UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of December 2023

Commission File Number: 001-39789

Fusion Fuel Green PLC

(Translation of registrant’s name into English)

10 Earlsfort Terrace

Dublin 2, D02 T380, Ireland

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form

20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

On December 4, 2023, Fusion Fuel Green PLC (“Company”) hosted a live conference call

and webcast to discuss the Company’s financial results for the quarter ended September 30, 2023, along with third quarter operational

highlights. A replay of the webcast, the investor presentation used during the webcast, and a quarterly shareholder update letter from

the Company’s executive committee, are each available on the Company’s website, fusion-fuel.eu. The shareholder update letter

and investor presentation are also attached as Exhibits 99.1 and 99.2 to this Report on Form 6-K, respectively, and are incorporated by

reference herein.

The information furnished in this Report on Form 6-K, including the exhibits related thereto, shall

not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or

otherwise subject to the liability of such section, nor shall such information be deemed incorporated by reference in any filing under

the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused

this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Fusion Fuel Green PLC |

| |

(Registrant) |

| |

|

| Date: December 4, 2023 |

/s/ Frederico Figueira de Chaves |

| |

Frederico Figueira de Chaves |

| |

Chief Executive Officer |

2

Exhibit 99.1

Disclaimer

This presentation includes statements of future events, conditions, expectations,

and projections of Fusion Fuel Green plc (the “Company”). Such statements are “forward looking statements” within

the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. The Company’s

actual results may differ from its expectations, estimates and projections and, consequently, you should not rely on these forward-looking

statements as predictions of future events. Words such as “expect,” “estimate,” “project,” “budget,”

“forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,”

“should,” “believe,” “predict,” “potential,” and similar expressions are intended to identify

such forward-looking statements. These forward-looking statements include, without limitation, estimates and projections of future performance,

which are based on numerous assumptions about sales, margins, competitive factors, industry performance and other factors which cannot

be predicted. Such assumptions involve a number of known and unknown risks, uncertainties, and other factors, many of which are outside

of the Company’s control, including, among other things: the failure to obtain required regulatory approvals; changes in Portuguese,

Spanish, Moroccan, or European green energy plans; the ability to obtain additional capital; field conditions and the ability to increase

production capacity; supply chain competition; changes adversely affecting the businesses in which the Company is engaged; management

of growth; general economic conditions, including changes in the credit, debit, securities, financial or capital markets; and the impact

of any adverse public health developments on the Company’s business and operations. Should one or more of these material risks occur

or should the underlying assumptions change or prove incorrect, the actual results of operations are likely to vary from the projections

and the variations may be material and adverse.

The forward-looking statements and projections herein should not be regarded

as a representation or prediction that the Company will achieve or is likely to achieve any particular results. This Presentation does

not constitute an offer to sell, a solicitation of an offer to buy, or a recommendation to purchase any equity, debt, or other financial

instruments of Fusion Fuel.

The Company cautions readers not to place undue reliance upon any forward-looking

statements and projections, which speak only as of the date made. The Company does not undertake or accept any obligation or undertaking

to release publicly any updates or revisions to any forward-looking statements to reflect any change in its expectations or any change

in events, conditions or circumstances on which any such statement is based.

Financial Update Presentation

The Company’s consolidated financial data discussed herein is prepared

in accordance with International Financial Reporting Standards as adopted by the International Accounting Standards Board (“IFRS”)

and is denominated in Euros (“EUR” or “€”). The numbers discussed in this management letter have not been

audited and therefore may vary to the final financial results disclosed by the company as part of its annual report on Form 20-F described

below. The unaudited consolidated financial data reflects, in the opinion of management, all adjustments, consisting of normal recurring

adjustments, considered necessary for a fair statement of the Company's financial data for the periods indicated. The unaudited consolidated

financial data should be regarded in conjunction with the audited consolidated financial statements and notes thereto for the year ended

December 31, 2022, included in the Company's Annual Report on Form 20-F for the year ended December 31, 2022.

Use of Social Media as a Source of Material News

The Company uses, and will continue to use, its LinkedIn profile, website,

press releases, and various social media channels, as additional means of disclosing information to investors, the media, and others interested

in the Company. It is possible that certain information that the Company posts on social media or its website, or disseminates in press

releases, could be deemed to be material information, and the Company encourages investors, the media and others interested in the Company

to review the business and financial information that the Company posts on its social media channels, website, and disseminates in press

releases, as such information could be deemed to be material information.

Dear Shareholders,

The third quarter was a challenging one for the green hydrogen industry

at large. Despite long-term structural tailwinds driven by ambitious decarbonization targets and considerable announced public funding,

the green hydrogen value chain has developed more slowly than anticipated, further hamstrung by challenging capital markets conditions.

