- Fourth quarter revenue of $282.0 million, net income of

$19.1 million and Adjusted EBITDA of $67.8 million

- Record annual revenue of $1.1 billion, record annual net

income of $161.8 million and record annual Adjusted EBITDA of

$291.7 million

- Quarterly and annual financial performance for all operating

segments exceeded prior year

- Repaid $25.0 million of term loan borrowings and repurchased

$10.6 million of common stock in the quarter

Golden Entertainment, Inc. (NASDAQ: GDEN) (“Golden

Entertainment” or the “Company”) today reported financial results

for the fourth quarter and full year ended December 31, 2021.

Blake Sartini, Chairman and Chief Executive Officer of Golden

Entertainment, commented, “Our strong fourth quarter results

concluded a record year for Golden, as we successfully navigated

challenges to our operations throughout 2021. The improved

performance across our diverse operations drove our total annual

revenue to over $1 billion for the first time in history with full

year Adjusted EBITDA growing to $292 million, almost 60% higher

than full year 2019. For 2022, we are focused on maximizing our

operating performance and cash flow which will position the Company

to refinance its existing indebtedness and accelerate returning

capital to shareholders.”

Consolidated Results

The Company’s 2021 fourth quarter revenues of $282.0 million

rose 37% from $205.6 million for the 2020 fourth quarter. Net

income for the 2021 fourth quarter was $19.1 million, or $0.59 per

fully diluted share, compared to a net loss of $18.5 million, or a

loss of $0.66 per share, for the 2020 fourth quarter. Adjusted

EBITDA was $67.8 million for the 2021 fourth quarter, a 72%

increase from Adjusted EBITDA of $39.4 million for the 2020 fourth

quarter. Adjusted EBITDA margin was 24% for the 2021 fourth quarter

compared to 19% for the 2020 fourth quarter.

Full year 2021 revenues of $1.1 billion rose 58% from $694.2

million for the 2020 full year. Adjusted EBITDA of $291.7 million

for the 2021 full year, represents a 165% increase compared to

Adjusted EBITDA of $110.3 million for the 2020 full year. Adjusted

EBITDA margin was 27% for the 2021 full year compared to 16% for

the 2020 full year.

During the 2021 fourth quarter, the Company updated its segment

reporting and now presents results of its operations through four

reportable segments:

Nevada Casino Resorts: comprised of The STRAT Hotel,

Casino & SkyPod, Aquarius Casino Resort and Edgewater Hotel

& Casino Resort, as well as Colorado Belle Hotel & Casino

Resort whose operations remain closed.

Nevada Locals Casinos: comprised of Arizona Charlie’s

Boulder, Arizona Charlie’s Decatur, Gold Town Casino, Lakeside

Casino & RV Park and Pahrump Nugget Hotel Casino.

Maryland Casino Resort: comprised of the Rocky Gap Casino

Resort.

Distributed Gaming: comprised of all of the Company’s

distributed gaming operations in Nevada and Montana including its

branded taverns in Nevada.

Nevada Casino Resorts

Revenues for Nevada Casino Resorts were $104.5 million for the

2021 fourth quarter compared to $64.5 million for the 2020 fourth

quarter. Adjusted EBITDA was $36.6 million compared to $14.9

million for the 2020 fourth quarter. Adjusted EBITDA margin was 35%

for the 2021 fourth quarter compared to 23% for the 2020 fourth

quarter.

Full year 2021 revenues for Nevada Casino Resorts were $389.7

million compared to $250.6 million in 2020. Full year 2021 Adjusted

EBITDA was $149.1 million compared to $57.5 million in 2020.

Adjusted EBITDA margin was 38% in 2021 compared to 23% in 2020.

Nevada Locals Casinos

Revenues for Nevada Locals Casinos were $39.7 million for the

2021 fourth quarter compared to $33.1 million for the 2020 fourth

quarter. Adjusted EBITDA was $18.8 million compared to $14.2

million for the 2020 fourth quarter. Adjusted EBITDA margin was 47%

for the 2021 fourth compared to 43% for the 2020 fourth

quarter.

