Monster Beverage Corporation (NASDAQ: MNST) today announced that it

has commenced a modified “Dutch auction” tender offer to purchase

shares of its common stock for cash at a price per share of not

less than $53.00 and not greater than $60.00, for a maximum

aggregate purchase price of up to $3.0 billion. The tender offer

begins today, May 8, 2024, and will expire at 11:59 p.m., New York

City time, on June 5, 2024, unless extended or earlier terminated

by Monster. The tender offer will be funded using a combination of

(1) $2.0 billion of cash on hand, (2) $750.0 million in borrowings

under a new term loan, and (3) $250.0 million in borrowings under a

new revolving credit facility. Monster and certain of its

subsidiaries expect to enter into a new credit agreement providing

for a new $750 million three-year delayed draw senior term loan A

facility (the “Term Loan”) and a new $750.0 million five-year

senior revolving credit facility (the “RCF”) at least five business

days prior to the expiration of the tender offer. It is a condition

to the consummation of the tender offer that the credit agreement

is entered into and at least $1.0 billion is funded under the Term

Loan and the RCF at least five business days prior to the

expiration of the tender offer (the “Financing Condition”). If the

Financing Condition is not satisfied and Monster does not waive the

Financing Condition, Monster may amend, terminate or extend the

tender offer.

Monster shareholders may tender all or a portion of their shares

at a price specified by the tendering shareholder of not less than

$53.00 nor greater than $60.00 per share in increments of $0.50.

Alternatively, Monster shareholders may tender shares without

specifying a purchase price, in which case their shares will be

purchased at the purchase price determined in accordance with the

tender offer. When the tender offer expires, Monster will determine

the lowest price per share within the range specified above that

will enable it to purchase the maximum number of shares of its

common stock having an aggregate purchase price up to $3.0 billion.

All shares accepted in the tender offer will be purchased at the

same price, which may be higher or lower than the market price

immediately prior to or during the tender offer. If the tender

offer is fully subscribed, then shares of common stock having an

aggregate purchase price of up to $3.0 billion will be purchased,

which would represent approximately between 4.8% to 5.4% of

Monster’s issued and outstanding shares as of April 22, 2024,

depending on the purchase price payable in the tender offer. In

addition, if shares valued at more than the maximum aggregate

purchase price of up to $3.0 billion are tendered in the tender

offer at or below the purchase price, Monster may accept for

purchase at the purchase price pursuant to the tender offer up to

an additional 2% of its outstanding shares without extending the

expiration time of the tender offer.

The tender offer is being made outside of Monster’s existing

stock repurchase programs. The tender offer provides all Monster

shareholders, including Rodney Sacks and Hilton Schlosberg,

Monster’s Co-CEOs, with the opportunity to obtain liquidity for all

or a portion of their shares with less potential disruption than

open-market sales or other transactions. Mr. Sacks and Mr.

Schlosberg have communicated their intent to tender up to 610,000

and 610,000 shares, respectively, for investment diversification

and estate planning purposes. In addition, Sterling Trustees LLC,

which controls trusts and entities for the benefit of certain

family members of Mr. Sacks and Mr. Schlosberg, has advised Monster

that it intends to tender up to an aggregate of 20,500,000 shares

on behalf of such trusts and entities. Mark S. Vidergauz and Mark

J. Hall, who are members of the Board, and Thomas J. Kelly and

Emelie C. Tirre, who are executive officers, have advised us that

they intend to tender up to 20,000, 500,000, 80,000 and 45,000

shares, respectively, that they beneficially own in the Offer. No

other directors or executive officers intend to tender any of their

shares in the tender offer. The tender of shares by Mr. Sacks, in

particular, may provide him some flexibility to consider his own

potential options, which may also help Monster continue succession

planning for its next phase of leadership. In this regard, after

consultation with the Board, Mr. Sacks is considering reducing his

day-to-day management responsibilities starting in 2025, while

continuing to manage certain areas of Monster's business for which

he has always been responsible. At that time, Mr. Sacks intends to

remain Chairman of the Board, and Mr. Schlosberg would segue from

Co-CEO to CEO.

Evercore Group L.L.C. and J.P. Morgan Securities LLC are acting

as dealer managers for the tender offer. D.F. King & Co., Inc.

is serving as the information agent, and Equiniti Trust Company,

LLC is acting as the depositary. The Offer to Purchase, the related

Letter of Transmittal and the other tender offer materials will be

sent to Monster shareholders shortly after commencement of the

tender offer. Each of these documents is also being filed with the

SEC, and shareholders may obtain free copies of these documents

from the SEC’s website at www.sec.gov. Shareholders should read

these materials carefully when they become available because they

will contain important information, including the terms and

conditions of the tender offer. Requests for documents may also be

directed to D.F. King & Co., Inc. at (888) 605-1958 or

MNST@dfking.com. Questions regarding the tender offer may be

directed to Evercore Group L.L.C. at (888) 474-0200 or J.P. Morgan

Securities LLC at (877) 371-5947.