The rapidly growing pipeline of announced production capacity belies an environment in which infrastructure bottlenecks, a lack of regulatory

clarity, and protracted funding processes have resulted in delays in project execution, particularly for larger-scale facilities, which

we expect to persist into the medium term. Meanwhile, for the few projects that have been successfully commissioned, the market has observed

meaningful underperformance, creating periods of high-profile supply disruptions and huge price spikes for green hydrogen.

Overall, the cost premium for green hydrogen compared to grey hydrogen

remains unchanged, with the market seemingly having re-baselined its expectations around when green hydrogen will become cost competitive.

Finally, the higher cost of capital has proven to be a challenge for players with a high cash burn rate and a commercial focus on large-scale,

capital-intensive projects that at this stage are unable to secure project financing without cash collateral. All of these challenges

have converged to create significant and structural market concerns and threaten the long-term viability of many first movers in this

space.

While we believe these macro-headwinds are transitory in nature, we are

not immune to their effects; we too have felt the impact of these dynamics, primarily in the form of continued pressure on our share price,

despite having achieved several commercial milestones in recent months that we had hoped might stem the tide. However, we benefit from

several unique attributes that have helped insulate us against some of these market challenges and, we believe, put us in an advantaged

position relative to the market:

| · | A market-leading cash burn rate, positioning us to target cash flow breakeven with lower sales volumes

than nearly all competitors. |

| · | A proprietary miniaturized PEM electrolyzer architecture and modular “building-block” design

approach that drives superior efficiency and enables us to deploy scalable solutions that grow with our customers. |

| · | A commercial focus on small-to-midscale projects that we can execute in a timely manner and do not require

balance sheet financing. |

| · | A successful track record of project development and engineering, with ongoing technical outperformance. |

Despite these advantages, macro-headwinds and liquidity concerns have contributed

to significant value erosion over recent months. Access to capital has proven to be an obstacle given the current capital markets environment,

most acutely for growth companies like Fusion Fuel, and obtaining attractive financing options has similarly grown more challenging. In

order to allay the concerns of the market and ensure that we are capitalized to deliver on our business plan, we have been actively pursuing

capital discussions for the better part of a year. Though we have had numerous opportunities to raise capital, we felt it was critical

to ensure that the financing solutions we chose would both solve for near-term liquidity concerns whilst also serving the best interests

of our shareholders. Too often the proposals provided were so costly, and so significantly constrained future fundraising efforts, that

they would do little more than ensure a death spiral.

In that context, we are thrilled with the convertible debt facility we

have agreed to with Macquarie, which we announced last week. Providing up to $20 million in financing, it is large enough to extend our

runway considerably, but it’s also a tranched structure which mitigates the dilutive impact of the financing as we can draw down

on only what we need at a given time in order to execute on our business plan. In addition, the strong relationship we have developed

with Macquarie over the due diligence period, along with the attractive and fair terms of the facility, position us to pursue complementary

forms of financing and other strategic sources of capital that would further strengthen our balance sheet. In the interim, we are confident

that drawdowns on the Macquarie facility, along with inflows from committed technology sales orders and government grants, will provide

a positive platform from the outset of 2024.

As we discuss over the balance of this letter, despite the prevailing headwinds

impacting the green hydrogen market broadly, we believe we are well positioned to deliver substantial value creation for our shareholders.

2023 is our first year posting revenues and already we expect to close the year within a range comparable to several of our competitors,

many of which boast valuations ten or more times higher. The valuation disconnect underscores the considerable fair value appreciation

potential for our company as we continue to execute on our business plan.

Financial Update

Revenue guidance

During the third quarter of 2023, we recognized revenue of €2.5 million

with respect to our green hydrogen plant in Madrid, Spain. As communicated as part of our second quarter investor presentation, the Provisional

Acceptance for this plant was issued in September. Following the recognition of this amount, we are maintaining our revenue guidance for

2023. We are slightly behind the delivery schedule for our project with CSIC, due to delays to the start date of implementation on the

part of the client, but we hope to make up this time during the final weeks of the year.

Looking ahead, we are forecasting revenues of €34 million for 2024.

This is driven by technology and project sales. For our technology sales, we will sell our electrolyzers, Balance of Plant equipment and

will provide EPC services as well. Of the forecasted €34 million, €7.4 million is attributable to pure equipment sales. As of

the date of this letter, this amount reflects only confirmed and contracted orders; we have deliberately excluded any prospective revenues

from potential project wins from our technology sales pipeline and proposals currently out in the market. Another revenue stream that

we have not considered in this number is potential inflows for engineering services. Through multiple tender processes, our engineering

capabilities have been commended, especially after the commissioning of our plant in Madrid, Spain. There is a ready market for these

services, and we expect to pursue this complementary opportunity more formally during 2024.

The balance of the €34 million forecast relates to the anticipated

sale of our Sines I development project. As we have explained previously, our strategy is to sell this asset to an infrastructure fund

that will then contract us to provide our HEVO-Chain technology to the project. The negotiations for the sale of our Sines I project are

progressing well, and we hope to be able to bring it to a close soon.

