Solid performance marked by higher revenues

and strong deposit generation

Independent Bank Corp. (Nasdaq Global Select Market: INDB),

parent of Rockland Trust Company, today announced 2024 second

quarter net income of $51.3 million, or $1.21 per diluted share,

compared to 2024 first quarter net income of $47.8 million, or

$1.12 per diluted share.

The Company generated a return on average assets of 1.07% and a

return on average common equity of 7.10% for the second quarter of

2024, as compared to 1.00% and 6.63%, respectively, for the prior

quarter.

“Our second quarter results reflect positive momentum in all of

the core components that drive the Company’s financial performance.

Despite persistent uncertainty in the broader macroeconomic

environment, our colleagues’ steadfast focus on each relationship

remains the backbone of our success,” said Jeffrey Tengel, the

Chief Executive Officer of Independent Bank Corp. and Rockland

Trust Company.

BALANCE SHEET

Total assets of $19.4 billion at June 30, 2024 increased $86.4

million, or 0.4%, from the prior quarter and reflect a healthy

remix of assets from securities into loans when compared to June

30, 2023 levels.

Total loans at June 30, 2024 of $14.4 billion increased by $70.3

million, or 0.5% (2.0% annualized), compared to the prior quarter

level. On the commercial side, loan growth was primarily driven by

an increase in the commercial and industrial portfolio, an area of

increased emphasis, which increased $22.7 million, or 1.4% (5.8%

annualized), while the combined commercial real estate and

construction loans outstanding were essentially flat. Commercial

loan pipelines remained healthy at quarter end. The small business

portfolio also continued its steady growth, rising by 2.9% during

the second quarter of 2024, while the total consumer portfolio

increased $39.2 million, or 1.1% (4.4% annualized) from the prior

quarter, reflecting strong overall closing activity and increased

home equity utilization.

Deposit balances rose to $15.4 billion at June 30, 2024,

representing growth of $366.4 million, or 2.4%, from March 31,

2024. This increase was experienced across all segments, with

municipal deposits comprising the majority of the growth. Though

some level of product remixing persists, overall core deposits

represented 81.9% of total deposits at June 30, 2024, as compared

to 83.2% at March 31, 2024, with total noninterest bearing demand

deposits comprising 28.7% of total deposits at June 30, 2024,

versus 29.7% at March 31, 2024. The total cost of deposits for the

second quarter increased 17 basis points to 1.65% compared to the

prior quarter.

In conjunction with deposit growth during the quarter, total

borrowings declined by $332.0 million, or 32.4%, during the second

quarter of 2024, driven by a reduction in Federal Home Loan Bank

(“FHLB”) borrowings. The overall cost of funding increased 8 basis

points as compared to 23 basis points in the prior quarter, as

ongoing increases in deposit costs were mitigated by reductions in

wholesale borrowing costs.

The securities portfolio decreased by $80.0 million, or 2.8%,

compared to March 31, 2024, driven primarily by paydowns and

maturities, offset in part by unrealized gains of $5.4 million in

the available for sale portfolio. Total securities represented

14.2% of total assets at June 30, 2024, as compared to 14.7% at

March 31, 2024.

Stockholders’ equity at June 30, 2024 increased $35.0 million,

or 1.2%, compared to March 31, 2024, driven primarily by strong

earnings retention as well as unrealized gains on the available for

sale investment securities portfolio included in other

comprehensive income. The Company’s ratio of common equity to

assets of 15.04% at June 30, 2024 represented an increase of 12

basis points from March 31, 2024 and an increase of 32 basis points

from June 30, 2023. The Company’s book value per share increased by

$0.80, or 1.2%, to $68.74 at June 30, 2024 as compared to the prior

quarter. The Company’s tangible book value per share at June 30,

2024 rose by $0.85, or 1.9%, from the prior quarter to $45.19, and

has grown by 7.9% from the year ago period. The Company’s ratio of

tangible common equity to tangible assets of 10.42% at June 30,

2024 represented an increase of 15 basis points from the prior

quarter and an increase of 37 basis points from the year ago

period. Please refer to Appendix A for a detailed reconciliation

of Non-GAAP balance sheet metrics.

NET INTEREST INCOME

Net interest income for the second quarter of 2024 increased

slightly to $137.9 million as compared to $137.4 million for the

prior quarter, due to modest loan growth and a slightly improved

net interest margin. The net interest margin of 3.25% increased 2

basis points when compared to the prior quarter, driven primarily

by higher loan yields, securities cash flow deployment, and

maturing loan hedges, offset by increased funding costs.

NONINTEREST INCOME

Noninterest income of $32.3 million for the second quarter of

2024 represented an increase of $2.4 million, or 8.0%, as compared

to the prior quarter. Significant changes in noninterest income for

the second quarter of 2024 compared to the prior quarter included

the following:

- Interchange and ATM fees increased by $301,000, or 6.8%, driven

by increased transaction volume during the second quarter of

2024.

- Investment management and advisory income increased by $1.0

million, or 10.5%, primarily driven by seasonal tax preparation

fees and insurance commissions, as well as an increase in total

assets under administration, which rose by $66.6 million, or 1.0%,

to a record level of $6.9 billion at June 30, 2024.

- Mortgage banking income grew by $524,000, or 65.8%, driven

primarily by a higher volume of sold originations during the

quarter.

- The Company received proceeds on life insurance policies

resulting in a gain of $263,000 during the first quarter of 2024,

while no such gains were recognized during the second quarter of

2024.

- Loan level derivative income rose by $393,000, reflecting an

increase from lower prior quarter levels.

- Other noninterest income increased by $210,000, or 3.4%, driven

primarily by outsized loan fees and FHLB dividend income, partially

offset by reduced gains on equity securities.