Although Monster has authorized the tender offer, none of the

Board, Monster, the dealer managers, the information agent or the

depositary or any of their affiliates has made, and they are not

making, any recommendation to shareholders as to whether

shareholders should tender or refrain from tendering their shares

or as to the price or prices at which shareholders may choose to

tender their shares. Monster has not authorized any person to make

any such recommendation. Shareholders must make their own decision

as to whether to tender their shares and, if so, how many shares to

tender and the price or prices at which they will tender the

shares. In doing so, shareholders should read carefully the

information in, or incorporated by reference in, the Offer to

Purchase and in the Letter of Transmittal, including the purpose

and effects of the tender offer. Shareholders are urged to discuss

their decision with their own tax advisors, financial advisors

and/or brokers.

This press release is for informational purposes only and does

not constitute an offer to sell, or a solicitation of an offer to

buy, any security. No offer, solicitation or sale will be made in

any jurisdiction in which such an offer, solicitation or sale would

be unlawful, save as in compliance with the requirements of Rule

13e-4(f)(8) promulgated under the Securities Exchange Act of 1934,

as amended. The tender offer is only being made pursuant to the

terms of the Offer to Purchase.

Monster Beverage Corporation

Based in Corona, California, Monster Beverage Corporation is a

holding company and conducts no operating business except through

its consolidated subsidiaries. Monster’s subsidiaries develop and

market energy drinks, including Monster Energy® drinks, Monster

Energy Ultra® energy drinks, Juice Monster® Energy + Juice energy

drinks, Java Monster® non-carbonated coffee + energy drinks, Rehab®

Monster® non-carbonated energy drinks, Monster Energy® Nitro energy

drinks, Reign® Total Body Fuel high performance energy drinks,

Reign Inferno® thermogenic fuel high performance energy drinks,

Reign Storm® total wellness energy drinks, NOS® energy drinks, Full

Throttle® energy drinks, Bang Energy® drinks, BPM® energy drinks,

BU® energy drinks, Burn® energy drinks, Gladiator® energy drinks,

Live+® energy drinks, Mother® energy drinks, Nalu® energy drinks,

Play® and Power Play® (stylized) energy drinks, Relentless® energy

drinks, Samurai® energy drinks, Ultra Energy® drinks, Predator®

energy drinks and Fury® energy drinks. Monster’s subsidiaries also

develop and market still and sparkling waters under the Monster

Tour Water® brand name. Monster’s subsidiaries also develop and

market craft beers, hard seltzers and flavored malt beverages under

a number of brands, including Jai Alai® IPA, Dale’s Pale Ale®,

Dallas Blonde®, Wild Basin® hard seltzers, The Beast Unleashed® and

Nasty Beast™ Hard Tea. For more information visit

www.monsterbevcorp.com.

Caution Concerning Forward-Looking

Statements

Certain statements made in this announcement may constitute

“forward-looking statements.” Monster cautions that these

statements are based on management’s current knowledge and

expectations and are subject to certain risks and uncertainties,

many of which are outside of the control of Monster, that could

cause actual results and events to differ materially from the

statements made herein. For a more detailed discussion of the risks

that could affect Monster’s operating results, see Monster’s

reports filed with the Securities and Exchange Commission,

including Monster’s annual report on Form 10-K for the year ended

December 31, 2023 and subsequently filed reports. Monster’s actual

results could differ materially from those contained in the

forward-looking statements, including with respect to the tender

offer.

CONTACTS:

Rodney C. Sacks Chairman and Co-Chief Executive Officer (951)

739-6200

Hilton H. Schlosberg Vice Chairman and Co-Chief Executive

Officer (951) 739-6200

Roger S. Pondel / Judy Lin PondelWilkinson Inc. (310)

279-5980

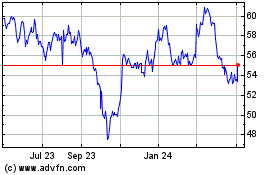

Monster Beverage (NASDAQ:MNST)

Historical Stock Chart

From Dec 2024 to Jan 2025

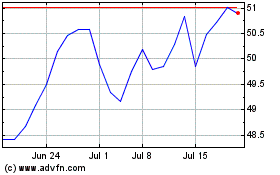

Monster Beverage (NASDAQ:MNST)

Historical Stock Chart

From Jan 2024 to Jan 2025