0000854560 False 0000854560 2024-10-16 2024-10-16 iso4217:USD xbrli:shares iso4217:USD xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM 8-K

_________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 16, 2024

_______________________________

GREAT SOUTHERN BANCORP, INC.

(Exact name of registrant as specified in its charter)

_______________________________

| Maryland | 0-18082 | 43-1524856 |

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

1451 East Battlefield

Springfield, Missouri 65804

(Address of Principal Executive Offices) (Zip Code)

(417) 887-4400

(Registrant's telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

_______________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

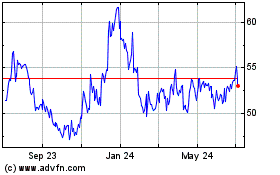

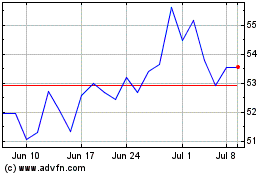

| Common Stock, par value $0.01 per share | GSBC | The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On October 16, 2024, Great Southern Bancorp, Inc. issued a press release reporting preliminary financial results for the quarter ended September 30, 2024. A copy of the press release, including unaudited financial information released as a part thereof, is attached as Exhibit 99.1 to this Current Report on Form 8-K and incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | GREAT SOUTHERN BANCORP, INC. |

| | | |

| | | |

| Date: October 16, 2024 | By: | /s/ Joseph W. Turner |

| | | Joseph W. Turner |

| | | President and Chief Executive Officer |

| | | |

EXHIBIT 99.1

Great Southern Bancorp, Inc. Reports Preliminary Third Quarter Earnings

of $1.41 Per Diluted Common Share

Preliminary Financial Results and Business Update for the Quarter and

Nine Months Ended September 30, 2024

SPRINGFIELD, Mo., Oct. 16, 2024 (GLOBE NEWSWIRE) -- Great Southern Bancorp, Inc. (NASDAQ:GSBC),

the holding company for Great Southern Bank, today reported that preliminary earnings for the three months ended September 30, 2024,

were $1.41 per diluted common share ($16.5 million net income) compared to $1.33 per diluted common share ($15.9 million net income)

for the three months ended September 30, 2023.

Preliminary earnings for the nine months ended September 30, 2024, were $3.99 per diluted common share

($46.9 million net income) compared to $4.52 per diluted common share ($54.7 million net income) for the nine months ended September

30, 2023.

For the quarter ended September 30, 2024, annualized return on average common equity was 11.10%, annualized

return on average assets was 1.11%, and annualized net interest margin was 3.42%, compared to 11.47%, 1.11% and 3.43%, respectively,

for the quarter ended September 30, 2023. For the nine months ended September 30, 2024, annualized return on average common equity was

10.83%, annualized return on average assets was 1.07%, and annualized net interest margin was 3.39%, compared to 13.15%, 1.28% and 3.66%,

respectively, for the nine months ended September 30, 2023.

Third Quarter 2024 Key Results:

- Significant or Non-Recurring Items:

During the three months ended September 30, 2024,

the Company reduced its non-performing assets by $12.7 million, primarily through the resolution by sale of three unrelated non-performing

assets. The Company recorded a gain on the sale of these foreclosed assets of $459,000 in the quarter ended September 30, 2024.

- Capital: The Company’s capital position remained strong as of September 30, 2024,

significantly exceeding the thresholds established by regulators. On a preliminary basis, as of September 30, 2024, the Company’s

Tier 1 Leverage Ratio was 11.0%, Common Equity Tier 1 Capital Ratio was 12.3%, Tier 1 Capital Ratio was 12.8%, and Total Capital Ratio

was 15.5%. Total stockholders’ equity increased $40.3 million in the nine months ended September 30, 2024, and the Company’s

tangible common equity to tangible assets ratio was 10.0% at September 30, 2024. Retained earnings increased $23.6 million during this

same nine-month period. See “Capital” section for additional information regarding the changes to total stockholders’

equity.

- Liquidity: The Company had secured borrowing line availability at the FHLBank and Federal

Reserve Bank of $1.12 billion and $305.0 million, respectively, at September 30, 2024. In addition, at September 30, 2024, the Company

had unpledged securities with a market value totaling $370.0 million, which could be pledged as collateral for additional borrowing capacity

at either the FHLBank or Federal Reserve Bank. Based partially on the foregoing, the Company believes it has ample sources of liquidity

as of September 30, 2024.

- Net Interest Income: Net interest income for the third quarter of 2024 increased $1.2

million (or approximately 2.6%) to $48.0 million compared to $46.7 million for the third quarter of 2023. Net interest margin was 3.42%

for the quarter ended September 30, 2024, compared to 3.43% for the quarter ended September 30, 2023. Net interest income and net interest

margin in the second quarter of 2024 were $46.8 million and 3.43%, respectively.

- Total Loans: Total outstanding loans, excluding mortgage loans held for sale, increased

$121.7 million, or 2.7%, from $4.59 billion at December 31, 2023, to $4.71 billion at September 30, 2024. This increase was primarily

in other residential (multi-family) loans with decreases in commercial construction loans, commercial business loans and one- to four-family

residential loans. As construction projects are completed, the loans either pay off or move to their respective loan categories, primarily

multi-family or commercial real estate.

- Asset Quality: Non-performing assets and potential problem loans totaled $13.7 million

at September 30, 2024, a decrease of $5.4 million from $19.1 million at December 31, 2023. At September 30, 2024, non-performing assets

were $7.7 million (0.13% of total assets), a decrease of $4.1 million from $11.8 million (0.20% of total assets) at December 31, 2023.

Non-performing assets decreased $12.7 million compared to June 30, 2024. The decrease in non-performing assets in the three months ended

September 30, 2024, was mainly due to the sale of two foreclosed assets and the payoff of a $2.4 million non-performing commercial real

estate loan. The Company experienced net charge-offs of $1.5 million in each of the three and nine months ended September 30, 2024. See

“Asset Quality” section for additional information regarding the changes to non-performing assets.

Great Southern President and CEO Joseph W. Turner commented, “Our third-quarter results reflect

solid earnings and a strong balance sheet, despite ongoing challenges in the broader economic and banking environment. We reported earnings

of $1.41 per diluted common share, or $16.5 million in net income, for the third quarter of 2024. This compares to $1.33 per diluted

common share, or $15.9 million in net income, for the third quarter of 2023 and $1.45 per diluted common share, or $17.0 million in net

income, for the second quarter of 2024. These results highlight our ability to maintain stability and deliver consistent performance

over the long term, even as we face ongoing macro pressures. I'm proud of our team for their focus on operational excellence and disciplined

approach to managing our business."

He continued, “Net interest income increased $1.2 million, or approximately 2.6%, to $48.0 million,

compared to $46.7 million for the third quarter of 2023. Our net interest margin was 3.42%, down slightly from 3.43% for both the second

quarter of 2024 and the third quarter of 2023. While market conditions have increased deposit costs, we've countered these headwinds

with higher yields on loans and securities. Recent interest rate cuts by the Federal Reserve may help moderate some of the upward pressure

on deposit costs, though we expect the full effects of these rate changes to become more apparent in the coming months.”

