UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

FOR THE MONTH OF JANUARY 2024

METHANEX CORPORATION

(Registrant’s name)

SUITE 1800, 200 BURRARD STREET, VANCOUVER, BC V6C 3M1 CANADA

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ¨ Form 40-F ý

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ¨ No ý

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82

| | | | | |

| NEWS RELEASE | Methanex Corporation 1800 - 200 Burrard St. Vancouver, BC Canada V6C 3M1 Investor Relations: (604) 661-2600 www.methanex.com |

For immediate release

January 31, 2024

Except where otherwise noted, all currency amounts are stated in United States dollars.

METHANEX REPORTS HIGHER FOURTH QUARTER 2023 EARNINGS AS METHANOL PRICES STRENGTHEN; GEISMAR 3 IN START UP PROCESS

•Net income attributable to Methanex shareholders of $33 million and Adjusted EBITDA of $148 million in the fourth quarter. The average realized price in the fourth quarter was $322 per tonne compared to $303 per tonne in the third quarter of 2023.

•Full year 2023 net income attributable to Methanex shareholders of $174 million and Adjusted EBITDA of $622 million.

•Fourth quarter production was higher compared to the third quarter due to higher production in Chile, New Zealand, Geismar and Medicine Hat which was partially offset by lower production in Egypt.

•The 1.8 million tonne methanol plant, Geismar 3 ("G3"), is in the process of starting up and we expect that commercial production is imminent. The plant is expected to ramp up to full rates over the month of February. G3 will have one of the lowest emission intensity profiles in the industry and will significantly enhance our cash flow capability at a range of methanol prices.

•Returned $136 million to shareholders through regular dividends and share purchases in 2023 and ended the fourth quarter with $458 million in cash.

VANCOUVER, BRITISH COLUMBIA - For the fourth quarter of 2023, Methanex (TSX:MX) (NASDAQ:MEOH) reported net income attributable to Methanex shareholders of $33 million ($0.50 net income per common share on a diluted basis) compared to net income of $24 million ($0.36 net income per common share on a diluted basis) in the third quarter of 2023. Net income in the fourth quarter of 2023 was higher compared to the prior quarter primarily due to a higher average realized price, higher sales of Methanex-produced methanol and lower mark-to-market impact of share-based compensation due to changes in Methanex's share price, offset by lower income from gas contract settlement recognized in the third quarter of 2023. Adjusted EBITDA for the fourth quarter of 2023 was $148 million and Adjusted net income was $35 million ($0.52 Adjusted net income per common share). This compares with Adjusted EBITDA of $105 million and Adjusted net income of $1 million ($0.02 Adjusted net income per common share) for the third quarter of 2023.

Our average realized price in the fourth quarter was $322 per tonne compared to $303 per tonne in the third quarter of 2023. Through the fourth quarter, market conditions strengthened, with increased demand primarily in China outpacing an increase in supply. On the supply side, production increased from coal-based producers in China which was offset by planned and unplanned outages in the US and Asia as well as lower production from natural gas restrictions in Iran and China. This led to a drawdown on inventories and increasing methanol prices through the quarter.

For the year ended December 31, 2023, Methanex reported net income attributable to Methanex shareholders of $174 million ($2.57 net income per common share on a diluted basis), Adjusted EBITDA of $622 million and an Adjusted net income of $153 million ($2.25 Adjusted net income per common share). This compares with a net income attributable to Methanex shareholders of $354 million ($4.86 net income per common share on a diluted basis), Adjusted EBITDA of $932 million and an Adjusted net income of $343 million ($4.79 Adjusted net income per common share) for the year ended December 31, 2022.

In 2023, we returned $136 million to shareholders through the regular dividend and share repurchases. We ended the year with $458 million in cash, or approximately $451 million in cash excluding non-controlling interests and including our share of cash in the Atlas joint venture. We also have an undrawn $300 million revolving credit facility that provides additional financial flexibility.

METHANEX CORPORATION 2023 FOURTH QUARTER NEWS RELEASE PAGE 1

Rich Sumner, President & CEO of Methanex, said, “I am proud of our G3 team that delivered a high quality plant with outstanding safety performance. G3 significantly enhances our asset portfolio and we expect it to generate strong shareholder returns. We remain focused on reliably operating our assets so we can deliver shareholder value over a variety of methanol prices."

FURTHER INFORMATION

The information set forth in this news release summarizes Methanex's key financial and operational data for the fourth quarter of 2023. It is not a complete source of information for readers and is not in any way a substitute for reading the fourth quarter 2023 Management’s Discussion and Analysis ("MD&A") dated January 31, 2024 and the unaudited condensed consolidated interim financial statements for the period ended December 31, 2023, both of which are available from the Investor Relations section of our website at www.methanex.com. The MD&A and the unaudited condensed consolidated interim financial statements for the period ended December 31, 2023 are also available on the Canadian Securities Administrators' SEDAR+ website at www.sedarplus.ca and on the United States Securities and Exchange Commission's EDGAR website at www.sec.gov.

FINANCIAL AND OPERATIONAL DATA

| | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Years Ended |

| ($ millions except per share amounts and where noted) | Dec 31

2023 | Sep 30

2023 | Dec 31

2022 | | Dec 31

2023 | Dec 31

2022 |

Production (thousands of tonnes) (attributable to Methanex shareholders) 1 | 1,779 | | 1,545 | | 1,526 | | | 6,642 | | 6,118 | |

| Sales volume (thousands of tonnes) | | | | | | |

| Methanex-produced methanol | 1,712 | | 1,473 | | 1,360 | | | 6,455 | | 6,141 | |

| Purchased methanol | 890 | | 905 | | 1,095 | | | 3,527 | | 3,688 | |

| Commission sales | 260 | | 342 | | 192 | | | 1,187 | | 945 | |

Total sales volume 1 | 2,862 | | 2,720 | | 2,647 | | | 11,169 | | 10,774 | |

| | | | | | |

Methanex average non-discounted posted price ($ per tonne) 2 | 421 | | 395 | | 469 | | | 434 | | 503 | |

Average realized price ($ per tonne) 3 | 322 | | 303 | | 373 | | | 333 | | 397 | |

| | | | | | |

| Revenue | 922 | | 823 | | 986 | | | 3,723 | | 4,311 | |

| Net income (attributable to Methanex shareholders) | 33 | | 24 | | 41 | | | 174 | | 354 | |

Adjusted net income 4 | 35 | | 1 | | 51 | | | 153 | | 343 | |

Adjusted EBITDA 4 | 148 | | 105 | | 160 | | | 622 | | 932 | |

| Cash flows from operating activities | 195 | | 106 | | 227 | | | 660 | | 987 | |

| | | | | | |

| Basic net income per common share | 0.50 | | 0.36 | | 0.59 | | | 2.57 | | 4.95 | |

| Diluted net income per common share | 0.50 | | 0.36 | | 0.59 | | | 2.57 | | 4.86 | |

Adjusted net income per common share 4 | 0.52 | | 0.02 | | 0.73 | | | 2.25 | | 4.79 | |

| | | | | | |

Common share information (millions of shares) | | | | | | |

| Weighted average number of common shares | 67 | | 67 | | 70 | | | 68 | | 71 | |

Diluted weighted average number of common shares | 68 | | 67 | | 70 | | | 68 | | 72 | |

Number of common shares outstanding, end of period | 67 | | 67 | | 69 | | | 67 | | 69 | |

1 Methanex-produced methanol represents our equity share of volume produced at our facilities and excludes volume marketed on a commission basis related to the 36.9% of the Atlas facility and 50% of the Egypt facility that we do not own.

2 Methanex average non-discounted posted price represents the average of our non-discounted posted prices in North America, Europe, China and Asia Pacific weighted by sales volume. Current and historical pricing information is available at www.methanex.com.

3 The Company has used Average realized price ("ARP") throughout this document. ARP is calculated as revenue divided by the total sales volume. It is used by management to assess the realized price per unit of methanol sold, and is relevant in a cyclical commodity environment where revenue can fluctuate in response to market prices.

4 Note that Adjusted net income, Adjusted net income per common share, and Adjusted EBITDA are non-GAAP measures and ratios that do not have any standardized meaning prescribed by GAAP and therefore are unlikely to be comparable to similar measures presented by other companies. Refer to the Additional Information - Non-GAAP Measures section on page 14 of our fourth quarter MD&A dated January 31, 2024 for a description of each non-GAAP measure.

