0001818331false00018183312024-02-202024-02-200001818331us-gaap:CommonClassAMember2024-02-202024-02-200001818331us-gaap:WarrantMember2024-02-202024-02-20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (date of earliest event reported): February 20, 2024

Commission file number 001-39482

GeneDx Holdings Corp.

(Exact name of registrant as specified in its charter)

| | | | | |

Delaware | 85-1966622 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| |

333 Ludlow Street, North Tower; 6th Floor Stamford, Connecticut 06902 |

| (Address of Principal Executive Offices) (Zip Code) |

Registrant's telephone number, including area code: (800) 298-6470

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Class A common stock, par value $0.0001 per share | | WGS | | The Nasdaq Stock Market LLC |

| Warrants to purchase one share of Class A common stock, each at an exercise price of $379.50 per share | | WGSWW | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On February 20, 2024, GeneDx Holdings Corp. (the “Company”) issued a press release (the “Press Release”) and will hold a conference call announcing the Company's financial results for the year ended December 31, 2023. Copies of the Press Release and Earnings Presentation are furnished as Exhibits 99.1 and 99.2, respectively, to this Current Report on Form 8-K.

The information furnished with this Item 2.02, including Exhibits 99.1 and 99.2 hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any other filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | |

Exhibit No | Description |

99.1 | |

99.2 | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| GENEDX HOLDINGS CORP. |

| |

| Date: February 20, 2024 | By: | /s/ Katherine Stueland |

| Name: | Katherine Stueland |

| Title: | Chief Executive Officer |

GeneDx Reports Fourth Quarter and Full Year 2023 Financial Results and Issues Guidance for Full Year 2024

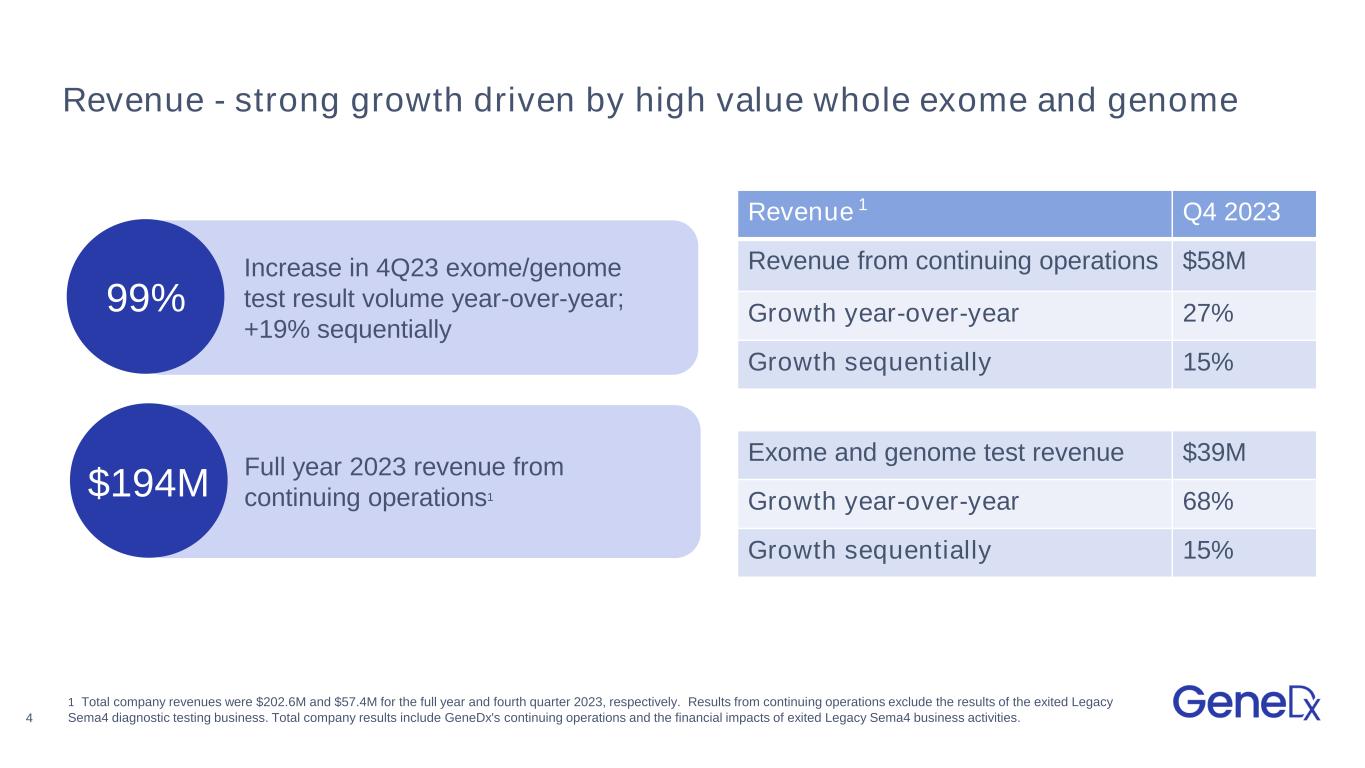

Reported fourth quarter 2023 revenue from continuing operations1 of $58.1M with more than 68% year-over-year growth of exome and genome test revenue

Expanded fourth quarter 2023 adjusted gross margins2 from continuing operations to 56%

Narrowed fourth quarter 2023 adjusted net loss2 to $17.8M and delivered 51% year-over-year cash burn reduction

Issued guidance to deliver between $220M and $230M in FY 2024 revenue and reiterate path to profitability in 2025

GeneDx to host conference call today at 4:30 p.m. ET

STAMFORD, Conn., February 20, 2024 — GeneDx Holdings Corp. (Nasdaq: WGS), a leader in delivering improved health outcomes through genomic and clinical insights, today reported its financial results for the fourth quarter and full year of 2023.

“Our strong fourth quarter results were a product of our relentless focus on exome and genome revenue growth, uplift from gross margin expansion, and continued efforts to meaningfully reduce our cash burn” said Katherine Stueland, Chief Executive Officer of GeneDx. “With our focus and disciplined approach to delivering on our goals in 2024, we are confident in our ability to continue to execute and reach profitability in 2025.”

Fourth Quarter and Full Year 2023 Financial Results (Unaudited)1,2,3

Revenues

Fourth quarter 2023:

•Revenues from continuing operations grew to $58.1 million, an increase of 27% year-over-year and 15% sequentially.

◦Total company revenues were $57.4 million.

•Exome and genome test revenue grew to $39.2 million, an increase of 68% year-over-year and 15% sequentially.

Full year 2023:

•Revenues from continuing operations grew to $194.4 million, an increase of 59% year-over-year and 14% year-over-year on a pro-forma basis3.

◦Total company revenues were $202.6 million.

•Exome and genome test revenue grew to $124.3 million, an increase of 43% year-over-year on a pro-forma basis3.

Exome and genome volume

Fourth quarter 2023:

•Exome and genome test results volume grew to 15,663, an increase of 99% year-over-year and 19% sequentially.

•Exome and genome represented 27% of all test results, up from 16% in the fourth quarter of 2022 and up from 23% in the third quarter of 2023.

Full year 2023:

•Exome and genome test results volume grew to 49,439, an increase of 62% year-over-year on a pro-forma basis3.