Turner remarked, “One of our important achievements this quarter was the significant reduction

in non-performing assets, which decreased by $12.7 million, bringing the total to $7.7 million, or 0.13% of total assets, at September

30, 2024. This reduction underscores our proactive management of credit risk and reflects the successful resolution of two key non-performing

assets. We did, however, record a $1.2 million provision for credit losses in the quarter, as a result of charge-offs and growth in the

loan portfolio. We do not believe this charge is indicative of broader portfolio concerns, however, and we continue to view the commercial

real estate loan market as a suitable option for potential growth."

He then noted, "Our total loan portfolio, excluding mortgage loans held for sale, has increased by $121.7

million, or 2.7%, since the end of 2023. This increase was driven primarily by growth in other residential (multi-family) loans, partially

offset by declines in construction loans, commercial business loans, and one- to-four-family residential loans, as some construction

projects were completed and transferred to other loan categories. At the end of the third quarter of 2024, our pipeline of loan commitments

and unfunded lines remained solid at more than $1.04 billion, despite a slight decrease from the previous quarter."

Regarding expenses, Turner noted, "Non-interest expenses decreased by $1.8 million, to $33.7 million,

compared to the third quarter of 2023. This reduction was primarily due to lower professional fees and gains from foreclosed asset sales."

In closing, Turner noted, "We view our capital position as very important and a strength of our Company.

Stockholders' equity increased by $40.3 million year to date, to $612.1 million, representing a tangible common equity ratio of 10.0%.

We continue to prioritize returning capital to our stockholders through dividends and strategic share repurchases. These actions reflect

our ongoing commitment to delivering long-term value to stockholders. Our performance in the third quarter underscores our ability to

navigate the challenges of the current interest rate environment while maintaining strong liquidity and capital positions. We remain

focused on prudent loan portfolio management, controlling deposit costs, and leveraging our strengths to deliver sustainable growth."

Selected Financial Data:

| (In thousands, except per share data) |

Three

Months Ended

September 30, |

|

Nine

Months Ended

September 30, |

| |

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Net interest income |

$ |

47,975 |

|

|

$ |

46,738 |

|

|

$ |

139,609 |

|

|

$ |

148,068 |

|

| Provision (credit) for credit losses on loans and unfunded commitments |

|

1,137 |

|

|

|

(1,195 |

) |

|

|

1,160 |

|

|

|

(2,140 |

) |

| Non-interest income |

|

6,992 |

|

|

|

7,852 |

|

|

|

23,631 |

|

|

|

23,510 |

|

| Non-interest expense |

|

33,717 |

|

|

|

35,557 |

|

|

|

104,548 |

|

|

|

104,738 |

|

| Provision for income taxes |

|

3,623 |

|

|

|

4,349 |

|

|

|

10,647 |

|

|

|

14,325 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

$ |

16,490 |

|

|

$ |

15,879 |

|

|

$ |

46,885 |

|

|

$ |

54,655 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings per diluted common share |

$ |

1.41 |

|

|

$ |

1.33 |

|

|

$ |

3.99 |

|

|

$ |

4.52 |

|

NET INTEREST INCOME

Net interest income for the third quarter of 2024 increased $1.2 million to $48.0 million, compared

to $46.7 million for the third quarter of 2023. Net interest margin was 3.42% in the third quarter of 2024, compared to 3.43% in the

same period of 2023 and the second quarter of 2024, a decrease of one basis point. In comparing the 2024 and 2023 third quarter periods,

the average yield on loans increased 52 basis points, the average yield on investment securities increased 26 basis points and the average

yield on other interest earning assets increased five basis points. The average rate on interest-bearing demand and savings deposits,

time deposits and brokered deposits increased 34 basis points, 65 basis points and seven basis points, respectively, in the three months

ended September 30, 2024 compared to the three months ended September 30, 2023. The average interest rate spread was 2.74% for the three

months ended September 30, 2024, compared to 2.79% for the three months ended September 30, 2023 and 2.77% for the three months ended

June 30, 2024. The ratio of average interest-earning assets to average interest-bearing liabilities was 126.8% in the three months ended

September 30, 2024, compared to 131.0% in the three months ended September 30, 2023 and 126.7% in the three months ended June 30, 2024.

Net interest income for the nine months ended September 30, 2024 decreased $8.5 million to $139.6 million,

compared to $148.1 million for the nine months ended September 30, 2023. Net interest margin was 3.39% in the nine months ended September

30, 2024, compared to 3.66% in the same period of 2023, a decrease of 27 basis points. The margin contraction primarily resulted from

increasing interest rates on all deposit types due to higher market interest rates and increased competition for deposits. In comparing

the 2024 and 2023 nine-month periods, the average yield on loans increased 47 basis points, the average yield on investment securities

increased 21 basis points and the average yield on other interest earning assets increased 35 basis points. The average rate on interest-bearing

demand and savings deposits, time deposits and brokered deposits increased 58 basis points, 125 basis points and 31 basis points, respectively,

in the nine months ended September 30, 2024, compared to the nine months ended September 30, 2023. The average interest rate spread was

2.72% for the nine months ended September 30, 2024, compared to 3.09% for the nine months ended September 30, 2023.

In October 2018, the Company entered into an interest rate swap transaction as part of its ongoing interest

rate management strategies to hedge the risk of its floating rate loans. The notional amount of the swap was $400 million with a contractual

termination date in October 2025. As previously disclosed by the Company, on March 2, 2020, the Company and its swap counterparty mutually

agreed to terminate this swap, effective immediately. The Company was paid $45.9 million, including accrued but unpaid interest, from

its swap counterparty as a result of this termination. This $45.9 million, less the accrued to date interest portion and net of deferred

income taxes, is reflected in the Company’s stockholders’ equity as part of Accumulated Other Comprehensive Income (AOCI)

and is being accreted to interest income on loans monthly through the original contractual termination date of October 6, 2025. The Company

recorded $2.0 million of interest income related to the swap in both the three months ended September 30, 2024 and the three months ended

September 30, 2023. The Company recorded $6.1 million of interest income related to the swap in both the nine months ended September

30, 2024 and the nine months ended September 30, 2023. The Company currently expects to have a sufficient amount of eligible variable

rate loans to continue to accrete this interest income ratably in future periods. If this expectation changes and the amount of eligible

variable rate loans decreases significantly, the Company may be required to recognize this interest income more rapidly.

In March 2022, the Company entered into another interest rate swap transaction as part of its ongoing

interest rate management strategies to hedge the risk of its floating rate loans. The notional amount of the swap was $300 million, with

a contractual termination date of March 1, 2024. Under the terms of the swap, the Company received a fixed rate of interest of 1.6725%

and paid a floating rate of interest equal to one-month USD-LIBOR (or the equivalent replacement USD-SOFR rate once the USD-LIBOR rate

ceased to be available). To the extent that the fixed rate exceeded one-month USD-LIBOR/SOFR, the Company received net interest settlements,

which were recorded as loan interest income. If one-month USD-LIBOR/SOFR exceeded the fixed rate of interest, the Company paid net settlements

to the counterparty and recorded those net payments as a reduction of interest income on loans. As this interest rate swap has reached

its contractual termination date of March 1, 2024, there have been no further interest income impacts related to this swap after that

date. The Company recorded a reduction of loan interest income related to this swap transaction of $1.9 million in the nine months ended

September 30, 2024. The Company recorded a reduction of loan interest income related to this swap transaction of $2.8 million and $7.5

million, respectively, in the three and nine months ended September 30, 2023.

