- 74.3% “BTC Yield” KPI achieved in FY 2024 and 2.9% in QTD

2025

- Revises annual BTC Yield target to a minimum of 15% for

2025

- Announces new “BTC Gain” and “BTC $ Gain” KPIs

- Announces an annual “BTC $ Gain” target of $10 billion for

2025

MicroStrategy® Incorporated d/b/a Strategy™ (Nasdaq: MSTR)

(“Strategy” or the “Company”), the largest corporate holder of

bitcoin and the world’s first Bitcoin Treasury Company, today

announced financial results for the three-month period ended

December 31, 2024 (the fourth quarter of its 2024 fiscal year).

"Earlier today, we announced that we are now Strategy, a new

name that powerfully and succinctly conveys the universal and

global appeal of our company. Strategy is at the cutting edge of

innovation, championing the two most transformative technologies of

the 21st century: Bitcoin and AI. We have completed $20 billion of

our $42 billion capital plan, significantly ahead of our initial

timelines, while leading the digital transformation of capital in

the financial markets. Looking ahead to the rest of 2025, we are

well-positioned to further enhance shareholder value by leveraging

the strong support from institutional and retail investors for our

strategic plan," said Phong Le, President and Chief Executive

Officer.

"The fourth quarter of 2024 marked our largest ever increase in

quarterly bitcoin holdings, culminating in the acquisition of

218,887 bitcoins acquired for $20.5 billion, since the end of Q3.

We carried this strong momentum forward into Q1, raising an

additional $584 million through the launch and upsize of the

inaugural STRK convertible preferred offering which was supported

by both institutional and retail investors. 2025 will take our

evolution further with the introduction of the BTC $ Gain KPI and

when we adopt fair value accounting for our bitcoin holdings with

our Q1 results, transforming our financial results and bringing

more transparency to the value generation and profitability of our

treasury operations," said Andrew Kang, Chief Financial

Officer.

On August 7, 2024, the Company completed a 10-for-1 stock split

of the Company’s class A and class B common stock. All prior period

share and per share information presented herein has been

retroactively adjusted to reflect the stock split.

Bitcoin Treasury Highlights

- “BTC Yield” KPI: For the full year 2024, the Company’s

BTC Yield was 74.3%. The Company is revising its 2025 target to

achieve an annual BTC Yield of more than 15%. BTC Yield is a key

performance indicator (“KPI”) that the Company uses to help assess

the performance of its strategy of acquiring bitcoin in a manner

the Company believes is accretive to shareholders. See “Important

Information about BTC Yield, BTC Gain and BTC $ Gain KPIs” in this

press release for the definition of BTC Yield and how it is

calculated.

- “BTC Gain” and “BTC $ Gain” KPIs: For the full year

2024, the Company’s BTC Gain was 140,538. The Company’s 2025 target

is to achieve an annual BTC $ Gain of $10 billion. BTC Gain and BTC

$ Gain are KPIs that the Company uses to assess the performance of

its strategy of acquiring bitcoin in a manner the Company believes

is accretive to shareholders. See “Important Information about BTC

Yield, BTC Gain and BTC $ Gain KPIs” in this press release for

definitions of BTC Gain and BTC $ Gain and how these metrics are

calculated.

- Digital Assets: As of December 31, 2024, the carrying

value of the Company’s digital assets (comprised of approximately

447,470 bitcoins) was $23.909 billion. As of December 31, 2024, the

original cost basis and market value of the Company’s bitcoin were

$27.968 billion and $41.789 billion, respectively, which reflects

an average cost per bitcoin of approximately $62,503 and a market

price per bitcoin of $93,390, respectively. On January 1, 2025, we

adopted ASU 2023-08. ASU 2023-08 requires us to measure our bitcoin

holdings at fair value in our statement of financial position, with

gains and losses from change in the fair value of our bitcoin

recognized in net income each reporting period. As a result of our

adoption of ASU 2023-08, as of January 1, 2025, we are required to

apply a cumulative-effect net increase to the opening balance of

our retained earnings of $12.745 billion.

- At-the-Market Equity Offering Program: During the three

months ended December 31, 2024, the Company issued and sold

42,308,443 shares of its class A common stock for aggregate net

proceeds of approximately $15.1 billion. Between January 1, 2025

and February 2, 2025, the Company issued and sold an additional

6,487,654 shares of its class A common stock for aggregate net

proceeds of approximately $2.4 billion. As of February 2, 2025,

approximately $4.3 billion of the Company's class A common stock

remained available for issuance and sale pursuant to its current

at-the-market equity offering program.

- Issuance of 2029 Convertible Notes: In November 2024,

the Company issued $3.0 billion aggregate principal amount of 0%

Convertible Senior Notes due 2029 (the “2029 Convertible Notes”)

with an initial conversion price of $672.40 per share of class A

common stock, for net proceeds of approximately $2.97 billion,

after deducting the initial purchasers’ discounts and commissions

and estimated offering expenses.

- Issuance of Perpetual Strike Preferred Stock: In January

2025, the Company issued 7,300,000 shares of 8.00% Series A

Perpetual Strike Preferred Stock (the “perpetual strike preferred

stock”), at a public offering price of $80.00 per share for net

proceeds of approximately $563.4 million, after deducting the

underwriting discounts and commissions and estimated offering

expenses. The perpetual strike preferred stock has a liquidation

preference of $100 per share and accumulates cumulative dividends

on the liquidation preference at a fixed rate of 8.00% per

annum.

- Redemption and Conversions of 2027 Convertible Notes: On

January 24, 2025, the Company announced that it delivered a notice

of redemption (the “Redemption Notice”) to the trustee of its 0.0%

Convertible Senior Notes due 2027 (the “2027 Convertible Notes”)

for redemption of all $1.05 billion in aggregate principal amount

of the 2027 Convertible Notes then outstanding on February 24, 2025

(the “Redemption Date”). As a result of the delivery of the

Redemption Notice, at any time prior to 5:00 p.m., New York City

time, on February 20, 2025, the 2027 Notes are convertible, at the

option of the holders of the 2027 Notes, at the applicable

conversion rate of 7.0234 shares of the Company’s class A common

stock per $1,000 principal amount (reflecting a conversion price of

$142.38 per share). In the event that any holder delivers a

conversion notice as provided in the indenture related to the 2027

Notes, the Company has elected to satisfy its conversion obligation

with respect to each $1,000 principal amount of 2027 Notes by

delivering solely shares of its class A common stock, together with

cash in lieu of any fractional shares.

