Monster Beverage Corporation (NASDAQ: MNST) today reported

financial results for the three- and twelve-months ended December

31, 2023.

Fourth Quarter ResultsNet sales for the 2023

fourth quarter increased 14.4 percent to $1.73 billion, from $1.51

billion in the comparable period last year. Net changes in foreign

currency exchange rates had an unfavorable impact on net sales for

the 2023 fourth quarter of $27.1 million. Net sales on a foreign

currency adjusted basis increased 16.1 percent in the 2023 fourth

quarter.

Net sales for the Company’s Monster Energy® Drinks segment,

which primarily includes the Company’s Monster Energy® drinks,

Reign Total Body Fuel® high performance energy drinks, Reign Storm®

total wellness energy drinks, Bang Energy® drinks and Monster Tour

Water®, increased 15.1 percent to $1.60 billion for the 2023 fourth

quarter, from $1.39 billion for the 2022 fourth quarter. Net

changes in foreign currency exchange rates had an unfavorable

impact on net sales for the Monster Energy® Drinks segment of

approximately $18.8 million for the 2023 fourth quarter. Net sales

on a foreign currency adjusted basis for the Monster Energy® Drinks

segment increased 16.5 percent in the 2023 fourth quarter.

Net sales for the Company’s Strategic Brands segment, which

primarily includes the various energy drink brands acquired from

The Coca-Cola Company, as well as the Company’s affordable energy

brands Predator® and Fury®, decreased 1.3 percent to $91.8 million

for the 2023 fourth quarter, from $93.0 million in the 2022 fourth

quarter. Net changes in foreign currency exchange rates had an

unfavorable impact on net sales for the Strategic Brands segment of

approximately $8.3 million for the 2023 fourth quarter. Net sales

on a foreign currency adjusted basis for the Strategic Brands

segment increased 7.7 percent in the 2023 fourth quarter.

Net sales for the Alcohol Brands segment, which is comprised of

The Beast Unleashed® which was launched in the 2023 first quarter,

as well as the various craft beers and hard seltzers purchased as

part of the CANarchy transaction on February 17, 2022, increased

30.6 percent to $35.2 million for the 2023 fourth quarter, from

$26.9 million in the 2022 fourth quarter.

Net sales for the Company’s Other segment, which primarily

includes certain products of American Fruits and Flavors, LLC, a

wholly owned subsidiary of the Company, sold to independent

third-party customers (the “AFF Third-Party Products”), increased

6.2 percent to $4.9 million for the 2023 fourth quarter, from $4.6

million in the 2022 fourth quarter.

Net sales to customers outside the United States increased 17.4

percent to $637.0 million in the 2023 fourth quarter, from $542.5

million in the 2022 fourth quarter. Such sales were approximately

37 percent of total net sales in the 2023 fourth quarter, compared

with 36 percent in the 2022 fourth quarter. Net sales to customers

outside the United States, on a foreign currency adjusted basis,

increased 22.4 percent in the 2023 fourth quarter.

Gross profit as a percentage of net sales for the

2023 fourth quarter was 54.2 percent, compared with 51.8 percent in

the 2022 fourth quarter. The increase in gross profit as a

percentage of net sales was primarily the result of pricing actions

in certain markets, decreased freight-in costs and lower input

costs. Inventory purchased as part of the Bang Transaction was

recorded at fair value. Certain of the purchased inventory was

subsequently sold in the 2023 fourth quarter and was recognized

through cost of sales at fair value (the “Bang Inventory Step-Up”).

As a result of the Bang Inventory Step-Up, gross profit was

adversely impacted by approximately $5.0 million during the 2023

fourth quarter.

Gross profit as a percentage of net sales was 54.5

percent for the 2023 fourth quarter, excluding the Bang Inventory

Step-Up.

Operating expenses for the 2023 fourth quarter were

$504.4 million, compared with $390.0 million in the 2022 fourth

quarter. Operating expenses as a percentage of net sales for the

2023 fourth quarter were 29.2 percent, compared with 25.8 percent

in the 2022 fourth quarter. Operating expenses for the 2023 fourth

quarter included $39.9 million of impairment charges related to the

Alcohol Brands segment (the “Alcohol Impairment Charges”), due in

part to the continuing challenges in the craft beer and seltzer

categories. The Alcohol Impairment Charges relate to certain

non-amortizing intangibles as well as property and equipment

acquired as part of the CANarchy transaction. Exclusive of the

Alcohol Impairment Charges, operating expenses as a percentage of

net sales were 26.8 percent for the 2023 fourth quarter.

