Director Compensation

We use a combination of cash and stock-based incentive compensation to attract and retain qualified candidates to serve as directors. In setting director compensation, the Board considers the significant amount of time that directors expend in fulfilling their duties to the Company as well as the skill level required by the Company of its directors.

|

|

|

Schedule of Director Retainers

|

|

Lead Independent Director

|

$

110,000

|

|

Other Directors

|

$

80,000

|

|

Audit Chair

|

$

10,000

|

|

Compensation Chair

|

$

7,500

|

|

Governance Chair

|

$

7,500

|

|

Finance Chair

|

$

7,500

|

|

|

Cash Compensation Paid to Directors

For the year ended December 31, 2019, all non-employee directors of the Company (except Nolan E. Karras and Lynne N. Ward) received an annual cash retainer of $80,000. Mr. Karras, as lead independent director, received an annual cash retainer of $110,000. Jill Anderson also received a pro-rated amount of $33,333 for service rendered from her appointment on January 1, 2019 to the date of the 2019 annual meeting of shareholders. In January 2020, Ms. Ward was paid $62,027, which represented a pro-rated portion of her retainer from the date of her appointment as a director of the Company on August 19, 2019 through the date of the Annual Meeting. Committee chair-specific retainers are set forth in the foregoing table. Directors are also reimbursed for (a) out-of-pocket travel and related expenses incurred in attending Board and committee meetings and other Company events, and (b) up to $5,000 for annual educational expenses.

Stock Option Awards

Directors are eligible to participate in our equity incentive programs. Each non-employee director who served during the year ended December 31, 2019 (except for Lynne N. Ward) received an option under the 2018 Incentive Plan to purchase up to 21,250 shares of Common Stock at an exercise price of $52.17 per share, which is not less than the per share market closing price on the date of the grant. Subsequent to her appointment as a director in August 2019, Ms. Ward received an option under the 2018 Incentive Plan to purchase up to 22,300 shares of Common Stock at an exercise price of $34.46 per share, the per share market closing price on the date of the grant. Subsequent to her appointment as a director in January 2019, Jill D. Anderson also received an option to purchase 9,726 shares of Common Stock under the 2018 Incentive Plan (which represented a pro-rated amount for her service from the date of her appointment as a director in January 2019 to the date of the 2019 annual meeting of the Company’s shareholders) at an exercise price of $51.31 per share, the per share market closing price on the date of the grant. Options granted to directors of the Company during 2019 vest over three years in three equal annual increments of one-third of the shares subject to the option per year.

The following table shows amounts paid to each of our non-employee directors in 2019:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-Employee Director Summary Compensation

|

|

Name (1)

|

|

Fees Earned or Paid in Cash ($)

|

|

Options Awards ($) (2)

|

|

Non-Equity Incentive Plan Compensation ($)

|

|

All Other Compensation ($)

|

|

Total Compensation ($)

|

|

A. Scott Anderson

|

|

87,500

|

|

|

242,400

|

|

|

—

|

|

|

—

|

|

|

329,900

|

|

|

Jill D. Anderson (3)

|

|

113,333

|

|

|

356,498

|

|

|

—

|

|

|

__

|

|

|

469,831

|

|

|

Thomas J. Gunderson

|

|

87,500

|

|

|

242,400

|

|

|

—

|

|

|

—

|

|

|

329,900

|

|

|

Nolan E. Karras

|

|

120,000

|

|

|

242,400

|

|

|

—

|

|

|

—

|

|

|

362,400

|

|

|

David M. Liu, M.D.(4)

|

|

80,000

|

|

|

242,400

|

|

|

—

|

|

|

—

|

|

|

322,400

|

|

|

Franklin J. Miller, M.D.

|

|

80,000

|

|

|

242,400

|

|

|

—

|

|

|

—

|

|

|

322,400

|

|

|

F. Ann Millner, Ed.D.

|

|

87,500

|

|

|

242,400

|

|

|

—

|

|

|

—

|

|

|

329,900

|

|

|

Kent W. Stanger

|

|

80,000

|

|

|

242,400

|

|

|

—

|

|

|

—

|

|

|

322,400

|

|

|

Lynne N. Ward (5)

|

|

—

|

|

|

187,153

|

|

|

—

|

|

|

—

|

|

|

187,153

|

|

|

|

(1)

|

|

Fred P. Lampropoulos served as a director of the Company during 2019 but is not identified in the foregoing director summary compensation table because of his dual status as an NEO and director. Information regarding Mr. Lampropoulos’ 2019 compensation can be found under “Executive Compensation” below.

|

|

|

(2)

|

|

The amounts shown for the option awards reflect the aggregate grant date fair value of all equity awards granted to the non-employee directors in 2019. We calculated these amounts in accordance with financial statement reporting rules, using the same assumptions we used for financial statement reporting purposes pursuant to our long-term incentive plans. Assumptions used in the calculation of these amounts are included in footnotes to our 2019 audited financial statements. As of December 31, 2019, each non-employee director held outstanding options for the following number of shares: Mr. Anderson, 125,250; Ms. Anderson, 30,976; Mr. Gunderson, 71,250; Mr. Karras, 154,250; Dr. Liu, 69,250; Dr. Miller, 166,250; Dr. Millner, 80,496; Mr. Stanger, 107,625; and Ms. Ward, 22,300.

|

|

|

(3)

|

|

Ms. Anderson was appointed to serve as a director of the Company on January 1, 2019. The amount shown under “Fees Earned or Paid in Cash ($)” includes $80,000 for her 2019 annual retainer, plus $33,333 for her pro-rated retainer earned for service rendered from her appointment date to the date of the 2019 annual meeting.

|

|

|

(4)

|

|

Prior to his appointment as a director of the Company, Dr. Liu entered into a technology license agreement with the Company, pursuant to which the Company acquired a license to use certain technology created by Dr. Liu and one of his colleagues. The Company did not pay to Dr. Liu any amounts under the license agreement during 2019; however, it is possible that the Company may pay to Dr. Liu future payments, in the form of consulting fees, royalties and lump-sum milestone payments. The terms of the license agreement with Dr. Liu were negotiated in an arms-length transaction.

|

|

|

(5)

|

|

Ms. Ward was appointed as a director of the Company on August 19, 2019. She was not paid a cash retainer during the year ended December 31, 2019. In January 2020, she was paid $62,027, which represented a pro-rated portion of her retainer from the date of her appointment in August 2019 through the date of the Annual Meeting.

|

Related Person Matters

Policies and Procedures Regarding Transactions with Related Persons

Our Code of Conduct requires that every employee avoid situations where loyalties may be divided between our interests and the employee’s own interests. Employees and directors must avoid conflicts of interest that interfere with the performance of their duties or are not in our best interests.

Pursuant to its written charter, the Audit Committee reviews and approves all “related party transactions” (as such term is used by ASC Topic 850 Related Party Disclosures) involving executive officers and directors, or as otherwise may be required to be disclosed in our financial statements or periodic filings with

the Securities and Exchange Commission (the Commission) (including under Item 404 of Regulation S-K under the Securities Act of 1933), other than:

|

|

(a)

|

|

grants of stock options made by the Board or any committee thereof or pursuant to an automatic grant plan; and

|

|

|

(b)

|

|

payment of compensation authorized by the Board or any committee thereof.

|

A “Related Person Transaction” is a transaction, arrangement or relationship (or any series of similar transactions, arrangements or relationships) in which the Company (including any of its subsidiaries) was, is or will be a participant and, as relates to directors or shareholders who have an ownership interest in the Company of more than 5%, the amount involved exceeds $120,000, and in which any Related Person (defined below) had, has or will have a direct or indirect material interest.