METHANEX CORPORATION 2023 FOURTH QUARTER NEWS RELEASE PAGE 2

▪A reconciliation from net income attributable to Methanex shareholders to Adjusted EBITDA, Adjusted net income and the calculation of Adjusted net income per common share is as follows:

| | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Years Ended |

| ($ millions) | Dec 31

2023 | Sep 30

2023 | Dec 31

2022 | | Dec 31

2023 | Dec 31

2022 |

| Net income attributable to Methanex shareholders | $ | 33 | | $ | 24 | | $ | 41 | | | $ | 174 | | $ | 354 | |

| Mark-to-market impact of share-based compensation | 3 | | 8 | | 12 | | | 16 | | (7) | |

| Gas contract settlement, net of tax | — | | (31) | | — | | | (31) | | — | |

| Depreciation and amortization | 100 | | 98 | | 86 | | | 392 | | 372 | |

| Finance costs | 30 | | 26 | | 32 | | | 117 | | 131 | |

| Finance income and other | (11) | | (2) | | (18) | | | (40) | | (25) | |

| Income tax expense (recovery) | (14) | | (18) | | 7 | | | 1 | | 120 | |

| Earnings of associate adjustment | 15 | | 23 | | 18 | | | 67 | | 74 | |

| Non-controlling interests adjustment | (8) | | (23) | | (18) | | | (74) | | (87) | |

| Adjusted EBITDA | $ | 148 | | $ | 105 | | $ | 160 | | | $ | 622 | | $ | 932 | |

| | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Years Ended |

| ($ millions except number of shares and per share amounts) | Dec 31

2023 | Sep 30

2023 | Dec 31

2022 | | Dec 31

2023 | Dec 31

2022 |

| Net income attributable to Methanex shareholders | $ | 33 | | $ | 24 | | $ | 41 | | | $ | 174 | | $ | 354 | |

| Mark-to-market impact of share-based compensation, net of tax | 3 | | 6 | | 11 | | | 13 | | (6) | |

| Gas contract settlement, net of tax | — | | (31) | | — | | | (31) | | — | |

| Impact of Egypt gas contract revaluation, net of tax | (1) | | 2 | | (1) | | | (3) | | (5) | |

| Adjusted net income | $ | 35 | | $ | 1 | | $ | 51 | | | $ | 153 | | $ | 343 | |

| Diluted weighted average shares outstanding (millions) | 68 | | 67 | | 70 | | | 68 | | 72 | |

| Adjusted net income per common share | $ | 0.52 | | $ | 0.02 | | $ | 0.73 | | | $ | 2.25 | | $ | 4.79 | |

▪We recorded net income attributable to Methanex shareholders of $33 million in the fourth quarter of 2023 compared to net income of $24 million in the third quarter of 2023. Net income in the fourth quarter of 2023 was higher compared to the prior quarter primarily due to a higher average realized price, higher sales of Methanex-produced methanol and lower mark-to-market impact of share-based compensation due to changes in Methanex's share price, offset by lower income from the gas contract settlement recognized in the third quarter of 2023. Income from gas contract settlement was excluded from Adjusted EBITDA and Adjusted net income in the third quarter of 2023.

▪We recorded Adjusted EBITDA of $148 million for the fourth quarter of 2023 compared to $105 million for the third quarter of 2023. We recorded Adjusted net income of $35 million for the fourth quarter of 2023 compared to Adjusted net income of $1 million for the third quarter of 2023. Adjusted EBITDA was higher in the fourth quarter of 2023 primarily due to a higher average realized price and higher sales of Methanex-produced methanol.

▪We sold 2,862,000 tonnes in the fourth quarter of 2023 compared to 2,720,000 tonnes for the third quarter of 2023. Sales of Methanex-produced methanol were 1,712,000 tonnes in the fourth quarter of 2023 compared to 1,473,000 tonnes in the third quarter of 2023.

▪Production for the fourth quarter of 2023 was 1,779,000 tonnes compared to 1,545,000 tonnes for the third quarter of 2023. Fourth quarter production was higher compared to the third quarter due to higher production in Chile, New Zealand, Geismar and Medicine Hat which was partially offset by lower production in Egypt.

▪The Geismar 3 plant is in the process of starting up, with total capital costs expected to come within budget of $1.25 - 1.3 billion. The remaining cash expenditure of approximately $60 to $110 million, including approximately $20 million of spending accrued in accounts payable, is fully funded with cash on hand. Geismar 3 has one of the lowest CO2 emissions intensity profiles in the industry and significantly enhances our cash generation capability. We expect the plant to ramp up to full rates over the month of February.

▪In the fourth quarter of 2023 we paid a quarterly dividend of $0.185 per common share for a total of $12.5 million.

METHANEX CORPORATION 2023 FOURTH QUARTER NEWS RELEASE PAGE 3

▪At December 31, 2023, we had a strong liquidity position including a cash balance of $458 million, or approximately $451 million excluding non-controlling interests and including our share of cash in the Atlas joint venture. We also have access to an undrawn $300 million revolving credit facility providing financial flexibility.

PRODUCTION HIGHLIGHTS

| | | | | | | | | | | | | | | | | | | | |

| (thousands of tonnes) | Annual Operating Capacity1 | 2023

Production | 2022

Production | Q4 2023 Production | Q3 2023 Production | Q4 2022 Production |

USA (Geismar) | 2,200 | | 2,142 | | 2,041 | | 587 | | 574 | | 437 | |

New Zealand 2 | 2,200 | | 1,381 | | 1,230 | | 344 | | 226 | | 395 | |

Trinidad (Methanex interest) 3 | 1,960 | | 1,074 | | 981 | | 283 | | 287 | | 225 | |

| Chile | 1,700 | | 993 | | 888 | | 403 | | 168 | | 226 | |

| Egypt (50% interest) | 630 | | 504 | | 385 | | 20 | | 160 | | 96 | |

| Canada (Medicine Hat) | 640 | | 548 | | 593 | | 142 | | 130 | | 147 | |

| 9,330 | | 6,642 | | 6,118 | | 1,779 | | 1,545 | | 1,526 | |

1The operating capacity of our production facilities may be higher or lower than original nameplate capacity as, over time, these figures have been adjusted to reflect ongoing operating efficiencies at these facilities. Actual production for a facility in any given year may be higher or lower than operating capacity due to a number of factors, including natural gas availability, feedstock composition, the age of the facility's catalyst, turnarounds and access to CO2 from external suppliers for certain facilities. We review and update the operating capacity of our production facilities on a regular basis based on historical performance.

2The operating capacity of New Zealand is made up of the two Motunui facilities and the Waitara Valley facility. The Waitara Valley plant is idled indefinitely due to natural gas constraints.

3The operating capacity of Trinidad is made up of the Titan (100% interest) and Atlas (63.1% interest) facilities. Refer to the Trinidad section below.

Key production and operational highlights during the fourth quarter include:

United States

Geismar produced 587,000 tonnes in the fourth quarter compared to 574,000 tonnes in the third quarter of 2023.

New Zealand

New Zealand produced 344,000 tonnes in the fourth quarter of 2023 compared to 226,000 tonnes in the third quarter of 2023. Production in the fourth quarter was higher compared to the third quarter due to the restart of Motunui 2 after the scheduled turnaround. Waitara Valley remains idled indefinitely. We estimate production for 2024 to be between 1.0 - 1.1 million tonnes. 2024 natural gas supply is expected to be impacted by a combination of our suppliers' planned natural gas infrastructure maintenance outages as well as lower than expected output from existing wells. While upstream investment has been made by our gas suppliers in New Zealand over the past two years, recent gas production results have been lower than originally expected which has contributed to the revised forecast for lower production in 2024.

Trinidad

Atlas produced 283,000 tonnes (Methanex interest) in the fourth quarter of 2023 compared to 287,000 tonnes in the third quarter of 2023. In October, Methanex signed a two-year natural gas supply agreement with the National Gas Company of Trinidad and Tobago (NGC) for its currently idled, wholly owned, Titan methanol plant (875,000 tonnes per year capacity) to restart operations in September 2024. Simultaneously, the Atlas plant (Methanex interest 63.1% or 1,085,000 tonnes per year capacity) will be idled in September 2024, when its legacy 20-year natural gas supply agreement expires.

Chile

Chile produced 403,000 tonnes in the fourth quarter of 2023 compared to 168,000 tonnes in the third quarter of 2023. Production was higher in the fourth quarter compared to the third quarter as both plants ran at full rates with full gas deliveries from Argentina. Both plants are expected to run at full rates from the end of September 2023 through April 2024, the Southern hemisphere summer months. We estimate production for 2024 will be between 1.1 - 1.2 million tonnes which is underpinned by year-round natural gas supply from Chile for about 30 – 35% of our requirements with the remaining 65 – 70% from Argentina during the non-winter period allowing us to operate both plants at full rates. Natural gas development and related infrastructure

METHANEX CORPORATION 2023 FOURTH QUARTER NEWS RELEASE PAGE 4

investments in Argentina continue to progress and we are working with our natural gas suppliers on extending the period of full gas availability to our plants.

Egypt

Egypt produced 40,000 tonnes (Methanex interest - 20,000 tonnes) in the fourth quarter of 2023 compared to 320,000 tonnes (Methanex interest - 160,000 tonnes) in the third quarter of 2023. Production was lower in Egypt due an unplanned outage in mid-October caused by a mechanical failure in the synthesis gas compressor. The unit was removed from service and repaired on an expedited schedule at the manufacturer overseas. The repairs were completed and the unit has now arrived back on site and we expect to be able to start up the plant in the first half of February.