- Increase in Authorized Class A Common Stock and Preferred

Stock. In January 2025, the Company’s stockholders approved an

amendment to the Company’s Certificate of Incorporation increasing

the number of authorized shares of class A common Stock from

330,000,000 to 10,330,000,000 and the number of authorized shares

of preferred stock from 5,000,000 to 1,005,000,000.

Q4 2024 Software Business Highlights

- Revenues:

- Total revenues were $120.7 million, a 3.0% decrease

year-over-year.

- Subscription Services Revenues were $31.9 million, a 48.4%

increase year-over-year.

- Product licenses and subscription services revenues were $47.2

million, a 18.3% increase year-over-year.

- Product support revenues were $58.4 million, an 10.8% decrease

year-over-year.

- Other services revenues were $15.1 million, an 20.8% decrease

year-over-year.

- Gross Profit: Gross profit was $86.5 million,

representing a 71.7% gross margin, compared to $96.3 million,

representing a gross margin of 77.3%, for the fourth quarter of

2023.

Other Q4 Financial Highlights

- Operating Expenses: Operating expenses were $1.103

billion, a 693.2% increase year-over-year. Operating expenses

include impairment losses on the Company’s digital assets, which

were $1.006 billion, compared to $39.2 million in the fourth

quarter of 2023.

- Loss from Operations and Net (Loss) Income: Loss from

operations was $1.016 billion, compared to $42.8 million for the

fourth quarter of 2023. Net loss was $670.8 million, or $3.03 per

share on a diluted basis, as compared to net income of $89.1

million, or $0.50 per share on a diluted basis, for the fourth

quarter of 2023.

- Cash and Cash Equivalents: As of December 31, 2024, the

Company had cash and cash equivalents of $38.1 million, as compared

to $46.8 million as of December 31, 2023, a decrease of $8.7

million.

The tables provided at the end of this press release include a

reconciliation of the most directly comparable financial measures

prepared in accordance with generally accepted accounting

principles in the United States (“GAAP”) to non-GAAP financial

measures for the three and twelve months ended December 31, 2024

and 2023. An explanation of non-GAAP financial measures is also

included under the heading “Non-GAAP Financial Measures” below.

Additional non-GAAP financial measures are included in Strategy’s

“Q4 2024 Earnings Presentation,” which will be available under the

“Events and Presentations” section of Strategy’s investor relations

website at https://www.strategy.com/investor-relations.

Strategy Dashboard

Strategy today announced that it is launching a dashboard on its

website, to be available at strategy.com, as a disclosure channel

to provide broad, non-exclusionary distribution of information

regarding the Company to the public. Some of the information

distributed through the website dashboard may be considered

material information. The website dashboard will include

information regarding market data for our securities and bitcoin,

BTC Yield, BTC Gain and BTC $ Gain KPIs, bitcoin purchases,

bitcoin holdings, capital markets activity, and other related

information. Investors and others are encouraged to regularly

review the information that the Company makes public via the

website dashboard.

Conference Call

Strategy will be discussing its fourth quarter 2024 financial

results on a live Video Webinar today beginning at approximately

5:00 p.m. ET. The live Video Webinar and accompanying presentation

materials will be available under the “Events and Presentations”

section of Strategy’s investor relations website at

https://www.strategy.com/investor-relations. Log-in instructions

will be available after registering for the event. An archived

replay of the event will be available beginning approximately two

hours after the call concludes.

About Strategy

MicroStrategy Incorporated d/b/a Strategy (Nasdaq: MSTR) is the

world's first and largest Bitcoin Treasury Company. We are a

publicly traded company that has adopted Bitcoin as our primary

treasury reserve asset. By using proceeds from equity and debt

financings, as well as cash flows from our operations, we

strategically accumulate Bitcoin and advocate for its role as

digital capital. Our treasury strategy is designed to provide

investors varying degrees of economic exposure to Bitcoin by

offering a range of securities, including equity and fixed-income

instruments. In addition, we provide industry-leading AI-powered

enterprise analytics software, advancing our vision of Intelligence

Everywhere. We leverage our development capabilities to explore

innovation in Bitcoin applications, integrating analytics expertise

with our commitment to digital asset growth. We believe our

combination of operational excellence, strategic Bitcoin reserve,

and focus on technological innovation positions us as a leader in

both the digital asset and enterprise analytics sectors, offering a

unique opportunity for long-term value creation.

Strategy, MicroStrategy, and Intelligence Everywhere are either

trademarks or registered trademarks of MicroStrategy Incorporated

in the United States and certain other countries. Other product and

company names mentioned herein may be the trademarks of their

respective owners.

Non-GAAP Financial Measures

Strategy is providing supplemental financial measures for (i)

non-GAAP loss from operations that excludes the impact of

share-based compensation expense, (ii) non-GAAP net (loss) income

and non-GAAP diluted (loss) earnings per share that exclude the

impacts of share-based compensation expense, interest expense

arising from the amortization of debt issuance costs related to

Strategy’s long-term debt, gains and losses on debt extinguishment,

and related income tax effects, and (iii) non-GAAP constant

currency revenues that exclude certain foreign currency exchange

rate fluctuations. These supplemental financial measures are not

measurements of financial performance under GAAP and, as a result,

these supplemental financial measures may not be comparable to

similarly titled measures of other companies. Management uses these

non-GAAP financial measures internally to help understand, manage,

and evaluate business performance and to help make operating

decisions.

Strategy believes that these non-GAAP financial measures are

also useful to investors and analysts in comparing its performance

across reporting periods on a consistent basis. The first

supplemental financial measure excludes a significant non-cash

expense that Strategy believes is not reflective of its general

business performance, and for which the accounting requires

management judgment and the resulting share-based compensation

expense could vary significantly in comparison to other companies.

The second set of supplemental financial measures excludes the

impacts of (i) share-based compensation expense, (ii) non-cash

interest expense arising from the amortization of debt issuance

costs related to Strategy’s long-term debt, (iii) gains and losses

on debt extinguishment, and (iv) related income tax effects. The

third set of supplemental financial measures excludes changes

resulting from certain fluctuations in foreign currency exchange

rates so that results may be compared to the same period in the

prior year on a non-GAAP constant currency basis. Strategy believes

the use of these non-GAAP financial measures can also facilitate

comparison of Strategy’s operating results to those of its

competitors.