In July 2022, the Company entered into two additional interest rate swap transactions as part of its

ongoing interest rate management strategies to hedge the risk of its floating rate loans. The notional amount of each swap is $200 million

with an effective date of May 1, 2023 and a termination date of May 1, 2028. Under the terms of one swap, the Company receives a fixed

rate of interest of 2.628% and pays a floating rate of interest equal to one-month USD-SOFR OIS. Under the terms of the other swap, the

Company receives a fixed rate of interest of 5.725% and pays a floating rate of interest equal to one-month USD-Prime. In each case,

the floating rate resets monthly and net settlements of interest due to/from the counterparty also occur monthly. To the extent the fixed

rate of interest exceeds the floating rate of interest, the Company receives net interest settlements, which are recorded as loan interest

income. If the floating rate of interest exceeds the fixed rate of interest, the Company pays net settlements to the counterparty and

records those net payments as a reduction of interest income on loans. The Company recorded a reduction of loan interest income related

to these swap transactions of $2.7 million in both the three months ended September 30, 2024 and the three months ended September 30,

2023. The Company recorded a reduction of loan interest income related to these swap transactions of $8.3 million in the nine months

ended September 30, 2024, compared to $4.4 million reduction of interest income in the 2023 nine-month period. At September 30, 2024,

the USD-Prime rate was 8.00% and the one-month USD-SOFR OIS rate was 5.16334%.

The Company’s net interest income in the third quarter of 2024 increased 2-3% compared to net

interest income in both the second quarter of 2024 and the third quarter of 2023. Net interest margin was consistent in each of the three

periods. The cost of deposits has been negatively impacted over several quarters by the high level of competition for deposits across

the industry and the lingering effects of liquidity events at several banks in March and April 2023. The Company also had a substantial

amount of time deposits maturing at relatively low rates after the second quarter of 2023, and these time deposits either renewed at

higher rates or left the Company, in the latter case requiring their replacement with other funding sources at then-current higher market

rates. Market rates for time deposits have recently declined as the FOMC has cut the federal funds rate by 50 basis points and signaled

further rate cuts may occur. As of September 30, 2024, time deposit maturities over the next 12 months were as follows: within three

months -- $537 million, with a weighted-average rate of 4.53%; within three to six months -- $507 million, with a weighted-average rate

of 4.07%; and within six to twelve months -- $145 million, with a weighted-average rate of 3.20%. Based on time deposit market rates

in September 2024, replacement rates for these maturing time deposits are likely to be approximately 3.50-4.20%.

For additional information on net interest income components, see the “Average Balances, Interest

Rates and Yields” tables in this release.

NON-INTEREST INCOME

For the quarter ended September 30, 2024, non-interest income decreased $860,000 to $7.0 million when

compared to the quarter ended September 30, 2023, primarily as a result of the following items:

- Overdraft and insufficient funds fees: Overdraft and insufficient funds fees decreased $710,000

compared to the prior-year quarter. This decrease was primarily due to the continuation of a multi-year trend whereby our customers are

choosing to forego authorizing payments of certain items which exceed their account balances, resulting in fewer overdrafts in checking

accounts and related fees.

- Point-of-sale and ATM fees: Point-of-sale and ATM fees decreased $257,000 compared to the prior-year

quarter primarily due to a portion of these transactions now being routed through channels with lower fees to us, which we expect will

continue in future periods.

- Net gains on loan sales: Net gains on loan sales increased $292,000 compared to the prior-year

quarter. The increase was partially due to an increase in balance of fixed-rate single-family mortgage loans sold during the third quarter

of 2024 compared to the third quarter of 2023. Fixed-rate single-family mortgage loans originated are generally subsequently sold in

the secondary market. The Company realized higher premiums on the sale of loans in the 2024 third quarter compared to the 2023 third

quarter, as market interest rates were more stable in the quarter ended September 30, 2024 compared to the quarter ended September 30,

2023.

For the nine months ended September 30, 2024, non-interest income increased $121,000 to $23.6 million

when compared to the nine months ended September 30, 2023, primarily as a result of the following items:

- Overdraft and insufficient funds fees: Overdraft

and insufficient funds fees decreased $2.1 million compared to the prior-year period, for the same reason noted in the quarterly comparison

above.

- Point-of-sale and ATM fees: Point-of-sale and ATM

fees decreased $966,000 compared to the prior-year period, for the same reason noted in the quarterly comparison above.

- Net gains on loan sales: Net gains on loan sales

increased $998,000 compared to the prior-year period, for the same reason noted in the quarterly comparison above.

- Other income: Other income increased $1.9 million

compared to the prior-year period. In the second quarter of 2024, the Company recorded $2.7 million of other income, net of expenses

and write-offs, related to the termination of the Master Agreement between the Company and a third-party software vendor for the conversion

of the Company’s core banking platform. This termination was previously disclosed in the Company’s Quarterly Report on Form

10-Q for the quarter ended March 31, 2024. This amount represented the elimination of certain deferred credits and other liabilities,

along with the write-off of certain capitalized hardware, software and other assets, that previously had been recorded as part of the

preparation to convert to the new core-banking platform.

NON-INTEREST EXPENSE

For the quarter ended September 30, 2024, non-interest expense decreased $1.8 million to $33.7 million

when compared to the quarter ended September 30, 2023, primarily as a result of the following items:

- Legal, Audit and Other Professional Fees: Legal, audit and other professional fees decreased

$1.0 million from the prior-year quarter, to $809,000. In the quarter ended September 30, 2024, the Company expensed a total of $39,000,

compared to $903,000 expensed in the quarter ended September 30, 2023, related to training and implementation costs for the intended

core systems conversion and professional fees to consultants engaged to support the Company’s proposed transition of core and ancillary

software and information technology systems.

- Expense on Other Real Estate Owned: Expense on other real estate owned decreased $598,000 from

the prior-year quarter, to a gain of $536,000 in the quarter ended September 30, 2024. In the third quarter of 2024, the Company recorded

a gain on foreclosed asset sales of $459,000 compared to $22,000 in the third quarter of 2023.

- Net occupancy expenses: Net occupancy expenses increased $409,000 from the prior-year quarter.

Various components of computer license and support expenses collectively increased by $369,000 in the third quarter of 2024 compared

to the third quarter of 2023.

For the nine months ended September 30, 2024, non-interest expense decreased $190,000 to $104.5 million

when compared to the nine months ended September 30, 2023, primarily as a result of the following items:

- Legal, Audit and Other Professional Fees: Legal, audit and other professional fees decreased

$1.1 million from the prior-year period, to $4.4 million. In the 2024 period, the Company expensed a total of $1.9 million, compared

to $2.7 million expensed in the 2023 period, related to training and implementation costs for the intended core systems conversion and

professional fees to consultants engaged to support the Company’s proposed transition of core and ancillary software and information

technology systems.

- Expense on Other Real Estate Owned: Expense on other real estate owned decreased $453,000 from

the prior-year period, to a gain of $190,000. In the 2024 period, the Company recorded a gain on foreclosed loan sales of $491,000 compared

to $41,000 in the 2023 period.

- Net occupancy expenses: Net occupancy expenses increased $960,000 from the prior-year period,

for the same reason noted in the quarterly comparison above.