Distribution expenses for the 2023 fourth quarter

were $79.6 million, or 4.6 percent of net sales, compared with

$76.1 million, or 5.0 percent of net sales, in the 2022 fourth

quarter.

Selling expenses for the 2023 fourth quarter were

$176.8 million, or 10.2 percent of net sales, compared with $145.3

million, or 9.6 percent of net sales, in the 2022 fourth

quarter.

General and administrative expenses for the 2023

fourth quarter were $248.0 million, or 14.3 percent of net sales,

compared with $168.5 million, or 11.1 percent of net sales, for the

2022 fourth quarter. General and administrative expenses for the

2023 fourth quarter include the Alcohol Impairment Charges.

Exclusive of the Alcohol Impairment Charges, general and

administrative charges as a percentage of net sales were 12.0

percent for the 2023 fourth quarter. Stock-based compensation was

$16.4 million for the 2023 fourth quarter, compared with $14.9

million in the 2022 fourth quarter.

Operating income for the 2023 fourth quarter

increased 10.0 percent to $434.0 million, from $394.4 million in

the 2022 fourth quarter, primarily as a result of an increase in

net sales, as well as an increase in gross profit as a percentage

of net sales. Operating income, adjusted for the Bang Inventory

Step-Up and Alcohol Impairment Charges, increased 21.4 percent to

$478.9 million in the 2023 fourth quarter.

The effective tax rate for the 2023 fourth quarter

was 18.5 percent, compared with 23.3 percent in the 2022 fourth

quarter. The decrease in the effective tax rate for the 2023 fourth

quarter was primarily due to a large increase in the tax benefit

related to the exercise of non-qualified stock options.

Net income for the 2023 fourth quarter increased

21.6 percent to $367.0 million, from $301.7 million in the 2022

fourth quarter. Net income, adjusted for the Bang Inventory Step-Up

and Alcohol Impairment Charges, net of tax, increased 33.1 percent

to $401.5 million in the 2023 fourth quarter. Net income per

diluted share for the 2023 fourth quarter increased 22.3 percent to

$0.35, from $0.29 in the fourth quarter of 2022. Net income per

diluted share, adjusted for the Bang Inventory Step-Up and Alcohol

Impairment Charges was $0.38 for the 2023 fourth quarter.

Hilton H. Schlosberg, Vice Chairman and Co-Chief

Executive Officer, said, “We continue to see sound growth in the

energy drink market globally. We are pleased to report another

quarter of solid revenue growth, with record sales for our fourth

quarter and 2023 financial year. The quarter and the 2023 financial

year were again impacted by unfavorable foreign currency exchange

rates.

“Gross profit margins in the quarter improved

significantly as compared to the 2022 fourth quarter, primarily the

result of pricing actions, decreased freight-in costs and

lower input costs. Gross profit margins also improved sequentially

from the previous quarters.

“The Bang Energy acquisition has been successfully

integrated and is performing according to expectations.”

“Operating expenses for the Alcohol Brands Segment

included impairment charges of $39.9 million for the 2023 fourth

quarter, relating to certain acquired non-amortizing intangibles as

well as property and equipment, as a result of the continuing

challenges in the craft beer and seltzer categories,” Schlosberg

said.

Rodney C. Sacks, Chairman and Co-Chief Executive

Officer, said, “Innovation continues to play an important role

in our strategy and contributed to our record sales in 2023. In

particular, among our innovation products in the United States,

Monster Energy® Zero Sugar and Monster Energy Ultra® Strawberry

Dreams™ are standouts. We have a wide range of new

innovation products planned for 2024 in the United States including

our new Monster Energy® Ultra Fantasy Ruby Red™ and Juice Monster®

Rio Punch™ products.

“Monster Energy® Zero Sugar was launched in Great

Britain, Ireland and Poland in the second half of 2023 with

additional launches planned throughout EMEA in 2024.

