false

--12-31

0001585608

0001585608

2024-05-17

2024-05-17

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 17, 2024

JAGUAR HEALTH, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

001-36714 |

46-2956775 |

(State or other jurisdiction of

incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

200 Pine Street, Suite 400

San Francisco, California |

94104 |

| (Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including

area code: (415) 371-8300

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Title of each class |

Trading

Symbol(s) |

Name

of each exchange on which

registered |

| Common Stock, Par Value $0.0001 Per Share |

JAGX |

The Nasdaq Capital Market |

Item 1.01 Entry into a Material Definitive Agreement.

On May 23,

2024, Jaguar Health, Inc. (the “Company”) entered into an amendment (the “Second ATM Amendment”) to

that certain At the Market Offering Agreement, dated December 10, 2021 (as amended by that certain amendment on February 2,

2022, and by the Second ATM Amendment, the “Agreement”), between the Company and Ladenburg Thalmann & Co. Inc., as

agent (“Ladenburg”). Pursuant to the Second ATM Amendment, the previous $75,000,000 limit on the aggregate offering amount

of shares of the Company’s common stock, $0.0001 par value per share (the “Shares”), which the Company may sell and

issue through Ladenburg, as the sales agent, was removed such that the amount issuable under the Agreement is limited solely by certain

limitations as specified in the Second ATM Amendment.

Also on

May 23, 2024, the Company filed a prospectus supplement with the Securities and Exchange Commission (the “Prospectus Supplement”)

in connection with the offer and sale of the Shares pursuant to the Agreement. The issuance and sale of the Shares by the Company under

the Agreement will be made pursuant to the Company’s registration statement on Form S-3 (File No. 333-278861) filed with

the SEC on April 22, 2024 and declared effective on May 1, 2024 (the “Registration Statement”), as supplemented

by a prospectus supplement dated May 23, 2024.

The opinion

of Reed Smith LLP, the Company’s counsel, regarding the legality of the Shares that may be issued pursuant to the Agreement, is

filed herewith as Exhibit 5.1.

The Shares

will be sold pursuant to the Registration Statement, and offerings of the Shares will be made only by means of the Prospectus Supplement

and the accompanying prospectus. This Current Report on Form 8-K shall not constitute an offer to sell or solicitation of an

offer to buy these securities, nor shall there be any sale of these securities in any state in which such offer, solicitation or sale

would be unlawful prior to registration or qualification under the securities law of such state or jurisdiction.

The Second

ATM Amendment is filed as Exhibit 10.1 to this Current Report on Form 8-K, and such document is incorporated herein by reference.

The foregoing is only a brief description of the material terms of the Second ATM Amendment, does not purport to be a complete description

of the rights and obligations of the parties thereunder and is qualified in its entirety by reference to such exhibit.

Item 3.03 Material Modification to Rights of Security Holders.

To the extent required by Item 3.03 of Form 8-K,

the information regarding the Reverse Stock Split (as defined below) contained in Item 5.03 of this Current Report on Form 8-K is

incorporated by reference herein.

Item 5.03 Amendment to Articles of Incorporation

or Bylaws; Change in Fiscal Year.

As

previously disclosed, at the special meeting of stockholders of the Company held on April 9, 2024 (the “Special Meeting”),

the Company’s stockholders approved an amendment (the “Eighth Amendment”) to the Company’s Third Amended and Restated

Certificate of Incorporation, as amended (the “COI”), to effect a reverse stock split of the Company’s voting common

stock (“Common Stock”) at a ratio of not less than one-for-two and not greater than one-for-one hundred fifty, with the exact

ratio within that range to be determined in the discretion of the Company’s board of directors (the “Board”) on or before

January 22, 2025.

Pursuant

to such authority granted by the Company’s stockholders, the Board approved a one-for-sixty (60) reverse stock split (the “Reverse

Stock Split”) of the Common Stock , and on May 17, 2024, the Company filed the Eighth Amendment with the Secretary of

State of the State of Delaware. The Reverse Stock Split will become effective in accordance with the terms of the Eighth Amendment at

12:01 am Eastern Time on May 23, 2024 (the “Effective Time”). When the Reverse Stock Split becomes effective, every sixty

(60) shares of the Company’s issued and outstanding Common Stock immediately prior to the Effective Time shall automatically be

reclassified into one (1) share of Common Stock, without any change in the par value per share. The Reverse Stock Split reduces the

number of shares of Common Stock issuable upon the conversion of the Company’s outstanding non-voting common stock and the exercise

or vesting of its outstanding stock options and warrants in proportion to the ratio of the Reverse Stock Split and causes a proportionate

increase in the conversion and exercise prices of such non-voting common stock, stock options and warrants. In addition, the number of

shares reserved for issuance under the Company’s equity compensation plans immediately prior to the Effective Time will be reduced

proportionately. The Reverse Stock Split did not change the total number of authorized shares of Common Stock or preferred stock.