Despite the challenges faced during 2023, we are increasingly confident

in the sales pipeline that we have built, particularly the more advanced development projects given the potential revenue that will be

realized if we are able to convert these into technology sales.

Third quarter results:

| § | Customer inflows - €0.9 million was received from Exolum regarding the plant constructed in Madrid,

Spain. In the fourth quarter, we received a further €0.6 million from other technology sales contracts. |

| § | Grant funding - €2.3 million was received. This was made up of €2 million from our C-14 and

€0.3 million from our C-5 grant awards previously approved by the Portuguese Government as part of Component 5 and 14 of their Recovery

and Resilience Plan. In November, we received a further €2.1 million from our C-5 grant award. |

| § | ATM - €0.6 million raised by selling 376,517 of our Class A ordinary shares. These sales were over

16 separate trading days. No sales made since September 20, 2023. |

| § | Debt facility - we repaid the €1.3 million which was drawn down during the second quarter of 2023

from our debt facility with a Portuguese based financial institution that was specifically related to our outstanding VAT receivables.

We drew down a further €0.2 million under this facility during Q3 2023. This facility has allowed us to speed up our available cash

resources. All amounts have been repaid under this facility as of the date of this letter. |

Cash outflows during the third quarter of 2023 included investment of €1.6 million in procurement, production, and research &

development of our HEVO technologies. This represents a reduction of €0.7 million versus the first quarter of 2023. In

addition, we made a further payment of €2 million towards the equipment that will be installed in our Benavente production facility.

Our compensation expenses were lower than the second quarter of 2023 as

our headcount reduced. Our other operating expenses continued to reduce as well during the third quarter. We recorded reductions in legal,

travel, and consulting fees.

As communicated in our last letter, we have commenced a thorough review

of all components making up our inventory. We recorded a net increase of €0.5 million to the impairment charge during the third quarter.

As a reminder, the impairment charge is related to the components manufactured to legacy design and to those components that were earmarked

for the two development projects that will not proceed as planned during 2023. The recovery value of these components is still to be determined,

but at this time we have decided to impair the full value. Since this process started, we have received €0.3 million through the

sale or scrapping of these legacy components.

While the reduction in outflows can be attributed to a more restrictive

capital position, we have also embarked on a rigorous review of our cost base. From cost of materials to general operating costs, we expect

to see the benefits of this review in future periods.

At quarter-end, the value of net assets amounted to €15.4 million, which represents a decrease

of €2.4 million on the value at the June 30, 2023, mainly driven by the reduction to inventory and provisions following the recognition

of revenue for our Madrid project. Our cash balance was €1.03 million on September 30, 2023.

Commercial Update

We continue to work towards our objective of being among the first green

hydrogen companies to reach cash-flow breakeven, which we expect to achieve during 2025. Based on our current cash burn rate, we will

need to sell approximately 4.5-5 MW of electrolyzers per month in order to reach that goal. This is one of the lowest breakeven thresholds

of the industry and will serve as a key yardstick for us as we enter the new year. From a commercial perspective, our strategy remains

largely unchanged: continue to advance our portfolio of green hydrogen projects to final investment decision and sale to third-party investors,

while focusing our business development efforts on small-to-midscale technology sale opportunities that can be executed in the short-to-medium

term and for which we have a track record of execution.

In prior quarters, we discussed the importance of having access to diverse

avenues of growth and, following the introduction of our HEVO-Chain technology, communicated a commitment to accelerating the development

of new markets. A key enabler of that strategy is channel partnerships, which have the potential to amplify our presence in geographies

where we may lack a meaningful operational footprint. To that end, during the third quarter we announced a strategic partnership with

Elemental Clean Fuels, a North American development company, which is intended to provide Fusion Fuel with exposure to green hydrogen

project opportunities in the emerging US and Canadian markets. The agreement grants Fusion Fuel the right to bid on all PEM-based green

hydrogen projects within Elemental’s North American pipeline for a period of three years. As part of the partnership, Fusion Fuel

has also agreed to contribute several development assets from its broader North American project portfolio to Elemental in exchange for

a minority equity ownership interest in the company. Fusion Fuel and Elemental are currently collaborating on a feasibility study for

a 2 MW green hydrogen project for a state utility to be delivered in 2024. We are excited about the value this partnership can provide

in broadening our access to new opportunities in the dynamic North American market, whilst simultaneously allowing us to remain laser

focused on building a world-class commercial organization in our core European markets.

With the introduction of the HEVO-Chain series and a strategic reorientation

of our business development efforts to prioritize near-term technology sales, we have seen a dramatic surge in the momentum of our sales

pipeline. We continue to be encouraged by the market response to our outbound proposals, with Fusion Fuel having been short-listed for

five opportunities, representing up to €67 million in potential revenues, and having closed on six contracts to date, representing

€12 million in associated revenues. This strong foundation to our contracted order book gives us confidence in our ability to deliver

on our 2024 revenue guidance.