Canada

Medicine Hat produced 142,000 tonnes in the fourth quarter of 2023 compared to 130,000 tonnes in the third quarter of 2023.

2024 Production Outlook

We expect production for 2024 to be higher than 2023 with the Geismar 3 start-up and to be approximately 8.1 million tonnes (Methanex interest). 2024 production guidance is based on the mid-point of Chile and New Zealand production guidance, G3 ramp up through February, Egypt restart in the first half of February, and all other plants operating at full rates. Actual production may vary by quarter based on timing of turnarounds, gas availability, unplanned outages and unanticipated events.

CONFERENCE CALL

A conference call is scheduled for February 1, 2024 at 11:00 am ET (8:00 am PT) to review these fourth quarter results. To access the call, dial the conferencing operator fifteen minutes prior to the start of the call at (646) 960-0479, or toll free at (888) 510-2296. The conference ID for the call is #7014770. A simultaneous audio-only webcast of the conference call can be accessed from our website at www.methanex.com/investor-relations/events and will also be available following the call.

ABOUT METHANEX

Methanex is a Vancouver-based, publicly traded company and is the world’s largest producer and supplier of methanol to major international markets. Methanex shares are listed for trading on the Toronto Stock Exchange in Canada under the trading symbol "MX" and on the NASDAQ Global Market in the United States under the trading symbol "MEOH".

FORWARD-LOOKING INFORMATION WARNING

This fourth quarter 2023 press release contains forward-looking statements with respect to us and the chemical industry. By its nature, forward-looking information is subject to numerous risks and uncertainties, some of which are beyond the Company's control. Readers are cautioned that undue reliance should not be placed on forward-looking information as actual results may vary materially from the forward-looking information. Methanex does not undertake to update, correct or revise any forward-looking information as a result of any new information, future events or otherwise, except as may be required by applicable law. Refer to Forward-Looking Information Warning in the fourth quarter 2023 Management's Discussion and Analysis for more information which is available from the Investor Relations section of our website at www.methanex.com, the Canadian Securities Administrators' SEDAR+ website at www.sedarplus.ca and on the United States Securities and Exchange Commission's EDGAR website at www.sec.gov.

NON-GAAP MEASURES

The Company has used the terms Adjusted EBITDA, Adjusted net income, and Adjusted net income per common share throughout this document. These items are non-GAAP measures and ratios that do not have any standardized meaning prescribed by GAAP. These measures represent the amounts that are attributable to Methanex Corporation shareholders and are calculated by excluding the mark-to-market impact of share-based compensation as a result of changes in our share price, the impact of the Egypt gas contract revaluation and the impact of certain items associated with specific identified events. Refer to Additional Information - Non-GAAP Measures on page 14 of the Company's MD&A for the period ended December 31, 2023 for reconciliations to the most comparable GAAP measures. Unless otherwise indicated, the financial information presented in this

METHANEX CORPORATION 2023 FOURTH QUARTER NEWS RELEASE PAGE 5

release is prepared in accordance with International Financial Reporting Standards ("IFRS") as issued by the International Accounting Standards Board ("IASB").

-end-

For further information, contact:

Sarah Herriott

Director, Investor Relations

Methanex Corporation

604-661-2600

METHANEX CORPORATION 2023 FOURTH QUARTER NEWS RELEASE PAGE 6

| | | | | | | | | | | |

| |

Share Information Methanex Corporation’s common shares are listed for trading on the Toronto Stock Exchange under the symbol MX and on the Nasdaq Global Market under the symbol MEOH.

Transfer Agents & Registrars TSX Trust Company 320 Bay Street Toronto, Ontario Canada M5H 4A6 Toll free in North America: 1-800-387-0825 |

Investor Information All financial reports, news releases and corporate information can be accessed on our website at www.methanex.com.

Contact Information Methanex Investor Relations 1800 - 200 Burrard Street Vancouver, BC Canada V6C 3M1 E-mail: invest@methanex.com Methanex Toll-Free: 1-800-661-8851 |

| 4 | |

Management's Discussion and Analysis for the Three Months and Year Ended December 31, 2023 |

At January 30, 2024 the Company had 67,387,492 common shares issued and outstanding and stock options exercisable for 1,625,585 additional common shares. |

FOURTH QUARTER MANAGEMENT’S DISCUSSION AND ANALYSIS ("MD&A")

Except where otherwise noted, all currency amounts are stated in United States dollars.

This Fourth Quarter 2023 Management’s Discussion and Analysis dated January 31, 2024 for Methanex Corporation ("the Company") should be read in conjunction with the Company’s unaudited condensed consolidated interim financial statements for the period ended December 31, 2023 as well as the 2022 Annual Consolidated Financial Statements and MD&A included in the Methanex 2022 Annual Report. Unless otherwise indicated, the financial information presented in this interim report is prepared in accordance with International Financial Reporting Standards ("IFRS") as issued by the International Accounting Standards Board ("IASB"). The Methanex 2022 Annual Report and additional information relating to Methanex is available on our website at www.methanex.com, the Canadian Securities Administrators' SEDAR+ website at www.sedarplus.ca and on the United States Securities and Exchange Commission's EDGAR website at www.sec.gov.

METHANEX CORPORATION 2023 FOURTH QUARTER

MANAGEMENT’S DISCUSSION AND ANALYSIS PAGE 1

FINANCIAL AND OPERATIONAL DATA

| | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Years Ended |

| ($ millions except per share amounts and where noted) | Dec 31

2023 | Sep 30

2023 | Dec 31

2022 | | Dec 31

2023 | Dec 31

2022 |

Production (thousands of tonnes) (attributable to Methanex shareholders) 1 | 1,779 | | 1,545 | | 1,526 | | | 6,642 | | 6,118 | |

| Sales volume (thousands of tonnes) | | | | | | |

| Methanex-produced methanol | 1,712 | | 1,473 | | 1,360 | | | 6,455 | | 6,141 | |

| Purchased methanol | 890 | | 905 | | 1,095 | | | 3,527 | | 3,688 | |

| Commission sales | 260 | | 342 | | 192 | | | 1,187 | | 945 | |

Total sales volume 1 | 2,862 | | 2,720 | | 2,647 | | | 11,169 | | 10,774 | |

| | | | | | |

Methanex average non-discounted posted price ($ per tonne) 2 | 421 | | 395 | | 469 | | | 434 | | 503 | |

Average realized price ($ per tonne) 3 | 322 | | 303 | | 373 | | | 333 | | 397 | |

| | | | | | |

| Revenue | 922 | | 823 | | 986 | | | 3,723 | | 4,311 | |

| Net income (attributable to Methanex shareholders) | 33 | | 24 | | 41 | | | 174 | | 354 | |

Adjusted net income 4 | 35 | | 1 | | 51 | | | 153 | | 343 | |

Adjusted EBITDA 4 | 148 | | 105 | | 160 | | | 622 | | 932 | |

| Cash flows from operating activities | 195 | | 106 | | 227 | | | 660 | | 987 | |

| | | | | | |

| Basic net income per common share | 0.50 | | 0.36 | | 0.59 | | | 2.57 | | 4.95 | |

| Diluted net income per common share | 0.50 | | 0.36 | | 0.59 | | | 2.57 | | 4.86 | |

Adjusted net income per common share 4 | 0.52 | | 0.02 | | 0.73 | | | 2.25 | | 4.79 | |

| | | | | | |

Common share information (millions of shares) | | | | | | |

| Weighted average number of common shares | 67 | | 67 | | 70 | | | 68 | | 71 | |

Diluted weighted average number of common shares | 68 | | 67 | | 70 | | | 68 | | 72 | |

Number of common shares outstanding, end of period | 67 | | 67 | | 69 | | | 67 | | 69 | |

1 Methanex-produced methanol represents our equity share of volume produced at our facilities and excludes volume marketed on a commission basis related to the 36.9% of the Atlas facility and 50% of the Egypt facility that we do not own.

2 Methanex average non-discounted posted price represents the average of our non-discounted posted prices in North America, Europe, China and Asia Pacific weighted by sales volume. Current and historical pricing information is available at www.methanex.com.

3 The Company has used Average realized price ("ARP") throughout this document. ARP is calculated as revenue divided by the total sales volume. It is used by management to assess the realized price per unit of methanol sold, and is relevant in a cyclical commodity environment where revenue can fluctuate in response to market prices.

4 Note that Adjusted net income, Adjusted net income per common share, and Adjusted EBITDA are non-GAAP measures and ratios that do not have any standardized meaning prescribed by GAAP and therefore are unlikely to be comparable to similar measures presented by other companies. Refer to the Additional Information - Non-GAAP Measures section on page 14 for a description of each non-GAAP measure.

