UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________________________________

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of April, 2011

Commission File Number

________________

Novogen Limited

(Translation of registrant’s name into English)

140 Wicks Road, North Ryde, NSW, Australia

(Address of principal executive office)

___________________________________

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F

x

Form 40-F

o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(l):

o

Note: Regulation S-T Rule 101 (b)( I) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule lO1(b)(7):

o

Note: Regulation S-T Rule l01(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule l2g3-2(b) under the Securities Exchange Act of 1934. Yes

o

No

x

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b):

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

Novogen Limited

(Registrant)

/s/ Ron Erratt

Ronald Lea Erratt

Company Secretary

Date 5 April, 2011

Fellow Shareholders

I am pleased to enclose a Notice and Explanatory Materials for an Extraordinary General Meeting of Novogen Limited (“Novogen”) to be held at 2.00 pm on 6 May, 2011 at the Education and Conference Centre Macquarie (NSEC) (in the grounds of the Macquarie Hospital), Wicks Road, North Ryde, New South Wales, Australia.

The Extraordinary General Meeting seeks shareholder approval for two resolutions. The most significant resolution asks for your approval to the matters announced on 22 December, 2010 that Novogen sell to its majority-owned subsidiary Marshall Edwards, Inc. (“Marshall Edwards”) Novogen’s isoflavone-based intellectual property portfolio in exchange for 1,000 shares of Marshall Edwards Series A Convertible Preferred Stock (the “Isoflavone Transaction”). Each share of Series A Convertible Preferred Stock will be convertible into 4,827 shares of Marshall Edwards common stock or, in the event Marshall Edwards reaches certain development milestones on the terms described in the accompanying document, any unconverted shares of Marshall Edwards Series A Convertible Preferred Stock will each be convertible into 9,654 shares of Marshall Edwards common stock, as further described in the accompanying document.

As I described at Novogen’s Annual General Meeting in October, Novogen’s Board has determined that it is in the interest of both Novogen and Marshall Edwards to consolidate all of the Novogen Group’s drug development activities into Marshall Edwards.

Marshall Edwards already controls significant portions of the Novogen Group’s drug discovery portfolio through a series of licence agreements with Novogen and has a last right to negotiate on any future compounds the Novogen Group might develop. With the appointment of Daniel P Gold as Chief Executive Officer in 2010, Marshall Edwards is best positioned to assemble a team and secure the capital to advance these compounds through the complex and costly process of possible approval as cancer therapeutics.

One of the critical steps to facilitate the success of the capital raising effort necessary to further develop and commercialise drug candidates from the isoflavone-based intellectual property is to simplify the structure by removing the licence agreements and transferring direct ownership of the intellectual property to Marshall Edwards.

Novogen now owns approximately 65% of Marshall Edwards. If approved, this transaction could see Novogen’s ownership increase to 78% or more, upon conversion of the Series A Convertible Preferred Stock.

The Board of Directors of Novogen believes that Marshall Edwards provides the best opportunity for Novogen shareholders to see added value to their investment in the future. This opinion is supported by a report from Grant Thornton Corporate Finance Pty Ltd (“Grant Thornton Corporate Finance”) which has formed the view that the proposed acquisition is fair and reasonable to shareholders not associated with Novogen. More information about the proposed Isoflavone Transaction is contained in the accompanying document. In particular, you should carefully consider the matters discussed under “Risk Factors” beginning on page 15.

The Resolution in Agenda Item 2 seeks your approval to the grant of share options to Directors of Novogen. Despite the fact that the shareholders have approved aggregate remuneration for the Directors of $560,000, the Directors continue to believe that it is important to conserve Novogen’s cash and in 2010 only $212,000 was paid to the Board members. I believe that it is important to attract qualified Directors to our Board and in order to do so, we need to provide appropriate compensation and incentives to the Board members to align their interests with those of the shareholders. We hope that you will support the hard work and dedication of the Board and approve the grant of the options.

Many thanks for your support over the past year. It has been a year of change and progress.

