Gladstone Investment Corporation Launches Public Offering of 6.00% Notes

August 05 2020 - 4:30PM

Gladstone Investment Corporation (Nasdaq: GAIN) (the “Company”)

today announced that on May 22, 2020 it filed a prospectus

supplement with the U.S. Securities and Exchange Commission (“SEC”)

for a continuous public offering of up to $350 million of its 6.00%

Notes due 2040 (the “Notes”) at an offering price of $25.00 per

share (the “Offering”). The Company is only offering up to $200

million aggregate principal amount of the Notes under the

prospectus supplement and intends to file a new shelf registration

statement on Form N-2 and a related prospectus supplement in order

to register and offer the entire aggregate principal amount of

Notes by July 2022. Of the $200 million in Notes offered under the

existing prospectus supplement, the Company expects up to $177

million in net proceeds, after payment of dealer manager fees and

selling commissions and estimated expenses of the Offering payable

by the Company, assuming all Notes are sold in the Offering.

Gladstone Securities, LLC, an affiliate of the Company (“Gladstone

Securities”), will serve as the Company’s exclusive dealer manager

in connection with the Offering. The Notes are being offered by

Gladstone Securities on a “reasonable best efforts” basis pursuant

to a Dealer Manager Agreement dated as of May 22, 2020, entered

into between the Company and Gladstone Securities (the “Dealer

Manager Agreement”).

The Company expects that the Offering will terminate on the date

that is the earlier of (1) July 1, 2025 (unless earlier terminated

or extended by our Board of Directors) and (2) the date on which

all $350 million of Notes offered are sold. There is currently no

public market for the Notes. The Company intends to apply to list

the Notes on Nasdaq or another national securities exchange within

one calendar year of the Termination Date, however, there can be no

assurance that a listing will be achieved in such timeframe, or at

all. We do not expect a public market to develop before the

Notes are listed on Nasdaq or another national securities exchange,

if at all.

The Offering is currently being conducted as a public offering

under the Company’s effective shelf registration statement, filed

with the SEC (File No. 333-232124), which became effective on July

24, 2019. Before you invest, you should read the prospectus in the

registration statement, the prospectus supplement, and other

documents that the Company has filed with the SEC for more complete

information about the Company or the Offering. You may access these

documents for free by visiting EDGAR on the SEC’s website at

www.SEC.gov. Alternatively, the Dealer Manager for the Offering,

Gladstone Securities, LLC, will arrange to mail you the prospectus

and prospectus supplement if you request one by calling toll-free

at (833) 849-5993 or sending a request to: Gladstone Securities,

LLC, 1521 Westbranch Drive, Suite 100 McLean, Virginia 22102, Attn:

John Kent.

Timbrel Capital, LLC is acting as National Accounts Manager on

the Offering and is a third party not affiliated with Gladstone

Securities LLC or the Company.

This communication shall not constitute an offer to sell or the

solicitation of an offer to buy nor shall there be any sale of

these securities in any state or other jurisdiction in which such

offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of any such state or

other jurisdiction.

About Gladstone Investment Corporation:

Gladstone Investment Corporation is a publicly traded business

development company that seeks to make secured debt and equity

investments in lower middle market businesses in the United States

in connection with acquisitions, changes in control and

recapitalizations. Information on the business activities of all

the Gladstone funds can be found at www.gladstonecompanies.com.

About Gladstone Securities, LLC:

Gladstone Securities, LLC (Member of FINRA/SIPC), our affiliated

broker dealer, is a boutique broker dealer that distributes certain

investment products through various participating broker dealers

and registered investment advisors. Gladstone Securities

serves as the dealer manager for Gladstone Investment Corporation,

Gladstone Land Corporation and Gladstone Commercial Corporation. In

addition to our Notes offering, Gladstone Securities also currently

serves as dealer manager for the Gladstone Commercial Corporation

$500 Million 6.0% Series F Cumulative Redeemable Preferred Stock

and the Gladstone Land Corporation $500 Million 6.0% Series C

Cumulative Redeemable Preferred Stock offerings. For more

information, call (833) 849-5993.

Forward-Looking Statements:

This press release contains statements as to the Company’s

intentions and expectations of the outcome of future events that

are forward-looking statements. You can identify these statements

by the fact that they do not relate strictly to historical or

current facts. Forward-looking statements are not guarantees of

future performance and involve known and unknown risks,

uncertainties and other factors that may cause the actual results

to differ materially from those anticipated at the time the

forward-looking statements are made. These statements relate to the

offering of the Notes, expected net proceeds and the anticipated

use of the net proceeds. No assurance can be given that the

transaction discussed above will be completed on the terms

described, or at all. Completion of the Offering on the terms

described are subject to numerous conditions, many of which are

beyond the control of the Company. The Company undertakes no

obligation to publicly update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise, except as required by law. For a description of

certain risks to which the Company is or may be subject, please

refer to the factors discussed under the captions “Forward-Looking

Statements” and “Risk Factors” and other similar headings included

in the Company’s filings with the SEC (accessible at

www.sec.gov).

Source: Gladstone Investment Corporation

Investor Relations Inquiries: Please visit

ir.gladstoneinvestment.com or +1-703-287-5893.

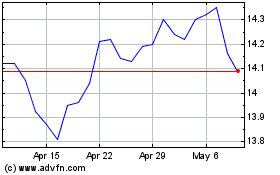

Gladstone Investment (NASDAQ:GAIN)

Historical Stock Chart

From Nov 2024 to Dec 2024

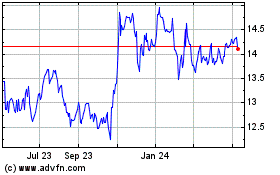

Gladstone Investment (NASDAQ:GAIN)

Historical Stock Chart

From Dec 2023 to Dec 2024