Form SC 13D/A - General Statement of Acquisition of Beneficial Ownership: [Amend]

September 25 2024 - 4:01PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

(Rule 13d-101)

INFORMATION TO BE INCLUDED IN STATEMENTS FILED

PURSUANT

TO RULE 13d-1(a) AND AMENDMENTS THERETO FILED

PURSUANT TO RULE 13d-2(a)

Under the Securities Exchange Act of 1934

(Amendment No. 15)*

Masimo Corporation

(Name of Issuer)

Common Stock, par value $0.001 per share

(Title of Class of Securities)

574795100

(CUSIP Number)

Quentin Koffey

Politan Capital Management LP

106 West 56th Street, 10th

Floor

New York, New York 10019

646-690-2830

With a copy to:

Richard M. Brand

Cadwalader, Wickersham & Taft LLP

200 Liberty Street

New York, NY 10281

212-504-6000

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

September 24, 2024

(Date of Event Which Requires Filing of This

Statement)

If the filing person has previously filed a statement

on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e),

13d-1(f) or 13d-1(g), check the following box. ¨

Note:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7

for other parties to whom copies are to be sent.

| * | The remainder of this cover page

shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for

any subsequent amendment containing information which would alter disclosures provided in a prior cover page. |

The information required on the remainder of this

cover page shall not be deemed to be “filed” for the purpose of section 18 of the Securities Exchange Act of 1934 (“Act”)

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see

the Notes).

|

CUSIP No. 574795100 |

|

Page 2 |

| 1 |

NAME OF REPORTING PERSON

Politan Capital Management LP |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) x

(b) ¨ |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS

OO (See Item 3) |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO

ITEMS 2(d) OR 2(e)

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

Number of

shares

beneficially

owned by

each

reporting

person

with |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

4,713,518 |

| 9 |

SOLE DISPOSITIVE POWER

0 |

| 10 |

SHARED DISPOSITIVE POWER

4,713,518 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

4,713,518 |

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

8.8%* |

| 14 |

TYPE OF REPORTING PERSON

IA |

* All percentage calculations set forth herein

are based upon the aggregate of 53,470,864 shares of Common Stock outstanding as of August 12, 2024, as reported in the Issuer’s

revised definitive proxy statement, filed with the Securities and Exchange Commission (the “SEC”) on August 22, 2024

(the “Issuer Revised Proxy Statement”).

| CUSIP No. 574795100 |

|

Page 3 |

| 1 |

NAME OF REPORTING PERSON

Politan Capital Management GP LLC |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) x

(b) ¨ |

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS

OO (See Item 3) |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO

ITEMS 2(d) OR 2(e)

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

Number of

shares

beneficially

owned by

each

reporting

person

with |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

4,713,518 |

| 9 |

SOLE DISPOSITIVE POWER

0 |

| 10 |

SHARED DISPOSITIVE POWER

4,713,518 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

4,713,518 |

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

8.8%* |

| 14 |

TYPE OF REPORTING PERSON

IA |

* All percentage calculations set forth herein

are based upon the aggregate of 53,470,864 shares of Common Stock outstanding as of August 12, 2024, as reported in the Issuer Revised

Proxy Statement.

| CUSIP No. 574795100 |

|

Page 4 |

| 1 |

NAME OF REPORTING PERSON

Politan Capital Partners GP LLC |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) x

(b) ¨ |

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS

OO (See Item 3) |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO

ITEMS 2(d) OR 2(e)

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

Number of

shares

beneficially

owned by

each

reporting

person

with |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

4,713,518 |

| 9 |

SOLE DISPOSITIVE POWER

0 |

| 10 |

SHARED DISPOSITIVE POWER

4,713,518 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

4,713,518 |

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

8.8%* |

| 14 |

TYPE OF REPORTING PERSON

IA |

* All percentage calculations set forth herein

are based upon the aggregate of 53,470,864 shares of Common Stock outstanding as of August 12, 2024, as reported in the Issuer Revised

Proxy Statement.