The projects that are currently scheduled to be in execution for 2024 are:

| § | 300 kW green hydrogen and oxygen plant, using HEVO-Chain, for a leading global building solutions supplier

for delivery in 1H 2024 |

| § | Two 1.25 MW green hydrogen plants for delivery in Portugal |

| § | Installation and delivery of BoP for a 440 kW green hydrogen plant in Spain |

| § | 1.1 MW HEVO-Chain system delivery to Italy |

| § | 10 MW plant in Portugal currently in negotiation phase |

As noted above, for many of these projects we will be delivering a full

plant, which also includes engineering services, allowing us to generate substantially higher revenues per megawatt delivered. Our in-house

engineering capability continues to be a meaningful value add in supporting the sale of both Fusion Fuel projects and technology. These

milestones further reinforce our confidence in our commercial strategy and in the market’s acceptance of our HEVO™ solutions.

Political Update

We would also like to take this opportunity to briefly comment on the recent

political turbulence within Portugal following the implication of multiple senior government officials in a corruption scandal that resulted

in the call for new elections early next year. There was some uncertainty as to whether and how these allegations would impact the government

and what this would mean for the future of green hydrogen in Portugal. We want to make it clear that neither Fusion Fuel nor any of our

employees were involved in any way in the alleged misconduct. While the hydrogen project in question – Green Flamingo – was

to be located in Sines, progress on our projects in the region has continued unabated. Furthermore, there was some concern as to whether

government grant funding processes would be impacted, but since that time we have received multiple grant payouts which indicate that

project and grant funding continue to proceed as normal. As we await further clarity on potential ramifications as additional information

comes to light, one thing is certain: our commitment to build this business with integrity, accountability, and good governance.

Closing

While it’s not yet over, this year has been key for Fusion Fuel.

Marked by a successful pivot to a new and leading-edge product in the HEVO-Chain, and significant changes to the senior leadership team

and the organization at large, we continue to ensure our business is fit for purpose and positioned around our distinctive strengths.

Despite the myriad challenges the green hydrogen industry has faced in 2023, as we look out into 2024 and beyond, we have never been more

optimistic about the prospects of our business and our positioning in the market.

Still, for both investors and developers, the green hydrogen value chain

continues to grapple with a lack of credibility: electrolyzer capital costs have not declined as quickly as anticipated, the chicken-and-egg

problem continues to stymy demand development, and several large-scale green hydrogen facilities have had to be taken offline due to performance

or reliability issues. By contrast, we see these roadblocks as a remarkable opportunity to establish Fusion Fuel as a market leader. We

have a proprietary electrolyzer technology with a proven track record of outperformance, a modular, “building-block” approach

that enables us to deliver tailored and scalable green hydrogen solutions, a world-class production facility that can produce our technology

at scale, a state-of-the-art R&D lab that continues to push the envelope in electrolyzer design, and unique expertise in end-to-end

engineering and construction of a full hydrogen plant.

Up until now, we believed our capital position was keeping us from being

viewed as a credible player in this market. However, with the signing of the facility with Macquarie, the recognition of revenues from

commercial activities that we expect will accelerate in the quarters ahead, and the receipt of nearly €11m of grant funding to date

with more to come as governments ramp up their support of the green hydrogen ecosystem, we are increasingly confident that 2024 will represent

an inflection point for Fusion Fuel.

Yours Sincerely,

Third Quarter Highlights

| · | Announced long-term green hydrogen supply contract with a Spanish industrial group. |

| · | Strategic partnership with Duferco Energia covering Italy, starting with a 1 MW HEVO-Chain Series NC project. |

| · | In negotiations with BGR Energy to install 1 MW HEVO-Chain demonstrator in India in 2024. |

| · | Announced strategic partnership with Elemental Clean Fuels covering the North American green hydrogen market. |

| · | Received order for 300 kW electrolyzer and balance of plant system from leading global building solutions supplier for delivery in

1H 2024. |

Subsequent Events

| · | Received two orders for 1.25 MW HEVO-Chain green hydrogen systems to be delivered in 2024. |

| · | Entered into a strategic tranched financing with Belike Nominees Pty Ltd., a Macquarie Group Company. |

