false

0000736012

false

false

false

false

0000736012

2024-01-31

2024-01-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

8-K

CURRENT REPORT

Pursuant to Section 13 or

15(d) of the Securities Exchange Act of 1934

Date of Report (Date of

earliest event reported): January 31, 2024

INTRUSION

INC.

(Exact Name of Registrant

as Specified in Its Charter)

| Delaware |

001-39608 |

75-1911917 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File

Number) |

(IRS Employer

Identification No.) |

101

East Park Blvd, Suite

1200

Plano, Texas |

75074 |

| (Address of Principal Executive Offices) |

(Zip Code) |

(888) 637-7770

(Registrant’s Telephone Number,

Including Area Code)

NOT APPLICABLE

(Former Name or Former Address, if Changed Since

Last Report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, $0.01 par value per share |

INTZ |

NASDAQ Capital Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if

the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01. Regulation FD Disclosure.

On January 31, 2024, Intrusion Inc. (the “Company”) issued

a letter to its stockholders (the “Stockholder Letter”) from the Company’s President and CEO, Tony Scott. The Stockholder

Letter is attached hereto as Exhibit 99.1.

The information included in this Item 7.01, including

Exhibit 99.1, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended

(the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall such information be deemed incorporated

by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by

specific reference in such a filing. The information set forth under this Item 7.01 shall not be deemed an admission as to the materiality

of any information in this Current Report on Form 8-K that is required to be disclosed solely to satisfy the requirements of Regulation

FD.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

SIGNATURE

Pursuant to the requirements of

the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto

duly authorized.

| |

INTRUSION INC. |

| |

|

| Dated: January 31, 2024 |

By: |

/s/ Anthony Scott |

| |

|

Anthony Scott |

| |

|

President & Chief Executive Officer |

Exhibit 99.1

Intrusion’s

CEO Issues Letter to Shareholders

PLANO, Texas, Jan. 31, 2024 (ACCESSWIRE) - Intrusion, Inc, (Nasdaq:

INTZ) a leader in cyber-attack prevention solutions, including zero-days, today issued the following letter to its shareholders from its

President & CEO, Tony Scott.

Dear Fellow Intrusion Shareholders,

In advance of the upcoming shareholder vote on several important matters

(see below), I wanted to provide you with my personal perspective of the journey we’ve been on, and the rationale behind the proposals

that are before you.

Fiscal 2023 was a year marked by multiple key product and financial

milestones as we continued to execute our strategy. While the year was filled with its challenges, we are proud of what we were able to

accomplish, such as a meaningful increase in bookings, including the finalizing of a major $5 million award, an escalating number of POVs

(proof of value) and POCs (proof of concept) in our pipeline, our product development team delivering exciting new capabilities to our

suite of products, and the successful closing of a private offering.

During 2023, we also favorably resolved all of the outstanding legal

issues we faced at the beginning of the year, including the SEC investigation, the shareholder derivative lawsuit, and the class action

lawsuit. Each of these has consumed valuable management time and attention, and cumulatively has been a distraction from our core mission

of developing, selling, and supporting innovative cybersecurity technology and services. We are happy to have these issues behind us.

Unfortunately, 2023 was also a year of mostly futile capital-raising

activities for Intrusion, in what many have described as the worst capital environment in decades. Despite multiple well-intentioned efforts

with three different investment banking firms, we were unable to reach an acceptable deal when the marketing periods for each of the offerings

ended. One of the consequences of these failed efforts was the sharp and continued pressure that has been put on our stock by short sellers.

We saw record levels of short interest through much of the offering periods and late into the year.

In November 2023, we closed a Private Offering pursuant to which we

sold an aggregate of 4.4 million shares of our common stock, each of which was coupled with a warrant to purchase two shares of common

stock, at an aggregate offering price of $0.60 per share, above the market price at the time. The Private Offering resulted in net proceeds

to Intrusion of approximately $2.4 million, which are being used for working capital and general corporate purposes. Members of our Executive

Team, Board of Directors, and several existing shareholders participated in the Private Offering, which we believe demonstrates the confidence

that both our organization and our loyal shareholders have in our unique technology. This Private Offering provided some much-needed short-term

financing but was only a stop-gap measure in terms of our overall needs for 2024 and beyond.