•Exome and genome represented 22% of all test results, up from 17% for the full year 2022 on a pro-forma basis3.

Gross margin

Fourth quarter 2023:

•Adjusted gross margin from continuing operations expanded to 56%, up from 41% in the fourth quarter of 2022 and up from 48% in the third quarter of 2023.

◦Total company gross margin was 53.6%.

•Exome and genome adjusted gross margin operated in excess of 60%.

Full year 2023:

•Adjusted gross margin from continuing operations expanded to 45%, up from 39% for full year 2022.

◦Total company gross margin was 44.4%.

•Exome and genome adjusted gross margin operated in excess of 60%.

Operating expenses

Fourth quarter 2023:

•Adjusted total operating expenses reduced to $48.3 million, a decrease of 36% year-over-year.

◦Total GAAP operating expenses were $54.4 million.

Full year 2023:

•Adjusted total operating expenses reduced to $216.3 million, a decrease of 33% year-over-year.

◦Total GAAP operating expenses were $253.0 million.

Net loss

Fourth quarter 2023:

•Adjusted net loss narrowed to $17.8 million, an improvement of 76% year-over-year and 16% sequentially.

◦GAAP net loss was $25.8 million.

Full year 2023:

•Adjusted net loss narrowed to $126.3 million, an improvement of 53% year-over-year.

◦GAAP net loss was $175.8 million.

Cash burn and cash position

•Excluding one-time items, representative continuing operations cash burn was $23.9 million in the fourth quarter of 2023. Total net use of cash, excluding net financing proceeds, was $32.9 million in the fourth quarter of 2023, an improvement of 51% year-over-year and 22% sequentially. The use of cash in the fourth quarter included $5 million in scheduled payments under the Legacy Sema4 payer settlement entered into in 2022, $3 million to discharge operating payables for the exited reproductive health business and $1 million in severance payments related to the previously announced cost reduction initiative.

•Cash, cash equivalents, marketable securities and restricted cash was $131.1 million as of December 31, 2023.

1Revenue and gross margin results from continuing operations, which we believe are representative of our ongoing business strategy exclude any revenue and cost of goods sold of the exited Legacy Sema4 diagnostic testing business. Total company results include GeneDx’s continuing operations and the financial impacts of exited Legacy Sema4 business activities.

2Adjusted gross margin, adjusted total operating expenses and adjusted net loss are non-GAAP financial measures. See appendix for a reconciliation of GAAP to Non-GAAP figures presented.

3Volume and revenue comparison for full year 2022 are on a pro forma basis assuming Legacy GeneDx and the Company were combined for the entirety of 2022.

GeneDx Full Year 2024 Guidance

Management expects GeneDx to:

•Drive full year 2024 revenues between $220 and $230 million;

•Expand full year 2024 adjusted gross margin profile to at least 50%;

•Use $75 to $80 million of net cash for full year 2024;

•Turn profitable in 2025.

2023 Business Highlights

Driving sustainable growth and market leadership

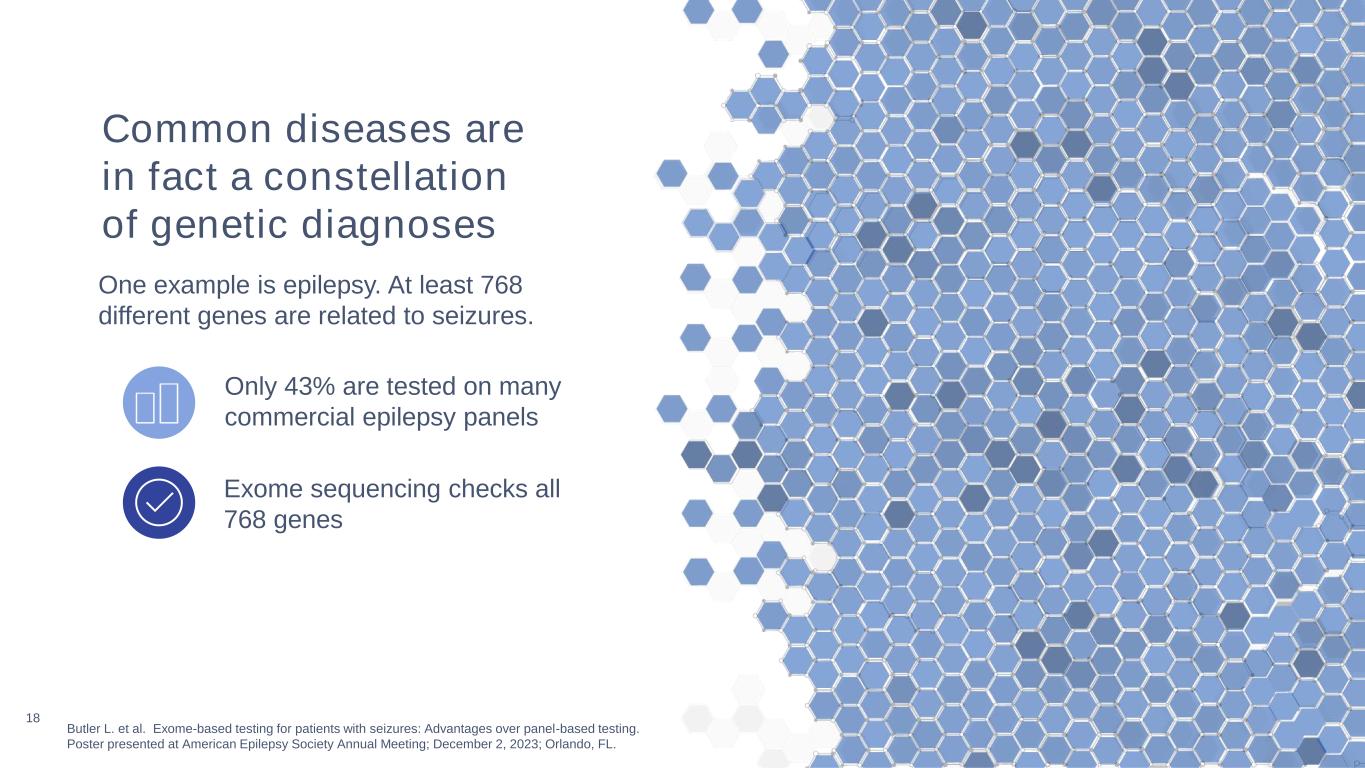

•Presented new data at the American Epilepsy Society Annual Meeting demonstrating that exome sequencing outperforms multi-gene panels for patients with epilepsy

•Announced that Genetics in Medicine, the official journal of the American College of Medical Genetics and Genomics (ACMG), published a peer-reviewed research analysis involving GeneDx that concluded that variants of unknown significance (VUS) are reported more frequently on multi-gene panels than exome and genome sequencing

•Reached a milestone of over 1,000 publications in peer-reviewed journals, demonstrating GeneDx’s leadership in furthering scientific discoveries and innovation in the commercial laboratory space

•Worked closely with state Medicaid programs, including Florida, Arizona, and Utah, to expand coverage of rapid genetic testing in the NICU

•Announced partnership program with the New York Center for Rare Diseases (NYCRD) at Montefiore, PacBio and Google Health to deliver genetic diagnoses for Bronx families living with rare diseases