Key Figures1

| Key Financial results / metrics (€’000) |

3Q 2023 |

2Q 2023 |

| Profit/loss |

|

|

| Revenues |

2,507 |

(0.6) |

| Cost of goods sold |

(3,178) |

(6,178) |

| SG&A |

(4,682) |

(5,044) |

| Pre-tax loss |

(4,043) |

(12,218) |

| |

|

|

| Balance sheet |

|

|

| Non-current assets |

36,760 |

33,939 |

| Cash balance |

1,025 |

3,085 |

| Inventory |

11,924 |

19,292 |

| Trade payables |

13,428 |

11,518 |

| Equity |

15,441 |

18,149 |

| |

|

|

| Employees |

|

|

| Headcount at end of period (FTE) |

142 |

157 |

| Production staff : Non-Production Staff |

52 : 90 |

58 : 99 |

| |

|

|

| Grants |

|

|

| Grants Approved |

60,000 |

60,000 |

| Grant Payments Received to date |

8,803 |

6,444 |

1 Please refer to our more detailed investor presentation

for further detail on our financial results for the third quarter of 2023.

|

Executive Offices

Ireland

Fusion Fuel Green Plc.

The Victorians

15 - 18 Earlsfort Terrace

Saint Kevin's - Dublin 2

Ireland

contact@fusion-fuel.eu

Portugal

Fusion Fuel Portugal

Rua da Fábrica, S/N, Sabugo

2715-376 Almargem do Bispo

Portugal

contact@fusion-fuel.eu

Shareholder Inquiries

Information about the firm, including all quarterly earnings releases and financial filings with

the U.S. Securities and Exchange Commission, can be accessed via our Web site at www.fusion-fuel.eu

Shareholder inquiries can also be directed to Investor Relations via email at

ir@fusion-fuel.eu

|

Transfer Agent and Registrar for Common Stock

Questions from registered shareholders of Fusion Fuel Green Plc. regarding lost or stolen stock

certificates, dividends, changes of address, and other issues related to registered share ownership should be

addressed to:

Mark Zimkind

1 State Street

New York, NY 10004 |

13

Exhibit 99.2

ALL RIG HT S BELONG TO FUSION - FUEL 3Q 2023 PRESENTATION

ALL RIG HT S BELONG TO FUSION - FUEL — Disclaimer This presentation includes statements of future events, conditions, expectations, and projections of Fusion Fuel Green plc (t he “Company”). Such statements are “forward looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Ref orm Act of 1995. The Company’s actual results may differ from its expectations, estimates and projections and, consequently, you should not rely on these forward - looking statemen ts as predictions of future events. Words such as “expect,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “ bel ieve,” “predict,” “potential,” and similar expressions are intended to identify such forward - looking statements. These forward - looking statements include, without limitation, estimate s and projections of future performance, which are based on numerous assumptions about sales, margins, competitive factors, industry performance and other factors whi ch cannot be predicted. Such assumptions involve a number of known and unknown risks, uncertainties, and other factors, many of which are outside of the Company’s con tro l, including, among other things: the failure to obtain required regulatory approvals; changes in Portuguese, Spanish, Moroccan, or European green energy plans; the abilit y t o obtain additional capital; field conditions and the ability to increase production capacity; supply chain competition; changes adversely affecting the businesses in which th e C ompany is engaged; management of growth; general economic conditions, including changes in the credit, debit, securities, financial or capital markets; or any adverse pu blic health developments on the Company’s business and operations. Should one or more of these material risks occur or should the underlying assumptions change or prov e i ncorrect, the actual results of operations are likely to vary from the projections and the variations may be material and adverse. The forward - looking statements and projections herein should not be regarded as a representation or prediction that the Company will achieve or is likely to achieve any particular results. The Company cautions readers not to place undue reliance upon any forward - looking statements and projections, which speak only a s of the date made. The Company does not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward - looking statements to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based. Financial Update Presentation The Company’s consolidated financial data is prepared in accordance with International Financial Reporting Standards as adopt ed by the International Accounting Standards Board (“IFRS”) and is denominated in Euros (“EUR” or “€”). The numbers shown in this presentation have not been audited and t her efore may vary to the final financial results disclosed by the company as part of the annual report. The unaudited consolidated financial data reflects, in the opinion of man agement, all adjustments, consisting of normal recurring adjustments, considered necessary for a fair statement of the Company's financial data for the periods indicated. T he unaudited consolidated financial data should be read in conjunction with the audited consolidated financial statements and notes thereto for the year ended December 31, 2022 in cluded in the Company's Annual Report on Form 20 - F for the year ended December 31, 2022. Use of Social Media as a Source of Material News The Company uses, and will continue to use, its LinkedIn profile, website, press releases, and various social media channels, as additional means of disclosing information to investors, the media, and others interested in the Company. It is possible that certain information that the Company posts on so cial media or its website, or disseminates in press releases, could be deemed to be material information, and the Company encourages investors, the media and others intere ste d in the Company to review the business and financial information that the Company posts on its social media channels, website, and disseminates in press releases, a s s uch information could be deemed to be material information.