| CUSIP No. 574795100 |

|

Page 5 |

| 1 |

NAME OF REPORTING PERSON

Quentin Koffey |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) x

(b) ¨ |

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS

OO (See Item 3) |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO

ITEMS 2(d) OR 2(e)

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

United States |

Number of

shares

beneficially

owned by

each

reporting

person

with |

7 |

SOLE VOTING POWER

3,018* |

| 8 |

SHARED VOTING POWER

4,713,518 |

| 9 |

SOLE DISPOSITIVE POWER

3,018* |

| 10 |

SHARED DISPOSITIVE POWER

4,713,518 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

4,716,536* |

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

8.8%** |

| 14 |

TYPE OF REPORTING PERSON

IN |

* Includes Mr. Koffey’s 1,228 restricted

share units granted to him on June 26, 2023 by virtue of his position as a director on the Board, which vested on June 26, 2024, and his

1,790 restricted share units granted to him on September 19, 2024 by virtue of his position as a director on the Board, which will vest

on the earlier of the first anniversary of the grant date or the date of the Issuer’s 2025 annual meeting of stockholders.

** Mr. Koffey’s percentage calculations

set forth herein are based upon the aggregate of 53,470,864 shares of Common Stock outstanding as of August 12, 2024, as reported in the

Issuer Revised Proxy Statement.

| CUSIP No. 574795100 |

|

Page 6 |

This Amendment No. 15 to Schedule

13D (this “Amendment No. 15”) amends and supplements the Schedule 13D filed on August 16, 2022 (as amended and supplemented

through the date of this Amendment No. 15, collectively, the “Schedule 13D”) by the Reporting Persons, relating to

the common stock, par value $0.001 per share, of Masimo Corporation, a Delaware corporation

(the “Issuer”). Capitalized terms not defined in this Amendment No. 15 shall have the meaning ascribed to them in the

Schedule 13D.

The information set forth

in response to Item 4 below shall be deemed to be a response to all Items where such information is relevant.

|

ITEM 4. PURPOSE OF TRANSACTION

Item 4 of the Schedule 13D is hereby amended

and supplemented with the following information:

According to the final vote

tabulation delivered to the Issuer by the independent inspector of election on September 24, 2024, in connection with the matters that

were submitted to a vote at the 2024 Annual Meeting on September 19, 2024, the 2024 Nominees (William Jellison and Darlene Solomon) were

elected to the Issuer’s Board at the 2024 Annual Meeting. |

| ITEM 7. |

MATERIAL TO BE FILED AS AN EXHIBIT |

| Exhibit 99.1 |

Joint Filing Agreement among Politan Capital Management LP, Politan Capital Management GP LLC, Politan Capital Partners GP LLC, and Quentin Koffey* |

| |

|

| Exhibit 99.2 |

Trading Data* |

| |

|

| Exhibit 99.3 |

Trading Data* |

| |

|

| Exhibit 99.4 |

Form of Verified Complaint, filed with the Delaware Court of Chancery on October 21, 2022* |

| |

|

| Exhibit 99.5 |

Form of Second Amended and Supplemented Complaint, filed as an Exhibit to the Motion for Leave to Amend with the Delaware Court of Chancery on March 10, 2023* |

| Exhibit 99.6 |

Form of Engagement and Indemnification Agreement entered into by and between Politan Capital Management LP and Michelle Brennan* |

| Exhibit 99.7 |

Trading Data* |

| Exhibit 99.8 |

Press Release, dated June 26, 2023* |

| Exhibit 99.9 |

Form of Engagement and Indemnification Agreement entered into by and between Politan Capital Management LP and each of William Jellison and Darlene Solomon* |

| Exhibit 99.10 |

Demand Letter, dated May 8, 2024* |

| Exhibit 99.11 |

Politan Letter, dated May 9, 2024* |

| Exhibit 99.12 |

Politan Letter, dated July 3, 2024* |

| Exhibit 99.13 |

Politan Letter, dated July 12, 2024* |

| Exhibit 99.14 |

Politan Letter, dated July 15, 2024* |

| Exhibit 99.15 |

Issuer’s Amended Complaint, filed August 26, 2024* |

| Exhibit 99.16 |

Issuer’s Preliminary Injunction Motion, filed August 23, 2024* |

| Exhibit 99.17 |

Politan’s Supplemental Proxy Materials, filed August 30, 2024* |

*Previously filed.

| CUSIP No. 574795100 |

|

Page 7 |

SIGNATURES

After reasonable inquiry and to the best of each

of the undersigned’s knowledge and belief, each of the undersigned certifies that the information set forth in this statement is

true, complete and correct.