Full year 2021 revenues for Nevada Locals Casinos were $159.9

million compared to $113.0 million in 2020. Full year 2021 Adjusted

EBITDA was $80.0 million compared to $45.6 million in 2020.

Adjusted EBITDA margin was 50% compared to 40% in 2020.

Maryland Casino Resort

Revenues for Maryland Casino Resort were $19.2 million for the

2021 fourth quarter compared to $15.0 million for the 2020 fourth

quarter. Adjusted EBITDA was $5.9 million compared to $4.4 million

for the 2020 fourth quarter. Adjusted EBITDA margin was 31% for the

2021 fourth quarter compared to 29% for the 2020 fourth

quarter.

Full year 2021 revenues for Maryland Casino Resort were $78.2

million compared to $51.6 million in 2020. Full year 2021 Adjusted

EBITDA was $26.7 million compared to $15.1 million in 2020.

Adjusted EBITDA margin was 34% compared to 29% in 2020.

Distributed Gaming

Revenues for Distributed Gaming were $118.3 million for the 2021

fourth quarter compared to $93.0 million for the 2020 fourth

quarter. Adjusted EBITDA was $20.3 million compared to $14.0

million for the 2020 fourth quarter. Adjusted EBITDA margin was 17%

for the 2021 fourth quarter compared to 15% for the 2020 fourth

quarter.

Full year 2021 revenues for Distributed Gaming were $467.6

million compared to $278.3 million in 2020. Adjusted EBITDA was

$87.3 million compared to $27.0 million in 2020. Adjusted EBITDA

margin was 19% in 2021 compared to 10% in 2020.

Debt and Liquidity

As of December 31, 2021, the total principal amount of debt

outstanding was approximately $1 billion, consisting primarily of

$650 million in term loan borrowings outstanding under the

Company’s existing credit facility and $375 million of senior

unsecured notes. There are no outstanding borrowings under the

Company’s $240 million revolving credit facility. The Company

repaid $25 million of its outstanding term loan during the quarter

and repurchased $10.6 million of its common shares at an average

price of $46.87 per share. The Company currently has approximately

$40 million remaining under its current share repurchase

authorization. As of December 31, 2021, the Company had cash and

cash equivalents of $220.5 million.

Investor Conference Call and

Webcast

The Company will host a webcast and conference call today,

February 17, 2022, at 5:00 p.m. Eastern Time, to discuss the 2021

fourth quarter and full year results. The conference call may be

accessed live over the phone by dialing (844) 465-3054 or for

international callers by dialing (480) 685-5227; the passcode is

6388552. A replay will be available beginning at 8:00 p.m. Eastern

Time today and may be accessed by dialing (855) 859-2056 or (404)

537-3406 for international callers; the passcode is 6388552. The

replay will be available until February 20, 2022. The call will

also be webcast live through the “Investors” section of the

Company’s website, www.goldenent.com. A replay of the audio webcast

will also be archived on the Company’s website,

www.goldenent.com.

Forward-Looking

Statements

This press release contains forward-looking statements regarding

future events and the Company’s future results that are subject to

the safe harbors created under the Securities Act of 1933 and the

Securities Exchange Act of 1934. Forward-looking statements can

generally be identified by the use of words such as “anticipate,”

“believe,” “continue,” “could,” “estimate,” “expect,” “forecast,”

“intend,” “may,” “plan,” “project,” “potential,” “seek,” “should,”

“think,” “will,” “would” and similar expressions, or they may use

future dates. In addition, forward-looking statements in this press

release include, without limitation: statements regarding: the

Company’s strategies, objectives and business opportunities;

anticipated future growth and trends in the Company’s business or

key markets; projections of future financial condition, operating

results, income, capital expenditures, costs or other financial

items, including anticipated future cash generation and resulting

ability to continue to reduce leverage and to return capital to

shareholders; proposed refinancing of indebtedness; and other

characterizations of future events or circumstances as well as

other statements that are not statements of historical fact.