In addition to our Private Offering, on January 2, 2024, I personally

entered into an accounts receivable invoice financing arrangement via a note purchase agreement, in which I purchased from Intrusion a

promissory note in the amount of $1.1 million in exchange for delivery of $1.0 million in cash to Intrusion. Not only does this purchase

agreement provide favorable terms for Intrusion, but this also demonstrates the confidence I have in Intrusion’s future.

Regaining Compliance with Nasdaq’s Listing Requirements

In April 2023, we received a letter from Nasdaq indicating that we

had failed to meet the Nasdaq Market Value of Listed Securities (or MVLS) standard of $35 million minimum requirement for continued listing

on The Nasdaq Capital Market. We were provided an initial period of 180 calendar days to regain compliance. On October 26, 2023, we received

a letter from Nasdaq informing us that our shares have failed to comply with the MVLS requirement for continued listing on The Nasdaq

Capital Market, and as a result, our shares are subject to delisting. To continue listing on The Nasdaq Capital Market, a company may,

as an alternative to the MVLS, maintain stockholders' equity of at least $2.5 million.

We requested a hearing with Nasdaq, which has automatically stayed

the delisting of our common stock from The Nasdaq Capital Market, pending a Nasdaq listing qualifications hearing panel's decision.

On September 26, 2023, we received a written notice from The Nasdaq

Stock Market notifying us that our closing bid price over the then-last 30 consecutive business days had fallen below $1.00 per share,

which is the minimum closing bid price required to maintain listing on The Nasdaq Capital Market under Listing Rule 5550(a)(2). In accordance

with Nasdaq Listing Rule 5810(c)(3)(A), Intrusion has 180 calendar days to regain compliance with the minimum bid requirement (the “Grace

Period”), or until March 25, 2024, subject to a potential 180 calendar day extension. To regain compliance, the closing bid price

of our common stock must be at least $1.00 per share for a minimum of 10 consecutive business days within the Grace Period. (Nasdaq has

the discretion to monitor for as long as 20 consecutive business days before deeming the Company in compliance).

The Company is considering all options available to it to regain compliance

and maintain its listing on the Nasdaq Capital Market. In an effort to regain compliance, on December 15, 2023, the Board of Directors

unanimously approved and declared advisable a Reverse Stock Split of our issued and outstanding common stock. We are asking shareholders

to approve the Reverse Stock Split at our Special Meeting on March 15, 2024. If approved by shareholders, the Board, in its discretion,

may effectuate the Reverse Stock Split at a ratio of no less than 1-for-2 and no more than 1-for-20. If approved by shareholders, the

effective date of the Reverse Stock Split will be determined by the Board of Directors and may occur shortly after the Special Meeting.

As part of our plan to meet the $2.5 million stockholders' equity standard,

the Company is considering its options, including the possible conversion of certain outstanding debt into preferred stock. Such an arrangement

would be subject to the Company and the debt holder entering into a definitive agreement and, depending on the amount of debt to be converted,

shareholder approval of certain amendments to the Company's certificate of incorporation that would have the effect of eliminating our

currently designated Series 1, 2, and 3 preferred shares, such that we would have 5 million shares of authorized, undesignated, preferred

stock.

While there can be no assurance that Intrusion will be able to regain,

and thereafter sustain, compliance with Nasdaq’s listing requirements, we believe that the Reverse Stock Split and the ability

to reduce our overall debt provide Intrusion with the best option to successfully regain compliance with Nasdaq’s listing requirements.

This is why we are asking all shareholders to approve Proposals 1 (Reverse Stock Split) and 2 (elimination of Series 1, 2, and 3 preferred

share designations) at the Special Meeting on March 15, 2024. The Board also encourages you to vote in favor of the other proposals being

presented at the Special Meeting.