A “Related Person” includes officers, directors, nominees, five percent beneficial owners and their respective immediate family members (which in turn includes person’s spouse, parents, siblings, children, in-laws, step relatives, and any other person sharing the household (other than a tenant or household employee)).

Related Person Transactions include transactions between the Company and its executive officers and directors. We have adopted written policies and procedures regarding the identification of Related Persons and Related Person Transactions and the approval process for such transactions. The Audit Committee considers each Related Person Transaction in light of the specific facts and circumstances presented, including but not limited to the risks, costs and benefits to the Company and the availability from other sources of comparable services or products.

Certain Related Person Transactions

The Board, acting through the Audit Committee, believes that the following Related Party Transactions are reasonable and fair to the Company:

|

|

·

|

|

Joseph C. Wright, President of Merit International, a division of the Company, is the brother-in-law of Fred P. Lampropoulos, Chair of the Board, CEO and President of the Company. In 2019 we provided to Mr. Wright total cash and equity compensation of $1,465,758.

|

|

|

·

|

|

Justin J. Lampropoulos, Executive Vice President of Sales, Marketing & Strategy of the Company, is the son of Fred P. Lampropoulos, Chair of the Board, CEO and President of the Company. In 2019 we provided to Mr. Justin J. Lampropoulos total cash and equity compensation of $1,211,599.

|

|

|

·

|

|

Charles Wright, Director of Business Development of the Company, is the brother-in-law of Fred P. Lampropoulos, Chair of the Board, CEO and President of the Company. In 2019 we provided to Mr. Wright total cash and equity compensation of $513,081.

|

|

|

·

|

|

Anne-Marie Wright, Vice President of Corporate Communications of the Company, is the wife of Fred P. Lampropoulos, Chair of the Board, CEO and President of the Company. In 2019 we provided to Ms. Wright total cash and equity compensation of $392,117.

|

|

|

·

|

|

Frank Wright, OEM Business Development Manager of the Company, is the brother-in-law of Fred P. Lampropoulos, Chair of the Board, CEO and President of the Company. In 2019 we paid to Mr. Wright total compensation of $260,878.

|

EXECUTIVE COMPENSATION

AND RELATED MATTERS

Executive summary

During 2019, we continued to execute our global growth plan, spurred by strategic acquisitions as well as internal product development. Among other significant accomplishments, we completed the integration of the soft tissue biopsy and pleural and peritoneal drainage product lines we acquired from Becton, Dickinson and Company, and rolled out sales and marketing programs to capitalize on the Cianna Medical, Vascular Insights LLC and Brightwater Medical Inc. acquisitions we completed in late 2018 and 2019. Those acquisitions, together with continued growth in sales of our legacy products and the introduction of new products commercialized through our continued research and development efforts, contributed to our achievement of record revenues in 2019. Unfortunately, we also experienced challenges associated with our acquisition integration and the adjustment of our sales force and associated marketing efforts, which resulted in a shortfall against our goals for the year. Consistent with the principles upon which our executive compensation program is based, the failure to achieve targeted levels of performance resulted in negative adjustments to the compensation amounts paid to our executive officers during the year, particularly in the decision of our Compensation Committee to pay no bonuses to our CEO and other NEOs, other than amounts tied directly to achievement of sales targets. The factors our Compensation Committee considered in reaching compensation decisions for our NEOs are outlined below.

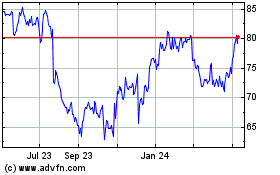

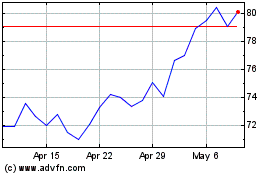

Key financial results for the last five fiscal years are highlighted below:

|

|

(1)

|

|

Non-GAAP net income, non-GAAP gross margin and non-GAAP earnings per share are non-GAAP financial measures. A reconciliation of non-GAAP financial measures used in this Proxy Statement to their most directly comparable GAAP financial measures is included under the heading “Non-GAAP Financial Measures” below.

|

The results of our operating and financial performance over the past five years are illustrated in the tables above. Although our historic results are not a guarantee of future performance, we believe Merit is well positioned for sustainable growth in profitability going forward.

Our operating and financial results were a significant factor in the deliberations of our Compensation Committee when evaluating the amount and form of compensation paid to our CEO and other NEOs. Our Compensation Committee believes there are multiple factors that have contributed to our financial and

operating performance, however, two of the key factors have been our outstanding employees and the leadership provided by our CEO and other executive officers. Accordingly, the Compensation Committee seeks to implement and advance an executive compensation program that recognizes Company performance and individual contribution, while encouraging long-term motivation and retention. The Compensation Committee believes our executive compensation program has been instrumental in helping the Company sustain its strong financial performance over many years.

Under the oversight of the Compensation Committee, our compensation philosophy is to offer compensation programs to the NEOs that align the interests of management and shareholders for the purpose of maximizing shareholder value, while considering the interests of other significant stakeholders such as employees, customers, business partners and the communities in which we operate.

Among other objectives, those programs are designed to:

|

|

·

|

|

focus executives on achieving or exceeding measurable performance targets;

|

|

|

·

|

|

influence executives to lead our employees in the implementation of cost-saving plans;

|

|

|

·

|

|

continue our entrepreneurial spirit;

|

|

|

·

|

|

attract and retain highly-qualified and motivated executives; and

|

|

|

·

|

|

promote a highly ethical environment and maintain health and safety standards.

|

Our executive compensation programs specific to the NEOs are overseen by the Compensation Committee. In pursuit of our compensation philosophy and objectives, the Compensation Committee believes that the compensation packages provided to the NEOs should generally include both cash and equity-based compensation, historically in the form of stock options. Base pay and benefits are set at levels considered necessary to attract and retain qualified and effective executives. Variable incentive pay is used to align the compensation of the NEOs with our short-term business and performance objectives, such as income and overall financial performance. Equity awards have historically been used to retain key employees and to motivate executives to create long-term shareholder value. During the 2019 fiscal year, the Compensation Committee determined to add awards of performance-based restricted stock units to our long-term equity incentive program effective in 2020. The performance-based restricted stock units are designed to increase the alignment of NEO compensation with the Company’s achievement of Board-approved performance measures.

|

|

|

Selected 2019 Highlights

|

|

Developed a program to award long-term performance stock units beginning in 2020 to increase the alignment of executive compensation with the Company’s achievement of Board-approved performance measures

Prioritized reduction of environmental footprint by continuing to implement new programs to reduce waste, conserve resources, and improve the areas where we do business

Implemented Company-wide operating efficiency initiatives designed to reduce operating expenses and increase profitability

Based on Company failure to achieve stated performance targets, no 2019 bonuses were paid to NEOs, other than amounts tied directly to achievement of sales targets.