NONINTEREST EXPENSE

Noninterest expense of $99.6 million for the second quarter of

2024 represented a decrease of $273,000, or 0.3%, as compared to

the prior quarter. Significant changes in noninterest expense for

the second quarter compared to the prior quarter included the

following:

- Salaries and employee benefits were essentially flat as

compared to the prior quarter, as increased commissions, equity

compensation and medical plan insurance were offset by an outsized

benefit related to the valuation of the Company’s split-dollar

bank-owned life insurance policies.

- Occupancy and equipment expenses decreased by $995,000, or

7.4%, due mainly to seasonal decreases in snow removal and

utilities costs.

- FDIC assessment decreased $288,000, or 9.7%, from the prior

quarter, driven primarily by the FDIC special assessment recognized

by the Company.

- Other noninterest expense increased by $1.1 million, or 4.6%,

due primarily to increases in advertising costs, director equity

compensation granted during the quarter, professional fees, and

subscriptions, partially offset by decreased debit card expenses

and card issuance costs.

The Company’s tax rate for the second quarter of 2024 decreased

to 22.69%, compared to 23.56% for the prior quarter, primarily due

to the timing of discrete items.

ASSET QUALITY

The second quarter provision for credit losses was $4.3 million

as compared to $5.0 million for the first quarter of 2024 and was

largely attributable to specific reserve allocations on existing

nonperforming loans. Net charge-offs remained minimal at $339,000

for the second quarter of 2024, as compared to $274,000 for the

prior quarter, representing 0.01% of average loans annualized for

each respective quarter. Nonperforming loans also stayed relatively

flat at $57.5 million at June 30, 2024, as compared to $56.9

million at March 31, 2024 and represented 0.40% of total loans at

each respective period. Delinquencies as a percentage of total

loans decreased 15 basis points from the prior quarter to 0.37% at

June 30, 2024.

The allowance for credit losses on total loans increased to

$150.9 million at June 30, 2024 compared to $146.9 million at March

31, 2024, and represented 1.05% and 1.03% of total loans, at June

30, 2024 and March 31, 2024, respectively.

CONFERENCE CALL INFORMATION

Jeffrey Tengel, Chief Executive Officer, and Mark Ruggiero,

Chief Financial Officer and Executive Vice President of Consumer

Lending, will host a conference call to discuss second quarter

earnings at 10:00 a.m. Eastern Time on Friday, July 19, 2024.

Internet access to the call is available on the Company’s website

at https://INDB.RocklandTrust.com or

via telephonic access by dial-in at 1-888-336-7153 reference: INDB.

A replay of the call will be available by calling 1-877-344-7529,

Replay Conference Number: 3664959 and will be available through

July 26, 2024. Additionally, a webcast replay will be available on

the Company’s website until July 19, 2025.

ABOUT INDEPENDENT BANK CORP.

Independent Bank Corp. (NASDAQ Global Select Market: INDB) is

the holding company for Rockland Trust Company, a full-service

commercial bank headquartered in Massachusetts. With retail

branches in Eastern Massachusetts and Worcester County as well as

commercial banking and investment management offices in

Massachusetts and Rhode Island, Rockland Trust offers a wide range

of banking, investment, and insurance services to individuals,

families, and businesses. The Bank also offers a full suite of

mobile, online, and telephone banking services. Rockland Trust is

an FDIC member and an Equal Housing Lender.

This press release contains certain “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act

of 1995 with respect to the financial condition, results of

operations and business of the Company. These statements may be

identified by such forward-looking terminology as “expect,”

“achieve,” “plan,” “believe,” “future,” “positioned,” “continued,”

“will,” “would,” “potential,” or similar statements or variations

of such terms. Actual results may differ from those contemplated by

these forward-looking statements.

Factors that may cause actual results to differ materially from

those contemplated by such forward-looking statements include, but

are not limited to:

- adverse economic conditions in the regional and local economies

within the New England region and the Company’s market area;

- events impacting the financial services industry, including

high profile bank failures, and any resulting decreased confidence

in banks among depositors, investors, and other counterparties, as

well as competition for deposits, significant disruption,

volatility and depressed valuations of equity and other securities

of banks in the capital markets;

- the effects to the Company of an increasingly competitive labor

market, including the possibility that the Company will have to

devote significant resources to attract and retain qualified

personnel;

- the instability or volatility in financial markets and

unfavorable domestic or global general economic, political or

business conditions, whether caused by geopolitical concerns,

including the Russia/Ukraine conflict, the conflict in Israel and

surrounding areas and the possible expansion of such conflicts,

changes in U.S. and international trade policies, or other factors,

and the potential impact of such factors on the Company and its

customers, including the potential for decreases in deposits and

loan demand, unanticipated loan delinquencies, loss of collateral

and decreased service revenues;

- unanticipated loan delinquencies, loss of collateral, decreased

service revenues, and other potential negative effects on the

Company’s local economies or the Company's business caused by

adverse weather conditions and natural disasters, changes in

climate, public health crises or other external events and any

actions taken by governmental authorities in response to any such

events;

- adverse changes or volatility in the local real estate

market;

- changes in interest rates and any resulting impact on interest

earning assets and/or interest bearing liabilities, the level of

voluntary prepayments on loans and the receipt of payments on

mortgage-backed securities, decreased loan demand or increased

difficulty in the ability of borrowers to repay variable rate

loans;

- acquisitions may not produce results at levels or within time

frames originally anticipated and may result in unforeseen

integration issues or impairment of goodwill and/or other

intangibles;

- the effect of laws, regulations, new requirements or

expectations, or additional regulatory oversight in the highly

regulated financial services industry, including as a result of

intensified regulatory scrutiny in the aftermath of recent bank

failures and the resulting need to invest in technology to meet

heightened regulatory expectations, increased costs of compliance

or required adjustments to strategy;