Forward-looking statements are based on the Company’s current

expectations and assumptions regarding its business, the economy

and other future conditions. These forward-looking statements are

subject to assumptions, risks and uncertainties that may change at

any time, and readers are therefore cautioned that actual results

could differ materially from those expressed in any forward-looking

statements. Factors that could cause the actual results to differ

materially include: the uncertainty of the extent, duration and

effects of the COVID-19 pandemic and the response of governments;

changes in national, regional and local economic and market

conditions; legislative and regulatory matters (including the cost

of compliance or failure to comply with applicable laws and

regulations); increases in gaming taxes and fees in the

jurisdictions in which the Company operates; the Company’s ability

to realize the anticipated cost savings, synergies and other

benefits of its casino and other acquisitions; litigation;

increased competition; the Company’s ability to renew its

distributed gaming contracts; reliance on key personnel (including

our Chief Executive Officer, President and Chief Financial Officer,

and Chief Operating Officer); the level of the Company’s

indebtedness and its ability to comply with covenants in its debt

instruments; terrorist incidents; natural disasters; severe weather

conditions (including weather or road conditions that limit access

to the Company’s properties); the effects of environmental and

structural building conditions; the effects of disruptions to the

Company’s information technology and other systems and

infrastructure; factors affecting the gaming, entertainment and

hospitality industries generally; and other risks and uncertainties

discussed in the Company’s filings with the SEC, including the

“Risk Factors” sections of the Company’s most recent Annual Report

on Form 10-K and Quarterly Reports on Form 10-Q. The Company

undertakes no obligation to update any forward-looking statements

as a result of new information, future developments or otherwise.

All forward-looking statements in this press release are qualified

in their entirety by this cautionary statement.

Non-GAAP Financial

Measures

To supplement the Company’s consolidated financial statements

presented in accordance with United States generally accepted

accounting principles (“GAAP”), the Company uses Adjusted EBITDA

because it is the primary metric used by its chief operating

decision makers and investors in measuring both the Company’s past

and future expectations of performance. Adjusted EBITDA provides

useful information to the users of the Company’s financial

statements by excluding specific expenses and gains that the

Company believes are not indicative of its core operating results.

Further, the Company’s annual performance plan used to determine

compensation for its executive officers and employees is tied to

the Adjusted EBITDA metric. It is also a measure of operating

performance widely used in the gaming industry.

The presentation of this additional information is not meant to

be considered in isolation or as a substitute for measures of

financial performance prepared in accordance with GAAP. In

addition, other companies in gaming industry may calculate Adjusted

EBITDA differently than the Company does.

The Company defines “Adjusted EBITDA” as earnings before

interest and other non-operating income (expense), income taxes,

depreciation and amortization, impairment of goodwill and

intangible assets, acquisition and severance expenses, preopening

and related expenses, gain or loss on disposal of assets,

share-based compensation expenses, change in non-cash lease

expense, change in fair value of derivative, and other non-cash

charges that are deemed to be not indicative of our core operating

results, calculated before corporate overhead (which is not

allocated to each reportable segment).

About Golden Entertainment,

Inc.

Golden Entertainment owns and operates a diversified

entertainment platform, consisting of a portfolio of gaming assets

that focus on casino and distributed gaming operations (including

gaming in the Company’s branded taverns). Golden Entertainment

operates over 16,900 slots, 120 table games, and 6,200 hotel rooms.

Golden Entertainment owns ten casinos – nine in Southern Nevada and

one in Maryland. Through its distributed gaming business in Nevada

and Montana, Golden Entertainment operates video gaming devices at

nearly 1,100 locations and owns over 60 traditional taverns in

Nevada. Golden Entertainment is also licensed in Illinois and

Pennsylvania to operate video gaming terminals. For more

information, visit www.goldenent.com.