•Continued to support the GUARDIAN study, which continued to offer data and insights on the benefits and potential for genetic diagnoses through newborn screening – a retrospective analysis of GeneDx data showed that more than 20% of individuals could have identified their genetic disease, on average, 7 to 11 years sooner had they received genome sequencing at birth

•Launched research collaboration with the University of Washington and PacBio to study the capabilities of long-read whole genome sequencing (WGS) to increase diagnostic rates in pediatric patients with genetic conditions

•Refined the strategic direction for biopharma and partnerships efforts and aligned the team within the Commercial organization, offering enhanced integration between our testing and data businesses

•Evolved the management team to include Melanie Duquette as Chief Growth Officer and Eric Olivares as Chief Product Officer

Strengthening our financial health and path to profitability

•On October 30, 2023, the Company announced a continued strategic realignment of its organization to key priorities which included the elimination of approximately 50 positions impacted on August 23, 2023 and approximately 35 positions impacted on October 30, 2023. Together these actions reduced the size of the Company’s workforce by 10% from the total number that existed at the time of the August reduction in force. In total, the Company announced cost saving initiatives, including but not limited to these reductions in force, that are expected to amount to approximately $40 million in annual cost reduction.

•Entered into a new, five-year senior secured credit facility with Perceptive Advisors. The agreement provides access of up to $75 million, consisting of an initial tranche of $50 million, and a subsequent tranche for an additional $25 million, subject to certain timelines and other defined criteria.

◦Interest is payable in cash on the outstanding principal amount at a rate per annum equal to the sum of the applicable secured overnight financing rate (SOFR), plus 7.5%.

◦Under the terms of the agreement, Perceptive was issued warrants to purchase 800,000 shares of the Company’s Class A common stock on the closing date, with an exercise price equal to $3.18. Upon the borrowing of the subsequent tranche, Perceptive will be issued warrants to purchase an additional 400,000 shares of Class A common stock.

Webcast and Conference Call Details

GeneDx will host a conference call today, February 20, 2024, at 4:30 p.m. Eastern Time. Investors interested in listening to the conference call are required to register online. A live and archived webcast of the event will be available on the “Events” section of the GeneDx investor relations website at https://ir.genedx.com/.

Forward-Looking Statements

This press release contains certain forward-looking statements within the meaning of the federal securities laws, including statements regarding our future performance and our market opportunity, including our expected full year 2024 reported revenue guidance, our expectations regarding our adjusted gross margin profile in 2024, our use of net cash in 2024 and our turning profitable in 2025, the expected annual cost reduction from our cost savings initiatives. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this press release, including but not limited to: (i) our ability to implement business plans, goals and forecasts, and identify and realize additional opportunities, (ii) the risk of downturns and a changing regulatory landscape in the highly competitive healthcare industry, (iii) the size and growth of the market in which we operate, (iv) our ability to pursue our new strategic direction, and (vi) our ability to enhance our artificial intelligence tools that we use in our clinical interpretation platform. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, filed with the U.S. Securities and Exchange Commission (the “SEC”) on March 16, 2023 and other documents filed by us from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and we assume no obligation and do not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise. We do not give any assurance that we will achieve our expectations.

About GeneDx

GeneDx (Nasdaq: WGS) delivers personalized and actionable health insights to inform diagnosis, direct treatment and improve drug discovery. The company is uniquely positioned to accelerate the use of genomic and large-scale clinical information to enable precision medicine as the standard of care. GeneDx is at the forefront of transforming healthcare through its industry-leading exome and genome testing and interpretation, fueled by one of the world’s largest rare disease data sets. For more information, please visit genedx.com and connect with us on LinkedIn, Facebook, Twitter and Instagram.

Investor Relations Contact:

Investors@GeneDx.com

Media Contact:

Press@GeneDx.com

Volume and revenue in the table below include the combination of the Legacy GeneDx diagnostic business with the data and information business of Legacy Sema4.

Volume & Revenue

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 4Q23 | | 3Q23 | | 2Q23 | | 1Q23 | | 4Q22 | | 2023 YTD | | 2022 YTD1 |

| Volumes | | | | | | | | | | | | | |

| Whole exome, whole genome | 15,663 | | 13,216 | | 11,855 | | 8,705 | | 7,862 | | 49,439 | | 30,560 |

| Exome based panels | 2,606 | | 2,922 | | 3,472 | | 3,136 | | 3,013 | | 12,136 | | 11,767 |

| Hereditary cancer | 8,240 | | 8,556 | | 7,142 | | 7,120 | | 6,069 | | 31,058 | | 25,334 |

| Other individual gene tests and multi-gene disease panels | 31,086 | | 32,939 | | 32,459 | | 33,817 | | 31,891 | | 130,301 | | 112,711 |

| Total | 57,595 | | 57,633 | | 54,928 | | 52,778 | | 48,835 | | 222,934 | | 180,372 |

| | | | | | | | | | | | | |

| Revenue ($ millions) | | | | | | | | | | | | | |

| Whole exome, whole genome | $ | 39.2 | | | $ | 34.0 | | | $ | 28.7 | | | $ | 22.4 | | | $ | 23.3 | | | $ | 124.3 | | | $ | 86.8 | |

| Exome based panels | 1.7 | | | 1.7 | | | 2.0 | | | 2.1 | | | 2.0 | | | 7.5 | | | 9.1 | |

| Hereditary cancer | 5.5 | | | 4.5 | | | 3.8 | | | 4.3 | | | 4.4 | | | 18.1 | | | 14.4 | |

| Other individual gene tests and multi-gene disease panels | 9.5 | | | 8.9 | | | 8.6 | | | 10.6 | | | 14.2 | | | 37.6 | | | 53.0 | |

| Data information | 2.2 | | | 1.3 | | | 2.1 | | | 1.3 | | | 1.9 | | | 6.9 | | | 7.7 | |

| Total | $ | 58.1 | | | $ | 50.4 | | | $ | 45.2 | | | $ | 40.7 | | | $ | 45.8 | | | $ | 194.4 | | | $ | 171.0 | |

1Volume and revenue comparison for full year 2022 are on a pro forma basis as if Legacy GeneDx and the Company were combined for the entirety of 2022.

Unaudited Select Financial Information (in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

| | | | | | | | | | | |

| Three months ended December 31, 2023 | | Three months ended December 31, 2022 |

| GeneDx | | Legacy Sema4 | | Total | | GeneDx | | Legacy Sema4 | | Total |

| Revenue | $58,107 | | $(689) | | $57,418 | | $45,824 | | $15,526 | | $61,350 |

| Adjusted cost of services | 25,626 | | — | | 25,626 | | 27,000 | | 30,153 | | 57,153 |

| Adjusted gross profit (loss) | $32,481 | | $(689) | | $31,792 | | $18,824 | | $(14,627) | | $4,197 |

| Adjusted gross margin % | 55.9% | | (100.0)% | | 55.4% | | 41.1% | | (94.2)% | | 6.8% |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year ended December 31, 2023 | | Year ended December 31, 2022 |

| GeneDx | | Legacy Sema4 | | Total | | GeneDx | | Legacy Sema4 | | Total |

| Revenue | $194,376 | | $8,190 | | $202,566 | | $122,234 | | $112,460 | | $234,694 |