- Salaries and employee benefits: Salaries and employee benefits increased $536,000, or 0.9%,

from the prior-year period. Much of this increase related to normal annual merit increases in various lending and operations areas.

The Company’s efficiency ratio for the quarter ended September 30, 2024, was 61.34% compared to

65.13% for the same quarter in 2023. The Company’s efficiency ratio for the nine months ended September 30, 2024, was 64.05% compared

to 61.04% for the same period in 2023. The Company’s ratio of non-interest expense to average assets was 2.27% and 2.38% for the

three- and nine-months ended September 30, 2024, respectively, compared to 2.49% and 2.45% for the three- and nine-months ended September

30, 2023, respectively. Average assets for the three months ended September 30, 2024, increased $249.6 million, or 4.4%, compared to

the three months ended September 30, 2023, and average assets for the nine months ended September 30, 2024, increased $139.6 million,

or 2.4%, compared to the nine months ended September 30, 2023. Both increases were primarily due to growth in net loans receivable and

available-for-sale securities.

INCOME TAXES

For the three months ended September 30, 2024 and 2023, the Company's effective tax rate was 18.0% and

21.5%, respectively. For the nine months ended September 30, 2024 and 2023, the Company's effective tax rate was 18.5% and 20.8%, respectively.

These effective rates were at or below the statutory federal tax rate of 21%, due primarily to the utilization of certain investment

tax credits and the Company’s tax-exempt investments and tax-exempt loans, which reduced the Company’s effective tax rate.

The Company’s effective tax rate may fluctuate in future periods as it is impacted by the level and timing of the Company’s

utilization of tax credits, the level of tax-exempt investments and loans, the amount of taxable income in various state jurisdictions

and the overall level of pre-tax income. State tax expense estimates continually evolve as taxable income and apportionment between states

are analyzed. The Company's effective income tax rate is currently generally expected to remain below the statutory federal tax rate

due primarily to the factors noted above. The Company currently expects its effective tax rate (combined federal and state) will be approximately

18.0% to 20.0% in future periods, primarily due to additional investment tax credits being utilized beginning in 2024.

CAPITAL

As of September 30, 2024, total stockholders’ equity was $612.1 million (10.1% of total assets),

equivalent to a book value of $52.40 per common share. Total stockholders’ equity at December 31, 2023, was $571.8 million (9.8%

of total assets), equivalent to a book value of $48.44 per common share. At September 30, 2024, the Company’s tangible common equity

to tangible assets ratio was 10.0%, compared to 9.7% at December 31, 2023. See “Non-GAAP Financial Measures.”

Included in stockholders’ equity at September 30, 2024 and December 31, 2023, were unrealized

losses (net of taxes) on the Company’s available-for-sale investment securities totaling $29.1 million and $40.5 million, respectively.

This change in net unrealized losses during the nine months ended September 30, 2024, primarily resulted from decreasing intermediate-term

market interest rates which generally increased the fair value of investment securities.

In addition, included in stockholders’ equity at September 30, 2024, were realized gains (net

of taxes) on the Company’s terminated cash flow hedge (interest rate swap), totaling $6.4 million. This amount, plus associated

deferred taxes, is expected to be accreted to interest income over the remaining term of the original interest rate swap contract, which

was to end in October 2025. At September 30, 2024, the remaining pre-tax amount to be recorded in interest income was $8.3 million. The

net effect on total stockholders’ equity over time will be no impact, as the reduction of this realized gain will be offset by

an increase in retained earnings (as the interest income flows through pre-tax income).

Also included in stockholders’ equity at September 30, 2024, was an unrealized loss (net of taxes)

on the Company’s two outstanding cash flow hedges (interest rate swaps) totaling $6.4 million. Increases in market interest rates

since the inception of these hedges have caused their fair values to decrease. The unrealized loss position on these swaps improved substantially

in the third quarter of 2024 due to a decline in market interest rates in the quarter.

As noted above, total stockholders' equity increased $40.3 million, from $571.8 million at December

31, 2023 to $612.1 million at September 30, 2024. Stockholders’ equity increased due to net income of $46.9 million in the nine-month

period ended September 30, 2024 and a $6.9 million increase in stockholders’ equity during that period due to stock option exercises.

Accumulated other comprehensive loss decreased $13.1 million during the nine months ended September 30, 2024, primarily due to increases

in the fair value of cash flow hedges and available-for-sale investment securities resulting from decreases in market interest rates.

Partially offsetting these increases were repurchases of the Company’s common stock during the nine months ended September 30,

2024 totaling $12.5 million and dividends declared on common stock during that period of $14.0 million.

The Company had unrealized losses on its portfolio of held-to-maturity investment securities, which

totaled $19.2 million at September 30, 2024, that were not included in its total capital balance. If these held-to-maturity unrealized

losses were included in capital (net of taxes), they would have decreased total stockholder’s equity by $14.6 million at September

30, 2024. This amount was equal to 2.4% of total stockholders’ equity of $612.1 million at September 30, 2024.

On a preliminary basis, as of September 30, 2024, the Company’s Tier 1 Leverage Ratio was 11.0%,

Common Equity Tier 1 Capital Ratio was 12.3%, Tier 1 Capital Ratio was 12.8%, and Total Capital Ratio was 15.5%.

On September 30,

2024, and on a preliminary basis, the Bank’s Tier 1 Leverage Ratio was 11.2%, Common Equity Tier 1 Capital Ratio was 12.9%, Tier

1 Capital Ratio was 12.9%, and Total Capital Ratio was 14.2%.

In December 2022, the Company’s Board of Directors authorized the purchase of an additional one

million shares of the Company’s common stock. As of September 30, 2024, a total of approximately 488,000 shares were available

in our stock repurchase authorization.

During the three months ended September 30, 2024, the Company repurchased 2,971 shares of its common

stock at an average price of $53.04, and the Company’s Board of Directors declared a regular quarterly cash dividend of $0.40 per

common share, which, combined, reduced stockholders’ equity by $4.8 million. During the nine months ended September 30, 2024, the

Company repurchased 239,933 shares of its common stock at an average price of $51.69, and the Company’s Board of Directors declared

regular quarterly cash dividends totaling $1.20 per common share, which, combined, reduced stockholders’ equity by $26.5 million.

LIQUIDITY AND DEPOSITS

Liquidity is a measure of the Company’s ability to generate sufficient cash to meet present and

future financial obligations in a timely manner. Liquid assets include cash, interest-bearing deposits with financial institutions and

certain investment securities and loans. As a result of the Company’s ability to generate liquidity primarily through liability

funding, management believes that the Company maintains overall liquidity sufficient to satisfy its depositors’ requirements and

meet its borrowers’ credit needs.

The Company’s primary sources of funds are customer deposits, FHLBank advances, other borrowings,

loan repayments, unpledged securities, proceeds from sales of loans and available-for-sale securities and funds provided from operations.

The Company utilizes some or all of these sources of funds depending on the comparative costs and availability at the time. The Company

has from time to time chosen not to pay rates on deposits as high as the rates paid by certain of its competitors and, when believed

to be appropriate, supplements deposits with less expensive alternative sources of funds.