- changes in trade, monetary and fiscal policies and laws,

including interest rate policies of the Board of Governors of the

Federal Reserve System;

- higher than expected tax expense, including as a result of

failure to comply with general tax laws and changes in tax

laws;

- increased competition in the Company’s market areas, including

competition that could impact deposit gathering, retention of

deposits and the cost of deposits, increased competition due to the

demand for innovative products and service offerings, and

competition from non-depository institutions which may be subject

to fewer regulatory constraints and lower cost structures;

- a deterioration in the conditions of the securities

markets;

- a deterioration of the credit rating for U.S. long-term

sovereign debt or uncertainties surrounding the federal

budget;

- inability to adapt to changes in information technology,

including changes to industry accepted delivery models driven by a

migration to the internet as a means of service delivery, including

any inability to effectively implement new technology-driven

products, such as artificial intelligence;

- electronic or other fraudulent activity within the financial

services industry, especially in the commercial banking

sector;

- adverse changes in consumer spending and savings habits;

- the effect of laws and regulations regarding the financial

services industry, including the need to invest in technology to

meet heightened regulatory expectations or introduction of new

requirements or expectations resulting in increased costs of

compliance or required adjustments to strategy;

- changes in laws and regulations (including laws and regulations

concerning taxes, banking, securities and insurance) generally

applicable to the Company’s business and the associated costs of

such changes;

- the Company’s potential judgments, claims, damages, penalties,

fines and reputational damage resulting from pending or future

litigation and regulatory and government actions;

- changes in accounting policies, practices and standards, as may

be adopted by the regulatory agencies as well as the Public Company

Accounting Oversight Board, the Financial Accounting Standards

Board, and other accounting standard setters;

- operational risks related to cyber threats, attacks,

intrusions, and fraud which could lead to interruptions or

disruptions of the Company’s operating systems, including systems

that are customer facing, and adversely impact the Company’s

business;

- any unexpected material adverse changes in the Company’s

operations or earnings.

The Company wishes to caution readers not to place undue

reliance on any forward-looking statements as the Company’s

business and its forward-looking statements involve substantial

known and unknown risks and uncertainties described in the

Company’s Annual Report on Form 10-K and subsequent Quarterly

Reports on Form 10-Q (“Risk Factors”). Except as required by law,

the Company disclaims any intent or obligation to update publicly

any such forward-looking statements, whether in response to new

information, future events or otherwise. Any public statements or

disclosures by the Company following this release which modify or

impact any of the forward-looking statements contained in this

release will be deemed to modify or supersede such statements in

this release. In addition to the information set forth in this

press release, you should carefully consider the Risk Factors.

This press release and the appendices attached to it contain

financial information determined by methods other than in

accordance with accounting principles generally accepted in the

United States of America (“GAAP”). This information may include

operating net income and operating earnings per share (“EPS”),

operating return on average assets, operating return on average

common equity, operating return on average tangible common equity,

core net interest margin (“core margin”), tangible book value per

share and the tangible common equity ratio.

Management reviews its core margin to determine any items that

may impact the net interest margin that may be one-time in nature

or not reflective of its core operating environment, such as

significant purchase accounting adjustments or other adjustments

such as nonaccrual interest reversals/recoveries and prepayment

penalties. Management believes that adjusting for these items to

arrive at a core margin provides additional insight into the

operating environment and how management decisions impact the net

interest margin.

Management also supplements its evaluation of financial

performance with analysis of tangible book value per share (which

is computed by dividing stockholders’ equity less goodwill and

identifiable intangible assets, or “tangible common equity,” by

common shares outstanding), the tangible common equity ratio (which

is computed by dividing tangible common equity by “tangible

assets,” defined as total assets less goodwill and other

intangibles), and return on average tangible common equity (which

is computed by dividing net income by average tangible common

equity). The Company has included information on tangible book

value per share, the tangible common equity ratio and return on

average tangible common equity because management believes that

investors may find it useful to have access to the same analytical

tools used by management. As a result of merger and acquisition

activity, the Company has recognized goodwill and other intangible

assets in conjunction with business combination accounting

principles. Excluding the impact of goodwill and other intangibles

in measuring asset and capital values for the ratios provided,

along with other bank standard capital ratios, provides a framework

to compare the capital adequacy of the Company to other companies

in the financial services industry.

These non-GAAP measures should not be viewed as a substitute for

operating results and other financial measures determined in

accordance with GAAP. An item which management excludes when

computing these non-GAAP measures can be of substantial importance

to the Company’s results for any particular quarter or year. The

Company’s non-GAAP performance measures, including operating net

income, operating EPS, operating return on average assets,

operating return on average common equity, core margin, tangible

book value per share and the tangible common equity ratio, are not

necessarily comparable to non-GAAP performance measures which may

be presented by other companies.

Category: Earnings Releases

INDEPENDENT BANK

CORP. FINANCIAL SUMMARY

CONSOLIDATED BALANCE SHEETS

(Unaudited, dollars in thousands)

% Change

% Change

June 30 2024

March 31 2024

June 30 2023

Jun 2024 vs.

Jun 2024 vs.