Sincerely,

William D Rueckert

Chairman

5 April, 2011

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the Marshall Edwards securities to be issued in the Isoflavone Transaction or determined whether this document is truthful or complete. Any representation to the contrary is a criminal offence.

Recent Developments at Marshall Edwards Inc.

Pursuant to the Stock Purchase Agreement between Marshall Edwards, Inc. and Ironridge Global IV, Ltd. described in "Marshall Edwards' Management's Discussion and Analysis of Financial Condition and Results of Operations" in the accompanying document, Marshall Edwards issued an aggregate of 644,347 shares of its common stock to Ironridge in exchange for promissory notes from Ironridge in an aggregate amount of $1,001,700. Upon the issuance of such common stock, Ironridge became obligated to purchase the Series B Preferred Shares, subject to the conditions also described in the accompanying document. After giving effect to the issuance of such common stock, Novogen's ownership percentage of Marshall Edwards' common stock decreased from the approximately 71% described in the accompanying document to approximately 65%.

Notice of Extraordinary General Meeting

Novogen Limited

ABN 37 063 259 754

Notice is hereby given that the Extraordinary General Meeting of Novogen Limited (“Novogen”) will be held at 2.00 pm, Friday 6 May, 2011 at the Education and Conference Centre Macquarie (NSEC) (in the grounds of the Macquarie Hospital), Wicks Road, North Ryde, New South Wales, Australia.

The Explanatory Statement to this Notice of Meeting provides additional information on matters to be considered at the Extraordinary General Meeting. The Explanatory Statement and the proxy form are part of this Notice of Meeting.

Business Agenda

1. Asset Purchase Agreement

To consider and if thought fit, pass the following resolution as an ordinary resolution of Novogen:

“That, subject to all necessary regulatory approvals and in accordance with ASX Listing Rule 10.1, completion of the Asset Purchase Agreement between Novogen, Novogen Research Pty Limited and Marshall Edwards, Inc dated 21 December, 2010 be approved including the issue of 1,000 Series A Convertible Preferred Stock in Marshall Edwards, Inc to Novogen”

2. Director options

To consider and if thought fit, pass the following resolution as an ordinary resolution of Novogen:

“That approval is given for all purposes including for the purpose of ASX Listing Rule 10.14:

(a) for the issue to William D Rueckert, a Director of Novogen, on or before 31 March, 2014 of up to 375,000 options;

(b) for the issue to Peter R White, a Director of Novogen, on or before 31 March, 2014 of up to 375,000 options;

(c) for the issue to Ross C Youngman, a Director of Novogen, on or before 31 March, 2014 of up to 375,000 options; and

(d) for the issue to Peter DA Scutt, a Director of Novogen, on or before 31 March, 2014 of up to 375,000 options,

in the share capital of Novogen pursuant to the Novogen Limited Employee Share Option Plan approved by the shareholders on 26 October, 2007.”

The terms of issue of the options including the exercise price are set out in the Explanatory Statement.

[Missing Graphic Reference]

By order of the Board.

Ron Erratt

Company Secretary

Sydney

5 April, 2011

TIME AND PLACE OF MEETING AND HOW TO VOTE

These notes form part of the Notice of Meeting.

Entitlement to vote

For the purposes of the meeting, in accordance with Regulation 7.11.37 of the Corporations Regulations, the Board has determined that a person’s entitlement to vote at the meeting will be the entitlement of that person set out in the register of members at 2.00 pm on Wednesday 4 May, 2011. Accordingly, transactions registered after that time will be disregarded in determining members entitled to attend and vote at the meeting.

How to Vote

Shareholders may vote by attending the meeting in person, by proxy or authorised representative.

Voting in Person

To vote in person, shareholders should attend the meeting on the date and at the place set out in the Notice of Meeting. The meeting will commence at 2.00 pm.

Appointment of a Proxy

A shareholder entitled to attend and vote at the meeting is entitled to appoint not more than two proxies, neither of whom needs to be a member of Novogen. If one proxy is appointed, that proxy may exercise the entire member’s voting rights. If a shareholder appoints 2 proxies and the appointment does not specify this proportion, each proxy may exercise half of the votes.