METHANEX CORPORATION 2023 FOURTH QUARTER

MANAGEMENT’S DISCUSSION AND ANALYSIS PAGE 2

FINANCIAL AND OPERATIONAL HIGHLIGHTS

▪A reconciliation from net income attributable to Methanex shareholders to Adjusted net income and the calculation of Adjusted net income per common share is as follows:

| | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Years Ended |

| ($ millions except number of shares and per share amounts) | Dec 31

2023 | Sep 30

2023 | Dec 31

2022 | | Dec 31

2023 | Dec 31

2022 |

| Net income attributable to Methanex shareholders | $ | 33 | | $ | 24 | | $ | 41 | | | $ | 174 | | $ | 354 | |

| Mark-to-market impact of share-based compensation, net of tax | 3 | | 6 | | 11 | | | 13 | | (6) | |

| Gas contract settlement, net of tax | — | | (31) | | — | | | (31) | | — | |

| Impact of Egypt gas contract revaluation, net of tax | (1) | | 2 | | (1) | | | (3) | | (5) | |

Adjusted net income 1 | $ | 35 | | $ | 1 | | $ | 51 | | | $ | 153 | | $ | 343 | |

| Diluted weighted average shares outstanding (millions) | 68 | | 67 | | 70 | | | 68 | | 72 | |

Adjusted net income per common share 1 | $ | 0.52 | | $ | 0.02 | | $ | 0.73 | | | $ | 2.25 | | $ | 4.79 | |

1 The Company has used the terms Adjusted EBITDA, Adjusted net income and Adjusted net income per common share throughout this document. These items are non-GAAP measures and ratios that do not have any standardized meaning prescribed by GAAP and therefore are unlikely to be comparable to similar measures presented by other companies. Refer to Additional Information - Non-GAAP Measures on page 14 of the MD&A for reconciliations to the most comparable GAAP measures.

▪We recorded net income attributable to Methanex shareholders of $33 million in the fourth quarter of 2023 compared to net income of $24 million in the third quarter of 2023. Net income in the fourth quarter of 2023 was higher compared to the prior quarter primarily due to a higher average realized price, higher sales of Methanex-produced methanol and lower mark-to-market impact of share-based compensation due to changes in Methanex's share price, offset by lower income from the gas contract settlement recognized in the third quarter of 2023. Income from gas contract settlement was excluded from Adjusted EBITDA and Adjusted net income in the third quarter of 2023.

▪We recorded Adjusted EBITDA of $148 million for the fourth quarter of 2023 compared to $105 million for the third quarter of 2023. We recorded Adjusted net income of $35 million for the fourth quarter of 2023 compared to Adjusted net income of $1 million for the third quarter of 2023. Adjusted EBITDA was higher in the fourth quarter of 2023 primarily due to a higher average realized price and higher sales of Methanex-produced methanol.

▪We sold 2,862,000 tonnes in the fourth quarter of 2023 compared to 2,720,000 tonnes for the third quarter of 2023. Sales of Methanex-produced methanol were 1,712,000 tonnes in the fourth quarter of 2023 compared to 1,473,000 tonnes in the third quarter of 2023. Refer to the Supply/Demand Fundamentals section on page 11 of the MD&A for more information.

▪Production for the fourth quarter of 2023 was 1,779,000 tonnes compared to 1,545,000 tonnes for the third quarter of 2023. Fourth quarter production was higher compared to the third quarter due to higher production in Chile, New Zealand, Geismar and Medicine Hat which was partially offset by lower production in Egypt. Refer to the Production Summary section on page 4 of the MD&A.

▪The Geismar 3 plant is in the process of starting up, with total capital costs expected to come within budget of $1.25 - 1.3 billion. The remaining cash expenditure of approximately $60 to $110 million, including approximately $20 million of spending accrued in accounts payable, is fully funded with cash on hand. Geismar 3 has one of the lowest CO2 emissions intensity profiles in the industry and significantly enhances our cash generation capability. We expect the plant to ramp up to full rates over the month of February.

▪In the fourth quarter of 2023 we paid a quarterly dividend of $0.185 per common share for a total of $12.5 million.

▪At December 31, 2023, we had a strong liquidity position including a cash balance of $458 million. We also have access to an undrawn $300 million revolving credit facility providing financial flexibility.

METHANEX CORPORATION 2023 FOURTH QUARTER

MANAGEMENT’S DISCUSSION AND ANALYSIS PAGE 3

PRODUCTION HIGHLIGHTS

| | | | | | | | | | | | | | | | | | | | |

| (thousands of tonnes) | Annual Operating Capacity1 | 2023

Production | 2022

Production | Q4 2023 Production | Q3 2023 Production | Q4 2022 Production |

USA (Geismar) | 2,200 | | 2,142 | | 2,041 | | 587 | | 574 | | 437 | |

New Zealand 2 | 2,200 | | 1,381 | | 1,230 | | 344 | | 226 | | 395 | |

Trinidad (Methanex interest) 3 | 1,960 | | 1,074 | | 981 | | 283 | | 287 | | 225 | |

| Chile | 1,700 | | 993 | | 888 | | 403 | | 168 | | 226 | |

| Egypt (50% interest) | 630 | | 504 | | 385 | | 20 | | 160 | | 96 | |

| Canada (Medicine Hat) | 640 | | 548 | | 593 | | 142 | | 130 | | 147 | |

| 9,330 | | 6,642 | | 6,118 | | 1,779 | | 1,545 | | 1,526 | |

1The operating capacity of our production facilities may be higher or lower than original nameplate capacity as, over time, these figures have been adjusted to reflect ongoing operating efficiencies at these facilities. Actual production for a facility in any given year may be higher or lower than operating capacity due to a number of factors, including natural gas availability, feedstock composition, the age of the facility's catalyst, turnarounds and access to CO2 from external suppliers for certain facilities. We review and update the operating capacity of our production facilities on a regular basis based on historical performance.

2The operating capacity of New Zealand is made up of the two Motunui facilities and the Waitara Valley facility. The Waitara Valley plant is idled indefinitely due to natural gas constraints. Refer to the New Zealand section below.

3The operating capacity of Trinidad is made up of the Titan (100% interest) and Atlas (63.1% interest) facilities. Refer to the Trinidad section below.

Key production and operational highlights during the fourth quarter include:

United States

Geismar produced 587,000 tonnes in the fourth quarter compared to 574,000 tonnes in the third quarter of 2023.

New Zealand

New Zealand produced 344,000 tonnes in the fourth quarter of 2023 compared to 226,000 tonnes in the third quarter of 2023. Production in the fourth quarter was higher compared to the third quarter due to the restart of Motunui 2 after the scheduled turnaround. Waitara Valley remains idled indefinitely. We estimate production for 2024 to be between 1.0 - 1.1 million tonnes. 2024 natural gas supply is expected to be impacted by a combination of our suppliers' planned natural gas infrastructure maintenance outages as well as lower than expected output from existing wells. While upstream investment has been made by our gas suppliers in New Zealand over the past two years, recent gas production results have been lower than originally expected which has contributed to the revised forecast for lower production in 2024.

Trinidad

Atlas produced 283,000 tonnes (Methanex interest) in the fourth quarter of 2023 compared to 287,000 tonnes in the third quarter of 2023. In October, Methanex signed a two-year natural gas supply agreement with the National Gas Company of Trinidad and Tobago (NGC) for its currently idled, wholly owned, Titan methanol plant (875,000 tonnes per year capacity) to restart operations in September 2024. Simultaneously, the Atlas plant (Methanex interest 63.1% or 1,085,000 tonnes per year capacity) will be idled in September 2024, when its legacy 20-year natural gas supply agreement expires.

Chile

Chile produced 403,000 tonnes in the fourth quarter of 2023 compared to 168,000 tonnes in the third quarter of 2023. Production was higher in the fourth quarter compared to the third quarter as both plants ran at full rates with full gas deliveries from Argentina. Both plants are expected to run at full rates from the end of September 2023 through April 2024, the Southern hemisphere summer months. We estimate production for 2024 will be between 1.1 - 1.2 million tonnes which is underpinned by year-round natural gas supply from Chile for about 30 – 35% of our requirements with the remaining 65 – 70% from Argentina during the non-winter period allowing us to operate both plants at full rates. Natural gas development and related infrastructure investments in Argentina continue to progress and we are working with our natural gas suppliers on extending the period of full gas availability to our plants.

METHANEX CORPORATION 2023 FOURTH QUARTER

MANAGEMENT’S DISCUSSION AND ANALYSIS PAGE 4

Egypt

Egypt produced 40,000 tonnes (Methanex interest - 20,000 tonnes) in the fourth quarter of 2023 compared to 320,000 tonnes (Methanex interest - 160,000 tonnes) in the third quarter of 2023. Production was lower in Egypt due an unplanned outage in mid-October caused by a mechanical failure in the synthesis gas compressor. The unit was removed from service and repaired on an expedited schedule at the manufacturer overseas. The repairs were completed and the unit has now arrived back on site and we expect to be able to start up the plant in the first half of February.