“We achieved our goal of securing availability of

The Beast Unleashed® throughout most of the United States by the

end of last year and have commenced with the roll-out of The Beast

Unleashed® in 24 oz. single serve cans in the convenience and gas

channel. We are currently launching Nasty Beast™, our new hard tea,

in 12 oz. variety packs, as well as in 24 oz. single serve cans.

Our innovation pipeline for both our non-alcohol and alcohol

beverages remains strong,” Sacks said.

2023 Full-Year ResultsNet sales

for the year ended December 31, 2023 increased 13.1 percent to

$7.14 billion, from $6.31 billion in the comparable period last

year. Net changes in foreign currency exchange rates had an

unfavorable impact on net sales for the year ended

December 31, 2023 of $146.7 million. Net sales on a foreign

currency adjusted basis increased 15.5 percent for the year ended

December 31, 2023.

Gross profit, as a percentage of net sales, for the

year ended December 31, 2023 was 53.1 percent, compared with 50.3

percent in the comparable period last year.

Operating expenses for the year ended December 31,

2023 were $1.84 billion, compared with $1.59 billion in the

comparable period last year.

Operating income for the year ended

December 31, 2023 increased to $1.95 billion, from $1.58

billion in the comparable period last year.

The effective tax rate was 21.2 percent for the

year ended December 31, 2023, compared with 24.2 percent in the

comparable period last year.

Net income for the year ended December 31, 2023

increased 36.9 percent to $1.63 billion, from $1.19 billion in the

comparable period last year. Net income per diluted share for

the year ended December 31, 2023 increased 38.0 percent to $1.54,

from $1.12 in the comparable period last year.

Share Repurchase ProgramDuring the

2023 fourth quarter, the Company purchased approximately 0.8

million shares of its common stock at an average purchase price of

$54.57 per share, for a total amount of $43.2 million (excluding

broker commissions). As of February 27, 2024, approximately $642.4

million remained available for repurchase under the previously

authorized repurchase programs.

Investor Conference CallThe

Company will host an investor conference call today, February 28,

2024, at 2:00 p.m. Pacific Time (5:00 p.m. Eastern Time). The

conference call will be open to all interested investors through a

live audio web broadcast via the internet at www.monsterbevcorp.com

in the “Events & Presentations” section. For those who are not

able to listen to the live broadcast, the call will be archived for

approximately one year on the website.

Monster Beverage CorporationBased in Corona,

California, Monster Beverage Corporation is a holding company and

conducts no operating business except through its consolidated

subsidiaries. The Company’s subsidiaries develop and market energy

drinks, including Monster Energy® drinks, Monster Energy Ultra®

energy drinks, Juice Monster® Energy + Juice energy drinks, Java

Monster® non-carbonated coffee + energy drinks, Rehab® Monster®

non-carbonated energy drinks, Monster Energy® Nitro energy drinks,

Reign® Total Body Fuel high performance energy drinks, Reign

Inferno® thermogenic fuel high performance energy drinks, Reign

Storm® total wellness energy drinks, NOS® energy drinks, Full

Throttle® energy drinks, Bang Energy® drinks, BPM® energy drinks,

BU® energy drinks, Burn® energy drinks, Gladiator® energy drinks,

Live+® energy drinks, Mother® energy drinks, Nalu® energy drinks,

Play® and Power Play® (stylized) energy drinks, Relentless® energy

drinks, Samurai® energy drinks, Ultra Energy® drinks, Predator®

energy drinks and Fury® energy drinks. The Company’s subsidiaries

also develop and market still and sparkling waters under the

Monster Tour Water® brand name. The Company’s subsidiaries also

develop and market craft beers, hard seltzers and flavored malt

beverages under a number of brands, including Jai Alai® IPA, Dale’s

Pale Ale®, Dallas Blonde®, Wild Basin® hard seltzers, The Beast

Unleashed® and Nasty Beast™ Hard Tea. For more information visit

www.monsterbevcorp.com.