A proxy may be, but need not be a shareholder and can be an individual or a body corporate.

A body corporate appointed as a proxy may appoint a representative to exercise any of the powers the body corporate may exercise as a proxy at the Extraordinary General Meeting. The representative should bring to the meeting evidence of his or her appointment, including any authority under which the appointment is signed, unless it has previously been given to Novogen.

Voting by Proxy

The proxy form and the Power of Attorney (if any) under which the form is signed must be received at:

|

·

|

Novogen’s registered office: Novogen Limited, 140 Wicks Road, North Ryde, NSW, 2113; or

|

|

·

|

Novogen’s Share Registry, Computershare Services Pty Limited: GPO Box 242, Melbourne, Victoria, 3001, Australia,

|

not less than 48 hours before the appointed time of the meeting.

For this purpose it is sufficient if the proxy is received at the registered office of Novogen or at Novogen’s Share Registry by facsimile transmission or by similar means of communication in a reasonably legible form. The facsimile number of the Share Registry is +61 3 9473 2555.

Enquiries

Shareholders are invited to contact Novogen’s Secretary, Mr Ron Erratt, on +61 2 9878 0088 if they have any queries in respect of the matters set out in this Notice of Meeting or the Explanatory Statement.

A personalised form of proxy is included with these documents.

EXPLANATORY STATEMENT

This Explanatory Statement has been prepared to provide Novogen shareholders with information about the business to be conducted at Novogen’s 2011 Extraordinary General Meeting to be held at 2.00 pm on Friday 6 May, 2011 at the Education and Conference Centre Macquarie (NSEC), Wicks Road, North Ryde, New South Wales, Australia.

This Explanatory Statement is an important document and should be read carefully and in its entirety by shareholders.

Agenda Item 1 - completion of the Asset Purchase Agreement

On 21 December, 2010, Novogen entered into an Asset Purchase Agreement (the “Asset Purchase Agreement”) with Novogen Research Pty Ltd and Marshall Edwards, Inc. (“Marshall Edwards”) on certain conditions including approval by Novogen’s shareholders.

Under the Asset Purchase Agreement, Marshall Edwards agreed to buy from Novogen certain assets used in or generated under or in connection with the discovery, development, manufacture and marketing of intellectual property and products based on the field of isoflavonoid technology and on compounds known as isoflavones, including those related to the drug candidates phenoxodiol, triphendiol, NV-143 and NV-128 (the “Isoflavone-related Assets”).

As consideration, Marshall Edwards will issue to Novogen 1,000 shares in Marshall Edwards of newly designated Series A Convertible Preferred Stock with par value US$0.01 per share (the “Series A Convertible Preferred Stock”) and will assume all liabilities relating to the Isoflavone-related Assets arising after completion of the Asset Purchase Agreement.

Under the terms of the Asset Purchase Agreement, Novogen has indemnified Marshall Edwards against any claims arising from a breach of the Asset Purchase Agreement. However, the indemnity expires on 30 June, 2011 and is limited to US$4,000,000. Marshall Edwards’ sole source of recovery in respect of any indemnification is the return of the Series A Convertible Preferred Stock (the Series A Convertible Preferred Stock being valued for this purpose at US$0.8286 per share of common stock issuable upon conversion of the Series A Convertible Preferred Stock).

A copy of the Asset Purchase Agreement is included in the accompanying documentation.

Effect of the proposed acquisition

Novogen will be the sole holder of Series A Convertible Preferred Stock.

Each share of the Series A Convertible Preferred Stock will be convertible into 4,872 shares of common stock in Marshall Edwards.

If a Phase II clinical trial involving any of the Isoflavone-related Assets achieves a statistically significant result or a first patient is enrolled in a Phase III clinical trial involving the Isoflavone-related Assets, whichever is earlier, each share of the Series A Convertible Preferred Stock not already converted may be converted into 9,654 shares of common stock.