Cumulative total return on our Common Stock from December 31, 2014 to December 31, 2019 of approximately 80% (1)

(1) Reflects five-year cumulative total return of our Common Stock, as reported by Nasdaq for the period from December 31, 2014 to December 31, 2019. Past results are not necessarily an indicator of future results.

|

Executive Officers

In addition to Fred Lampropoulos (whose biography is included above under “Directors Whose Terms of Office Continue”), we have included the following information related to our executive officers:

|

|

|

|

|

|

raul parra

Chief Financial Officer and Treasurer

Age: 42

|

Current Position Since: July 2018

Education: B.S. (business administration with accounting emphasis), Sonoma State; Certified Public Accountant (CPA)

|

|

Highlights

Previous positions at Merit include Interim CFO, Vice President of Accounting, Corporate Controller and Director of Financial Reporting

Before joining Merit, held various audit positions at Deloitte & Touche, LLP

|

|

|

|

|

|

|

Ronald A. Frost

Chief Operating Officer

Age: 58

|

Current Position Since: January 2014

Education: Manufacturing Engineering Technology, AAS, Machine Tooling, Weber State University

|

Highlights

More than 27 years of service to Merit and its shareholders

Previous positions at Merit include Vice President (Materials and Operations), Quality Engineer, Manufacturing Engineer, Custom Kits Manager, Customer Service Manager, Production Planning and Warehouse Manager, General Manager of our Richmond, Virginia operations, and Vice President (Technology Transfer), 1991 to 2014

|

|

|

|

|

|

Joseph C. Wright

President,

International Division

Age: 50

|

Current Position Since: July 2015

Education: B.A., (political science), Columbia University; M.B.A., (finance) Columbia University; Speaks Japanese

Mr. Wright is the brother-in-law of Fred P. Lampropoulos, Merit’s Chair of the Board, President and CEO

|

Highlights

Previous positions at Merit include (a) President, Technology Group – overseeing Merit OEM, Merit Sensor Systems, Inc. and Merit’s coating division, (b) Vice President of Marketing, and (c) Vice President, International – responsible for sales in Canada, Asia Pacific, and Latin America, 2005 to 2015

Manages businesses in all global markets outside the U.S., Europe, Middle East and Africa

Before joining Merit, held sales, marketing and business development positions with several companies, including Motorola and Micron

|

|

|

|

|

|

Brian G. Lloyd

Chief Legal Officer,

Corporate Secretary

Age: 59

|

Current Position Since: April 2016

Education: B.S. (finance), Brigham Young University; J.D., Columbia Law School

|

Highlights

Practiced as an attorney, specializing in corporate governance, securities regulation and mergers & acquisitions, with the law firm of Parr Brown Gee & Loveless in Salt Lake City, Utah for more than 20 years

Also practiced law in those areas of specialization as a partner with the law firm of Stoel Rives, LLP for four years

|

|

|

|

|

|

Justin j. lampropoulos

Executive Vice President, Sales, Marketing and Strategy

Age: 37

|

Current Position Since: May 2015

Education: Completed postgraduate studies at Oxford University's Saïd Business School in Oxford, England in strategic management and is an alumnus of Harvard Business School.

Mr. Justin J. Lampropoulos is the son of Fred P. Lampropoulos, Merit’s Chair of the Board, President and CEO

|

Highlights

From 2010 to 2015 led Merit’s Europe, Middle East and Africa business unit from Maastricht, the Netherlands

Began his career in the medical device technology field in 2004

Compensation Discussion and

Analysis

This Compensation Discussion and Analysis is designed to explain our philosophy and objectives underlying our executive compensation policies, the processes we follow in setting executive compensation, and the components of executive compensation that we utilize in compensating our NEOs, who are listed below.

|

|

|

|

|

|

|

The Summary Compensation Table and other compensation tables under “Executive Compensation Tables” below should be read in conjunction with this section.

|

|

|

|

|

Fred P. Lampropoulos

|

Chair, CEO and President

|

|

Raul Parra

|

Chief Financial Officer and Treasurer

|

|

Ronald A. Frost

|

Chief Operating Officer

|

|

Joseph C. Wright

|

President, International

|

|

Justin J. Lampropoulos

|

Executive Vice President, Sales, Marketing and Strategy

|

Process for Establishing Executive Compensation

Procedure

The Compensation Committee has oversight responsibility for establishing compensation practices for our CEO and the other NEOs. The Compensation Committee also reviews all compensation decisions for employees of the Company who are related to our CEO.

Performance reviews of the CEO are conducted by the Compensation Committee based on our performance during a given year, compared with our performance objectives, as well as other factors intended to maximize short-term and long-term shareholder value.

Performance reviews of the other NEOs are based on the CEO’s evaluation of individual officer and Company performance for that year, with the objective of maximizing shareholder value. With respect to the compensation levels for the other NEOs, the Compensation Committee considers input and recommendations from the CEO. The CEO makes recommendations concerning salary adjustments, cash bonus programs and equity awards for the other NEOs, and the Compensation Committee considers those recommendations in determining the compensation of the other NEOs.

Role of Consultants

The Compensation Committee engaged Pearl Meyer & Partners (Pearl Meyer), an independent compensation consulting firm, to review our executive officer and director compensation practices and advise the Compensation Committee with respect to those compensation practices, including salary, bonus, benefits and equity awards for our executive officers and retainers, meeting fees and equity awards for our directors. The Compensation Committee has generally evaluated and considered Pearl Meyer’s reports and recommendations.

In conducting its review of our executive compensation practices for 2019, the Compensation Committee consulted with Pearl Meyer regarding the Company’s executive composition practices for 2019, the implementation of our Executive Bonus Plan discussed on page 46 and the issuance of performance-based restricted stock units (PSUs) designed to increase the alignment of executive compensation with the Company’s achievement of Board-approved performance measures, as discussed on page 48. During 2019, the Compensation Committee reviewed industry and peer compensation data for medical device companies included in published surveys issued by Radford, Aon Hewitt’s medical device consulting group (Radford). During 2019, we participated in the Radford Global Technology Survey (Radford Survey), which includes more than 100 medical device companies with headquarters located in the United States. The Radford Survey – which we believe is generally considered a standard source of information for executive compensation – provides valuable information regarding industry and peer executive compensation practices. Our management uses the Radford Survey to determine the reasonableness of compensation for various levels of employees, including executive officers.

The Compensation Committee also directed management to perform an internal review of Company executive compensation practices, as well as the executive compensation practices of other U.S. publicly-traded companies in the medical device industry.

Neither the consultation with Pearl Meyer, the Radford Survey nor our internal review yielded any significant concerns at the Compensation Committee level regarding our executive compensation practices.

Evaluation

In evaluating compensation of the NEOs for the year ended December 31, 2019, the Compensation Committee considered, among other factors, our performance and relative shareholder return in 2019, as compared to our performance targets for 2019, and other factors considered relevant by the Compensation Committee.

Notwithstanding the Compensation Committee’s use of the information supplied by Pearl Meyer, and information obtained from the Radford Survey and our management’s review of executive compensation practices, the decisions of the Compensation Committee with regard to the NEOs for 2019 were based principally on objective and subjective evaluations of the individual NEOs.

Other Considerations

The Compensation Committee also relied on its experience and judgment in making executive compensation decisions after reviewing our performance on a quarterly and annual basis, and evaluating each NEO’s individual performance and responsibilities with the Company, as well as current compensation arrangements. The compensation program for the NEOs and the Compensation Committee assessment process have been designed to be flexible in an effort to respond to the evolving business environment and individual circumstances relative to Company and individual performance, shareholder value, as well as internal equity for compensation levels among our executives.

Our executive compensation program is divided into the following two general categories: fixed pay and variable pay.

Fixed pay consists of base salary and is intended to provide each NEO with a level of assured cash compensation appropriate for his or her position within the Company. Variable pay includes annual cash bonus awards and equity-based awards in the form of stock options, each as explained in more detail below. Additionally, beginning in 2020, variable pay includes PSUs.