Golden Entertainment, Inc.

Consolidated Statements of Operations (Unaudited, in

thousands, except per share data)

Three Months Ended December

31,

Year Ended December

31,

2021

2020

2021

2020

Revenues

Gaming

$

191,183

$

147,340

$

766,307

$

476,753

Food and beverage

44,802

31,681

167,815

112,081

Rooms

29,589

17,314

109,802

71,411

Other

16,384

9,293

52,619

33,910

Total revenues

281,958

205,628

1,096,543

694,155

Expenses

Gaming

106,719

85,570

416,197

275,041

Food and beverage

33,285

24,922

118,541

92,202

Rooms

13,419

10,283

48,632

39,935

Other operating

6,538

2,510

16,968

11,789

Selling, general and administrative

60,634

47,465

221,967

183,122

Depreciation and amortization

26,350

29,793

106,692

124,430

Loss (gain) on disposal of assets

513

(14

)

1,260

803

Preopening expenses

14

121

246

308

Impairment of goodwill and intangible

assets

—

6,092

—

33,964

Total expenses

247,472

206,742

930,503

761,594

Operating income (loss)

34,486

(1,114

)

166,040

(67,439

)

Non-operating expense

Other non-operating income

—

—

60,000

—

Interest expense, net

(15,101

)

(17,535

)

(62,853

)

(69,110

)

Loss on debt extinguishment and

modification

(216

)

—

(975

)

—

Change in fair value of derivative

—

—

—

(1

)

Total non-operating expense,

net

(15,317

)

(17,535

)

(3,828

)

(69,111

)

Income (loss) before income tax

(provision) benefit

19,169

(18,649

)

162,212

(136,550

)

Income tax (provision) benefit

(70

)

180

(436

)

(61

)

Net income (loss)

$

19,099

$

(18,469

)

$

161,776

$

(136,611

)

Weighted-average common shares

outstanding

Basic

29,035

28,186

28,709

28,080

Diluted

32,394

28,186

32,123

28,080

Net income (loss) per share

Basic

$

0.66

$

(0.66

)

$

5.64

$

(4.87

)

Diluted

$

0.59

$

(0.66

)

$

5.04

$

(4.87

)

Golden Entertainment, Inc.

Reconciliation of Adjusted EBITDA (Unaudited, in

thousands)

Three Months Ended December

31,

Year Ended December

31,

2021

2020

2021

2020

Revenues

Nevada Casino Resorts (1)

Gaming

$

44,733

$

30,483

$

179,793

$

114,571

Food and beverage

22,962

14,095

83,092

55,588

Rooms

25,517

14,469

94,952

61,070

Other

11,308

5,460

31,875

19,414

Nevada Casino Resorts revenue

$

104,520

$

64,507

$

389,712

$

250,643

Nevada Locals Casinos (2)

Gaming

$

29,311

$

24,697

$

120,537

$

82,522

Food and beverage

6,119

5,317

24,036

18,406

Rooms

2,206

1,306

7,626

5,598

Other

2,042

1,801

7,656

6,505

Nevada Locals Casinos revenues

$

39,678

$

33,121

$

159,855

$

113,031

Maryland Casino Resort (3)

Gaming

$

14,812

$

11,754

$

60,797

$

40,505

Food and beverage

2,065

1,363

7,932

4,669

Rooms

1,866

1,539

7,224

4,743

Other

432

310

2,202

1,719

Maryland Casino Resort revenues

$

19,175

$

14,966

$

78,155

$

51,636

Distributed Gaming (4)

Gaming

$

102,330

$

80,405

$

405,183

$

239,154

Food and beverage

13,656

10,906

52,755

33,418

Other

2,351

1,719

9,646

5,684

Distributed Gaming revenues

$

118,337

$

93,030

$

467,584

$

278,256

Corporate and other

248

4

1,237

589

Total Revenues

$

281,958

$

205,628

$

1,096,543

$

694,155

(1)

Comprised of The STRAT Hotel, Casino &

SkyPod, Aquarius Casino Resort, Edgewater Hotel & Casino Resort

and Colorado Belle Hotel & Casino Resort.

