Gladstone Investment Corporation Prices Common Stock Offering

March 10 2015 - 9:21AM

Gladstone Investment Corporation (Nasdaq:GAIN) (the "Company")

today announced that it has entered into an agreement to sell

3,300,000 shares of its common stock at a public offering price of

$7.40 per share, raising $24.4 million in gross proceeds and $23.0

million in net proceeds after payment of underwriting discounts and

commissions and estimated expenses of the offering payable by the

Company. The Company has also granted the underwriters a 30-day

option to purchase up to 495,000 additional shares of common stock

on the same terms and conditions solely to cover over-allotments,

if any. The closing of the transaction is subject to customary

closing conditions and the shares are expected to be delivered on

March 13, 2015. Janney Montgomery Scott LLC, BB&T Capital

Markets, a division of BB&T Securities LLC, Ladenburg Thalmann

& Co. Inc., a subsidiary of Ladenburg Thalmann Financial

Services Inc. (NYSE MKT:LTS), and Wunderlich Securities, Inc. are

serving as the offering's joint book-running mangers and J.J.B.

Hilliard, W.L. Lyons, LLC, and Maxim Group LLC are serving as

co-managers.

The Company intends to use the net proceeds from this offering

to repay outstanding borrowings under its revolving credit

facility.

Investors are advised to carefully consider the

investment objectives, risks and charges and expenses of the

Company before investing. A prospectus supplement, dated March 10,

2015, which will be filed with the Securities and Exchange

Commission, and the accompanying prospectus, dated September 4,

2014, which has been filed with the Securities and Exchange

Commission, contain this and other information about the Company

and should be read carefully before investing.

The offering is being conducted as a public offering under the

Company's effective shelf registration statement filed with the

Securities and Exchange Commission (Registration No. 333-181879).

To obtain a copy of the prospectus supplement for this

offering and the accompanying prospectus, please contact: Janney

Montgomery Scott LLC, 60 State Street, Boston, MA 02109, Attention:

Equity Capital Markets Group or

prospectus@janney.com.

This communication shall not constitute an offer to sell or the

solicitation of an offer to buy nor shall there be any sale of

these securities in any state or other jurisdiction in which such

offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of any such state or

other jurisdiction.

Gladstone Investment Corporation is a publicly traded business

development company that seeks to make debt and equity investments

in small- and mid-sized businesses in the United States in

connection with acquisitions, changes in control and

recapitalizations. The Company has paid 116 consecutive monthly

cash distributions on its common stock. Information on the business

activities of all the Gladstone funds can be found at

www.gladstonecompanies.com.

CONTACT: For further information contact Investor Relations at (703) 287-5893.

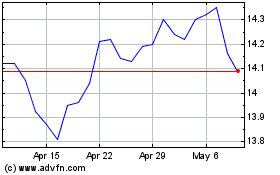

Gladstone Investment (NASDAQ:GAIN)

Historical Stock Chart

From Oct 2024 to Nov 2024

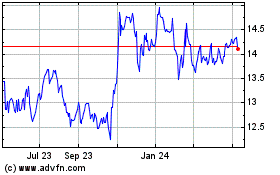

Gladstone Investment (NASDAQ:GAIN)

Historical Stock Chart

From Nov 2023 to Nov 2024