The Compensation Committee believes that a portion of total compensation of the NEOs should be both at-risk and tied to the Company’s performance goals.

Generally, at the beginning of each year, the CEO identifies performance goals which are intended to align the efforts of our executive officers, including the NEOs, with our achievement of our strategic business plan to maximize shareholder value. The CEO then reviews those performance goals with the Compensation Committee. Those goals then become targets for the variable annual performance bonus component of our executive compensation program. Because the performance goals are generally established at the beginning of each year and market conditions fluctuate throughout the year, the performance goals may not correspond to subsequent annual earnings estimates released by the Company.

Compensation Committee Consideration of Shareholder Advisory Votes

At our annual meeting of shareholders held on May 23, 2019, we submitted the compensation of our executive officers to our shareholders in a non-binding vote. Our executive compensation program received the support of holders of approximately 94% of the shares represented at the meeting.

At our annual meeting of shareholders held on May 24, 2017, our shareholders voted on an advisory basis with respect to the frequency of future advisory votes on executive compensation. Holders of approximately 77% of the shares represented at that meeting expressed their preference for an annual advisory vote. Accordingly, we intend to hold an annual advisory vote on executive compensation until the next “say-on-frequency” vote at our annual meeting of shareholders in 2023.

The Compensation Committee will continue to review future shareholder voting results and determine whether changes should be made to our executive compensation program based on such voting results.

Pay Mix

The allocation between cash and non-cash NEO compensation is influenced by the practices of subjective and objective analysis conducted by the Compensation Committee and is intended to reflect the Compensation Committee’s determination of the appropriate compensation mix among base pay, annual cash incentives and long-term equity incentives for each NEO. Actual cash and equity-based incentive awards are determined based on the performance of the Company and/or the individual NEO, depending on the position of the NEO, the type of award and our performance, compared to established goals.

For 2019, the elements of the compensation mix for the NEOs included:

|

|

·

|

|

base salary (designed to attract and retain executives over time);

|

|

|

·

|

|

annual performance bonus (designed to focus on business objectives established by the Compensation Committee for a particular year);

|

|

|

·

|

|

long-term equity-based incentive compensation in the form of stock option awards (designed to further align NEO pay with performance);

|

|

|

·

|

|

broad-based employee retirement, welfare and fringe benefits programs, and other personal benefits; and

|

|

|

·

|

|

executive deferred compensation.

|

|

|

|

|

|

Among the factors the Compensation Committee considered when establishing the amounts of fixed and variable compensation paid to our NEOs for 2019 were:

|

|

Fred P. Lampropoulos

|

|

leadership and direction of our Company and employees in a challenging business environment;

our 2019 operating and financial performance;

development and oversight of operating efficiency initiatives designed to reduce operating expenses and increase profitability;

operational management, product development (including inventions and patent prosecution), international expansion, subsidiary development, risk management, and manufacturing capacity planning;

strategic business development, and management development and oversight; and

shareholder relations.

|

|

Raul Parra

|

|

responsibility for the financial and accounting affairs of an increasingly large and complex organization;

implementation of operating efficiency initiatives designed to reduce operating expenses and increase profitability;

oversight of our cash flow and budgeting practices; and

accounting for, and financing of, acquired enterprises and products.

|

|

Ronald A. Frost

|

|

conducting our worldwide operations within the budget established by the Board;

integration of the operations of acquired enterprises, particularly the operations acquired from Becton, Dickinson and Company;

implementation and oversight of our efforts to reduce our environmental footprint and promote sustainability; and

implementation of operating efficiency initiatives designed to reduce operating expenses and increase profitability.

|

|

Joseph C. Wright

|

|

management of our international division, including oversight of our international growth and sales;

identifying potential new markets for expansion and growth and development of our international sales strategy; and

budget management.

|

|

Justin J. Lampropoulos

|

|

management of our sales and marketing activities throughout the United States, Europe, the Middle East and Africa;

development and coordination of new product launches, market research, and analysis;

implementation of sales strategies and performance goals; and

budget management.

|

Fixed Compensation

Base Salary

The Compensation Committee does not use a specific formula for evaluating individual performance of the NEOs. The performance of the NEOs other than the CEO is assessed by the Compensation Committee taking into account the CEO's input regarding each NEO’s contributions to our performance for the applicable year. The CEO’s performance is assessed by the Compensation Committee in formal and informal meetings with the CEO, as well as executive sessions conducted by the Compensation Committee.

The criteria used in setting the base salary for each NEO, including the CEO, vary depending on the NEO’s function, but generally include the Compensation Committee’s assessment of the NEO’s:

|

|

·

|

|

advancement of our interests with shareholders and customers and in other strategic business relationships;

|

|

|

·

|

|

achievement of our financial results, position and experience (in an effort to avoid gender or age discrimination);

|

|

|

·

|

|

leadership inside and outside the Company;

|

|

|

·

|

|

contribution to specific Company initiatives, such as expense reduction efforts, product quality and development and environmental and social objectives; and

|

|

|

·

|

|

advancement in skills and responsibility.

|

Given the subjective nature of the criteria identified above, the Compensation Committee has not attempted to develop numeric measurements in determining base salaries for the NEOs. Instead, the Compensation Committee establishes base salaries at levels commensurate with the Compensation Committee’s evaluation of each NEO’s contribution to our business success. The Compensation Committee has also consulted with Pearl Meyer to assess the levels of base salary and other compensation paid to the CEO and other NEOs, relative to the Company’s peers. In particular, the Compensation Committee has set the base salary and incentive cash bonus of the CEO at levels which are higher than the aggregate amount of base salary and incentive bonus paid to the principal executive officers of a number of our peers. Because the CEO is a founder of the Company and currently owns a substantial number of shares of Common Stock, the Compensation Committee believes his personal interests are closely aligned with the interests of our stakeholders and that the payment of cash compensation in amounts approved by the Compensation Committee is effective in further aligning his interests with the interests of our stakeholders.

Based on its evaluation, the Compensation Committee approved the following NEO base salaries for the year ended December 31, 2019, which are also reflected in the Summary Compensation Table under “Executive Compensation Tables” below.

|

|

|

|

|

Named Executive Officer

|

|

Base Salary (1)

|

|

Fred P. Lampropoulos

|

$

|

1,804,136

|

|

Raul Parra

|

$

|

580,769

|

|

Ronald A. Frost

|

$

|

598,077

|

|

Joseph C. Wright

|

$

|

550,000

|

|

Justin J. Lampropoulos

|

$

|

596,154

|

|

|

|

|

|

|

(1)

|

|

The base salary amounts shown above reflect amounts paid to the NEOs during 2019 as reported in the Summary Compensation Table shown on page 54. The annual base salary amounts for fiscal year 2020 as approved by the Compensation Committee are: Mr. F. Lampropoulos, $1,750,000; Mr. Parra $600,000; Mr. Frost, $600,000, Mr. Wright, $550,000, and Mr. J. Lampropoulos $600,000.

|

In April 2020, after giving consideration to the significant impact of the COVID-19 pandemic on the Company’s personnel, operations and financial results and uncertainly regarding the scope and duration of that impact, the Company implemented a temporary salary reduction for executive management and certain other salaried personnel. The amount of the reduction for each affected employee was based upon the base salary of that employee. As a consequence of those salary reductions, the base salary for each of the NEOs was temporarily reduced by 20% from the amounts indicated in footnote 1 of the preceding table.