At September 30, 2024, the Company had the following available secured lines and on-balance sheet liquidity:

| |

|

|

|

|

|

|

| |

|

|

September

30, 2024

|

|

| |

Federal Home Loan Bank line |

|

$ |

1,116.7 million |

|

|

| |

Federal Reserve Bank line |

|

$ |

305.0 million |

|

|

| |

Cash and cash equivalents |

|

$ |

208.4 million |

|

|

| |

Unpledged securities – Available-for-sale |

|

$ |

344.3 million |

|

|

| |

Unpledged securities – Held-to-maturity |

|

$ |

25.5 million |

|

|

| |

|

|

|

|

|

|

During the three months ended September 30, 2024, the Company’s total deposits increased $82.2

million. Interest-bearing checking balances increased $45.1 million (about 2.1%), primarily in certain money market accounts, partially

offset by decreases in NOW accounts, while non-interest-bearing checking balances decreased $13.5 million (about 1.6%). Time deposits

generated through the Company’s banking center and corporate services networks decreased $87.7 million (about 10.1%). Brokered

deposits increased $140.4 million (about 21.0%) through a variety of sources. The brokered deposits received during the three months

ended September 30, 2024 generally have a term of less than three months, so these funds may be able to be replaced at a lower interest

rate upon maturity, depending on market interest rates at the time.

During the nine months ended September 30, 2024, the Company’s total deposits decreased $24.2

million. Interest-bearing checking balances increased $19.7 million (about 0.9%) and non-interest-bearing checking balances decreased

$38.8 million (about 4.3%). Time deposits generated through the Company’s banking center and corporate services networks decreased

$141.6 million (about 15.3%). Brokered deposits increased $148.9 million (about 22.5%) through a variety of sources.

At September 30, 2024, the Company had the following deposit balances:

| |

|

|

September

30, 2024

|

|

| |

Interest-bearing checking |

|

$ |

2,236.1

million |

|

|

| |

Non-interest-bearing checking |

|

|

856.7 million |

|

|

| |

Time deposits |

|

|

794.2 million |

|

|

| |

Brokered deposits |

|

|

810.4 million |

|

|

| |

|

|

|

|

|

|

At September 30, 2024, the Company estimated that its uninsured deposits, excluding deposit accounts

of the Company’s consolidated subsidiaries, were approximately $668 million (14% of total deposits).

LOANS

Total net loans, excluding mortgage loans held for sale, increased $121.7 million, or 2.7%, from $4.59

billion at December 31, 2023 to $4.71 billion at September 30, 2024. This increase was primarily in other residential (multi-family)

loans ($628 million increase), partially offset by decreases in construction loans ($383 million decrease), commercial business loans

($91 million decrease) and one- to four-family residential loans ($52 million decrease). The pipeline of loan commitments increased in

the third quarter of 2024. The unfunded portion of construction loans remained significant, but continued to decline, in the third quarter

of 2024. As construction projects were completed, the related loans were either moved from the construction category to the appropriate

permanent loan categories or paid off.

For further information about the Company’s loan portfolio, please see the quarterly loan portfolio

presentation available on the Company’s Investor Relations website under “Presentations.”

Loan commitments and the unfunded portion of loans at the dates indicated were as follows (in thousands):

| |

|

September

30, 2024 |

|

June

30, 2024 |

|

March

31, 2024 |

|

December

31, 2023 |

|

December

31, 2022 |

|

December

31, 2021 |

| Closed non-construction loans

with unused available lines |

|

|

|

|

|

|

|

|

|

|

|

|

| Secured by real estate (one- to four-family) |

$ |

205,677 |

$ |

200,630 |

$ |

206,992 |

$ |

203,964 |

$ |

199,182 |

$ |

175,682 |

| Secured by real estate (not one- to four-family) |

|

— |

|

— |

|

— |

|

— |

|

— |

|

23,752 |

| Not secured by real estate – commercial business |

|

120,847 |

|

122,685 |

|

120,387 |

|

82,435 |

|

104,452 |

|

91,786 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Closed construction loans with unused available lines |

|

|

|

|

|

|

|

|

|

|

|

|

| Secured by real estate (one-to four-family) |

|

79,554 |

|

109,153 |

|

103,839 |

|

101,545 |

|

100,669 |

|

74,501 |

| Secured by real estate (not one-to four-family) |

|

477,741 |

|

570,621 |

|

680,149 |

|

719,039 |

|

1,444,450 |

|

1,092,029 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Loan commitments not closed |

|

|

|

|

|

|

|

|

|

|

|

|

| Secured by real estate (one-to four-family) |

|

20,622 |

|

21,698 |

|

20,410 |

|

12,347 |

|

16,819 |

|

53,529 |

| Secured by real estate (not one-to four-family) |

|

118,046 |

|

33,273 |

|

50,858 |

|

48,153 |

|

157,645 |

|

146,826 |

| Not secured by real estate – commercial business |

|

17,821 |

|

14,949 |

|

9,022 |

|

11,763 |

|

50,145 |

|

12,920 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

$ |

1,040,308 |

$ |

1,073,009 |

$ |

1,191,657 |

$ |

1,179,246 |

$ |

2,073,362 |

$ |

1,671,025 |

PROVISION FOR CREDIT LOSSES AND ALLOWANCE FOR CREDIT LOSSES

Management estimates the allowance balance using relevant available information, from internal and external

sources, relating to past events, current conditions, and reasonable and supportable forecasts. Historical credit loss experience provides

the basis for the estimation of expected credit losses. Adjustments to historical loss information are made for differences in current

loan-specific risk characteristics such as changes in underwriting standards, portfolio mix, delinquency level or term, as well as for

changes in economic conditions, including but not limited to changes in the national unemployment rate, commercial real estate price

index, consumer sentiment, gross domestic product (GDP) and construction spending.

Challenging or worsening economic conditions from higher inflation or interest rates, COVID-19 and subsequent

variant outbreaks or similar events, global unrest or other factors may lead to increased losses in the portfolio and/or requirements

for an increase in provision expense. Management maintains various controls in an attempt to identify and limit future losses, such as

a watch list of problem loans and potential problem loans, documented loan administration policies and loan review staff to review the

quality and anticipated collectability of the portfolio. Additional procedures provide for frequent management review of the loan portfolio

based on loan size, loan type, delinquencies, financial analysis, ongoing correspondence with borrowers and problem loan workouts. Management

determines which loans are collateral-dependent, evaluates risk of loss and makes additional provisions to expense, if necessary, to

maintain the allowance at a satisfactory level.

During the quarter ended September 30, 2024, the Company recorded provision expense of $1.2 million

on its portfolio of outstanding loans. During the quarter ended September 30, 2023, the Company did not record a provision expense on

its portfolio of outstanding loans. During the nine months ended September 30, 2024, the Company recorded provision expense of $1.7 million

on its portfolio of outstanding loans, compared to $1.5 million in the nine months ended September 30, 2023. Total net charge-offs were

$1.5 million for the three months ended September 30, 2024, compared to net charge-offs of $99,000 in the three months ended September

30, 2023. Total net charge-offs were $1.5 million for the nine months ended September 30, 2024, compared to net charge-offs of $227,000

in the nine months ended September 30, 2023. For the three months ended September 30, 2024, the Company recorded a negative provision

for losses on unfunded commitments of $63,000, compared to a negative provision of $1.2 million for the three months ended September

30, 2023. For the nine months ended September 30, 2024, the Company recorded a negative provision for losses on unfunded commitments

of $540,000, compared to a negative provision of $3.6 million for the nine months ended September 30, 2023. General market conditions

and unique circumstances related to specific industries and individual projects contribute to the determination of the level of provisions

and charge-offs in each period.