Important Information About BTC Yield, BTC Gain and BTC $

Gain KPIs

BTC Yield is a key performance indicator (“KPI”) that

represents the percentage change, during a period, of the ratio

between the Company’s bitcoin holdings and its Assumed Diluted

Shares Outstanding, where:

- “Assumed Diluted Shares Outstanding” refers to the aggregate of

our Basic Shares Outstanding as of the end of each period plus all

additional shares that would result from the assumed conversion of

all outstanding convertible notes and convertible preferred stock,

exercise of all outstanding stock option awards, and settlement of

all outstanding restricted stock units and performance stock units.

Assumed Diluted Shares Outstanding is not calculated using the

treasury method and does not take into account any vesting

conditions (in the case of equity awards), the exercise price of

any stock option awards or any contractual conditions limiting

convertibility of convertible debt instruments.

- “Basic Shares Outstanding” reflects the actual class A common

stock and class B common stock outstanding as of the dates

presented. For purposes of this calculation, outstanding shares of

such stock are deemed to include shares, if any, that were sold

under at-the-market equity offering programs or that were to be

issued pursuant to options that had been exercised or restricted

stock units that have vested, but which in each case were pending

issuance as of the dates presented.

BTC Gain is a KPI that represents the number of bitcoins

held by the Company at the beginning of a period multiplied by the

BTC Yield for such period.

BTC $ Gain is a KPI that represents the dollar value of

the BTC Gain calculated by multiplying the BTC Gain by the market

price of bitcoin as of 4:00pm ET on the Coinbase exchange on the

last day of the applicable period. The Company has selected 4:00pm

ET on the last day of the applicable period as the date and time of

determination of the market price of bitcoin solely for the purpose

of facilitating this illustrative calculation.

The Company uses BTC Yield, BTC Gain and BTC $ Gain as KPIs to

help assess the performance of its strategy of acquiring bitcoin in

a manner the Company believes is accretive to shareholders. The

Company believes these KPIs can be used to supplement an investor’s

understanding of the Company’s decision of the manner in which it

funds the purchase of bitcoin and the value created in a period

by:

- in the case of BTC Yield, comparing the rate of change in the

Company’s bitcoin holdings as compared to the rate of change in the

number of shares of its common stock and instruments convertible to

common stock;

- in the case of BTC Gain, hypothetically expressing the change

reflected in the BTC Yield metric as if it reflected an increase in

the amount of bitcoin held at the end the applicable period as

compared to the beginning of such period; and

- in the case of BTC $ Gain, further expressing that gain as a

dollar value by multiplying that bitcoin-denominated gain by the

market price of bitcoin at the end of the applicable period as

described above.

When the Company uses these KPIs, management also takes into

account the various limitations of these metrics, including that

they do not take into account debt, preferred stock and other

liabilities and claims on company assets that would be senior to

common equity and that they assume that all indebtedness will be

refinanced or, in the case of the Company’s senior convertible debt

instruments and convertible preferred stock, converted into shares

of common stock in accordance with their respective terms.

Additionally, BTC Yield is not, and should not be understood as,

an operating performance measure or a financial or liquidity

measure. In particular, BTC Yield is not equivalent to “yield” in

the traditional financial context. It is not a measure of the

return on investment the Company’s shareholders may have achieved

historically or can achieve in the future by purchasing stock of

the Company, or a measure of income generated by the Company’s

operations or its bitcoin holdings, return on investment on its

bitcoin holdings, or any other similar financial measure of the

performance of its business or assets.

BTC Gain and BTC $ Gain are not, and should not be understood

as, operating performance measures or financial or liquidity

measures. In particular, BTC Gain and BTC $ Gain are not equivalent

to “gain” in the traditional financial context. They also are not

measures of the return on investment the Company’s shareholders may

have achieved historically or can achieve in the future by

purchasing stock of the Company, or measures of income generated by

the Company’s operations or its bitcoin holdings, return on

investment on its bitcoin holdings, or any other similar financial

measure of the performance of its business or assets. It should

also be understood that BTC $ Gain does not represent a fair value

gain of the Company’s bitcoin holdings, and BTC $ Gain may be

positive during periods when the Company has incurred fair value

losses on its bitcoin holdings.

The trading price of the Company’s class A common stock is

informed by numerous factors in addition to the amount of bitcoins

the Company holds and number of actual or potential shares of its

stock outstanding, and as a result, the market value of the

Company’s shares may trade at a discount or a premium relative to

the market value of the bitcoin the Company holds, and neither BTC

Yield, BTC Gain nor BTC $ Gain are indicative or predictive of the

trading price of the Company’s securities.

As noted above, these KPIs are narrow in their purpose and are

used by management to assist it in assessing whether the Company is

using equity capital in a manner accretive to shareholders solely

as it pertains to its bitcoin holdings.

In calculating these KPIs, the Company does not take into

account the source of capital used for the acquisition of its

bitcoin. The Company notes in particular, it has acquired bitcoin

using proceeds from the offering of its 6.125% Senior Secured Notes

due 2028 (which the Company has since redeemed), which were not

convertible to shares of the Company’s common stock, as well as

from the offerings of its convertible senior notes, which at the

time of issuance had, and may from time-to-time thereafter have,

conversion prices above the current trading prices of the Company’s

common stock, or as to which the holders of such convertible notes

may not then be entitled to exercise the conversion rights of the

notes. Such offerings have had the effect of increasing the BTC

Yield, BTC Gain and BTC $ Gain without taking into account the

corresponding debt. Conversely, if any of the Company’s convertible

notes mature or are redeemed without being converted into common

stock, the Company may be required to sell shares in quantities

greater than the shares such notes are convertible into or generate

cash proceeds from the sale of bitcoin, either of which would have

the effect of decreasing the BTC Yield, BTC Gain and BTC $ Gain due

to changes in the Company’s bitcoin holdings and shares in ways

that were not contemplated by the assumptions in calculating BTC

Yield, BTC Gain and BTC $ Gain, respectively. Accordingly, these

metrics might overstate or understate the accretive nature of the

Company’s use of equity capital to buy bitcoin because not all

bitcoin may be acquired using proceeds of equity offerings and not

all issuances of equity may involve the acquisition of bitcoin.