Mar 2024

Jun 2023

Assets

Cash and due from banks

$

192,845

$

165,331

$

181,810

16.64

%

6.07

%

Interest-earning deposits with banks

121,036

55,985

126,454

116.19

%

(4.28

)%

Securities

Trading

4,384

4,759

4,477

(7.88

)%

(2.08

)%

Equities

21,028

22,858

21,800

(8.01

)%

(3.54

)%

Available for sale

1,220,656

1,272,831

1,372,903

(4.10

)%

(11.09

)%

Held to maturity

1,519,655

1,545,267

1,623,892

(1.66

)%

(6.42

)%

Total securities

2,765,723

2,845,715

3,023,072

(2.81

)%

(8.51

)%

Loans held for sale

17,850

11,340

6,577

57.41

%

171.40

%

Loans

Commercial and industrial

1,602,752

1,580,041

1,723,219

1.44

%

(6.99

)%

Commercial real estate

8,151,805

8,108,836

7,812,796

0.53

%

4.34

%

Commercial construction

786,743

828,900

1,022,796

(5.09

)%

(23.08

)%

Small business

269,270

261,690

237,092

2.90

%

13.57

%

Total commercial

10,810,570

10,779,467

10,795,903

0.29

%

0.14

%

Residential real estate

2,439,646

2,420,705

2,221,284

0.78

%

9.83

%

Home equity - first position

504,403

507,356

546,240

(0.58

)%

(7.66

)%

Home equity - subordinate positions

612,404

593,230

549,158

3.23

%

11.52

%

Total consumer real estate

3,556,453

3,521,291

3,316,682

1.00

%

7.23

%

Other consumer

33,919

29,836

27,326

13.68

%

24.13

%

Total loans

14,400,942

14,330,594

14,139,911

0.49

%

1.85

%

Less: allowance for credit losses

(150,859

)

(146,948

)

(140,647

)

2.66

%

7.26

%

Net loans

14,250,083

14,183,646

13,999,264

0.47

%

1.79

%

Federal Home Loan Bank stock

32,738

46,304

39,488

(29.30

)%

(17.09

)%

Bank premises and equipment, net

191,303

192,563

193,642

(0.65

)%

(1.21

)%

Goodwill

985,072

985,072

985,072

—

%

—

%

Other intangible assets

15,161

16,626

21,537

(8.81

)%

(29.60

)%

Cash surrender value of life insurance

policies

300,111

298,352

296,687

0.59

%

1.15

%

Other assets

539,115

523,679

527,328

2.95

%

2.24

%

Total assets

$

19,411,037

$

19,324,613

$

19,400,931

0.45

%

0.05

%

Liabilities and Stockholders’

Equity

Deposits

Noninterest-bearing demand deposits

$

4,418,891

$

4,469,820

$

4,861,092

(1.14

)%

(9.10

)%

Savings and interest checking

5,241,154

5,196,195

5,525,223

0.87

%

(5.14

)%

Money market

3,058,109

2,944,221

3,065,520

3.87

%

(0.24

)%

Time certificates of deposit

2,691,433

2,432,985

1,796,216

10.62

%

49.84

%

Total deposits

15,409,587

15,043,221

15,248,051

2.44

%

1.06

%

Borrowings

Federal Home Loan Bank borrowings

630,527

962,535

788,479

(34.49

)%

(20.03

)%

Junior subordinated debentures, net

62,859

62,858

62,857

—

%

—

%

Subordinated debentures, net

—

—

49,933

nm

(100.00

)%

Total borrowings

693,386

1,025,393

901,269

(32.38

)%

(23.07

)%

Total deposits and borrowings

16,102,973

16,068,614

16,149,320

0.21

%

(0.29

)%

Other liabilities

388,815

371,791

396,697

4.58

%

(1.99

)%

Total liabilities

16,491,788

16,440,405

16,546,017

0.31

%

(0.33

)%

Stockholders’ equity

Common stock

423

422

440

0.24

%

(3.86

)%

Additional paid in capital

1,904,869

1,902,063

1,997,674

0.15

%

(4.65

)%

Retained earnings

1,128,182

1,101,061

1,009,735

2.46

%

11.73

%

Accumulated other comprehensive loss, net

of tax

(114,225

)

(119,338

)

(152,935

)

(4.28

)%

(25.31

)%

Total stockholders' equity

2,919,249

2,884,208

2,854,914

1.21

%

2.25

%

Total liabilities and stockholders’

equity

$

19,411,037

$

19,324,613

$

19,400,931

0.45

%

0.05

%

CONSOLIDATED STATEMENTS OF

INCOME

(Unaudited, dollars in thousands, except

per share data)

Three Months Ended

% Change

% Change

June 30 2024

March 31 2024

June 30 2023

Jun 2024 vs.

Jun 2024 vs.

