UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

OF THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2023

Commission File Number: 001-40258

HIGH TIDE INC.

(Registrant)

11127 - 15 Street N.E., Unit 112

Calgary, Alberta

Canada T3K 2M4

(Address of Principal Executive Offices)

Indicate by check mark whether the Registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☐ Form 40-F ☒

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

HIGH TIDE INC.

|

|

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

Date: November 1, 2023

|

|

|

|

By

|

|

/s/ Raj Grover

|

|

|

|

|

|

|

|

Raj Grover

|

|

|

|

|

|

|

|

President and Chief Executive Officer

|

|

|

|

|

|

|

|

|

EXHIBIT INDEX

Exhibit

99.1

High Tide Restructures

$8.9 Million of Outstanding Secured Debt

This

news release constitutes a "designated news release" for the purposes of the Company's prospectus supplement dated August 31,

2023, to its short-form base shelf prospectus dated August 3, 2023

CALGARY, AB, Nov. 1,

2023 /CNW/ - High Tide Inc. ("High Tide" or the "Company") (Nasdaq: HITI) (TSXV: HITI) (FSE: 2LYA),

the high-impact, retail-forward enterprise built to deliver real-world value across every component of cannabis, is pleased to announce

that it has successfully completed a restructuring (the "Debt Restructuring") of approximately $8.9 million of the Company's

outstanding debt held by a key industry lender ("Key Lender" and together with High Tide, the "Parties")

under a senior secured convertible debenture issued on July 23, 2020, as amended, maturing on January 1, 2025 (the "Debenture")

pursuant to a debt restructuring agreement dated July 23, 2020, as amended, entered into between the parties (the "Debt Restructuring

Agreement").

Pursuant to the terms

of the Debt Restructuring Agreement, the parties have agreed to settle the outstanding structured installment payments, which equals

the aggregate sum of $5,024,546 (the "Outstanding Structured Payment"), in common shares in the capital of High Tide

("High Tide Shares") at a deemed price of $2.0168 per High Tide Share, to the Key Lender (each an "Installment

Share"), subject to prior approval and compliance with the policies of the TSX Venture Exchange ("TSXV"), calculated

on basis of a deemed price per High Tide Share equal to the ten (10) day volume-weighted average trading price (in Canadian dollars)

of the High Tide Shares on the TSXV ("VWAP") ending on October 31, 2023. Upon the Outstanding Structured Payment being

satisfied in High Tide Shares, the outstanding amount of the Debenture will be reduced proportionately.

Future structured payments

("Structured Payments") have been changed from a quarterly obligation to a semi-annual obligation, and each remaining

Structured Payment may be paid in cash or satisfied in free trading High Tide Shares, provided that: * High Tide provides the Key Lender

thirty (30) days prior written notice of its intention to make a Structured Payment in free trading High Tide Shares; (y) the Key Lender,

at its sole unfettered discretion, does not provide notice to High Tide at least ten (10) days before the applicable Structured Payment

is due, that a portion of or all of the applicable Structured Payment is to be paid in cash. If both conditions have been met, subject

to prior approval by the TSXV, High Tide shall be entitled to satisfy the applicable Structured Payment, or the remaining portion thereof,

through the issuance of Installment Shares, calculated on the basis of a deemed price per High Tide Share equal to the ten (10) day VWAP

ending on the day prior to the public announcement of such issuance.

The Installment Shares

issued in connection with the Outstanding Structured Payment, and any Installment Shares issued in settlement of any future Structure

Payments, shall be subject to certain resale, volume and trading restrictions as agreed by the Parties.

High Tide's obligations

under the Debenture are secured by the assets of High Tide and certain of its subsidiaries (the "Debtors") pursuant

to a subordinated security interest (ranking behind the senior creditors of the Debtors) granted in favour of the Key Lender and such

other persons who may from time to time become a party to the security agreement entered into by the parties in connection with the Debt

Restructuring.

"I'm excited to

announce the restructuring of the debenture, which creates more flexibility on our balance sheet as we start pushing the momentum on

new store openings again. Recall that at the beginning of 2021, just after the acquisition of META, our gross debt stood at approximately

65 million dollars. Over the past three years, we have now cut our outstanding debt in half to 32 million dollars today, representing

just 1.2 times the Adjusted EBITDA we reported over the past four quarters," said Raj Grover, Founder and Chief Executive Officer

of High Tide.

"While eliminating this debt, we have simultaneously grown High Tide to an annual revenue run rate exceeding half a billion dollars

and generated 4.1 million dollars in free cash flow during our last reported quarter, ending it with a cash balance exceeding 25 million

dollars. As mentioned during our last quarterly call, with regular payments coming due, amending the terms of this debt was a priority

for us, as it now allows us to allocate more cash toward the acceleration of organic store openings. On that front, we have secured more

than fifteen premiere locations, with more in the pipeline, and we are excited to now crystalize these opportunities to generate even

more cash for shareholders, " added Mr. Grover.