The Bank’s allowance for credit losses as a percentage of total loans was 1.36%, 1.39% and 1.39%

at September 30, 2024, December 31, 2023 and June 30, 2024, respectively. Management considers the allowance for credit losses adequate

to cover losses inherent in the Bank’s loan portfolio at September 30, 2024, based on recent reviews of the Bank’s loan portfolio

and current economic conditions. If challenging economic conditions were to last longer than anticipated or deteriorate further or management’s

assessment of the loan portfolio were to change, additional credit loss provisions could be required, thereby adversely affecting the

Company’s future results of operations and financial condition.

ASSET QUALITY

At September 30, 2024, non-performing assets were $7.7 million, a decrease of $4.1 million from $11.8

million at December 31, 2023, and a decrease of $12.7 million from $20.4 million at June 30, 2024. Non-performing assets as a percentage

of total assets were 0.13% at September 30, 2024, compared to 0.20% at December 31, 2023. One loan relationship, totaling $9.3 million,

was transferred from non-performing loans to foreclosed assets held for sale in the three months ended June 30, 2024 and was sold during

the three months ended September 30, 2024. Another non-performing loan totaling $2.4 million was also resolved in the three months ended

September 30, 2024. As a result of changes in loan portfolio composition, changes in economic and market conditions and other factors

specific to a borrower’s circumstances, the level of non-performing assets will fluctuate.

Compared to December 31, 2023, non-performing loans decreased $4.3 million to $7.5 million at September

30, 2024. The majority of this decrease was in the non-performing commercial real estate loans category, which decreased $4.4 million

from December 31, 2023. Compared to June 30, 2024, non-performing loans decreased $3.5 million.

Compared to December 31, 2023, foreclosed assets increased $240,000 to $263,000 at September 30, 2024.

The majority of this increase was in the commercial real estate loans category, which increased $230,000 from December 31, 2023. Compared

to June 30, 2024, foreclosed assets decreased $9.2 million, primarily due to the sale of one asset noted previously.

Activity in the non-performing loans categories during the quarter ended September 30, 2024, was as

follows:

| |

|

Beginning

Balance,

July

1 |

|

Additions

to

Non-

Performing |

|

Removed

from

Non-

Performing |

|

Transfers

to

Potential

Problem

Loans |

|

Transfers

to

Foreclosed

Assets and

Repossessions |

|

Charge-

Offs |

|

Payments |

|

Ending

Balance,

September

30 |

| |

|

(In

thousands) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| One- to four-family

construction |

$ |

— |

$ |

— |

$ |

— |

|

$ |

— |

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

— |

| Subdivision construction |

|

— |

|

— |

|

— |

|

|

— |

|

— |

|

|

— |

|

|

— |

|

|

— |

| Land development |

|

— |

|

553 |

|

— |

|

|

— |

|

— |

|

|

— |

|

|

— |

|

|

553 |

| Commercial construction |

|

— |

|

— |

|

— |

|

|

— |

|

— |

|

|

— |

|

|

— |

|

|

— |

| One- to four-family residential |

|

1,147 |

|

41 |

|

(524 |

) |

|

— |

|

— |

|

|

— |

|

|

(71 |

) |

|

593 |

| Other residential (multi-family) |

|

— |

|

— |

|

— |

|

|

— |

|

— |

|

|

— |

|

|

— |

|

|

— |

| Commercial real estate |

|

9,764 |

|

287 |

|

— |

|

|

— |

|

(230 |

) |

|

(1,368 |

) |

|

(2,351 |

) |

|

6,102 |

| Commercial business |

|

— |

|

139 |

|

— |

|

|

— |

|

— |

|

|

— |

|

|

— |

|

|

139 |

| Consumer |

|

73 |

|

73 |

|

— |

|

|

— |

|

— |

|

|

(15 |

) |

|

(35 |

) |

|

96 |

| Total

non-performing loans |

$ |

10,984 |

$ |

1,093 |

$ |

(524 |

) |

$ |

— |

$ |

(230 |

) |

$ |

(1,383 |

) |

$ |

(2,457 |

) |

$ |

7,483 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

At September 30, 2024, the non-performing commercial real estate category included three loans, none

of which was added during the current quarter. The largest relationship in the category, which totaled $6.0 million, or 98.6% of the

total category, was added to non-performing loans during the second quarter of 2023 and is collateralized by an office building in Missouri.

The balance of this relationship was reduced by a charge-off of $1.2 million during the three months ended September 30, 2024. Another

loan, totaling $2.4 million, which was a purchased participation loan originally obtained through an FDIC-assisted acquisition, was collateralized

by a low-income assisted living facility in Wisconsin. During the third quarter of 2024, the Company initiated foreclosure on this collateral

through a sheriff’s sale. The Company was outbid at the sale by another party. Under the sale process in the State of Wisconsin,

the buyer has a short period of time to provide the balance of the sales proceeds to the court (10% of the sales price was placed with

the court as non-refundable funds and would be remitted to the Company should the buyer fail to complete the purchase). The judge has

signed the order confirming the sheriff’s sale, and we expect this transaction will be completed in October 2024. The non-performing

one- to four-family residential category included four loans. The largest relationship in the category totaled $525,000, or 88.6% of

the category, and was added in the second quarter of 2024. The land development category consisted of one loan added during the current

quarter. This loan is collateralized by improved commercial land in the Omaha, Neb. area. The non-performing consumer category included

six loans, three of which were added during the current quarter.

Potential problem loans decreased $1.4 million, to $6.0 million at September 30, 2024 from $7.4 million

at December 31, 2023. Compared to June 30, 2024, potential problem loans increased $385,000. The increase during the quarter was primarily

due to multiple loans totaling $502,000 being added to potential problem loans, partially offset by $51,000 in loan payments, $32,000

in loans moved to non-performing, $28,000 in charge-offs and $6,000 in loans removed from the potential problem category.

Activity in the potential problem loans category during the quarter ended September 30, 2024, was as

follows:

| |

|

Beginning

Balance,

July

1 |

|

Additions

to

Potential

Problem |

|

Removed

from

Potential

Problem |

|

Transfers

to

Non-

Performing |

|

Transfers

to

Foreclosed

Assets and

Repossessions |

|

Charge-

Offs |

|

Loan

Advances

(Payments) |

|

Ending

Balance,

September

30 |

| |

|

(In

thousands) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| One- to four-family