Mar 2024

Jun 2023

Interest income

Interest on federal funds sold and

short-term investments

$

397

$

483

$

3,312

(17.81

)%

(88.01

)%

Interest and dividends on securities

13,994

14,232

15,583

(1.67

)%

(10.20

)%

Interest and fees on loans

197,274

193,226

179,759

2.09

%

9.74

%

Interest on loans held for sale

199

104

39

91.35

%

410.26

%

Total interest income

211,864

208,045

198,693

1.84

%

6.63

%

Interest expense

Interest on deposits

61,469

54,320

31,909

13.16

%

92.64

%

Interest on borrowings

12,469

16,286

14,238

(23.44

)%

(12.42

)%

Total interest expense

73,938

70,606

46,147

4.72

%

60.22

%

Net interest income

137,926

137,439

152,546

0.35

%

(9.58

)%

Provision for credit losses

4,250

5,000

5,000

(15.00

)%

(15.00

)%

Net interest income after provision for

credit losses

133,676

132,439

147,546

0.93

%

(9.40

)%

Noninterest income

Deposit account fees

6,332

6,228

5,508

1.67

%

14.96

%

Interchange and ATM fees

4,753

4,452

4,478

6.76

%

6.14

%

Investment management and advisory

10,987

9,941

10,348

10.52

%

6.18

%

Mortgage banking income

1,320

796

670

65.83

%

97.01

%

Increase in cash surrender value of life

insurance policies

2,000

1,928

1,940

3.73

%

3.09

%

Gain on life insurance benefits

—

263

176

(100.00

)%

(100.00

)%

Loan level derivative income

473

80

1,275

491.25

%

(62.90

)%

Other noninterest income

6,465

6,255

6,362

3.36

%

1.62

%

Total noninterest income

32,330

29,943

30,757

7.97

%

5.11

%

Noninterest expenses

Salaries and employee benefits

57,162

57,174

53,975

(0.02

)%

5.90

%

Occupancy and equipment expenses

12,472

13,467

12,385

(7.39

)%

0.70

%

Data processing and facilities

management

2,405

2,483

2,530

(3.14

)%

(4.94

)%

FDIC assessment

2,694

2,982

2,674

(9.66

)%

0.75

%

Other noninterest expenses

24,881

23,781

23,991

4.63

%

3.71

%

Total noninterest expenses

99,614

99,887

95,555

(0.27

)%

4.25

%

Income before income taxes

66,392

62,495

82,748

6.24

%

(19.77

)%

Provision for income taxes

15,062

14,725

20,104

2.29

%

(25.08

)%

Net Income

$

51,330

$

47,770

$

62,644

7.45

%

(18.06

)%

Weighted average common shares (basic)

42,468,658

42,553,714

44,129,152

Common share equivalents

4,308

12,876

7,573

Weighted average common shares

(diluted)

42,472,966

42,566,590

44,136,725

Basic earnings per share

$

1.21

$

1.12

$

1.42

8.04

%

(14.79

)%

Diluted earnings per share

$

1.21

$

1.12

$

1.42

8.04

%

(14.79

)%

Performance

ratios

Net interest margin (FTE)

3.25

%

3.23

%

3.54

%

Return on average assets (calculated by

dividing net income by average assets) (GAAP)

1.07

%

1.00

%

1.29

%

Return on average common equity

(calculated by dividing net income by average common equity)

(GAAP)

7.10

%

6.63

%

8.78

%

Return on average tangible common equity

(Non-GAAP) (calculated by dividing net income by average tangible

common equity)

10.83

%

10.15

%

13.54

%

Noninterest income as a % of total revenue

(calculated by dividing total noninterest income by net interest

income plus total noninterest income)

18.99

%

17.89

%

16.78

%

Efficiency ratio (calculated by dividing

total noninterest expense by total revenue)

58.51

%

59.68

%

52.13

%

CONSOLIDATED STATEMENTS OF

INCOME

(Unaudited, dollars in thousands, except

per share data)

Six Months Ended

% Change

June 30 2024

June 30 2023

Jun 2024 vs.

Jun 2023

Interest income

Interest on federal funds sold and

short-term investments

$

880

$

3,977

(77.87

)%

Interest and dividends on securities

28,226

30,893

(8.63

)%

Interest and fees on loans

390,500

350,685

11.35

%

Interest on loans held for sale

303

73

315.07

%

Total interest income

419,909

385,628

8.89

%

Interest expense

Interest on deposits

115,789

54,584

112.13

%

Interest on borrowings

28,755

19,500

47.46

%

Total interest expense

144,544

74,084

95.11

%

Net interest income

275,365

311,544

(11.61

)%

Provision for credit losses

9,250

12,250

(24.49

)%

Net interest income after provision for

credit losses

266,115

299,294

(11.09

)%

Noninterest income

Deposit account fees

12,560

11,424

9.94

%

Interchange and ATM fees

9,205

8,662

6.27

%

Investment management and advisory

20,928

20,127

3.98

%

Mortgage banking income

2,116

978

116.36

%

Increase in cash surrender value of life

insurance policies

3,928

3,794

3.53

%

Gain on life insurance benefits

263

187

40.64

%

Loan level derivative income

553

1,683

(67.14

)%

Other noninterest income

12,720

12,144

4.74

%

Total noninterest income

62,273

58,999

5.55

%

Noninterest expenses

Salaries and employee benefits

114,336

110,950

3.05

%

Occupancy and equipment expenses

25,939

25,207

2.90

%

Data processing and facilities

management

4,888

5,057

(3.34

)%

FDIC assessment

5,676

5,284

7.42

%

Other noninterest expenses

48,662

47,718

1.98

%

Total noninterest expenses

199,501

194,216

2.72

%

Income before income taxes

128,887

164,077

(21.45

)%

Provision for income taxes

29,787

40,186

(25.88

)%

Net Income

$

99,100

$

123,891

(20.01

)%

Weighted average common shares (basic)

42,511,186

44,564,209

Common share equivalents

8,592

13,568

Weighted average common shares

(diluted)

42,519,778

44,577,777

Basic earnings per share

$

2.33

$

2.78

(16.19

)%

Diluted earnings per share

$

2.33

$

2.78

(16.19

)%

Performance ratios

Net interest margin (FTE)

3.24

%

3.67

%

Return on average assets (GAAP)

(calculated by dividing net income by average assets)

1.03

%

1.29

%

Return on average common equity (GAAP)

(calculated by dividing net income by average common equity)

6.87

%

8.70

%

Return on average tangible common equity

(Non-GAAP) (calculated by dividing net income by average tangible

common equity)

10.49

%

13.42

%

Noninterest income as a % of total revenue

(calculated by dividing total noninterest income by net interest

income plus total noninterest income)

18.44

%

15.92

%

Efficiency ratio (GAAP) (calculated by

dividing total noninterest expense by total revenue)

59.09

%

52.41

%

nm = not meaningful

ASSET

QUALITY

(Unaudited, dollars in thousands)