Variable Compensation

In general, our variable compensation programs are designed to align the interests of our executive officers, including the NEOs, with our operating and financial results.

Annual Performance Cash Bonuses

Our general practice is to provide our NEOs with the opportunity to earn annual performance bonus compensation under a program that recognizes attainment of key objectives. The key objectives that underlie our annual incentive compensation programs are established annually by the Compensation Committee based upon recommendations made by the CEO, and may vary between years and between NEOs, but generally include objectives that reward attainment of targeted levels of sales, earnings and gross margins.

In setting the performance bonus amounts that an NEO is eligible to earn for achieving specified objectives, the Compensation Committee and the CEO consider bonus and total cash compensation levels for each NEO. Although bonus opportunities for achieving objectives are generally established for each NEO based on job scope and contribution, the Compensation Committee retains discretion to positively or negatively adjust performance bonus amounts based on factors that are not included in the pre-determined objectives. NEOs also have the opportunity to earn additional discretionary bonuses for extraordinary performance, as determined by the Compensation Committee.

The decision as to whether to provide an annual performance bonus program to any NEO for any year, the type and funding of any program offered, and the objectives that underlie any program, are subject to the discretion of the Compensation Committee, taking into account the recommendation of the CEO and industry-specific conditions existing during the applicable year. The Compensation Committee may also exercise positive or negative discretion based on its assessment of the individual NEO’s contribution and accountability for the objectives that are the subject of the bonus recommendations from the CEO and any other factors the Compensation Committee considers relevant.

For 2019 (and after considering the CEO’s recommendations), the Compensation Committee established incentive cash performance bonus objectives for Fred Lampropoulos and Joseph Wright, but did not establish specific incentive cash performance bonus objectives for the other NEOs. The incentive cash performance bonus objectives for Mr. Lampropoulos were based on sales, gross margins (calculated on a non-GAAP basis), and earnings per share (calculated on a non-GAAP basis). The incentive cash performance bonus objectives for Mr. Wright were based on sales of the Company’s products in all global markets other than the United States, Europe, the Middle East, and Africa.

The specific 2019 performance bonus objectives established by the Compensation Committee for Mr. Fred Lampropoulos, together with the level of our actual 2019 performance in those categories, were as follows.

|

|

|

|

|

|

|

|

Performance Bonus Objectives

|

|

2019 Goals

|

|

2019 Results

|

|

|

|

|

|

|

|

|

|

Sales

|

|

$1,011 – 1,030M

|

|

$994.9M

|

|

|

Gross Margin (Non-GAAP) (1)

|

|

50.6 – 51.3%

|

|

48.6%

|

|

|

Earnings Per Share (Non-GAAP) (2)

|

|

$1.97 - $2.08

|

|

$

1.46

|

|

|

|

|

|

|

(1)

|

|

Non-GAAP Gross Margin is calculated by adjusting GAAP gross profit by amounts recorded for amortization of intangible assets and inventory mark-up related to acquisitions. See “Non-GAAP Financial Measures” presented on page 74 of this Proxy Statement for additional information.

|

|

|

(2)

|

|

Non-GAAP Earnings Per Share is calculated as GAAP net income excluding intangible amortization expense, acquisition related costs, intangible and other asset impairment charges, contingent consideration expense (benefits), certain legal expenses, and severance costs. All excluded items are tax affected and total Non-GAAP net income is divided by the weighted average diluted shares outstanding. See “Non-GAAP Financial Measures” presented on page 74 of this Proxy Statement for additional information.

|

The specific 2019 performance bonus objectives for Mr. Fred Lampropoulos in the categories outlined above align with the guidance we issued publicly on February 26, 2019, but were not adjusted downward to reflect the updated guidance we issued publicly on July 25, 2019 and October 30, 2019.

The Compensation Committee’s evaluation of the performance bonus objectives and results shown above indicated that we did not reach performance levels that met or exceeded any of the three objectives established by the Compensation Committee. Accordingly, the Compensation Committee determined that no incentive cash performance bonus should be paid to Mr. Fred Lampropoulos with respect to the 2019 fiscal year. Although the Compensation Committee did not establish specific 2019 incentive cash performance bonus objectives for Messrs. Parra, Frost and Justin J. Lampropoulos, the Compensation Committee determined that no discretionary incentive cash performance bonuses should be paid to such officers in 2019 due to the Company’s failure to meet the performance goals listed above (See Discretionary Bonuses).

With respect to Mr. Wright, the Compensation Committee approved incentive cash performance bonus objectives based on the following sales targets for our international operations for which Mr. Wright has supervisory responsibility.

|

|

|

|

|

2019 Goal

|

|

2019 Results

|

|

$216.4 million

|

|

$227.0 million

|

Based on the Company’s achievement of the incentive cash performance bonus objectives approved by the Compensation Committee, the Compensation Committee approved the payment to Mr. Wright of an incentive cash performance bonus in the amount of $300,000, as reflected in the Summary Compensation Table set forth on page 54.

Executive Bonus Plan

After reviewing our executive incentive compensation practices, and based upon the preferences communicated by the institutional shareholder community, in 2019 our Board adopted the Merit Medical Systems, Inc. Executive Bonus Plan (the Executive Bonus Plan). The purposes of the Executive Bonus Plan are to motivate and reward the Company’s executive employees by making a portion of their annual cash compensation dependent on the achievement of certain pre-determined corporate performance goals, to align the interests of those executives with those of the Company, and to attract and retain superior executive employees by providing a competitive bonus program that rewards outstanding performance. The Executive Bonus Plan is administered by the Compensation Committee and became effective for the year ending December 31, 2019 and thereafter. During each year of the operation of the Executive Bonus Plan, the Compensation Committee will establish a target bonus amount and performance criteria and goals for each participating executive officer. At the conclusion of such year, the Compensation Committee will determine the bonus amount payable to each participating executive officer and the Company will pay to the executive officer the determined bonus amount not later than the 15th day of the third month following the conclusion of the applicable year. In determining the amount of each award to be paid, the Compensation Committee may reduce, eliminate or increase (but not above 110% of the applicable award amount otherwise payable) the amount of an Award if, in its discretion, such reduction, elimination or increase is appropriate. The amounts payable to executive officers participating in the Executive Bonus Plan will be determined and allocated based on the performance criteria established for the applicable year, and the Company’s performance relative to those criteria. For 2019, the performance criteria were based upon the Company’s net sales, non-GAAP net income and non-GAAP gross margin. For 2019, the Compensation Committee established a target award amount for Mr. Fred Lampropoulos of $1,000,000; however, because the Company did not achieve the performance criteria established pursuant to the Executive Bonus Plan, Mr. Fred Lampropoulos did not receive any payment under the plan. Although all NEOs are eligible to participate in the Executive Bonus Plan, for 2019 the Compensation Committee did not establish target award amounts under the plan of any NEOs other than Mr. Fred Lampropoulos.

For 2020, the Compensation Committee has established target award amounts for each of the executive officers of the Company, including Mr. Fred Lampropoulos and the other NEOs other than Mr. Wright. The Compensation Committee has also established the corporate performance goals (revenues, non-GAAP gross margin and non-GAAP earnings per share) upon which payments (if any) under the Executive Bonus Plan will be determined. The Compensation Committee does not anticipate that Mr. Wright will participate in the Executive Bonus Plan during 2020 because his incentive compensation goal for the year has already been established based on the Company’s sale targets for the international operations for which Mr. Wright has supervisory responsibility.