Caution Concerning Forward-Looking

StatementsCertain statements made in this announcement may

constitute “forward-looking statements” within the meaning of the

U.S. federal securities laws, as amended, regarding the

expectations of management with respect to our future operating

results and other future events including revenues and

profitability. The Company cautions that these statements are based

on management’s current knowledge and expectations and are subject

to certain risks and uncertainties, many of which are outside of

the control of the Company, that could cause actual results and

events to differ materially from the statements made herein. Such

risks and uncertainties include, but are not limited to, the

following: the impact of the military conflict in Ukraine,

including supply chain disruptions, volatility in commodity prices,

increased economic uncertainty and escalating geopolitical

tensions; our extensive commercial arrangements with The Coca-Cola

Company (TCCC) and, as a result, our future performance’s

substantial dependence on the success of our relationship with

TCCC; our ability to implement our growth strategy, including

expanding our business in existing and new sectors; the inherent

operational risks presented by the alcoholic beverage industry that

may not be adequately covered by insurance or lead to litigation

relating to the abuse or misuse of our products; our ability to

successfully integrate Bang Energy® businesses and assets,

transition the acquired beverages to the Company’s primary

distributors, and retain and increase sales of the acquired

beverages; exposure to significant liabilities due to litigation,

legal or regulatory proceedings; intellectual property injunctions;

unanticipated litigation concerning the Company’s products; the

current uncertainty and volatility in the national and global

economy and changes in demand due to such economic conditions;

changes in consumer preferences; adverse publicity surrounding

obesity, alcohol consumption and other health concerns related to

our products, product safety and quality; activities and strategies

of competitors, including the introduction of new products and

competitive pricing and/or marketing of similar products; changes

in the price and/or availability of raw materials; other supply

issues, including the availability of products and/or suitable

production facilities including limitations on co-packing

availability including retort production; disruption to our

manufacturing facilities and operations related to climate, labor,

production difficulties, capacity limitations, regulations or other

causes; product distribution and placement decisions by retailers;

the effects of retailer and/or bottler/distributor consolidation on

our business; unilateral decisions by bottlers/distributors, buying

groups, convenience chains, grocery chains, mass merchandisers,

specialty chain stores, e-commerce retailers, e-commerce websites,

club stores and other customers to discontinue carrying all or any

of our products that they are carrying at any time, restrict the

range of our products they carry, impose restrictions or

limitations on the sale of our products and/or the sizes of

containers for our products and/or devote less resources to the

sale of our products; changes in governmental regulation; the

imposition of new and/or increased excise sales and/or other taxes

on our products; our ability to adapt to the changing retail

landscape with the rapid growth in e-commerce retailers and

e-commerce websites; the impact of proposals to limit or restrict

the sale of energy or alcohol drinks to minors and/or persons below

a specified age and/or restrict the venues and/or the size of

containers in which energy or alcohol drinks can be sold; possible

recalls of our products and/or the consequences and costs of

defective production; or our ability to absorb, reduce or pass on

to our bottlers/distributors increases in commodity costs,

including freight costs. For a more detailed discussion of these

and other risks that could affect our operating results, see the

Company’s reports filed with the Securities and Exchange

Commission, including our annual report on Form 10-K for the year

ended December 31, 2022 and our subsequently filed quarterly

reports. The Company’s actual results could differ materially from

those contained in the forward-looking statements. The Company

assumes no obligation to update any forward-looking statements,

whether as a result of new information, future events or

otherwise.

(tables below)

MONSTER BEVERAGE CORPORATION AND

SUBSIDIARIESCONDENSED CONSOLIDATED STATEMENTS OF

INCOME AND OTHER INFORMATIONFOR THE THREE- AND

TWELVE-MONTHS ENDED DECEMBER 31, 2023 AND 2022(In

Thousands, Except Per Share Amounts)

(Unaudited)