In addition, we are required to pay dividends with respect to

our perpetual strike preferred stock in perpetuity. We could pay

these dividends with cash or by issuing shares of class A common

stock. If we issue shares of class A common stock in lieu of paying

dividends in cash, or if we issue shares of class A common stock

for cash to fund the payment of dividends in cash, then we would

experience an increase in our Assumed Diluted Shares Outstanding

without a corresponding increase in our bitcoin holdings and a

decrease in BTC Yield, BTC Gain and BTC $ Gain for the period in

which such issuance of shares of class A common stock occurred.

The Company has historically not paid any dividends on its

shares of class A common stock, and by presenting these KPIs the

Company makes no suggestion that it intends to do so in the future.

Ownership of the Company’s securities, including its class A common

stock and preferred stock, does not represent an ownership interest

in the bitcoin the Company holds.

The Company determines its KPI targets based on its history and

future goals. The Company’s ability to achieve positive BTC Yield,

BTC Gain, or BTC $ Gain may depend on a variety of factors,

including its ability to generate cash from operations in excess of

its fixed charges and other expenses, as well as factors outside of

its control, such as the price of bitcoin, and the availability of

debt and equity financing on favorable terms. Past performance is

not indicative of future results.

Investors should rely on the financial statements and other

disclosures contained in the Company’s SEC filings. These KPIs are

merely supplements, not a substitute. They should be used only by

sophisticated investors who understand their limited purpose and

many limitations.

Forward-Looking Statements

This press release may include statements that may constitute

“forward-looking statements,” including estimates of future

business prospects or financial results, our targets relating to

our BTC Yield, BTC Gain and BTC $ Gain, and statements containing

the words “believe,” “estimate,” “project,” “expect,” “will,” or

similar expressions. Forward-looking statements inherently involve

risks and uncertainties that could cause actual results of

MicroStrategy Incorporated and its subsidiaries (collectively, the

“Company”) to differ materially from the forward-looking

statements. Factors that could contribute to such differences

include: fluctuations in the market price of bitcoin and any

associated impairment charges that the Company may incur as a

result of a decrease in the market price of bitcoin below the value

at which the Company’s bitcoins are carried on its balance sheet;

the availability of debt and equity financing on favorable terms;

gains or losses on any sales of bitcoins; changes in the accounting

treatment relating to the Company’s bitcoin holdings; changes in

securities laws or other laws or regulations, or the adoption of

new laws or regulations, relating to bitcoin that adversely affect

the price of bitcoin or the Company’s ability to transact in or own

bitcoin; the impact of the availability of spot exchange traded

products for bitcoin and other digital assets; a decrease in

liquidity in the markets in which bitcoin is traded; security

breaches, cyberattacks, unauthorized access, loss of private keys,

fraud or other circumstances or events that result in the loss of

the Company’s bitcoins; impacts to the price and rate of adoption

of bitcoin associated with financial difficulties and bankruptcies

of various participants in the digital asset industry; the level

and terms of the Company’s substantial indebtedness and its ability

to service such debt; the extent and timing of market acceptance of

the Company’s new product offerings; continued acceptance of the

Company’s other products in the marketplace; the Company’s ability

to recognize revenue or deferred revenue through delivery of

products or satisfactory performance of services; the timing of

significant orders; delays in or the inability of the Company to

develop or ship new products; customers continuing to shift from a

product license model to a cloud subscription model, which may

delay the Company’s ability to recognize revenue; fluctuations in

tax benefits or provisions; changes in the market price of bitcoin

as of period-end and their effect on our deferred tax assets,

related valuation allowance, and tax expense; other potentially

adverse tax consequences, including the potential taxation of

unrealized gains on our bitcoin holdings; competitive factors;

general economic conditions, including levels of inflation and

interest rates; currency fluctuations; and other risks detailed in

the Company’s registration statements and periodic and current

reports filed with the Securities and Exchange Commission (“SEC”).

The Company undertakes no obligation to update these

forward-looking statements for revisions or changes after the date

of this release.

MICROSTRATEGY

INCORPORATED

CONSOLIDATED STATEMENTS OF

OPERATIONS

(in thousands, except per

share data)

Three Months Ended

Twelve Months Ended

December 31,

December 31,

2024

2023

2024

2023*

(unaudited)

(unaudited)

(unaudited)

Revenues

Product licenses

$

15,256

$

18,372

$

48,567

$

75,351

Subscription services

31,930

21,517

106,776

81,179

Total product licenses and subscription

services

47,186

39,889

155,343

156,530

Product support

58,365

65,466

243,805

263,888

Other services

15,146

19,129

64,308

75,843

Total revenues

120,697

124,484

463,456

496,261

Cost of revenues

Product licenses

930

609

3,060

1,929

Subscription services

12,822

8,676

42,440

31,776

Total product licenses and subscription

services

13,752

9,285

45,500

33,705

Product support

7,977

5,319

33,289

22,434

Other services

12,440

13,617

50,679

53,805

Total cost of revenues

34,169

28,221

129,468

109,944

Gross profit

86,528

96,263

333,988

386,317

Operating expenses

Sales and marketing

34,965

40,299

138,081

149,671

Research and development

25,691

30,158

118,486

120,530

General and administrative

36,237

29,353

140,537

115,312

Digital asset impairment losses

1,006,055

39,238

1,789,862

115,851

Total operating expenses

1,102,948

139,048

2,186,966

501,364

Loss from operations

(1,016,420

)

(42,785

)

(1,852,978

)

(115,047

)

Interest expense, net

(16,465

)

(11,929

)

(61,941

)

(48,960

)

(Loss) gain on debt extinguishment

0

0

(22,933

)

44,686

Other income (expense), net

6,150

(5,930

)

3,506

(5,204

)

Loss before income taxes

(1,026,735

)

(60,644

)

(1,934,346

)

(124,525

)

Benefit from income taxes

(355,925

)

(149,770

)

(767,685

)

(553,646

)

Net (loss) income

$

(670,810

)

$

89,126

$

(1,166,661

)

$

429,121

Basic (loss) earnings per share

(1):

$

(3.03

)

$

0.58

$

(6.06

)

$

3.14

Weighted average shares outstanding used

in computing basic (loss) earnings per share

221,608

153,361

192,549

136,706

Diluted (loss) earnings per share

(1):

$

(3.03

)

$

0.50

$

(6.06

)

$

2.64

Weighted average shares outstanding used

in computing diluted (loss) earnings per share

221,608

183,757

192,549

165,662

(1)

Basic and fully diluted (loss) earnings

per share for class A and class B common stock are the same.