Return of Incentive Compensation (“Clawback Policy”)

The Executive Bonus Plan provides to our Board the authority to obtain reimbursement from any participant in the plan if the Board determines that: (a) a significant restatement of the Company’s financial results for any of the three prior fiscal years is required; and (b) the participant’s award amount would have been lower had the financial results been properly calculated. Such reimbursement shall consist of any portion of any award previously paid to such participant that is greater than the award that would have been paid if calculated based upon the restated financial results. The action permitted to be taken by the Board under the Executive Bonus Plan is in addition to, and not in lieu of, any and all other rights of the Board and/or the Company under applicable law or any other claw-back or similar policy of the Company. The PSU agreements which are part of the long-term equity incentive program which our Compensation Committee implemented in 2020 also include a “clawback” feature which permits our Compensation Committee to recover payments from award recipients if (i) the payment was predicated upon achieving financial results that were subsequently the subject of a restatement of the Company’s financial statements filed with the Commission; (ii) the Compensation Committee determines that the recipient engaged in intentional misconduct, gross negligence or fraudulent or illegal conduct that caused or substantially caused the need for the restatement; and (iii) a lower amount would have been paid to the recipient based upon the restated financial results.

Discretionary Bonuses

In addition to the cash bonus opportunities under the performance bonus program described above, the Compensation Committee (with the input of the CEO) may choose to reward extraordinary performance and achievements by awarding discretionary bonuses to the NEOs and other executives from time to time that are not part of the annual incentive plan or any other plan. Based upon the Compensation Committee’s review of the performance bonus objectives discussed above, the Compensation Committee determined that no discretionary bonuses should be paid to any NEOs in 2019. There is no standing expectation that all (or any) NEOs will receive discretionary performance bonuses in any particular year, and the criteria for such bonuses are not established in advance.

Long-Term Incentive Compensation

Historically, long-term equity awards, in the form of stock options, have been granted at the Compensation Committee’s discretion to the NEOs annually in an effort to provide long-term performance-based compensation, to encourage the NEOs to continue their engagement with the Company throughout the vesting periods, and to align management and shareholder interests. Beginning with our 2019 fiscal year, long-term equity awards were and will continue to be made under the 2018 Incentive Plan. Although we have traditionally made long-term equity incentive awards to our NEOs solely in the form of stock options, during 2019, the Compensation Committee developed a program, which was implemented in 2020, to grant to the Company’s executive officers long-term equity awards in the form of stock options and performance-based restricted stock units or PSUs, with the objective of more closely aligning management and shareholder interests. For 2020, the Compensation Committee reduced the number of stock options awarded to each NEO to approximately 40% of the total target long-term incentive compensation amount for that NEO, with the remaining portion of the NEO’s long-term incentive compensation amount awarded in the form of PSUs.

In making awards under our 2018 Incentive Plan, the Compensation Committee considers grant size, the appropriate combination of equity-based awards, the impact of the grant on our financial performance (as determined in accordance with the requirements of the Financial Accounting Standards Board ASC Topic 718 (ASC Topic 718)), and the corresponding compensation value used by the Company in determining the amount of the awards (which may vary from the ASC Topic 718 expense).

Generally, the amount of long-term equity awards granted to the NEOs has been based upon the Compensation Committee’s assessment of each NEO’s expected future contributions to the Company and other factors. The amount or existence of those awards may also be influenced by external factors such as general economic or industry-specific conditions. We generally grant long-term equity awards at the regularly-scheduled Compensation Committee meeting held in February or May of each year but may vary the date of grant from year to year.

Stock Options

During 2019, the Compensation Committee granted stock option awards to NEOs under the 2018 Incentive Plan in the following amounts:

|

|

|

|

Named Executive Officer

|

Number of Options Granted

|

|

Fred P. Lampropoulos

|

159,151

|

|

Raul Parra

|

30,000

|

|

Ronald A. Frost

|

30,000

|

|

Joseph C. Wright

|

30,000

|

|

Justin J. Lampropoulos

|

30,000

|

Performance Stock Units

During 2019, in consultation with Pearl Meyer, the Compensation Committee developed a program, which was implemented 2020, to grant to the Company’s executive officers equity awards under our 2018 Incentive Plan consisting in part of PSUs, with the objective of more closely aligning management and shareholder interests. Subject to the terms and conditions of PSU award agreements executed with the Company’s executive officers, each executive officer is entitled to receive a payment in shares of Common Stock based upon the target number of shares determined by the Compensation Committee and the Company’s performance during the applicable performance period with respect to the achievement of free cash flow (FCF) targets as defined in the agreements and the Company’s relative total shareholder return (rTSR) compared to the Russell 2000 index (Performance Goals). The actual number of shares to be issued to each executive officer will be determined by the Compensation Committee by multiplying the total target number of shares for that employee by the applicable FCF and rTSR multipliers, based on the Company’s performance during the applicable performance period. The Compensation Committee has the sole authority and discretion to determine the achievement level with respect to the number of shares earned at the end of each performance period. PSUs may also include a feature providing for the payment of a long-term cash award based on the degree of attainment of the same designated Performance Goals that apply to the earning and issuance of shares of Common Stock under the PSUs. The Compensation Committee consulted with Pearl Meyer in reaching its determination of the number of shares subject to the PSU awards granted to each of the NEOs in 2020.

Broad-Based Benefits Programs

We offer multiple broad-based benefits programs to our employees, including our NEOs. Those programs include benefits such as health, dental, vision, disability and life insurance, health savings accounts, health care reimbursement accounts, employee stock purchase plan, paid vacation time and discretionary Company contributions to a 401(k) profit sharing plan.

Benefits are provided to our NEOs in accordance with practices the Compensation Committee believes are consistent with industry standards. The Compensation Committee believes such benefits are a necessary element of compensation in attracting and retaining employees. In addition, the NEOs receive limited perquisites in an attempt to achieve a competitive pay package, as further detailed in the Summary Compensation Table.

Deferred Compensation Plan

We provide a non-qualified deferred compensation plan for the benefit of certain of our highly-compensated executives, including the NEOs. Under the non-qualified deferred compensation plan, eligible participants may elect in advance of each calendar year to defer up to 100% of their cash salary and bonus compensation earned with respect to such year. Amounts deferred are credited to an unfunded liability account maintained by the Company on behalf of the applicable participant, which account is deemed invested in and earns a rate of return based upon certain notational and self-directed investment options offered under the plan. In our discretion, we may elect to credit each eligible participant’s account under the deferred compensation plan with an employer matching contribution but, to date, we have never elected to do so. Participant account balances under the deferred compensation plan are fully-vested and will be paid by the Company to each participant upon retirement or separation from employment, or on other specified dates, in a lump sum or in installments according to a schedule elected in advance by the participant.

The Company and its subsidiaries do not maintain any other executive pension or retirement plans for the NEOs.

Employment Agreements

The Compensation Committee has determined that executive employment agreements are necessary to provide competitive compensation arrangements to our NEOs, particularly because such agreements are common in our industry. Moreover, the Compensation Committee believes that the change in control provisions within the executive employment agreements help to retain the NEOs by reducing personal uncertainty and anxiety that may arise from the possibility of a future business combination.