Canada

Medicine Hat produced 142,000 tonnes in the fourth quarter of 2023 compared to 130,000 tonnes in the third quarter of 2023.

2024 Production Outlook

We expect production for 2024 to be higher than 2023 with the Geismar 3 start-up and to be approximately 8.1 million tonnes (Methanex interest). 2024 production guidance is based on the mid-point of Chile and New Zealand production guidance, G3 ramp up through February, Egypt restart in the first half of February, and all other plants operating at full rates. Actual production may vary by quarter based on timing of turnarounds, gas availability, unplanned outages and unanticipated events.

FINANCIAL RESULTS

For the fourth quarter of 2023, we reported net income attributable to Methanex shareholders of $33 million ($0.50 net income per common share on a diluted basis) compared to net income attributable to Methanex shareholders for the third quarter of 2023 of $24 million ($0.36 net income per common share on a diluted basis) and net income attributable to Methanex shareholders for the fourth quarter of 2022 of $41 million ($0.59 net income per common share on a diluted basis). For the year ended December 31, 2023, we reported net income attributable to Methanex shareholders of $174 million ($2.57 net income per common share on a diluted basis) compared to net income for the same period in 2022 of $354 million ($4.86 net income per common share on a diluted basis). Net income in the fourth quarter of 2023 was higher compared to the prior quarter primarily due to a higher average realized price, higher sales of Methanex-produced methanol and lower mark-to-market impact of share-based compensation due to changes in Methanex's share price, offset by lower income from the gas contract settlement recognized in the third quarter of 2023. Income from gas contract settlement was excluded from Adjusted EBITDA and Adjusted net income in the third quarter of 2023. Net income was lower compared to the fourth quarter of 2022 primarily due to a lower average realized price, partially offset by higher sales of Methanex-produced methanol in the fourth quarter of 2023.

For the fourth quarter of 2023, we recorded Adjusted EBITDA of $148 million and Adjusted net income of $35 million ($0.52 Adjusted net income per common share). This compares with Adjusted EBITDA of $105 million and Adjusted net income of $1 million ($0.02 Adjusted net income per common share) for the third quarter of 2023 and Adjusted EBITDA of $160 million and Adjusted net income of $51 million ($0.73 Adjusted net income per common share) for the fourth quarter of 2022. For the year ended December 31, 2023, we recorded Adjusted EBITDA of $622 million and Adjusted net income of $153 million ($2.25 Adjusted net income per common share) compared to Adjusted EBITDA of $932 million and Adjusted net income of $343 million ($4.79 Adjusted net income per common share) for the same period in 2022.

We calculate Adjusted EBITDA and Adjusted net income by including amounts related to our equity share of the Atlas facility (63.1% interest) and by excluding the non-controlling interests' share, the mark-to-market impact of share-based compensation as a result of changes in our share price, the impact of the Egypt gas contract revaluation included in finance income and other and the impact of certain items associated with specific identified events. Refer to Additional Information - Non-GAAP Measures on page 14 for a further discussion on how we calculate these measures. Our analysis of depreciation and amortization, finance costs, finance income and other and income taxes is consistent with the presentation of our consolidated statements of income and excludes amounts related to Atlas.

METHANEX CORPORATION 2023 FOURTH QUARTER

MANAGEMENT’S DISCUSSION AND ANALYSIS PAGE 5

We review our financial results by analyzing changes in Adjusted EBITDA, mark-to-market impact of share-based compensation, depreciation and amortization, gas contract settlement, finance costs, finance income and other and income taxes. A summary of our consolidated statements of income is as follows:

| | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Years Ended |

| ($ millions) | Dec 31

2023 | Sep 30

2023 | Dec 31

2022 | | Dec 31

2023 | Dec 31

2022 |

| Consolidated statements of income: | | | | | | |

| Revenue | $ | 922 | | $ | 823 | | $ | 986 | | | $ | 3,723 | | $ | 4,311 | |

| Cost of sales and operating expenses | (772) | | (730) | | (841) | | | (3,068) | | (3,446) | |

| Egypt gas redirection and sale proceeds | — | | — | | 2 | | | — | | 118 | |

| Mark-to-market impact of share-based compensation | 3 | | 8 | | 12 | | | 16 | | (7) | |

| Adjusted EBITDA attributable to associate | 30 | | 47 | | 36 | | | 135 | | 151 | |

Amounts excluded from Adjusted EBITDA attributable to non-controlling interests | (35) | | (43) | | (35) | | | (184) | | (195) | |

| Adjusted EBITDA | 148 | | 105 | | 160 | | | 622 | | 932 | |

| | | | | | |

| Mark-to-market impact of share-based compensation | (3) | | (8) | | (12) | | | (16) | | 7 | |

| Depreciation and amortization | (100) | | (98) | | (86) | | | (392) | | (372) | |

| Gas contract settlement, net of tax | — | | 31 | | — | | | 31 | | — | |

| Finance costs | (30) | | (26) | | (32) | | | (117) | | (131) | |

| Finance income and other | 11 | | 2 | | 18 | | | 40 | | 25 | |

| Income tax recovery (expense) | 14 | | 18 | | (7) | | | (1) | | (120) | |

Earnings of associate adjustment 1 | (15) | | (23) | | (18) | | | (67) | | (74) | |

Non-controlling interests adjustment 2 | 8 | | 23 | | 18 | | | 74 | | 87 | |

| Net income attributable to Methanex shareholders | $ | 33 | | $ | 24 | | $ | 41 | | | $ | 174 | | $ | 354 | |

| Net income | $ | 60 | | $ | 44 | | $ | 58 | | | $ | 284 | | $ | 462 | |

1 This adjustment represents the deduction of depreciation and amortization, finance costs, finance income and other and income taxes associated with our 63.1% interest in the Atlas methanol facility which are excluded from adjusted EBITDA but included in net income attributable to Methanex shareholders.

2 This adjustment represents the add-back of the portion of depreciation and amortization, finance costs, finance income and other and income taxes associated with our non-controlling interests' share which has been deducted above but is excluded from net income attributable to Methanex shareholders.

Adjusted EBITDA

Our operations consist of a single operating segment - the production and sale of methanol. We review the results of operations by analyzing changes in the components of Adjusted EBITDA. For a discussion of the definitions used in our Adjusted EBITDA analysis, refer to How We Analyze Our Business on page 18. Changes in these components - average realized price, sales volume and total cash costs - similarly impact net income attributable to Methanex shareholders. The changes in Adjusted EBITDA resulted from changes in the following:

| | | | | | | | | | | |

| ($ millions) | Q4 2023

compared with

Q3 2023 | Q4 2023

compared with

Q4 2022 | 2023

compared with

2022 |

| Average realized price | $ | 51 | | $ | (132) | | $ | (657) | |

| Sales volume | 15 | | 12 | | 16 | |

| Total cash costs | (23) | | 108 | | 331 | |

| Increase (decrease) in Adjusted EBITDA | $ | 43 | | $ | (12) | | $ | (310) | |

METHANEX CORPORATION 2023 FOURTH QUARTER

MANAGEMENT’S DISCUSSION AND ANALYSIS PAGE 6

Average realized price

| | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Years Ended |

| ($ per tonne) | Dec 31

2023 | Sep 30

2023 | Dec 31

2022 | | Dec 31

2023 | Dec 31

2022 |

| Methanex average non-discounted posted price | 421 | | 395 | | 469 | | | 434 | | 503 | |

| Methanex average realized price | 322 | | 303 | | 373 | | | 333 | | 397 | |

Methanex’s average realized price for the fourth quarter of 2023 was $322 per tonne compared to $303 per tonne in the third quarter of 2023 and $373 per tonne in the fourth quarter of 2022, resulting in an increase of $51 million and a decrease of $132 million in Adjusted EBITDA, respectively. For the year ended December 31, 2023, our average realized price was $333 per tonne compared to $397 per tonne for the same period in 2022, decreasing Adjusted EBITDA by $657 million. Through the fourth quarter, market conditions strengthened, with increased demand primarily in China outpacing an increase in supply. On the supply side, production increased from coal-based producers in China which was offset by planned and unplanned outages in the US and Asia as well as lower production from natural gas restrictions in Iran and China. This led to a drawdown on inventories and increasing methanol prices through the quarter. Refer to the Supply/Demand Fundamentals section on page 11 of the MD&A for more information.

Sales volume

Methanol sales volume excluding commission sales volume in the fourth quarter of 2023 was 224,000 tonnes higher than the third quarter of 2023 and 147,000 tonnes higher than the fourth quarter of 2022. The increase in sales volume in the fourth quarter of 2023 compared to the third quarter of 2023 increased Adjusted EBITDA by $15 million. The increase in sales volume for the fourth quarter of 2023 compared to the same period in 2022 increased Adjusted EBITDA by $12 million. For the year ended December 31, 2023, compared to the same period in 2022, methanol sales volume excluding commission sales volume was 153,000 tonnes higher, increasing Adjusted EBITDA by $16 million. Sales volume may vary quarter to quarter depending on customer requirements and inventory levels as well as the available commission sales volume.

