Inspired Receives Affirmation of Credit Rating by Fitch

March 21 2024 - 8:30AM

Inspired Entertainment, Inc. (“Inspired” or the “Company”) (NASDAQ:

INSE), a leading B2B provider of gaming content, systems and

solutions, announced today that Fitch Ratings (“Fitch”) has

affirmed Inspired’s Long-Term Issuer Default Rating at ‘B’. The

outlook for the rating is stable. In addition, Fitch has also

affirmed Inspired's senior secured instrument rating at ‘BB-’ with

a Recovery Rating of ‘RR2’.

In affirming the credit ratings Fitch cited that

Inspired’s Virtuals and Interactive segments are “highly profitable

and have higher structural growth, which should contribute

positively to group profitability.” Fitch also noted that, “The

Stable Outlook reflects our assumptions that Inspired's organic

deleveraging in the upcoming years will be followed by timely

addressing its upcoming debt maturities through refinancing.”

About Inspired Entertainment,

Inc.

Inspired offers an expanding portfolio of

content, technology, hardware and services for regulated gaming,

betting, lottery, social and leisure operators across retail and

mobile channels around the world. The Company’s gaming,

virtual sports, interactive and leisure products appeal to a wide

variety of players, creating new opportunities for operators to

grow their revenue. The Company operates in approximately

35 jurisdictions worldwide, supplying gaming systems with

associated terminals and content for approximately 50,000 gaming

machines located in betting shops, pubs, gaming halls and other

route operations; virtual sports products through more than 32,000

retail venues and various online websites; interactive games for

170+ websites; and a variety of amusement entertainment solutions

with a total installed base of more than 16,000

terminals. Additional information can be found

at www.inseinc.com.

Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. These statements can be identified by the use

of forward-looking terminology such as "expects," "believes,"

"estimates," "projects," "intends," "plans," "seeks," "may,"

"will," "should" or "anticipates" or the negative or other

variations of these or similar words. Although the Company believes

that its expectations are based on reasonable assumptions within

the bounds of the Company's knowledge of its business, there can be

no assurance that actual results, including the impact of the

restatement, will not differ materially from its expectations.

Meaningful factors that could cause actual results to differ from

expectations include, but are not limited to, risks relating to the

final impact of the restatement on the Company's financial

statements; the impact of the restatement on the Company's

evaluation of the effectiveness of its internal control over

financial reporting and disclosure controls and procedures; delays

in the preparation of the financial statements; the risk that

additional information will come to light during the course of the

Company's financial statement and accounting policy review that

alters the scope or magnitude of the restatement; and the risk that

the Company will be unable to obtain, if needed, any required

waivers under its debt indenture with respect to a significant

delay in filing its periodic reports with the SEC, which could

affect its liquidity; and the risk that the Company may not be able

to satisfy the terms of the Plan of Compliance it has submitted to

Nasdaq, or that Nasdaq will provide any other accommodations to the

Company. The Company does not intend to update publicly any

forward-looking statements, except as required by law. In light of

these risks, uncertainties and assumptions, the forward-looking

events discussed in this news release may not occur.

Contact:

For InvestorsIR@inseinc.com+1 (646) 277-1285

For Press and Salesinspiredsales@inseinc.com

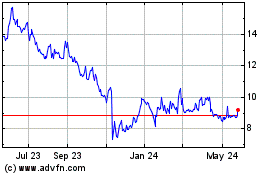

Inspired Entertainment (NASDAQ:INSE)

Historical Stock Chart

From Dec 2024 to Jan 2025

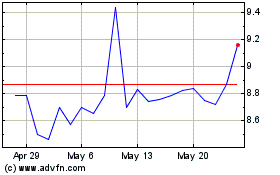

Inspired Entertainment (NASDAQ:INSE)

Historical Stock Chart

From Jan 2024 to Jan 2025