We have entered into employment agreements (collectively, the Employment Agreements) with each of the NEOs. The annual base salaries paid under the Employment Agreements for 2019 were:

|

|

|

|

|

Named Executive Officer

|

|

Base Salary (1)

|

|

Fred P. Lampropoulos

|

$

|

1,804,136

|

|

Raul Parra

|

$

|

580,769

|

|

Ronald A. Frost

|

$

|

598,077

|

|

Joseph C. Wright

|

$

|

550,000

|

|

Justin J. Lampropoulos

|

$

|

596,154

|

|

|

(1)

|

|

The base salary amounts shown above reflect amounts paid to the NEOs during 2019 as reported in the Summary Compensation Table shown on page 54. The annual base salary amounts for fiscal year 2020 as approved by the Compensation Committee are: Mr. F. Lampropoulos, $1,750,000; Mr. Parra $600,000; Mr. Frost, $600,000, Mr. Wright, $550,000, and Mr. J. Lampropoulos $600,000.

|

The amount of the base salary payable to each NEO may be subject to change based on review by the Compensation Committee on an annual basis. Although the employment status of each of the NEOs is “at will,” the Employment Agreements provide for mandatory severance payments to each NEO in the event the NEO’s employment terminates for certain reasons in connection with a “Change in Control” (as defined below). Those severance arrangements are discussed in greater detail below under the heading “Executive Compensation Tables—Potential Payments upon Termination or Change in Control.”

In addition to the annual base salary described above, the Employment Agreements also allow the NEOs to receive an annual cash bonus payment in an amount to be determined in the sole discretion of the Board (which has delegated that authority to the Compensation Committee). Notably, in fiscal years ending after a Change in Control, the annual bonus must be at least equal to an NEO’s average annual cash bonus for the last three full fiscal years ending prior to the Change in Control.

The NEOs (and to the extent applicable, their spouses and eligible dependents) are eligible to participate in all incentive, savings and retirement, health insurance, term life insurance, long-term disability insurance, deferred compensation, employee stock purchase and other employee benefit plans, policies or arrangements we maintain for our employees generally and, at the discretion of the Compensation Committee, in the 2018 Incentive Plan and other benefit plans maintained by the Company for our executives.

The terms of the Employment Agreements reflect in part the concern of the Compensation Committee that a future threatened or actual change in control, such as through an acquisition or merger, could cause disruption and harm to the Company in the event of the resulting loss of any of its key executives. The change in control provisions in the Employment Agreements are intended to provide a measure of incentive and security to our key executives until the resolution of any such threatened or actual change in control.

However, the Compensation Committee believes that such agreements should not include provisions that would obligate a potential acquirer of the Company to make large payouts to the NEOs simply because a change in control has occurred. Because of this concern, the occurrence of a change in control event alone will not trigger any payment obligations to the NEOs under their respective Employment Agreements. Additional change in control payment obligations under the Employment Agreements only arise in the event the NEO’s employment is terminated “without Cause” in connection with the change in control or the NEO

resigns “for Good Reason” (with each capitalized term in this sentence defined in the Employment Agreements and described under the heading “Potential Payments Upon Termination or Change in Control—Employment Agreements” below) in connection with a change in control. Thus, the Compensation Committee regards the employment agreements as “double trigger” change in control agreements.

Tax Deductibility and Executive Compensation

Section 162(m) (Section 162(m)) of the Internal Revenue Code of 1986, as amended (the Code) imposes a $1.0 million annual limit on the amount that a public company may deduct for compensation paid to a company’s chief executive officer, chief financial officer, or any of the company’s three other most highly compensated executive officers for a tax year. For tax years beginning before 2018, the limit did not apply to compensation that met the requirements of Section 162(m) for “qualified performance-based” compensation (i.e., compensation paid only if the executive meets pre-established, objective goals based upon performance criteria approved by our shareholders). Qualified performance-based awards, such as stock options, issued prior to 2018 remain under certain conditions exempt from Section 162(m) even if exercised after 2017.

The Compensation Committee reviews and considers the deductibility of executive compensation under Section 162(m) and attempts, to the extent practical, to implement compensation policies and practices that maximize the potential income tax deductions available to the Company.

In certain situations, the Compensation Committee may approve compensation that will exceed the deduction limitations of Section 162(m) in order to ensure competitive levels of total compensation for its executive officers. In such situations, the portion of the compensation payable to the executive officer that exceeds the $1.0 million limit will not be deductible for tax purposes. Although deductibility of executive compensation for tax purposes is generally preferred, tax deductibility is not the primary objective of our executive compensation programs. The Company and the Compensation Committee believe that meeting the compensation objectives described above is more important than the benefit of being able to deduct the compensation for tax purposes.

All compensation paid to the NEOs, other than Mr. Fred Lampropoulos, during 2019 was intended to be deductible under Section 162(m). Although Mr. Fred Lampropoulos’ compensation for 2019 exceeded the deduction limits of Section 162(m), the Compensation Committee approved that compensation amount in order to provide Mr. Fred Lampropoulos with a compensation package that the Compensation Committee considers competitive and in the best interests of the Company and its shareholders.

Additionally, under Sections 280G and 4999 of the Code, our NEOs and other Company executives may be subject to additional taxes if they receive payments or benefits in connection with a change of control of the Company that exceed certain prescribed limits (so-called Excess Parachute Payments), and the Company or its successor may not deduct such Excess Parachute Payments. The Company is not obligated to provide any NEO or other executive with a “gross-up” or other reimbursement payment for any tax liability that the executive might owe as a result of the application of Sections 280G or 4999 of the Code. Certain potential future payments described in the table captioned “Termination Without Cause or For Good Reason in Connection with a Change in Control” on page 61 may, however, constitute Excess Parachute Payments that the Company or its successor could not fully deduct.

Compensation Policies and Practices Relating to Risk Management

The Compensation Committee has reviewed our company-wide compensation program, which applies to all of our full-time employees, including the NEOs. The Compensation Committee has also reviewed our executive compensation practices with Pearl Meyer. Based on the Compensation Committee’s review of the various elements of our executive compensation practices and policies, the Compensation Committee believes our compensation policies and practices are designed to create appropriate and meaningful incentives for our employees without encouraging excessive or inappropriate risk taking.

After undertaking this review, the Compensation Committee came to the following conclusions:

|

|

·

|

|

Our compensation policies and practices are designed to include a significant level of long-term compensation, which discourages short-term risk taking;

|

|

|

·

|

|

The base salaries we provide to our employees are generally consistent with salaries paid for comparable positions in our industry, and provide our employees with steady income while reducing the incentive for employees to take risks in pursuit of short-term benefits;

|

|

|

·

|

|

Our incentive compensation is capped for some NEOs at levels established by the Compensation Committee, which it believes reduces the incentive for excessive risk-taking;

|

|

|

·

|

|

We have established and adopted codes of ethics and business conduct, which are designed to reinforce the balanced compensation objectives established by the Compensation Committee; and

|

|

|

·

|

|

We have adopted equity ownership guidelines for our executive officers, which the Compensation Committee believes discourages excessive risk-taking.

|

Based on the review outlined above, the Compensation Committee has further concluded that the risks arising from our compensation policies and practices for its employees are not reasonably likely to have a material adverse effect on the Company.

Compensation Committee Report

The Compensation Committee establishes and oversees the design and function of our executive compensation programs.

The members of the Compensation Committee have reviewed and discussed the foregoing Compensation Discussion and Analysis with the management of the Company and recommended to the Board that the Compensation Discussion and Analysis be included in this Proxy Statement.

|

|

|

Compensation Committee:

A. Scott Anderson (Chair)

Franklin J. Miller, M.D.

