Current Report Filing (8-k)

October 25 2019 - 7:32AM

Edgar (US Regulatory)

FLUSHING FINANCIAL CORP false 0000923139 0000923139 2019-10-24 2019-10-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): October 25, 2019 (October 24, 2019)

FLUSHING FINANCIAL CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

001-33013

|

|

11-3209278

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(Commission

File No.)

|

|

(IRS Employer

Identification No.)

|

220 RXR Plaza, Uniondale, NY 11556

(Address of principal executive offices, including zip code)

(718) 961-5400

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☒

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 140.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common Stock, $0.01 par value

|

|

FFIC

|

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR 240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 7.01

|

Regulation FD Disclosure

|

On October 25, 2019, Flushing Financial Corporation (NASDAQ: FFIC) (“Flushing Financial”) released a presentation to investors about the Transaction (as defined below under Item 8.01). The presentation is attached to this Current Report on Form 8-K as Exhibit 99.1 and is incorporated herein by reference.

The preceding information, as well as Exhibit 99.1 to this Current Report on Form 8-K, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, or incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

On October 25, 2019, Flushing Financial and Empire Bancorp, Inc. (“Empire”) issued a joint press release announcing the execution of an Agreement and Plan of Merger, dated as of October 24, 2019, by and among Flushing Financial, Empire and Lighthouse Acquisition Co., Inc., a wholly owned subsidiary of Flushing Financial, pursuant to which Empire will be merged with and into Flushing Financial (the “Transaction”). A copy of the joint press release is attached to this Current Report on Form 8-K as Exhibit 99.2 and is incorporated herein by reference.

|

Item 9.01

|

Financial Statements and Exhibits

|

|

(d)

|

Exhibits. The following exhibits are filed with this report:

|

Cautionary Notes on Forward-Looking Statements

This report contains “forward-looking statements” within the meaning of the federal securities laws, including Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements may include: management plans relating to the proposed transaction; the expected timing of the completion of the proposed transaction; the ability to complete the proposed transaction; the ability to obtain any required regulatory, shareholder or other approvals; any statements of the plans and objectives of management for future operations, products or services, including the execution of integration plans relating to the proposed transaction; any statements of expectation or belief; projections related to certain financial metrics; and any statements of assumptions underlying any of the foregoing. Forward-looking statements are typically identified by words such as “believe,” “expect,” “anticipate,” “intend,” “seek,” “plan,” “may,” “will,” “should,” “could,” “would,” “target,” “outlook,” “estimate,” “forecast,” “project” and other similar words and expressions or negatives of these words. Forward-looking statements are subject to numerous assumptions, risks and uncertainties, which change over time and are beyond our control. Forward-looking statements speak only as of the date they are made. Neither Flushing Financial nor Empire assumes any duty and does not undertake to update any forward-looking statements. Because forward-looking statements are by their nature, to different degrees, uncertain and subject to assumptions, actual results or future events could differ, possibly materially, from those that Flushing Financial or Empire anticipated in its forward-looking statements, and future results could differ materially from historical performance.

Factors that could cause or contribute to such differences include, but are not limited to, those included under Item 1A “Risk Factors” in Flushing Financial’s Annual Report on Form 10-K and those disclosed in Flushing Financial’s other periodic reports filed with the Securities and Exchange Commission (the “SEC”), as well as the possibility that the expected benefits of the proposed transaction may not materialize in the timeframe expected or at all, or may be more costly to achieve; that the proposed Transaction may not be timely completed, if at all; that prior to the completion of the proposed Transaction or thereafter, Flushing Financial’s and Empire’s respective businesses may not perform as expected due to transaction-related uncertainty or other factors; that the parties are unable to successfully implement integration strategies related to the proposed transaction; that required regulatory,

shareholder or other approvals are not obtained or other customary closing conditions are not satisfied in a timely manner or at all; reputational risks and the reaction of the companies’ shareholders, customers, employees and other constituents to the proposed Transaction; and diversion of management time on merger-related matters. These risks, as well as other risks associated with the proposed transaction, will be more fully discussed in the proxy statement and prospectus that will be included in the registration statement on Form S-4 that will be filed with the SEC in connection with the proposed Transaction. While the list of factors presented here is, and the list of factors to be presented in the registration statement on Form S-4 will be, considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties. Unlisted factors may present significant additional obstacles to the realization of forward looking statements. For any forward-looking statements made in this report or in any documents, Flushing Financial and Empire claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995.