(2)

Comprised of Arizona Charlie’s Boulder,

Arizona Charlie’s Decatur, Gold Town Casino, Lakeside Casino &

RV Park and Pahrump Nugget Hotel Casino.

(3)

Comprised of the operations of the Rocky

Gap Casino Resort.

(4)

Comprised of Nevada Distributed Gaming,

Nevada Taverns and Montana Distributed Gaming.

Three Months Ended December

31,

Year Ended December

31,

(In thousands)

2021

2020

2021

2020

Adjusted EBITDA

Nevada Casino Resorts (1)

$

36,591

$

14,908

$

149,077

$

57,462

Nevada Locals Casinos (2)

18,775

14,248

80,005

45,610

Maryland Casino Resort (3)

5,866

4,395

26,697

15,094

Distributed Gaming (4)

20,324

14,035

87,276

26,952

Corporate and other

(13,776

)

(8,146

)

(51,337

)

(34,861

)

Total Adjusted EBITDA

$

67,780

$

39,440

$

291,718

$

110,257

Adjustments

Other non-operating income

$

—

$

—

$

60,000

$

—

Depreciation and amortization

(26,350

)

(29,793

)

(106,692

)

(124,430

)

Change in non-cash lease expense

(245

)

(589

)

(762

)

(1,344

)

Share-based compensation

(5,639

)

(2,115

)

(14,401

)

(9,637

)

(Loss) gain on disposal of assets

(513

)

14

(1,260

)

(803

)

Loss on debt extinguishment and

modification

(216

)

—

(975

)

—

Preopening and related expenses (5)

(14

)

(121

)

(246

)

(533

)

Acquisition and severance expenses

(35

)

(343

)

(228

)

(3,710

)

Impairment of goodwill and intangible

assets

—

(6,092

)

—

(33,964

)

Other, net

(498

)

(1,515

)

(2,089

)

(3,275

)

Interest expense, net

(15,101

)

(17,535

)

(62,853

)

(69,110

)

Change in fair value of derivative

—

—

—

(1

)

Income tax (provision) benefit

(70

)

180

(436

)

(61

)

Net income (loss)

$

19,099

$

(18,469

)

$

161,776

$

(136,611

)

(1)

Comprised of The STRAT Hotel, Casino &

SkyPod, Aquarius Casino Resort, Edgewater Hotel & Casino Resort

and Colorado Belle Hotel & Casino Resort.

(2)

Comprised of Arizona Charlie’s Boulder,

Arizona Charlie’s Decatur, Gold Town Casino, Lakeside Casino &

RV Park and Pahrump Nugget Hotel Casino.

(3)

Comprised of the operations of the Rocky

Gap Casino Resort.

(4)

Comprised of Nevada Distributed Gaming,

Nevada Taverns and Montana Distributed Gaming.

(5)

Preopening and related expenses consist of

labor, food, utilities, training, initial licensing, rent and

organizational costs incurred in connection with the opening of

tavern and casino locations.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220217005842/en/

Golden Entertainment, Inc. Charles H. Protell President and

Chief Financial Officer (702) 893-7777

Investor Relations Richard Land JCIR (212) 835-8500 or

gden@jcir.com

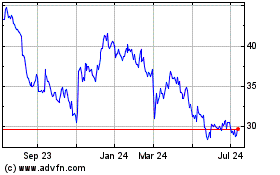

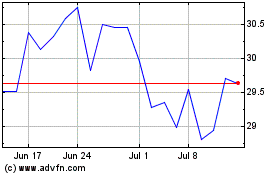

Golden Entertainment (NASDAQ:GDEN)

Historical Stock Chart

From Oct 2024 to Nov 2024

Golden Entertainment (NASDAQ:GDEN)

Historical Stock Chart

From Nov 2023 to Nov 2024