F. Ann Millner. Ed. D.

|

|

Proposal No. 2– Advisory Vote on Executive Compensation

|

Board Recommendation

|

|

The Board unanimously recommends a vote FOR this proposal

|

Section 14A of the Exchange Act (Section 14A), which was enacted pursuant to the Dodd-Frank Wall Street Reform and Consumer Protection Act, requires that we provide shareholders with the opportunity to vote on an advisory (non-binding) resolution to approve the compensation of the NEOs disclosed in this Proxy Statement (colloquially referred to as a “Say-on-Pay” proposal).

Accordingly, the following resolution will be submitted to our shareholders for approval at the Annual Meeting:

|

proxy statement for the 2019 Annual Meeting of Shareholders, pursuant to the compensation disclosure rules of the U.S. Securities and Exchange Commission, including the Compensation Discussion and Analysis, the Summary Compensation Table and the other related tables and disclosures.”

|

|

“RESOLVED, that the Company’s shareholders APPROVE, on an advisory basis, the compensation of the named executive officers, as disclosed in the Company’s proxy statement for the 2020 Annual Meeting of Shareholders, pursuant to the compensation disclosure rules of the U.S. Securities and Exchange Commission, including the Compensation Discussion and Analysis, the Summary Compensation Table and the other related tables and disclosures.”

|

As described above under the heading “Compensation Discussion and Analysis,” the Board believes our compensation of the NEOs achieves the primary goals of:

|

|

·

|

|

focusing our executives on achieving or exceeding measurable performance targets;

|

|

|

·

|

|

encouraging continuation of our entrepreneurial spirit;

|

|

|

·

|

|

attracting and retaining highly-qualified and motivated executives;

|

|

|

·

|

|

promoting our guiding principles for adherence to a high ethical environment, as well as health and safety standards; and

|

|

|

·

|

|

aligning management compensation with shareholder value.

|

The Board encourages shareholders to review in detail the Compensation Discussion and Analysis beginning on page 39 of this Proxy Statement and the executive compensation tables beginning on page 54 of this Proxy Statement. In light of the information set forth in such sections, the Board believes the compensation of the NEOs for the fiscal year ended December 31, 2019 was fair and reasonable and that our compensation programs and practices are in the best interests of the Company and our shareholders.

The advisory vote on this Say-on-Pay resolution is not intended to address any specific element of compensation; rather, the vote relates to all aspects of the compensation of the NEOs, as described in this Proxy Statement. While this vote is only advisory in nature, which means that the vote is not binding on the Company, the Board or the Compensation Committee (which is composed solely of independent directors), value the opinion of our shareholders and will consider the outcome of the vote when addressing future compensation arrangements.

In the 2017 annual meeting of shareholders, held on May 24, 2017, our shareholders recommended that they be given an opportunity to vote on a Say-on-Pay resolution every year at our annual meeting of shareholders. Consequently, we intend to hold an annual advisory vote on executive compensation until the next “say-on-frequency” vote at our annual meeting of shareholders in 2023 (as required by Section 14A).

Approval of the resolution above (on a non-binding, advisory basis) requires that the number of votes cast at the Annual Meeting, in person or by proxy, in favor of the resolution exceeds the number of votes cast in opposition to the resolution.

EXECUTIVE COMPENSATION

TABLES

Summary Compensation Table

The following Summary Compensation Table summarizes the total compensation earned by each of the NEOs for the years indicated.

|

|

|

Salary

|

Bonus

|

Stock Awards

|

Non-Equity Incentive Plan Compensation

|

All Other Compensation

|

|

Total

|

|

Name and Position

|

Year

|

($)

|

($) (1)

|

($) (2)

|

($) (3)

|

($)

|

|

($)

|

|

Fred P. Lampropoulos

|

2019

|

1,804,136

|

—

|

3,008,622

|

—

|

236,528

|

(4)(5)

|

5,049,286

|

|

Chair of the Board, CEO and President

|

2018

|

1,700,000

|

—

|

587,861

|

1,300,000

|

92,719

|

(4)(5)

|

3,680,580

|

|

2017

|

1,412,308

|

400,000

|

1,838,700

|

600,000

|

59,787

|

(4)(5)

|

4,310,795

|

|

|

|

|

|

|

|

|

|

|

Raul Parra

|

2019

|

580,769

|

—

|

567,126

|

—

|

20,873

|

(4)(5)

|

1,168,768

|

|

Chief Financial Officer and Treasurer (6)

|

2018

|

319,231

|

275,000

|

154,692

|

—

|

51,987

|

(4)(5)

|

800,910

|

|

|

|

|

|

|

|

|

|

|

Ronald A. Frost

|

2019

|

598,077

|

—

|

567,126

|

—

|

65,515

|

(4)(5)

|

1,230,718

|

|

Chief Operating Officer

|

2018

|

532,692

|

150,000

|

618,768

|

—

|

65,499

|

(4)(5)

|

1,366,959

|

|

2017

|

400,000

|

200,000

|

459,675

|

—

|

23,145

|

(4)(5)

|

1,082,820

|

|

|

|

|

|

|

|

|

|

|

Joseph C. Wright

|

2019

|

550,000

|

—

|

567,126

|

300,000

|

48,632

|

(4)(5)

|

1,465,758

|

|

President, Merit

International

|

2018

|

536,538

|

—

|

386,730

|

300,000

|

25,298

|

(4)(5)

|

1,248,566

|

|

2017

|

473,078

|

—

|

229,838

|

225,000

|

15,551

|

(4)(5)

|

943,467

|

|

|

|

|

|

|

|

|

|

|

Justin J. Lampropoulos

|

2019

|

596,154

|

—

|

567,126

|

—

|

48,319

|

(4)(5)

|

1,211,599

|

|

Executive Vice President, Sales, Marketing and Strategy

|

2018

|

500,000

|

50,000

|

309,384

|

—

|

45,267

|

(4)(5)

|

904,651

|

|

2017

|

500,000

|

50,000

|

229,838

|

—

|

5,963

|

(5)

|

785,801

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

|

|

Bonus amounts represent discretionary bonuses not based solely upon pre-determined performance criteria.

|

|

|

(2)

|

|

Stock Awards reflect the aggregate grant date fair value of the awards granted to the NEOs in the year shown under our 2006 Incentive Plan or our 2018 Incentive Plan, as applicable, computed in accordance with FASB ASC Topic 718. Such amounts have been calculated in accordance with current financial statement reporting guidance, using the same assumptions the Company has used for financial statement reporting purposes with respect to our long-term incentive plans. Assumptions used in the calculation of these amounts for 2019, 2018, and 2017 are included in footnotes to our audited consolidated financial statements for the years ended December 31, 2019, 2018, and 2017 (which are included in our Annual Reports on Form 10-K filed with the Commission on March 2, 2020, March 1, 2019, and March 1, 2018, respectively).

|

|

|

(3)

|

|

Incentive bonuses under our performance-based annual bonus plan based on pre-established performance criteria appear in the Non-Equity Incentive Plan Compensation column. The Compensation Committee’s evaluation of our achievement of the performance bonus goals for Mr. Wright in 2019 indicated that we achieved the goal established for international operations for which Mr. Wright has supervisory responsibility. Based upon the Company’s achievement of this goal established by the Compensation Committee, the Compensation Committee determined to award to Mr. Wright the full amount of the targeted annual cash bonus established for him. No other NEOs earned bonuses of any kind with respect to 2019.

|

|

|

(4)

|

|

Amounts include vacation benefits paid to the NEOs in cash in lieu of vacation benefits, as follows:

|

|

|

·

|

|