No fractional shares will be issued as a result

of the Reverse Stock Split. Stockholders who otherwise would be entitled to receive a fractional share in connection with the Reverse

Stock Split will receive a cash payment in lieu thereof.

Equiniti Trust Company, LLC is acting as exchange

agent for the Reverse Stock Split and will correspond stockholders of record regarding the Reverse Stock Split. Stockholders who hold

their shares in book-entry form or in “street name” (through a broker, bank or other

holder of record) are not required to take any action.

Commencing on May 23, 2024, trading of the

Company’s Common Stock will continue on The Nasdaq Capital Market on a Reverse Stock Split-adjusted basis. The new CUSIP number

for the Company’s Common Stock following the Reverse Stock Split is 47010C805.

The foregoing description of the Eighth Amendment

does not purport to be complete and is qualified in its entirety by reference to the full text of the Eighth Amendment, which is filed

as Exhibit 3.1 to this report and incorporated by reference herein.

Item 7.01. Regulation FD Disclosure.

On May 17, 2024, the Company issued a press release announcing

the effectuation of the Reverse Stock Split, a copy of which is furnished as Exhibit 99.1.

The information in Exhibit 99.1 attached

hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the

“Exchange Act”), or otherwise subject to the liabilities of that Section, or incorporated by reference into any of the Company’s

filings under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference

in any such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly

authorized.

| |

JAGUAR HEALTH, INC. |

| |

|

|

| |

By: |

/s/ Lisa A. Conte |

| |

|

Name: |

Lisa A. Conte |

| |

|

Title: |

Chief Executive Officer & President |

| |

|

|

|

| Date: May 23, 2024 |

|

|

|

Exhibit 3.1

CERTIFICATE OF EIGHTH AMENDMENT TO THE

THIRD AMENDED AND RESTATED CERTIFICATE OF INCORPORATION

OF JAGUAR HEALTH, INC.

Jaguar Health, Inc., a corporation

organized and existing under the laws of the State of Delaware (the “Corporation”), hereby certifies that:

1. The

name of the Corporation is Jaguar Health, Inc. The date of filing of the Corporation’s original Certificate of Incorporation

with the Secretary of State of the State of Delaware (the “Delaware Secretary of State”) was June 6, 2013, under

the name Jaguar Animal Health, Inc.

2. This

Certificate of Eighth Amendment to the Third Amended and Restated Certificate of Incorporation was duly authorized and adopted by the

Corporation’s Board of Directors and stockholders in accordance with Section 242 of the General Corporation Law of the State

of Delaware and amends the provisions of the Company’s Third Amended and Restated Certificate of Incorporation.

3. The

amendment to the existing Third Amended and Restated Certificate of Incorporation being effected hereby is as follows:

| a. | Add the following paragraph at the end of Section IV.A. as a

new Section IV.A.10: |

“10. Fifth Reverse Stock

Split. Upon this Amendment to the Third Restated Certificate becoming effective pursuant to the DGCL (the “Eighth Amendment

Effective Time”), each two (2) to one hundred fifty (150) shares of Common Stock issued and outstanding immediately

prior to the Eighth Amendment Effective Time shall automatically be reclassified and combined into one (1) validly issued, fully

paid and non-assessable share of Common Stock, the exact ratio within the foregoing range to be determined by the Board of Directors

prior to the Eighth Amendment Effective Time and publicly announced by the Corporation, without any further action by the Corporation

or the holder thereof (the “Fifth Reverse Stock Split”). No fractional shares shall be issued in connection

with the Fifth Reverse Stock Split. Stockholders who otherwise would be entitled to receive fractional shares of Common Stock shall be

entitled to receive cash (without interest or deduction) from the Corporation’s transfer agent in lieu of such fractional share

interests upon the submission of a transmission letter by a stockholder holding the shares in book-entry form and, where shares are held

in certificated form, upon the surrender of the stockholder’s Old Certificates (as defined below), in an amount equal to the product

obtained by multiplying (a) the closing price per share of the Common Stock as reported on the Nasdaq Capital Market as of

the date of the Eighth Amendment Effective Time, by (b) the fraction of one share owned by the stockholder. Each certificate that

immediately prior to the Eighth Amendment Effective Time represented shares of Common Stock (“Old Certificates”),

shall thereafter represent that number of shares of Common Stock into which the shares of Common Stock represented by the Old Certificate

shall have been combined, subject to the elimination of fractional share interests as described above.”