| Adjusted cost of services | 106,983 | | 2,305 | | 109,288 | | 74,213 | | 148,897 | | 223,110 |

| Adjusted gross profit (loss) | $87,393 | | $5,885 | | $93,278 | | $48,021 | | $(36,437) | | $11,584 |

| Adjusted gross margin % | 45.0% | | 71.9% | | 46.0% | | 39.3% | | (32.4)% | | 4.9% |

| | | | | | | | | | | | | | | | | |

| Three months ended September 30, 2023 |

| GeneDx | | Legacy Sema4 | | Total |

| Revenue | $50,350 | | $2,953 | | $53,303 |

| Adjusted cost of services | 26,079 | | 225 | | 26,304 |

| Adjusted gross profit (loss) | $24,271 | | $2,728 | | $26,999 |

| Adjusted gross margin % | 48.2% | | 92.4% | | 50.7% |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the three months ended December 31, 2023 |

| Reported | | Depreciation and amortization | | Stock-based compensation expense | | Restructuring costs | | Change in FV of financial liabilities | | Charges related to business exit | | Other | | Adjusted |

| Diagnostic test revenue | $ | 55,214 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | 55,214 | |

| Other revenue | 2,204 | | | — | | | — | | | — | | | — | | | — | | | — | | | 2,204 | |

| Total revenue | 57,418 | | | — | | | — | | | — | | | — | | | — | | | — | | | 57,418 | |

| Cost of services | 26,664 | | | (915) | | | (123) | | | — | | | — | | | — | | | — | | | 25,626 | |

| Gross profit (loss) | 30,754 | | | 915 | | | 123 | | | — | | | — | | | — | | | — | | | 31,792 | |

| Gross margin | 53.6 | % | | | | | | | | | | | | | | 55.4 | % |

| | | | | | | | | | | | | | | |

| Research and development | 12,248 | | | (919) | | | 2,320 | | | (1,300) | | | — | | | — | | | — | | | 12,349 | |

| Selling and marketing | 15,559 | | | (1,225) | | | 1,071 | | | (487) | | | — | | | — | | | — | | | 14,918 | |

| General and administrative | 26,626 | | | (3,035) | | | (2,356) | | | (197) | | | — | | | — | | | — | | | 21,038 | |

| Impairment loss | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| Other, net | 1,964 | | | — | | | — | | | — | | | — | | | (1,277) | | | — | | | 687 | |

| | | | | | | | | | | | | | | |

| Loss from operations | (25,643) | | | 6,094 | | | (912) | | | 1,984 | | | — | | | 1,277 | | | — | | | (17,200) | |

| | | | | | | | | | | | | | | |

| Interest income (expense), net | (978) | | | — | | | — | | | — | | | — | | | — | | | — | | | (978) | |

| Other income (expense), net | 437 | | | — | | | — | | | — | | | (485) | | | — | | | 48 | | | — | |

| Income tax benefit | 411 | | | — | | | — | | | — | | | — | | | — | | | — | | | 411 | |

| Net loss | $ | (25,773) | | | $ | 6,094 | | | $ | (912) | | | $ | 1,984 | | | $ | (485) | | | $ | 1,277 | | | $ | 48 | | | $ | (17,767) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the three months ended December 31, 2022 |

| Reported | | Depreciation and amortization | | Stock-based compensation expense | | Restructuring costs | | Change in FV of financial liabilities | | Charges related to business exit | | | | Adjusted |

| Diagnostic test revenue | $ | 59,345 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | | | $ | 59,345 | |

| Other revenue | 2,005 | | | — | | | — | | | — | | | — | | | — | | | | | 2,005 | |

| Total revenue | 61,350 | | | — | | | — | | | — | | | — | | | — | | | | | 61,350 | |

| Cost of services | 77,676 | | | (19,993) | | | (412) | | | (118) | | | — | | | — | | | | | 57,153 | |

| Gross profit (loss) | (16,326) | | | 19,993 | | | 412 | | | 118 | | | — | | | — | | | | | 4,197 | |

| Gross margin | (26.6) | % | | | | | | | | | | | | | | 6.8 | % |

| | | | | | | | | | | | | | | |

| Research and development | 24,366 | | | (9,149) | | | 937 | | | (892) | | | — | | | — | | | | | 15,262 | |

| Selling and marketing | 29,236 | | | (1,226) | | | 324 | | | (3,476) | | | — | | | — | | | | | 24,858 | |

| General and administrative | 43,209 | | | (3,672) | | | (1,271) | | | (2,770) | | | — | | | — | | | | | 35,496 | |

| Impairment loss | 210,145 | | | — | | | — | | | — | | | — | | | (210,145) | | | | | — | |

| Other, net | 1,600 | | | — | | | — | | | — | | | — | | | — | | | | | 1,600 | |

| | | | | | | | | | | | | | | |

| Loss from operations | (324,882) | | | 34,040 | | | 422 | | | 7,256 | | | — | | | 210,145 | | | | | (73,019) | |

| | | | | | | | | | | | | | | |

| Interest income (expense), net | 333 | | | — | | | — | | | — | | | — | | | — | | | | | 333 | |

| Other income (expense), net | 15,878 | | | — | | | — | | | — | | | (15,878) | | | — | | | | | — | |

| Income tax benefit | (90) | | | — | | | — | | | — | | | — | | | — | | | | | (90) | |

| Net loss | $ | (308,761) | | | $ | 34,040 | | | $ | 422 | | | $ | 7,256 | | | $ | (15,878) | | | $ | 210,145 | | | | | $ | (72,776) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the year ended December 31, 2023 |

| Reported | | Depreciation and amortization | | Stock-based compensation expense | | Restructuring costs | | Change in FV of financial liabilities | | Charges related to business exit | | Other | | Adjusted |

| Diagnostic test revenue | $ | 195,654 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | 195,654 | |

| Other revenue | 6,912 | | | — | | | — | | | — | | | — | | | — | | | — | | | 6,912 | |

| Total revenue | 202,566 | | | — | | | — | | | — | | | — | | | — | | | — | | | 202,566 | |

| Cost of services | 112,560 | | | (4,350) | | | 1,217 | | | (139) | | | — | | | — | | | — | | | 109,288 | |

| Gross profit (loss) | 90,006 | | | 4,350 | | | (1,217) | | | 139 | | | — | | | — | | | — | | | 93,278 | |

| Gross margin | 44.4 | % | | | | | | | | | | | | | | 46.0 | % |

| | | | | | | | | | | | | | | |

| Research and development | 58,266 | | | (6,710) | | | 2,585 | | | (3,176) | | | — | | | — | | | — | | | 50,965 | |

| Selling and marketing | 60,956 | | | (4,902) | | | 1,266 | | | (1,371) | | | — | | | — | | | — | | | 55,949 | |

| General and administrative | 133,755 | | | (17,772) | | | (4,742) | | | (1,846) | | | — | | | — | | | — | | | 109,395 | |

| Impairment loss | 10,402 | | | — | | | — | | | — | | | — | | | (10,402) | | | — | | | — | |

| Other, net | 7,223 | | | — | | | — | | | — | | | — | | | (1,957) | | | — | | | 5,266 | |

| | | | | | | | | | | | | | | |

| Loss from operations | (180,596) | | | 33,734 | | | (326) | | | 6,532 | | | — | | | 12,359 | | | — | | | (128,297) | |