construction |

$ |

— |

$ |

— |

$ |

— |

|

$ |

— |

|

$ |

— |

$ |

— |

|

$ |

— |

|

$ |

— |

| Subdivision construction |

|

— |

|

— |

|

— |

|

|

— |

|

|

— |

|

— |

|

|

— |

|

|

— |

| Land development |

|

— |

|

— |

|

— |

|

|

— |

|

|

— |

|

— |

|

|

— |

|

|

— |

| Commercial construction |

|

— |

|

— |

|

— |

|

|

— |

|

|

— |

|

— |

|

|

— |

|

|

— |

| One- to four-family residential |

|

326 |

|

378 |

|

— |

|

|

(32 |

) |

|

— |

|

— |

|

|

(4 |

) |

|

668 |

| Other residential (multi-family) |

|

— |

|

— |

|

— |

|

|

— |

|

|

— |

|

— |

|

|

— |

|

|

— |

| Commercial real estate |

|

4,358 |

|

— |

|

— |

|

|

— |

|

|

— |

|

— |

|

|

(19 |

) |

|

4,339 |

| Commercial business |

|

208 |

|

— |

|

— |

|

|

— |

|

|

— |

|

— |

|

|

(15 |

) |

|

193 |

| Consumer |

|

713 |

|

124 |

|

(6 |

) |

|

— |

|

|

— |

|

(28 |

) |

|

(13 |

) |

|

790 |

| Total

potential problem loans |

$ |

5,605 |

$ |

502 |

$ |

(6 |

) |

$ |

(32 |

) |

$ |

— |

$ |

(28 |

) |

$ |

(51 |

) |

$ |

5,990 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

At September 30, 2024, the commercial real estate category of potential problem loans included three

loans, all of which are part of one relationship and were added during the second quarter of 2024. This relationship is collateralized

by three nursing care facilities located in southwest Missouri. The borrower’s business cash flow was negatively impacted by a

labor shortage and a decrease in Medicaid reimbursement during 2022-2023. Monthly payments were timely made prior to the transfer to

this category and have continued to be paid. The one- to four-family residential category of potential problem loans included seven loans,

three of which were added during the current quarter. The largest relationship in this category totaled $154,000, or 23.0% of the total

category. The commercial business category of potential problem loans included two loans. The largest relationship in this category totaled

$191,000, or 99.0% of the total category, and was added during the second quarter of 2024. The consumer category of potential problem

loans included 13 loans, five of which were added during the current quarter, including one home equity loan totaling $598,000 that is

related to the nursing care facility relationship noted above.

Activity in foreclosed assets and repossessions during the quarter ended September 30, 2024 was as follows:

| |

|

Beginning

Balance,

July

1 |

|

Additions |

|

ORE

and

Repossession

Sales |

|

Capitalized

Costs |

|

ORE

and

Repossession

Write-Downs |

|

Ending

Balance,

September

30 |

| |

|

(In

thousands) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| One-to four-family construction |

$ |

— |

$ |

— |

$ |

— |

|

$ |

— |

$ |

— |

$ |

— |

| Subdivision construction |

|

— |

|

— |

|

— |

|

|

— |

|

— |

|

— |

| Land development |

|

133 |

|

— |

|

(133 |

) |

|

— |

|

— |

|

— |

| Commercial construction |

|

— |

|

— |

|

— |

|

|

— |

|

— |

|

— |

| One- to four-family residential |

|

— |

|

— |

|

— |

|

|

— |

|

— |

|

— |

| Other residential (multi-family) |

|

9,279 |

|

— |

|

(9,279 |

) |

|

— |

|

— |

|

— |

| Commercial real estate |

|

— |

|

230 |

|

— |

|

|

— |

|

— |

|

230 |

| Commercial business |

|

— |

|

— |

|

— |

|

|

— |

|

— |

|

— |

| Consumer |

|

17 |

|

35 |

|

(19 |

) |

|

— |

|

— |

|

33 |

| Total

foreclosed assets and repossessions |

$ |

9,429 |

$ |

265 |

$ |

(9,431 |

) |

$ |

— |

$ |

— |

$ |

263 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

At September 30, 2024, the commercial real estate category of foreclosed assets consisted of one property

which was transferred from non-performing loans during the three months ended September 30, 2024, as indicated above, and was subsequently

sold in October 2024. The additions and sales in the consumer category were due to the volume of repossessions of automobiles, which

generally are subject to a shorter repossession process. The other residential (multi-family) category of foreclosed assets previously

included one property consisting of student housing in Texas, which was added during the three months ended June 30, 2024, as indicated

above. This property was sold in the three months ended September 30, 2024, with the Company realizing a gain of $300,000.

BUSINESS INITIATIVES

Since early 2022, Great Southern had been preparing to convert to a new core banking platform (New System)

to be delivered by a third-party vendor. As previously disclosed, the migration to the New System, originally scheduled for the

third quarter of 2023, was delayed to mid-2024. In addition, as also previously disclosed, certain contractual disputes arose between

Great Southern and the third-party vendor. While discussions were ongoing between the parties for an extended period of time, no

meaningful progress was made in resolving the contractual disputes.

The system migration efforts were beset by a variety of significant issues, including having missed

a second conversion date because of continued operational and system problems. Therefore, Great Southern took the following actions to

protect its interests. On April 24, 2024, Great Southern informed the third-party vendor that it was terminating the Master Agreement

between Great Southern and the third-party vendor in accordance with Great Southern’s rights under the Master Agreement. In addition,

on April 24, 2024, Great Southern initiated legal action against the third-party vendor by filing a complaint in the U.S. District Court

for the Western District of Missouri, Southern Division. The complaint seeks to recover damages caused by the third-party vendor’s

material breach of the Master Agreement, inability and/or inaction on the part of the third-party vendor to effectively and timely manage

the system migration, as well as the third-party vendor’s misrepresentations and omissions. The third-party vendor filed a counterclaim

alleging that Great Southern terminated the Master Agreement without cause and that Great Southern must pay an early termination fee

in an amount to be proven at trial. Great Southern denies the allegations in the third-party vendor's counterclaim and will vigorously

defend itself. The parties continue informal settlement discussions, but there is no guarantee that the parties will reach a mutually

agreed upon settlement to terminate the litigation.

Great Southern now expects to continue operations with its current core banking provider, which will

allow Great Southern to offer its full array of products and services.

In 2025, the banking center at Benton and Chestnut in Springfield, Mo. will be replaced with a newly-constructed

building on the same property at 723 N. Benton. Construction on the new building is anticipated to begin in the first quarter of 2025,

with completion in the fourth quarter of 2025. During construction, customers will be served in a temporary facility on the property.

The Company also has 11 other banking centers and an Express Center in Springfield.

Kris Conley, Chief Retail Banking Officer, will retire in December 2024 after a notable career at Great

Southern Bank. He joined the company in 1998 and has led the retail banking division since 2010. During his tenure, Great Southern expanded

from 30 banking centers, mainly in southwest Missouri, to 89 banking centers across six states. In early 2023, Conley announced his retirement

plans to facilitate a smooth transition, with Laura Smith named as his successor. Smith, who has been with Great Southern since 2003,

previously managed the Company’s investment services division.

Kelly Polonus, Chief Communications & Marketing Officer, will also retire in December 2024, concluding

a distinguished 41-year career in banking, including the last 22 years at Great Southern Bank. She announced her retirement in mid-2023

to ensure a seamless management transition. Succeeding Polonus will be Stacy Fender, who joined Great Southern in June 2024 after serving

18 years in communications and marketing roles at a regional healthcare system.

The Company will host a conference call on Thursday, October 17, 2024, at 2:00 p.m. Central Time to

discuss third quarter 2024 preliminary earnings. The call will be available live or in a recorded version at the Company’s Investor

Relations website, http://investors.greatsouthernbank.com. Participants may register for the call at https://register.vevent.com/register/BIcf52d5fdfdb24c6383d492e9d4e7b00b.