Annualized, pro forma, projected and estimated numbers are used for illustrative purposes only, are not forecasts and may not reflect actual results.

Additional Information about the Proposed Transaction

In connection with the proposed Transaction, Flushing Financial intends to file a registration statement on Form S-4 with the SEC that will include a proxy statement of Empire and a prospectus of Flushing Financial, and Flushing Financial will file other documents regarding the proposed transaction with the SEC. Before making any voting or investment decision, investors and shareholders of Flushing Financial and Empire are urged to carefully read the entire registration statement, proxy statement and prospectus when they become available and any other relevant documents filed with the SEC, as well as any amendments or supplements to those documents, because they will contain important information about the proposed Transaction. A definitive proxy statement will be sent to the shareholders of Empire seeking the required shareholder approvals. When available, copies of the registration statement, the proxy statement and the prospectus may be obtained free of charge from the SEC’s website at www.sec.gov, from Flushing Financial by sending a written request to Flushing Financial Corporation, 220 RXR Plaza, Uniondale, NY 11556, Attn: Susan K. Cullen or calling 718-961-5400, and from Empire by sending a written request to Empire Bancorp, Inc., 1707 Veterans Highway, Islandia, NY 11749, Attn: William Franz, or calling 631-348-4444.

Investors and shareholders are also urged to carefully review and consider Flushing Financial’s public filings with the SEC, including but not limited to its Annual Reports on Form 10-K, Current Reports on Form 8-K, Quarterly Reports on Form 10-Q and proxy statements. The documents filed by Flushing Financial with the SEC may be obtained free of charge from the SEC’s website at www.sec.gov or through a link on Flushing Financial’s website at www.flushingbank.com. These documents may also be obtained free of charge from Flushing Financial by sending a written request to Flushing Financial Corporation, 220 RXR Plaza, Uniondale, NY 11556, Attn: Susan K. Cullen, or calling 718-961-5400.

Participants in the Solicitation

Flushing Financial, Empire and certain of their respective directors and executive officers, under the SEC’s rules, may be deemed to be participants in the solicitation of proxies of Empire’s shareholders in connection with the proposed Transaction. Information about the directors and executive officers of Flushing Financial and their ownership of Flushing Financial common stock is set forth in the proxy statement for Flushing Financial’s 2019 Annual Meeting of Stockholders filed with the SEC on April 18, 2019. Information about the directors and executive officers of Empire is available on Empire’s website at empirenb.com. Additional information regarding the interests of those participants and other persons who may be deemed participants in the solicitation of proxies from Empire’s shareholders in connection with the proposed Transaction may be obtained by reading the proxy statement and prospectus regarding the proposed transaction when it becomes available. Once available, free copies of the proxy statement and prospectus may be obtained as described in the preceding paragraph.

No Offer or Solicitation

This communication is not intended to and shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote of approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FLUSHING FINANCIAL CORPORATION

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Maria A. Grasso

|

|

Date: October 25, 2019

|

|

|

|

|

|

Maria A. Grasso

|

|

|

|

|

|

|

|

Senior Executive Vice President and Chief Operating Officer

|

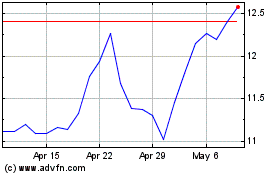

Flushing Financial (NASDAQ:FFIC)

Historical Stock Chart

From Oct 2024 to Nov 2024

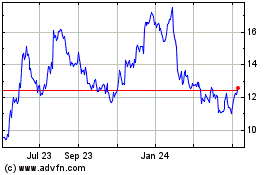

Flushing Financial (NASDAQ:FFIC)

Historical Stock Chart

From Nov 2023 to Nov 2024