| | | | | | | | | | | | | | | |

| Interest income (expense), net | 1,114 | | | — | | | — | | | — | | | — | | | — | | | — | | | 1,114 | |

| Other income (expense), net | 2,789 | | | — | | | — | | | — | | | (1,170) | | | — | | | (1,619) | | | — | |

| Income tax benefit | 926 | | | — | | | — | | | — | | | — | | | — | | | — | | | 926 | |

| Net loss | $ | (175,767) | | | $ | 33,734 | | | $ | (326) | | | $ | 6,532 | | | $ | (1,170) | | | $ | 12,359 | | | $ | (1,619) | | | $ | (126,257) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the year ended December 31, 2022 |

| Reported | | Depreciation and amortization | | Stock-based compensation expense | | Restructuring costs | | Change in FV of financial liabilities | | Charges related to business exit | | Other | | Adjusted |

| Diagnostic test revenue | $ | 227,334 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | | | $ | 227,334 | |

| Other revenue | 7,360 | | | — | | | — | | | — | | | — | | | — | | | — | | | 7,360 | |

| Total revenue | 234,694 | | | — | | | — | | | — | | | — | | | — | | | — | | | 234,694 | |

| Cost of services | 261,444 | | | (31,328) | | | (5,080) | | | (1,926) | | | — | | | — | | | — | | | 223,110 | |

| Gross profit (loss) | (26,750) | | | 31,328 | | | 5,080 | | | 1,926 | | | — | | | — | | | — | | | 11,584 | |

| Gross margin | (11.4) | % | | | | | | | | | | | | | | 4.9 | % |

| | | | | | | | | | | | | | | |

| Research and development | 86,203 | | | (14,960) | | | (1,755) | | | (3,260) | | | — | | | — | | | — | | | 66,228 | |

| Selling and marketing | 122,075 | | | (3,271) | | | (5,390) | | | (7,979) | | | — | | | — | | | — | | | 105,435 | |

| General and administrative | 216,167 | | | (9,750) | | | (29,750) | | | (12,645) | | | — | | | — | | | (13,436) | | | 150,586 | |

| Impairment loss | 210,145 | | | — | | | — | | | — | | | — | | | (210,145) | | | — | | | — | |

| Other, net | 6,312 | | | — | | | — | | | — | | | — | | | — | | | — | | | 6,312 | |

| | | | | | | | | | | | | | | |

| Loss from operations | (667,652) | | | 59,309 | | | 41,975 | | | 25,810 | | | — | | | 210,145 | | | 13,436 | | | (316,977) | |

| | | | | | | | | | | | | | | |

| Interest income (expense), net | (666) | | | — | | | — | | | — | | | — | | | — | | | — | | | (666) | |

| Other income (expense), net | 70,286 | | | — | | | — | | | — | | | (70,229) | | | — | | | (57) | | | — | |

| Income tax benefit | 49,052 | | | — | | | — | | | — | | | — | | | — | | | — | | | 49,052 | |

| Net loss | $ | (548,980) | | | $ | 59,309 | | | $ | 41,975 | | | $ | 25,810 | | | $ | (70,229) | | | $ | 210,145 | | | $ | 13,379 | | | $ | (268,591) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the three months ended September 30, 2023 |

| Reported | | Depreciation and amortization | | Stock-based compensation expense | | Restructuring costs | | Change in FV of financial liabilities | | Charges related to business exit | | Other | | Adjusted |

| Diagnostic test revenue | $ | 51,955 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | 51,955 | |

| Other revenue | 1,348 | | | — | | | — | | | — | | | — | | | — | | | — | | | 1,348 | |

| Total revenue | 53,303 | | | — | | | — | | | — | | | — | | | — | | | — | | | 53,303 | |

| Cost of services | 28,044 | | | (1,613) | | | (75) | | | (52) | | | | | | | | | 26,304 | |

| Gross profit (loss) | 25,259 | | | 1,613 | | | 75 | | | 52 | | | — | | | — | | | — | | | 26,999 | |

| Gross margin | 47.4 | % | | | | | | | | | | | | | | 50.7 | % |

| | | | | | | | | | | | | | | |

| Research and development | 14,288 | | | (283) | | | 533 | | | (970) | | | — | | | — | | | — | | | 13,568 | |

| Selling and marketing | 16,763 | | | (1,225) | | | 115 | | | (416) | | | — | | | — | | | — | | | 15,237 | |

| General and administrative | 26,099 | | | (5,551) | | | (1,004) | | | (753) | | | — | | | — | | | — | | | 18,791 | |

| Impairment loss | 8,282 | | | — | | | — | | | — | | | — | | | (8,282) | | | — | | | — | |

| Other, net | 2,794 | | | — | | | — | | | — | | | — | | | (1,014) | | | — | | | 1,780 | |

| | | | | | | | | | | | | | | |

| Loss from operations | (42,967) | | | 8,672 | | | 431 | | | 2,191 | | | — | | | 9,296 | | | — | | | (22,377) | |

| | | | | | | | | | | | | | | |

| Interest income (expense), net | 1,053 | | | — | | | — | | | — | | | — | | | — | | | — | | | 1,053 | |

| Other income (expense), net | (544) | | | — | | | — | | | — | | | (590) | | | — | | | 1,134 | | | — | |

| Income tax benefit | 172 | | | — | | | — | | | — | | | — | | | — | | | — | | | 172 | |

| Net loss | $ | (42,286) | | | $ | 8,672 | | | $ | 431 | | | $ | 2,191 | | | $ | (590) | | | $ | 9,296 | | | $ | 1,134 | | | $ | (21,152) | |

GeneDx Holdings Corp.

Consolidated Balance Sheets

(in thousands, except share and per share amounts)

| | | | | | | | | | | |

| December 31, |

| 2023 | | 2022 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 99,681 | | | $ | 123,933 | |

| Marketable securities | 30,467 | | | — | |

| Accounts receivable | 32,371 | | | 42,634 | |

| Due from related parties | 445 | | | 708 | |

| Inventory, net | 8,777 | | | 13,665 | |

| Prepaid expenses and other current assets | 10,598 | | | 31,682 | |

| Total current assets | 182,339 | | | 212,622 | |

| Operating lease right-of-use assets | 26,900 | | | 32,758 | |

| Property and equipment, net | 32,479 | | | 51,527 | |

| Intangible assets, net | 172,625 | | | 186,650 | |

Other assets (1) | 4,413 | | | 7,385 | |

| Total assets | $ | 418,756 | | | $ | 490,942 | |

| Liabilities and Stockholders’ Equity | | | |

| Current liabilities: | | | |

| Accounts payable and accrued expenses | $ | 37,456 | | | $ | 84,878 | |

| Due to related parties | 1,379 | | | 3,593 | |

| Short-term lease liabilities | 3,647 | | | 6,121 | |

| Other current liabilities | 16,336 | | | 49,705 | |

| Total current liabilities | 58,818 | | | 144,297 | |

| Long-term debt, net of current portion | 52,688 | | | 6,250 | |

| Long-term lease liabilities | 62,938 | | | 60,013 | |

| Other liabilities | 14,735 | | | 24,018 | |

| Deferred taxes | 1,560 | | | 2,659 | |

| Total liabilities | 190,739 | | | 237,237 | |

| | | |

| | | |

| | | |

| Stockholders’ Equity: | | | |

| Preferred stock | — | | | — | |

| Class A common stock | 2 | | | 1 | |

| Additional paid-in capital | 1,527,778 | | | 1,378,125 | |

| Accumulated deficit | (1,300,188) | | | (1,124,421) | |

| Accumulated other comprehensive income | 425 | | | — | |

| Total stockholders’ equity | 228,017 | | | 253,705 | |

| Total liabilities and stockholders’ equity | $ | 418,756 | | | $ | 490,942 | |

(1)Other assets includes $987 thousand and $900 thousand of restricted cash as of December 31, 2023 and December 31, 2022, respectively.