Headquartered in Springfield, Missouri, Great Southern offers a broad range of banking services to customers.

The Company operates 89 retail banking centers in Missouri, Iowa, Kansas, Minnesota, Arkansas and Nebraska and commercial lending offices

in Atlanta, Charlotte, Chicago, Dallas, Denver, Omaha, and Phoenix. The common stock of Great Southern Bancorp, Inc. is listed on the

Nasdaq Global Select Market under the symbol “GSBC.”

www.GreatSouthernBank.com

Forward-Looking Statements

When used in this press release and in other documents filed or furnished by Great Southern Bancorp,

Inc. (the “Company”) with the Securities and Exchange Commission (the “SEC”), in the Company's other press releases

or other public or stockholder communications, and in oral statements made with the approval of an authorized executive officer, the

words or phrases “may,” “might,” “could,” “should,” "will likely result," "are expected

to," "will continue," "is anticipated," “believe,” "estimate," "project," "intends" or similar expressions are intended to

identify "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements

also include, but are not limited to, statements regarding plans, objectives, expectations or consequences of announced transactions,

known trends and statements about future performance, operations, products and services of the Company. The Company’s ability to

predict results or the actual effects of future plans or strategies is inherently uncertain, and the Company’s actual results could

differ materially from those contained in the forward-looking statements.

Factors that could cause or contribute to such differences include, but are not limited to: (i) expected

revenues, cost savings, earnings accretion, synergies and other benefits from the Company's merger and acquisition activities might

not be realized within the anticipated time frames or at all, and costs or difficulties relating to integration matters, including but

not limited to customer and employee retention, might be greater than expected; (ii) changes in economic conditions, either nationally

or in the Company's market areas; (iii) the remaining effects of the COVID-19 pandemic on general economic and financial market conditions

and on public health; (iv) fluctuations in interest rates, the effects of inflation or a potential recession, whether caused by Federal

Reserve actions or otherwise; (v) the impact of bank failures or adverse developments at other banks and related negative press about

the banking industry in general on investor and depositor sentiment; (vi) slower economic growth caused by changes in energy prices,

supply chain disruptions or other factors; (vii) the risks of lending and investing activities, including changes in the level and direction

of loan delinquencies and write-offs and changes in estimates of the adequacy of the allowance for credit losses; (viii) the possibility

of realized or unrealized losses on securities held in the Company's investment portfolio; (ix) the Company's ability to access cost-effective

funding and maintain sufficient liquidity; (x) fluctuations in real estate values and both residential and commercial real estate market

conditions; (xi) the ability to adapt successfully to technological changes to meet customers' needs and developments in the marketplace;

(xii) the possibility that security measures implemented might not be sufficient to mitigate the risk of a cyber-attack or cyber theft,

and that such security measures might not protect against systems failures or interruptions; (xiii) legislative or regulatory changes

that adversely affect the Company's business; (xiv) changes in accounting policies and practices or accounting standards; (xv) results

of examinations of the Company and Great Southern Bank by their regulators, including the possibility that the regulators may, among

other things, require the Company to limit its business activities, change its business mix, increase its allowance for credit losses,

write-down assets or increase its capital levels, or affect its ability to borrow funds or maintain or increase deposits, which could

adversely affect its liquidity and earnings; (xvi) costs and effects of litigation, including settlements and judgments; (xvii) competition;

and (xviii) natural disasters, war, terrorist activities or civil unrest and their effects on economic and business environments in which

the Company operates. The Company wishes to advise readers that the factors listed above and other risks described in the Company’s

most recent Annual Report on Form 10-K, including, without limitation, those described under “Item 1A. Risk Factors,” subsequent

Quarterly Reports on Form 10-Q and other documents filed or furnished from time to time by the Company with the SEC (which are available

on our website at www.greatsouthernbank.com and the SEC’s website at www.sec.gov), could affect the Company's financial performance

and cause the Company's actual results for future periods to differ materially from any opinions or statements expressed with respect

to future periods in any current statements.

The Company does not undertake-and specifically declines any obligation- to publicly release the result

of any revisions which may be made to any forward-looking statements to reflect events or circumstances after the date of such statements

or to reflect the occurrence of anticipated or unanticipated events.

The following tables set forth selected consolidated financial information of the Company at the dates

and for the periods indicated. Financial data at all dates and for all periods is unaudited. In the opinion of management, all adjustments,

which consist only of normal recurring accrual adjustments, necessary for a fair presentation of the results at and for such unaudited

dates and periods have been included. The results of operations and other data for the three and nine months ended September 30, 2024

and 2023, and the three months ended June 30, 2024, are not necessarily indicative of the results of operations which may be expected

for any future period.

| |

|

September

30, 2024 |

|

|

December

31, 2023 |

| Selected Financial

Condition Data: |

(In

thousands) |

| |

|

|

|

|

|

| Total

assets |

$ |

6,036,521 |

|

$ |

5,812,402 |

| Loans

receivable, gross |

|

4,781,953 |

|

|

4,661,348 |

| Allowance

for credit losses |

|

64,915 |

|

|

64,670 |

| Other

real estate owned, net |

|

263 |

|

|

23 |

| Available-for-sale

securities, at fair value |

|

565,225 |

|

|

478,207 |

| Held-to-maturity

securities, at amortized cost |

|

189,257 |

|

|

195,023 |

| Deposits |

|

4,697,460 |

|

|

4,721,708 |

| Total

borrowings |

|

618,651 |

|

|

423,806 |

| Total

stockholders’ equity |

|

612,090 |

|

|

571,829 |

| Non-performing

assets |

|

7,746 |

|

|

11,771 |

| |

|

Three

Months Ended |

|

|

Nine

Months Ended |

|

|

Three

Months

Ended |

| |

|

September

30, |

|

|

September

30, |

|

|

June

30, |

| |

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

| |

|

(In

thousands) |

| Selected Operating Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest

income |

$ |

83,796 |

|

|

$ |

75,272 |

|

|

$ |

242,113 |

|

|

$ |

220,353 |

|

|

$ |

80,927 |

|

| Interest

expense |

|

35,821 |

|

|

|

28,534 |

|

|

|

102,504 |

|

|

|

72,285 |

|

|

|

34,109 |

|

| Net

interest income |

|

47,975 |

|

|

|

46,738 |

|

|

|

139,609 |

|

|

|

148,068 |

|

|

|

46,818 |

|

| Provision

(credit) for credit losses on loans and unfunded commitments |

|

1,137 |

|

|

|

(1,195 |

) |

|

|

1,160 |

|

|

|

(2,140 |

) |

|

|

(607 |

) |

| Non-interest

income |

|

6,992 |

|

|

|

7,852 |

|

|

|

23,631 |

|

|

|

23,510 |

|

|

|

9,833 |

|

| Non-interest

expense |

|

33,717 |

|

|

|

35,557 |

|

|

|

104,548 |

|

|

|

104,738 |

|

|

|

36,409 |

|

| Provision

for income taxes |

|

3,623 |

|

|

|

4,349 |

|

|

|

10,647 |

|

|

|

14,325 |

|

|

|

3,861 |

|

| Net

income |

$ |

16,490 |

|

|

$ |

15,879 |

|

|

$ |

46,885 |

|

|

$ |

54,655 |

|