Nonperforming Assets

At

June 30 2024

March 31 2024

June 30 2023

Nonperforming loans

Commercial & industrial loans

$

17,793

$

17,640

$

3,235

Commercial real estate loans

23,479

24,213

29,910

Small business loans

437

316

348

Residential real estate loans

10,629

9,947

8,179

Home equity

5,090

4,805

3,944

Other consumer

23

20

86

Total nonperforming loans

57,451

56,941

45,702

Other real estate owned

110

110

110

Total nonperforming assets

$

57,561

$

57,051

$

45,812

Nonperforming loans/gross loans

0.40

%

0.40

%

0.32

%

Nonperforming assets/total assets

0.30

%

0.30

%

0.24

%

Allowance for credit losses/nonperforming

loans

262.59

%

258.07

%

307.75

%

Allowance for credit losses/total

loans

1.05

%

1.03

%

0.99

%

Delinquent loans/total loans

0.37

%

0.52

%

0.30

%

Nonperforming Assets

Reconciliation for the Three Months Ended

June 30 2024

March 31 2024

June 30 2023

Nonperforming assets beginning balance

$

57,051

$

54,493

$

56,235

New to nonperforming

6,201

19,258

18,018

Loans charged-off

(808

)

(881

)

(23,767

)

Loans paid-off

(3,458

)

(6,982

)

(3,984

)

Loans restored to performing status

(1,429

)

(8,855

)

(680

)

Other

4

18

(10

)

Nonperforming assets ending balance

$

57,561

$

57,051

$

45,812

Net Charge-Offs

(Recoveries)

Three Months Ended

Six Months Ended

June 30 2024

March 31 2024

June 30 2023

June 30 2024

June 30 2023

Net charge-offs (recoveries)

Commercial and industrial loans

$

(2

)

$

(85

)

$

23,174

$

(87

)

$

23,450

Commercial real estate loans

—

—

—

—

—

Small business loans

48

70

51

118

48

Home equity

(137

)

(133

)

(10

)

(270

)

(26

)

Other consumer

430

422

269

852

550

Total net charge-offs

$

339

$

274

$

23,484

$

613

$

24,022

Net charge-offs to average loans

(annualized)

0.01

%

0.01

%

0.67

%

0.01

%

0.35

%

BALANCE SHEET AND CAPITAL

RATIOS

June 30 2024

March 31 2024

June 30 2023

Gross loans/total deposits

93.45

%

95.26

%

92.73

%

Common equity tier 1 capital ratio (1)

14.42

%

14.16

%

14.06

%

Tier 1 leverage capital ratio (1)

11.09

%

10.95

%

10.85

%

Common equity to assets ratio GAAP

15.04

%

14.92

%

14.72

%

Tangible common equity to tangible assets

ratio (2)

10.42

%

10.27

%

10.05

%

Book value per share GAAP

$

68.74

$

67.94

$

64.69

Tangible book value per share (2)

$

45.19

$

44.34

$

41.88

(1)

Estimated number for June 30, 2024.

(2)

See Appendix A for detailed reconciliation

from GAAP to Non-GAAP ratios.

INDEPENDENT BANK

CORP. SUPPLEMENTAL FINANCIAL INFORMATION

(Unaudited, dollars in thousands)

Three Months Ended

June 30, 2024

March 31, 2024

June 30, 2023

Interest

Interest

Interest

Average

Earned/

Yield/

Average

Earned/

Yield/

Average

Earned/

Yield/

Balance

Paid (1)

Rate

Balance

Paid (1)

Rate

Balance

Paid (1)

Rate

Interest-earning assets

Interest-earning deposits with banks,

federal funds sold, and short term investments

$

47,598

$

397

3.35

%

$

50,583

$

483

3.84

%

$

270,443

$

3,312

4.91

%

Securities

Securities - trading

4,739

—

—

%

4,779

—

—

%

4,487

—

—

%

Securities - taxable investments

2,793,145

13,992

2.01

%

2,867,460

14,231

2.00

%

3,071,752

15,581

2.03

%

Securities - nontaxable investments

(1)

189

2

4.26

%

190

2

4.23

%

191

2

4.20

%

Total securities

$

2,798,073

$

13,994

2.01

%

$

2,872,429

$

14,233

1.99

%

$

3,076,430

$

15,583

2.03

%

Loans held for sale

12,610

199

6.35

%

7,095

104

5.90

%

2,977

39

5.25

%

Loans

Commercial and industrial (1)

1,583,858

28,305

7.19

%

1,559,978

27,629

7.12

%

1,686,348

29,451

7.00

%

Commercial real estate (1)