Total cash costs

The primary drivers of changes in our total cash costs are changes in the cost of Methanex-produced methanol and changes in the cost of methanol we purchase from others ("purchased methanol"). We supplement our production with methanol produced by others through methanol offtake contracts and purchases on the spot market to meet customer needs and to support our marketing efforts within the major global markets.

We apply the first-in, first-out method of accounting for inventories and it generally takes between 30 and 60 days to sell the methanol we produce or purchase. Accordingly, the changes in Adjusted EBITDA as a result of changes in Methanex-produced and purchased methanol costs primarily depend on changes in methanol pricing and the timing of inventory flows.

In a rising price environment, our margins at a given price are higher than in a stable price environment as a result of timing of methanol purchases and production versus sales. Generally, the opposite applies when methanol prices are decreasing.

The changes in Adjusted EBITDA due to changes in total cash costs were due to the following:

| | | | | | | | | | | |

| ($ millions) | Q4 2023

compared with

Q3 2023 | Q4 2023

compared with

Q4 2022 | 2023

compared with

2022 |

| Methanex-produced methanol costs | $ | (3) | | $ | 62 | | $ | 199 | |

| Proportion of Methanex-produced methanol sales | 8 | | 31 | | 18 | |

| Purchased methanol costs | (25) | | 36 | | 207 | |

| Logistics costs | (7) | | (16) | | (18) | |

| | | |

| Egypt gas redirection and sale proceeds | — | | — | | (58) | |

| Other, net | 4 | | (5) | | (17) | |

| Increase (decrease) in Adjusted EBITDA due to changes in total cash costs | $ | (23) | | $ | 108 | | $ | 331 | |

METHANEX CORPORATION 2023 FOURTH QUARTER

MANAGEMENT’S DISCUSSION AND ANALYSIS PAGE 7

Methanex-produced methanol costs

Natural gas is the primary feedstock at our methanol facilities and is the most significant component of Methanex-produced methanol costs. We purchase natural gas for more than half of our production under agreements where the unique terms of each contract include a base price and a variable price component linked to methanol revenue to reduce our commodity price risk exposure. The variable price component is adjusted by a formula linked to methanol sales prices above a certain level. We also purchase natural gas in North America and are exposed to natural gas spot price fluctuations for the unhedged portion of our gas needs in the region.

For the fourth quarter of 2023 compared to the third quarter of 2023, higher Methanex-produced methanol costs decreased Adjusted EBITDA by $3 million. For the fourth quarter of 2023 compared to the same period in 2022, lower Methanex-produced methanol costs increased Adjusted EBITDA by $62 million. For the year ended December 31, 2023 compared with the same period in 2022, lower Methanex-produced methanol costs increased Adjusted EBITDA by $199 million. Changes in Methanex-produced methanol costs for all periods presented are primarily due to the impact of changes in realized methanol prices on the variable portion of our natural gas cost, changes in spot gas prices which impact the unhedged portion of our North American operations, timing of inventory flows and changes in the mix of production sold from inventory.

Proportion of Methanex-produced methanol sales

The cost of purchased methanol is linked to the selling price for methanol at the time of purchase and the cost of purchased methanol is generally higher than the cost of Methanex-produced methanol. Accordingly, an increase (decrease) in the proportion of Methanex-produced methanol sales results in a decrease (increase) in our overall cost structure for a given period. For the fourth quarter of 2023 compared to the third quarter of 2023 and the fourth quarter of 2022, a higher proportion of Methanex-produced methanol sales increased Adjusted EBITDA by $8 million and $31 million, respectively. For the year ended December 31, 2023 compared with the same period in 2022, a higher proportion of Methanex-produced methanol sales increased Adjusted EBITDA by $18 million.

Purchased methanol costs

Changes in purchased methanol costs for all periods presented are primarily a result of changes in methanol pricing and the timing of purchases sold from inventory, as well as the volume and regional mix of sourcing for purchased methanol. For the fourth quarter of 2023 compared to the third quarter of 2023, the impact of higher purchased methanol costs decreased Adjusted EBITDA by $25 million. For the fourth quarter of 2023 compared to the fourth quarter of 2022, the impact of lower purchased methanol costs increased Adjusted EBITDA by $36 million. For the year ended December 31, 2023 compared with the same period in 2022, lower purchased methanol costs increased Adjusted EBITDA by $207 million.

Logistics costs

Logistics costs include the cost of transportation, storage, and handling of product, and can vary from period to period primarily depending on the levels of production from each of our production facilities, the resulting impact on our supply chain, and variability in bunker fuel costs. Logistics costs for the fourth quarter of 2023, compared with the third quarter of 2023, were higher by $7 million. For the fourth quarter of 2023 compared to the fourth quarter of 2022, logistics costs were higher by $16 million. Logistics costs for the year ended December 31, 2023 were $18 million higher compared to the same period in 2022. Higher logistics costs for all periods presented were due to the mix of production from various plants and the impact of longer supply routes, with the outage in Egypt and preparation for Geismar 3 causing increased costs in the fourth quarter of 2023. We expect our supply chain will normalize with the start-up of Geismar 3 and Egypt in the first quarter of 2024.

Egypt gas redirection and sale proceeds

In the third quarter of 2022, we entered into an agreement to redirect and sell the Egypt plant's contracted natural gas during an extended turnaround for a three-month period. Adjusted EBITDA for the year ended December 31, 2022 includes $58 million (attributable to Methanex) from this transaction which did not recur in 2023.

Other, net

Other, net relates to unabsorbed fixed costs, selling, general and administrative expenses and other operational items. Other costs were $4 million lower during the fourth quarter of 2023 compared to the third quarter of 2023. Other costs during the fourth quarter of 2023 were $5 million higher compared to the fourth quarter of 2022. For the year ended December 31, 2023 compared with the

METHANEX CORPORATION 2023 FOURTH QUARTER

MANAGEMENT’S DISCUSSION AND ANALYSIS PAGE 8

same period in 2022, other costs were higher by $17 million, mainly due to the organization build-up of costs relating to the start-up of Geismar 3 plant.

Mark-to-Market Impact of Share-based Compensation

We grant share-based awards as an element of compensation. Share-based awards granted include stock options, share appreciation rights, tandem share appreciation rights, deferred share units, restricted share units and performance share units. For all share-based awards, share-based compensation is recognized over the related vesting period for the proportion of the service that has been rendered at each reporting date. Share-based compensation includes an amount related to the grant-date value and a mark-to-market impact as a result of subsequent changes in the fair value of the share-based awards primarily driven by the Company’s share price. The grant-date value amount is included in Adjusted EBITDA and Adjusted net income. The mark-to-market impact of share-based compensation as a result of changes in our share price is excluded from Adjusted EBITDA and Adjusted net income and analyzed separately.

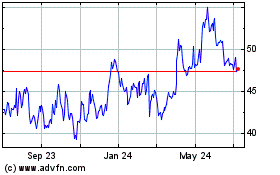

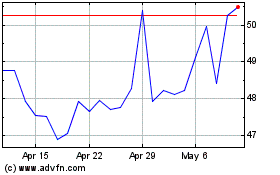

| | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Years Ended |

| ($ millions except share price) | Dec 31

2023 | Sep 30

2023 | Dec 31

2022 | | Dec 31

2023 | Dec 31

2022 |

Methanex Corporation share price 1 | $ | 47.36 | | $ | 45.05 | | $ | 37.86 | | | $ | 47.36 | | $ | 37.86 | |

Grant-date fair value expense included in Adjusted EBITDA and Adjusted net income | 4 | | 4 | | 3 | | | 19 | | 22 | |

Mark-to-market impact 2 | 3 | | 8 | | 12 | | | 16 | | (7) | |

| Total share-based compensation expense, before tax | $ | 7 | | $ | 12 | | $ | 15 | | | $ | 35 | | $ | 15 | |

1 US dollar share price of Methanex Corporation as quoted on the NASDAQ Global Market on the last trading day of the respective period.

2For all periods presented, the mark-to-market impact on share-based compensation is primarily due to changes in the Methanex Corporation share price.

Gas Contract Settlement

In the third quarter of 2023, we recognized a settlement of $31 million (Methanex's share, net of tax) related to a historical dispute under an existing gas contract. For additional information, refer to Note 4 of the condensed consolidated interim financial statements.

Depreciation and Amortization

Depreciation and amortization was $100 million for the fourth quarter of 2023 compared to $98 million for the third quarter of 2023 and $86 million for the fourth quarter of 2022. Depreciation and amortization for the year ended December 31, 2023 was $392 million compared to $372 million in the same period in 2022. Compared to the year ended December 31, 2022, depreciation and amortization in 2023 was higher due to the higher cost base of depreciable property, plant and equipment driven by additional capitalized maintenance costs and ocean going vessel additions.