ALL RIG HT S BELONG TO FUSION - FUEL ▪ Focus on Fusion ▪ Industry POV ▪ Q3 Financials & Highlights ▪ Business Update ▪ 2023 Milestones and Priorities ▪ Q&A AGENDA

ALL RIG HT S BELONG TO FUSION - FUEL 01 – FOCUS ON FUSION

ALL RIG HT S BELONG TO FUSION - FUEL 5 Unique offering based on patented micro - electrolyzer De - risked near - term project pipeline Differentiated strategy of tech sales and project development Significant growth potential ▪ Modular PEM architecture unlocks cost advantage at small - to - midscale project sizes ▪ Enables distributed hydrogen production, bypassing need for costly infrastructure buildout or last - mile logistics & distribution ▪ Diversified revenue streams from multifaceted commercial model (tech sales, project sales, development fees, O&M service fees, hydrogen sales) ▪ Development pipeline drives incremental technology sale demand ▪ €60+ million of grant funding awarded in Portugal and Spain ▪ 240+ MW technology sale pipeline through 2025 ▪ Large project pipeline focused on Portugal, Spain, Italy and North America, with further potential growth ramp ▪ Production facility aims to reach 500 MW of annual electrolysis production capacity by the end of 2025; ‘cut & paste’ approach for new geographies 01 – FUSION FUEL AT A GLANCE Fusion Fuel is a pure - play green hydrogen solutions company. We are committed to making the energy transition more accessible through the development o f disruptive, scalable, modular hydrogen solutions.

ALL RIG HT S BELONG TO FUSION - FUEL 6 01 – INDUSTRY POV The green hydrogen sector is facing significant macro - headwinds… ▪ Continued levelized cost premium for green hydrogen vs. grey ▪ Developers are struggling to secure offtake agreements due to cost gap ▪ Lack of confidence in timely availability of hydrogen infrastructure ▪ Lack of firm projects driving structural market concerns ▪ Production of green hydrogen continues to be hampered by project delays and technical underperformance ▪ Challenging capital markets conditions hindering players with high cash burn rate, focus on large - scale projects Fusion Fue l’s modest burn rate, miniaturized PEM architecture, modular design approach, and focus on co - located, small - to - midscale projects puts us in an advantaged position relative to the market

ALL RIG HT S BELONG TO FUSION - FUEL 02 – Q3 FINANCIALS & HIGHLIGHTS

ALL RIG HT S BELONG TO FUSION - FUEL Key Developments ▪ Announced long - term green hydrogen supply contract with a Spanish industrial group ▪ Strategic partnership with Duferco Energia covering Italy, starting with a 1 MW HEVO - Chain Series NC project ▪ In negotiations with BGR Energy to install 1 MW HEVO - Chain demonstrator in India in 2024 ▪ Announced strategic partnership with Elemental Clean Fuels covering the North American green hydrogen market ▪ Received order for 300 kW electrolyzer and balance of plant system from leading global building solutions supplier for delivery in 1 H 2024 Subsequent Events ▪ Received two orders for 1 . 25 MW HEVO - Chain green hydrogen systems to be delivered to projects in Portugal in 2024 ▪ Signed a strategic financing agreement from Belike Nominees Pty Ltd . , a Macquarie Group Company, 8 02 – THIRD QUARTER HIGHLIGHTS

ALL RIG HT S BELONG TO FUSION - FUEL 2Q 2023 3Q 2023 K ey Financial Results / Metrics (€’000) Profit/loss (0.6) 2,507 Revenues (6,178) (3,178) Cost of goods sold (5,044) (4,682) SG&A (12,218) (4,043) Pre - tax loss Balance sheet 33,939 36,760 Non - current assets 3,085 1,025 Cash balance 19,292 11,924 Inventory 11,518 13,428 Trade payables 18,149 15,441 Equity Employees 157 142 Headcount at end of period (FTE) 58 : 99 52 : 90 Production Staff : Non - Production Staff Grants 60,000 60,000 Grants Approved 6,444 8,803 Grant Payments Received to date 9 Key developments in Q 3 2023 Recognition of revenue and warranty provision related to our Exolum contract following issuance of Provisional Acceptance . Write - back of onerous contract provision related to the Exolum project based on revision of costs to complete project . Reversal of revenue & related COGS that were previously recorded in Q 1 2023 as the project will no longer proceed . We are working with the customer to migrate the equipment for this technology supply agreement to a separate project of a similar size . Inventory impairment provision of € 0 . 5 million . Decrease in SG&A of € 0 . 4 million . Fair value gain on derivative financial instruments of € 2 . 1 million . Q 3 ATM sales of $ 0 . 7 million 1 . Grant payments received of € 2 . 3 million during the quarter . 02 – FINANCIAL DATA (UNAUDITED) 1 During Q3 2023, we sold 376,517 class A ordinary shares for net proceeds of $ 655,656 at an average sales price of $ 1.89 per share. We paid $ 16,956 in commissions to agents as part of these trades. No ATM Shares have been sold during Q4 2023 to date.