GeneDx Holdings Corp.

Consolidated Statements of Operations

(in thousands, except share and per share amounts)

| | | | | | | | | | | | | | | |

| | | Year ended December 31, |

| | | | | 2023 | | 2022 |

| Revenue | | | | | | | |

| Diagnostic test revenue | | | | | $ | 195,654 | | | $ | 227,334 | |

| Other revenue | | | | | 6,912 | | | 7,360 | |

| Total revenue | | | | | 202,566 | | | 234,694 | |

| Cost of services | | | | | 112,560 | | | 261,444 | |

| Gross profit (loss) | | | | | 90,006 | | | (26,750) | |

| Research and development | | | | | 58,266 | | | 86,203 | |

| Selling and marketing | | | | | 60,956 | | | 122,075 | |

| General and administrative | | | | | 133,755 | | | 216,167 | |

| Impairment loss | | | | | 10,402 | | | 210,145 | |

| Other operating expenses, net | | | | | 7,223 | | | 6,312 | |

| Loss from operations | | | | | (180,596) | | | (667,652) | |

| | | | | | | |

| Non-operating income (expenses), net | | | | | | | |

| Change in fair market value of warrant and earn-out contingent liabilities | | | | | 1,170 | | | 70,229 | |

| Interest income (expense), net | | | | | 1,114 | | | (666) | |

| Other income, net | | | | | 1,619 | | | 57 | |

| Total non-operating income, net | | | | | 3,903 | | | 69,620 | |

| Loss before income taxes | | | | | $ | (176,693) | | | $ | (598,032) | |

| Income tax benefit | | | | | 926 | | | 49,052 | |

| Net loss | | | | | $ | (175,767) | | | $ | (548,980) | |

| | | | | | | |

| Weighted average shares outstanding of Class A common stock | | | | | 24,311,989 | | 10,236,960 |

| Basic and diluted net loss per share, Class A common stock | | | | | $ | (7.23) | | | $ | (53.63) | |

GeneDx Holdings Corp.

Consolidated Statements of Cash Flows

(in thousands)

| | | | | | | | | | | | | |

| Year Ended December 31, |

| 2023 | | 2022 | | |

| Operating activities | | | | | |

| Net loss | $ | (175,767) | | | $ | (548,980) | | | |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | | | |

| Depreciation and amortization expense | 33,734 | | | 59,309 | | | |

| Stock-based compensation expense | (326) | | | 41,975 | | | |

| Change in fair value of warrant and contingent liabilities | (1,170) | | | (70,229) | | | |

| Deferred tax benefit | (926) | | | (49,124) | | | |

| Provision for excess and obsolete inventory | 3,913 | | | 1,125 | | | |

| Third-party payor reserve release | (9,745) | | | — | | | |

| | | | | |

| Gain on sale of assets | (1,677) | | | — | | | |

| Gain on debt forgiveness | (2,750) | | | — | | | |

| Impairment loss | 10,402 | | | 210,145 | | | |

| Other | 1,308 | | | 2,743 | | | |

| Change in operating assets and liabilities, net of effects from purchase of business: | | | | | |

| Accounts receivable | 10,263 | | | 5,527 | | | |

| Inventory | 975 | | | 2,350 | | | |

| Accounts payable and accrued expenses | (46,953) | | | 34,459 | | | |

| Other assets and liabilities | (2,526) | | | (8,455) | | | |

| Net cash used in operating activities | (181,245) | | | (319,155) | | | |

| Investing activities | | | | | |

| Consideration on escrow paid for GeneDx acquisition | (12,144) | | | (127,004) | | | |

| Purchases of property and equipment | (5,250) | | | (7,156) | | | |

| Proceeds from sale of assets | 4,034 | | | — | | | |

| Purchases of marketable securities | (47,670) | | | — | | | |

| Proceeds from maturities of marketable securities | 17,765 | | | — | | | |

| Development of internal-use software assets | (461) | | | (7,166) | | | |

| Net cash used in investing activities | (43,726) | | | (141,326) | | | |

| Financing activities | | | | | |

| | | | | |

| Proceeds from PIPE issuance, net of issuance costs | — | | | 197,659 | | | |

| Proceeds from offerings, net of issuance costs | 143,002 | | | — | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

Proceeds from long-term debt, net of issuance costs | 48,549 | | | — | | | |

| Exercise of stock options | 285 | | | 2,948 | | | |

| | | | | |

| Long-term debt principal payments | (2,000) | | | — | | | |

| Finance lease payoff and principal payments | (2,500) | | | (3,292) | | | |

| Net cash provided by financing activities | 187,336 | | | 197,315 | | | |

Net decrease in cash, cash equivalents and restricted cash | (37,635) | | | (263,166) | | | |

| Cash, cash equivalents and restricted cash, at beginning of year | 138,303 | | | 401,469 | | | |

Cash, cash equivalents and restricted cash, at end of year (1) | $ | 100,668 | | | $ | 138,303 | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

(1)Cash, cash equivalents and restricted cash at December 31, 2023 excludes marketable securities of $30.5 million.

One test. Big picture. Brighter futures. February 20, 2024 GeneDx (Nasdaq: WGS) 4Q 2023 Earnings Presentation Exhibit 99.2

