H&E Equipment Services Reports Quarterly Cash Dividend

May 12 2023 - 4:05PM

Business Wire

H&E Equipment Services, Inc. (NASDAQ: HEES) today announced

that its Board of Directors declared a regular quarterly cash

dividend on May 12, 2023, to be paid to its stockholders. The

Company announced a quarterly cash dividend of $0.275 per share of

common stock to be paid on June 9, 2023, for stockholders of record

as of the close of business on May 25, 2023.

About H&E Equipment Services, Inc.

Founded in 1961, H&E Equipment Services, Inc. is one of the

largest rental equipment companies in the nation. The Company’s

fleet is among the industry’s youngest and most versatile with a

superior equipment mix comprised of aerial work platforms,

earthmoving, material handling, and other general and specialty

lines. H&E serves a diverse set of end markets in many

high-growth geographies including branches throughout the Pacific

Northwest, West Coast, Intermountain, Southwest, Gulf Coast,

Southeast, Midwest, and Mid-Atlantic regions.

Forward-Looking Statements

Statements contained in this press release that are not

historical facts, including statements about H&E’s beliefs and

expectations, are “forward-looking statements” within the meaning

of the federal securities laws. Statements containing the words

“may,” “could,” “would,” “should,” “believe,” “expect,”

“anticipate,” “plan,” “estimate,” “target,” “project,” “intend,”

“foresee” and similar expressions constitute forward-looking

statements. Forward-looking statements involve known and unknown

risks and uncertainties, which could cause actual results to differ

materially from those contained in any forward-looking statement.

Such factors include, but are not limited to, the following: (1)

risks related to a global pandemic, including COVID-19, and similar

health concerns, such as the scope and duration of the outbreak,

government actions and restrictive measures implemented in response

to the pandemic, material delays and cancellations of construction

or infrastructure projects, labor shortages, supply chain

disruptions and other impacts to the business; (2) general economic

conditions and construction and industrial activity in the markets

where we operate in North America; (3) our ability to forecast

trends in our business accurately, and the impact of economic

downturns and economic uncertainty on the markets we serve

(including as a result of current uncertainty due to COVID-19 and

inflation); (4) the impact of conditions in the global credit and

commodity markets (including as a result of current volatility and

uncertainty in credit and commodity markets due to COVID-19 and

increased interest rates) and their effect on construction spending

and the economy in general; (5) trends in oil and natural gas which

could adversely affect the demand for our services and products;

(6) our inability to obtain equipment and other supplies for our

business from our key suppliers on acceptable terms or at all, as a

result of supply chain disruptions, insolvency, financial

difficulties, supplier relationships or other factors; (7)

increased maintenance and repair costs as we age our fleet and

decreases in our equipment’s residual value; (8) our indebtedness;

(9) risks associated with the expansion of our business and any

potential acquisitions we may make, including any related capital

expenditures, or our ability to consummate such acquisitions; (10)

our possible inability to integrate any businesses we acquire; (11)

competitive pressures; (12) security breaches, cybersecurity

attacks, failure to protect personal information, compliance with

data protection laws and other disruptions in our information

technology systems; (13) adverse weather events or natural

disasters; (14) risks related to climate change and climate change

regulation; (15) compliance with laws and regulations, including

those relating to environmental matters, corporate governance

matters and tax matters, as well as any future changes to such laws

and regulations; and (16) other factors discussed in our public

filings, including the risk factors included in the Company’s most

recent Annual Report on Form 10-K and the Company's most recent

Quarterly Report on Form 10-Q. Investors, potential investors and

other readers are urged to consider these factors carefully in

evaluating the forward-looking statements and are cautioned not to

place undue reliance on such forward-looking statements. Except as

required by applicable law, including the securities laws of the

United States and the rules and regulations of the Securities and

Exchange Commission, we are under no obligation to publicly update

or revise any forward-looking statements after the date of this

release, whether as a result of any new information, future events

or otherwise. These statements are based on the current beliefs and

assumptions of H&E’s management, which in turn are based on

currently available information and important, underlying

assumptions. Investors, potential investors, security holders and

other readers are urged to consider the above-mentioned factors

carefully in evaluating the forward-looking statements and are

cautioned not to place undue reliance on such forward-looking

statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230512005290/en/

Leslie S. Magee Chief Financial Officer 225-298-5261

lmagee@he-equipment.com

Jeffrey L. Chastain Vice President of Investor Relations

225-952-2308 jchastain@he-equipment.com

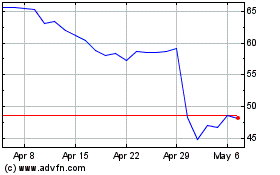

H and E Equipment Services (NASDAQ:HEES)

Historical Stock Chart

From Jan 2025 to Feb 2025

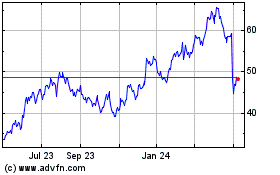

H and E Equipment Services (NASDAQ:HEES)

Historical Stock Chart

From Feb 2024 to Feb 2025