*

Derived from audited financial

statements.

MICROSTRATEGY

INCORPORATED

CONSOLIDATED BALANCE

SHEETS

(in thousands, except per

share data)

December 31,

December 31,

2024

2023*

(unaudited)

Assets

Current assets:

Cash and cash equivalents

$

38,117

$

46,817

Restricted cash

1,780

1,856

Accounts receivable, net

181,203

183,815

Prepaid expenses and other current

assets

31,224

35,407

Total current assets

252,324

267,895

Digital assets

23,909,373

3,626,476

Property and equipment, net

26,327

28,941

Right-of-use assets

54,560

57,343

Deposits and other assets

75,794

24,300

Deferred tax assets, net

1,525,307

757,573

Total assets

$

25,843,685

$

4,762,528

Liabilities and Stockholders’

Equity

Current liabilities:

Accounts payable, accrued expenses, and

operating lease liabilities

$

52,982

$

43,090

Accrued compensation and employee

benefits

58,362

50,045

Accrued interest

5,549

1,493

Current portion of long-term debt, net

517

483

Deferred revenue and advance payments

237,974

228,162

Total current liabilities

355,384

323,273

Long-term debt, net

7,191,158

2,182,108

Deferred revenue and advance payments

4,970

8,524

Operating lease liabilities

56,403

61,086

Other long-term liabilities

5,379

22,208

Deferred tax liabilities

407

357

Total liabilities

7,613,701

2,597,556

Stockholders’ Equity

Preferred stock undesignated, $0.001 par

value; 5,000 shares authorized; no shares issued or outstanding

0

0

Class A common stock, $0.001 par value;

330,000 shares authorized; 226,138 shares issued and 226,138 shares

outstanding, and 157,725 shares issued and 149,041 shares

outstanding, respectively

226

24

Class B convertible common stock, $0.001

par value; 165,000 shares authorized; 19,640 shares issued and

outstanding, and 19,640 shares issued and outstanding,

respectively

20

2

Additional paid-in capital

20,411,998

3,957,728

Treasury stock, at cost; 0 shares and

8,684 shares, respectively

-

(782,104

)

Accumulated other comprehensive loss

(15,384

)

(11,444

)

Accumulated deficit

(2,166,876

)

(999,234

)

Total stockholders’ equity

18,229,984

2,164,972

Total liabilities and stockholders’

equity

$

25,843,685

$

4,762,528

*

Derived from audited financial

statements.

MICROSTRATEGY

INCORPORATED

CONSOLIDATED CONDENSED

STATEMENTS OF CASH FLOWS

(in thousands)

Twelve Months Ended

December 31,

2024

2023*

(unaudited)

Net cash (used in) provided by operating

activities

$

(53,032

)

$

12,712

Net cash used in investing activities

(22,086,237

)

(1,905,237

)

Net cash provided by financing

activities

22,132,641

1,889,886

Effect of foreign exchange rate changes on

cash, cash equivalents, and restricted cash

(2,148

)

444

Net decrease in cash, cash equivalents,

and restricted cash

(8,776

)

(2,195

)

Cash, cash equivalents, and restricted

cash, beginning of year

48,673

50,868

Cash, cash equivalents, and restricted

cash, end of year

$

39,897

$

48,673

*

Derived from audited financial

statements.

MICROSTRATEGY

INCORPORATED

DIGITAL ASSETS – ADDITIONAL

INFORMATION

ROLLFORWARD OF BITCOIN

HOLDINGS

(unaudited)

Source of Capital Used to

Purchase Bitcoin

Digital Asset Original Cost

Basis (in thousands)

Digital Asset Impairment

Losses (in thousands)

Digital Asset Carrying Value

(in thousands)

Approximate Number of Bitcoins

Held *

Approximate Average Purchase

Price Per Bitcoin

Balance at December 31, 2022

$

3,993,190

$

(2,153,162

)

$

1,840,028

132,500

$

30,137

Digital asset purchases

(a)

179,275

179,275

7,500

23,903

Digital asset impairment losses

(18,911

)

(18,911

)

Balance at March 31, 2023

$

4,172,465

$

(2,172,073

)

$

2,000,392

140,000

$

29,803

Digital asset purchases

(b)

347,003

347,003

12,333

28,136

Digital asset impairment losses

(24,143

)

(24,143

)

Balance at June 30, 2023

$

4,519,468

$

(2,196,216

)

$

2,323,252

152,333

$

29,668

Digital asset purchases

(c)

161,681

161,681

5,912

27,348

Digital asset impairment losses

(33,559

)

(33,559

)

Balance at September 30, 2023

$

4,681,149

$

(2,229,775

)

$

2,451,374

158,245

$

29,582

Digital asset purchases

(d)

1,214,340

1,214,340

30,905

39,293

Digital asset impairment losses

(39,238

)

(39,238

)

Balance at December 31, 2023

$

5,895,489

$

(2,269,013

)

$

3,626,476

189,150

$

31,168

Digital asset purchases

(e)

1,639,309

1,639,309

25,128

65,238

Digital asset impairment losses

(191,633

)

(191,633

)

Balance at March 31, 2024

$

7,534,798

$

(2,460,646

)

$

5,074,152

214,278

$

35,164

Digital asset purchases

(f)

793,828

793,828

12,053

65,861

Digital asset impairment losses

(180,090

)

(180,090

)

Balance at June 30, 2024

$

8,328,626

$

(2,640,736

)

$

5,687,890

226,331

$

36,798

Digital asset purchases

(g)

1,575,073

1,575,073

25,889

60,839

Digital asset impairment losses

(412,084

)

(412,084

)

Balance at September 30, 2024

$

9,903,699

$

(3,052,820

)

$

6,850,879

252,220

$

39,266

Digital asset purchases

(h)

18,064,549

18,064,549

195,250

92,520

Digital asset impairment losses

(1,006,055

)

(1,006,055

)

Balance at December 31, 2024

$

27,968,248

$

(4,058,875

)

$

23,909,373

447,470

$

62,503

*

MicroStrategy owns and has

purchased bitcoins both directly and indirectly through its

wholly-owned subsidiary, MacroStrategy. References to MicroStrategy

below refer to MicroStrategy and its subsidiaries on a consolidated

basis.