|

|

|

|

Three-Months Ended |

|

Twelve-Months Ended |

|

|

December 31, |

|

December 31, |

|

|

2023 |

|

2022 |

|

2023 |

|

2022 |

|

|

|

|

|

|

|

|

|

|

Net sales¹ |

$ |

1,730,108 |

|

|

$ |

1,512,930 |

|

|

$ |

7,140,027 |

|

|

$ |

6,311,050 |

|

| |

|

|

|

|

|

|

|

| Cost of sales |

|

791,736 |

|

|

|

728,615 |

|

|

|

3,345,821 |

|

|

|

3,136,483 |

|

| |

|

|

|

|

|

|

|

| Gross profit¹ |

|

983,372 |

|

|

|

784,315 |

|

|

|

3,794,206 |

|

|

|

3,174,567 |

|

| Gross profit as a percentage

of net sales |

|

54.2% |

|

|

|

51.8% |

|

|

|

53.1% |

|

|

|

50.3% |

|

| |

|

|

|

|

|

|

|

| Operating expenses |

|

504,414 |

|

|

|

389,964 |

|

|

|

1,840,851 |

|

|

|

1,589,846 |

|

| Operating expenses as a

percentage of net sales |

|

29.2% |

|

|

|

25.8% |

|

|

|

25.8% |

|

|

|

25.2% |

|

| |

|

|

|

|

|

|

|

| Operating income¹ |

|

433,958 |

|

|

|

394,351 |

|

|

|

1,953,355 |

|

|

|

1,584,721 |

|

| Operating income as a

percentage of net sales |

|

25.1% |

|

|

|

26.1% |

|

|

|

27.4% |

|

|

|

25.1% |

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Interest and other income

(expense), net |

|

16,117 |

|

|

|

(825 |

) |

|

|

115,127 |

|

|

|

(12,757 |

) |

| |

|

|

|

|

|

|

|

| Income before provision for

income taxes¹ |

|

450,075 |

|

|

|

393,526 |

|

|

|

2,068,482 |

|

|

|

1,571,964 |

|

| |

|

|

|

|

|

|

|

| Provision for income

taxes |

|

83,097 |

|

|

|

91,853 |

|

|

|

437,494 |

|

|

|

380,340 |

|

| Income taxes as a percentage

of income before taxes |

|

18.5% |

|

|

|

23.3% |

|

|

|

21.2% |

|

|

|

24.2% |

|

| |

|

|

|

|

|

|

|

| Net income |

$ |

366,978 |

|

|

$ |

301,673 |

|

|

$ |

1,630,988 |

|

|

$ |

1,191,624 |

|

| Net income as a percentage of

net sales |

|

21.2% |

|

|

|

19.9% |

|

|

|

22.8% |

|

|

|

18.9% |

|

| |

|

|

|

|

|

|

|

| Net income per common

share: |

|

|

|

|

|

|

|

|

Basic |

$ |

0.35 |

|

|

$ |

0.29 |

|

|

$ |

1.56 |

|

|

$ |

1.13 |

|

|

Diluted |

$ |

0.35 |

|

|

$ |

0.29 |

|

|

$ |

1.54 |

|

|

$ |

1.12 |

|

| |

|

|

|

|

|

|

|

| Weighted average number of

shares of common stock and common stock equivalents: |

|

|

|

|

|

|

|

|

Basic |

|

1,040,584 |

|

|

|

1,044,746 |

|

|

|

1,044,887 |

|

|

|

1,053,558 |

|

|

Diluted |

|

1,052,524 |

|

|

|

1,058,310 |

|

|

|

1,057,981 |

|

|

|

1,066,442 |

|

| |

|

|

|

|

|

|

|

| Energy Drink Case sales (in

thousands) (in 192-ounce case equivalents) |

|

185,304 |

|

|

|

166,227 |

|

|

|

769,241 |

|

|

|

701,677 |

|

| Average net sales per

case2 |

$ |

9.12 |

|

|

$ |

8.91 |

|

|

$ |

9.01 |

|

|

$ |

8.82 |

|

| |

|

|

|

|

|

|

|

¹Includes $10.0 million and $9.9 million for the

three-months ended December 31, 2023 and 2022, respectively,

related to the recognition of deferred revenue. Includes $40.0

million for both the twelve-months ended December 31, 2023 and

2022, related to the recognition of deferred revenue.

2Excludes Alcohol Brands segment and Other

segment average net sales per case.