2 Disclaimer This presentation contains forward-looking statements under the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are statements that do not relate to historical facts and events and such statements and opinions pertaining to the future that, for example, contain wording such as “may,” “might,” “will,” “could,” “would,” “should,” “expect,” “intend,” “plan,” “objective,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “continue,” “ongoing,” or the negative of these terms, or other comparable terminology intended to identify statements about the future. Forward- looking statements contained in this presentation may include, but are not limited to, statements about: our future performance and our market opportunity, certain unaudited fourth quarter and full year 2023 results and our expectations regarding full year 2024 revenue, adjusted gross margin profile and cash burn and, our expectation of turning profitable in 2025. We cannot assure that the forward- looking statements in this presentation will prove to be accurate. Furthermore, if our forward-looking statements prove to be inaccurate, the inaccuracy may be material. These statements involve known and unknown risks, uncertainties and other important factors that may cause our actual results, levels of activity, performance or achievements to be materially different from the information expressed or implied by these forward-looking statements. The forward-looking statements and opinions contained in this presentation are based on our management’s beliefs and assumptions and are based upon information currently available to our management as of the date of this presentation and, while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. Many factors could cause actual future events to differ materially from the forward-looking statements in this presentation, including but not limited to: (i) the completion of the preparation of our 2023 year-end financial statements (including all required disclosures) and our 2023 year-end audit, (ii) the ability to implement business plans, goals and forecasts, and identify and realize additional opportunities, (iii) the risk of downturns and a changing regulatory landscape in the highly competitive healthcare industry, (iv) the size and growth of the market in which we operate, and (v) our ability to pursue our new strategic direction. The information, opinions and forward-looking statements contained in this announcement speak only as of its date and are subject to change without notice. This presentation contains estimates, projections and other information concerning our industry, our business, and the markets for our products and services. Information that is based on estimates, forecasts, projections, market research or similar methodologies is inherently subject to uncertainties, and actual events or circumstances may differ materially from events and circumstances that are assumed in this information. Unless otherwise expressly stated, we obtained this industry, business, market and other data from our own internal estimates and research as well as from reports, research surveys, studies and similar data prepared by market research firms and other third parties, industry, medical and general publications, government data and similar sources. While we believe our internal company research as to such matters is reliable and the market definitions are appropriate, neither such research nor these definitions have been verified by any independent source. We discuss these and other risks and uncertainties in greater detail in the sections entitled “Risk Factors” and "Management's Discussion and Analysis of Financial Condition and Results of Operations" in our periodic reports and other filings we make with the SEC from time to time. Given these uncertainties, you should not place undue reliance on the forward-looking statements. Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. Except as required by law, we undertake no obligation to update publicly any forward-looking statements for any reason after the date of this presentation to conform these statements to actual results or to changes in our expectations. We file reports, proxy statements, and other information with the SEC. Such reports, proxy statements, and other information concerning us are available www.sec.gov. Requests for copies of such documents should be directed to our Investor Relations department at GeneDx Holdings Corp. 333 Ludlow Street, North Tower, Stamford, Connecticut, 06902. Our telephone number is 800-298-6470. GeneDx has not completed the preparation of its consolidated financial statements for the year ended December 31, 2023. The preliminary, unaudited results presented in this presentation for the year ended December 31, 2023, are based on current expectations and are subject to adjustment, as the company completes the preparation of its 2023 year-end consolidated financial statements and its 2023 year-end audit.

WGS 4Q 2023 Results 3 Fourth quarter 2023 revenue from continuing operations of $58M with 68% year-over-year revenue growth for exome and genome test revenue Reiterating the path to profitability in 2025 Reduced cash burn 51% year-over-year and 22% sequential Ending December 31, 2023 cash, cash equivalents, marketable securities and restricted cash position of $131 million 1 Results from continuing operations include exclude the results of the exited Legacy Sema4 diagnostic testing business. Total company results include GeneDx's continuing operations and the financial impacts of exited Legacy Sema4 business activities. 1

4 99% Revenue - strong growth driven by high value whole exome and genome Revenue Q4 2023 Revenue from continuing operations $58M Growth year-over-year 27% Growth sequentially 15% Exome and genome test revenue $39M Growth year-over-year 68% Growth sequentially 15% Increase in 4Q23 exome/genome test result volume year-over-year; +19% sequentially 1 Total company revenues were $202.6M and $57.4M for the full year and fourth quarter 2023, respectively. Results from continuing operations exclude the results of the exited Legacy Sema4 diagnostic testing business. Total company results include GeneDx's continuing operations and the financial impacts of exited Legacy Sema4 business activities. 1 Full year 2023 revenue from continuing operations1$194M

5 Gross profit – expansion driven by mix shift, cost per test reductions Adj. Gross Profit for continuing operations 4Q23 QoQ Sequential YoY Adj. Gross Margin $32.5M +34% +73% Adj. Gross Margin % 56% +770bps +1,480bps Q4 2023 includes non-recurring items which positively impacted adjusted gross margin by approximately 400bps. Exome/genome can be the best test for patients. They are also best for our business. Volume Mix 4Q22 1Q23 2Q23 3Q23 4Q23 Exome/ Genome 16% 17% 22% 23% 27% Non-Exome 84% 83% 78% 77% 73% 27% Exome/genome test result volume mix in 4Q23, up from 16% in the 4Q22 and 23% in 3Q23 56% Adjusted gross margins for continuing operations in 4Q23, up from 41% in 4Q22 and 48% in 3Q23

6 Cash - Balance sheet bolstered to execute growth strategy Net use of cash Q4 2023 Total company $33M Continuing operations $24M 1 Total Company use of cash in the fourth quarter included $5 million in scheduled payments under the 2022 Legacy Sema4 payer settlement, $3 million to discharge remaining operating payables for the exited reproductive health business and $1 million in severance payments related to the previously announced cost reduction initiative. 2 An additional $25M in debt capacity is contingently available to use under the five-year senior secured credit facility with Perceptive Advisors entered into on October 30, 2023. The agreement provides access of up to $75 million, consisting of an initial tranche of $50 million, which has been drawn and is represented in the Company's year-end cash position, and a subsequent tranche of $25 million is available – at the Company's option, subject to certain timelines and other defined criteria. 1 Results from continuing operations exclude the results of the exited Legacy Sema4 diagnostic testing business. Total company results include GeneDx's continuing operations and the financial impacts of exited Legacy Sema4 business activities. 51% 7 Consecutive quarters of cash burn reduction since acquiring GeneDx $131M Cash, cash equivalents, marketable securities and restricted cash on hand December 31, 2023 Improvement in total company net cash burn rate year-over-year; improved 22% sequentially 2

7 Confidential and Proprietary; Do Not Distribute OPEX reduction plan What we need for profitability and beyond ▪ On October 30, 2023, we enacted a plan to remove approximately $40M in annual operating expense including no less than $20M through headcount reductions which have already been completed ▪ Revenue growth through 2025 expected to be driven by whole exome/genome testing, which operates at >60% gross margins ▪ Assuming no change in the current margin profile, increasing exome/genome’s annual gross profit by $65M requires us to maintain growth rates in 2024 and 2025 at nearly half of what was achieved in 2023 ▪ As exome/WGS takes more share of test mix from low/negative margin legacy panels, gross margin will rise ▪ Beyond break-even, we see significant additional upside in – ▪ Further reducing exome/WGS COGS as we benefit from scale and certain in-flight AI/automation initiatives ▪ Improving collection rates across the portfolio as payor coverage expands and we increase internal performance regarding collection/reimbursement performance ▪ Acceleration of our biopharma/data business ▪ Untapped long-term opportunities providing WGS newborn screening, interpretation as a service, and others Exome and genome growth Additional opportunities 4Q23 annualized net loss OPEX reduction Additional margin expansion Exome and genome growth Profitability in 2025 Our path to profitability and beyond For illustrative purposes, not formal guidance How we will achieve those goals 1 2 3 1 2 3 Statements regarding our path to profitability constitute forward-looking statements and are subject to numerous risks and assumptions. See slide 2 for more information. You should not rely upon forward-looking statements as predictions of future events

2024 Guidance 8 Drive full year 2024 revenues between $220 to $230 million Expand full year 2024 adjusted gross margin profile to at least 50% Use $75 to $80 million of net cash for full year 2024 Turn profitable in 2025

9 One test. Big picture. Brighter futures.

10 Thank you

11 Appendix

12 Lack of genomic data can lead to a cycle of misdiagnosis and suboptimal care Missed diagnoses impact everyone 5-8 years Patients/Caregivers • Inappropriate treatments and delayed care • Suffering Healthcare systems • Increased costs and burden • Missed opportunities to develop treatments Providers • Stress from continued patient suffering • Inconclusive diagnoses Try new doctors Patients miss milestones Patient presents with symptoms Suboptimal care More tests, no answersInappropriate treatments Tests are orderedMore spending

13 Genomic information is the most foundational health data source Each person's unique genetic code influences their health – and fundamentally informs how we use other data tools.