4. This

Certificate of Eighth Amendment to the Third Amended and Restated Certificate of Incorporation shall be effective at 12:01 a.m., Eastern

Time, on May 23, 2024.

****

IN WITNESS WHEREOF, Jaguar

Health, Inc. has caused this Certificate of Eighth Amendment to the Third Amended and Restated Certificate of Incorporation to be

signed by Lisa A. Conte, its President and Chief Executive Officer, this 17th day of May, 2024.

| |

JAGUAR HEALTH, INC. |

| |

A Delaware corporation |

| |

|

| |

By: |

/s/

Lisa A. Conte |

| |

|

Name: |

Lisa A. Conte |

| |

|

Title: |

President & CEO |

Exhibit 5.1

|

Reed Smith LLP |

| |

101 Second Street |

| |

Suite 1800 |

| |

San Francisco, CA 94105-3659 |

| |

Tel +1 415 543 8700 |

| |

Fax +1 415 391 8269 |

| |

reedsmith.com |

| |

|

| |

May 23, 2024 |

| Jaguar Health, Inc. |

|

| 200 Pine Street, Suite 400 |

|

| San Francisco, California 94104 |

|

Ladies and Gentlemen:

We have acted as counsel to

Jaguar Health, Inc., a Delaware corporation (the “Company”), in connection with the offer and sale by the Company

of up to $75,000,000 of shares (the “Shares”) of the Company’s voting common stock, par value $0.0001 per share,

pursuant to that certain At the Market Offering Agreement, dated as of December 10, 2021, by and between the Company and Ladenburg

Thalmann Co. Inc. as sales agent, as amended on February 2, 2022 and further amended on May 23, 2024 (the “Sales Agreement”).

The Shares will be offered and sold pursuant to the Company’s effective Registration Statement on Form S-3 (File No. 333-278861)

(the “Registration Statement”) filed with the Securities and Exchange Commission (the “Commission”)

under the Securities Act of 1933, as amended (the “Securities Act”), relating to the sale of the Shares as set forth

in a prospectus supplement, dated May 23, 2024 (the “Prospectus Supplement”), supplementing the prospectus, dated

May 1, 2024 (the “Base Prospectus”). As used in this opinion letter, the term “Prospectus”

means the Prospectus Supplement and the Base Prospectus, including the documents incorporated or deemed to be incorporated by reference

therein pursuant to Item 12 of Form S-3 under the Securities Act.

In rendering the opinion set forth herein, we have

examined originals or copies, certified or otherwise identified to our satisfaction, of such documents, corporate records, certificates

of public officials and other instruments as we have deemed necessary or advisable.

In such examination, we have assumed the genuineness

of all signatures, the legal capacity of natural persons, the authenticity of all items submitted to us as originals, the conformity with

originals of all items submitted to us as copies, and the authenticity of the originals of such copies. As to any facts material to the

opinions expressed herein that we did not independently establish or verify, we have relied upon statements and representations of officers

and other representatives of the Company and public officials.

This opinion is based solely on the General Corporation

Law of the State of Delaware.

Based upon and subject to the foregoing, we are

of the opinion that the Shares have been duly authorized for issuance, and when issued and delivered by the Company pursuant to the provisions

of the Sales Agreement against payment of the requisite consideration therefor, will be validly issued, fully paid and nonassessable.

Jaguar Health, Inc.

May 23, 2024

Page 2 |

|

The opinions set forth herein

are given as of the date hereof, and we undertake no obligation to update or supplement this opinion letter if any applicable law changes

after the date hereof or if we become aware of any fact or other circumstances that changes or may change our opinion set forth herein

after the date hereof or for any other reason.