MONSTER BEVERAGE CORPORATION AND

SUBSIDIARIESCONDENSED CONSOLIDATED BALANCE

SHEETSAS OF DECEMBER 31, 2023 AND

2022(In Thousands, Except Par Value)

(Unaudited)

|

|

|

|

December 31,2023 |

|

December 31,2022 |

|

ASSETS |

|

|

|

| CURRENT ASSETS: |

|

|

|

|

Cash and cash equivalents |

$ |

2,297,675 |

|

|

$ |

1,307,141 |

|

| Short-term investments |

|

955,605 |

|

|

|

1,362,314 |

|

| Accounts receivable, net |

|

1,193,964 |

|

|

|

1,016,203 |

|

| Inventories |

|

971,406 |

|

|

|

935,631 |

|

| Prepaid expenses and other

current assets |

|

116,195 |

|

|

|

109,823 |

|

| Prepaid income taxes |

|

54,151 |

|

|

|

33,785 |

|

|

Total current assets |

|

5,588,996 |

|

|

|

4,764,897 |

|

| |

|

|

|

| INVESTMENTS |

|

76,431 |

|

|

|

61,443 |

|

| PROPERTY AND EQUIPMENT,

net |

|

890,796 |

|

|

|

516,897 |

|

| DEFERRED INCOME TAXES,

net |

|

175,003 |

|

|

|

177,039 |

|

| GOODWILL |

|

1,417,941 |

|

|

|

1,417,941 |

|

| OTHER INTANGIBLE ASSETS,

net |

|

1,427,139 |

|

|

|

1,220,410 |

|

| OTHER ASSETS |

|

110,216 |

|

|

|

134,478 |

|

|

Total Assets |

$ |

9,686,522 |

|

|

$ |

8,293,105 |

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

| CURRENT LIABILITIES: |

|

|

|

| Accounts payable |

$ |

564,379 |

|

|

$ |

444,265 |

|

| Accrued liabilities |

|

183,988 |

|

|

|

172,991 |

|

| Accrued promotional

allowances |

|

269,061 |

|

|

|

255,631 |

|

| Deferred revenue |

|

41,914 |

|

|

|

43,311 |

|

| Accrued compensation |

|

87,392 |

|

|

|

72,463 |

|

| Income taxes payable |

|

14,955 |

|

|

|

13,317 |

|

|

Total current liabilities |

|

1,161,689 |

|

|

|

1,001,978 |

|

| |

|

|

|

| DEFERRED REVENUE |

|

204,251 |

|

|

|

223,800 |

|

| |

|

|

|

| OTHER LIABILITIES |

|

91,838 |

|

|

|

42,286 |

|

| |

|

|

|

| STOCKHOLDERS' EQUITY: |

|

|

|

| |

|

|

|

|

|

|

|

| Common stock - $0.005 par

value; 5,000,000 shares authorized; 1,122,592 shares issued and

1,041,571 shares outstanding as of December 31, 2023; 1,283,688

shares issued and 1,044,600 shares outstanding as of December 31,

2022 |

|

5,613 |

|

|

|

6,418 |

|

| Additional paid-in

capital |

|

4,975,115 |

|

|

|

4,776,804 |

|

| Retained earnings |

|

5,939,736 |

|

|

|

9,001,173 |

|

| Accumulated other

comprehensive loss |

|

(125,337 |

) |

|

|

(159,073 |

) |

| Common stock in treasury, at

cost; 81,021 shares and 239,088 shares as of December 31, 2023 and

December 31, 2022, respectively |

|

(2,566,383 |

) |

|

|

(6,600,281 |

) |

|

Total stockholders' equity |

|

8,228,744 |

|

|

|

7,025,041 |

|

|

Total Liabilities and Stockholders’ Equity |

$ |

9,686,522 |

|

|

$ |

8,293,105 |

|

| |

| CONTACTS: |

Rodney C.

Sacks |

| |

Chairman and Co-Chief Executive Officer |

| |

(951) 739-6200 |

| |

|

| |

Hilton H. Schlosberg |

| |

Vice Chairman and Co-Chief Executive Officer |

| |

(951) 739-6200 |

| |

|

| |

Roger S. Pondel / Judy Lin |

| |

PondelWilkinson Inc. |

| |

(310) 279-5980 |

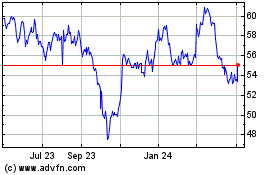

Monster Beverage (NASDAQ:MNST)

Historical Stock Chart

From Jan 2025 to Feb 2025

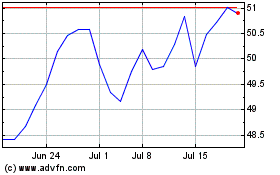

Monster Beverage (NASDAQ:MNST)

Historical Stock Chart

From Feb 2024 to Feb 2025