Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

July 18 2023 - 9:58PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of July 2023

Commission File Number 001-39476

GreenPower Motor Company Inc.

(Translation of registrant’s name into English)

#240 - 209 Carrall Street, Vancouver, British Columbia V6B 2J2

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F. Form 20-F [X] Form 40-F [ ]

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1) [ ]

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): [ ]

SUBMITTED HEREWITH

Exhibit 99.2 of this Form 6-K is incorporated by reference into, or as additional exhibits to, as applicable, the registrant’s Registration Statements on Form F-10 (File No. 333-258099) and Form S-8 (No. 333-261422).

99.1 News Release dated July 18, 2023

99.2 Material Change Report dated July 18, 2023

- 2 -

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

GreenPower Motor Company Inc.

/s/ Michael Sieffert

Michael Sieffert, Chief Financial Officer

Date: July 18, 2023

Exhibit 99.1

GreenPower Announces Revocation of Cease Trade Order

LOS ANGELES, July 18, 2023 /PRNewswire/ -- GreenPower Motor Company Inc. (NASDAQ: GP (TSXV: GPV) ("GreenPower"), today announced that the British Columbia Securities Commission and the Ontario Securities Commission have revoked a "failure to file" cease trade order in respect of GreenPower's securities under Multilateral Instrument 11-103 Failure-to-File Cease Trade Orders in Multiple Jurisdictions (the "CTO").

The CTO was issued as a result of GreenPower's failure to file its audited financial statements, management's discussion and analysis and related certifications for the year ended March 31, 2023 before the June 29, 2023 filing deadline. These documents were filed by GreenPower on SEDAR on July 14, 2023.

GreenPower is coordinating with the TSX Venture Exchange a resumption of trading as expeditiously as possible.

In addition, GreenPower announced that it has signed a non-binding term sheet with a lender (the "Lender") for a secured term loan credit facility of up to US$15,000,000 (the "Loan") for the purpose of working capital requirements to cover manufacturing costs of GreenPower's existing sales pipeline. It is contemplated that certain subsidiaries of GreenPower will be guarantors of the Loan and that the Loan will be available for 12 months from the date of a credit agreement (the "Credit Agreement") to be entered into between GreenPower and the Lender. It is also contemplated that the Loan will bear interest at the rate of U.S. prime plus the margin (5% p.a.) with a default interest rate of 2% above the pre-default rate of interest payable on demand, and that the Loan will be repayable in 36 substantially equal, consecutive, monthly installments commencing on the 20th day of the 13th month following the first advance, and amounts repaid will not be available for reborrowing. The Loan would be subordinate to GreenPower's existing US$8 million line of credit and will be subject to an entry into the Credit Agreement, related financing documents, and other conditions customary for a loan of this type. There is no assurance that GreenPower will enter into the Credit Agreement with the Lender on the terms expected, or at all.

Contacts

Fraser Atkinson, CEO

(604) 220-8048

Brendan Riley, President

(510) 910-3377

Michael Sieffert, CFO

(604) 563-4144

About GreenPower Motor Company Inc.

GreenPower designs, builds and distributes a full suite of high-floor and low-floor all-electric medium and heavy-duty vehicles, including transit buses, school buses, shuttles, cargo van, and a cab and chassis. GreenPower employs a clean-sheet design to manufacture all-electric vehicles that are purpose built to be battery powered with zero emissions while integrating global suppliers for key components. This OEM platform allows GreenPower to meet the specifications of various operators while providing standard parts for ease of maintenance and accessibility for warranty requirements. GreenPower was founded in Vancouver, Canada with primary operational facilities in southern California. Listed on the Toronto exchange since November 2015, GreenPower completed its U.S. IPO and NASDAQ listing in August 2020. For further information go to www.greenpowermotor.com