ALL RIG HT S BELONG TO FUSION - FUEL 10 02 – FINANCIAL DATA (UNAUDITED) 1 2023 projects also include some installation and commissioning charges, as well and engineering services rendered. The final sp lit may vary as some projects are still underway. Project sales tend to include a full turnkey solution and therefore will have components of both BoP and electrolyzer equipment provision in the revenues in addition to engineering and other services, these have not been broke n out in these charts. Projections are based on the financial and business model of Fusion Fuel, constitute “forward - looking statements” and involve a number of risks, uncertainties or other assumptions that may cause actual results or performance to be materially different. See disclosures and disclaimers at the start of this presentation. ▪ We maintain our 2023 guidance that was presented in our 2 Q 23 update . ▪ We have confirmed orders of € 7 . 5 m for 2024 . ▪ We are in advanced discussions on the sale of part of our Portugal project portfolio, which has the potential to represent approximately € 27 m of revenues in 2024 . ▪ We are forecasting a decrease in SG&A for 2024 . We will provide more detailed guidance on our cost breakdown in a future update : • The primary driver for the decrease in 2024 is the reduction of personnel costs . • As we expect to be at our production capacity throughout 2024 , we will absorb the costs of production relates staff into our cost of goods sold . To date, we have not done this as our production levels have been lower than our installed capacity . • Our non - production headcount for 2024 is expected to average 80 FTEs, a 20 % decrease YoY vs . 2023 . • Our cost - cutting plan will reduce spend on consulting, travel and numerous professional fees in 2024 . Commentary on 2023 - 24 Guidance Revenue Guidance 1

ALL RIG HT S BELONG TO FUSION - FUEL 03 – BUSINESS UPDATE

ALL RIG HT S BELONG TO FUSION - FUEL 12 Exolum Green Hydrogen Plant Green Hydrogen Plant Live in Spain Evora Green Hydrogen Plant First Green Hydrogen Plant Live in Portugal Benavente Production Facility First Electrolyzer Factory in Southern Europe Fusion Fuel Laboratory Designing Leading - Edge PEM Electrolysis Technology Fusion Fuel is a green hydrogen pioneer, developing proprietary technology in - house, establishing the first PEM electrolyzer fac tory in Southern Europe and installing the first green hydrogen plants in Portugal and Spain. 03 – GREEN HYDROGEN IN ACTION

ALL RIG HT S BELONG TO FUSION - FUEL 13 03 – FUSION FUEL GREEN HYDROGEN EXPERTISE ▪ Engineering team has fully designed more than 10 green h ydrogen plants in Portugal and Spain . ▪ Engaged in ATEX, QRA & HAZOP studies, licensing, design audits, installation and commissioning of turnkey plants, in some cases also supplying the balance of plant equipment . ▪ Expertise in the full value chain of production and use of green hydrogen and incorporation into various sectors . ▪ This integrated approach sets us apart, creating tailored solutions for our clients . Full Green Hydrogen Engineering Design & Proposal Capabilities Balance of Plant designed for a plant in Spain Engineering & Mechanical Designs prepared by Fusion Fuel for connection to BoP compression equipment

ALL RIG HT S BELONG TO FUSION - FUEL 14 03 – FUSION FUEL GREEN HYDROGEN EXPERTISE 1 MW Plant* 3 MW Plant* 5 MW Plant* ▪ Fusion Fuel ’ s Engineering team has fully designed more than 10 green h ydrogen plants, both for own projects and for clients . This includes the electrolyzer system as well as the full balance of plant solution . ▪ Plants have been designed for mobility, gas blending, tube trailer filling and for use in industrial furnaces, and from pressure ranges from 2 barg up to 1 , 000 barg . ▪ These include the already live project with Exolum in Madrid, the projects underway in Zaragoza and Toledo, as well as the upcoming projects to be started in 2024 . These are designs of full green hydrogen plants, using HEVO - Chain and including balance of plant. Images shown are rendering of solutions designed for clients and for proposals currently in discussions. One of the few companies with the expertise to design complete, end - to - end green hydrogen p lants

ALL RIG HT S BELONG TO FUSION - FUEL 15 03 – 300 kW HEVO - CHAIN PROJECT IN SPAIN ▪ Client : a global leader in sustainable building solutions ▪ 300 kW HEVO - Chain Series NC electrolyzer and associated Balance of Plant equipment . ▪ HEVO - Chain technology, with modular 20 kW Cubes to create a customized green hydrogen solution . ▪ Project will include the first commercial application of Fusion Fuel’s oxygen capture system ▪ Solution also required innovative solution for air venting and management system given fine particulate matter present at client’s facility . ▪ The project is being developed in Spain and is expected to be fully installed and operational in the first half of 2024 . Note: Images and rendering are illustrative HEVO - Chain demonstrator installed in Évora 20 kW HEVO - Chain Cube HEVO - Chain – 300 kW Spain Project Render