8,112,683

104,449

5.18

%

8,110,813

102,054

5.06

%

7,803,702

91,813

4.72

%

Commercial construction

834,876

15,451

7.44

%

842,480

15,421

7.36

%

1,044,650

17,212

6.61

%

Small business

265,273

4,376

6.63

%

257,022

4,160

6.51

%

230,371

3,501

6.10

%

Total commercial

10,796,690

152,581

5.68

%

10,770,293

149,264

5.57

%

10,765,071

141,977

5.29

%

Residential real estate

2,427,635

26,472

4.39

%

2,418,617

26,083

4.34

%

2,153,563

20,943

3.90

%

Home equity

1,109,979

18,826

6.82

%

1,094,856

18,444

6.78

%

1,094,329

17,394

6.38

%

Total consumer real estate

3,537,614

45,298

5.15

%

3,513,473

44,527

5.10

%

3,247,892

38,337

4.73

%

Other consumer

31,019

593

7.69

%

30,669

609

7.99

%

28,863

566

7.87

%

Total loans

$

14,365,323

$

198,472

5.56

%

$

14,314,435

$

194,400

5.46

%

$

14,041,826

$

180,880

5.17

%

Total interest-earning assets

$

17,223,604

$

213,062

4.98

%

$

17,244,542

$

209,220

4.88

%

$

17,391,676

$

199,814

4.61

%

Cash and due from banks

178,558

177,506

178,707

Federal Home Loan Bank stock

41,110

47,203

44,619

Other assets

1,876,081

1,809,640

1,826,879

Total assets

$

19,319,353

$

19,278,891

$

19,441,881

Interest-bearing liabilities

Deposits

Savings and interest checking accounts

$

5,166,340

$

16,329

1.27

%

$

5,165,866

$

14,856

1.16

%

$

5,512,995

$

9,425

0.69

%

Money market

2,909,503

17,409

2.41

%

2,844,014

15,991

2.26

%

3,044,486

12,331

1.62

%

Time deposits

2,579,336

27,731

4.32

%

2,297,219

23,473

4.11

%

1,630,015

10,153

2.50

%

Total interest-bearing deposits

$

10,655,179

$

61,469

2.32

%

$

10,307,099

$

54,320

2.12

%

$

10,187,496

$

31,909

1.26

%

Borrowings

Federal Home Loan Bank borrowings

957,268

11,329

4.76

%

1,185,296

14,631

4.96

%

1,068,585

12,576

4.72

%

Junior subordinated debentures

62,859

1,140

7.29

%

62,858

1,147

7.34

%

62,856

1,044

6.66

%

Subordinated debentures

—

—

—

%

40,651

508

5.03

%

49,921

618

4.97

%

Total borrowings

$

1,020,127

$

12,469

4.92

%

$

1,288,805

$

16,286

5.08

%

$

1,181,362

$

14,238

4.83

%

Total interest-bearing liabilities

$

11,675,306

$

73,938

2.55

%

$

11,595,904

$

70,606

2.45

%

$

11,368,858

$

46,147

1.63

%

Noninterest-bearing demand deposits

4,360,897

4,439,107

4,873,767

Other liabilities

375,629

347,573

336,210

Total liabilities

$

16,411,832

$

16,382,584

$

16,578,835

Stockholders’ equity

2,907,521

2,896,307

2,863,046

Total liabilities and stockholders’

equity

$

19,319,353

$

19,278,891

$

19,441,881

Net interest income

$

139,124

$

138,614

$

153,667

Interest rate spread (2)

2.43

%

2.43

%

2.98

%

Net interest margin (3)

3.25

%

3.23

%

3.54

%

Supplemental

Information

Total deposits, including demand

deposits

$

15,016,076

$

61,469

$

14,746,206

$

54,320

$

15,061,263

$

31,909

Cost of total deposits

1.65

%

1.48

%

0.85

%

Total funding liabilities, including

demand deposits

$

16,036,203

$

73,938

$

16,035,011

$

70,606

$

16,242,625

$

46,147

Cost of total funding liabilities

1.85

%

1.77

%

1.14

%

(1) The total amount of adjustment to

present interest income and yield on a fully tax-equivalent basis

was $1.2 million for both the three months ended June 30, 2024 and

March 31, 2024, and $1.1 million for the three months ended and

June 30, 2023, determined by applying the Company’s marginal tax

rates in effect during each respective quarter.

(2) Interest rate spread represents the

difference between weighted average yield on interest-earning

assets and the weighted average cost of interest-bearing

liabilities.

(3) Net interest margin represents

annualized net interest income as a percentage of average

interest-earning assets.

Six Months Ended

June 30, 2024

June 30, 2023

Interest

Interest

Average

Earned/

Yield/

Average

Earned/

Yield/

Balance

Paid

Rate

Balance

Paid

Rate

Interest-earning assets

Interest earning deposits with banks,

federal funds sold, and short term investments

$

49,091

$

880

3.60

%

$

172,569

$

3,977

4.65

%

Securities

Securities - trading

4,759

—

—

%

4,292

—

—

%

Securities - taxable investments

2,830,302

28,223

2.01

%

3,094,263

30,890

2.01

%

Securities - nontaxable investments

(1)

190

4

4.23

%

192

4

4.20

%

Total securities

$

2,835,251

$

28,227

2.00

%

$

3,098,747

$

30,894

2.01

%

Loans held for sale

9,853

303

6.18

%

2,727

73

5.40

%

Loans

Commercial and industrial (1)

1,571,918

55,911

7.15

%

1,652,527

56,023

6.84

%

Commercial real estate (1)

8,111,748

206,526

5.12

%

7,788,304

181,394

4.70

%

Commercial construction

838,678

30,872

7.40

%

1,089,311

33,679

6.23

%

Small business

261,147

8,536

6.57

%

226,479

6,720

5.98

%

Total commercial

10,783,491

301,845

5.63

%

10,756,621

277,816

5.21

%

Residential real estate

2,423,126

52,555

4.36

%

2,105,311

40,301

3.86

%

Home equity

1,102,418

37,270

6.80

%

1,091,707

33,638

6.21

%

Total consumer real estate

3,525,544

89,825

5.12

%

3,197,018

73,939

4.66

%

Other consumer

30,844

1,202

7.84

%

30,940

1,143

7.45

%

Total loans

$

14,339,879

$

392,872

5.51

%

$

13,984,579

$

352,898

5.09

%

Total interest-earning assets

$

17,234,074

$

422,282

4.93

%

$

17,258,622

$

387,842

4.53

%

Cash and due from banks

178,032

180,047

Federal Home Loan Bank stock

44,157

29,749

Other assets

1,842,859

1,835,669

Total assets

$

19,299,122

$

19,304,087

Interest-bearing liabilities

Deposits

Savings and interest checking accounts

$

5,166,103

$

31,185

1.21

%

$

5,628,535

$

16,898

0.61

%

Money market

2,876,759

33,400

2.33

%

3,143,355

22,724

1.46

%

Time deposits

2,438,277

51,204

4.22

%

1,462,929

14,962

2.06

%

Total interest-bearing deposits

$

10,481,139

$

115,789

2.22

%

$

10,234,819

$

54,584

1.08

%

Borrowings

Federal Home Loan Bank borrowings

1,071,282

25,960

4.87

%

685,626

16,220

4.77

%

Junior subordinated debentures

62,858

2,287

7.32

%

62,856

2,045

6.56

%

Subordinated debentures

20,326

508

5.03

%

49,909

1,235

4.99

%

Total borrowings

$

1,154,466

$

28,755

5.01

%

$

798,391

$

19,500

4.93

%

Total interest-bearing liabilities

$

11,635,605

$

144,544

2.50

%

$

11,033,210

$

74,084

1.35

%

Noninterest-bearing demand deposits

4,400,002

5,045,694

Other liabilities

361,601

355,097

Total liabilities

$

16,397,208

$

16,434,001

Stockholders’ equity

2,901,914

2,870,086

Total liabilities and stockholders’

equity

$

19,299,122

$

19,304,087

Net interest income

$

277,738

$

313,758

Interest rate spread (2)

