Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

October 07 2024 - 7:07AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

Date of Report: October 2024

Commission File Number: 001-39368

MAXEON SOLAR TECHNOLOGIES, LTD.

(Exact Name of registrant as specified in its charter)

8 Marina Boulevard #05-02

Marina Bay Financial Centre

018981, Singapore

(Address of principal executive office) Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Reverse Stock Split; Record Date

Maxeon Solar Technologies, Ltd. (NASDAQ:MAXN) (the “Company”) is reporting that its board of directors (the “Board”) has approved a reverse stock split (the “Reverse Stock Split”) of the Company’s ordinary shares, no par value (the “Ordinary Shares”), at a ratio of 1-for-100 (the “Reverse Split Ratio”). The Reverse Stock Split was approved by the Company’s shareholders at the annual general meeting held on August 29, 2024.

The Company is undertaking the Reverse Stock Split with the objective of meeting the minimum $1.00 per Ordinary Share bid requirement for maintaining the listing of the Ordinary Shares on The Nasdaq Global Select Market.

The Reverse Stock Split will be effective at 04:01 p.m. (ET) on Tuesday, October 8, 2024 (the “Record Date”) and the Ordinary Shares will begin trading on a split-adjusted basis when the Nasdaq Stock Market LLC opens for trading on Wednesday, October 9, 2024. The Ordinary Shares will continue to trade on The Nasdaq Global Select Market under the trading symbol “MAXN” but will trade under the following new CUSIP number: Y58473128.

As a result of the Reverse Stock Split, every 100 Ordinary Shares held as of the Record Date will be automatically combined into one Ordinary Share. The number of outstanding Ordinary Shares will be reduced from approximately 1,529 million Ordinary Shares to approximately 15 million Ordinary Shares, to be adjusted for the round-down of fractional shares. No fractional shares will be created or issued in connection with the reverse stock split, and the Board has approved the aggregation and sale of all fractional shares to which holders of the existing outstanding shares would otherwise be entitled to, and the distribution of the proceeds on a pro rata basis to such holders.

The Reverse Stock Split will affect all holders of Ordinary Shares uniformly and will not affect any shareholder’s percentage ownership interest in the Company, except as a result of the treatment of fractional shares. Neither will the Reverse Stock Split have any direct impact on the market capitalization of the Company, nor modify any voting rights or other terms of the Ordinary Shares. The Company’s outstanding warrants, convertible notes, and equity-based awards will be proportionately adjusted.

Shareholders with shares held in book-entry form or through a bank, broker, or other nominee are not required to take any action and will see the impact of the Reverse Stock Split reflected in their accounts on or after October 8, 2024. Such beneficial holders may contact their bank, broker, or nominee for more information.

Incorporation By Reference

The information contained in this report is hereby incorporated by reference into the Company’s registration statements on Form F-3 (File No. 333-271971), Form F-3 (File No. 333-265253), Form F-3 (File No. 333-268309), Form S-8 (File No. 333-277501) and Form S-8 (File No. 333-241709), each filed with the Securities and Exchange Commission.

Forward-Looking Statements

This current report on Form 6-K contains “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The forward-looking statements can be also identified by terminology such as “may,” “might,” “could,” “will,” “aims,” “expects,” “anticipates,” “future,” “intends,” “plans,” “believes,” “estimates” and similar statements.

These forward-looking statements are based on our current assumptions, expectations and beliefs and involve substantial risks and uncertainties that may cause results, performance or achievement to materially differ from those expressed or implied by these forward-looking statements. These statements are not guarantees of future performance and are subject to a number of risks. The reader should not place undue reliance on these forward-looking statements, as there can be no assurances that the plans, initiatives or expectations upon which they are based will occur. A detailed discussion of factors that could cause or contribute to such differences and other risks that affect our business is included in filings we make with the Commission from time to time, including our most recent report on Form 20-F, particularly under the heading “Risk Factors”. Copies of these filings are available online from the SEC at www.sec.gov, or on the SEC Filings section of our Investor Relations website at https://

corp.maxeon.com/investor-relations. All forward-looking statements in this current report on Form 6-K are based on information currently available to us, and we assume no obligation to update these forward-looking statements in light of new information or future events.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | MAXEON SOLAR TECHNOLOGIES, LTD.

(Registrant) |

| | | |

| October 7, 2024 | | | | By: | | /s/ Kenneth Bryan Olson |

| | | | | | Kenneth Bryan Olson |

| | | | | | Interim Chief Financial Officer |

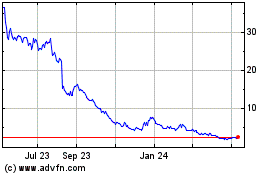

Maxeon Solar Technologies (NASDAQ:MAXN)

Historical Stock Chart

From Nov 2024 to Dec 2024

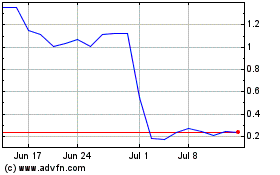

Maxeon Solar Technologies (NASDAQ:MAXN)

Historical Stock Chart

From Dec 2023 to Dec 2024