Finance Costs

| | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Years Ended |

| ($ millions) | Dec 31

2023 | Sep 30

2023 | Dec 31

2022 | | Dec 31

2023 | Dec 31

2022 |

Finance costs before capitalized interest | $ | 45 | | $ | 41 | | $ | 43 | | | $ | 173 | | $ | 167 | |

| | | | | | |

| Less capitalized interest | (15) | | (15) | | (11) | | | (55) | | (36) | |

Finance costs | $ | 30 | | $ | 26 | | $ | 32 | | | $ | 117 | | $ | 131 | |

Finance costs are primarily comprised of interest on borrowings and lease obligations.

Finance costs were higher for the fourth quarter of 2023 compared to the third quarter of 2023 due to new leases associated with additional Geismar 3 requirements. Finance costs were lower for the three months and the year ended December 31, 2023 compared to the same period in 2022 primarily due to additional interest capitalized for the Geismar 3 project. Refer to the Liquidity and Capital Resources section on page 12.

METHANEX CORPORATION 2023 FOURTH QUARTER

MANAGEMENT’S DISCUSSION AND ANALYSIS PAGE 9

Finance Income and Other

| | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Years Ended |

| ($ millions) | Dec 31

2023 | Sep 30

2023 | Dec 31

2022 | | Dec 31

2023 | Dec 31

2022 |

| Finance income and other | $ | 11 | | $ | 2 | | $ | 18 | | | $ | 40 | | $ | 25 | |

Finance income and other was higher during the fourth quarter of 2023 compared to the third quarter of 2023 due to higher unrealized gain on the derivative Egypt gas supply contract (refer to Note 10 of the fourth quarter 2023 condensed consolidated interim financial statements) and higher proceeds from a vessel sale. Finance income and other was higher for the year ended December 31, 2023 compared to the same period in 2022 primarily due to higher interest income.

Income Taxes

A summary of our income taxes for the fourth quarter of 2023 compared to the third quarter of 2023 and the year ended December 31, 2023 compared to the same period in 2022 is as follows:

| | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, 2023 | | Three Months Ended September 30, 2023 |

| ($ millions except where noted) | Per consolidated statement of income | Adjusted 1, 2, 3, 4 | | Per consolidated statement of income | Adjusted 1, 2, 3, 4 |

| Net income before income tax | $ | 45 | | $ | 44 | | | $ | 26 | | $ | (2) | |

| Income tax recovery (expense) | 15 | | (9) | | | 18 | | 3 | |

| Net income after income tax | $ | 60 | | $ | 35 | | | $ | 44 | | $ | 1 | |

| Effective tax rate | (32) | % | 20 | % | | (69) | % | 150 | % |

| | | | | | | | | | | | | | | | | |

| Year Ended December 31, 2023 | | Year Ended December 31, 2022 |

| ($ millions, except where noted) | Per consolidated statement of income | Adjusted 1, 2, 3, 4 | | Per consolidated statement of income | Adjusted 1, 2, 3, 4 |

| Net income before income tax | $ | 286 | | $ | 199 | | | $ | 582 | | $ | 482 | |

| Income tax expense | (2) | | (46) | | | (120) | | (139) | |

| Net income after income tax | $ | 284 | | $ | 153 | | | $ | 462 | | $ | 343 | |

| Effective tax rate | 1 | % | 23 | % | | 21 | % | 29 | % |

1 Adjusted net income before income tax reflects amounts required for the inclusion of 63.1% of Atlas income, 50% of Egypt and 60% of Waterfront Shipping, as well as amounts required to exclude the mark-to-market impact of share-based compensation expense or recovery, the impact of the Egypt gas contract revaluation, and the impact of the settlement of a historical dispute under an existing gas contract. The most directly comparable measure in the financial statements is net income before tax.

2 Adjusted income tax expense reflects amounts required for the inclusion of 63.1% of Atlas income, 50% of Egypt and 60% of Waterfront Shipping, as well as amounts required to exclude the tax impact of mark-to-market impact of share-based compensation expense or recovery, the impact of the Egypt gas contract revaluation, and the impact of the settlement of a historical dispute under an existing gas contract calculated at the appropriate applicable tax rate for their respective jurisdictions. The most directly comparable measure in the financial statements is income tax expense.

3 Adjusted effective tax rate is a non-GAAP ratio and is calculated as adjusted income tax expense or recovery, divided by adjusted net income before tax.

4 Adjusted net income before income tax and Adjusted income tax expense are non-GAAP measures. Adjusted effective tax rate is a non-GAAP ratio. These do not have any standardized meaning prescribed by GAAP and therefore are unlikely to be comparable to similar measures presented by other companies. Management uses these to assess the effective tax rate. These measures and ratios are useful as they are a better measure of our underlying tax rate across the jurisdictions in which we operate.

We earn the majority of our income in the United States, New Zealand, Trinidad, Chile, Egypt and Canada. Including applicable withholding taxes, the statutory tax rate applicable to Methanex in the United States is 23%, New Zealand is 28%, Trinidad is 38%, Chile is 35%, Egypt is 30% and Canada is 24.5%. We accrue for withholding taxes that will be incurred upon distributions from our subsidiaries when it is probable that the earnings will be repatriated. As the Atlas entity is accounted for using the equity method, any income taxes related to Atlas are included in earnings of associate and therefore excluded from total income taxes but included in the calculation of Adjusted net income.

METHANEX CORPORATION 2023 FOURTH QUARTER

MANAGEMENT’S DISCUSSION AND ANALYSIS PAGE 10

The effective tax rate based on Adjusted net income was 20% for the fourth quarter of 2023 and 150% for the third quarter of 2023. For the twelve month period ended December 31, 2023 compared to the same period in 2022, the effective tax rate based on Adjusted net income was 23% and 29%, respectively. Adjusted net income represents the amount that is attributable to Methanex shareholders and excludes the mark-to-market impact of share-based compensation and the impact of certain items associated with specific identified events. The effective tax rate differs from period to period depending on the source of earnings and the impact of foreign exchange fluctuations against the United States dollar. In periods with low income levels, the distribution of income and loss between jurisdictions can result in income tax rates that are not indicative of the longer term corporate tax rate.

The following table shows a reconciliation of Net income to Adjusted net income before tax, and of Income taxes to Adjusted income tax expense:

| | | | | | | | | | | | | | | | | |

| Three Months Ended | | Year Ended |

| ($ millions except per share amounts and where noted) | Dec 31

2023 | Dec 31

2022 | | Dec 31

2023 | Dec 31

2022 |

| Net income | $ | 60 | | $ | 58 | | | $ | 284 | | $ | 462 | |

| Adjusted for: | | | | | |

| Income tax expense (recovery) | (14) | | 7 | | | 1 | | 120 | |

| Earnings from associate | (14) | | (19) | | | (99) | | (77) | |

| Share of associate's income before tax | 21 | | 27 | | | 152 | | 120 | |

| Net income before tax of non-controlling interests | (11) | | (17) | | | (103) | | (130) | |

| Mark-to-market impact of share-based compensation | 3 | | 12 | | | 16 | | (7) | |

| Gas contract settlement | — | | — | | | (47) | | — | |

| Impact of Egypt gas contract revaluation | (1) | | (1) | | | (5) | | (6) | |

| Adjusted net income before tax | $ | 44 | | $ | 67 | | | $ | 199 | | $ | 482 | |

| | | | | |

| Income tax recovery (expense) | $ | 14 | | $ | (7) | | | $ | (1) | | $ | (120) | |

| Adjusted for: | | | | | |

| Inclusion of our share of associate's adjusted tax expense | (7) | | (8) | | | (37) | | (43) | |

| Removal of non-controlling interest's share of tax expense | (16) | | | | (7) | | 22 | |

| Tax on mark-to-market impact of share-based compensation | — | | (1) | | | (3) | | 1 | |

| | | | | |

| Tax on impact of Egypt gas contract revaluation | — | | — | | | 2 | | 1 | |

| Adjusted income tax expense | $ | (9) | | $ | (16) | | | $ | (46) | | $ | (139) | |

SUPPLY/DEMAND FUNDAMENTALS

Demand

We estimate that global methanol demand increased to approximately 91 million tonnes in 2023 driven primarily by growth in China. In the fourth quarter, global methanol demand grew by over three percent compared to the third quarter with strong operating rates in the methanol-to-olefins sector and growth in traditional demand in China while outside of China demand for traditional and energy applications remained relatively stable.