(a)

In the first quarter of 2023,

MicroStrategy purchased bitcoin using $179.3 million of the net

proceeds from its sale of class A common stock under its

at-the-market equity offering program.

(b)

In the second quarter of 2023,

MicroStrategy purchased bitcoin using $336.9 million of the net

proceeds from its sale of class A common stock under its

at-the-market equity offering program and $10.1 million from Excess

Cash.

(c)

In the third quarter of 2023,

MicroStrategy purchased bitcoin using $147.3 million of the net

proceeds from its sale of class A common stock under its

at-the-market equity offering program and $14.4 million from Excess

Cash.

(d)

In the fourth quarter of 2023,

MicroStrategy purchased bitcoin using $1.201 billion of the net

proceeds from its sale of class A common stock under its

at-the-market equity offering program and $13.4 million from Excess

Cash.

(e)

In the first quarter of 2024,

MicroStrategy purchased bitcoin using $782.0 million of the net

proceeds from its issuance of the 2030 Convertible Notes, $592.3

million of the net proceeds from its issuance of the 2031

Convertible Notes, $137.3 million of the net proceeds from its sale

of class A common stock under its at-the-market equity offering

program, and $127.7 million from Excess Cash.

(f)

In the second quarter of 2024,

MicroStrategy purchased bitcoin using $756.0 million of the net

proceeds from its issuance of the 2032 Convertible Notes and $37.8

million from Excess Cash.

(g)

In the third quarter of 2024,

MicroStrategy purchased bitcoin using $1.105 billion of the net

proceeds from its sale of class A common stock under its

at-the-market offering program, $458.2 million of the net proceeds

from its issuance of the 2028 Convertible Notes, and $11.4 million

from Excess Cash.

(h)

In the fourth quarter of 2024,

MicroStrategy purchased bitcoin using $15.088 billion of the net

proceeds from its sale of class A common stock under its

at-the-market offering program, $2.974 billion of the net proceeds

from its issuance of the 2029 Convertible Notes, and $2.7 million

from Excess Cash.

Excess Cash refers to cash in excess of the minimum Cash Assets

that MicroStrategy is required to hold under its Treasury Reserve

Policy, which may include cash generated by operating activities

and cash from the proceeds of financing activities. Cash Assets

refers to cash and cash equivalents and short-term investments.

MICROSTRATEGY

INCORPORATED

DIGITAL ASSETS – ADDITIONAL

INFORMATION

MARKET VALUE OF BITCOIN

HOLDINGS

(unaudited)

Approximate Number of Bitcoins

Held at End of Quarter *

Lowest Market Price Per

Bitcoin During Quarter (a)

Market Value of Bitcoin Held

at End of Quarter Using Lowest Market Price (in thousands)

(b)

Highest Market Price Per

Bitcoin During Quarter (c)

Market Value of Bitcoin Held

at End of Quarter Using Highest Market Price (in thousands)

(d)

Market Price Per Bitcoin at

End of Quarter (e)

Market Value of Bitcoin Held

at End of Quarter Using Ending Market Price (in thousands)

(f)

December 31, 2022

132,500

$

15,460.00

$

2,048,450

$

21,478.80

$

2,845,941

$

16,556.32

$

2,193,712

March 31, 2023

140,000

$

16,490.00

$

2,308,600

$

29,190.04

$

4,086,606

$

28,468.44

$

3,985,582

June 30, 2023

152,333

$

24,750.00

$

3,770,242

$

31,443.67

$

4,789,909

$

30,361.51

$

4,625,060

September 30, 2023

158,245

$

24,900.00

$

3,940,301

$

31,862.21

$

5,042,035

$

27,030.47

$

4,277,437

December 31, 2023

189,150

$

26,521.32

$

5,016,508

$

45,000.00

$

8,511,750

$

42,531.41

$

8,044,816

March 31, 2024

214,278

$

38,501.00

$

8,249,917

$

73,835.57

$

15,821,338

$

71,028.14

$

15,219,768

June 30, 2024

226,331

$

56,500.00

$

12,787,702

$

72,777.00

$

16,471,691

$

61,926.69

$

14,015,930

September 30, 2024

252,220

$

49,050.01

$

12,371,394

$

70,000.00

$

17,655,400

$

63,462.97

$

16,006,630

December 31, 2024

447,470

$

58,863.90

$

26,339,829

$

108,388.88

$

48,500,772

$

93,390.21

$

41,789,317

*

MicroStrategy owns and has purchased

bitcoins both directly and indirectly through its wholly-owned

subsidiary, MacroStrategy. References to MicroStrategy below refer

to MicroStrategy and its subsidiaries on a consolidated basis.

(a)

The "Lowest Market Price Per

Bitcoin During Quarter" represents the lowest market price for one

bitcoin reported on the Coinbase exchange during the respective

quarter, without regard to when MicroStrategy purchased any of its

bitcoin.

(b)

The "Market Value of Bitcoin Held

at End of Quarter Using Lowest Market Price" represents a

mathematical calculation consisting of the lowest market price for

one bitcoin reported on the Coinbase exchange during the respective

quarter multiplied by the number of bitcoins held by MicroStrategy

at the end of the applicable period.

(c)

The "Highest Market Price Per

Bitcoin During Quarter" represents the highest market price for one

bitcoin reported on the Coinbase exchange during the respective

quarter, without regard to when MicroStrategy purchased any of its

bitcoin.

(d)

The "Market Value of Bitcoin Held

at End of Quarter Using Highest Market Price" represents a

mathematical calculation consisting of the highest market price for

one bitcoin reported on the Coinbase exchange during the respective

quarter multiplied by the number of bitcoins held by MicroStrategy

at the end of the applicable period.

(e)

The "Market Price Per Bitcoin at

End of Quarter" represents the market price of one bitcoin on the

Coinbase exchange at 4:00 p.m. Eastern Time on the last day of the

respective quarter.

(f)

The "Market Value of Bitcoin Held

at End of Quarter Using Ending Market Price" represents a

mathematical calculation consisting of the market price of one

bitcoin on the Coinbase exchange at 4:00 p.m. Eastern Time on the

last day of the respective quarter multiplied by the number of

bitcoins held by MicroStrategy at the end of the applicable

period.