ALL RIG HT S BELONG TO FUSION - FUEL 16 ▪ Secured two contracts in Portugal for 1 . 25 MW electrolyzer systems and full plant design, engineering and balance of plant supply . ▪ Projects will use HEVO - Chain systems, with new modular building blocks – “Cabinets” – as their electrolyzer stack . ▪ The integrated electrolyzer and hydrogen refuelling initiatives received funding from the European Commission under Portugal's Recovery and Resilience Plan . ▪ The facilities, aimed at producing, storing, and distributing green hydrogen for the transport sector are expected to be operational by the end of 2024 . 03 – 1.25 MW HEVO - CHAIN PROJECTS IN PORTUGAL Note: Images and rendering are illustrative and follow the project design and specifications HEVO - Chain Cabinets HEVO - Chain – 1.25 MW Portugal Project Render

ALL RIG HT S BELONG TO FUSION - FUEL 17 1 Including BoP & Engineering for 5 of the 6 projects; also includes Exolum project as final payment tranche is still outstanding 2 Refers to Sines I, a project SPV owned by Fusion Fuel in sale negotiation ACTIVE PROPOSALS ~162 MW ~ € 172m 45 proposals submitted SHORTLISTED OFFERS ~ 46 MW ~ €67m 5 offers shortlisted, in negotiations AWARDED + BOOKED ORDERS ~ 6 MW ~ € 12m 1 6 orders contracted Figures for each stage are current as of end Nov 2023 03 – TECHNOLOGY SALES PIPELINE & 2024 EXECUTION PLAN Technology Sales Pipeline 2024 Sales Execution Plan Our 2024 revenue guidance is based on the expected sale of the Sines I project SPV, along with the execution and delivery of the following confirmed tech sales : Awarded and in execution : ▪ 1 . 25 MW HEVO - Chain Series NC + full BoP (Portugal) ▪ 1 . 25 MW HEVO - Chain Series NC + full BoP (Portugal) ▪ 1 . 10 MW HEVO - Chain Series C (Italy) ▪ 440 kW HEVO - Solar + full BoP + power supply delivery (Spain) ▪ 300 kW HEVO - Chain Series NC + full BoP + oxygen capture (Spain) In negotiation : ▪ 10 MW green hydrogen plant (Portugal) 2 Other proposals outstanding : ▪ Shortlisted proposals to prospective clients may enable us to exceed our projections, but as the timing of these projects are uncertain, they have not been included in the revenue guidance . Sales pipeline continues to mature, with substantial interest in our HEVO - Chain series and several requests for proposal submitted : In addition, we have started to receive requests for standalone engineering services, which we will evaluate on a case - by - case basis . These opportunities have not been reflected in our future revenue plans at this time .

ALL RIG HT S BELONG TO FUSION - FUEL 04 – 2023 MILESTONES

ALL RIG HT S BELONG TO FUSION - FUEL 19 1. Commence commercial activities in Northern Europe ▪ Submitted first HEVO - Chain offers to prospective clients in Northern Europe during the third quarter 2. Strengthen balance sheet and capital position ▪ Entered into a strategic tranched financing agreement with Belike Nominees Pty Ltd . , a Macquarie Group Company for up to $ 20 million in funding ▪ We remain open to complementary and strategic sources of capital if and when necessary to further strengthen our balance sheet in our path to cash - flow breakeven, which is expected during 2025 3. Develop technology for large - scale projects ▪ HEVO - Chain offerings developed for 5 MW & 10 MW scale projects ; offerings can be scaled up incrementally using existing building block elements (HC - Cube + HC - Cabinet) 4. Continue to prioritize corporate culture ▪ Continue to right - size company structure and costs, making strategic resource allocation changes 5. Pursue strategic commercial and production partnerships ▪ Entered into strategic partnership agreement with Elemental Clean Fuels for North American market and Duferco Energia for the Italian market . ▪ Continue to pursue strategic partnerships across the hydrogen value chain and within key geographies 04 – PROGRESS AGAINST 2023 STRATEGIC PRIORITIES

ALL RIG HT S BELONG TO FUSION - FUEL Q&A

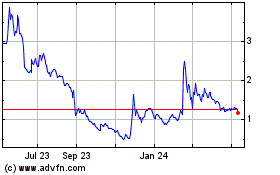

Fusion Fuel Green (NASDAQ:HTOO)

Historical Stock Chart

From Oct 2024 to Nov 2024

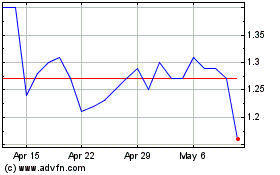

Fusion Fuel Green (NASDAQ:HTOO)

Historical Stock Chart

From Nov 2023 to Nov 2024