We consent to the inclusion of this opinion as

an exhibit to the Company’s Current Report on Form 8-K filed on May 23, 2024, for incorporation by reference into the

Registration Statement, and further consent to all references to us under the caption “Legal Matters” in the Prospectus constituting

a part of the Registration Statement. In giving this consent, we do not admit that we are in the category of persons whose consent is

required under Section 7 of the Securities Act or the rules and regulations of the Commission.

| |

Very truly yours, |

| |

|

| |

/s/ REED SMITH LLP |

| |

|

| |

REED SMITH LLP |

Exhibit 10.1

May 23, 2024

Jaguar Health, Inc.

200 Pine Street, Suite 400

San Francisco, CA 94104

Attn: Lisa A. Conte, President & CEO

Dear Ms. Conte:

Reference is made to the At The Market Offering

Agreement, dated as of December 10, 2021 (the “ATM Agreement”), between Jaguar Health, Inc. (the “Company”)

and Ladenburg Thalmann & Co., Inc. (the “Ladenburg”), as amended by way of letter agreement dated February 2,

2022. This letter (the “Amendment”) constitutes an agreement between the Company and Ladenburg to amend

the ATM Agreement as set forth herein. Defined terms that are used but not defined herein shall have the meanings ascribed

to such terms in the ATM Agreement.

1. The

defined term “Agreement” in the ATM Agreement is amended to mean the ATM Agreement as amended by this Amendment.

2. The

defined term “Registration Statement” in Section 1 of the ATM Agreement is hereby amended and restated as follows:

““Registration Statement”

shall mean the shelf registration statements (File Numbers 333-278861 and 333-261283) on Form S-3, including exhibits and financial

statements and any prospectus supplements relating to the Shares that are filed with the Commission pursuant to Rule 424(b) and

deemed part of such registration statements pursuant to Rule 430B, as amended on each Effective Date and, in the event any post-effective

amendments thereto become effective, shall also mean such registration statements as so amended.”

“Base Prospectus”

shall mean the sales agreement prospectus contained in the Registration Statements relating to the Shares.

3. Section 2

of the ATM Agreement is hereby amended and restated as follows:

“2. Sale

and Delivery of Shares. The Company proposes to issue and sell through or to the Manager, as sales agent and/or principal, from time

to time during the term of this Agreement and on the terms set forth herein, shares (the “Shares”) of the Company’s

common stock, $0.0001 par value per share (“Common Stock”), from time to time during the term of this Agreement

and on the terms set forth herein; provided, however, that in no event shall the Company issue or

sell through the Manager such number of Shares that (a) exceeds the number or dollar amount of shares of Common Stock registered

on the Registration Statement, pursuant to which the offering is being made, less the dollar amount of securities issued under the Registration

Statement prior to the date of this Agreement, (b) exceeds the number of authorized but unissued shares of Common Stock (less the

number of shares of Common Stock issuable upon exercise, conversion or exchange of any outstanding securities of the Company or otherwise

reserved from the Company’s authorized capital stock), or (c) would cause the Company or the offering of the Shares to not

satisfy the eligibility and transaction requirements for use of Form S-3, including, if applicable, General Instruction I.B.6 of

Registration Statement on Form S-3 (the lesser of (a), (b) and (c), the “Maximum Amount”).”

4. Section 3(f) of

the ATM Agreement is hereby amended and restated as follows:

Issuance of Shares.

The Shares are duly authorized and, when issued and paid for in accordance with this Agreement, will be duly and validly issued, fully

paid and nonassessable, free and clear of all Liens imposed by the Company. The issuance by the Company of the Shares has been registered

under the Act and all of the Shares are freely transferable and tradable by the purchasers thereof without restriction (other than any

restrictions arising solely from an act or omission of such a purchaser). The Shares are being issued pursuant to the Registration Statement

and the issuance of the Shares has been registered by the Company under the Act. The “Plan of Distribution” section

within the Registration Statement permits the issuance and sale of the Shares as contemplated by this Agreement. Upon receipt of the Shares,

the purchasers of such Shares will have good and marketable title to such Shares and the Shares will be freely tradable on the Trading

Market.

5. The

Company and Ladenburg hereby agree that the date of this Amendment shall be a Representation Date under the ATM Agreement (provided, however,

that the deliverables under Section 4(m) of the ATM Agreement shall not be required on the date of this Amendment) and the Company

shall file the Base Prospectus with the Commission on the date hereof.