The amounts reported as “Market Value” in the above table

represent only a mathematical calculation consisting of the price

for one bitcoin reported on the Coinbase exchange (MicroStrategy’s

principal market for bitcoin) in each scenario defined above

multiplied by the number of bitcoins held by MicroStrategy at the

end of the applicable period. Bitcoin and bitcoin markets may be

subject to manipulation and the spot price of bitcoin may be

subject to fraud and manipulation. Accordingly, the Market Value

amounts reported above may not accurately represent fair market

value, and the actual fair market value of MicroStrategy’s bitcoin

may be different from such amounts and such deviation may be

material. Moreover, (i) the bitcoin market historically has been

characterized by significant volatility in price, limited liquidity

and trading volumes compared to sovereign currencies markets,

relative anonymity, a developing regulatory landscape, potential

susceptibility to market abuse and manipulation, compliance and

internal control failures at exchanges, and various other risks

that are, or may be, inherent in its entirely electronic, virtual

form and decentralized network and (ii) MicroStrategy may not be

able to sell its bitcoins at the Market Value amounts indicated

above, at the market price as reported on the Coinbase exchange

(its principal market) on the date of sale, or at all.

MICROSTRATEGY

INCORPORATED

RECONCILIATION OF GAAP TO

NON-GAAP MEASURES

LOSS FROM OPERATIONS

(in thousands)

Three Months Ended

Twelve Months Ended

December 31,

December 31,

2024

2023

2024

2023

(unaudited)

(unaudited)

(unaudited)

(unaudited)

Reconciliation of non-GAAP

loss from operations:

Loss from operations

$

(1,016,420

)

$

(42,785

)

$

(1,852,978

)

$

(115,047

)

Share-based compensation expense

19,335

19,716

77,124

69,571

Non-GAAP loss from operations

$

(997,085

)

$

(23,069

)

$

(1,775,854

)

$

(45,476

)

MICROSTRATEGY

INCORPORATED

RECONCILIATION OF GAAP TO

NON-GAAP MEASURES

NET (LOSS) INCOME AND DILUTED

(LOSS) EARNINGS PER SHARE

(in thousands, except per

share data)

Three Months Ended

Twelve Months Ended

December 31,

December 31,

2024

2023

2024

2023

(unaudited)

(unaudited)

(unaudited)

(unaudited)

Reconciliation of non-GAAP net (loss)

income:

Net (loss) income

$

(670,810

)

$

89,126

$

(1,166,661

)

$

429,121

Share-based compensation expense

19,335

19,716

77,124

69,571

Interest expense arising from amortization

of debt issuance costs

5,105

2,209

15,336

8,808

Loss (gain) on debt extinguishment

0

0

22,933

(44,686

)

Income tax effects (1)

(62,138

)

(8,600

)

(243,102

)

(6,062

)

Non-GAAP net (loss) income

$

(708,508

)

$

102,451

$

(1,294,370

)

$

456,752

Reconciliation of non-GAAP diluted

(loss) earnings per share (2):

Diluted (loss) earnings per share

$

(3.03

)

$

0.50

$

(6.06

)

$

2.64

Share-based compensation expense (per

diluted share)

0.09

0.11

0.40

0.42

Interest expense arising from amortization

of debt issuance costs (per diluted share) (3)

0.02

0.00

0.08

0.01

Loss (gain) on debt extinguishment (per

diluted share)

0.00

0.00

0.12

(0.27

)

Income tax effects (per diluted share)

(3)

(0.28

)

(0.05

)

(1.26

)

(0.02

)

Non-GAAP diluted (loss) earnings per

share

$

(3.20

)

$

0.56

$

(6.72

)

$

2.78

(1)

Income tax effects reflect the

net tax effects of share-based compensation, which includes tax

benefits and expenses on exercises of stock options and vesting of

share-settled restricted stock units, interest expense for

amortization of debt issuance costs, and gains and losses on debt

extinguishment.

(2)

For reconciliation purposes, the

non-GAAP diluted earnings (loss) per share calculations use the

same weighted average shares outstanding as that used in the GAAP

diluted earnings (loss) per share calculations for the same period.

For example, in periods of GAAP net loss, otherwise dilutive

potential shares of common stock from MicroStrategy’s share-based

compensation arrangements and convertible notes are excluded from

the GAAP diluted loss per share calculation as they would be

antidilutive, and therefore are also excluded from the non-GAAP

diluted earnings or loss per share calculation.

(3)

For the three and twelve months

ended December 31, 2023, interest expense from the amortization of

issuance costs of the convertible notes has been added back to the

numerator in the GAAP diluted earnings per share calculation, and

therefore the per diluted share effects of the amortization of

issuance costs of the convertible notes have been excluded from the

“Interest expense arising from amortization of debt issuance costs

(per diluted share)” and “Income tax effects (per diluted share)”

lines in the above reconciliation for the three and twelve months

ended December 31, 2023.

MICROSTRATEGY

INCORPORATED

RECONCILIATION OF GAAP TO

NON-GAAP MEASURES

CONSTANT CURRENCY

(in thousands)

Three Months Ended December

31,

(unaudited)

GAAP

Foreign Currency Exchange Rate

Impact (1)

Non-GAAP Constant Currency

(2)

GAAP

GAAP % Change

Non-GAAP Constant Currency %

Change (3)

2024

2024

2024

2023

2024

2024

Revenues

Product licenses

$

15,256

$

(239

)

$

15,495

$

18,372

-17.0

%

-15.7

%

Subscription services

31,930

(5

)

31,935

21,517

48.4

%

48.4

%

Total product licenses and subscription

services

47,186

(244

)

47,430

39,889

18.3

%

18.9

%

Product support

58,365

(241

)

58,606

65,466

-10.8

%

-10.5

%

Other services

15,146

(31

)

15,177

19,129

-20.8

%

-20.7

%

Total revenues

120,697

(516

)

121,213

124,484

-3.0

%

-2.6

%

Twelve Months Ended December

31,

(unaudited)

GAAP

Foreign Currency Exchange Rate

Impact (1)

Non-GAAP Constant Currency

(2)

GAAP

GAAP % Change

Non-GAAP Constant Currency %

Change (3)

2024

2024

2024

2023

2024

2024

Revenues

Product licenses

$

48,567

$

(504

)

$

49,071

$

75,351

-35.5

%

-34.9

%

Subscription services

106,776

65

106,711

81,179

31.5

%

31.5

%

Total product licenses and subscription

services

155,343

(439

)

155,782

156,530

-0.8

%

-0.5

%

Product support

243,805

(214

)

244,019

263,888

-7.6

%

-7.5

%

Other services

64,308

(43

)

64,351

75,843

-15.2

%

-15.2

%

Total revenues

463,456

(696

)

464,152

496,261

-6.6

%

-6.5

%

(1)

The “Foreign Currency Exchange

Rate Impact” reflects the estimated impact of fluctuations in

foreign currency exchange rates on international revenues. It shows

the increase (decrease) in international revenues from the same

period in the prior year, based on comparisons to the prior year

quarterly average foreign currency exchange rates. “International

revenues” refers to revenues from operations outside of the United

States and Canada only where the functional currency is the local

currency (i.e., excluding any location whose economy is considered

highly inflationary).