Date: September 25, 2024

| |

POLITAN CAPITAL MANAGEMENT LP |

| |

|

|

|

|

| |

By: |

Politan Capital Management GP LLC |

| |

|

its general partner |

| |

|

|

|

| |

By: |

/s/ Quentin Koffey |

|

| |

|

Name: |

Quentin Koffey |

| |

|

Title: |

Managing Member |

| |

|

|

|

| |

POLITAN CAPITAL MANAGEMENT GP LLC |

| |

|

|

|

| |

By: |

/s/ Quentin Koffey |

|

| |

|

Name: |

Quentin Koffey |

| |

|

Title: |

Managing Member |

| |

|

|

|

| |

POLITAN CAPITAL PARTNERS GP LLC |

| |

|

|

| |

By: |

/s/ Quentin Koffey |

|

| |

|

Name: |

Quentin Koffey |

| |

|

Title: |

Managing Member |

| |

|

|

|

| |

QUENTIN KOFFEY |

| |

|

|

|

| |

By: |

/s/ Quentin Koffey |

|

| |

|

Name: |

Quentin Koffey |

| |

|

|

|

| CUSIP No. 574795100 |

|

Page 8 |

INDEX TO EXHIBITS

|

Exhibit |

Description |

| Exhibit 99.1 |

Joint Filing Agreement among Politan Capital Management LP, Politan Capital Management GP LLC, Politan Capital Partners GP LLC, and Quentin Koffey* |

| |

|

| Exhibit 99.2 |

Trading Data* |

| |

|

| Exhibit 99.3 |

Trading Data* |

| |

|

| Exhibit 99.4 |

Form of Verified Complaint, filed with the Delaware Court of Chancery on October 21, 2022* |

| |

|

| Exhibit 99.5 |

Form of Second Amended and Supplemented Complaint, filed as an Exhibit

to the Motion for Leave to Amend with the Delaware Court of Chancery on March 10, 2023*

|

| Exhibit 99.6 |

Form of Engagement and Indemnification Agreement entered into by and between Politan Capital Management LP and Michelle Brennan* |

| Exhibit 99.7 |

Trading Data* |

| Exhibit 99.8 |

Press Release, dated June 26, 2023* |

| Exhibit 99.9 |

Form of Engagement and Indemnification Agreement entered into by and between Politan Capital Management LP and each of William Jellison and Darlene Solomon* |

| Exhibit 99.10 |

Demand Letter, dated May 8, 2024* |

| Exhibit 99.11 |

Politan Letter, dated May 9, 2024* |

| Exhibit 99.12 |

Politan Letter, dated July 3, 2024* |

| Exhibit 99.13 |

Politan Letter, dated July 12, 2024* |

| Exhibit 99.14 |

Politan Letter, dated July 15, 2024* |

| Exhibit 99.15 |

Issuer’s Amended Complaint, filed August 26, 2024* |

| Exhibit 99.16 |

Issuer’s Preliminary Injunction Motion, filed August 23, 2024* |

| Exhibit 99.17 |

Politan’s Supplemental Proxy Materials, filed August 30, 2024* |

*Previously filed.

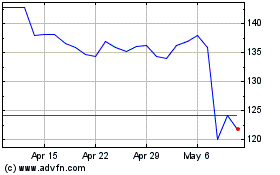

Masimo (NASDAQ:MASI)

Historical Stock Chart

From Dec 2024 to Jan 2025

Masimo (NASDAQ:MASI)

Historical Stock Chart

From Jan 2024 to Jan 2025