6. In

connection with the amendments to the ATM Agreement set forth herein, the Company shall reimburse Ladenburg for the fees and expenses

of Ladenburg’s counsel in an amount not to exceed $10,000, which shall be paid on the date hereof, such amount to be inclusive of

the expenses incurred in the due diligence session with respect to the Representation Date hereof.

7. Except

as expressly set forth herein, all of the terms and conditions of the ATM Agreement shall continue in full force and effect after the

execution of this Amendment and shall not be in any way changed, modified or superseded by the terms set forth herein.

8. This

Amendment may be executed in two or more counterparts and by facsimile or “.pdf” signature or otherwise, and each of such

counterparts shall be deemed an original and all of such counterparts together shall constitute one and the same agreement.

[remainder of page intentionally left blank]

In acknowledgment that the

foregoing correctly sets forth the understanding reached by the Company and Ladenburg, please sign in the space provided below, whereupon

this Amendment shall constitute a binding amendment to the ATM Agreement as of the date indicated above.

| |

Very truly yours, |

| |

|

| |

LADENBURG THALMANN &

CO., INC. |

| |

|

| |

By: |

/s/

Nicholas Stergis |

| |

Name: |

Nicholas Stergis |

| |

Title: |

Managing Director Investment Banking |

| Accepted and Agreed: |

|

| |

|

| JAGUAR HEALTH, INC. |

|

| |

|

| By: |

/s/

Lisa A. Conte |

|

| Name: |

Lisa A. Conte |

|

| Title: |

President & Chief Executive Officer |

|

[SIGNATURE

PAGE TO JAGX AMENDMENT TO

ATM

AGREEMENT]

Exhibit 99.1

Jaguar Health, Inc. Announces Reverse Stock

Split

Reverse split approved at April 2024 Special

Meeting of Stockholders

Shares of Jaguar Health common stock to begin

trading on split-adjusted basis on May 23, 2024

San Francisco, CA (May 17, 2024): Jaguar

Health, Inc. (NASDAQ: JAGX) (“Jaguar” or the “Company”) today

announced that the Company will effect a reverse stock split of its issued and outstanding voting common stock (“Common Stock”),

at an exchange ratio of 1-for-60, on Thursday, May 23, 2024 (the “Effective Date”) in order to support the Company’s

compliance with Nasdaq’s listing standards. The Company’s Common Stock will begin trading on a split-adjusted basis when the

market opens on the Effective Date and will remain listed on The Nasdaq Capital Market under the symbol “JAGX”. The new CUSIP

number for the Company’s Common Stock following the reverse stock split is 47010C805.

“Jaguar’s board of directors has determined that effecting

a reverse stock split at this time will, in addition to supporting the Company’s compliance with Nasdaq’s listing standards,

provide Jaguar with the opportunity to achieve a share price and outstanding share count that is more attractive to institutional investors,”

said Lisa Conte, Jaguar’s president and CEO.

The effectuation of the reverse stock split follows the approval of

a proposal submitted to Jaguar stockholders at a Special Meeting of Stockholders (the “Special Meeting”). This proposal, which

was approved by the affirmative vote of the holders of a majority in voting power of the votes cast affirmatively or negatively (excluding

abstention and broker non-votes) on such proposal by shares of Jaguar Common Stock and Series J Perpetual Preferred Stock of the

Company outstanding as of the record date for the Special Meeting, is described in detail in the Company’s definitive proxy statement

on Schedule 14A relating to the Special Meeting filed with the Securities and Exchange Commission (the “SEC”) on March 15,

2024. Stockholders may obtain a free copy of the proxy statement and other documents filed by Jaguar with the SEC at http://www.sec.gov.

The proxy statement is also available on the Company’s corporate website.

When the reverse stock split becomes effective, every sixty (60) shares

of the Company’s Common Stock immediately prior to the Effective Date shall automatically be reclassified into one (1) share

of Common Stock, without any change in the par value per share, and this change will be reflected on Nasdaq’s website and other

stock quote platforms. No fractional shares will be issued as a result of the reverse stock split. Stockholders who otherwise would be

entitled to receive a fractional share in connection with the reverse stock split will receive a cash payment in lieu thereof.

Equiniti Trust Company, LLC is acting as exchange agent for the reverse

stock split and will send instructions to stockholders of record who hold stock certificates regarding the exchange of their certificates

for post-reverse stock split shares of Common Stock. Stockholders who hold their shares in brokerage accounts or “street name”

are not required to take any action to effect the exchange of their shares.