Marshall Edwards will have an option to purchase, in a single transaction, all unconverted Series A Convertible Preferred Stock for an aggregate exercise price of US$12,000,000 in cash. Where a portion of the Series A Convertible Preferred Stock has been converted, the exercise price is to be pro-rated.

The Series A Convertible Preferred Stock:

|

·

|

does not include the right to receive any dividend except in the event that the board of directors of Marshall Edwards declare and authorise a special dividend in relation to the Series A Convertible Preferred Stock;

|

|

·

|

does not entitle the holder to a right to vote; and

|

|

·

|

does not entitle the holder to any right of pre-emption.

|

The Series A Convertible Preferred Stock will automatically convert into shares of Marshall Edwards common stock on the earlier of (i) the fifth anniversary of the completion of the Isoflavone Transaction or (ii) a change in control of Novogen.

Legal and regulatory requirements

Under Australian Stock Exchange (“ASX”) Listing Rule 10.1, a listed company must not acquire a substantial asset from, or dispose of a substantial asset to, specified persons or entities without the approval of shareholders at a general meeting.

An asset is treated as a substantial asset if its value, or the value of the consideration for it, is 5% or more of the listed company’s equity interests as set out in the latest financial statements given to ASX.

The proposed acquisition exceeds 5% of Novogen’s equity interests and is therefore a substantial asset for these purposes.

Marshall Edwards is a subsidiary of Novogen as at the date of this Explanatory Statement, Novogen held 71.3% of the common stock of Marshall Edwards.

Therefore, Novogen shareholder approval under ASX Listing Rule 10.1 is required.

Independent expert’s report

Under ASX Listing Rule 10.10.2, where approval of Novogen’s shareholders is sought under ASX Listing Rule 10.1, shareholders must be given an independent expert’s report on the proposed acquisition. The report must state whether the proposed acquisition is fair and reasonable to shareholders that are not associated with Novogen (“Non-Associated Shareholders”).

The Directors of Novogen appointed Grant Thornton Corporate Finance to prepare the report to the shareholders. A copy of this report is included in the accompanying documentation.

On the basis of the matters discussed in its report, Grant Thornton Corporate Finance has formed the opinion that the proposed acquisition is fair and reasonable to Non-Associated Shareholders. Shareholders should read Grant Thornton Corporate Finance’s report in full.

US securities laws

As Marshall Edwards is listed on the Nasdaq, in order for the Marshall Edwards common stock underlying the Marshall Edwards Series A Convertible Preferred Stock to be readily transferable in certain circumstances in the future it must be registered under the US Securities Act of 1933. In order to achieve that registration a Form S-4 “registration statement” containing a “proxy statement/prospectus” must be submitted to the United States Securities and Exchange Commission (“SEC”) and a copy provided to the shareholders of Novogen.

This Explanatory Statement should be read in conjunction with the accompanying documentation.

The special committee of the Marshall Edwards board of directors received a fairness opinion from an independent financial advisor in connection with the transactions contemplated by the Asset Purchase Agreement, which under US securities laws must also be filed with the SEC. This fairness opinion, included in the accompanying document to comply with US securities laws, has not been prepared on the same basis as the report prepared by Grant Thornton Corproate Finance and does not comply with the Corporations Act 2001 (Cth) or Regulatory Guide 111 “Content of Experts Reports” published by the Australian Securities and Investments Commission.

A copy of the opinion of Marshall Edwards' financial advisor is included in the accompanying documentation.

Voting exclusion and recommendation

William D Rueckert and any other associate of Novogen or Marshall Edwards will be excluded from voting in relation to the Resolution in Agenda Item 1.

The Directors recommend that you vote in favour of the Resolution in Agenda Item 1.

Agenda Item 2 – Director options

Under the terms of the Novogen Limited Employee Share Option Plan (the “Option Plan”), the Directors are entitled to be issued options in the capital of Novogen. It is proposed that the following Directors be issued with the respective number of options:

|

Name of Director

|

Number of options

|

|

William D Rueckert

|

375,000

|

|

Peter R White

|

375,000

|

|

Ross C Youngman

|

375,000

|

|

Peter DA Scutt

|

375,000

|

None of the Directors have previously been issued any options under the Option Plan.