ABOUT HIGH TIDE

High Tide, Inc. is

the leading community-grown, retail-forward cannabis enterprise engineered to unleash the full value of the world's most powerful plant.

High Tide (HITI) is uniquely-built around the cannabis consumer, with wholly-diversified and fully-integrated operations across all components

of cannabis, including:

Bricks & Mortar

Retail: Canna Cabana™ is the largest non-franchised cannabis retail chain in Canada, with 156 current locations spanning British

Columbia, Alberta, Saskatchewan, Manitoba and Ontario and growing. In 2021, Canna Cabana became the first cannabis discount club retailer

in Canada.

Retail Innovation:

Fastendr™ is a unique and fully automated technology that integrates retail kiosks and smart lockers to facilitate a better buying

experience through browsing, ordering and pickup.

E-commerce Platforms:

High Tide operates a suite of leading accessory sites across the world, including Grasscity.com, Smokecartel.com, Dailyhighclub.com,

and Dankstop.com.

CBD: High Tide

continues to cultivate the possibilities of consumer CBD through Nuleafnaturals.com, FABCBD.com, blessedcbd.de and blessedcbd.co.uk.

Wholesale Distribution:

High Tide keeps that cannabis category stocked with wholesale solutions via Valiant™.

Licensing: High

Tide continues to push cannabis culture forward through fresh partnerships and license agreements under the Famous Brand™ name.

High Tide consistently

moves ahead of the currents, having been named one of Canada's Top Growing Companies in 2021, 2022 and 2023 by the Globe and Mail's Report

on Business Magazine and was ranked number one in the retail category on the Financial Times list of Americas' Fastest Growing Companies

for 2023. To discover the full impact of High Tide, visit www.hightideinc.com. For investment performance, don't miss the High Tide profile

pages on SEDAR+ and EDGAR.

Cautionary Note Regarding Forward-Looking

Information

This press release

may contain "forward-looking information" and "forward-looking statements within the meaning of applicable securities

legislation. The use of any of the words "could", "intend", "expect", "believe", "will",

"projected", "estimated" and similar expressions and statements relating to matters that are not historical facts

are intended to identify forward-looking information and are based on the Company's current belief or assumptions as to the outcome and

timing of such future events. The forward-looking statements herein include, but are not limited to, statements regarding: the Company

receiving the requisite regulatory approvals; the ability of the Company to make the remaining Structured Payments; the remaining Structured

Payments being paid in cash or being satisfied in High Tides Shares as more particularly set out herein; future Installment Shares being

subject to resale, volume and trading restrictions; the Company pushing momentum on new store openings; the Company allocating more cash

towards an acceleration of organic store openings; the Company securing additional premiere locations; and the Company generating more

cash for shareholders.

Readers are cautioned

to not place undue reliance on forward-looking information. Actual results and developments may differ materially from those contemplated

by these statements. Although the Company believes that the expectations reflected in these statements are reasonable, such statements

are based on expectations, factors, and assumptions concerning future events which may prove to be inaccurate and are subject to numerous

risks and uncertainties, certain of which are beyond the Company's control, including but not limited to the risk factors discussed under

the heading "Non-Exhaustive List of Risk Factors" in Schedule A to our current annual information form, and elsewhere in this

press release, as such factors may be further updated from time to time in our periodic filings, available at www.sedarplus.ca

and www.sec.gov, which factors are incorporated herein by reference. Forward-looking statements contained in this press

release are expressly qualified by this cautionary statement and reflect the Company's expectations as of the date hereof and are subject

to change thereafter. The Company undertakes no obligation to update or revise any forward-looking statements, whether as a result of

new information, estimates or opinions, future events or results, or otherwise, or to explain any material difference between subsequent

actual events and such forward-looking information, except as required by applicable law.

View original content

to download multimedia:https://www.prnewswire.com/news-releases/high-tide-restructures-8-9-million-of-outstanding-secured-debt-301975139.html

SOURCE High Tide Inc.

View original content

to download multimedia: http://www.newswire.ca/en/releases/archive/November2023/01/c5475.html

%CIK: 0001847409

For further information: Media Inquiries:

Omar Khan, Chief Communications and Public Affairs Officer, High Tide Inc., omar@hightideinc.com, 403-770-3080; Investor Inquiries, Vahan

Ajamian, Capital Markets Advisor, High Tide Inc., vahan@hightideinc.com

CO: High Tide Inc.

CNW 23:00e 01-NOV-23

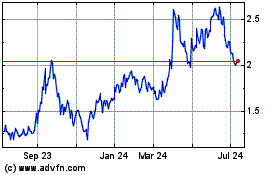

High Tide (NASDAQ:HITI)

Historical Stock Chart

From Oct 2024 to Nov 2024

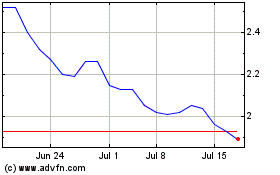

High Tide (NASDAQ:HITI)

Historical Stock Chart

From Nov 2023 to Nov 2024