2.43

%

3.18

%

Net interest margin (3)

3.24

%

3.67

%

Supplemental

Information

Total deposits, including demand

deposits

$

14,881,141

$

115,789

$

15,280,513

$

54,584

Cost of total deposits

1.56

%

0.72

%

Total funding liabilities, including

demand deposits

$

16,035,607

$

144,544

$

16,078,904

$

74,084

Cost of total funding liabilities

1.81

%

0.93

%

(1) The total amount of adjustment to

present interest income and yield on a fully tax-equivalent basis

is $2.4 million and $2.2 million for the six months ended June 30,

2024 and 2023, respectively.

(2) Interest rate spread represents the

difference between weighted average yield on interest-earning

assets and the weighted average cost of interest-bearing

liabilities.

(3) Net interest margin represents

annualized net interest income as a percentage of average

interest-earning assets.

Certain amounts in prior year financial

statements have been reclassified to conform to the current year’s

presentation.

APPENDIX A: NON-GAAP Reconciliation of

Balance Sheet Metrics

(Unaudited, dollars in thousands, except per share data)

The following table summarizes the calculation of the Company’s

tangible common equity to tangible assets ratio and tangible book

value per share, at the dates indicated:

June 30 2024

March 31 2024

June 30 2023

Tangible common equity

(Dollars in thousands, except per

share data)

Stockholders’ equity (GAAP)

$

2,919,249

$

2,884,208

$

2,854,914

(a)

Less: Goodwill and other intangibles

1,000,233

1,001,698

1,006,609

Tangible common equity (Non-GAAP)

$

1,919,016

$

1,882,510

$

1,848,305

(b)

Tangible assets

Assets (GAAP)

$

19,411,037

$

19,324,613

$

19,400,931

(c)

Less: Goodwill and other intangibles

1,000,233

1,001,698

1,006,609

Tangible assets (Non-GAAP)

$

18,410,804

$

18,322,915

$

18,394,322

(d)

Common Shares

42,469,867

42,452,457

44,130,901

(e)

Common equity to assets ratio (GAAP)

15.04

%

14.92

%

14.72

%

(a/c)

Tangible common equity to tangible assets

ratio (Non-GAAP)

10.42

%

10.27

%

10.05

%

(b/d)

Book value per share (GAAP)

$

68.74

$

67.94

$

64.69

(a/e)

Tangible book value per share

(Non-GAAP)

$

45.19

$

44.34

$

41.88

(b/e)

APPENDIX B: Non-GAAP Reconciliation of

Earnings Metrics

(Unaudited, dollars in thousands)

The following table summarizes the calculation of the Company’s

return on average tangible common equity for the periods

indicated:

Three Months Ended

Six Months Ended

June 30 2024

March 31 2024

June 30 2023

June 30 2024

June 30 2023

Net income (GAAP)

$

51,330

$

47,770

$

62,644

$

99,100

$

123,891

Average common equity (GAAP)

$

2,907,521

$

2,896,307

$

2,863,046

$

2,901,914

$

2,870,086

Less: Average goodwill and other

intangibles

1,000,972

1,002,506

1,007,500

1,001,739

1,008,415

Tangible average tangible common equity

(Non-GAAP)

$

1,906,549

$

1,893,801

$

1,855,546

$

1,900,175

$

1,861,671

Return on average tangible common equity

(Non-GAAP) (calculated by dividing annualized net income by average

tangible common equity)

10.83

%

10.15

%

13.54

%

10.49

%

13.42

%

APPENDIX C: Net Interest Margin

Analysis & Non-GAAP Reconciliation of Core

Margin

Three Months Ended

June 30, 2024

March 31, 2024

Volume

Interest

Margin Impact

Volume

Interest

Margin Impact

(Dollars in thousands)

Reported total interest earning assets

$

17,223,604

$

139,124

3.25

%

$

17,244,542

$

138,614

3.23

%

Acquisition fair value marks:

Loan accretion

(74

)

(109

)

CD amortization

—

9

(74

)

—

%

(100

)

—

%

Nonaccrual interest, net

(131

)

—

%

(341

)

(0.01

)%

Other noncore adjustments

(4,020

)

(499

)

(0.01

)%

(4,460

)

(582

)

(0.01

)%

Core margin (Non-GAAP)

$

17,219,584

$

138,420

3.24

%

$

17,240,082

$

137,591

3.21

%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240717397649/en/

Jeffrey Tengel President and Chief Executive Officer (781)

982-6144

Mark J. Ruggiero Chief Financial Officer and Executive Vice

President of Consumer Lending (781) 982-6281

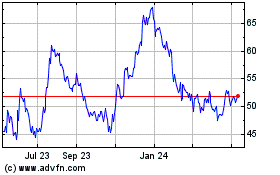

Independent Bank (NASDAQ:INDB)

Historical Stock Chart

From Feb 2025 to Mar 2025

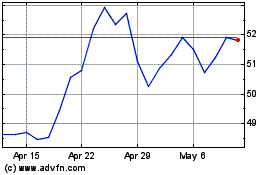

Independent Bank (NASDAQ:INDB)

Historical Stock Chart

From Mar 2024 to Mar 2025