14 As a leader in exome and genome testing, GeneDx leverages the power of this data to: o inform personalized health plans o accelerate drug discovery o improve efficiencies for health systems o enable healthier populations Exome and genome testing unlock the most comprehensive genomic data

GeneDx is positioned to enable a data-informed future for healthcare.

16 Leading exome and genome products o For more than 20 years, our advanced genomic technologies and unparalleled data have helped diagnose the hardest cases. o Now we’re helping patients with more common conditions harness the power of their genome and live healthier lives. Translating complex genomic data into definitive diagnoses for patients

17 Butler L. et al. Exome-based testing for patients with seizures: Advantages over panel-based testing. Poster presented at American Epilepsy Society Annual Meeting; December 2, 2023; Orlando, FL. Only 43% are tested on many commercial epilepsy panels Common diseases are in fact a constellation of genetic diagnoses One example is epilepsy. At least 768 different genes are related to seizures.

18 Butler L. et al. Exome-based testing for patients with seizures: Advantages over panel-based testing. Poster presented at American Epilepsy Society Annual Meeting; December 2, 2023; Orlando, FL. Exome sequencing checks all 768 genes Only 43% are tested on many commercial epilepsy panels Common diseases are in fact a constellation of genetic diagnoses One example is epilepsy. At least 768 different genes are related to seizures.

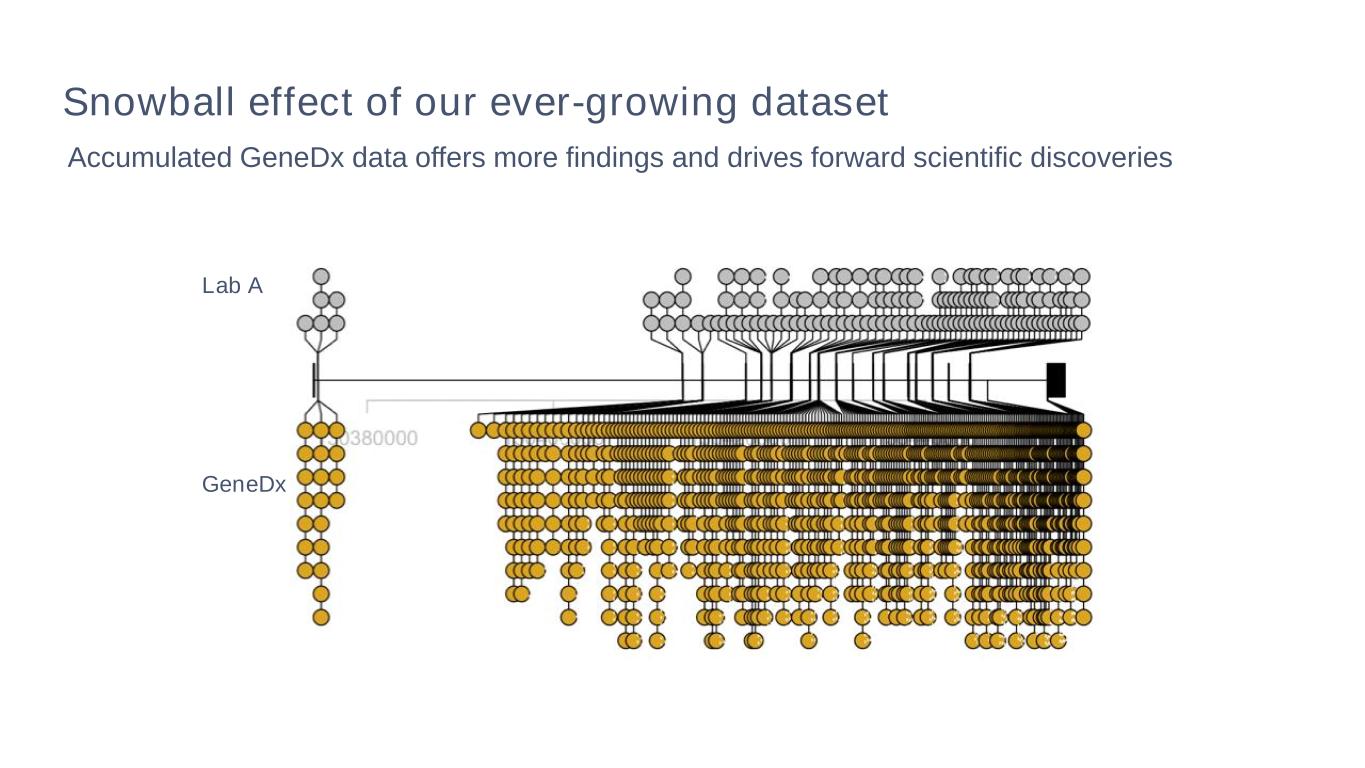

19 500K sequenced exomes Data is at the center of our business Our huge dataset and intelligent interpretation platform set us apart and fuel innovation Simplifies complex genomic data Reduces variants of unknown significance Increases diagnostic yield Significant clinical and genomic data Fuels improved testing accuracy Advances science and powering future discoveries Advanced interpretation platform

20 Pay-it-forward data strategy For every patient that we test, our underlying interpretation platform gets smarter, and we can offer more answers to more patients. The impact scales as we capture more and more of the market. dditional patients tested mproved interpretation platform More underlying data More answ ers for patients providers igher diagnostic y ield f ewer S dditional patients tested mproved interpretation platform More underlying data More answ ers for patients providers igher diagnostic yield fewer S

Accumulated GeneDx data offers more findings and drives forward scientific discoveries Lab A GeneDx Snowball effect of our ever-growing dataset

v3.24.0.1

Document and Entity Information Document

|

Feb. 20, 2024 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 20, 2024

|

| Entity Registrant Name |

GeneDx Holdings Corp.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-39482

|

| Entity Tax Identification Number |

85-1966622

|

| Entity Address, Address Line One |

333 Ludlow Street

|

| Entity Address, City or Town |

Stamford

|

| Entity Address, State or Province |

CT

|

| Entity Address, Postal Zip Code |

06902

|

| City Area Code |

800

|

| Local Phone Number |

298-6470

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

false

|

| Entity Address, Address Line Two |

North Tower

|

| Entity Address, Address Line Three |

6th Floor

|

| Entity Central Index Key |

0001818331

|

| Amendment Flag |

false

|

| Common Class A |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Class A common stock, par value $0.0001 per share

|

| Trading Symbol |

WGS

|

| Security Exchange Name |

NASDAQ

|

| Warrant |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Warrants to purchase one share of Class A common stock, each at an exercise price of $379.50 per share

|

| Trading Symbol |

WGSWW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonClassAMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_WarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

GeneDx (NASDAQ:WGS)

Historical Stock Chart

From Oct 2024 to Nov 2024

GeneDx (NASDAQ:WGS)

Historical Stock Chart

From Nov 2023 to Nov 2024