Over the long term, we believe that traditional chemical demand for methanol is influenced by the strength of global and regional economies and industrial production levels. We believe that demand for energy-related applications will be influenced by energy prices, pricing of end products, and government policies that are playing an increasing role in encouraging new applications for methanol due to its emissions benefits as a fuel. The demand outlook for methanol as marine fuel continues to grow with orders for dual-fueled vessels and retrofits. The current vessels operating coupled with the order book for new builds and retrofits represents over 250 dual-fueled ships with potential methanol demand of over eight and a half million tonnes per year in the next five years assuming they run 100% of the time on methanol. Actual methanol consumption from marine applications will depend on regulations, relative economics versus other fuels, and other factors. The future operating rates and methanol consumption from MTO producers will depend on a number of factors including the pricing for their various final products, the degree of downstream

METHANEX CORPORATION 2023 FOURTH QUARTER

MANAGEMENT’S DISCUSSION AND ANALYSIS PAGE 11

integration of these units with other products, the impact of olefin industry feedstock costs, including naphtha, on relative competitiveness and plant maintenance schedules.

Supply

In the fourth quarter production increased from coal-based producers in China which was offset by planned and unplanned outages in the US and Asia as well as lower production from natural gas restrictions in Iran and China.

We expect limited capacity additions in the next five years. Our 1.8 million tonne Geismar 3 plant is in the process of starting up and we expect the plant to ramp up to full rates over the month of February. In Malaysia, a 1.8 million tonne plant is under construction with a scheduled start up in 2024. In Iran, a new plant was commissioned at the end of 2023 but plant operating rates continue to be uncertain and challenged due to the impact of sanctions, plant technical issues and seasonal natural gas constraints. We expect to see increased supply from new capacities to be partially offset by rationalization of existing supply in the market in 2024. With the shut down of Atlas and the restart of Titan in September 2024 the overall production in Trinidad will be lower by approximately one million tonnes annually (Methanex net share 0.2 million tonnes) and we continue to monitor other factors that could further impact supply such as the announced gas diversion from methanol to LNG in Equatorial Guinea. In China, there are planned capacity additions over the near-to-medium term which we expect will be somewhat offset by the closure of some small-scale, inefficient and older plants. New capacity built in China is expected to be consumed domestically as China requires methanol imports to meet growing demand.

Methanol Price

Our average realized price in the fourth quarter of 2023 was $322 per tonne compared to $303 per tonne in the third quarter of 2023. Through the fourth quarter, market conditions strengthened, with increased demand primarily in China outpacing an increase in supply. On the supply side, production increased from coal-based producers in China which was offset by planned and unplanned outages in the US and Asia as well as lower production from natural gas restrictions in Iran and China. This led to a drawdown on inventories and increasing methanol prices through the quarter.

Future methanol prices will depend on the strength of the global economy, industry operating rates, global energy prices, new supply additions and the strength of global demand.

The following table outlines our recent regional non-discounted posted prices. Methanol is a global commodity and future methanol prices are directly impacted by changes in methanol supply and demand. Based on the diversity of end products in which methanol is used, demand for methanol is driven by a number of factors including: strength of global and regional economies, industrial production levels, energy and derivatives prices, pricing of end products and government regulations and policies. Methanol industry supply is impacted by the cost and availability of feedstock, methanol industry operating rates and new methanol industry capacity additions.

| | | | | | | | | | | | | | | | | |

Methanex Non-Discounted Regional Posted Prices 1 |

| (US$ per tonne) | Feb 2024 | Jan 2024 | Dec 2023 | Nov 2023 | Oct 2023 |

| North America | 575 | | 575 | | 575 | | 549 | | 516 | |

Europe 2 | 575 | | 575 | | 400 | | 400 | | 400 | |

| Asia Pacific | 390 | | 380 | | 380 | | 370 | | 360 | |

| China | 360 | | 360 | | 360 | | 360 | | 360 | |

1 Discounts from our posted prices are offered to customers based on various factors.

2 €525 for Q1 2024 (Q4 2023 – €375) converted to United States dollars.

LIQUIDITY AND CAPITAL RESOURCES

We operate in a highly competitive commodity industry and therefore are committed to maintaining a strong balance sheet and financial flexibility. At December 31, 2023, our cash balance was $458 million, or approximately $451 million excluding non-controlling interest portion of $61 million but including our share of cash held by the Atlas joint venture of $54 million. We invest our cash only in highly rated instruments that have maturities of three months or less to ensure preservation of capital and appropriate liquidity. We continuously evaluate the liquidity requirements needed to achieve our strategic objectives, including our capital expenditures.

METHANEX CORPORATION 2023 FOURTH QUARTER

MANAGEMENT’S DISCUSSION AND ANALYSIS PAGE 12

A summary of our sources and uses of cash for the three months and year ended December 31, 2023, compared to the same periods in 2022, is as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Years Ended |

| ($ millions, except as otherwise noted) | Dec 31

2023 | Dec 31

2022 | Variance | | Dec 31

2023 | Dec 31

2022 | Variance |

| Cash provided by operating activities | $ | 195 | | $ | 227 | | $ | (32) | | | $ | 660 | | $ | 987 | | $ | (327) | |

| Cash used in financing activities | (166) | | (189) | | 23 | | | (551) | | (508) | | (43) | |

| Cash used in investing activities | (100) | | (143) | | 43 | | | (509) | | (553) | | 44 | |

| Increase (decrease) in cash and cash equivalents | $ | (71) | | $ | (105) | | $ | 34 | | | $ | (400) | | $ | (74) | | $ | (326) | |

Cash flows from operating activities in the fourth quarter of 2023 were $195 million compared to $227 million for the fourth quarter of 2022. Cash flows from operating activities were lower in the fourth quarter of 2023 compared to the fourth quarter of 2022 due to the differences in working capital changes in the fourth quarter of 2023. Cash flows from operating activities in the year ended December 31, 2023 were $660 million compared with $987 million for the same period in 2022, and were lower primarily as a result of lower methanol pricing and lower earnings.

Cash used in financing activities in the fourth quarter of 2023 was $166 million compared to $189 million for the fourth quarter of 2022 as the outflows in the fourth quarter of 2022 included payments for shares repurchased under our normal course issuer bid. This, along with the positive impact of working capital changes, was partially offset by higher distributions to non-controlling interests in the fourth quarter of 2023 compared to the fourth quarter of 2022. Cash used in financing activities for the year ended December 31, 2023 was $551 million compared to $508 million for the same period in 2022, and were higher as 2022 included higher payments for shares repurchased under our normal course issuer bid, the impact of which was offset in the same period by proceeds received upon a sale of partial interest in a subsidiary of $145 million.

In the fourth quarter of 2023 we paid a quarterly dividend of $0.185 per common share for a total of $12.5 million.

Our intent remains to repay rather than re-finance the $300 million bond due at the end of 2024 and under current market conditions and pricing levels we will be prioritizing excess cash towards this repayment.

Cash used in investing activities relates to capital spend on maintenance and major projects including our Geismar 3 plant. For more information on our capital projects, please see Capital Projects and Growth Opportunities below.

Capital Projects and Growth Opportunities

The Geismar 3 plant is in the process of starting up, with total capital costs expected to come within budget of $1.25 - 1.3 billion. The remaining cash expenditure of approximately $60 to $110 million, including approximately $20 million of spending accrued in accounts payable, is fully funded with cash on hand. Geismar 3 has one of the lowest CO2 emissions intensity profiles in the industry and significantly enhances our cash generation capability. We expect the plant to ramp up to full rates over the month of February.

Our planned operational capital expenditures directed towards maintenance, turnarounds, and catalyst changes, including our 63.1% share of Atlas and 50% of Egypt, is currently estimated to be approximately $130 million for 2024.

METHANEX CORPORATION 2023 FOURTH QUARTER

MANAGEMENT’S DISCUSSION AND ANALYSIS PAGE 13

ADDITIONAL INFORMATION – NON-GAAP MEASURES

In addition to providing measures prepared in accordance with IFRS, we present certain additional non-GAAP measures and ratios throughout this document. These are Adjusted EBITDA, Adjusted net income, Adjusted net income per common share, Adjusted net income before income tax, Adjusted income tax expense, and Adjusted effective tax rate. These non-GAAP financial measures and ratios reflect our 63.1% economic interest in the Atlas Facility, our 50% economic interest in the Egypt Facility and our 60% economic interest in Waterfront Shipping, and are useful as they are a better measure of our underlying performance, and assist in assessing the operating performance of the Company's business. These measures, at our share of our facilities, are a better measure of our underlying performance, as we fully run the operations on our partners' behalf, despite having less than full share of the economic interest. Adjusted EBITDA is also frequently used by securities analysts and investors when comparing our results with those of other companies. These measures do not have any standardized meaning prescribed by generally accepted accounting principles ("GAAP") and therefore are unlikely to be comparable to similar measures presented by other companies. These supplemental non-GAAP measures and ratios are provided to assist readers in determining our ability to generate cash from operations and improve the comparability of our results from one period to another.

These measures should be considered in addition to, and not as a substitute for, net income and revenue reported in accordance with IFRS.

Adjusted EBITDA