Promising Sales Pipeline

Cyberattacks have been on the rise worldwide, and as I have previously

noted, a large majority of companies have been going through some form of flattening or reduction in growth when it comes to their cybersecurity

teams and their budgets. This has put a significant amount of pressure on CIOs and CISOs to keep up with both technology and staffing

needs with more limited new resources. We believe that this provides Intrusion with a significant opportunity to step in and help fill

the gaps these companies currently have in their technology stack and in their cybersecurity teams to provide them with the needed capability

to identify, deflect, and eliminate any cyber threats that they may encounter.

As you may have seen from our recent press release, we are continuing

to see an increase in bookings, such as the $5 million multi-year Intrusion Shield agreement with a large telecommunications provider

to provide Intrusion Shield support for its data centers. The terms of the award allows for further expansion of the use of Intrusion

Shield, with the possibility of generating additional revenue after the completion of the initial set of projects. This new agreement

and other contracts signed in recent months are directly related to our growing reseller base which are continuing to lead to new opportunities

to showcase our technology and generate new business. Our reseller agreements have also helped us create a robust sales pipeline, and

we are focused on converting existing POVs and POCs to revenue-generating customers throughout fiscal year 2024.

It is our belief that with this growing traction in the marketplace

for Intrusion’s Shield technology, we will be able to provide both proof points and revenue that will help us secure agreements

with larger technology players.

Finally, while government spending decisions continue to be delayed,

we remain optimistic about the demand for our products and services in our consulting business, and we believe that we will see some positive

consulting customer growth, as well as the opportunity for rate increases and other revenue generating enhancements to existing customers.

In summary, our commitment to our employees, customers, shareholders,

and other stakeholders has never wavered. We are moving forward with a clear vision for the future, and we are focused on transforming

that vision into action through compelling products and innovative strategies that position us to capitalize on the robust opportunities

in our evolving marketplace. I wish to thank our Board of Directors for their continued stewardship and guidance; our employees for their

tireless dedication to our mission; and our customers and shareholders for their continued support. We are excited about the future here

at Intrusion, and we look forward to sharing additional updates during our fourth quarter earnings call in March.

Sincerely,

Tony Scott, President & CEO

Intrusion, Inc.

About Intrusion, Inc.

Intrusion, Inc. is a cybersecurity company based in Plano, Texas. The

Company offers its customers access to its exclusive threat intelligence database containing the historical data, known associations,

and reputational behavior of over 8.5 billion IP addresses. After years of gathering global internet intelligence and working with government

entities, the company released its first commercial product in 2021. Intrusion Shield allows businesses to incorporate a Zero Trust,

reputation-based security solution into their existing infrastructure. Intrusion Shield observes traffic flow and instantly blocks

known or unknown malicious connections from entering or exiting a network to help protect against zero-day and ransomware attacks. Incorporating

Intrusion Shield into a network elevates an organization's overall security posture by enhancing the performance and decision-making

of other solutions in its cybersecurity architecture.

Cautionary Statement Regarding Forward-Looking Information

This release may contain certain forward-looking statements, including,

without limitations, comments about the performance of protections provided by our Intrusion Shield product and any other words

that react to management’s expectations regarding future events and operating performance. These forward-looking statements speak

only as of the date hereof. They involve several risks and uncertainties, including, without limitation, the chances that our products

and solutions do not perform as anticipated or do not meet with widespread market acceptance. These statements are made under the “safe

harbor” provisions of the Private Securities Litigation Reform Act of 1995 and involve risks and uncertainties which could cause

actual results to differ materially from those in the forward-looking statements, including risks that we have detailed in the Company’s

most recent reports on Form 10-K and Form 10-Q, particularly under the heading “Risk Factors.”

IR Contact

Alpha IR Group

Mike Cummings or Josh Carroll

INTZ@alpha-ir.com

Source: Intrusion, Inc.

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

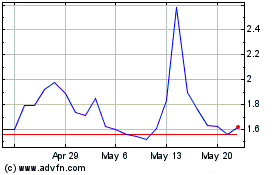

Intrusion (NASDAQ:INTZ)

Historical Stock Chart

From Nov 2024 to Dec 2024

Intrusion (NASDAQ:INTZ)

Historical Stock Chart

From Dec 2023 to Dec 2024