the other documents the Company has filed with the SEC prior

to, or will file with the SEC subsequent to, the filing of this Schedule TO relating to the Offer are available at the SEC’s website

at www.sec.gov.

SIGNATURE

After due inquiry and to the best of my knowledge

and belief, I certify that the information set forth in this statement is true, complete and correct.

| |

MONSTER BEVERAGE CORPORATION |

| |

|

| |

By: |

/s/

Thomas J. Kelly |

| |

|

Name: Thomas J. Kelly |

| |

|

Title: Chief Financial Officer |

Date: May 16, 2024

INDEX

TO EXHIBITS

Exhibit

Number |

Description |

| (a)(1)(A) |

Offer

to Purchase, dated May 8, 2024.* |

| (a)(1)(B) |

Letter

of Transmittal.* |

| (a)(1)(C) |

Notice

of Guaranteed Delivery.* |

| (a)(1)(D) |

Letter

to Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees.* |

| (a)(1)(E) |

Letter

to Clients for use by Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees.* |

| (a)(1)(F) |

Summary

Advertisement.* |

| (a)(5)(A) |

Press release issued by Monster Beverage Corporation on May 2, 2024 (incorporated by reference to Exhibit 99.1 to our Form 8-K dated May 2, 2024).* |

| (a)(5)(B) |

Transcript of applicable portions of our First Quarter 2024 Earnings Call, dated May 2, 2024 (incorporated by reference to Exhibit 99.1 to our Schedule TO-C dated May 2, 2024).* |

| (a)(5)(C) |

Press release issued by Monster Beverage Corporation on May 8, 2024.* |

| (d)(1) |

Transaction Agreement, dated as of August 14, 2014, by and among Monster Beverage Corporation, New Laser Corporation, New Laser Merger Corp, The Coca-Cola Company and European Refreshments (incorporated by reference from Exhibit 2.1 to our Form 8-K dated August 18, 2014).* |

| (d)(2) |

Amendment to Transaction Agreement, dated as of March 16, 2018, by and among Monster Beverage Corporation, New Laser Corporation, New Laser Merger Corp., The Coca-Cola Company and European Refreshments (incorporated by reference to Exhibit 2.1 to our Form 8-K dated March 20, 2018).* |

| (d)(3) |

Asset Transfer Agreement, dated as of August 14, 2014, by and among Monster Beverage Corporation, New Laser Corporation and The Coca-Cola Company Refreshments (incorporated by reference from Exhibit 2.2 to our Form 8-K dated August 18, 2014).* |

| (d)(4) |

Form of Indemnification Agreement (to be provided by Monster Beverage Corporation to its directors and officers) (incorporated by reference to Exhibit 10.1 to our Form 8-K dated June 11, 2019).* |

| (d)(5) |

Form of Restricted Stock Unit Agreement pursuant to the Monster Beverage Corporation 2017 Compensation Plan for Non-Employee Directors (incorporated by reference to Exhibit 10.4 to our Form 10-K dated March 1, 2021).* |

| (d)(6) |

Form of Restricted Stock Agreement (incorporated by reference to Exhibit 10.1 to our Form 10-Q dated August 9, 2011).* |

| (d)(7) |

Monster Beverage Corporation 2011 Omnibus Incentive Plan (incorporated by reference to Exhibit 10.1 to our Form 8-K dated May 24, 2011).* |

| (d)(8) |

Employment Agreement between Monster Beverage Corporation and Rodney C. Sacks (incorporated by reference to Exhibit 10.1 to our Form 8-K dated March 19, 2014).* |

| (d)(9) |

Employment Agreement between Monster Beverage Corporation and Hilton H. Schlosberg (incorporated by reference to Exhibit 10.2 to our Form 8-K dated March 19, 2014).* |

Exhibit

Number |

Description |

| (d)(10) |

Form of

Stock Option Agreement for grants under the Monster Beverage Corporation 2011 Omnibus Incentive Plan (incorporated by reference to