On 26 January, 2011, the Board of Novogen agreed to grant the options subject to the approval of Novogen shareholders with a nil issue price.

The Option Plan

A share option plan was established by Novogen and approved by shareholders in October, 2007 to provide the mechanism for that purpose without using any of Novogen’s cash.

The Directors are a new group who have taken on the responsibility and risk of trying to reposition Novogen for future success. Novogen believes it is important to provide an equity incentive to the Board members to fully align their interests with those of the shareholders.

Novogen is asking the shareholders to approve the grant of share options to four of the five Directors. Joe Austin, Novogen’s largest shareholder, has declined the offer of any options due to his existing substantial holding in the Company.

Options vest equally over a two year period from the date of grant and expire four years after grant date.

No performance conditions apply to the options granted, however, the unvested option lapses if the Director ceases to be a Director during the vesting period.

Options are not transferable and cannot be settled by Novogen in cash. The Option Plan provides that if there is a change of control of Novogen outstanding options become exercisable regardless of vesting status.

Terms of issue of the options

Each option to be issued entitles its holder to acquire one fully paid ordinary share.

The options will be issued under the terms of the Option Plan; however the Board has designated that the exercise price of the options will be subject to a 10% premium. That is, the exercise price of the options to be issued under Agenda Item 2 will be equivalent to the weighted average price of Novogen’s shares at the close of trading on the ASX for the ten days prior to the date of the meeting plus an additional 10% of that figure.

Each option will vest as follows:

|

·

|

187,500 on 1 July, 2011; and

|

|

·

|

187,500 on 1 July, 2012.

|

If the options are not exercised before 26 January, 2015 they will lapse.

If the Resolution in Agenda Item 2 is passed, the 2010 - 2011 Annual Report of Novogen will set out:

|

·

|

the details of the options issued under the Option Plan; and

|

|

·

|

that approval for the issue of the options under the Option Plan was obtained under ASX Listing Rule 10.14.

|

If, after the Resolution in Agenda Item 2 is passed, any additional persons become entitled to participate in the Option Plan, the additional persons will not participate in the Option Plan until approval is obtained under ASX Listing Rule 10.14.

Voting exclusion and recommendation

Novogen will disregard any votes cast on Agenda Item 2 by:

|

·

|

any of the Directors; and

|

|

·

|

an associate of any of them.

|

However Novogen need not disregard a vote on Agenda Item 2 if:

|

·

|

it is cast by a person as proxy for another who is entitled to vote, in accordance with the directions on the proxy form; or

|

|

·

|

it is cast by the person chairing the meeting as proxy for a person who is entitled to vote, in accordance with a direction on the proxy form to vote as the proxy decides.

|

The Directors recommend that you vote in favour of the Resolution in Agenda Item 2.

Requests for additional information

Shareholders will have the opportunity at the Extraordinary General Meeting to raise questions and to make comments on the proposed sale of the Isoflavone-related Assets.

Shareholders may also wish to submit written questions in relation to the proposed resolutions to Novogen no later than 2.00 pm on 4 May, 2011, addressed as follows:

Company Secretary,

Novogen Limited,

140 Wicks Road,

North Ryde, NSW, 2113, Australia

or by facsimile addressed to the Novogen Company Secretary on facsimile number +612 9878 0055.

The accompaning memoranda referred to above can be downloaded from the Company's website at the following link:

http://www.novogen.com/invest/invest0601.cfm?mainsection=06&subsection=03

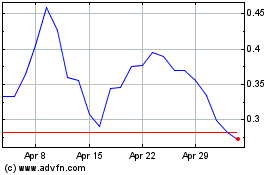

Kazia Therapeutics (NASDAQ:KZIA)

Historical Stock Chart

From Jun 2024 to Jul 2024

Kazia Therapeutics (NASDAQ:KZIA)

Historical Stock Chart

From Jul 2023 to Jul 2024