(2)

The “Non-GAAP Constant Currency”

reflects the current period GAAP amount, less the Foreign Currency

Exchange Rate Impact.

(3)

The “Non-GAAP Constant Currency %

Change” reflects the percentage change between the current period

Non-GAAP Constant Currency amount and the GAAP amount for the same

period in the prior year.

MICROSTRATEGY

INCORPORATED

DEFERRED REVENUE

DETAIL

(in thousands)

December 31,

December 31,

2024

2023*

(unaudited)

Current:

Deferred product licenses revenue

$

1,777

$

3,579

Deferred subscription services revenue

107,119

65,512

Deferred product support revenue

124,684

152,012

Deferred other services revenue

4,394

7,059

Total current deferred revenue and advance

payments

$

237,974

$

228,162

Non-current:

Deferred product licenses revenue

$

174

$

0

Deferred subscription services revenue

2,263

3,097

Deferred product support revenue

2,111

4,984

Deferred other services revenue

422

443

Total non-current deferred revenue and

advance payments

$

4,970

$

8,524

Total current and non-current:

Deferred product licenses revenue

$

1,951

$

3,579

Deferred subscription services revenue

109,382

68,609

Deferred product support revenue

126,795

156,996

Deferred other services revenue

4,816

7,502

Total current and non-current deferred

revenue and advance payments

$

242,944

$

236,686

*

Derived from audited financial

statements.

MICROSTRATEGY INCORPORATED SEGMENT

INFORMATION (in thousands, unaudited)

MicroStrategy has one reportable operating segment, the

“Software Business,” which is engaged in the design, development,

marketing, and sales of the Company’s enterprise analytics software

platform through cloud subscriptions and licensing arrangements and

related services (i.e., product support, consulting, and

education). The “Corporate & Other” category presented in the

following tables is not considered an operating segment. It

consists primarily of costs and expenses related to executing the

Company’s bitcoin strategy and includes the impairment charges and

other third-party costs associated with the Company’s bitcoin

holdings, net interest expense primarily related to long-term debt

obligations (the net proceeds of which were primarily used to

purchase bitcoin), and income tax effects generated from the

Company’s bitcoin holdings and related debt issuances. Segment

assets allocated to the Corporate & Other category are the

Company’s digital assets and deferred tax assets related primarily

to digital asset impairment losses and interest expense.

Three Months Ended December

31, 2024

Software Business

Corporate & Other

Total Consolidated

Total revenues

$

120,697

$

120,697

Total expenses

(127,641

)

(1,009,476

)

(1,137,117

)

Loss from operations

$

(6,944

)

$

(1,009,476

)

$

(1,016,420

)

Interest expense, net

(16,465

)

(16,465

)

Income tax benefit

61,499

294,426

355,925

Other segment items to reconcile to net

income (loss)

6,150

6,150

Net income (loss)

$

60,705

$

(731,515

)

$

(670,810

)

Total assets, as of December 31, 2024

$

743,190

$

25,100,495

$

25,843,685

Three Months Ended December

31, 2023

Software Business

Corporate & Other

Total Consolidated

Total revenues

$

124,484

$

124,484

Total expenses

(127,247

)

(40,022

)

(167,269

)

Loss from operations

$

(2,763

)

$

(40,022

)

$

(42,785

)

Interest expense, net

(11,929

)

(11,929

)

Income tax benefit

17,557

132,213

149,770

Other segment items to reconcile to net

income

(5,930

)

(5,930

)

Net income

$

8,864

$

80,262

$

89,126

Total assets, as of December 31, 2023

$

470,353

$

4,292,175

$

4,762,528

Year-Ended December 31,

2024

Software Business

Corporate & Other

Total Consolidated

Total revenues

$

463,456

$

463,456

Total expenses

(518,863

)

(1,797,571

)

(2,316,434

)

Loss from operations

$

(55,407

)

$

(1,797,571

)

$

(1,852,978

)

Interest expense, net

(61,941

)

(61,941

)

Loss on debt extinguishment

(22,933

)

(22,933

)

Income tax benefit

226,961

540,724

767,685

Other segment items to reconcile to net

income (loss)

3,506

3,506

Net income (loss)

$

175,060

$

(1,341,721

)

$

(1,166,661

)

Total assets, as of December 31, 2024

$

743,190

$

25,100,495

$

25,843,685

Year-Ended December 31,

2023

Software Business

Corporate & Other

Total Consolidated

Total revenues

$

496,261

$

496,261

Total expenses

(492,703

)

(118,605

)

(611,308

)

Income (loss) from operations

$

3,558

$

(118,605

)

$

(115,047

)

Interest expense, net

(48,960

)

(48,960

)

Gain on debt extinguishment

44,686

44,686

Income tax benefit

10,553

543,093

553,646

Other segment items to reconcile to net

income

(5,204

)

(5,204

)

Net income

$

8,907

$

420,214

$

429,121

Total assets, as of December 31, 2023

$

470,353

$

4,292,175

$

4,762,528

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250205209141/en/

Strategy Shirish Jajodia Corporate Treasurer

ir@microstrategy.com

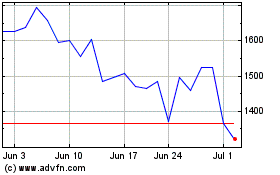

MicroStrategy (NASDAQ:MSTR)

Historical Stock Chart

From Jan 2025 to Feb 2025

MicroStrategy (NASDAQ:MSTR)

Historical Stock Chart

From Feb 2024 to Feb 2025