Exhibit 10.10 to our Form 10-K dated March 1, 2018).* |

| (d)(11) |

Form of

Stock Option Agreement of Co-Chief Executive Officers for grants under the Monster Beverage Corporation 2011 Omnibus Incentive Plan

(incorporated by reference to Exhibit 10.11 to our Form 10-K dated March 1, 2018).* |

| (d)(12) |

Form of

2020 Annual Incentive Award Agreement for grants under the Monster Beverage Corporation 2011 Omnibus Incentive Plan (incorporated

by reference to Exhibit 10.1 to our Form 10-Q dated May 11, 2020).* |

| (d)(13) |

Form of

Performance Share Unit Award Agreement for grants under the Monster Beverage Corporation 2011 Omnibus Incentive Plan (incorporated

by reference to Exhibit 10.2 to our Form 10-Q dated May 11, 2020).* |

| (d)(14) |

Form of

Restricted Stock Unit Agreement for grants under the Monster Beverage Corporation 2011 Omnibus Incentive Plan (incorporated by reference

to Exhibit 10.13 to our Form 10-K dated March 1, 2021).* |

| (d)(15) |

Form of

Restricted Stock Unit Agreement of Co-Chief Executive Officers for grants under the Monster Beverage Corporation 2011 Omnibus Incentive

Plan (incorporated by reference to Exhibit 10.14 to our Form 10-K dated March 1, 2021).* |

| (d)(16) |

Monster

Beverage Corporation 2020 Omnibus Incentive Plan (incorporated by reference to Appendix A to our Definitive Proxy Statement on Schedule

14A, filed April 21, 2020).* |

| (d)(17) |

Monster

Beverage Corporation 2017 Compensation Plan for Non-Employee Directors as Amended and Restated on February 23, 2022 (incorporated

by reference to Exhibit 10.1 to our Form 10-Q dated May 6, 2022).* |

| (d)(18) |

Monster

Beverage Corporation Deferred Compensation Plan for Non-Employee Directors (incorporated by reference to Exhibit 4.2 to our

Form S-8 dated June 21, 2017).* |

| (d)(19) |

Amended

and Restated Monster Beverage Corporation Deferred Compensation Plan (incorporated by reference to Exhibit 10.14 to our Form 10-K

dated March 1, 2018).* |

| (d)(20) |

Form of

Stock Option Award Agreement for grants under the Monster Beverage Corporation 2020 Omnibus Incentive Plan (incorporated by reference

to Exhibit 10.1 to our Form 10-Q dated May 7, 2021).* |

| (d)(21) |

Form of

Annual Incentive Award Agreement for grants under the Monster Beverage Corporation 2020 Omnibus Incentive Plan (incorporated by reference

to Exhibit 10.2 to our Form 10-Q dated May 7, 2021).* |

| (d)(22) |

Form of

Performance Share Unit Award Agreement for grants under the Monster Beverage Corporation 2020 Omnibus Incentive Plan (incorporated

by reference to Exhibit 10.3 to our Form 10-Q dated May 7, 2021).* |

| (d)(23) |

Form of

Restricted Stock Unit Award Agreement for grants under the Monster Beverage Corporation 2020 Omnibus Incentive Plan (incorporated

by reference to Exhibit 10.4 to our Form 10-Q dated May 7, 2021).* |

| (g) |

Not

applicable. |

* Previously filed.

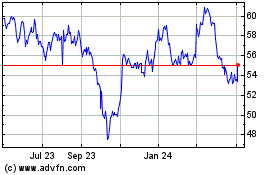

Monster Beverage (NASDAQ:MNST)

Historical Stock Chart

From Dec 2024 to Jan 2025

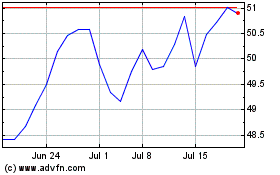

Monster Beverage (NASDAQ:MNST)

Historical Stock Chart

From Jan 2024 to Jan 2025