About the Jaguar Health Family of Companies

Jaguar Health, Inc. (Jaguar) is a commercial stage pharmaceuticals

company focused on developing novel proprietary prescription medicines sustainably derived from plants from rainforest areas for people

and animals with gastrointestinal distress, specifically associated with overactive bowel, which includes symptoms such as chronic debilitating

diarrhea, urgency, bowel incontinence, and cramping pain. Jaguar family company Napo Pharmaceuticals (Napo) focuses on developing innovative,

patient-centric therapeutic solutions for essential supportive care and the management of neglected side effects across complicated disease

states. Napo’s goal is to redefine what is possible in supportive care, providing hope and improving outcomes for patients worldwide.

Napo’s crofelemer drug product candidate is the subject of the OnTarget study, a pivotal Phase 3 clinical trial for preventive

treatment of chemotherapy-induced overactive bowel (CIOB) in adults with cancer on targeted therapy. Jaguar family company Napo Therapeutics

is an Italian corporation Jaguar established in Milan, Italy in 2021 focused on expanding crofelemer access in Europe and specifically

for orphan and/or rare diseases. Jaguar Animal Health is a Jaguar tradename. Magdalena Biosciences, a joint venture formed by Jaguar

and Filament Health Corp. that emerged from Jaguar’s Entheogen Therapeutics Initiative (ETI), is focused on developing novel prescription

medicines derived from plants for mental health indications.

For more information about:

Jaguar Health, visit https://jaguar.health

Napo Pharmaceuticals, visit www.napopharma.com

Napo Therapeutics, visit napotherapeutics.com

Magdalena Biosciences, visit magdalenabiosciences.com

Visit Jaguar on LinkedIn: https://www.linkedin.com/company/jaguar-health/

Visit Jaguar on X: https://twitter.com/Jaguar_Health

Visit Jaguar on Instagram: https://www.instagram.com/jaguarhealthcommunity/

Forward-Looking Statements

Certain statements in this press release constitute “forward-looking

statements.” These include statements regarding Jaguar’s expectation that the Company’s Common Stock will begin trading

on a split-adjusted basis when the market opens on the Effective Date, and the expectation that effecting a reverse stock split may provide

Jaguar with the opportunity to achieve a share price and outstanding share count that is more attractive to institutional investors.

In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,”

“expect,” “plan,” “aim,” “anticipate,” “could,” “intend,” “target,”

“project,” “contemplate,” “believe,” “estimate,” “predict,” “potential”

or “continue” or the negative of these terms or other similar expressions. The forward-looking statements in this release

are only predictions. Jaguar has based these forward-looking statements largely on its current expectations and projections about future

events. These forward-looking statements speak only as of the date of this release and are subject to a number of risks, uncertainties

and assumptions, some of which cannot be predicted or quantified and some of which are beyond Jaguar’s control. Except as required

by applicable law, Jaguar does not plan to publicly update or revise any forward-looking statements contained herein, whether as a result

of any new information, future events, changed circumstances or otherwise.

Source: Jaguar Health, Inc.

Contact:

hello@jaguar.health

Jaguar-JAGX

v3.24.1.1.u2

Cover

|

May 17, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

May 17, 2024

|

| Current Fiscal Year End Date |

--12-31

|

| Entity File Number |

001-36714

|

| Entity Registrant Name |

JAGUAR HEALTH, INC.

|

| Entity Central Index Key |

0001585608

|

| Entity Tax Identification Number |

46-2956775

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

200 Pine Street

|

| Entity Address, Address Line Two |

Suite 400

|

| Entity Address, City or Town |

San Francisco

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94104

|

| City Area Code |

415

|

| Local Phone Number |

371-8300

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, Par Value $0.0001 Per Share

|

| Trading Symbol |

JAGX

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

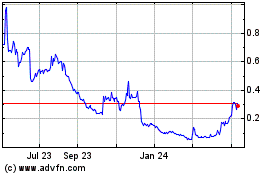

Jaguar Health (NASDAQ:JAGX)

Historical Stock Chart

From Oct 2024 to Nov 2024

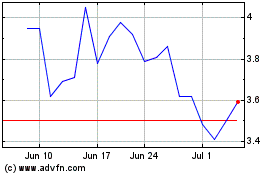

Jaguar Health (NASDAQ:JAGX)

Historical Stock Chart

From Nov 2023 to Nov 2024