Forward-Looking Statements

This news release contains forward-looking statements relating to, among other things, GreenPower's business and operations and the environment in which it operates, which are based on GreenPower's operations, estimates, forecasts, and projections. Forward-looking statements are not based on historical facts, but rather on current expectations and projections about future events, and are therefore subject to risks and uncertainties which could cause actual results to differ materially from the future results expressed or implied by the forward-looking statements. These statements generally can be identified by the use of forward-looking words such as "upon", "may", "should", "will", "could", "intend", "estimate", "plan", "anticipate", "expect", "believe" or "continue", or the negative thereof or similar variations. The forward-looking statements in this news release include the statement related to the resumption of trading on the TSX Venture Exchange and the proposed terms of the Loan and entry into the Credit Agreement and other financing documents with the Loan. These statements are not guarantees of future performance and involve risks and uncertainties that are difficult to predict or are beyond GreenPower's control. A number of important factors, including those set forth in other public filings (filed under GreenPower's profile on www.sedar.com), could cause actual outcomes and results to differ materially from those expressed in these forward-looking statements. Consequently, readers should not place any undue reliance on such forward-looking statements. In addition, these forward-looking statements relate to the date on which they are made. GreenPower disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as required by applicable securities laws.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. All amounts are in US dollars © 2023 GreenPower Motor Company Inc. All rights reserved.

Exhibit 99.2

51-102F3

Material Change Report

Item 1 Name and Address of Company

GreenPower Motor Company Inc. (the “Company” or “GreenPower”)

#240 – 209 Carrall Street

Vancouver, BC V6B 2J2

Item 2 Date of Material Change

July 18, 2023

Item 3 News Release

The news release dated July 18, 2023 was disseminated through PR Newswire

Item 4 Summary of Material Change

The Company announced that the British Columbia Securities Commission and the Ontario Securities Commission have revoked a “failure to file” cease trade order in respect of GreenPower’s securities under Multilateral Instrument 11-103 Failure-to-File Cease Trade Orders in Multiple Jurisdictions (the “CTO”).

The CTO was issued as a result of GreenPower’s failure to file its audited financial statements, management’s discussion and analysis and related certifications for the year ended March 31, 2023 before the June 29, 2023 filing deadline. These documents were filed by GreenPower on SEDAR on July 14, 2023.

GreenPower is coordinating with the TSX Venture Exchange a resumption of trading as expeditiously as possible.

In addition, GreenPower announced that it has signed a non-binding term sheet with a lender (the “Lender”) for a secured term loan credit facility of up to US$15,000,000 (the “Loan”) for the purpose of working capital requirements to cover manufacturing costs of GreenPower’s existing sales pipeline. It is contemplated that certain subsidiaries of GreenPower will be guarantors of the Loan and that the Loan will be available for 12 months from the date of a credit agreement (the “Credit Agreement”) to be entered into between GreenPower and the Lender. It is also contemplated that the Loan will bear interest at the rate of U.S. prime plus the margin (5% p.a.) with a default interest rate of 2% above the pre-default rate of interest payable on demand, and that the Loan will be repayable in 36 substantially equal, consecutive, monthly installments commencing on the 20th day of the 13th month following the first advance, and amounts repaid will not be available for reborrowing. The Loan would be subordinate to GreenPower’s existing US$8 million line of credit and will be subject to an entry into the Credit Agreement, related financing documents, and other conditions customary for a loan of this type. There is no assurance that GreenPower will enter into the Credit Agreement with the Lender on the terms expected, or at all.

- 2 –

Item 5 Full Description of Material Change

5.1 Full Description of Material Change

See Item 4 above and in the News Release dated July 18, 2023 as filed on SEDAR at www.sedar.com for a full description of the material change.

5.2 Disclosure for Restructuring Transactions

Not applicable.

Item 6 Reliance on subsection 7.1(2) or (3) of National Instrument 51-102

Not applicable.

Item 7 Omitted Information

None.

Item 8 Executive Officer

Fraser Atkinson, CEO, Chairman and Director, (604) 220-8048

Item 9 Date of Report

July 18, 2023

.

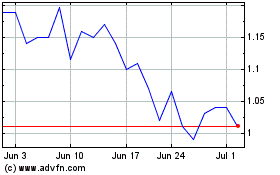

GreenPower Motor (NASDAQ:GP)

Historical Stock Chart

From Oct 2024 to Nov 2024

GreenPower Motor (NASDAQ:GP)

Historical Stock Chart

From Nov 2023 to Nov 2024